On October 23rd, 2019, Tesla released their Q3 earnings report.

Without exaggeration, this was Tesla’s strongest quarter since its IPO on June 29, 2010. From the perspective of Elon Musk’s ten-year master plan, Part Deux, Q3 of 2019 was undoubtedly a pivotal quarter in Tesla’s history.

During the Q3 earnings call, Elon stated that it was a very strong quarter. Since the production of the Model 3, Tesla’s operating costs have been at an all-time low. In fact, this was the key in turning Tesla’s Q3 results from a loss to a profit.

Just prior to the earnings report, Elon tweeted that Tesla could not continue to lose money. In order to achieve their goal of accelerating the world’s transition to sustainable energy, Tesla must be financially sustainable, otherwise it will not exist.

So, how was Tesla able to turn its fortunes around and respond to everything? Let’s start from the beginning.

Sales, Deliveries, and Market Share

Tesla’s co-founder and former CTO, JB Straubel, once said that Tesla’s fundamental strategy for problem-solving is: you must understand that the final improvement is a systemic progress brought by small improvements in the details. Find 10 or 15 places to improve, and you will eventually get a good result.

In my opinion, Tesla’s Q3 results are the product of this strategy.

In Q3 of 2019, Tesla delivered 97,000 vehicles, a new record high. On September 26th, Elon’s delivery email arrived as promised: the demand was so strong that our challenge is to ensure that the right regions have the right models, and to use all of our resources to help deliver at the end of the quarter. This is a top priority in the last five days of Q3.

Under the direction of this email, from top management to product experts, the global Tesla team once again tilted its resources to help with deliveries, without exception. When Robyn Denholm took over as Tesla’s chairman in November 2018, she probably never imagined that she would be busy delivering Model 3s at the end of the quarter one year later.

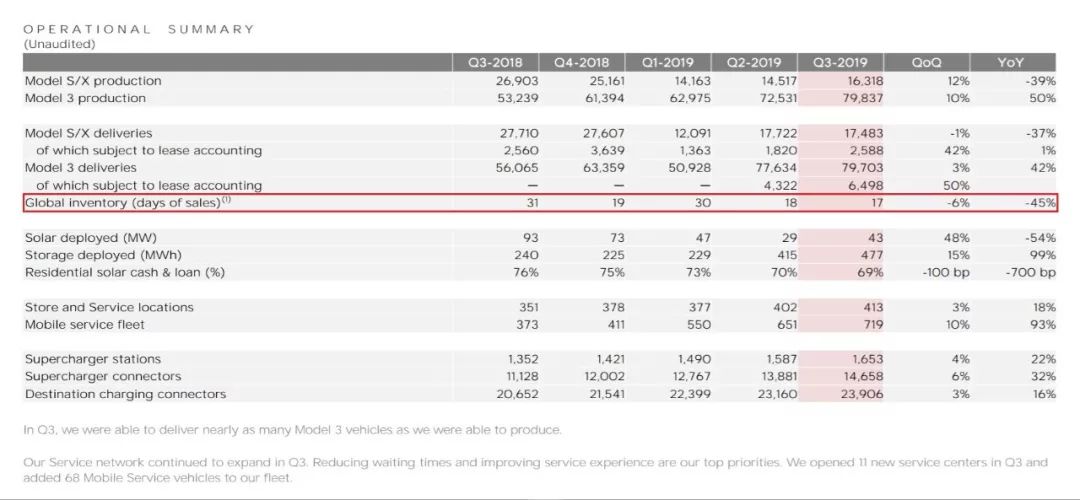

In addition, Tesla has made significant progress in inventory management.

According to Tesla’s financial report, the global inventory level of Tesla in Q3 dropped to 17 days. Many people do not have a clear concept of this number. Data from Cox Automotive shows that the average inventory level of the US auto industry is 61 days. Tesla’s inventory management has achieved 1/4 of the industry’s average inventory.

In fact, this is closely related to the logistics policy Tesla has implemented since early September. Previously, Tesla’s orders in the United States had to be confirmed for delivery dates by users before they were shipped from the Fremont factory in California. Elon requires Tesla’s delivery team to immediately place orders for the destination upon the completion of vehicles, and confirm the delivery dates with users during transportation.

You may say that the Q3 sales volume increased by only 2,000 units compared to Q2, which is still far from the 100,000 units mentioned in the email.

This cannot be separated from the problem of the overall auto industry environment. Not to mention China, the world’s largest auto market with the first negative growth in 28 years, the US auto sales remained low in the first three quarters of 2019, reaching the worst level since 2014. As mentioned earlier, the average inventory level of the US auto industry is 61 days, and how about the US auto industry’s shining star General Motors? It is 77 days.

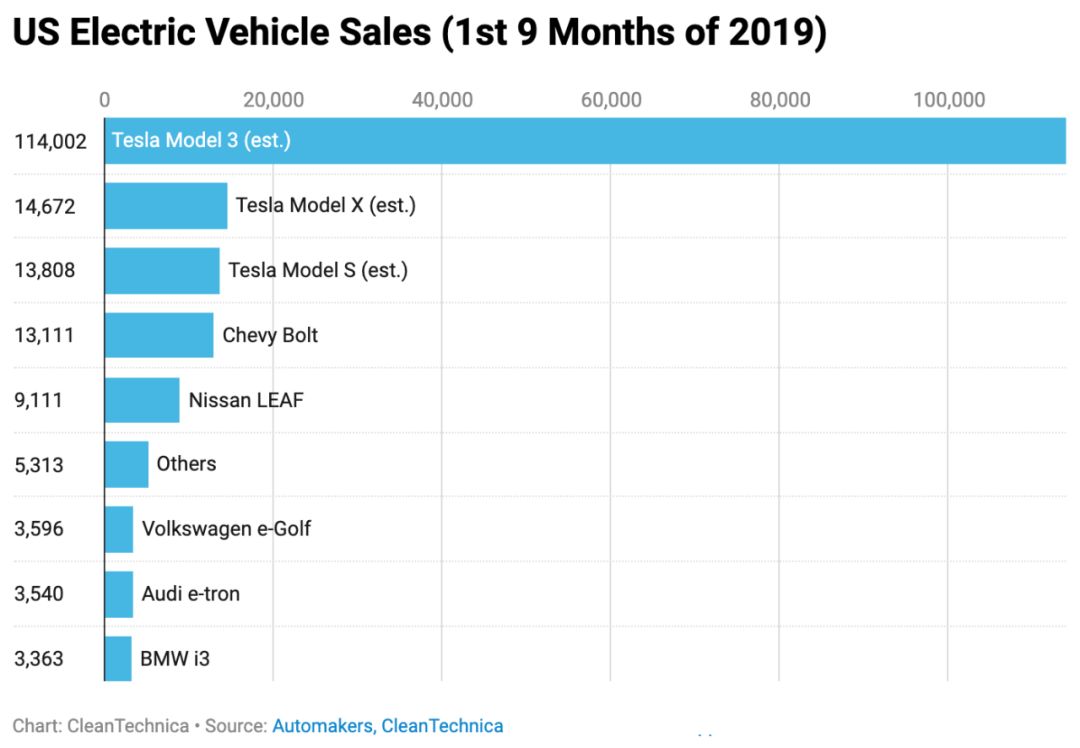

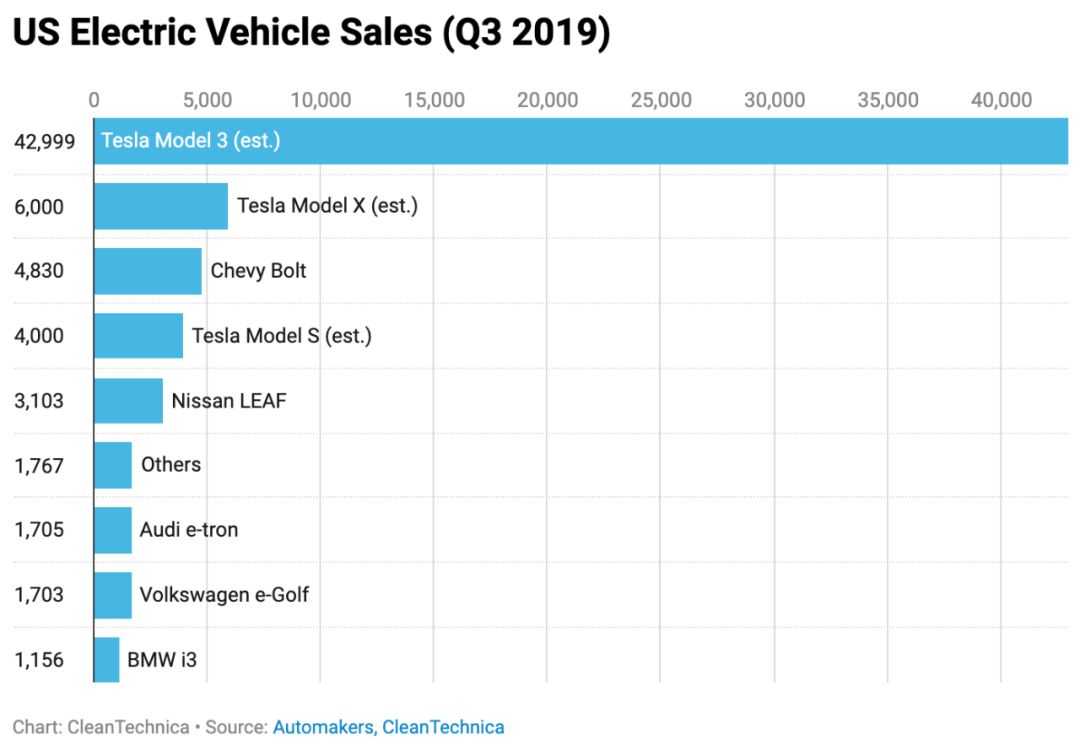

Although the absolute value of sales volume growth is limited, in the context of the industry, Tesla’s share in the US domestic pure electric vehicle market has soared from the previous 64% to 75-85%, occupying an absolute dominant position.

The last struggle of the bears is that the high sales volume in Q3 is unsustainable, and the overdrawn Q4 will definitely plummet. Let Tesla CFO Zachary Kirkhorn put an end to this issue.

Our global order rate remains strong and continues to increase. Despite increases to production levels, our order backlog has been growing, and quarter to date orders are significantly higher than at this point in last quarter.

In the immediate term, we’re focused on increasing production of Model 3 and Model S and Model X as quickly as we can.

我们的全球订单需求强劲且持续增长。 尽管产能有所增加,但我们的积压订单仍在增长,迄今为止的 Q4 订单量明显高于 Q3 的同一时期。

我们将专注于尽快增加 Model 3/S/X 的产量。

From Autopilot to FSD

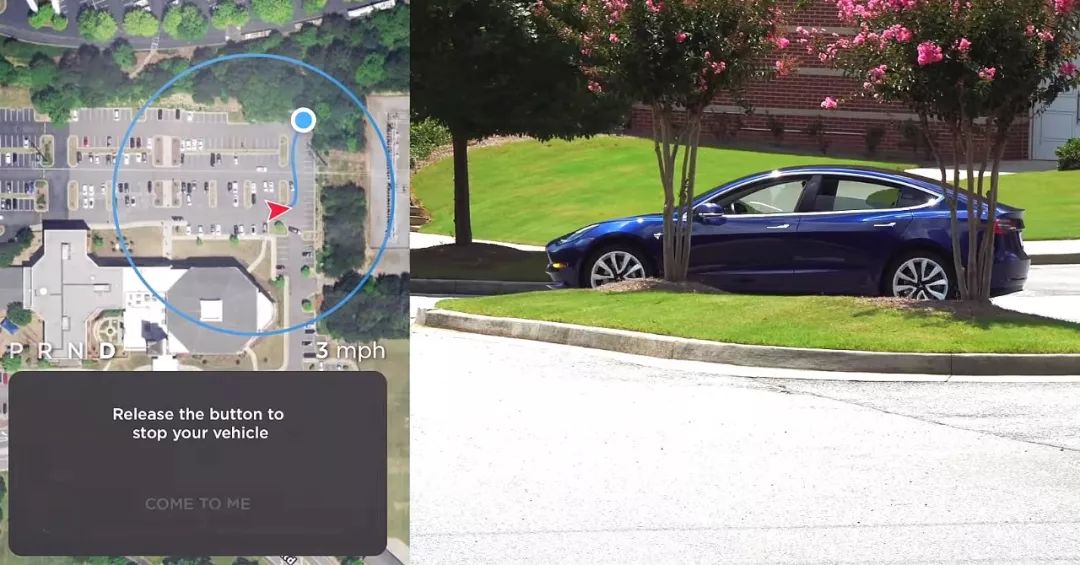

In the past quarter, Tesla finally released the long-awaited Smart Summon feature multiple times after many delays.

Smart Summon is the ability to respond to the driver’s smartphone app from any parking space and drive autonomously to the driver’s location from the farthest 65 meters away. Although it is a semi-closed low-speed scenario, strong perception, decision-making, and control capabilities are indispensable in the process of landing the function.

In its financial report, Tesla announced that “since its initial release in September, the Autopilot Summon feature has been used one million times. Our neural network learning approach allows us to iterate and improve the feature over time.”

In its financial report, Tesla announced that “since its initial release in September, the Autopilot Summon feature has been used one million times. Our neural network learning approach allows us to iterate and improve the feature over time.”

Using the Navigate on Autopilot (NoA) as an example, Tesla released the first beta version of NoA in version 2018.42 on October 27, 2018. Despite the terrible experience, the Autopilot’s handling of ramp entries and exits, automatic lane change logic, and lane change speed was poor. Whenever a scenario occurs that the system cannot handle, the driver will choose to take over, but at the same time, Autopilot will record and upload these unfamiliar scenarios to the background. In subsequent version updates, Autopilot engineers will optimize and repair each bug and feature.

Through this “user development, rapid iteration” approach, Tesla subsequently pushed NoA for Europe and Asia Pacific (China) in version updates 2019.8.3, 2019.8.5, and 2019.16 respectively. The latest version in North America now supports automatic lane change without confirmation.

All indications suggest that Tesla is attempting to complete the development of its Summon feature on a global scale using the same development method.

Tesla expert @green, who is active on Twitter, said that Tesla collects a lot of statistical data every time you use Summon. From the background, it can be seen that Summon uses high-precision maps and vision (cameras) to detect pedestrians and cars (dynamic obstacles).

Following the update of Summon, many Tesla owners reported that abnormal traffic upload occurred on their cars.

During the financial report conference, Elon stated that “after the one million times of training data, the improved version of Summon will be released within a week. In the next few weeks, Summon will be rapidly improved to become better, just like Navigate on Autopilot.”# Tesla Acquires Self-Driving Perception Startup DeepScale, Speeding Up Autopilot FSD Development

On October 1, 2019, CNBC reported that Tesla has acquired DeepScale, a startup with expertise in improving neural network efficiency for self-driving perception. Elon Musk stated that DeepScale, consisting of only 12 people, will accelerate the development progress of Tesla’s Autopilot FSD.

We have previously discussed DeepScale in our articles. The company has significant experience in developing high-performance self-driving perception systems under computational and power constraints.

So what about Smart Summon? As we have discussed before, from a technical perspective, Smart Summon and highway autonomous driving have similar requirements in perception, decision-making, and control. In other words, Smart Summon is a critical part of Tesla’s path to full self-driving (FSD). After Smart Summon, only the recognition of traffic signs (road markings and traffic lights) and city automatic navigation assistance remain as features included in Tesla’s FSD optional package.

How far are we from true FSD?

The successful landing of Smart Summon has boosted Elon Musk’s confidence. During the earnings call, Elon stated that the first version of FSD (i.e., a vehicle that can drive autonomously from home to work without intervention from the driver but with full supervision still required) remains on track for release at the end of this year. The plan for launching Robo-Taxi (an autonomous taxi) by the end of 2020 is also unchanged.

In addition, Elon analyzed the three levels of autonomy for self-driving technology: 1) vehicles that can support autonomous driving in most scenarios but still require driver supervision and intervention when needed (i.e., the FSD version that Tesla plans to release by the end of this year); 2) fully autonomous driving that Tesla considers to be safe enough to not need driver supervision (i.e., the Robo-Taxi version set to launch by the end of 2020); and 3) autonomous driving that has been approved by local regulatory agencies with zero accident records per 1.6 billion kilometers driven.

Elon believes that this is the basic roadmap for FSD commercialization. With the increasing number of Tesla vehicles equipped with the company’s AI chip (AP 3.0) and the replacement of chips in over 200,000 vehicles with the older AP 2.+ version, the development of Tesla FSD will accelerate further.

Energy Business “Returns” after a Decade Puzzle is Pieced Together

Why use the word “returns”? It has been a long time since we have heard any good news from Tesla’s energy business.In the Tesla management, apart from CEO Elon Musk and CFO Zachary Kirkhorn, there were only three executives present at the Q3 earnings report, one of whom was Kunal Girotra, Senior Director of Energy Operations.

On August 3, 2018, during the Q2 earnings report meeting, three executives from the Autopilot department made a rare appearance. Afterwards, it was revealed that Tesla’s AI chip was certified in July 2018, and the B0 version began production testing.

Does Kunal Girotra’s attendance at the Q3 earnings report mean that the lackluster energy business will soon accelerate?

At the beginning of the Q3 earnings report, Elon announced that the third version of the solar roof (Solar Roof V3) would be released the next day, and that Gigafactory 2 in Buffalo, New York was expanding Solar Roof V3 production.

During the subsequent earnings report meeting, Elon stated that the energy business (energy storage and solar roofs) is the most overlooked business by Tesla investors.

It is well known that due to insufficient production capacity of the power battery, Tesla once stopped the production of energy batteries and used all 14 battery production lines in Gigafactory 1 in Nevada for the production of Model 3 power batteries. Tesla’s energy business had to procure energy storage batteries from Samsung SDI and LG Chem in order to maintain basic operations.

Elon revealed during the earnings report that in order to stabilize and increase Model 3 production capacity and simplify the vehicle’s design, Tesla even deployed engineering resources from the energy department to the automotive department to solve the challenges faced by the automotive business. Similar adjustments were also reflected in personnel arrangements: former Senior Vice President of Energy Operations at Tesla, Sanjay Shah, had long been responsible for the delivery of Tesla vehicles in North America.

The problem with prioritizing the Model 3 as a top business priority is that the energy business is not receiving attention from the management in the long-term.But as the Model 3 production stabilized, Tesla is refocusing its engineering resources on energy storage and solar businesses. This shift can be seen in the products that Tesla offers. In addition to the Solar Roof V3, which will be unveiled tomorrow, Tesla introduced a new industrial-scale energy storage product called Megapack in a blog post on July 29.

This highly integrated, high-capacity energy storage product greatly simplifies the complexity of large-scale energy storage and streamlines the installation and connection process. With Megapack, Tesla can deploy 250 MW/1 GWh of renewable energy generation in just three months. Tesla announced in its recent earnings report that Megapack will begin deliveries in Q4 2019.

Tesla has also launched a streamlined and transparent commercial solar configurator in the North American market, offering three standard sizes of products and restarting the sale of Tesla solar products. To simplify the approval process, Tesla has invested a lot of effort in developing a general installation permit template. Finally, at the installation stage, through high product integration, Tesla has greatly simplified the complexity of product installation, ensuring low-cost installation completion.

The “return” of the energy business is about to enter a period of rapid growth. Elon mentioned in the earnings report that, after seasonal fluctuations, the growth of solar and energy storage businesses will exceed that of the automotive business. Over time, the scale of Tesla’s energy business will grow to be on par with that of its automotive business.

Finally, Elon answered two questions:

Why did you not focus on the energy business before? There’s only one answer: if we didn’t solve the Model 3, Tesla wouldn’t survive.

Why do you place so much emphasis on the energy business today? For a long time, a widespread skepticism of electric vehicles is that they are only clean on the surface, as the electricity used to power them often comes from fossil fuels. Today, Tesla is actively expanding its energy business to complete the production, storage and use of sustainable energy, creating a complete energy consumption cycle.A one-stop energy solution provider, this is what Elon defined for Tesla in his ten-year plan Master Plan, Part Deux on July 20, 2016. Don’t forget Tesla’s mission: to accelerate the world’s transition to sustainable energy.

One More Thing

Since the release of the chip on the Autonomy Investor Day on April 23, Elon has repeatedly stated that every time Tesla pushes an optional Autopilot feature, the FSD package price will be raised by $1,000. “Tesla is demanding profits from Autopilot” has become an open secret.

In Q3 2019, FSD finally started to affect the financial report. However, strange enough. Despite the accumulated FSD revenue of up to $500 million, Tesla only confirmed $30 million in revenue. CFO Zachary Kirkhorn explained:

Note that with the release of Smart Summon in the US, we were able to recognize $30 million of deferred revenue. As we expand Smart Summon to additional markets and release new features, we will continue to recognize additional deferred revenue.

However, the problem lies in the fact that Tesla does not sell Smart Summon alone. Judging from sales distribution and FSD acceptance (long-term proportion of over 50% in the United States / better Autopilot experience in the US / the first to receive updates), the $30 million is obviously not the total FSD revenue in the US.

What I mean is that Tesla seems to have not explained the FSD revenue deferral rules. Considering that FSD’s optional revenue will grow with the expansion of new functions in various regional markets and the delivery of new vehicles in the new quarter, Tesla will have greater control over the “free cash flow” and “profit” parts of future financial reports.

Short sellers, did you see that?

-

Tesla Acquires DeepScale, Adding Another Player to the Game of Perception Fusion

-

Tesla’s Last Ace up its Sleeve: A Battery that Lasts for 1.6 Million Kilometers

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.