Author: The Office

On May 23, XPeng released its Q1 2022 financial report.

Two weeks before the report was published, XPeng announced a series of business updates, including a sales strategy that bundled software and hardware for vehicles equipped with high-end intelligent driving assistance systems (see “New Products, Standard Features, or Downsizing? XPeng Rearranges Its Lineup”); one week before publication, XPeng held a test ride experience for the XPeng P5 LCC enhanced version based on LiDAR and visual fusion in Guangzhou. This represents XPeng’s new progress in the field of intelligent driving.

The combined pressure of the pandemic and XPeng’s frequent business updates has drawn sufficient attention to this season’s financial results conference call. However, CEO He XPeng and his executive team did not disappoint, delivering a content-rich conference call. Let’s take a look at it together.

At Present

As of March 31, XPeng sold 34,561 vehicles in Q1, a year-on-year increase of up to 159%, with a drop of only 17% compared to the traditional sales peak of Q4. Of particular importance, the XPeng P7, which has been on sale for more than two years, achieved a new monthly sales record of over 9,000 units in March, showing a strong momentum.

Considering the impact of the pandemic, the continuous supply restrictions of electronic cores, rising raw material prices – even XPeng had to announce a comprehensive price increase in March – the delivery performance of the P7 is impressive.

He XPeng did not downplay the seriousness of the chip shortage. On the contrary, he may be one of the most candid CEOs on Wall Street: “The supply chain challenges brought by chips may last longer than everyone thinks.”

He XPeng attributes one of the reasons for XPeng’s strong performance in Q1 to its deep in-house capability for the research and development of embedded system software and hardware. This is a self-developed plan that started as early as 2015. After years of hard work, its value has been further magnified in the current situation of chip shortages.

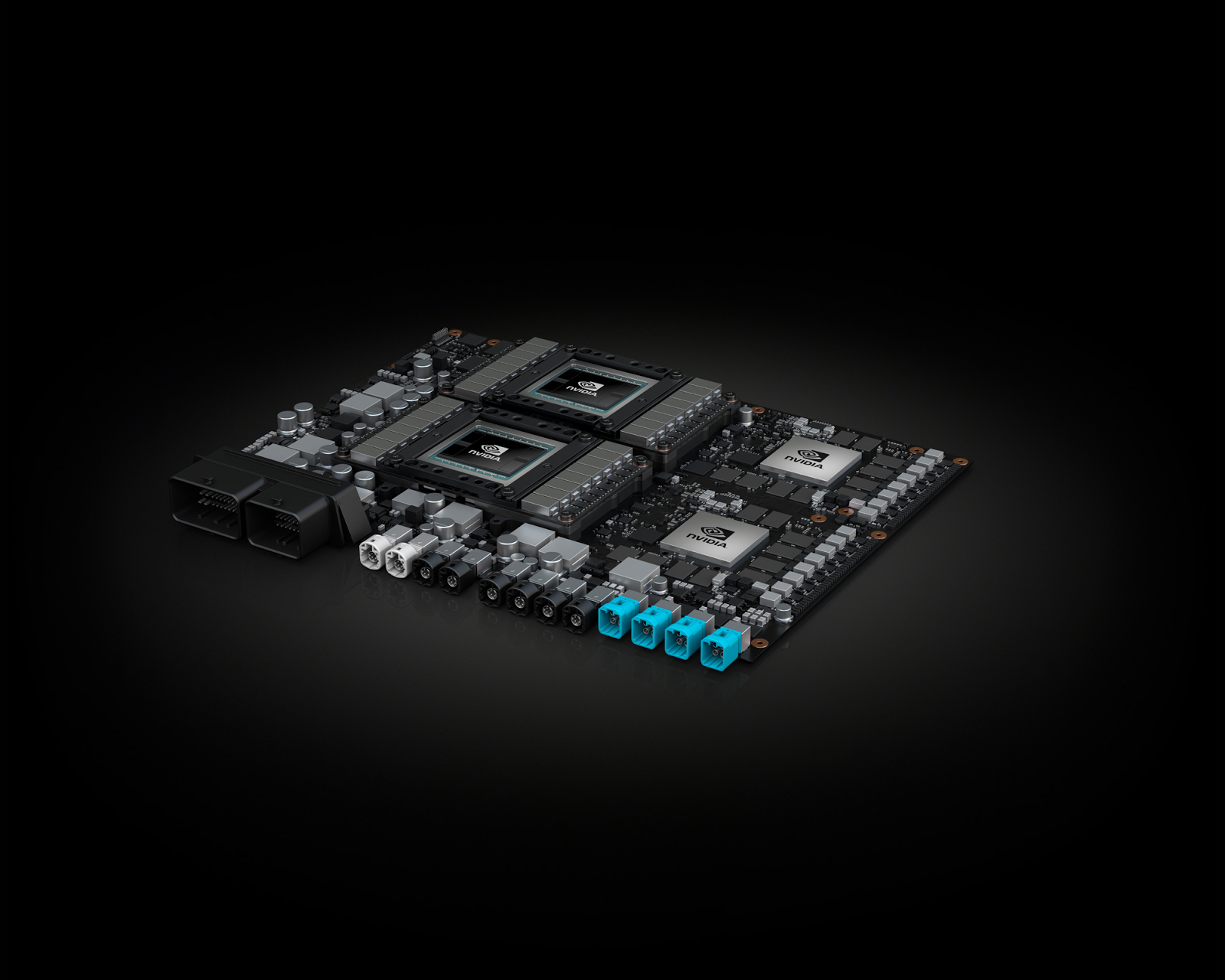

According to XPeng’s statistics, a smart car contains up to 5,000 chips. However, in many cases, the limitation of chips is not high-performance or advanced process chips such as the NVIDIA Xavier chips used in XPILOT 3.0/3.5, but rather small chips such as seat controls.

XPeng’s deep in-house capability for the research and development of embedded system software and hardware gives XPeng the opportunity to quickly develop new control software based on new chip signals after chip shortages occur, ultimately achieving the delivery capability of completely consistent functions and experiences for both software and hardware.

Currently, XPeng’s team has the ability to reprogram, verify, integrate and switch based on new chips within a few months. The value behind this is not only “chip supply protection,” but greater flexibility often means more proactive and better cost control.

Currently, XPeng’s team has the ability to reprogram, verify, integrate and switch based on new chips within a few months. The value behind this is not only “chip supply protection,” but greater flexibility often means more proactive and better cost control.

Of course, rather than the chip itself, the price fluctuations of upstream raw materials for batteries have a greater chance of becoming the keywords that constrain the growth of new energy vehicles in 2022.

The relief of this issue shows a bit of foresight. XPeng began to promote the diversification of battery suppliers in 2021, and by Q2 of this year, all new suppliers’ battery products have been basically put into mass production, which means that the risks of a single supplier concentration and a single supply area have been better mitigated.

For XPeng, having more suppliers has raised higher requirements for operational management, but also increased its bargaining power in the game of supply and cost.

Naturally, even so, speculative price increases in upstream raw materials still have a universal impact on the entire industry, and XPeng has not been spared. On March 18th, XPeng announced price adjustments for its on-sale models, with price increases ranging from 10,100 to 20,000 yuan.

Given that XPeng P5’s starting price has already fallen below 2 million yuan, it’s unrealistic to say that this adjustment has had no impact on demand. However, according to XPeng’s disclosure at the financial report meeting, if we do not consider regions affected by the epidemic, XPeng’s order growth in May has returned to the level before the price hike.

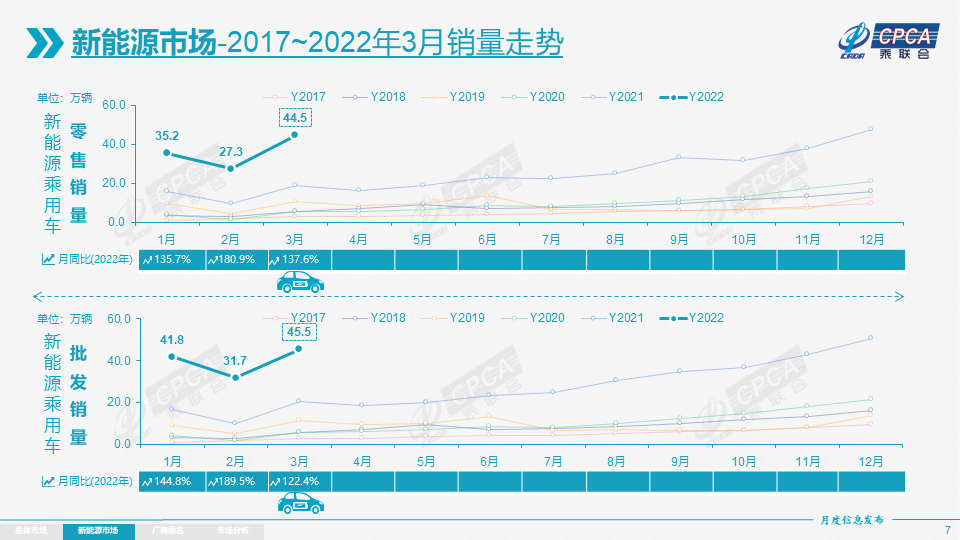

If we look at the entire industry, according to data from China’s passenger car insurance, the penetration rate of pure electric vehicles exceeded 24% in March, with Shenzhen and Shanghai exceeding 30%. This means that the endless constraints have not fundamentally affected the trend of electrification of automobiles.

If we compare the sales trend of new automakers in Q1, we can see that XPeng has avoided chip and raw material impacts to the greatest extent possible by stocking parts earlier and developing diversified suppliers and embedded technologies. The 159% YoY growth is therefore not surprising.

Current Status

According to the financial report meeting, XPeng resumed dual-shift production at its Zhaoqing plant in mid-May. Although He XPeng himself admitted that when the chip shortage was at its worst, the supply could not meet the demand for the next month, and many times it was so bad that we could only see the next week, the resumption of dual-shift production means that the supply chain-related alarm has been temporarily lifted.Let’s talk about “Underfoot”. Just a week before the financial report was released, XPeng completed the scale trial of the LCC enhanced version based on LiDAR and visual fusion, which is a pity that all members of the Star Channel were in Shanghai due to the impact of the epidemic and could not experience this function in person.

What is the LCC enhanced version?

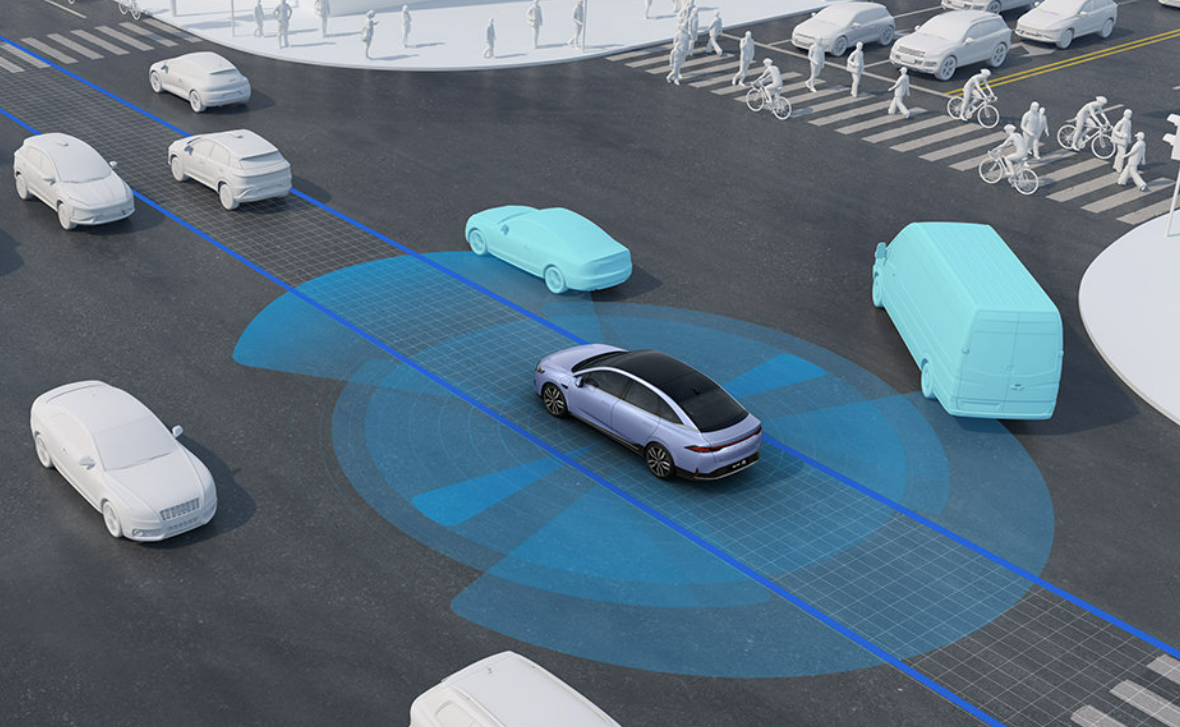

Simply put, before this, XPeng’s LCC lane-keeping was the same as other head car companies based on visual and millimeter-wave fusion perception R&D. Such perception hardware and algorithms can basically ensure a user experience in high-speed and elevated scenarios with clear weather and clear lane lines.

However, actual usage scenarios are often not so ideal. The old road’s lane lines are not clear or even completely disappear, there are guide cones for road repairs, and there are frequently large curved ramps limited by space in urban areas.

These are the corner cases that break the continuous experience of the LCC.

On the other hand, XPeng has already carried out engineering research and development on some even more complex scenarios based on the XPILOT 3.5 platform equipped with dual LiDARs on the P5. If some of the perception and algorithm abilities of the city NGP are re-targeted to strengthen the extreme scenarios of the LCC, it seems like a logical approach.

The LCC enhanced version was born, and according to the actual experience of various media, the LCC enhanced version has indeed improved to varying degrees in terms of user experience compared to the existing LCC. We also look forward to testing the LCC enhanced version as soon as the unblocking measures are lifted.

However, compared to the LCC enhanced version, the XPeng G9 announced by He XPeng at the financial report meeting, and even the two new models next year, are more anticipated.

He XPeng bluntly pointed out that “only when the city NGP reaches the perfect stage and forms an end-to-end closed loop of intelligent assisted driving system capabilities can it fundamentally change the user experience.”

On the one hand, this statement comes from the fact that XPeng has completed the engineering development of high-speed NGP, cross-floor memory parking VPA-L, LCC-L, and even the city NGP is only waiting for high-precision map related approvals. On the other hand, it also gives all friendly competitors who are ready to enter the field of intelligent driving in cities a knowing blow: without end-to-end closed-loop and scenario-separated intelligent driving, no matter how cool it is, the benefits at the user experience level will always be limited.

Next, the XPeng G9 will connect the functions of the above-mentioned segmented scenarios. According to He XPeng, “the G9 will obviously exceed all products currently in the industry in terms of safety, performance, cost, and usage scenarios.” The weight of this sentence is not light, and we look forward to it.One worth anticipating prediction from He XPeng at the financial report conference is that in the second half of 2023, there will be a prominent turning point in the electrification and intelligence of cars.

From the perspective of electrification, XPeng will lay out new battery cell materials, CTP integration technology, supercharging capacity, silicon carbide inverters, and do better in wind resistance and weight reduction on the new battery platform, plus the deployment of XPeng 70 kW destination fast charging and 480 kW ultra-fast charging, XPeng believes that users will have the opportunity to experience better range and better energy replenishment system at a lower cost and lower battery degree.

The improvements in user experience will, in turn, have a significant enhancement on fuel vehicles and current hybrid models (yes, including hybrid models) and drive the continuous growth of sales and conversion for pure electric models under new technology architecture.

In terms of intelligence, XPeng will integrate its self-developed intelligent driving, cockpit, chassis, power system, and new generation EEA 3.0 horizontally, which will greatly enhance the experience of the whole car scene, including comfort and safety. XPeng also adjusts its pricing strategy, bundles the sale of high-end intelligent driving hardware and services, and guides users, which has the implication of accelerating the large-scale popularization of intelligent driving.

According to XPeng’s financial report, the two new vehicles based on the B and C-class platforms to be launched next year, except for the XPeng G9, will turn the ideas in the fields of intelligence and electrification into reality to a greater extent. XPeng expects these two new cars to achieve “multiple world-first technological innovations.”

In simpler terms, He XPeng expects these two new cars to have an impact on XPeng no less than creating two more P7s and to structurally improve XPeng’s operating quality, helping XPeng to approach the medium- to long-term gross profit margin target of more than 25%.

Since we have already talked about gross profit margin, there is no need to be shy about it. Looking at this indicator alone, XPeng is not outstanding among the new carmakers. Especially considering the continuous price increases in the supply chain mentioned earlier, coupled with XPeng’s shift to a sales policy of software-hardware bundling, XPeng’s gross profit margin in the next period of time became the most concerned topic for many analysts at the financial report conference.Huang XPeng did not dodge the issue, attributing the adjustment of the sales policy to the engineering progress of XPeng’s intelligent driving technology. In the upcoming advanced intelligent driving, which is the era of human-machine sharing, XPeng believes that packaging sales of OTA services related to software and hardware will not only accelerate the scale and popularity of intelligent driving and bring direct improvements to the user experience, but also have a direct and positive impact on the company’s gross profit.

In addition, in the long run, XPeng is exploring more forward-looking business models that match the technological progress, including charging based on usage time or mileage, or charging based on software packages + scenarios after the landing of fully automatic driving technology.

In summary, technological investment and commercial realization will complement each other and evolve in a spiral.

But what is important is that XPeng’s starting point as a listed commercial company is still “intelligence” when it comes to answering the fundamental proposition of creating value for society and creating profits for shareholders.

This is fundamentally different from Ideal Auto and NIO, which also belong to the new car camp and excel in product capabilities focusing on explosive products and user-centered enterprises, respectively.

From the financial report, XPeng bets on “intelligence” for the improvement of user experience, the growth of technology capabilities, and the improvement of gross profit margin.

At the beginning of the financial report conference, Huang XPeng briefly mentioned XPeng’s concept of intelligence: “We will not pursue the stacking of intelligent hardware configurations. Our goal is the optimal solution of technology capabilities under suitable BOM costs, thus realizing stronger and safer automatic driving capabilities in almost all scenarios, creating greater user and enterprise value.”

Low cost and high performance is the only way to achieve the impossible triangle of user experience, technology capabilities, and gross profit margin. How will this conviction affect XPeng? See you in the second half of 2023.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.