Jia Haonan posted from the passenger seat temple

Reference for smart cars | Wechat official account: AI4Auto

Selling cars without making money, just make friends with “Peng”.

XPeng Motors released its financial report for the first quarter of this year, which is the most intuitive feeling.

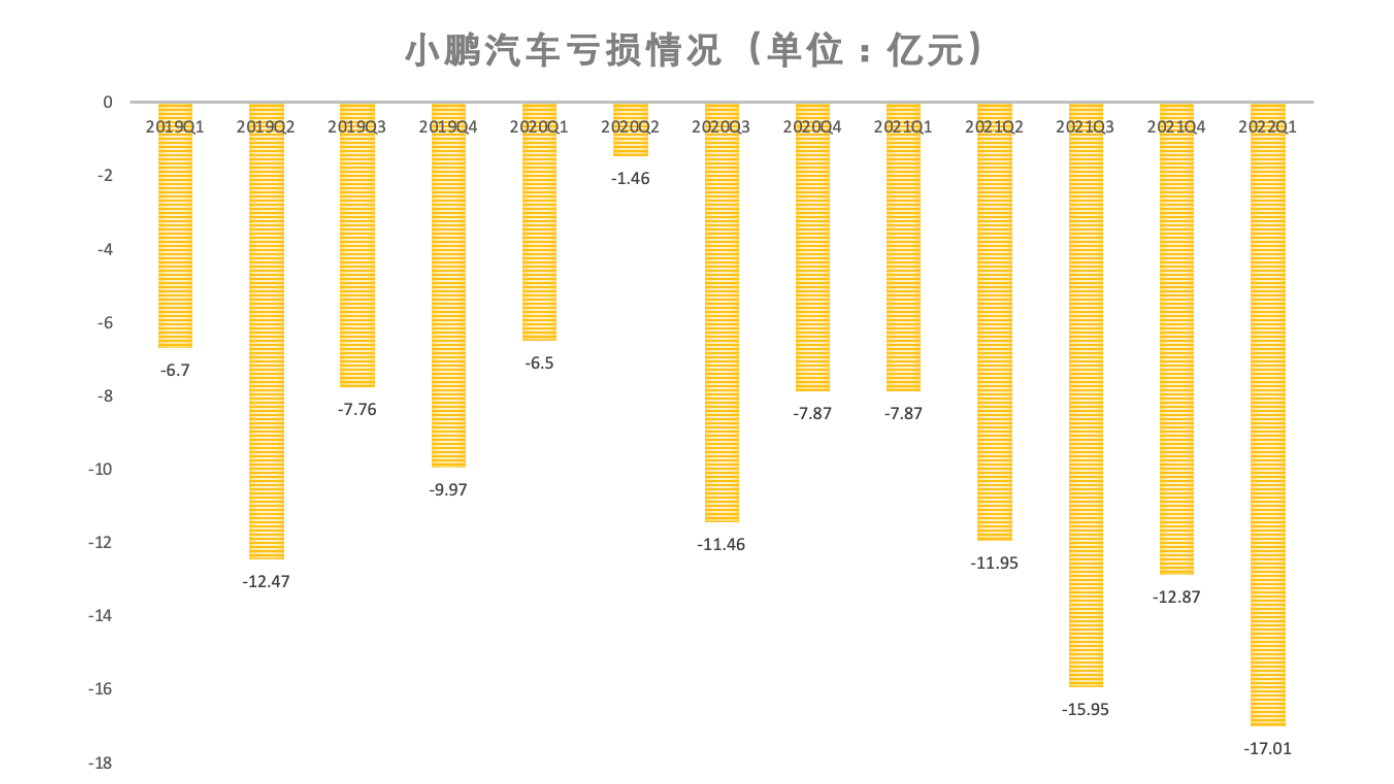

In Q1 2022, XPeng Motors had a net loss of 1.7 billion yuan, setting the record for the largest loss since its listing:

As a comparison, Li Auto, which has already released its data, only lost 10 million yuan in Q1, and even achieved profitability before, at least standing at the threshold of “hematopoiesis”.

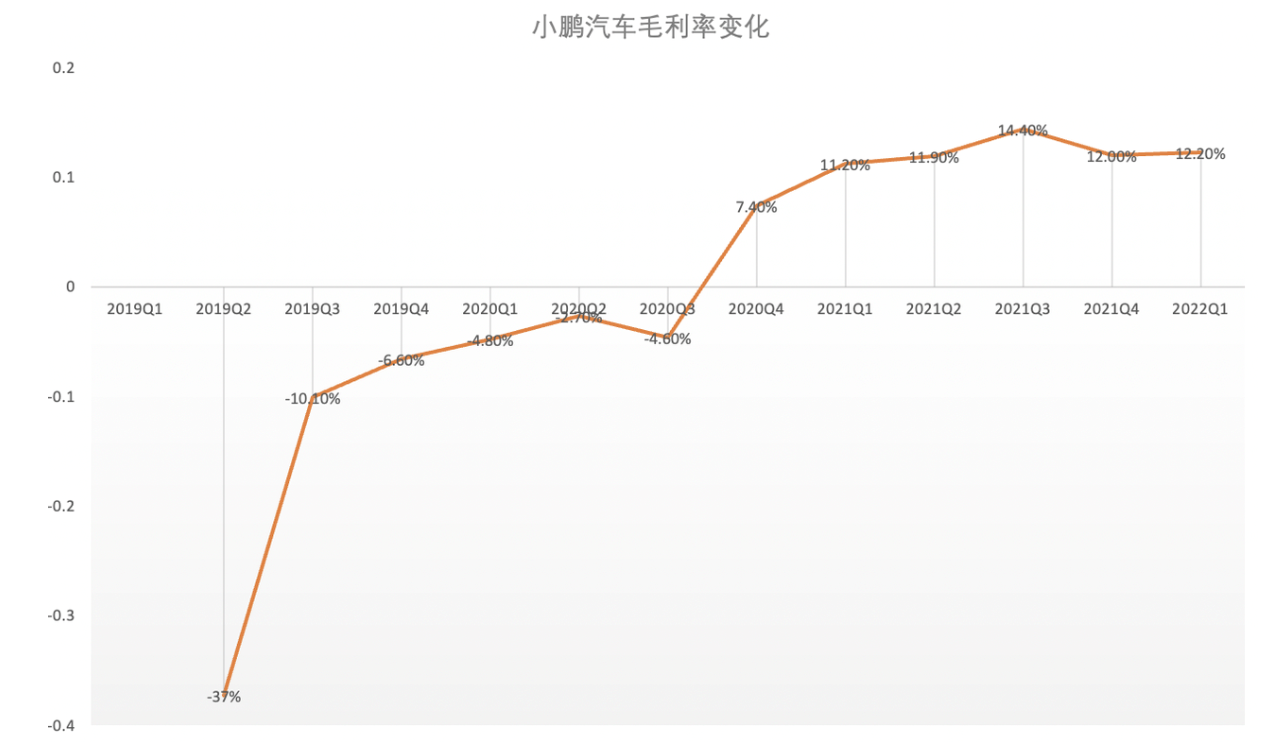

In addition, XPeng Motors’ gross profit margin has been hovering between 11-15% for a long time, and the Q1 2022 data is 12.2%, which should be the lowest among the three without accident:

Therefore, XPeng Motors is still the least profitable among the new forces, eight years after its establishment, and still racing against the Reaper.

However, on the other hand: XPeng’s speed is the fastest in the field.

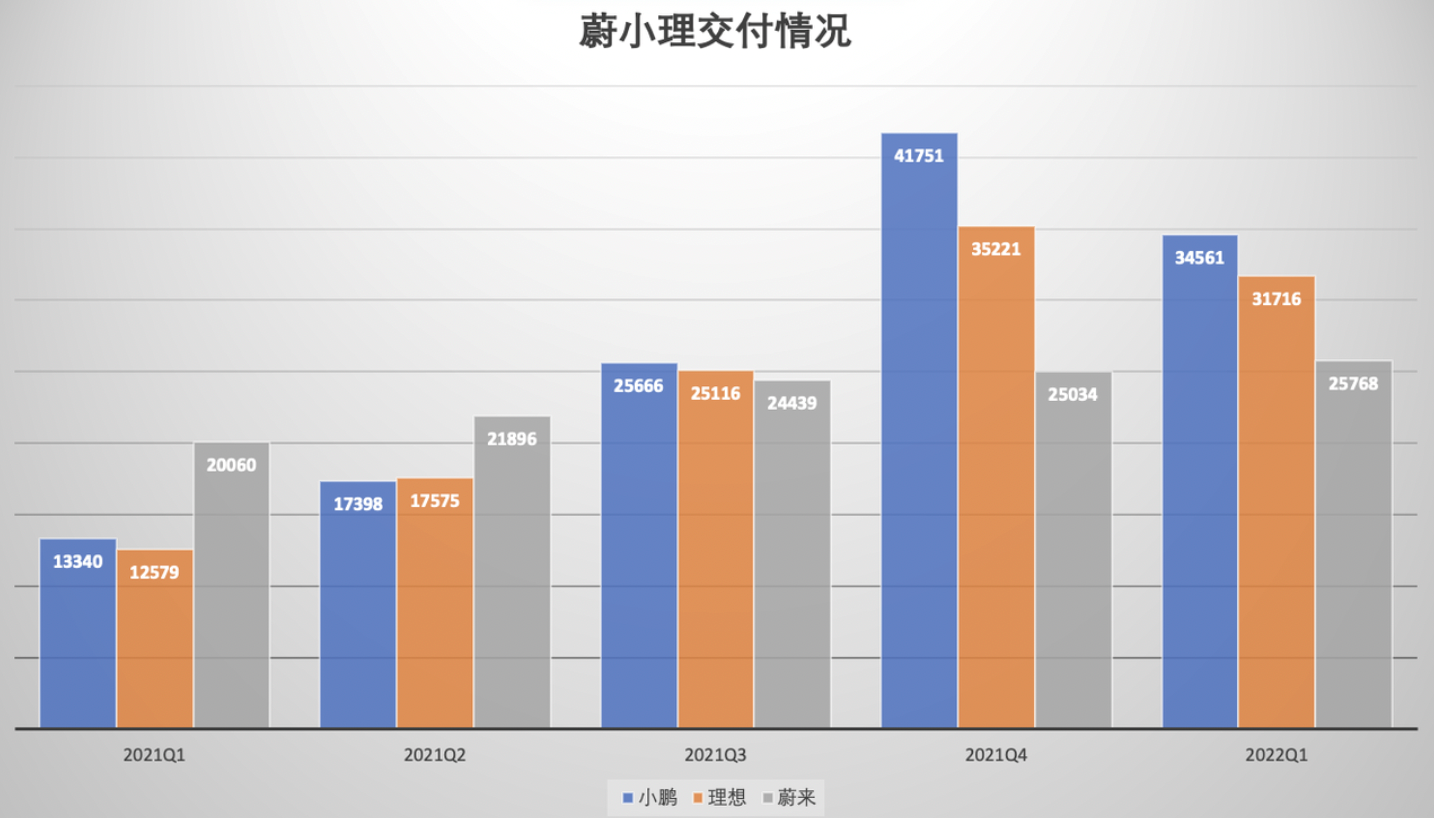

It has been the sales champion of new forces for several consecutive quarters. In Q1 2022, XPeng Motors delivered a total of 34,561 vehicles:

Revenue has also doubled year-on-year, with a total revenue of RMB 7.45 billion in Q1, an increase of 152.6% compared with RMB 2.951 billion in the same period in 2021.

This growth rate is also why XPeng can still “walk as fast as flying” in the case of long-term low gross profit and high losses.

Just the faster you run, the bigger you lose. If making cars doesn’t make money, just make friends. This is very similar to the past few years in the field of smartphones, and XPeng’s current situation is very similar to that of Lei Jun’s Xiaomi.

XPeng is to cars what Xiaomi is to electronics?

The most complete answer comes from the latest quarterly report and conference call disclosure.

Who is paying for XPeng?

To figure out why XPeng is not profitable, one must first understand where XPeng’s income comes from.

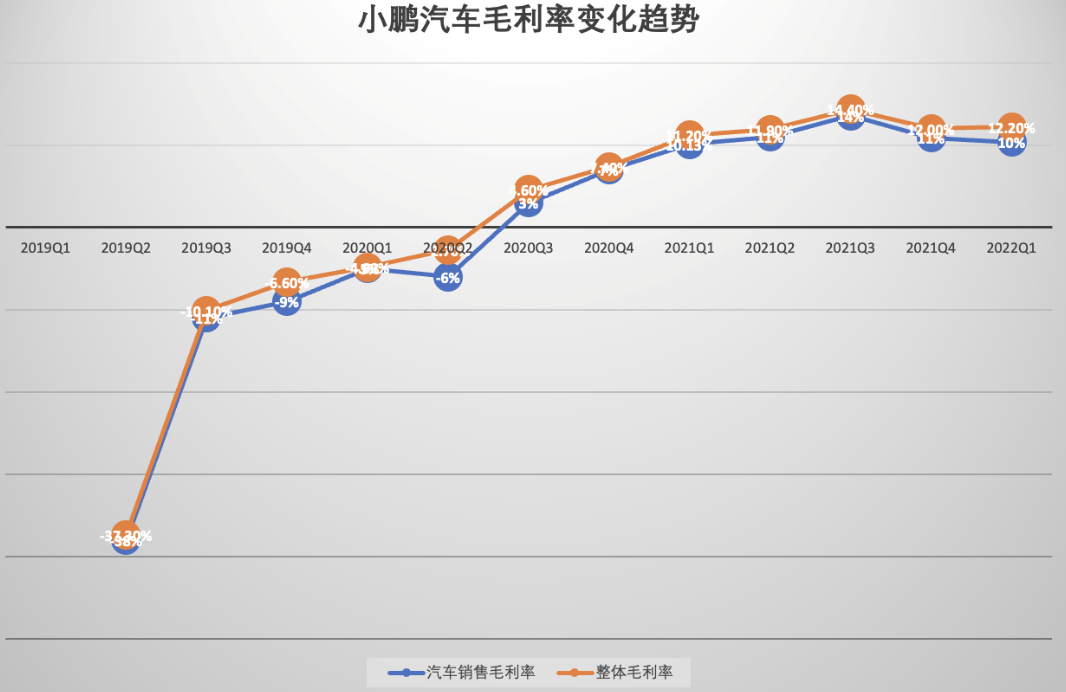

Comparing XPeng’s overall gross profit margin with automotive sales gross profit margin shows that the fluctuations of these two curves are completely consistent.

This illustrates that the high growth of XPeng Motors mainly comes from car sales.

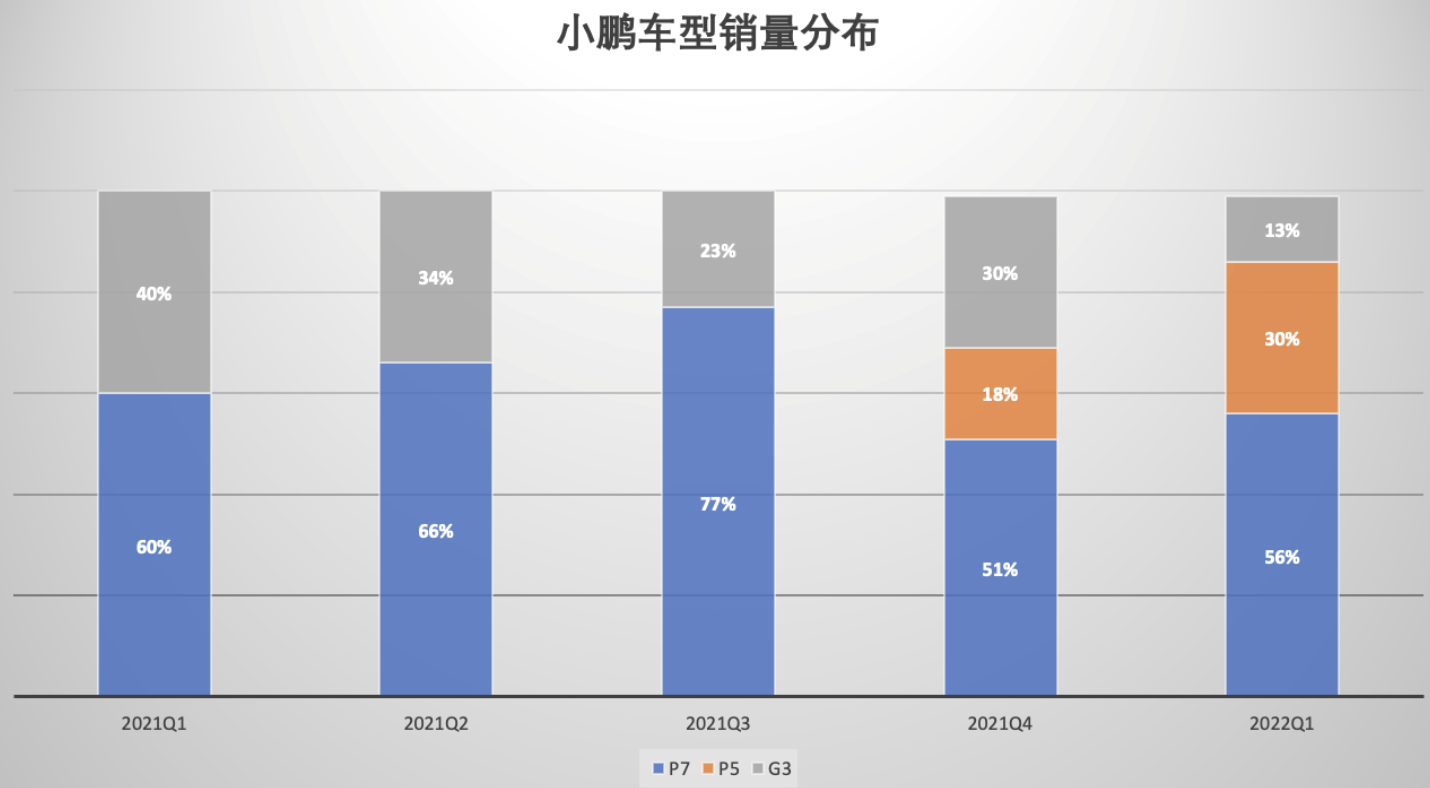

In Q1 2022, XPeng Motors delivered a total of 34,561 vehicles, with P7 being the main delivery, accounting for 56% of the total. The cheaper P5 has grown rapidly and contributed 30% of the sales.

On the contrary, the cheapest G3 series only accounts for 13%.

This situation actually reflects the “intelligence” feature of XPeng Motors.

The G3 series has the lowest price and was originally a trial entry into the market, with less support for intelligent functions compared to P5 and P7.

After XPeng’s brand awareness was established with recognition of “intelligence”, the G3 model is no longer the main sales force, but rather a role in the layout of the 150,000-200,000 price range.

In addition, XPeng’s pure electric vehicle products mainly target users in economically developed cities, with the majority having a car purchasing budget between 200,000 and 300,000 yuan.

This is also the reason why the XPeng P5, priced at over 200,000 yuan, has grown rapidly. It can be foreseen that in the future, P5 will replace P7 as the main delivery force with its intelligence, household and price advantages.

Among the three new forces in the automobile industry, XPeng Motors has the most precise positioning and the most comprehensive layout, and is also aimed at the largest consumer group. This strategy has brought XPeng rich rewards.

After stability in the market was achieved for all vehicles last year, XPeng saw rapid growth in deliveries and revenue, and has been leading the new forces ever since.

But why doesn’t XPeng make money even with so many people buying?

Why is there no profit even with so many buyers?

This problem can be attributed to two reasons.

One is profit, which is mainly related to vehicle prices; the other is expenses, which are related to R&D and operating expenses.

Starting with profit, the most direct influencing factor is that the average price of XPeng’s vehicles is not high enough.

According to the sales distribution, before P7 was launched, the average price of XPeng’s vehicle models for sale, except for G3, was stable at around 160,000 yuan.

2020 Q2 P7 went on sale, which significantly raised the average price of the vehicles. As the monthly sales of P7 stabilized at over 6,000 units, the average price also increased to around 200,000-210,000 RMB.

2020 Q2 P7 went on sale, which significantly raised the average price of the vehicles. As the monthly sales of P7 stabilized at over 6,000 units, the average price also increased to around 200,000-210,000 RMB.

Last year in Q4, with the launch of the cheaper P5, the average price was pulled back to 190,000 RMB. In the context of supply chain tightness this year, the average price has increased slightly.

However, since the delivery volume of P5 will continue to grow in the future, the average price will inevitably decrease.

The core of the problem lies in the layout of the models with an average price of around 180,000-190,000 RMB, which focuses on practicality and value for money. The profit margin is much lower than that of NIO and IDEAL, which sell vehicles with labels such as “luxury” and prices ranging from 300,000-400,000 RMB.

XPeng’s low profitability is also closely related to its expansion in technology and sales.

Smart technology serves as XPeng’s biggest differentiator, with R&D spending accounting for the highest percentage of revenue among new forces most of the time.

In 2022 Q1, XPeng’s R&D spending was RMB 1.22 billion, a year-on-year increase of 128%, accounting for 16.3% of total revenue.

He XPeng once said that XPeng Automobile’s accumulated R&D investment has exceeded RMB 9 billion, and R&D investment in 2022 will exceed the sum of the past one or two years.

In the first two years, XPeng’s R&D spending was RMB 5.8402 billion, which means that the average R&D spending for the next three quarters must remain above RMB 1.54 billion.

In addition to R&D, XPeng’s sales expenses have also remained high.

As of the end of Q1 this year, XPeng had 366 offline stores and sales expenses of RMB 1.64 billion, a year-on-year increase of 105% and 127%, respectively.

The main reason for this is that the market competition intensity of XPeng’s models is much higher than that of NIO and IDEAL.

Many models from BYD, GAC, Tesla, and others have strong competitiveness in this market, and later entrants like Great Wall, Changan, and the new brand from NIO are also targeting this segment.

Therefore, while focusing on R&D, XPeng cannot afford to relax on the sales side.

What should be done?

XPeng is not making money from its car sales, which is closely related to its focus on intelligent technology.

The progress of intelligent driving capabilities, on the surface, appears to be a competition of cost and talents, but in essence it is a cycle of “collecting, processing, training, deploying, and collecting” data.

The more efficient the data collection, the lower the cost, and the more sustainable the development of intelligent driving can be.

Tesla has already verified this route. XPeng and other self-driving companies in the industry have inevitably followed suit.

Therefore, XPeng must position its models in a price range that most consumers can afford in order to ensure long-term effective data collection.

But how can we make money by selling cars like this, besides “making friends”?

XPeng gave its current strategy at the Q1 earnings call.

First is the model layout, which is a direct means of structurally improving gross margin.

He XPeng revealed that the mid-to-largesize flagship SUV G9 will be launched in the fourth quarter of this year, which will result in a significant increase in the average price and gross profit of its models.

In 2023, XPeng will also launch the C-level platform, with a selling price of around 400,000 yuan. However, higher-positioned models are currently not included in the plan.

Ultimately, XPeng plans to cover all car models in the 150,000-400,000 yuan price range, with corresponding sedans and SUVs in each price range, and expects a medium-to-long-term gross profit margin of around 25%.

To put it in a comparative way, this positioning and pricing are also the markets of Toyota and Volkswagen, the two largest car manufacturers in the world in terms of sales.

In addition to selling cars, XPeng also has new moves in terms of revenue from intelligent software.

In the past, XPeng’s intelligent driving software was paid for separately, but the hardware was pre-installed in the car. Next, XPeng will explore the sales method of a bundled offering of software and hardware.

This means that the pricing of different car models will have a price difference based on the sale of software and hardware as an integrated package. XPeng believes that this approach will also help increase its profit margin.

In addition, XPeng has given a trend: gross profit margin will have a significant increase beginning Q3 this year.

This is because since the end of June, the delivery of models with price increases due to supply chain impacts has begun. Since May, XPeng’s order volume has returned to pre-price increase levels, indicating that market demand is still strong.

However, in the face of market competition, XPeng must have differentiated advantages among a series of similarly priced products, and increasing technological development is still a road that must be taken.

It was revealed that in the second half of this year, R&D will be increased in multiple branches such as CTP (Integrated Battery Pack Technology), Super Charging, Aerodynamics, Lightweight, Electrode Material & Technology, and SiC Technology.

For example, a 480 kW fast charging function will be launched in the fourth quarter, allowing for driving 200 kilometers with only 5 minutes of charging.Therefore, for XPeng Motors, intelligence requires high R&D investment and guaranteed installation volume, resulting in conflicts between high expenditure and low profits. The only solution to this problem is to accelerate sales growth and reach a certain benchmark for R&D investment, truly using intelligent technology to widen the gap with other car companies. Therefore, in order to stimulate sales and revenue, XPeng must quickly launch more new models, but this also means more R&D and sales expenses. To compete for market share in the 150,000-400,000 yuan range, XPeng must differentiate its cars while strictly controlling supply chain costs. The development of various high-tech technologies cannot be stopped.

Currently, Ideal seems to be the most conservative and financially comfortable of the three, focusing on solving survival problems and then pursuing the high ground of intelligence.

NIO is innovative and has turned the simple service of pouring tea into the biggest selling point, cutting into profit margins, but it does not have outstanding advantages in intelligence and electrification – and it also faces the dilemma of the “rich man’s mine” being almost depleted and growth being sluggish.

XPeng takes a path that relies on technology and cannot turn back. This path has already been trodden by Tesla, and XPeng’s greatest opportunity lies in two major misplaced advantages when facing Tesla – the first is China’s road conditions, which foreign companies like Tesla may struggle with. The second is the price, as Tesla has not yet shown any intention to develop cheaper models for the Chinese market, even though there have been rumors multiple times.

Therefore, in summary, following the current path, the future of XPeng Motors may be bright, but the road will surely be tricky. The biggest challenge in this tricky road is racing against the “grim reaper”, constantly increasing R&D investment while also continuously improving sales volume and gross profit. The real balance point has not yet come. Once it arrives, XPeng may become strongly associated with the labels of high-tech and self-research, like Huawei in the field of smartphones. Why not the “iPhone of cars”? Because Li Xiang, who represents the extended range three-cylinder engine, said that Ideal ONE can be compared to the iPhone~

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.