Author: Shiyun Zhu

Editor: Kaijun Qiu

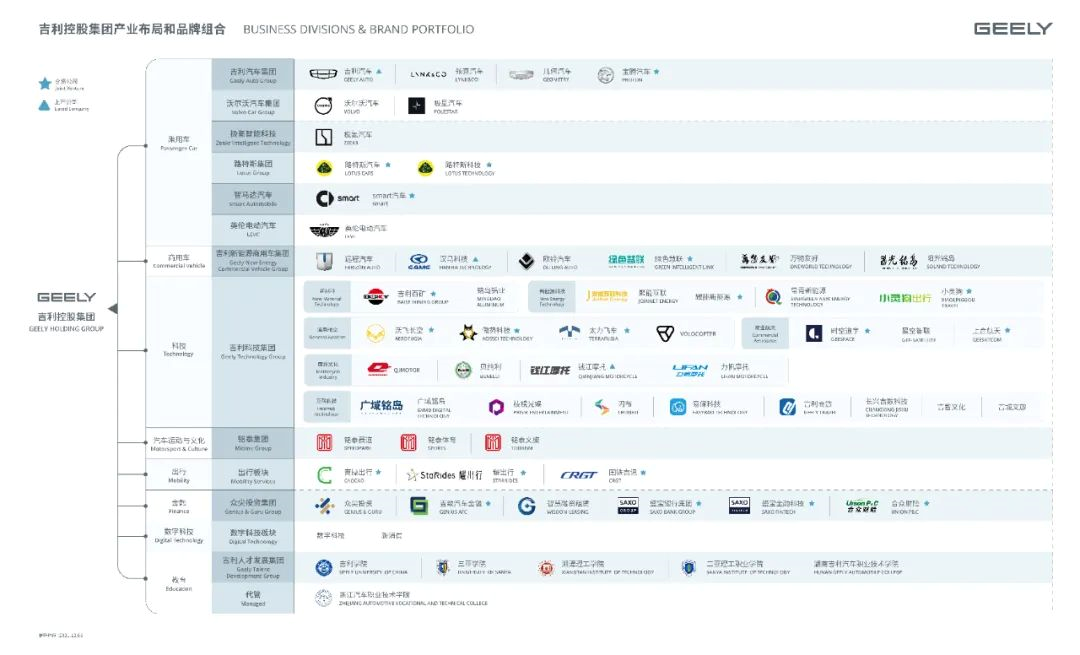

In May, Geely Automobile invested 1.4 billion yuan in Renault Samsung Motors, which surprised nobody.

From Volvo to Proton, to Mercedes-Benz and Renault Samsung Motors, “buy, buy, buy” has become one of Geely’s labels. Some see Geely’s acquisitions as expanding their empire, while others call it a path dependency problem. “Buy” has driven Geely’s transformation from “just avoid defeat” to a multinational automaker, but it also came with the failure of their first Blue Geely plan.

Behind the “buy, buy, buy,” how does Geely rotate the capital wheel?

And will the previous mode and achievements become a burden or foundation for Geely in this round of electric and intelligent transformation?

The question is, can Geely achieve its core goal of scale advantage after the transformation through acquisition?

Volvo: Technology + Brand + Premium Assets

In 2010, Geely Holding Group acquired Volvo Cars from Ford Motor Company.

Through Volvo, Li Shufu, Chairman of Geely Holding Group, established himself as a top player in China’s capital operation of the automotive industry.

In August 2010, Geely Holding Group completed the acquisition of all shares of Volvo Cars for USD 1.5-1.8 billion (RMB 9.9-11.9 billion).

This is not the first time that a Chinese automaker has attempted to acquire an international brand. Brands and assets of well-known companies such as Rover Group, Saab Automobile, and Ssangyong Motor have all been acquired by Chinese companies. However, only Volvo has been reborn in Chinese hands.

At the beginning of the acquisition in 2012, Geely Automobile and Volvo signed a technology transfer agreement. However, like China’s previous experience with buying technical drawings without the cooperation of foreign engineers, it is difficult for Chinese companies who lack advanced technology to digest and develop technology beyond the initial purchase of blueprints.

Therefore, in 2013, CEVT, a research and development center in Europe wholly owned by Geely Holding Group, was officially established, and joint research and development with engineers from Volvo was conducted in Gothenburg, which gave birth to the CMA and PMA platforms, which are entirely owned by Geely Holding Group on their intellectual property rights.Geely is being re-recognized by the market since 2014 when it changed its logo and launched three whole vehicle platforms: FE Platform (Emgrand and Vision series), KC Platform (Borui series), and CMA Platform (Lynk & Co.), covering five major car series. Following that, Geely opened the era of its brand 3.0 premium cars.

The question afterwards was how to land the R&D results and ensure iterative capability on a greater scale within the complex Geely system.

In 2017, two important new companies were born in the Geely system: The first company is the joint venture of Lynk & Co. established by Geely Automobile, Volvo Cars, and Geely Holding; the second company is Ningbo Geely Innovation Research Institute co-established by Geely Holding and Volvo in a 50:50 joint venture partnership. This ensures that Volvo is an important technical support and can continuously enjoy various technological dividends.

Thus, Geely and Volvo have bred high-end technologies with a brand and products that can be implemented and updated continuously through an organizational mechanism.

In 2020, based on the PMA pure electric platform jointly developed by Geely and Volvo, the SEA architecture was further developed, and the 4.0 architecture era was born, with Geely entering a new era supported by four architectures: BMA (Geely self-developed), CMA (jointly developed), SPA (Volvo self-developed), and SEA.

Subsequently, the four architectures produced cars quickly: BMA and CMA platforms were applied to Geely and Geometry brands, with Geometry C and Star series coming out one after another. Lynk & Co., which started with the CMA platform, later stepped up to its 09 flagship model created using the SPA, while Polestar 2, targeted at Tesla Model 3, was based on the CMA platform and well received in overseas markets. The first car model of the HA architecture, Zero-One, came out.

As a result, Geely has entered the fast lane of sales and profit growth. By 2018, Geely Holding’s sales had doubled to 2.15 million vehicles over the course of four years, and its net profit reached a historical high of 20.3 billion yuan. Although the net profit of Geely Holding started to decline due to the double impact of the pandemic and the replacement of 4.0 models from 2019 to 2021, the debt ratio has started to decline continuously, and the safety margin of operation has been increased.

In addition, Geely produced many “golden eggs” within the Geely system due to these acquisitions.

Volvo’s 2021 annual report shows a global sales volume of nearly 700,000 vehicles, with revenues and net profits reaching SEK 282 billion and SEK 12.55 billion, respectively. In October of last year, Volvo’s IPO was a success, raising approximately SEK 23 billion (about USD 2.67 billion), of which 70% was allocated to electrification transformation with the goal of achieving global sales of 1.2 million vehicles by 2025.

Volvo’s 2021 annual report shows a global sales volume of nearly 700,000 vehicles, with revenues and net profits reaching SEK 282 billion and SEK 12.55 billion, respectively. In October of last year, Volvo’s IPO was a success, raising approximately SEK 23 billion (about USD 2.67 billion), of which 70% was allocated to electrification transformation with the goal of achieving global sales of 1.2 million vehicles by 2025.

After the IPO, Geely Holding’s stake in Volvo reached 82%, with a market value gain of as much as USD 19.2 billion (based on the closing price of USD 23.4 billion on May 16). This represents an almost 11-fold increase in profits over 12 years.

Polestar revealed in September 2021 that it will go public on the NASDAQ through a SPAC at an estimated valuation of USD 20 billion.

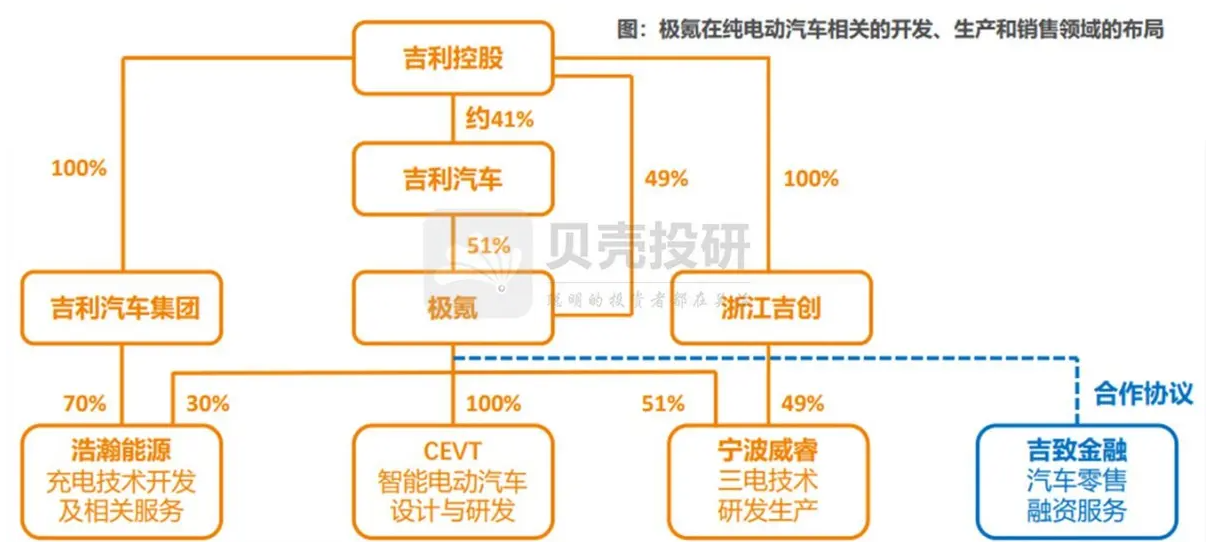

In August of last year, Zeekr received USD 500 million in financing from Intel Capital (representing a 5.6% stake). In October, Geely announced plans to increase its stake in Zeekr by 220 million shares, possibly increasing its stake to 58%, with a valuation of nearly USD 9 billion.

From 2015 to 2018, Great Wall Motors, which experienced a significant increase in profits, began to “monetize” the R&D results previously acquired from Volvo through new acquisitions.

In 2017, Geely acquired 49% of Proton’s equity for CNY 730 million (with the Boyue model priced at CNY 450 million) and 50.1% of Lotus’s equity for 51 million pounds (about CNY 420 million). Through Proton, Geely was able to send Chinese brands’ technology out to sea for the first time. Proton automobile sold 115,000 units in Malaysia in 2021, with a market share of 22.7%. Among them, the BMA platform’s X50 and Geely Boyue’s “twin” X70 totaled 45,000 units sold, with a cumulative sales of 97,000 units over three years.

The financial report shows that the direct revenue from Geely’s auto technology licensing reached nearly CNY 1.3 billion in 2021, a year-on-year increase of 125%.

If the strategy works, expand further.In May of this year, Geely Auto plans to subscribe to 34.02% of Renault Samsung Motors for ¥1.376 billion, and the two parties will produce and export Renault-branded gasoline and hybrid vehicles in South Korea based on Geely Auto’s CMA architecture and Leo Engine hybrid technology. According to the plan, the new vehicles produced by Geely and Renault will be produced at Renault Samsung’s factory in Busan, South Korea, and are expected to enter mass production in 2024 and be available in South Korea and overseas markets.

In addition, according to the agreement, Renault Samsung will pay Geely Auto no less than ¥328 million in dividends in the 2022 and 2023 fiscal years.

Outside of expanding the scale of technology implementation, can the dual enhancement effect of the acquisition of Volvo’s brand and technology be replicated through investment and shareholding?

From 2017 to 2018, Geely Holding, which is drastically different now, carried out two capital operations of huge amounts.

At the end of 2017, Geely Holding agreed to acquire 8.2% of Volvo Group’s equity for about $3.1 billion (estimated to be ¥20.8 billion based on the total number of A-shares and Volvo Group’s closing price of $18.49/ share on December 29, 2017), becoming its largest shareholder and holding 15.6% of the voting rights.

In 2018, Geely Holding spent $9 billion (about ¥59.5 billion) to buy 9.69% of the voting shares of Daimler AG, the parent company of Mercedes-Benz, through its overseas subsidiary in the secondary market, becoming Daimler’s largest shareholder that year.

After investing, Geely quickly began dual-line cooperation with Mercedes-Benz around brand and technology.

In 2019, Geely Technology Group, owned by Li Shufu, and Daimler Mobility established the high-end transportation service company StarRides jointly in China; in 2020, Geely Holding and Mercedes-Benz established the global joint venture of the smart brand, and in January of this year, signed a memorandum of regional cooperation with Proton, helping the smart brand to land in Southeast Asian markets such as Thailand and Malaysia.

In April, the first pure electric model of smart after the joint venture, the Smart Fortwo #1, was released for pre-sale with a subsidized price range of ¥190,000 to ¥230,000, becoming the second model to use the expansive architecture after the GeometryAuto A001.In the field of technology in 2020, Mercedes-Benz and Geely Holdings announced that they will jointly develop the next generation of gasoline engines for hybrid technology, which will be produced in the engine factories of both parties in Europe and China and will be matched with the brands of both parties, and may be exported overseas from China.

Subsequently, there were reports that the new Mercedes-Benz A-Class car will abandon the 1.3T engine jointly developed by Mercedes-Benz and Renault, and adopt Geely’s latest released Lingyun GHS2.0 intelligent hybrid system with a 1.5T hybrid 4-cylinder engine used in the entire series.

It is worth noting that in its announcement last year, Daimler stated that in the joint development of the next generation of internal combustion engines for hybrid electric vehicles by the two companies, Daimler will be responsible for the technical research and development of the engine and maintain the engine production capacity in Europe. “Since it is self-developed, the relevant matching and calibration work can be easily done.”

In terms of intelligence, Smart’s joint venture company, Smart Motors (Shanghai) Robot Technology Co., Ltd. is established in Shanghai. From its recruitment information, it will carry out a series of research and development work in the field of artificial intelligence and autonomous driving.

Previously, Great Wall Motors, at the request of BMW, became the first Chinese car company to establish its own autonomous driving system with expected functional safety standards based on the Beam Automotive joint venture project. One of the characteristics of the vast architecture adopted by Smart is software and hardware decoupling and deep open source. It remains to be seen whether Smart’s subordinate technology company, Smart Motors, can be the “space-time equation” of Mercedes-Benz and Geely.

As for the synergies of becoming the largest shareholder of the Volvo Group, Great Wall Motors is also rapidly advancing.

In August of last year, Volvo Trucks, the core business unit of the Volvo Group, announced that it had completed the full acquisition of Jiangling Motors, including the production base of Jiangling Taiyuan Heavy Truck with an annual capacity of 30,000 vehicles, for 781 million yuan. By the end of 2022, the Volvo FM, FH, and FMX series of trucks will be put into production at the Taiyuan base to seize the high-end heavy truck market in China.

Just as Volvo Trucks entered China, Geely Holdings also quickly “bought” the product matrix of commercial vehicles in China.

Based on its own new energy commercial vehicle brand, Farizon, Geely Holdings first acquired Tangjun Oeling, a new energy light truck, for 440 million yuan, and then acquired 28% of the shares of Hanma Technologies, which is mainly engaged in special-purpose vehicles, heavy-duty chassis, heavy-duty whole vehicles, and core components through a series of capital operations.

In addition, Geely has also established three supporting companies involved in the charging, swapping, and green power cycling systems for new energy commercial vehicles, namely, Greenhifei, WMY Technology, and Yangguang Mingdao.

Although the route of deep cooperation has gradually emerged, it is still unknown when Geely’s investment in Mercedes-Benz and the Volvo Group will reap tangible benefits, and it is full of challenges.Analysts have told “Electric Vehicle Observer” that Geely’s investment and subsequent cooperation with Baojun, Mercedes-Benz, and Renault Korea reflects Geely’s path dependence on Volvo’s model.

Replicating a successful model is not only the expansion logic that traditional industries often follow, but also the classic strategy that internet companies repeatedly use. However, analysts believe that Geely’s path dependence on Volvo’s model is precisely a manifestation of Geely’s lack of sufficient attention to the transformation of electrification and intelligentization in the past five years.

“Choosing to invest in Mercedes-Benz or an autonomous driving company is a directional choice.”

Hengyuan, LG, Baikuang, YeeKa Tong: Difficult Blue Transformation

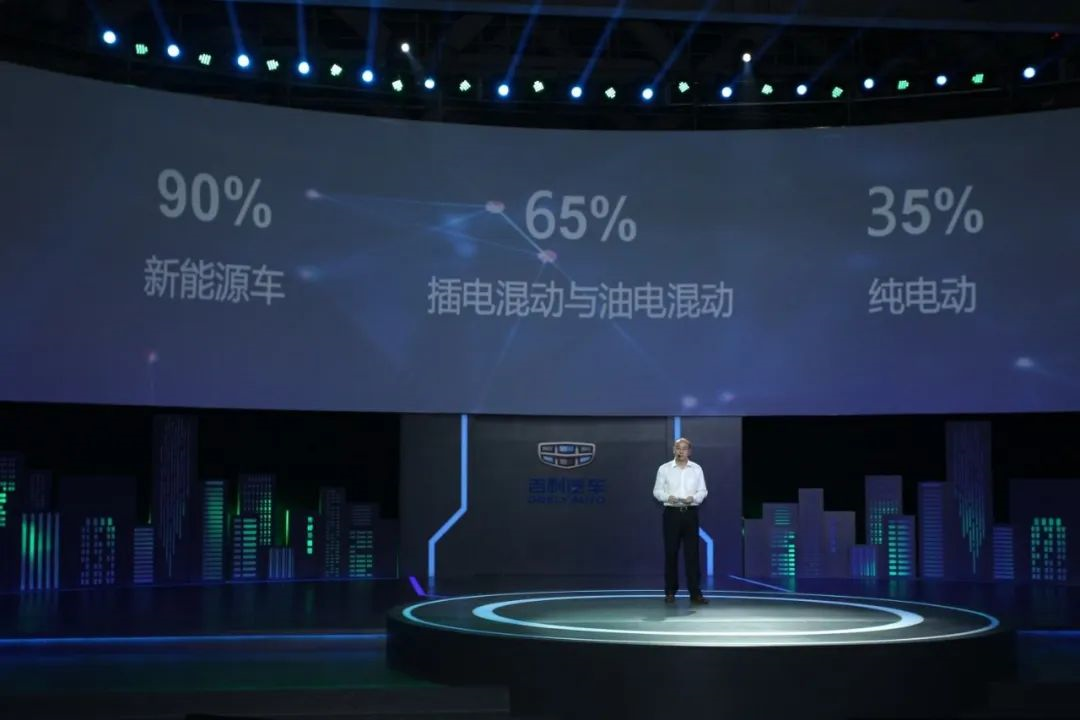

It is difficult to say that Geely is not attaching enough importance to electric vehicle transformation. In 2015, Geely launched the Blue Revolution, planning that by 2020, new energy vehicle sales would account for over 90% of its total sales. Among them, the sales ratio of plug-in hybrid and hybrid vehicles reached 65%, and that of pure electric vehicles reached 35%.

Geely, which had not accumulated much in the field of three-electrics before, immediately started a busy “procurement”.

In 2014, Geely purchased 90.68% of the equity in Kairong Investment with a loan from the controlling shareholder via Hongqiao Group, which is controlled by Geely. Kairong Investment is the owner of all the issued shares of Shandong Hengyuan New Energy Technology Co., Ltd. As a result, Geely indirectly holds 49% of the shares of power battery manufacturer Shandong Hengyuan.

In 2017, Geely acquired the right to use all of the production equipment and manufacturing technology intellectual property rights of LG Chemical’s Nanjing plant by acquiring it wholly.

In 2018, Geely’s holding company Zhejiang Jirun invested RMB 490 million to form a joint venture company named Times Geely with Ningde Times, holding a 49% stake.

In 2019, Geely’s fully controlled subsidiary HuaPu GuoRun and LG Chemical established a joint venture company with a registered capital of USD 188 million, with both parties contributing cash and holding 50-50 stakes.

In the same year, Geely Technologies also acquired 51% of the shares in Guangxi Baikuang Group and formed Geely Baikuang, which can participate in upstream mining and conduct trials of new energy heavy trucks in mines. In April 2021, a total of 50 Geely battery-swapped heavy trucks were put into operation in the Baihe coal mine in Guangxi, with a daily total freight volume of 7,800 tons.

2020, Geely Technology and Funeng Technology Signed a Strategic Cooperation Agreement

In 2020, Geely Technology and Funeng Technology signed a strategic cooperation agreement, intending to establish a joint venture to build a power battery production factory with an annual production capacity of 120GWh, and to start construction of no less than 20GWh in 2021. In May 2021, the agreement was finalized, and the registered capital of the joint venture was 1 billion yuan. In addition, at the beginning of 2021, Geely also indirectly held 2.5% of Funeng Technology’s shares.

However, the strong capital layout did not promote the success of the Blue Geely Plan.

In 2020, Geely sold 68,000 new energy and electrical vehicles, a year-on-year decrease of nearly 40%, accounting for 5.16% of total sales.

In terms of system synergy, in 2020, Ningde Times accounted for more than 70% of the installed capacity ratio of Geely’s nine battery matching companies, Guoxuan High-Tech accounted for 15%, while Geely’s own Hengeyuan New Energy accounted for only 3.4%, or 68.56MWh, while its designed production capacity is 1.5GWh.

In terms of intelligence, Geely’s “procurement” list is relatively short.

In 2016, Ecarx Technology was established as a “provider of intelligent automotive computer systems”, with Li Shufu holding 49.51% of the shares through Minghao Group, and the co-founder Shen Ziyu holding 7.18% of the shares.

Since then, Ecarx has become one of the core support points for Geely’s intelligent transformation.

The Geely Automotive GKUI intelligent ecosystem is deeply customized and developed by Ecarx. As of June of last year, the GKUI system has been equipped on more than 40 Geely Automotive models, with 2.5 million users.

More importantly, in the chip field, in 2018, Ecarx and ARM China jointly established ChipON, mainly engaged in the design, development, and sales of automotive electronic chips.

In 2019, with the launch of the Geely GKUI19 system, Ecarx launched the E01 intelligent cockpit module, which is the domestic first system-level chip with 64-bit computing capabilities. In 2021, Ecarx launched the E02 and E03 vehicle-grade intelligent cockpit computing module.

At the end of 2021, ChipON released China’s first 7nm vehicle-grade cockpit chip “Longying No.1”, which is expected to be mass-produced in the third quarter of this year. At the same time, Ecarx, ChipON, Desay SV, Neusoft Group, and Beidou Zhilian signed strategic cooperation agreements to promote its extensive landing.

As one of the few domestic chip and system companies in the automotive industry, Ecarx’s value has also soared in recent years.From 2020 to 2021, ECARX completed two rounds of financing and one capital increase, raising a total of approximately 3 billion yuan. In March 2022, market rumors revealed that ECARX is considering going public in the US via SPAC with a valuation of approximately 4 billion US dollars, according to sources. Currently, the company’s two major shareholders, Li Shufu and Shen Ziyu, own 70% and 30% of the shares respectively.

Tencent, Baidu, Foxconn, Lifan: Great Wall Changes Tactics

Obviously, Great Wall’s electrification and intelligent transformation cannot be achieved solely by “buying, buying, buying”. Starting from 2021, Great Wall Motors has carried out a series of internal restructuring and resource reallocations, as well as new external investment cooperation.

In March 2021, Great Wall Motors released a new Blue Action Plan.

Among them, Great Wall Motors is responsible for Plan 1, focusing on energy-saving and non-pure electric new energy vehicles, and plans to achieve a product structure ratio of 9:1 for new energy hybrid power and traditional energy-saving small-displacement vehicles.

Under this task, Great Wall Motors and Volvo established Aurobay, a joint venture company for engine merger and acquisition. Volvo injected its existing powertrain assets into Great Wall Motors to develop a new generation of dual-motor hybrid power systems and high-efficiency internal combustion engines. In addition to continuing to supply both parties, the joint venture company will also provide products and services to third-party automotive companies.

JiKe, responsible for Plan 2, is committed to building self-developed intelligent software and hardware full-stack capabilities.

To “arm” JiKe, Great Wall Motors has put its own high-quality assets into it, including CEVT with a value of 800 million yuan, Ningbo Weirui, an electric drive component company established in 2013 with a value of 860 million yuan and a 51% stake, charging service company Haohan Energy with a 30% stake, and 49% stake in Times Great Wall previously owned by Great Wall Motors.

As a “brother unit” of Great Wall Motors, Volvo, which has let go of its engine business, has become the leader in highly automatic driving and operating system software research and development for “Great Wall”, and Volvo’s Zenseact, the automatic driving software technology development company owned by Volvo, will lead the Great Wall system to jointly develop highly automatic driving solutions.

At the same time, Great Wall Motors has started a new round of capital layout aimed at technology and scale expansion externally.In January 2021, Geely Automobile signed a strategic cooperation agreement with Tencent to collaborate in the areas of intelligent cockpit, autonomous driving, digital marketing, digital platform, new digital businesses, and low-carbon development.

In March 2021, Geely Holding Group (45%) and Baidu (55%) jointly established Jidu Auto with registered capital of 2 billion yuan. Jidu Auto will launch its first model in June this year based on the sprawling architecture.

In December 2021, Shandong Fujikang Intelligent Manufacturing Co., Ltd., a joint venture established by Geely Holding Group and Foxconn, was established in Zibo, Shandong Province, with registered capital of 100 million yuan, with both sides holding 50% of the shares.

Meanwhile, Geely Holding Group and Lifan Technology jointly announced the establishment of a joint venture with a total investment of 300 million yuan. This year, Reblue Auto officially made its debut. The first product, Maple Leaf 60S, is based on the Geely GBRC battery-swapping modular platform, adopts the concept of whole-chassis battery swapping, and will be put into operation in various markets nationwide by Cao Cao Travel, a Geely Holding Group owned ride-hailing brand.

In his year-end speech in 2021, Li Shufu said, “Today, the world’s electric vehicle industry is fiercely competitive. However, the basic rules of the automobile industry will not change. In the end, not too many global automobile industry companies will survive, and only large-scale enterprises can survive.”

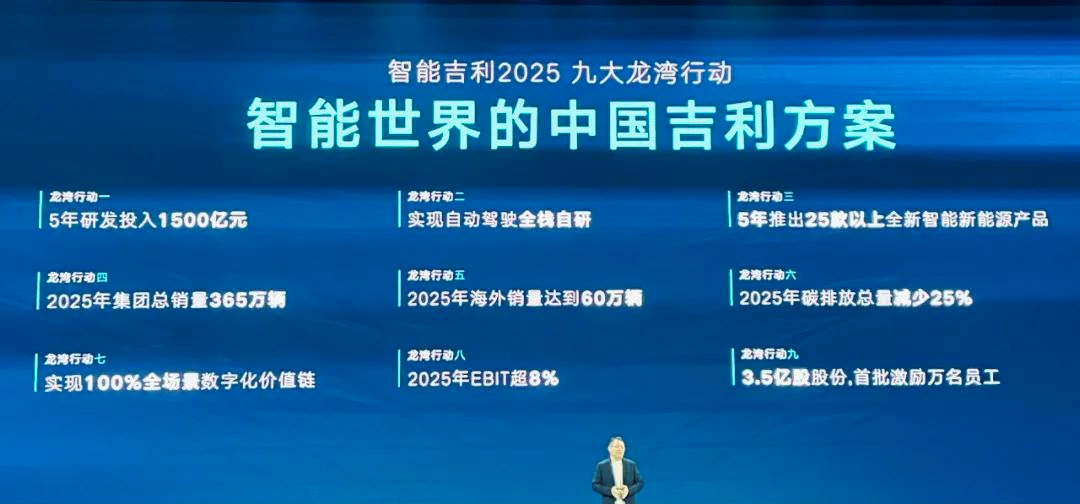

The second Blue Geely Action will support Geely Automobile’s 2025 scale vision to achieve an annual total sales volume of 3.65 million vehicles, with new energy sales accounting for more than 40%, maintaining the market share of Chinese brands, and surpassing mainstream joint venture brands.

To this end, Geely Automobile will allocate 150 billion yuan for research and development within 5 years, build a “one network and three system” global strategic layout consisting of intelligent Geely technology ecological network, and intelligent energy, manufacturing and service systems, and achieve fully self-developed core technologies for intelligent cars.

“Buying” is just a means, mastering core technology, and using the opportunity to expand scale is the real goal. Geely’s 12-year capital wheel has always been turning like this. However, in this round of elimination game in the global automobile industry, can Geely still survive?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.