Author: Zhu Yulong

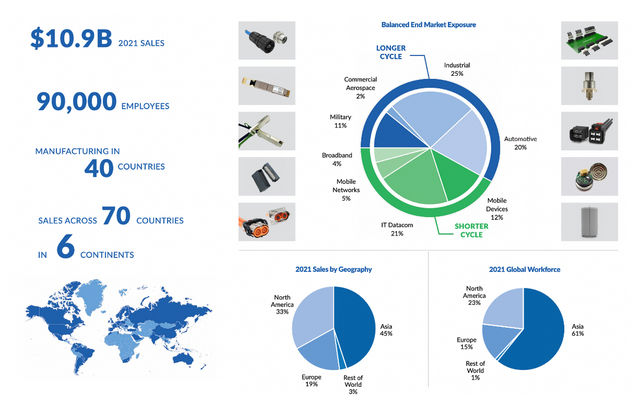

Recently, I have spent a lot of time exploring the mid-level industry to find the growth path of the company. In the field of connectors and sensors, Amphenol is very interesting. Through the acquisition of 22 companies in the past, Amphenol has established a complete business structure. In 2021, Amphenol had a revenue of US$10.9 billion, with the automotive business accounting for approximately 20% of the company’s business (connectors and sensors accounting for 96%).

From the perspective of employee and sales layout, 61% of Amphenol’s employees are in Asia, mainly focusing on the three markets of Asia-Pacific, Europe and North America. Its business covers stable businesses (industrial, automotive, military and aerospace) and rapidly changing businesses (mobile devices, communication networks, etc.). It is a very balanced company.

The history of Amphenol

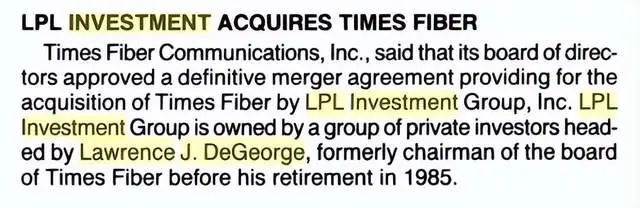

Amphenol was founded in 1932 and is headquartered in Connecticut, USA. It is one of the world’s largest connector manufacturers. In 1984, Amphenol began to enter the Chinese market. Actually, this company is quite interesting. Amphenol was a department of Allied Signal and was split from Allied Signal in 1987 for US$439 million (with a sales revenue of US$500 million at that time) to LPL Group, a family business whose management is Mr. Lawrence J. DeGeorge, who mainly buys and sells other companies and arranges financing through its subsidiary LPL Investment. Mr. DeGeorge, the founder of Times Fiber communication company, started a legendary journey through financial means. Dissatisfied with the operating mode of Insilco, he bought back the founding company and acquired Amphenol in 1987, becoming the chairman of the company. The company was listed on the New York Stock Exchange in 1991, and the DeGeorge family collectively owns approximately 30% of the voting rights shares of Amphenol, making them the largest shareholder.

In 1996, the octogenarian decided to retire and liquidate his holdings, but he was unwilling to entrust his company to competitors or inexperienced managers. After communicating with several potential buyers, DeGeorge selected KKR, a legendary private equity investment company headquartered in New York, USA, which managed numerous investment funds and focused on leveraged buyouts of mature enterprises, having completed over $400 billion in private equity transactions (representative in the field of leveraged buyouts).

In 1996, the octogenarian decided to retire and liquidate his holdings, but he was unwilling to entrust his company to competitors or inexperienced managers. After communicating with several potential buyers, DeGeorge selected KKR, a legendary private equity investment company headquartered in New York, USA, which managed numerous investment funds and focused on leveraged buyouts of mature enterprises, having completed over $400 billion in private equity transactions (representative in the field of leveraged buyouts).

KKR was interested in companies that could generate stable cash flow, had low debt ratios, and ample funding. The result of the transaction was that they hoped to retain most of the existing management team and introduce greater financial leverage into the company.

In 1997, KKR invested $341 million in equity capital and $990 million in leveraged funds to acquire AMP, holding approximately 75% of the shares after completion of the acquisition. This is considered a classic case of a leveraged buyout.

Thereafter, AMP’s management continued the investment company’s style, pursuing outward expansion through mergers and acquisitions, acquiring multiple connector and sensor companies in 22 transactions, and covering product lines in military, aviation, aerospace, and communications, among other fields.

Most of these mergers and acquisitions were of the horizontal variety, expanding the application areas of connectors through the direct acquisition of competitors and targets from PE funds. They acquired Singapore’s Fu Jia Yi Connector for $1.275 billion and MTS Systems for $1.7 billion afterwards.

In terms of its sensor business, the purchase of GE’s sensor division was a critical starting point. From the current product structure, AMP’s sensor business includes gas humidity, liquid level, position, pressure, and vibration sensors; in the connector field, it covers fiber optic, high speed, power, and radio frequency, gradually covering all categories.

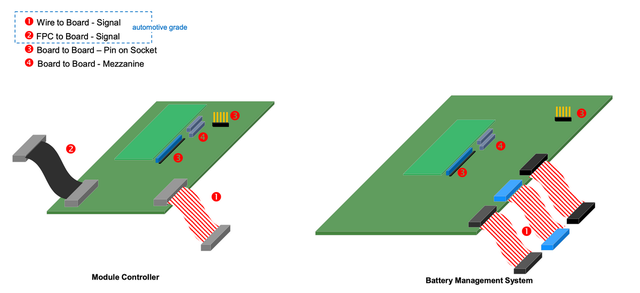

Regarding the automotive business, AMP has a comprehensive product line in the design and manufacture of connector systems, sensors, and modules for a wide range of automotive applications.In the automotive industry, Amphenol’s business accounts for approximately 20% of the $10.2 billion, or about $2.05 billion, and mainly includes various wire harnesses, connectors, and the like. The major components are FPC and connectors in CCS, high-voltage connectors, and so on. This company’s management style is somewhat similar to GE’s segmentation management, with elements of Chinese private enterprises infused into the American management style, making it a very interesting enterprise.

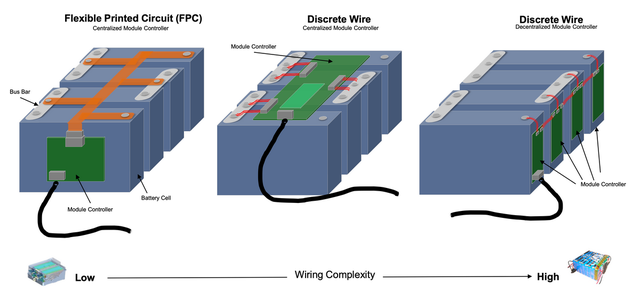

Taking the design in the battery system as an example, expanding business should be achieved by improving the overall plan of wires and connectors through various schemes, as shown below by the module FPC scheme and side-connected scheme.

This kind of plan very much tests the ability of the entire plan during the process of development, simplifying purchasing complexity through a complete set of schemes. Many connectors originally used in the industrial and other fields need to adjust their design to meet the requirements of cars.

Summary: From the perspective of internal enterprise development, expansion has its limitations. In the field of connectors and sensors, Amphenol still has a legendary color in its past. I feel that in the future, with the mutual penetration of Chinese industry and finance, investment in the field of mergers and acquisitions and integration may be a difficult but interesting path to take.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.