Sales and prices take off together!

Author: CH_Chen

Preemptive Defense Against Dispute:

Don’t ask for the sales data of Tesla and BYD yet!

In March, the prices of domestic new energy vehicles rose in general. However, this did not seem to affect the popularity of new energy vehicles. Even a sentiment of “buying up and not buying down” emerged in the market. This not only attracted more attention to previously popular models, but also ignited the second-hand market for new energy vehicles.

On April 1st, the “new vehicle” companies in China as usual released their delivery performance report for last month. This month, four “new vehicle” companies had sales exceeding 10,000, but there were significant changes in the sales rankings. Let’s take a look together.

XPeng: 15,414 deliveries in March, 34,561 in Q1

After temporarily relinquishing the top position in February due to factory retooling, XPeng Motors regained the top spot in “new vehicle” sales with strong sales performance in March.

In March, XPeng Motors delivered a total of 15,414 new cars, an increase of 148% month-on-month and 202% year-on-year. The cumulative delivery volume in the first quarter reached 34,561, which is 2.6 times that of the same period last year. Thus far, the historical cumulative delivery volume of XPeng Motors has exceeded 170,000 units.

Among the sales in March, the XPeng P7 was still the absolute mainstay with deliveries exceeding 9,000 units for the first time, reaching 9,183 units, just one step away from breaking the 10,000 monthly sales per vehicle threshold. The other sedan, the XPeng P5, showed significant growth in sales, with deliveries of 4,398 in March and cumulative deliveries of 10,486 in the first quarter, up 38% from the fourth quarter of last year. In addition, the delivery volume of the XPeng G3 series was 1,833 units.With the continuous expansion of the new energy market, the sales of XPeng’s two sedan models have continued to grow. Next, XPeng’s new flagship SUV, the XPeng G9, is also about to be launched and will be delivered in September. According to this trend, XPeng Motors will have a great opportunity to retain its title as the “newly-manufactured car” annual sales champion this year.

NIO: 12,026 delivered in March, 30,162 in Q1

In March, “newly-manufactured car” sales runner-up was still NIO! NIO Motors continued to rank among the top-selling “newly-manufactured cars” with its two models.

In March, NIO Motors delivered a total of 12,026 vehicles, a year-on-year increase of 270%. Among them, the delivery volume of NIO V was 8,122 and the delivery volume of NIO U was 3,904. In the first quarter, NIO Motors delivered a total of 30,152 vehicles, a year-on-year increase of 305%, ranking third among “newly-manufactured cars,” second only to XPeng and Li Auto.

Recently, NIO has started the preheating of its new flagship sedan, the NIO S. Whether it can successfully attack the mid-to-high-end market this year remains to be seen!

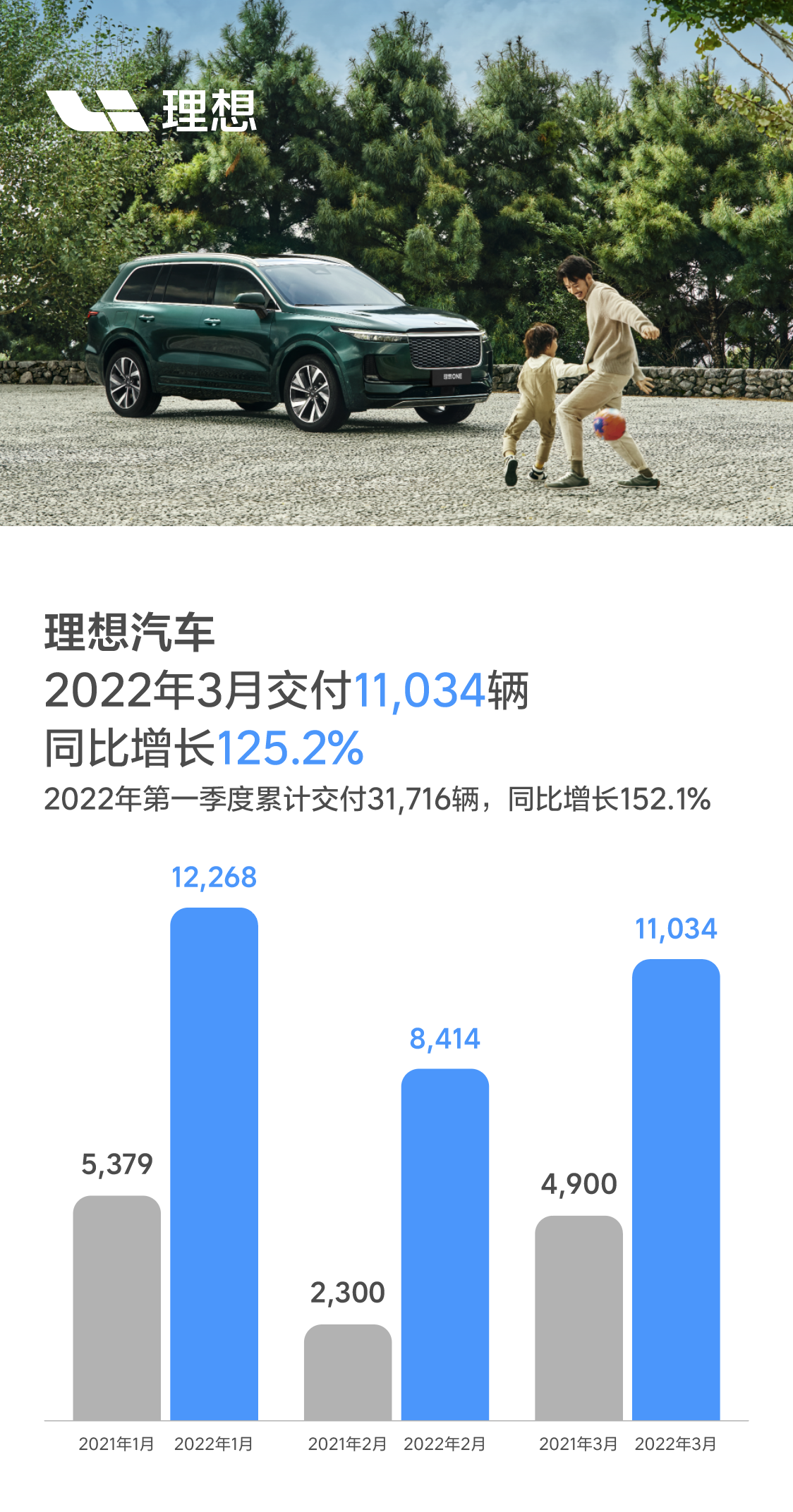

Li Auto: 11,034 delivered in March, 31,716 in Q1

After winning the “newly-manufactured car” sales champion in February, Li Auto was affected by the Yangtze River Delta epidemic in March, resulting in a shortage of some auto parts and affecting its delivery volume.

In March, Li Auto delivered a total of 11,034 Li ONE vehicles, a year-on-year increase of 125.2%, and Li ONE continued to steadily occupy the top spot on the “newly-manufactured car” sales chart. In the first quarter of this year, Li Auto’s cumulative delivery volume reached 31,716 vehicles, a year-on-year increase of 152.1%, second only to XPeng Motors among the “newly-manufactured car” camp. So far, Li ONE’s historical cumulative delivery volume has reached 155,804 vehicles.

Last month, Li Auto had launched its new flagship SUV, the Li Auto L9, which is positioned as a luxury three-row family car in the price range of 450,000-500,000 yuan. Based on official reports, the larger size, more luxurious interior, and higher level of intelligence of the Li Auto L9 compared to the Li ONE will be completely upgraded. Whether Li Auto can create another explosive model in the 400,000-500,000 yuan price range is worth looking forward to.

Leapmotor: 10,059 delivered in March, 21,579 in Q1

Who would have thought that LI Auto’s deliveries in March not only exceeded 10,000 for the first time but also ranked fourth among “newly established automakers.”

Who would have thought that LI Auto’s deliveries in March not only exceeded 10,000 for the first time but also ranked fourth among “newly established automakers.”

“In March, LI Auto delivered 10,059 vehicles, an increase of 193% compared to the previous month, and the year-on-year growth rate of monthly deliveries exceeded 200% for 12 consecutive months.” In the first quarter of this year, LI Auto delivered a total of 21,579 vehicles, an increase of 410% year-on-year. It’s worth noting that the number of vehicles delivered by LI in March has already exceeded the total number of vehicles delivered from January to May last year, with a strong increase.

However, LI has not yet announced specific sales figures for each model. After a significant price increase of RMB 20,000 in March, the LI C11, which was once known as the “SUV with the highest cost performance under RMB 200,000” has greatly weakened its cost advantage. The sales trend of LI’s models requires further observation.

NIO, in March, delivered 9,985 vehicles, an increase of 37.6% year-on-year. In the first quarter of this year, NIO delivered 25,768 new vehicles, an increase of 28.5% year-on-year, and has maintained positive growth for eight consecutive quarters. So far, NIO’s accumulated delivery volume has reached 192,838 vehicles.

In March, NIO’s ES6 was still the main sales force, delivering 5,064 vehicles. In addition, NIO’s EC6 delivered 3,032 vehicles, and NIO’s ES8 delivered 1,726 vehicles. The delivery volume of NIO’s newly launched ET7 on March 28 was 163 vehicles.

Despite being ranked fifth in delivery volume in March, NIO’s performance is in line with expectations considering its average car price of over RMB 400,000. Next, the NIO ET7 will make a greater contribution to sales volume, the new large five-seater SUV ES7 will be released in May, and the NIO ET5 will be delivered in September. NIO’s sales explosion is still to come.

In March, due to the impact of the epidemic and chip supply, Jidu Auto delivered 1,795 vehicles. In the first quarter, Jidu delivered 8,241 Jidu 001, and the cumulative delivery volume reached 14,248.

According to Jidu’s official statement, they still have a large number of backlogged orders awaiting delivery, but the production and supply situation in April will be greatly improved, and it is expected that delivery volume will see a significant rebound.## Huachen: Delivery of 1,689 Z03s in March, with orders reaching 3,016

In March, Huachen Automobile delivered a total of 1,689 Z03s and received 3,016 orders, with a year-on-year growth rate of 8,000%. However, the company has not disclosed its overall sales and first-quarter accumulative sales data.

Formerly known as GAC NIO, Huachen Automobile has become well known since it became a major shareholder in Zhuto, Guangdong, and has achieved significant growth in sales. How to use its abundant resources to narrow the gap with first- and second-tier “new car” companies is a topic that Huachen needs to study this year.

Voyah: Delivery of 1,400 cars in March, with accumulative sales of 3,693 in the first quarter

In March, Voyah Automobile delivered 1,400 cars, with first-quarter accumulative sales reaching 3,693 and a historical accumulative sales total of 10,484.

On April 7th, Voyah will launch its second car model, the medium-to-large luxury electric MPV Dreamer, for presale. The new car will offer two power options – pure electric and extended range – and two layouts, 6/7 seats and luxury 4 seats, marking the first shot in the “new car” MPV market.

GAC Aion: Sales of 20,317 in March, with first-quarter sales of 44,874

Strictly speaking, GAC Aion cannot be considered a “new car” company, but it is adopting the attitude of wanting to become one by introducing third-party capital for mixed ownership reform. Releasing sales data on the first of every month is the first step for them.

In March, GAC Aion achieved sales of 20,317, a year-on-year growth rate of 189%. In the first quarter of this year, GAC Aion sold 44,874 vehicles, and the AION Y, AION S Plus, and AION V Plus all have strong competitiveness in their corresponding markets.

In February, GAC Aion completed the expansion of its factory’s production capacity, doubling its production capacity and laying a foundation for future sales growth.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.