On the night of November 5th around 23:10, NIO officially announced a strategic partnership with the world’s top ADAS giant Mobileye. To put it in a bit of a humorous way, this is the first time a new Chinese car company has allied with a world-class autonomous driving R&D enterprise.

As soon as this news came out, it immediately sparked widespread discussion, with different groups either being bullish or bearish on NIO. Many also attributed NIO’s 36% surge in stock price yesterday to the boost from the Mobileye partnership.

How should we view this partnership?

Why 23:10? At that time, I felt that this timing was not in line with NIO’s style. Even if it’s a small-scale workshop, NIO would prepare in advance in order to achieve the best dissemination effect. This “sudden attack” is more like Tesla’s style.

The answer was soon revealed – at the same time that NIO announced the partnership, Amnon Shashua, President, CEO & CTO of Mobileye, held an investors summit at the Mobileye headquarters in Jerusalem to announce Mobileye’s next series of big moves – and the strategic partnership with NIO was one of them.

From both sides’ announcements, NIO’s announcement is more popular and geared towards the general public, while Mobileye continues its high-density informational style.

NIO summarized the partnership into two things: “joint development with Mobileye for L4 autonomous driving vehicles” and “Mobileye’s bulk purchase of NIO special edition vehicles for smart travel services.” NIO didn’t focus too much on the details of the partnership.

However, from Mobileye’s announcement and sharing at the investor summit, it appears that NIO’s autonomous driving strategy has undergone a certain degree of adjustment and the partnership between the two parties will have a wide and far-reaching impact.

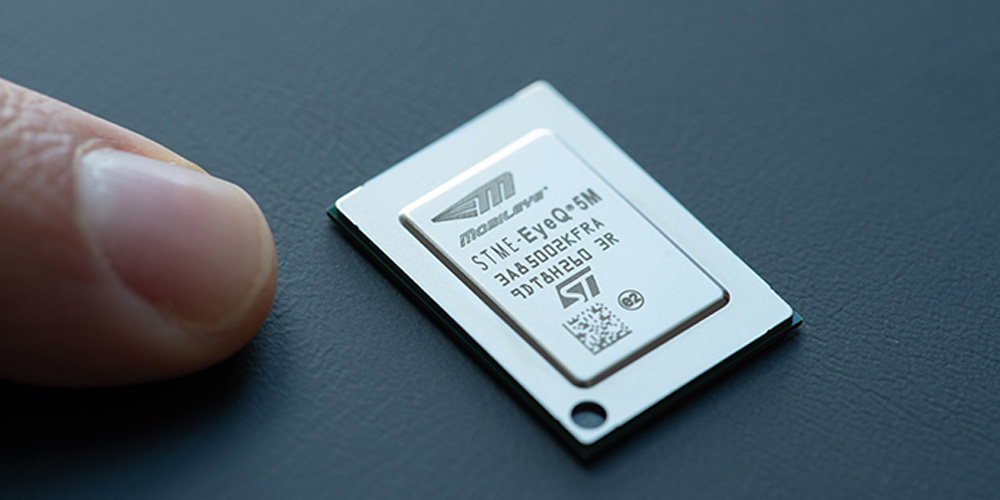

NIO’s alliance with Mobileye, a shift toward pure vision L4?Apart from the Tesla controversy in 2016, Mobileye EyeQ series ADAS products have shipped more than 50 million units cumulatively since its commercialization in 2008, with a compound annual growth rate (CAGR) of 44% since the outbreak of global ADAS in 2014, thanks to Mobileye’s deep technological accumulation in the field of computer vision and reinforcement learning technology-driven ADAS.

In NIO’s announcement, we saw Mobileye blurredly described as “a provider of leading Mobileye EyeQ system chips and related software.” However, we also did not see the typical flowerpot-shaped lidar on Mobileye’s autonomous driving car. Does this mean that NIO’s L4 level autonomous driving technology will abandon the multi-sensor fusion route, including lidar, and turn to a pure visual L4 perception path?

In fact, as early as May this year, Mobileye announced the establishment of a new sensor department, LiDAR.AI. The name of this department is very descriptive, and the team of this department comes from Eonite Perception, a start-up acquired by Mobileye’s parent company, Intel, in November 2018, which is dedicated to using lidar for 3D mapping, tracking, and recognition.

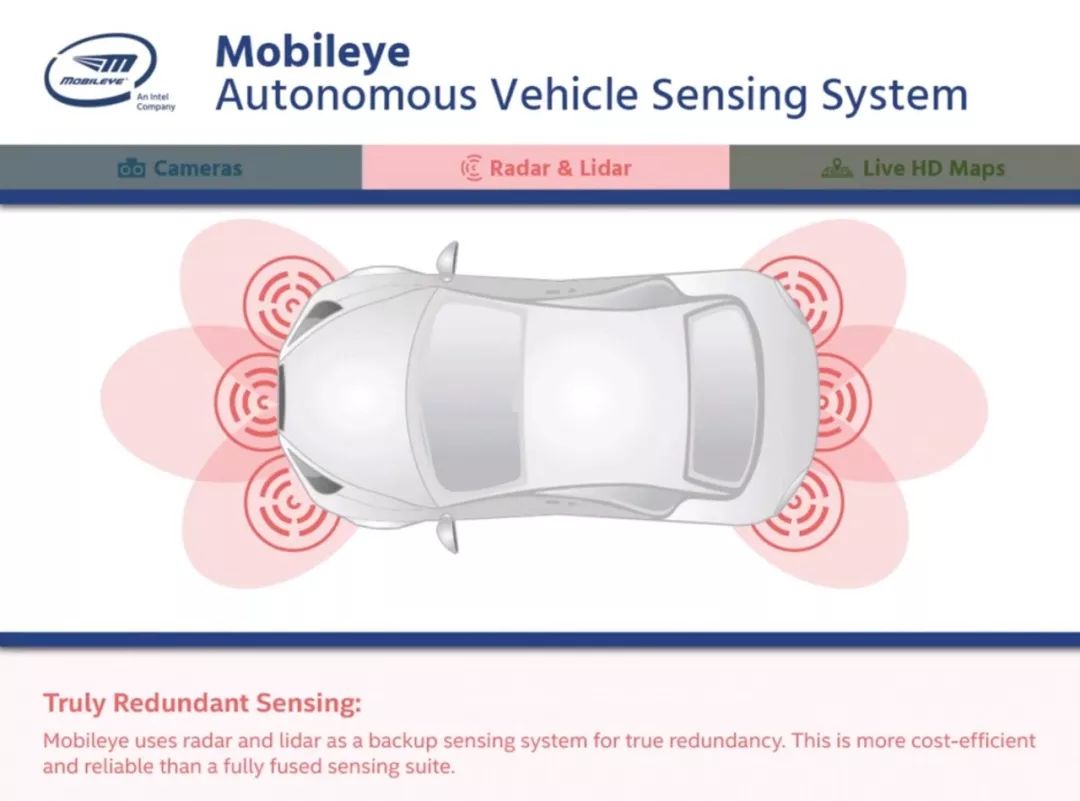

In Mobileye’s official video of the autonomous driving car perception system, it clearly indicates that the three levels of perception for autonomous driving cars are cameras, millimeter-wave radars & lidars, and high-precision maps.

In another picture, Mobileye also shows the specific layout of the millimeter-wave radar & lidar. Of course, Mobileye, which originated from vision, regards millimeter-wave radars & lidars as perception backups to achieve redundancy of the perception system. This also means that the position of the camera as the main sensor in the autonomous driving system of Mobileye is still unshakable.

You may say that this is only Mobileye’s autonomous driving system, and whether it is this system that works with NIO is still uncertain.

Don’t worry, keep reading.

How do NIO and Mobileye divide their work?

This is a question that all groups concerned about NIO are paying attention to. In the How it works section of Mobileye’s official announcement, Mobileye details the work that both parties need to do in the collaboration.

Simply put, Mobileye will provide NIO’s L4 autonomous driving suite, which includes EyeQ series chips, hardware, driving decision-making, safety software, and map drawing solutions. NIO will be responsible for completing the engineering, integration, and mass production of autonomous driving vehicles based on Mobileye’s L4 autonomous driving suite.

So what is the L4 autonomous driving suite mentioned here? Below the announcement, Mobileye provides a detailed explanation, including the necessary hardware, driving decision-making, and safety software.

-

Hardware: EyeQ5 chip, camera, millimeter-wave radar, LIDAR, power supply, modem, GPS, and other mechanical components

-

Driving decision-making: Mobileye’s proprietary reinforcement learning algorithm, path planning, and decision-making capabilities

-

Safety software: Mobileye’s RSS responsibility-sensitive safety model, which helps open and transparent safety decision-making for autonomous driving vehicles

In other words, in the development of L4 autonomous driving vehicles, NIO has significantly adjusted the development strategy of autonomous driving systems from NIO Platform 1.0 era to a form of cooperation with world-class autonomous driving companies on software and hardware development.

But we all know that NIO has built a large-scale autonomous driving research and development team in China and the United States. In addition to the iteration optimization of NIO Pilot and the “engineering, integration, and mass production of L4 suite” mentioned earlier, what other work will this team do? More accurately, in this collaboration, what other work is NIO responsible for?

At Mobileye’s Investor Summit, Amnon Shashua further explained the details of the collaboration with NIO using a PPT page.

In short, Mobileye is responsible for the hardware design and software (HW design + SW) of L4 autonomous driving suite, as well as high-precision maps. Here is the focus: apart from engineering integration and mass production mentioned before, NIO is also responsible for applying for the qualification of Chinese maps.

How important are maps to autonomous driving vehicles? Here is the screenshot again: as far as Mobileye is concerned, maps, cameras, millimeter-wave radar & LiDAR are equally important and constitute one of the three layers of perception for autonomous driving vehicles.

This also answers another question: Why does Mobileye cooperate with NIO?

At the CVPR conference in 2016, Amnon Shashua introduced Mobileye’s visual high-precision map and positioning scheme REM (Road Experience Management) for the first time, which is committed to a low-cost crowdsourcing approach to drawing high-precision maps covering the world.

With the mass production and installation of the EyeQ4 chip in 2018, the REM project officially started. After a year, how has REM progressed?

The above is the progress of REM in Europe and the United States. Mobileye expects to complete the coverage of the entire Europe in Q1 2020, and cover most of the United States by the end of 2020.

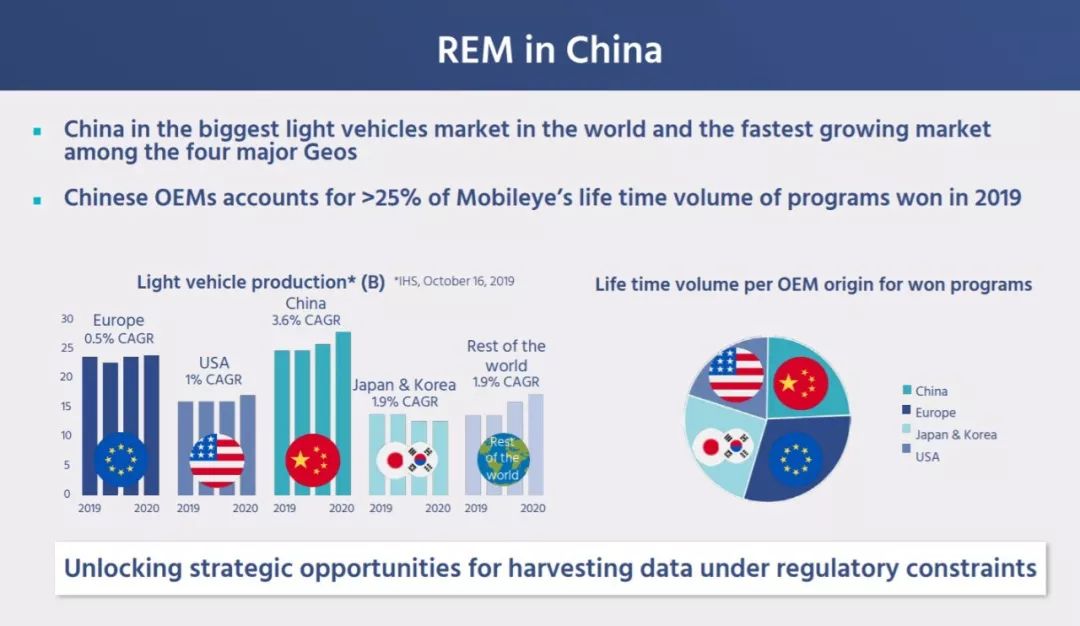

So what about China, the world’s largest automobile market?

As the world’s largest automobile market and the fastest-growing market among Mobileye’s four global regional markets (China, the United States, Europe, and Japan-Korea), Mobileye summarizes REM’s progress in China in one sentence: Unlocking strategic opportunities for harvesting data under regulatory constraints.

This is an euphemistic representation for investors, bluntly speaking, since the launch of REM project one year ago, there has been zero progress in China.

On the other hand, NIO ES8 is the first car model worldwide equipped with EyeQ4 chip, supporting the REM project, with a mass production time earlier than new BMW X5, new Nissan Teana and Volkswagen 9th generation Golf. This almost indicates that the promotion of REM in China is facing some challenges other than technical and commercialization: regulatory issues.

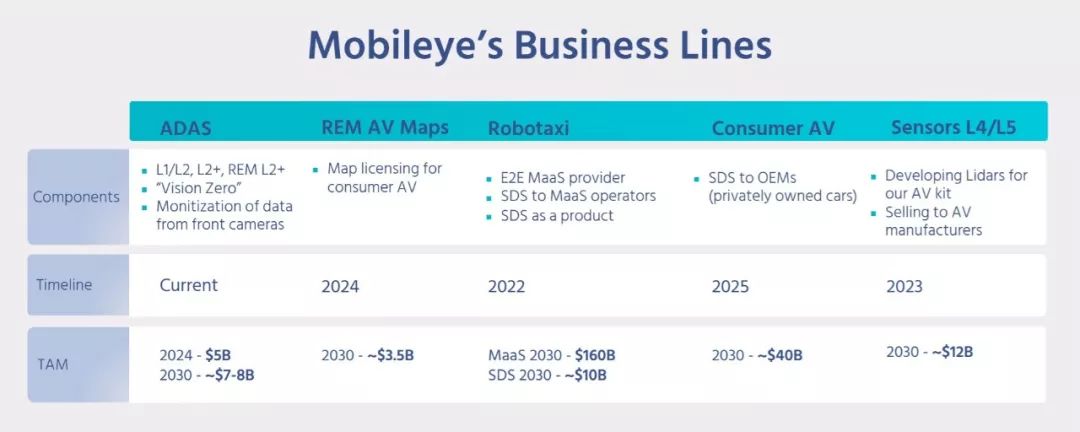

In Mobileye’s commercial blueprint, it plans to become an end-to-end autonomous driving travel service provider (E2E MaaS provider) by 2022 and provide self-driving solutions to other travel service operators.

These two points completely match the announcement at the beginning of the article: “working with Mobileye to create L4 autonomous driving models” and “Mobileye’s bulk purchase of NIO special edition cars for smart travel services”.

The background here is that as of the end of 2019, not a single frame of REM map in mainland China has been shot.

In view of this, the cooperation between NIO and Mobileye, as well as the division of labor between the two parties, is a natural fit.

The background of NIO’s adjustment

NIO founder Li Bin has repeatedly stated publicly that globally, only Tesla and NIO have the ability to independently develop the 6 core technologies of intelligent electric vehicles. These 6 core technologies are: motor, electronic control, battery pack, digital cockpit, intelligent gateway, and autonomous driving assistance.

Regarding autonomous driving assistance, NIO’s strategy has changed from “independently developing” to “cooperating with top suppliers for research and development”. What does this adjustment mean?

The fact that lies before us is that as of 2019,for top automakers persisting in independent R&D in autonomous driving technology throughout the world, Tesla is the only one left. Whether it is Volkswagen, GM, Mercedes-Benz, BMW or any other automotive giant you are familiar with, they have all formed alliances.

The interdisciplinary technologies and industrial chains involved in autonomous driving cars are so extensive that their volume is tens or even hundreds of times that of NIO’s giants who have chosen to cooperate in joint ventures to seek greater chances of winning. But Mobileye needs to answer a question: Why NIO?

The interdisciplinary technologies and industrial chains involved in autonomous driving cars are so extensive that their volume is tens or even hundreds of times that of NIO’s giants who have chosen to cooperate in joint ventures to seek greater chances of winning. But Mobileye needs to answer a question: Why NIO?

From a business perspective, as the first automaker in the world to adopt the EyeQ4 chip, NIO occupies an important position in Mobileye’s partner list. However, this alone is not enough to explain the problem. BMW or Volkswagen’s orders can easily surpass NIO’s within minutes.

From the perspective of technical division of labor, Chinese companies like NIO benefit a lot from their Chinese identity. High-precision maps are an indispensable part of the commercialization of autonomous driving cars, which has become a common consensus in the industry (except for Tesla). The fastest-growing but most regulated Chinese market has always been a stumbling block on Mobileye’s 10-year growth strategy toward commercialization.

Finally, from the perspective of commercialization timetable, NIO Platform 2.0’s first model is scheduled to be launched in 2022, while Mobileye’s schedule for the commercialization of their autonomous driving solution is also the same year. The urgent and consistent commercialization timetable of both parties has also played an important role.

With all the layers of screening, who else besides NIO, among Chinese automakers who have a long-term mutual trust with Mobileye and have a pressing need for commercialization of L4 autonomous driving technology, could be qualified?

The final question is left to the new automaker camp: NIO has already played the L4 card, what about you?

* William Li Bin: NIO is doing well with firm deployment of next-generation technologies

* William Li Bin: NIO is doing well with firm deployment of next-generation technologies

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.