Introduction

Recently, Ideal Automotive has established Sichuan Ideal Intelligent Dynamic Technology Co., Ltd, which includes chip design in its business scope. With Nio and XPeng already involved in chip design, Ideal Automotive has also joined the field of self-developed chips.

Self-developed AI control chip with high threshold

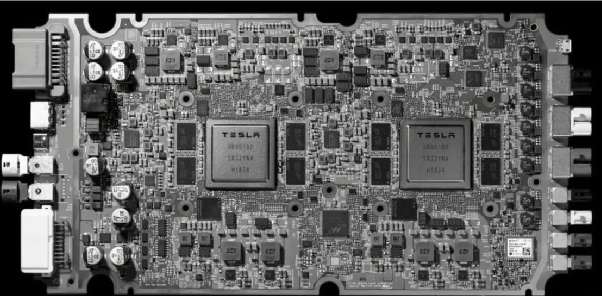

The earliest self-developed chip for an automaker was started by Tesla. Among them, we are most familiar with Tesla’s self-developed exclusive autonomous driving chip, which surpassed Nvidia’s general-purpose chip in computing power. Of course, this comparison is not fair to Nvidia, but the fact is that Tesla’s self-developed chip ability is commendable.

Later, Tesla began to build a supercomputer, Dojo. It is precisely with the support of this larger computing power chip that Tesla has opened up a completely different technical route from other automakers for autonomous driving: that is, through pure visual methods, without introducing laser radar, to continuously approach and eventually achieve L4-level autonomous driving functions.

Building an exclusive autonomous driving chip is of great significance for improving autonomous driving performance, but it is also very costly.

According to Semiengingeering, a well-known semiconductor technology research institution, the cost of developing a 7nm chip is as high as 297 million US dollars, and the cost of developing a 5nm chip exceeds 500 million US dollars. The Qualcomm Snapdragon 8155 chip, which is already deployed in the intelligent cockpit of many domestic car companies, is at the level of 7nm. Its R&D cost of nearly 300 million US dollars does not include the cost of wafer production after R&D.In addition, the labor cost is also a considerable expense. According to relevant data, Xilinx mentioned that it took 1500 engineers 4 years to successfully develop FPGA chips with 7nm process under the R&D code name Everest. Considering that senior chip engineers in China now have an annual salary of over 500,000 yuan, and GPU chips, which are even more difficult, are needed for autonomous driving/intelligent cockpit, the entire project team’s labor cost will be higher.

Chip outsourcing is always a sword of Damocles hanging over our heads

Regarding the ideal situation, one thing worth noting is how to find the foundry enterprise after designing a high-process chip by ourselves.

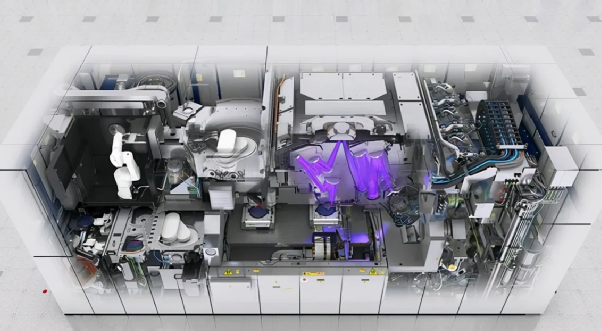

Currently, the most advanced process in China is only for processing 7nm chips, which means that if Ideal Research and Development is developing chips with 5nm or even higher levels, the foundry of these chips will depend on the few global chip foundry enterprises like TSMC and Samsung, and the relevant lithography machines are monopolized by Dutch enterprise ASML.

Looking at Huawei’s example, once domestic enterprises perform well and even overpower foreign enterprises, they will be listed in various sanction lists, including the Entity List. In this case, TSMC and Samsung will not provide them with chip outsourcing. This was the reason why Huawei had to withdraw from the smartphone market despite holding the leading Kirin chip and Hongmeng system.

Therefore, not only Ideal but also new forces in the automobile industry like NIO and XPeng need to be prepared. Once Chinese new forces in the automobile industry have truly gained the strength to confront Tesla and American car companies like Ford and GM on the global stage, the lessons of Huawei are likely to fall on them.

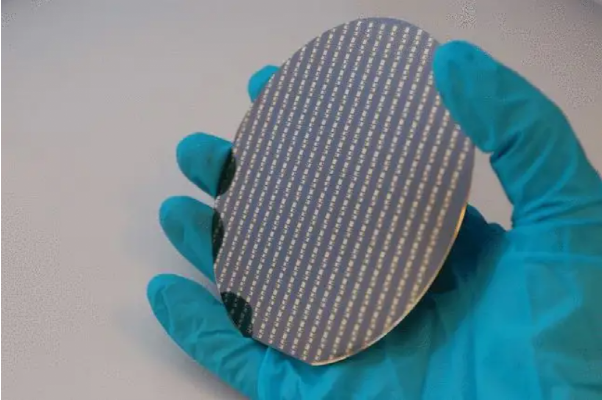

Silicon Carbide (SiC) Chips

In addition to the chips used for autonomous driving/intelligent cockpit, Silicon Carbide (SiC) chips are also an area that Ideal needs to pay attention to. Even compared with high-process AI main control chips, SiC chips have a wider range of applications and lower barriers to entry. For electric vehicles, the range and energy replenishment time are two areas that manufacturers are most concerned about, and it is precisely these two areas where SiC chips can show their skills.Introduction: Compared with traditional power chips such as IGBT, silicon carbide semiconductors only have half of the thermal energy loss of pure silicon chips, and the chip area is also smaller. Through the smaller energy loss, silicon carbide chips can reduce the workload of the cooling system of electric vehicles, reduce the weight of the vehicle, and ultimately improve the range of electric vehicles. In addition, through the infiltration of C atoms, SiC silicon carbide enables raw materials to support higher switching frequencies, which lays a solid foundation for the deployment of 800V high-voltage supercharging. Many vehicle and component companies, including BYD, Tesla, Bosch, and Infineon, are actively deploying SiC chips. From the perspective of Ideal Automotive, which recently established a joint venture with Sanan Optoelectronics to develop SiC chips and holds a 70% stake in the joint venture, the establishment of a chip design company may be related to further strengthening the deployment of SiC chips.

For new energy vehicle companies like Ideal Automotive, there are numerous things to do. However, entering the chip field requires better planning. It is necessary to sort out the most needed types of chips at present and integrate them with their future business, rather than being greedy and eager to develop high-process automatic driving AI control chips all at once. Taking small steps and moving quickly, pushing the chip company IPO at the right time, and developing in a rolling and fast-realizing way may be the best way for new energy vehicle companies that have not achieved profitability to develop chips.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.