According to the data from the National Bureau of Statistics, the added value of the automobile manufacturing industry in April 2022 decreased by 31.8% YoY. In terms of regions, the industrial added value above designated size in the Yangtze River Delta area decreased by 14.1%, and the industrial added value in the northeast region decreased by 16.9%, both due to the impact of the pandemic.

Under the influence of the pandemic, the automobile industry has been greatly affected in terms of both demand and supply. However, the recovery of automobile production capacity is relatively not difficult. As the pandemic prevention and control gradually improves, whether demand can quickly recover in a short period of time remains a big question mark.

Automobile retail accounts for about 10% of the total social retail sales. Whether automobile consumption can be restored has an important impact on stabilizing the economy and ensuring growth. This article will discuss what possible policy changes may occur in the automobile industry after the severe pandemic.

The Current Dilemma

People often say that confidence is more important than gold.

On April 18th, the National Bureau of Statistics announced that the GDP in the first quarter increased by 4.8% YoY.

On April 29th, the Central Political Bureau held a meeting to analyze and study the current economic situation and economic work, maintaining the unchanged target of 5.5% economic growth for the whole year and increasing the intensity of macroeconomic policy adjustments. This means that there is great pressure on economic growth in the next few quarters.

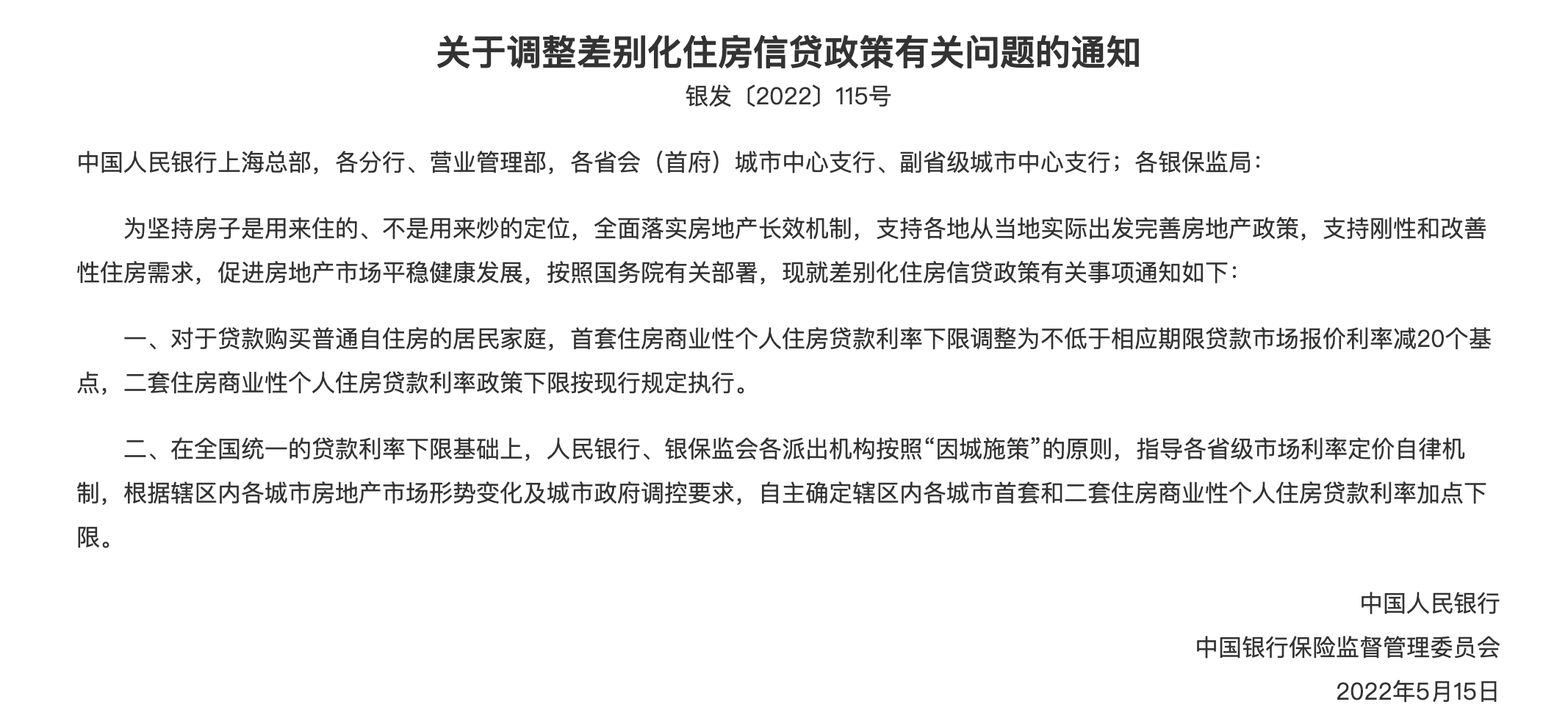

On May 15th, there was a strong signal, but friends in the automobile industry may not pay much attention to the news. The People’s Bank of China and the China Banking and Insurance Regulatory Commission released a notice on the adjustment of housing credit policies, stating that the lower limit of the interest rate for the first home commercial loan can be reduced by 20 basis points on the basis of LPR.

In other words, the lowest interest rate for commercial bank mortgages of more than 5 years can be 4.4%, while it was previously 4.6%. However, last year, the loan interest rates in many cities were higher than LPR, and some provinces and cities even reached 6.37%.

The background of the adjustment is that strict real estate regulation since last year has put great pressure on the real estate industry. In addition to the impact of the pandemic this year, from January to April, the sales area of commercial housing was 397.68 million square meters, a YoY decrease of 20.9%; the sales amount of commercial housing was CNY 3,778.9 billion, a decrease of 29.5%.

Based on an estimate of a loan amount of CNY one million, a loan term of 30 years, and equal principal and interest repayment, if the interest rate is reduced by 20 basis points, the average monthly payment can be reduced by approximately CNY 120, and the interest expenditure can be reduced by approximately CNY 40,000 in the next 30 years. The amount is not large, but the message conveyed is important, and many local real estate policies have also been implemented accordingly, which is aimed at changing expectations and boosting confidence.

In order to promote economic development, policies have already begun to take action.

And of course, what we care about is another important economic support besides real estate—the automobile industry.On May 16th, the economic data for April released by the National Bureau of Statistics showed that due to the increasingly complex international environment and the significant impact of domestic epidemic, the downward pressure on the economy had further increased. Major economic indicators, such as industry, services, investment, and consumption, all showed decline, with the value added of automobile manufacturing industry decreasing by 31.8% YoY in April.

According to China Passenger Car Association, in April, the retail sales of domestic passenger car market were 1.042 million, down 35.5% YoY and 34.0% MoM, setting the lowest record since the outbreak of COVID-19 in 2020.

Housing market downturn and depreciation of houses may be the main reason why many homebuyers choose to adopt a wait-and-see attitude. However, the reasons why people do not buy cars are often simpler – their income has decreased or their expectations for future income have decreased, so they postpone buying or choose cheaper and more economical cars.

On the one hand, economic recovery can boost people’s confidence in consumption and thus promote automobile consumption. On the other hand, automobile consumption can effectively promote economic recovery. The current difficulty lies in how to make this wheel turn effectively.

Short-term stimulus

On April 25th, the General Office of the State Council issued the “Opinions on Further Releasing Consumer Potential and Promoting Continuous Recovery of Consumption”, which mainly involves the following aspects concerning automobiles:

- Responding to the impact of the epidemic and promoting the orderly recovery and development of consumption

(7) Vigorously develop green consumption.

…… Support the accelerated development of new energy vehicles. ……

(8) Fully tap the consumption potential of counties and townships.

…… focusing on automobiles and home appliances, guiding enterprises to promote sales in rural areas, encouraging the promotion of new energy vehicles and green smart home appliances, and promoting the construction of supporting facilities such as charging stations (piles). ……

- Continuously deepen reforms and create a safe, trustworthy and credible consumption environment.

(13) Removing obstacles to consumption restrictions.

…… Stabilize and increase the consumption of large consumer goods such as automobiles. Regional authorities are not allowed to impose new restrictions on the purchase of automobiles. The areas that have implemented purchase restrictions should gradually increase the number of incremental indicators for automobiles and relax the qualification restrictions for car buyers. Encourage regions with purchase restrictions to implement differentiated policies on indicators between urban and suburban areas, and gradually cancel the purchase restrictions according to local conditions, and promote the transition of automobile and other consumer goods from purchase management to use management through laws, economics and science and technology. Establish and improve the management mechanism for the automobile modification industry, and accelerate the development of the automobile aftermarket. Fully cancel the policy of limiting the transfer of second-hand cars, and implement the measure of cross-provincial registration of small non-operating second-hand car transactions. Implement refined management of pickup trucks entering the city, and study further relaxation of restrictions on pickup trucks entering the city.

From this, we can see the three key points for promoting automobile consumption under the current circumstances, namely new energy vehicles, selling cars in rural areas, and removing purchase restrictions to fully unleash demand.

Stepping up efforts on new energy vehicles.Supporting the rapid development of new energy vehicles goes without saying. In the past decade, new energy vehicles have been favored by policies. Domestic new energy vehicles have also made themselves proud, achieving a magnificent turnaround from “unfavorable” to “delivery cycle of several months.” However, the “favoritism” of policies is ultimately limited, and the entire new energy vehicle is gradually moving from a “policy-oriented market” to a “market-oriented market.”

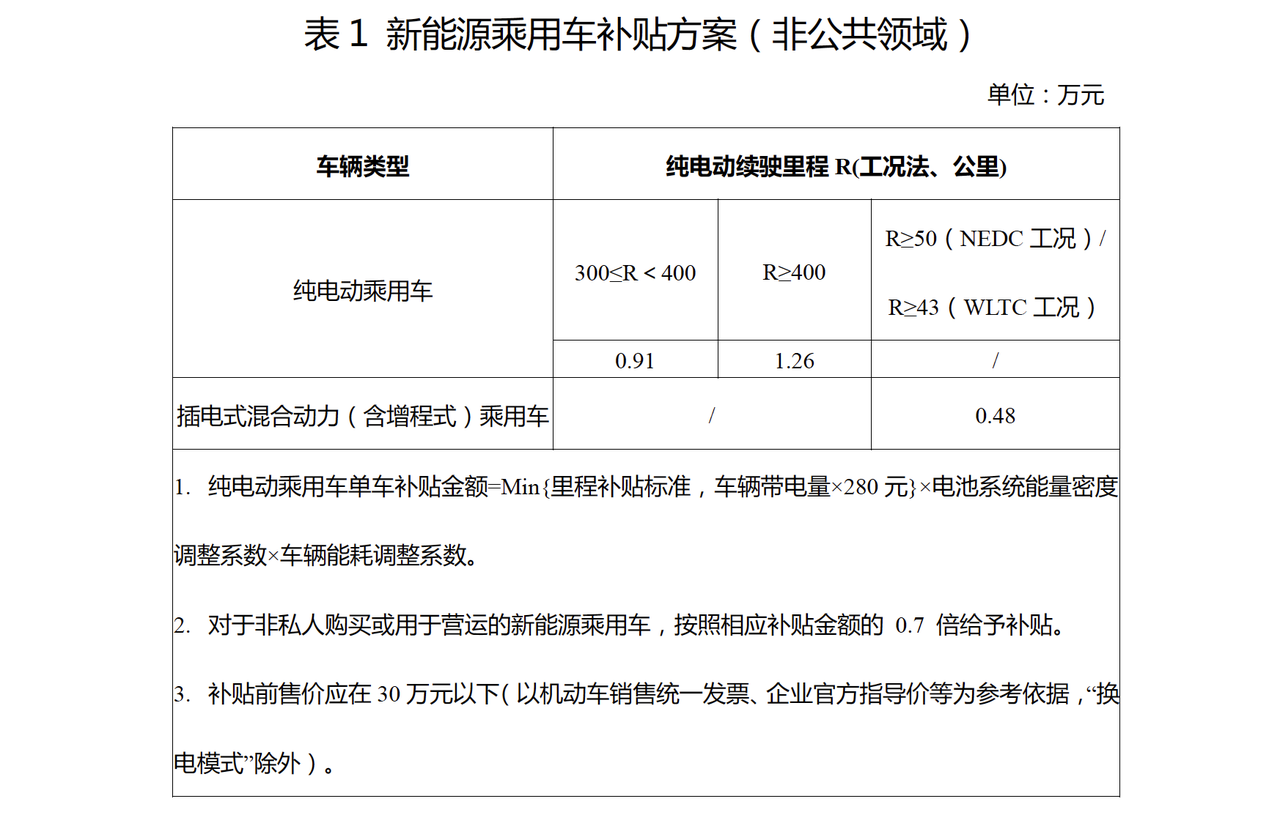

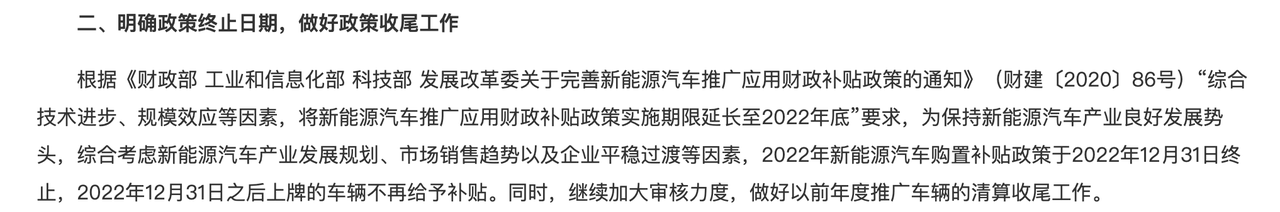

Since the start of the new energy subsidy policy in the private sector in 2010, it has been more than a decade. In 2013, the policy first proposed subsidy reduction. After years of development, this year is the last year for the new energy subsidy policy, with the subsidy amount having fallen to its lowest point in history.

At the same time, in 2014, the new energy vehicle tax incentives were first proposed, and the policy plan was to exempt pure electric vehicles and plug-in hybrid (including range-extending) vehicles from purchase tax from September 1, 2014 to December 31, 2017. After several delays, the latest policy is valid until December 31, 2022.

In other words, at the most important national policy level to support the development of new energy vehicles, subsidies and exemption from purchase tax will both end this year.

According to the notice “On the 2022 Financial Subsidy Policy for Promoting the Application of New Energy Vehicles” issued by four ministries on December 31, 2021, the deadline for the new energy financial subsidy policy, which has been extended since 2020, will expire at the end of this year, and the possibility of further extension is not high.

However, the policy of exempting purchase tax, which has a greater impact on consumers’ car purchasing decisions, may be extended again.

As early as February 28, Vice Minister of Industry and Information Technology, Xin Guobin said at a press conference on promoting the stable operation and high-quality upgrading of industry and information technology held by the State Council Information Office that one of the key points in the next step of supporting the development of new energy vehicles is to improve supporting policies, such as “closely studying and determining the extension of tax incentives for new energy vehicle purchases,” optimizing the “double credits” management method, making effective connections with subsidy reduction, and stabilizing market expectations.

Combining the fact that new energy vehicles are currently experiencing a collective price increase due to the rise in raw material prices, and have been greatly affected by the epidemic, the possibility of an extension in the policy of exemption from purchase tax to promote the development of new energy vehicles is very high.Currently, the maximum subsidy for new energy vehicles is CNY 12,600, while the purchase tax for a car priced over ten thousand yuan is already more than this subsidy amount. This means that the purchase tax has a greater impact on consumers’ car-buying decisions than government subsidies. For the automotive industry and consumers, another extension of the policy is a great benefit.

Rural Subsidies and Local Incentives

China’s first rural car purchase policy was introduced over a decade ago. In January 2009, the State Council released the “Automobile Industry Adjustment and Revitalization Plan,” which provided a one-time financial subsidy to farmers who purchased micro passenger cars with an engine capacity of 1.3 liters or less or exchanged their own three-wheeled vehicles or low-speed trucks for light-duty trucks. The plan also introduced preferential policies such as halving the purchase tax and exchanging old cars for new ones.

The background of the second rural car purchase policy was mainly influenced by the global financial crisis in 2008. The Chinese government launched a ten-point industry revitalization plan, and rural car purchases were an important policy measure. Driven by the policy of rural car purchase and a series of other policies, China’s automobile sales reached 13.6448 million vehicles in 2009, surpassing the United States for the first time and promoting the development of the automotive industry.

The second round of rural car purchase policies was implemented in 2020 and 2021, with the Ministry of Commerce and 12 other departments jointly issuing the “Notice on Several Measures to Boost Key Consumer Consumption for the Release of Rural Consumption Potential.” It launched a new round of rural car purchases and old-for-new exchanges and encouraged eligible areas to provide subsidies to rural residents for purchasing trucks with a maximum weight of 3.5 tons and passenger cars with an engine capacity of 1.6 liters or less. The plan also encouraged residents to scrap vehicles that met the National III or lower emissions standards and purchase new vehicles.

Soon, the third round of rural car purchase policies will be implemented. According to Caixin, a new round of rural car purchase policies will be announced soon. On May 17, Caixin reported that the policy is expected to be announced in early June, encouraging the purchase of cars priced at CNY 150,000 or less, including both fuel-only and new energy vehicles, with subsidies ranging from CNY 3,000 to CNY 5,000 per vehicle. Industry experts predict that the rural car purchase policy will promote the sales of fuel-only vehicles by 200,000 to 300,000 units and new energy vehicles by 300,000 to 500,000 units. This plan is in line with the announcement to promote consumption from the State Council office on April 25th.

As the current urban car consumption approaches saturation and traffic pressure becomes more significant, fully tapping the consumption potential of rural areas is indeed a direction that can be promoted. Cui Dongshu, Secretary-General of the China Passenger Car Association, believes that a large number of rural people are currently moving to county seats, and the development potential of the consumption market in county seats is enormous. There is a huge space for new energy vehicles and fuel-powered vehicles to enter county seats. By developing eligible county seats and forming several new urbanization and town-building development points, we can develop county-level economic entities with potential and strengthen the foundation of automotive consumption. County seats will become new growth points for China’s automotive development.However, it should be anticipated that the promotion of automobile consumption through the “rural car purchase” policy is limited, without the simultaneous and coordinated preferential treatment of the purchase tax policy, and relying only on limited subsidies cannot stimulate a huge volume of market sales.

As for the policy of preferential purchase tax on fuel vehicles, there is little mention of it in the current notice. China has previously launched stimulus policies of “halving purchase tax” in 2009 and “quarter exemption of purchase tax” in 2015-2016, which achieved good results at that time, especially in the 2009 round. However, the accompanying side effects overdrawed the consumption capacity in advance, resulting in automobile sales lower than expected after the policies were withdrawn.

Currently, the possibility of preferential purchase tax policies for fuel vehicles is unlikely.

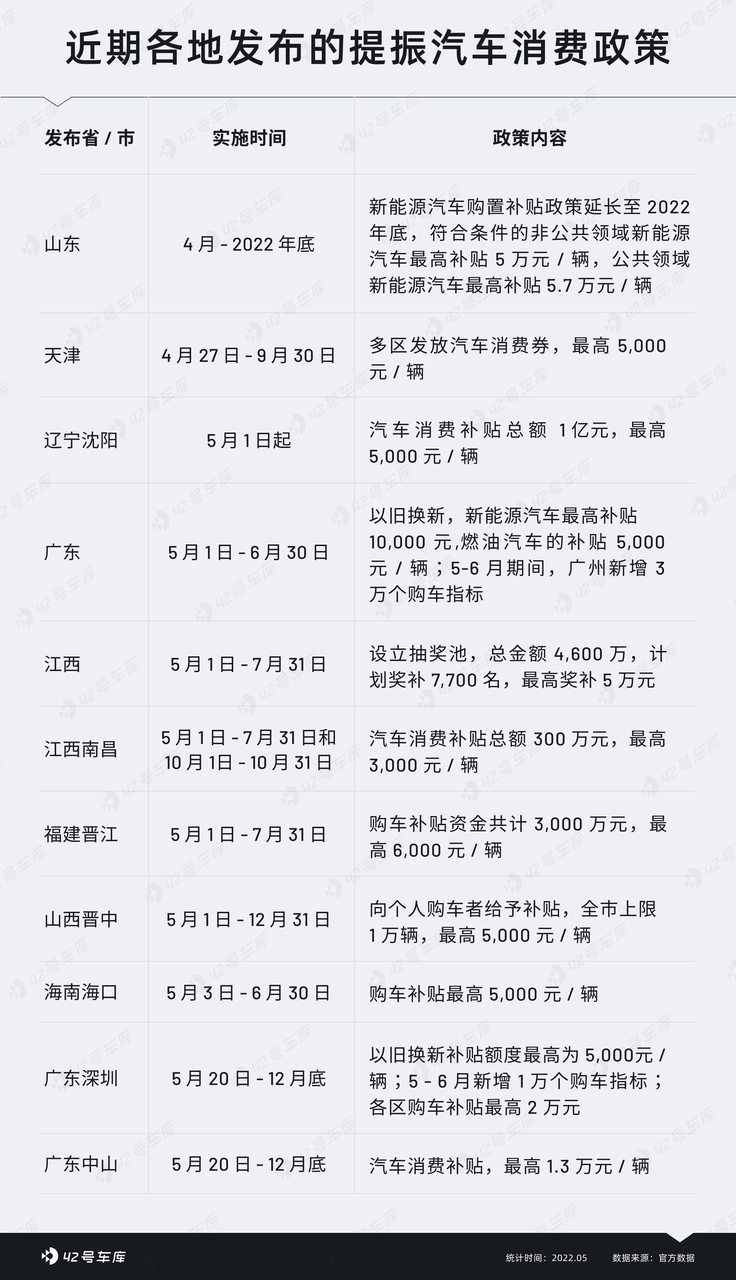

Overall, since the promotion fee notice on April 25th, local governments have launched many significant automobile subsidy policies to boost automobile consumption, which should have a certain pulling effect in the short term.

Breaking Barriers to Automobile Consumption

The idea of breaking barriers that limit consumption has been around for a long time. The barriers that need to be broken down are, on the one hand, regional protection for foreign products, and on the other hand, limitations on local automobile purchases and usage.

In April, the central government issued a document requiring the acceleration of the construction of a unified national large market, with full openness being one of the keywords. The practice of individual cities excluding foreign car manufacturers’ products from the new energy free license plate quota through regulations on the fuel tank volume of hybrid vehicles and the overall length of pure electric vehicles is a negative example.

For local internal issues, many cities have certain policies restricting car purchases and usage. This notice clearly requires a gradual cancellation of automobile purchase restrictions based on local conditions, and promotes the shift from purchase management to usage management for consumer goods, which is a positive sign for the general public and can promote automobile consumption to a certain extent.

The policy of lifting restrictions on the transfer of used cars has also been proposed for a few years and has been partially implemented. Currently, except for a few key cities, the convenience of transferring and registering used cars has been greatly improved, promoting the circulation of used cars in the national market.

In addition, the refined management of pickup trucks entering the city and the further relaxation of restrictions on pickup trucks entering the city are also worth mentioning. For a long time, policies on the management of pickup trucks have been relatively strict, such as “scrap after 15 years” and “cannot enter the city,” which discouraged many pickup truck enthusiasts.

Since 2020, in order to alleviate the impact of the epidemic and boost automobile consumption, the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Commerce, and other national departments have encouraged the “lifting of restrictions on pickup trucks entering the city.” The pickup truck market has ushered in a real spring of lifting restrictions. In 2021, China’s pickup truck sales were 550,000, a year-on-year increase of 14\%, far higher than the 4.4\% growth rate of passenger cars in 2021.The notice also mentioned the establishment of a sound management mechanism for the automotive modification industry and the acceleration of the development of the automotive aftermarket. It is remarkable that, under the background of stimulating economic growth, our vehicle policy environment is becoming increasingly favorable.

In conclusion

In 2020, an epidemic has caused many changes.

Under the changing situation, the economy is under pressure. As a pillar industry in the country, the automobile industry undoubtedly plays a role in stabilizing the economy and promoting economic growth. How to boost automobile consumption under the declining consumer income and weakened consumer expectations is a difficult problem facing policymakers.

In the short term, promoting the development of new energy vehicles, providing short-term subsidies for automobile purchase in rural areas, and removing barriers to automobile consumption can effectively promote the recovery of automobile consumption.

However, in the long run, only by maintaining a medium-high rate of economic growth, achieving high-quality economic growth, improving residents’ income levels, and enhancing long-term consumer confidence can we truly realize the stable and long-term growth of the automobile market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.