Monthly Vehicle Insurance Data in April 2022

Author: Zhu Yulong

The official data is out! Let’s take a look at the overall data, which is not too different from the expectations provided by the China Association of Automobile Manufacturers (CAAM).

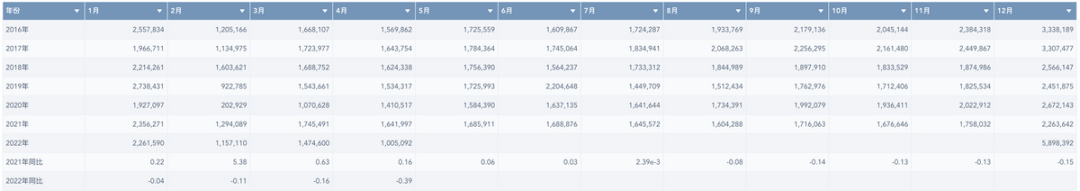

- The number of insured passenger cars in April was 1.005 million, a 38.8% year-on-year decline. This figure is slightly lower than previously estimated, and a table view will make it clearer.

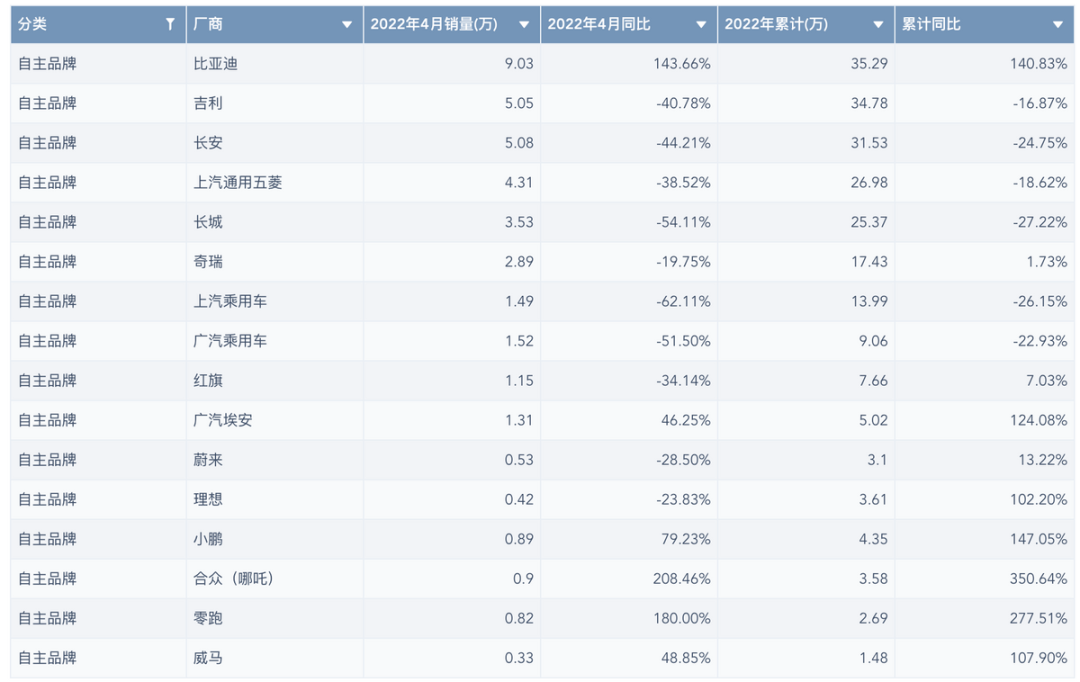

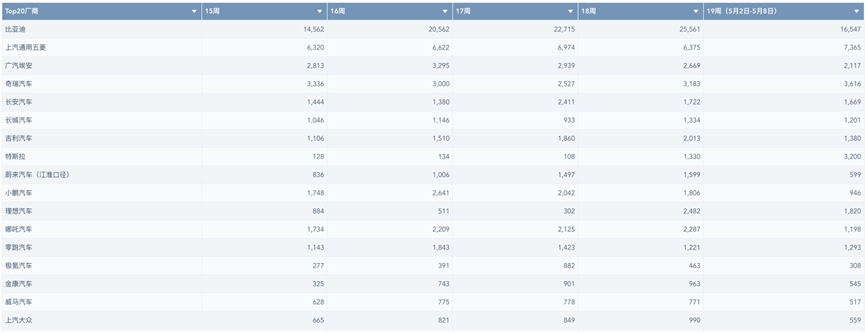

- Among the domestic brands, BYD sold the most with 90,000 units, followed by Geely and Changan with 50,000 units each, and SAIC-GM-Wuling with 43,000 units.

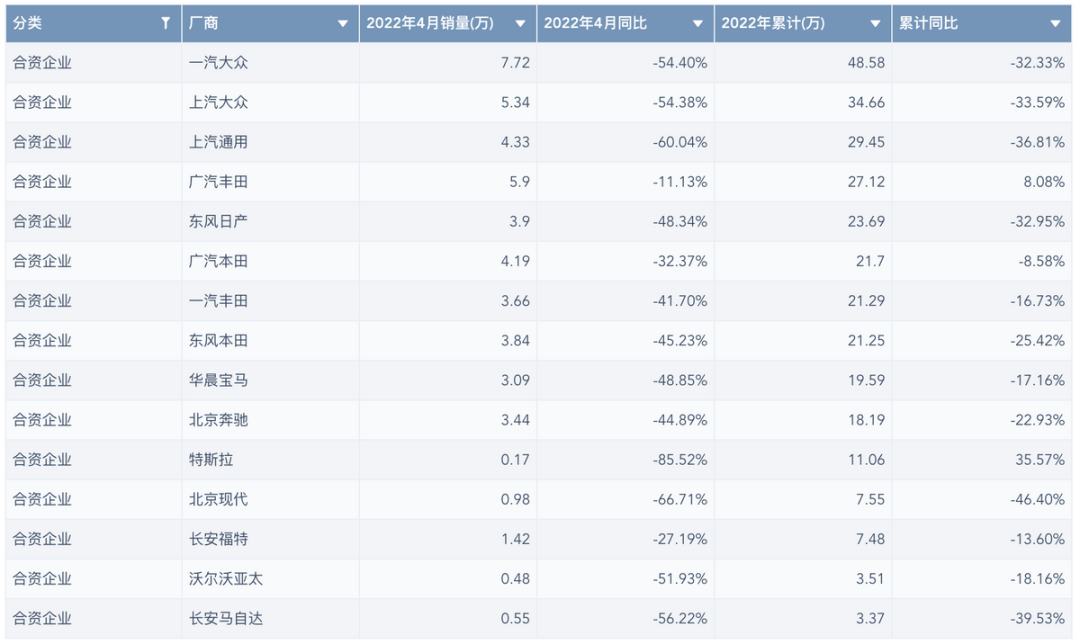

- Among the joint ventures, FAW-Volkswagen sold 77,100 units, SAIC-Volkswagen sold 53,300 units, SAIC-GM sold 43,200 units, and Tesla had 1,700 insured vehicles.

In terms of supply, due to the control measures in the Yangtze River Delta and automotive industry clusters, the data of both domestic and foreign car companies is not satisfactory. With the resumption of work and production in May, it is likely that there will be some recovery. At present, most car companies are optimistic about their targets for this year.

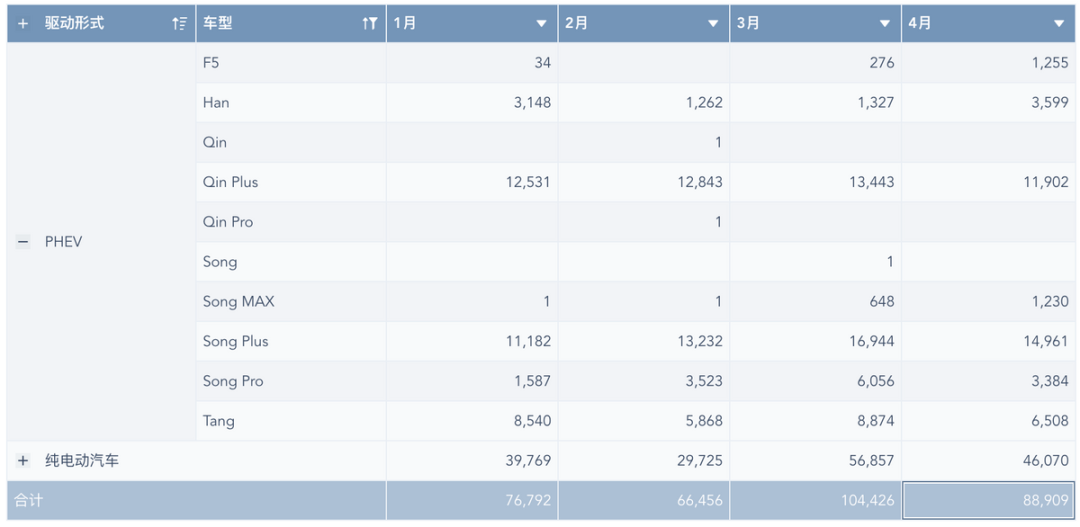

BYD

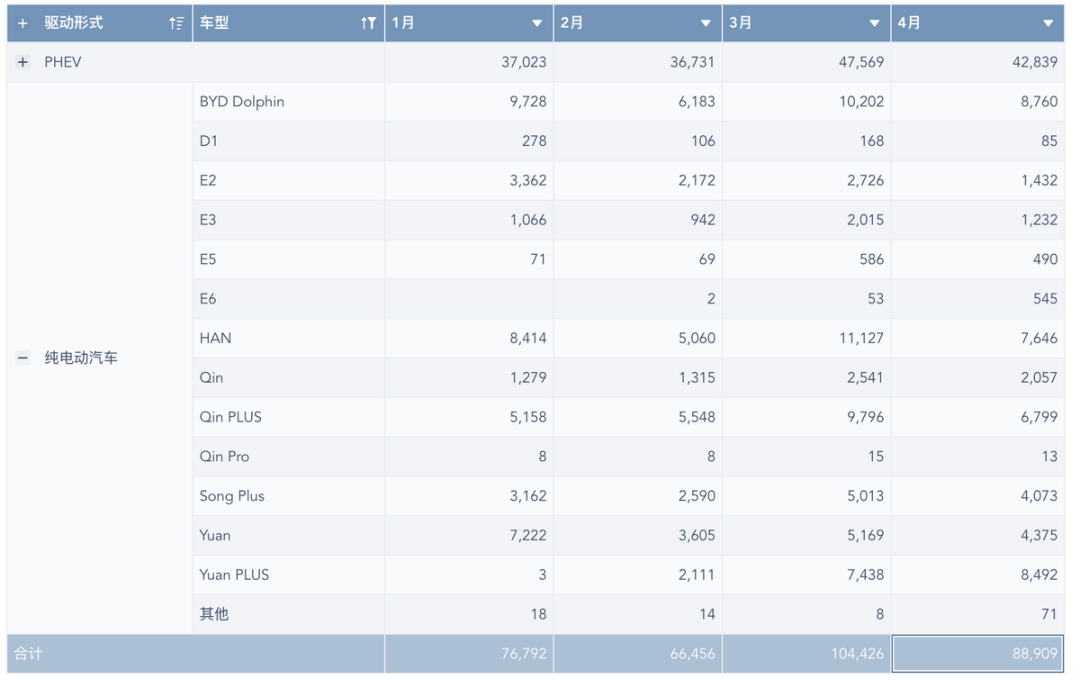

Let’s focus on BYD this time. In April, pure electric cars did not exceed 10,000 units. Currently, the company is heavily promoting several models, including Han EV, Dolphin, Qin Plus, and Yuan Plus, which all have sales of 7,000 to 8,000 units per month. Normally, this is based on a benchmark of 10,000 units per month.

From the perspective of models from 2019 to 2022, they have developed:

- Small cars

Including Dolphin, a small SUV Yuan and Yuan Plus, which have been in demand for a long time. They previously relied on high subsidies to compete in first-tier cities. As oil prices have risen, this field has expanded to second- and third-tier cities. The core logic of these cars is a battery configuration of 40-50kWh of lithium iron phosphate.

- Compact cars

Including E5 and E2 models and the Qin series. Currently, the main focus is on Qin Plus.

- Mid-to-high-end cars# Breakthrough in BYD’s EV and Its Impact on the Market

BYD’s breakthrough in the electric vehicle (EV) market is bringing more competition to Tesla’s Model 3. The company is also making progress with its SUV line, especially with the recent success of the Song Plus series.

One of the advantages of BYD’s pure electric vehicles is the use of lithium iron phosphate batteries, which provide various ranges for different models, including the advantage of the blade battery technology.

In April, BYD sold 42,800 plug-in hybrid electric vehicles (PHEVs), and the demand for the new Han DM-i model has quickly bounced back. The success of Han DM-i will mainly depend on the Qin Plus and Song Plus series. However, the overall performance of the Tang DM-i has been unstable.

BYD’s PHEVs have made great progress, covering not only the restricted license plate cities but also first-tier, second-tier, and even third-tier cities in China. The innovation of powertrain technology has brought immediate results. For private consumers, PHEV can significantly promote consumption with good acceleration and fuel economy in times of uncertain income.

The Trend of Reproduction

Looking at the following data:

-

For small cars, Wuling’s A00-level car still needs some time to reach the previous sales scale of around 30,000. Chery’s A00-level car maintains a volume of 15,000, and both companies are expected to supply around 50,000 cars in May.

-

For the IDEAL, a recent delivery has been record-breaking, with 2482 and 1820 cars delivered in the last two weeks. It is expected to climb to around 9,000 this month.

-

The delivery data for other companies in the first week is not particularly ideal.

In conclusion: The impact of the pandemic has accelerated the operational rhythm of all car companies, but those aiming to make a significant impact in 2022 will have to wait for the recovery of the supply chain and consumer confidence, the latter of which is harder to assess.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.