Manbetx sent from the copilot temple.

Intelligent cars reference | Official Account AI4Auto

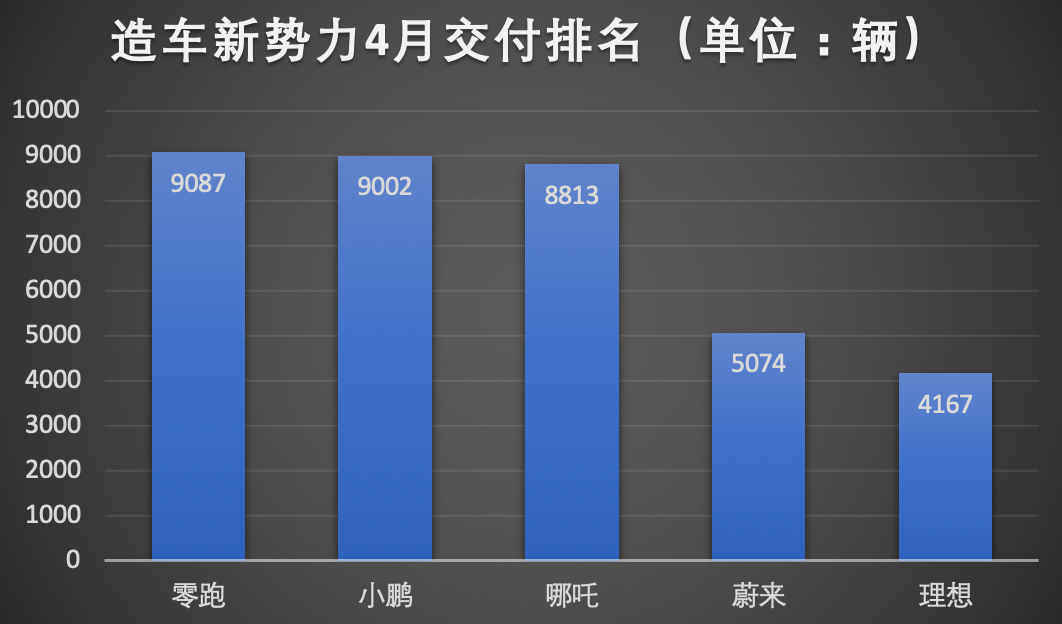

The new forces in the automobile industry showed expected and unexpected results in their April delivery report.

Unexpectedly, the internal rankings have shifted:

Leading the monthly deliveries for the first time is LINGPAI, which knocked XIAOPENG off the top spot with 9087 deliveries.

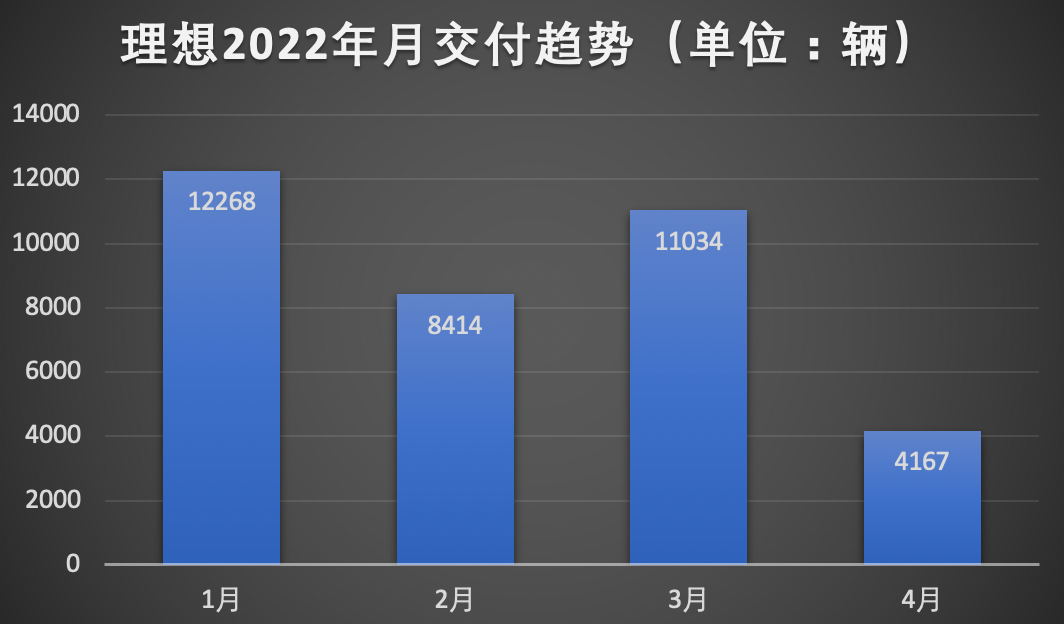

However, IDEAL’s performance was unsatisfactory, with a month-on-month decline of more than 60% in comparison to March, placing them at the bottom of the new automobile manufacturing power rankings.

As for the expected overall performance, under the impact of the epidemic, all domestic new automobile manufacturers experienced a decline in delivery performance, and no company surpassed the threshold of delivering 10,000 vehicles. Among the big three (WM, XP, IDEAL), the biggest declines were experienced by WEY, XIAOPENG, and IDEAL, whereas LINGPAI and NETA were relatively less affected.

Behind this, the truth is somewhat ironic – LINGPAI and NETA models aren’t high-end.

LINGPAI: The New Leader in April Delivery?

The biggest surprise came from LINGPAI, which crossed the monthly 10,000-vehicle threshold in March and achieved another milestone in April – ranking first among the new automobile manufacturers for the month.

Official information shows that LINGPAI delivered 9,087 vehicles in April, with an increase over the same period last year of more than 200%, but a decrease of 9.6% from March. Year-to-date deliveries of 30,666 automobiles represent an increase of more than 4 times compared to the same period last year.

However, while LINGPAI’s monthly delivery volume has made it the top domestic new car manufacturer, it is still a victory mainly based on quantity. Its ability to command premium prices remains entirely different from the models offered by WEY, XIAOPENG, and IDEAL.

Therefore, a more comprehensive approach is needed for LINGPAI to enter the domestic high-end automobile market.

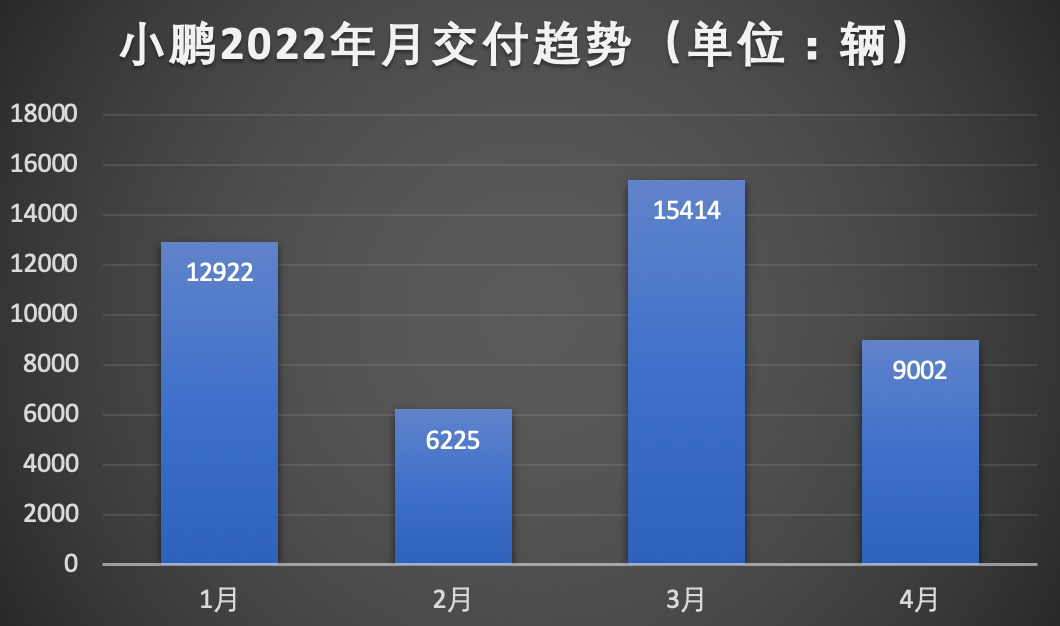

XIAOPENG ranked second to LINGPAI, with 9002 deliveries in April, a year-on-year increase of 75% but a decrease of 41.6% compared to March’s 15,414 deliveries. Between January and April, XIAOPENG’s year-to-date deliveries were 43,563, a YoY increase of 136%.

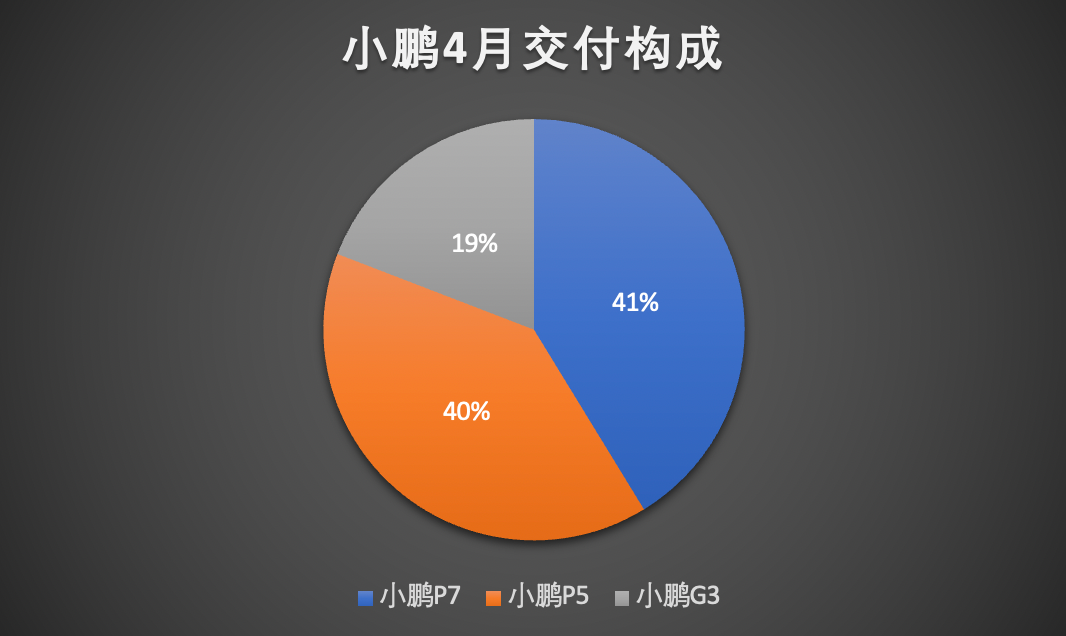

Regarding specific models, XIAOPENG delivered 3,714 P7 models, a 60% decrease from the previous month’s 9,183 deliveries, while 3,564 P5 models and 1,724 G3 models were also delivered.So, it can be seen from the data that Xpeng’s delivery volume in April dropped by over 40%, and the main reason was the poor performance of its flagship model, the Xpeng P7.

Li Auto’s stable performance remains consistent and ranks 3rd among the new car makers.

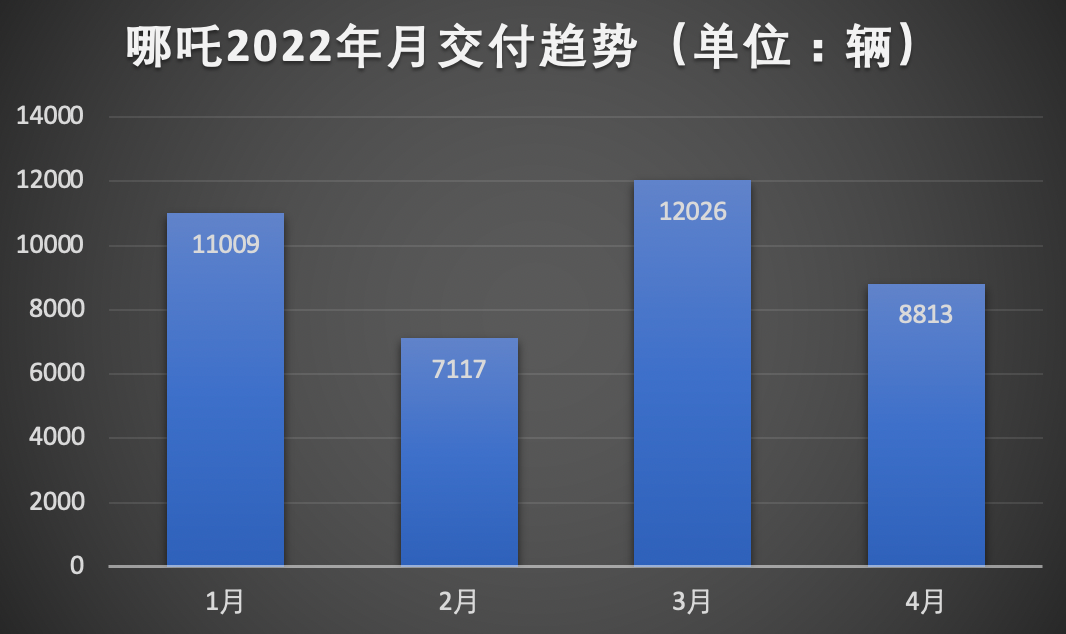

In April, Li Auto delivered 8,813 vehicles, a 120% increase from the same period last year, but a 26.72% decrease compared to March.

From January to April this year, Li Auto delivered a total of 38,965 vehicles, a 240% increase from the same period last year.

As for specific models, Li Auto did not disclose, but according to the current on-sale models, the main ones are still the Li ONE and Li Xiang Family series, with prices mainly distributed around 100,000 yuan.

As to whether it can achieve a breakthrough in the mid-to-high-end market, it still depends on the market performance of the Li Xiang One SUV after its launch.

Coming in fourth is NIO.

In April, NIO delivered 5,074 new cars, a 29% decrease from the same period last year and a 49% decrease from March this year, almost halving its deliveries.

From January to April, NIO delivered a total of 30,842 vehicles, up 12.9% from last year’s 27,323 vehicles.

NIO also announced the cumulative delivery volume of its popular new car, the ET7, which is 693 vehicles.

On the other hand, NIO also recently announced the production of its 200,000th new car, becoming the first player among China’s new car makers to achieve this goal.

Since the start of deliveries, NIO has delivered a cumulative total of 197,912 vehicles. Unless something unexpected happens, the goal of delivering over 200,000 vehicles will be achieved and announced by NIO in the next month.

The biggest change in the delivery pattern among new car makers in April was that Ideal Automobile slid to the bottom of the list.

Data shows that in April, Ideal’s only on-sale model, the Ideal One, had a delivery volume of 4,167 vehicles, a year-on-year decrease of 15% and a 62% decrease from March.# This is the English Markdown text:

From January to April this year, Li Auto has delivered a total of 35,883 vehicles, a year-on-year increase of 98%.

In addition, when the new car-making forces declined collectively, under the head car-making forces, Geely’s Ji Ke also released its delivery performance report:

2137 vehicles were delivered, which is not a large volume, but it surprisingly increased by 19% month-on-month, which is rare compared to the declining first-tier new forces.

Above is the overall performance of China’s new car-making forces in April, as well as the change in structure.

Apart from ranking changes, the two biggest changes I believe have been spotted by everyone:

Delivery volume is all below ten thousand, and even the top Zeekr has delivered only 9,087 units.

The five major new forces all declined in month-on-month deliveries in April.

April should have been a period when the auto market recovered after the winter of February and the climb in March. However, the new car-making forces failed collectively at this time, why?

The answer has already been revealed on the Weibo page of the bigwigs in the auto circle:

The shutdown of the epidemic in Shanghai has caused an unstable supply chain.

Is it all because of the epidemic?

As early as April 9th, Li Bin announced on the official platform that due to the impact of the epidemic in Shanghai, Jiangsu, Geelyn and other places, supply chain partners had to stop production, and Nio had to stop production in response.

In addition, Great Wall officially announced that the Tank 300, a popular off-road vehicle on the internet, also had to stop production due to the epidemic.

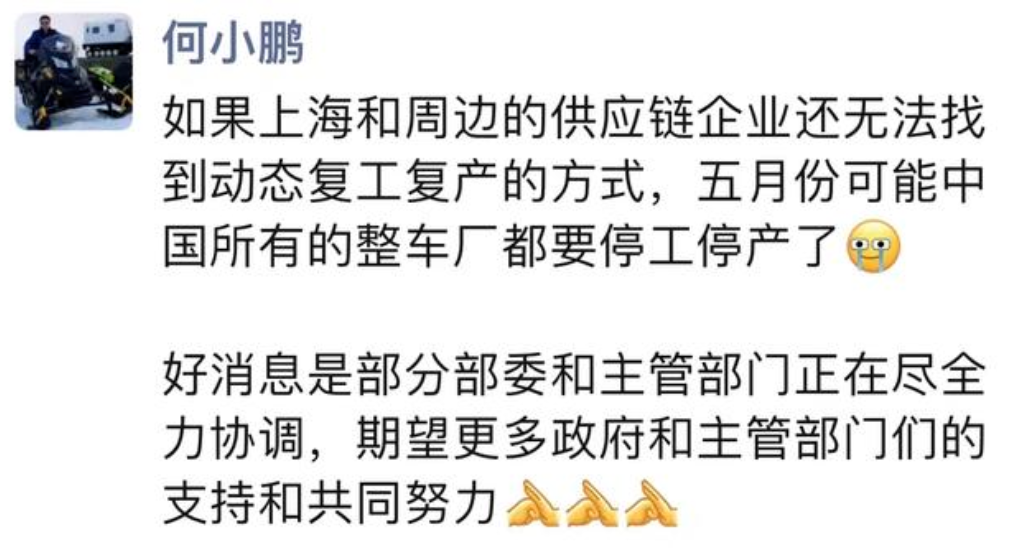

Afterwards, important figures in the auto circles such as He XPeng and Yu Chengdong also issued warnings one after another.

The negative impact of the epidemic in Shanghai on the auto industry has reached the edge of suspension from upstream supply chains to downstream host factories.

Under the trend of the entire industry entering the winter of the epidemic, the delivery performance of the new car-making forces also reveals another truth:

The COVID-19 epidemic has caused a shutdown of production, which has harmed the sales of mid to high-end vehicle models.

From the data point of view, although the delivery volume of the five major new car-making players all declined to varying degrees in April, the most significant decline was in NIO, Xpeng, and Li Auto, the three companies that targeted the mid to high-end market. The decline in delivery volume was generally above 40%.

The worst-hit high-end models, including Ideal One, have experienced a drop of more than 60%, while XPeng’s P7 high-end model has also decreased by 60%.

The worst-hit high-end models, including Ideal One, have experienced a drop of more than 60%, while XPeng’s P7 high-end model has also decreased by 60%.

Meanwhile, smaller companies like Lengpao and Nio, which have priced their mid-to-low-end models at around RMB 100,000, have either emerged victorious or remained stable despite a dip in delivery volume. However, the question arises: why have mid-to-high-end models been the hardest hit in terms of supply chain instability?

The answer can be deduced from the simple comparison of two models, Lengpao U Pro and XPeng P7. Lengpao U Pro is equipped with 18 sensors comprising one millimeter-wave radar, 12 ultrasonic radars, and five cameras, while XPeng P7 features 31 sensors, consisting of five high-precision millimeter-wave radars, 12 ultrasonic sensors, four surround-view cameras, and ten highly sensitive autonomous driving cameras. Each sensor is connected to a large number of components, such as chips and optical components.

Therefore, high-end models often focus on adding more features, such as intelligent driving and smart cabins, which result in more complex and diverse supply chains.

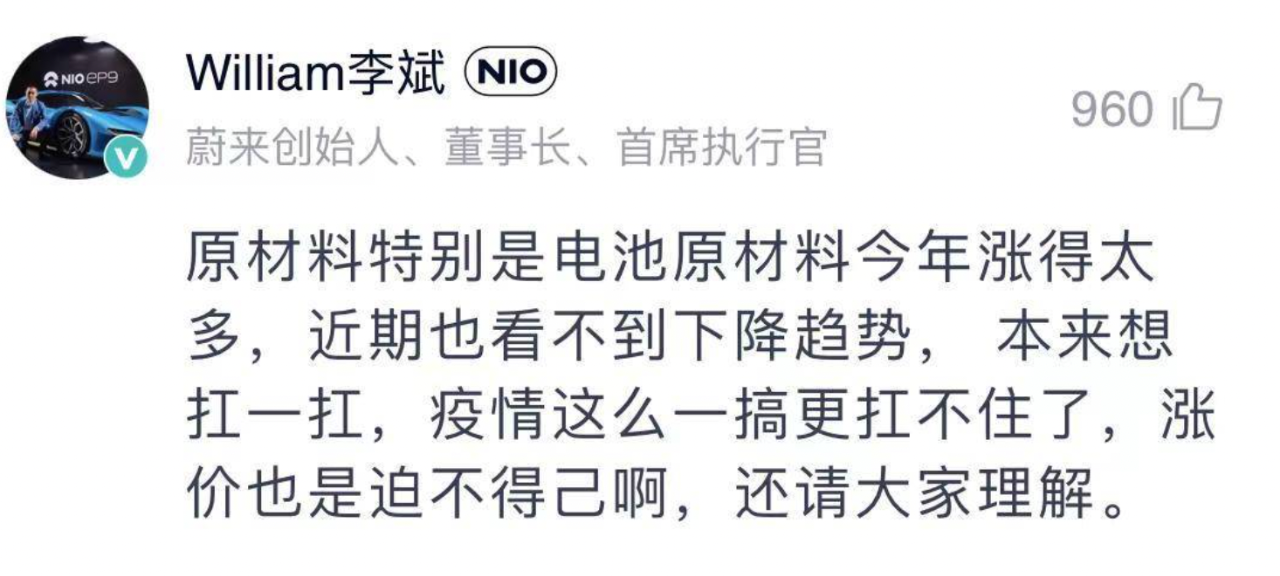

However, as pointed out by Li Bin, CEO of Nio: “A car cannot be produced if even one component is missing.” The regions hit hardest by the pandemic, including Shanghai, Geelyn, and Jiangsu, are densely populated with the automotive industry and upstream supply chains.

Take Nio for example. Not only is its global headquarters located in Shanghai, but 25 of its upstream suppliers, including battery supplier CATL, are also based in the city, involved in multiple systems such as the vehicle’s three electrical systems, intelligent driving, and the vehicle body.

So far, the question remains whether the automotive industry will recover in May, as infections persist across the country. According to the latest official news from Shanghai, approximately 70% of the companies in the first batch of 666 key enterprises have resumed production gradually, and automakers, semiconductor manufacturers, and other automotive-related companies are the key industries for resumption.

But resumption is just a beginning. Under the impact of the pandemic, the uncertainties of traffic, logistics, and other fields may still affect the complete satisfaction of the automotive industry’s supply chain.Notwithstanding, there are solutions to deal with it. For example, like XPeng, sell cars first and then supply LiDAR later, or like Porsche’s “downgrade faction,” might become a trend?

What do you think?

— End —

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.