May 1st, today is the second day of the May Day holiday and the day when various automotive companies release last month’s delivery volume. However, it is obvious that everyone’s enthusiasm is not high today.

The just-passed April was undoubtedly a special month. The outbreak of the Omicron epidemic caused Shanghai to enter an extraordinary period. Shanghai citizens spent more than 30 days in a difficult and controlled life. The stagnation of logistics not only made the purchase of daily necessities extremely difficult but also cut off Shanghai’s industrial bloodline and forced this auto stronghold into a severe shutdown state.

The voice of Li Bin, He XPeng, and Yu Chengdong and others in mid-April put this round of the epidemic’s impact on the entire automotive industry into the public eye and also planted the seeds for April’s automobile delivery volume.

The data announced today by various manufacturers also confirmed such concerns.

Overview of April Delivery Volume

The following are delivery volume data for April that had been announced by manufacturers before the release of this article:

- Xpeng: 2,137 vehicles

- Li Auto: 4,167 vehicles

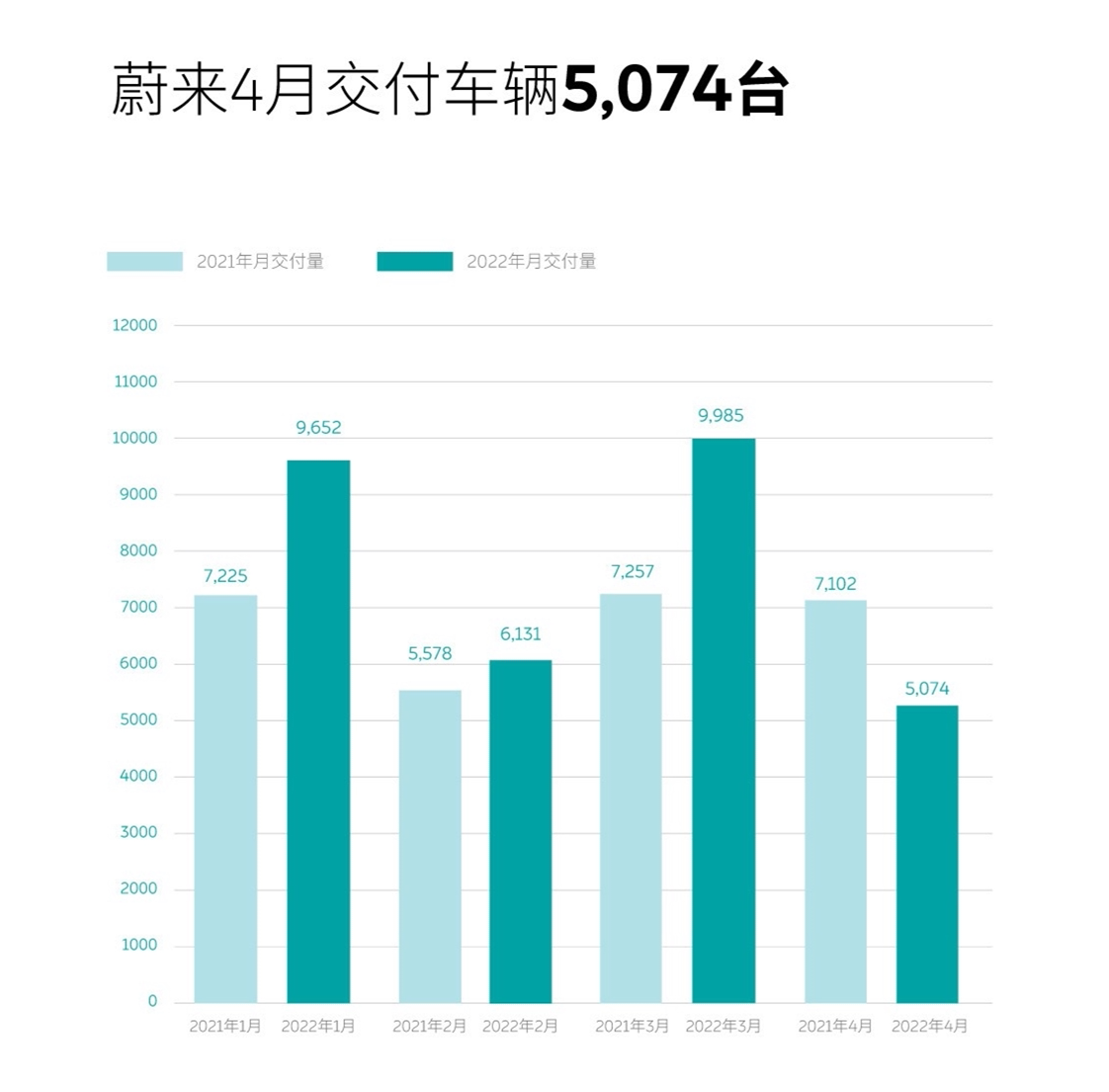

- Nio: 5,074 vehicles

- NEXTEV: 8,813 vehicles

- XPeng: 9,002 vehicles

- Leapmotor: 9,087 vehicles

Xpeng Takes the Lead: Increased Month-over-Month and Orders Over 10,000

The first car company to announce the delivery volume today is Xpeng, who boldly takes the lead in this market.

In April, Xpeng delivered a total of 2,137 Xpeng 001 vehicles. The data is not particularly outstanding and ranks fourth in the median since Xpeng’s delivery started seven months ago. However, the rare thing is that the data increased compared to the 1,795 vehicles delivered in March under the epidemic.

In addition, the company officially stated that Xpeng set a historical high for new orders in April. The poster only shows more than 10,000 orders, but internal sources revealed that it exceeded 12,000, which is higher than during the April 2021 conference period. Compared with the delivery volume, this part of the order is more worthy of attention.

In fact, there have always been complaints about the slow production ramp-up and delivery of Xpeng’s vehicle community, and the supply shortage of parts such as air suspension at the early stage of Xpeng’s delivery did indeed affect delivery efficiency. Similarly, the intelligent display of the entire car, is also a key point that the users pay attention to.In February and March, Jikang conducted multiple OTA updates, fixing some bugs that were frequently complained about by users, and improving the smoothness of the car system, which received positive feedback from car owners. In late March, Jikang announced at a user communication meeting that the Jikang special production line for Weiback suspension had been put into operation and the delivery of corresponding vehicles will be accelerated. The improvement of these key issues undoubtedly played a positive role in attracting potential users.

Another more direct reason was that Jikang announced in April that it would implement a price increase plan for its vehicle series starting May 1st, including WE version models increasing by 5,000 and YOU version models increasing by 20,000, including adjustments for deposit discounts. Amid the background of rising battery raw materials and the collective price increase of new energy vehicles, this signal prompted many potential users to place orders before the price increase. These multiple reasons ultimately helped Jikang set a new record of new orders in April.

The Second Tier Players: Still Holding Strong

Among the ruins, LINGPAO and NIO achieved exception results in April.

LINGPAO delivered a total of 9,087 vehicles in April, with a year-on-year growth of over 200% for 13 consecutive months. Although it decreased by 10% compared to 10,059 in March, it had the smallest month-on-month decline among all new energy players except for Jikang. Given LINGPAO’s relatively large monthly delivery volume, it is curious how it managed to ensure production and delivery during the pandemic. LINGPAO CEO Zhu Jiangming gave a polite response to our question:

“When the pandemic was not serious in the first half of the month, we were very tight.”

“Feed the troops before engaging in battle,” it is indeed the fundamental truth. In addition, last week LINGPAO held the CTC battery platform integration technology release conference and announced more information about its upcoming flagship sedan C01. As supply improves further, LINGPAO with its new products will expand its product line growth.

NIO delivered 8,813 vehicles in April, a 27% decrease from 12,026 in March but still a 120% increase year-on-year. In the last six months, from November 2021 to now, NIO has delivered over 10,000 vehicles for four months, with the remaining two months being February affected by the Spring Festival holiday (7,117 vehicles) and April affected by the pandemic. In terms of vehicle models, NIO delivered 5,694 vehicles for the NIO V series and 3,119 vehicles for the NIO U series.

Leading the market in which both LINGPAO and NIO’s products are positioned to focus on the concerns of the majority of high demand users, their rise may represent the resurgence of the mass line.

Three New Energy Elites with Their Respective Struggles

In April, the three first-tier new energy players suffered a significant decline in deliveries. Although they faced the same background, the pandemic’s impact on each of their timing also had they own special nature.

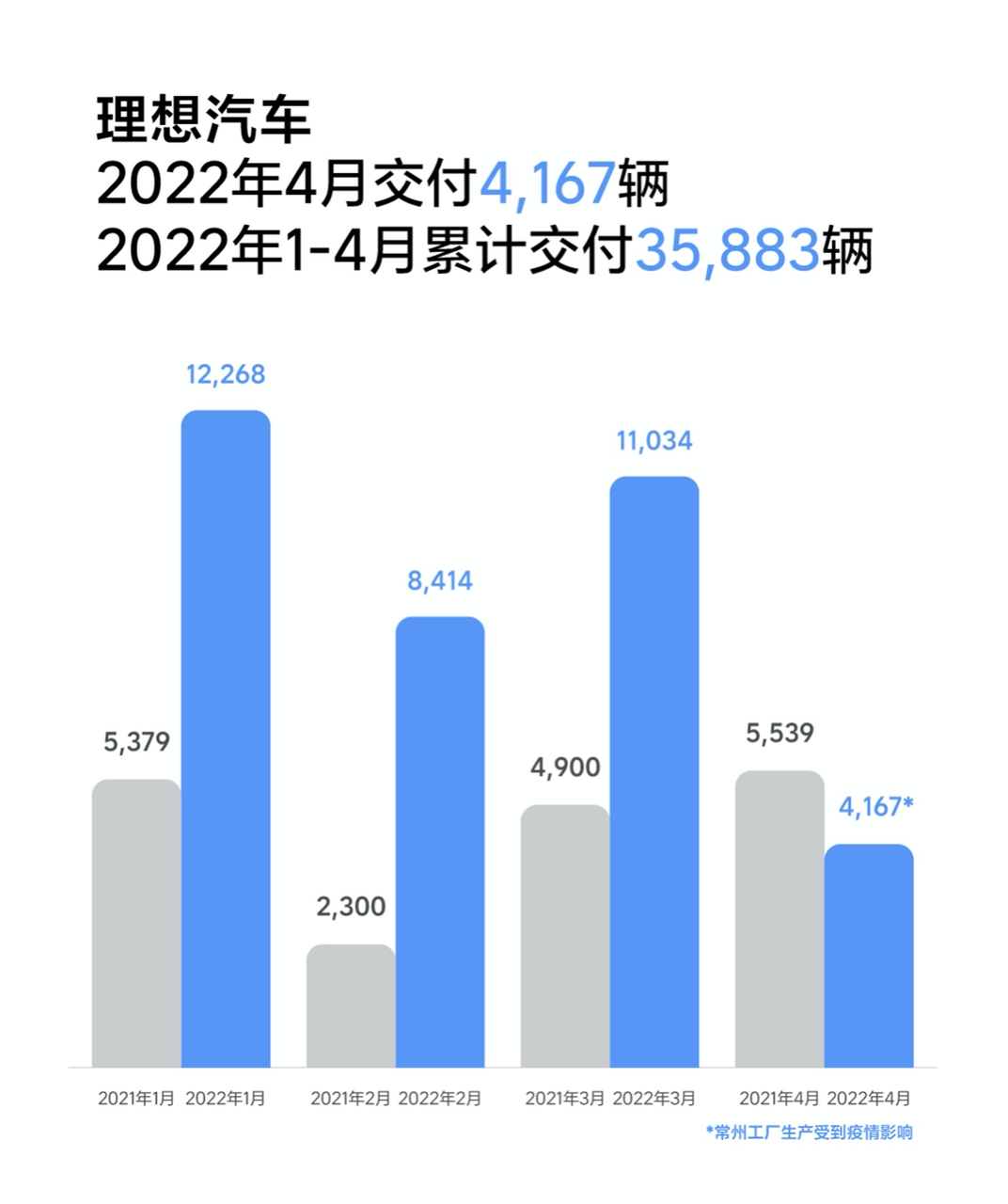

Li Xiang: Supply Stagnation, Plummets 60%Firstly, Ideanomics (理想汽车) delivered 4,167 vehicles in April, a staggering decline of 62.2% compared to the previous month. Based on past data, the monthly insurance volume of Ideanomics in the Shanghai area is around 500 to 600 vehicles. Even if the delivery volume lost due to the inability to deliver in Shanghai is added to the April delivery volume based on this data, 4,700 vehicles are still far from recent delivery data.

Regarding the decline in delivery volume in April, Ideanomics co-founder and CEO, Stefan Qin, responded as follows:

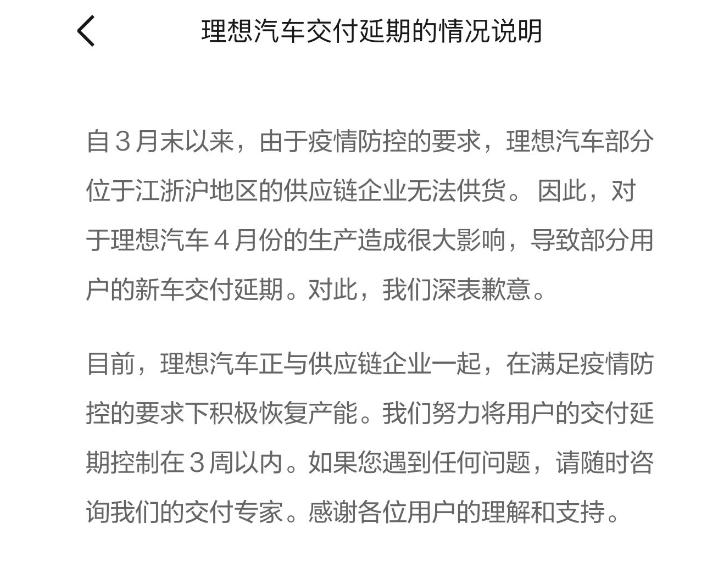

Since the end of March, due to the rebound of the epidemic in the Yangtze River Delta, the supply chain, logistics, and production of the entire industry have been seriously disrupted. Ideanomics’ Changzhou base is located in Changzhou, Jiangsu Province, in the center of the Yangtze River Delta. More than 80% of Ideanomics’ component suppliers are distributed in the Yangtze River Delta region, and a large part of them are located in Shanghai and Kunshan, Jiangsu. Affected by the epidemic in the Yangtze River Delta region, some suppliers in Shanghai, Jiangsu Kunshan, and other regions cannot supply, and some suppliers are even completely shut down, making it impossible to continue production after the existing component inventory is consumed. This had a huge impact on Ideanomics’ production in April and resulted in delays in new car deliveries to some users.

On April 20th, Ideanomics issued an explanation of the delivery delay to users in the official app, summarizing that Ideanomics has been hindered from delivering new cars due to supply and logistics issues since the end of March. The content is basically similar to Stefan Qin’s response.

According to the latest display on the Ideanomics app, the waiting time for new car delivery is now 6 to 8 weeks, which is about 3 weeks longer than the delivery period before the epidemic.

Furthermore, two other things happened in April that affected the delivery volume of Ideanomics, in addition to the supply issue.

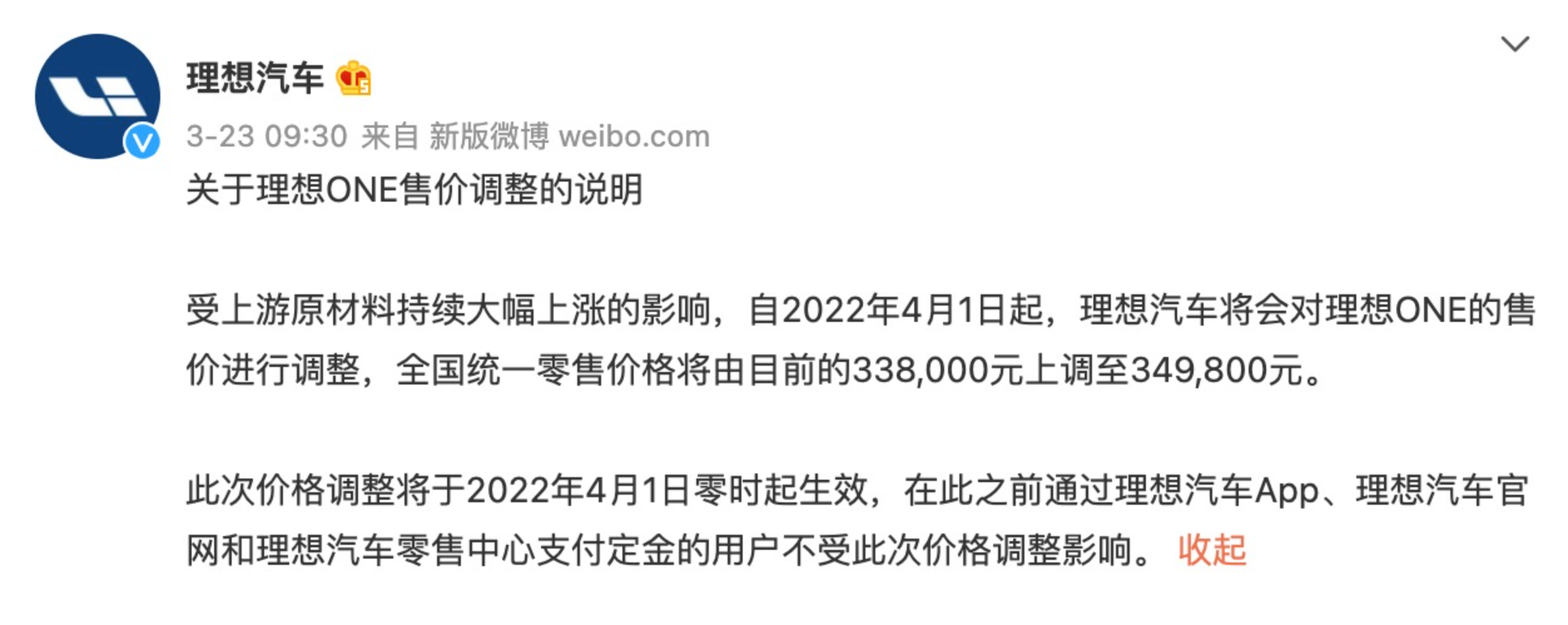

The first was the announcement of the price increase on March 23rd. From April 1st, the price was raised by RMB 11,800, leaving potential buyers with a one-week window between the announcement and implementation. Previously, Ideanomics’ delivery time was about one month. This adjustment should theoretically have promoted short-term orders and increased the delivery volume in April, but the arrival of the epidemic obviously disrupted the delivery plan.

The second item is the delayed release of Ideal L9. As the most important new product of Ideal this year, Ideal L9 started preheating and shaping earlier, and had multiple rounds of explosive information disclosure in March, attracting a large number of followers.

The second item is the delayed release of Ideal L9. As the most important new product of Ideal this year, Ideal L9 started preheating and shaping earlier, and had multiple rounds of explosive information disclosure in March, attracting a large number of followers.

The original plan for L9 release was in mid-to-late April. Prior to the release, a considerable number of spectators were watching for new cars. As a 6-seater SUV, L9 overlaps with Ideal ONE in product attributes, and the price difference between Ideal L9 and Ideal ONE will be a key reference for users to choose between the two.

Therefore, the delay in the release of L9 has actually led to a delay in users’ purchasing decisions. Based on this analysis, it can be inferred that Ideal’s new orders in April were greatly affected, but considering the backlog of delayed deliveries before April, the core of determining the delivery volume in May will still be supply.

NIO: factory shutdown and difficulty in new car delivery

In April, NIO delivered 5,074 vehicles, a month-on-month decrease of 49.2\%, and the biggest problem was still supply.

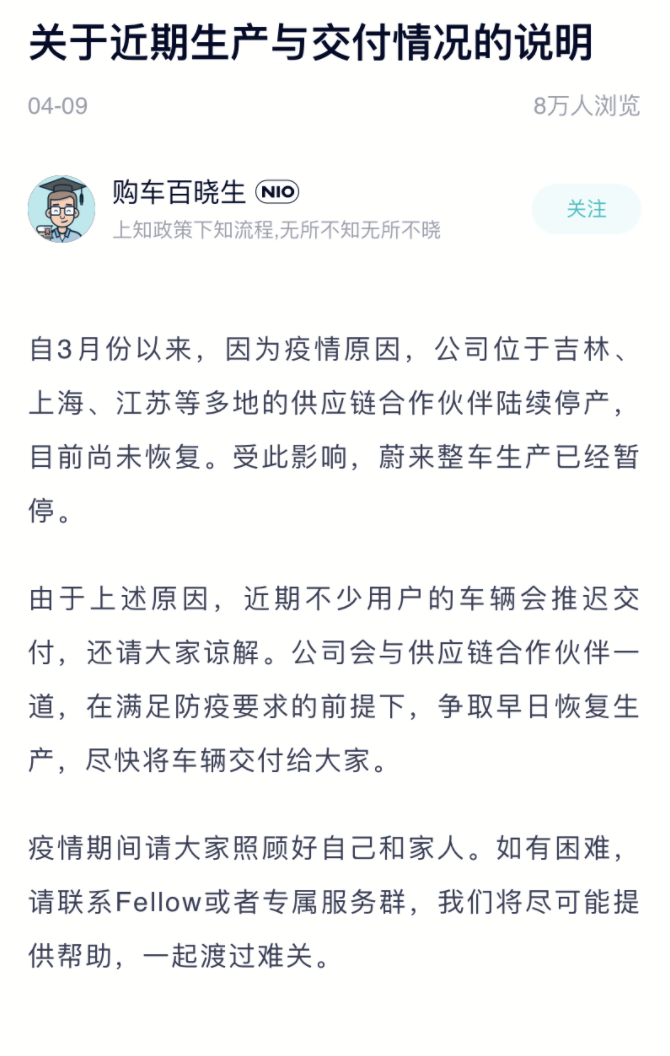

During the epidemic, NIO was the first among the top three new forces to announce the impact of production and delivery. In the announcement on April 9, it clearly stated that it was forced to suspend vehicle production due to the continuous shutdown of the supply chain.

Subsequently, on April 14, NIO announced the resumption of vehicle production. The epidemic not only caused a few days of shutdown but also brought serious difficulties to daily production and transportation.

This month, NIO delivered 1,878 ES6, 1,252 ES6s, and 1,251 ES8s. The first full delivery month of the ET7 only delivered 693 vehicles this month.

In March, the number of insured vehicles for NIO in Shanghai was 836, and this number was basically zero in April. Our already produced ET7 was delayed for delivery as well. Excluding the delivery volume in Shanghai, NIO’s delivery affected by the epidemic in other areas of Shanghai in April is expected to be 3,000 vehicles.

The problem of alternating old and new products has also affected NIO. On April 1st, NIO announced that the ES8, ES6, and EC6 models will release new versions in May, which will be equipped with upgraded 8155 chips, 5G connectivity, and a higher-definition 360-degree surround view system.

The problem of alternating old and new products has also affected NIO. On April 1st, NIO announced that the ES8, ES6, and EC6 models will release new versions in May, which will be equipped with upgraded 8155 chips, 5G connectivity, and a higher-definition 360-degree surround view system.

However, on the one hand, NIO explicitly stated that the existing models could undergo the same hardware upgrade. On the other hand, NIO announced a price increase on April 10th, with the three 866 models increasing in price by 10,000 yuan, which will take effect on May 10th. Therefore, the impact of the new version is relatively limited.

Instead, the new ES7, which currently has little information, may have a greater impact on potential customers. Although NIO currently has four models on the market, the sales of ES6 and EC6 account for a large proportion. The rumored new version of ES7, as an upgraded version of ES6, is expected to be released in May. Before that, some users may hold a wait-and-see attitude, and orders may be delayed.

Therefore, NIO’s delivery in May may rebound as the supply recovers. The level of rebound depends on both the production capacity and delivery situation of ET7, as well as how much assistance can be provided by the promotional orders of 866 before the price increase in April and the backlog orders in March.

XPeng: highest deliveries and smallest decrease

In April, XPeng delivered 9,002 vehicles, a decrease of 41.6% from the previous month. Although the decline also reached 40%, XPeng still outperformed the other two major new forces and delivered almost the same amount as the other two combined. The delivery numbers of the three models on sale were P7 at 3,714, P5 at 3,564, and G3i at 1,724.

Regarding this performance, analyzing from the supply side, it is not difficult to find that XPeng is located in Guangzhou and is relatively less affected by the automotive supply chain in the Yangtze River Delta compared to NIO and Li Auto. This geographic advantage brings more deliveries to Guangdong and its surrounding areas. Furthermore, having dual plants means that there is some redundancy in inventory and production.

However, it should be noted that when we talk about the smallest decrease, we are talking in terms of percentage. In terms of absolute numbers, XPeng has still suffered a significant decline in deliveries.For the Shanghai area, XPeng had an insurance coverage of 565 vehicles in March. If this part of the delivery volume is zero in April, XPeng’s lost delivery volume due to the epidemic in areas outside of Shanghai is still 4 to 5 thousand vehicles.

Moreover, XPeng was the earliest of the top three new forces to announce a price increase due to raw material problems on March 18, leaving a three-day consideration period until March 21st, and had already completed its promotion by the time April approached.

XPeng also has a new product, the G9, but it does not significantly overlap with XPeng’s existing product line, unlike Li Auto and NIO. The preheating period before the launch will not have a significant impact on potential customers of existing models.

Therefore, if the production capacity recovers well in May, XPeng is likely to win the monthly sales crown of the top three new forces again.

Summary

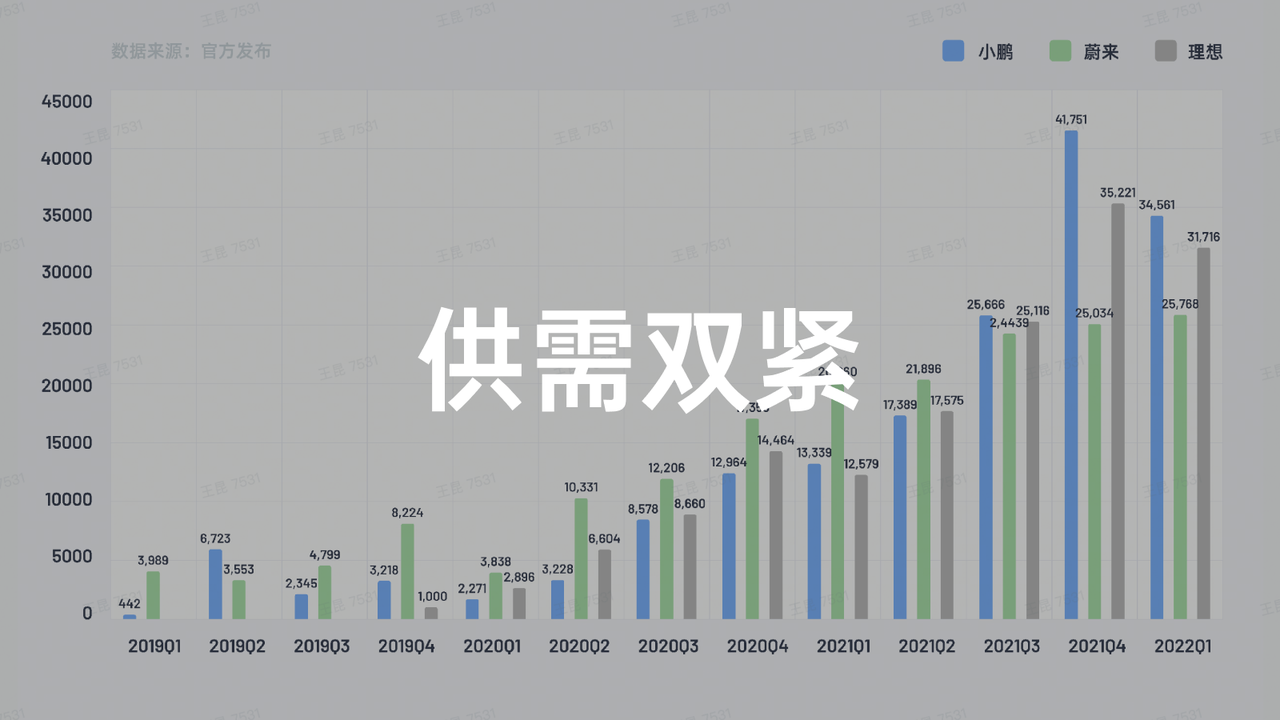

2022 was originally a year in which the top three new forces simultaneously strived for an annual sales of 200,000. The sudden epidemic not only caused the first-tier members to lose tens of thousands of deliveries this month but also disrupted the release rhythm of new products of each company, prolonged the decision-making period of users, and continued to affect the overall new order in the coming months.

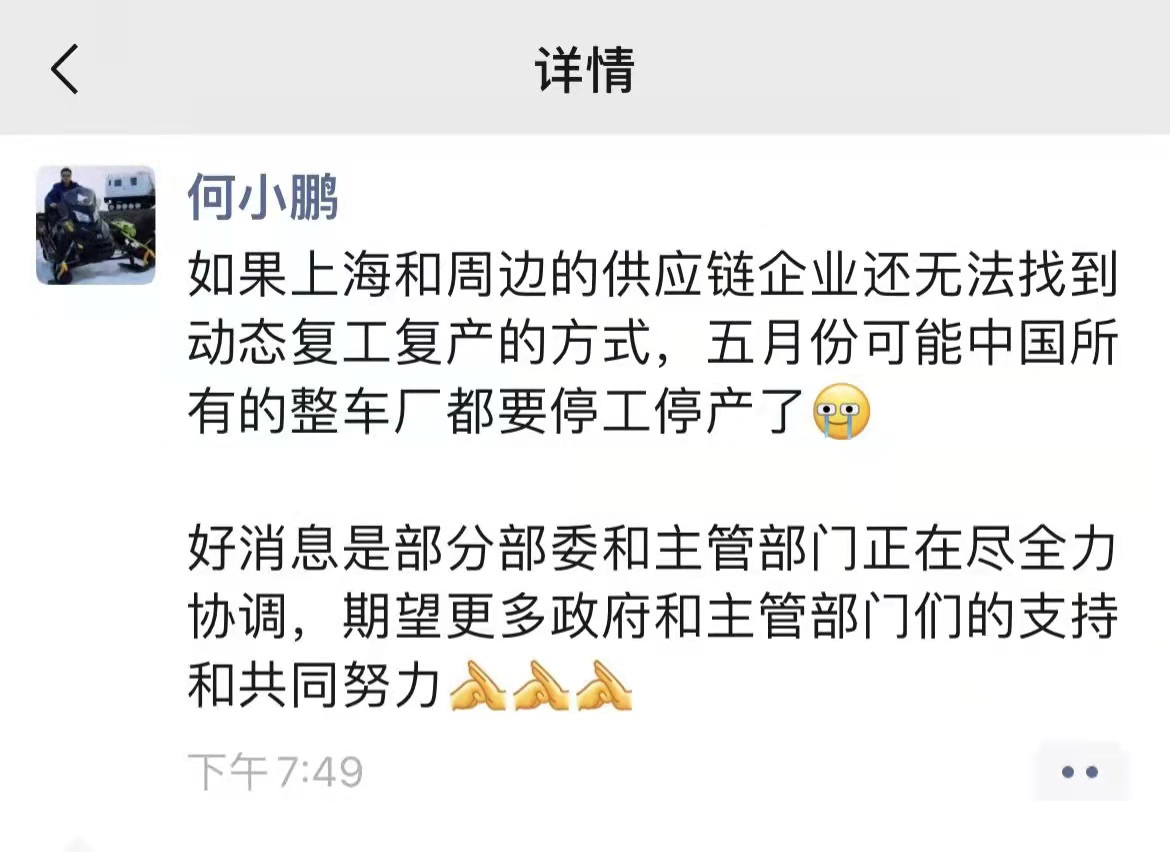

More worrying is that as a key area of China’s automobile industry, the Yangtze River Delta region where Shanghai is located plays an indispensable role in the normal operation of the domestic automobile industry. On April 14th, He XPeng had expressed his concerns about the epidemic’s continuous impact in his moments.

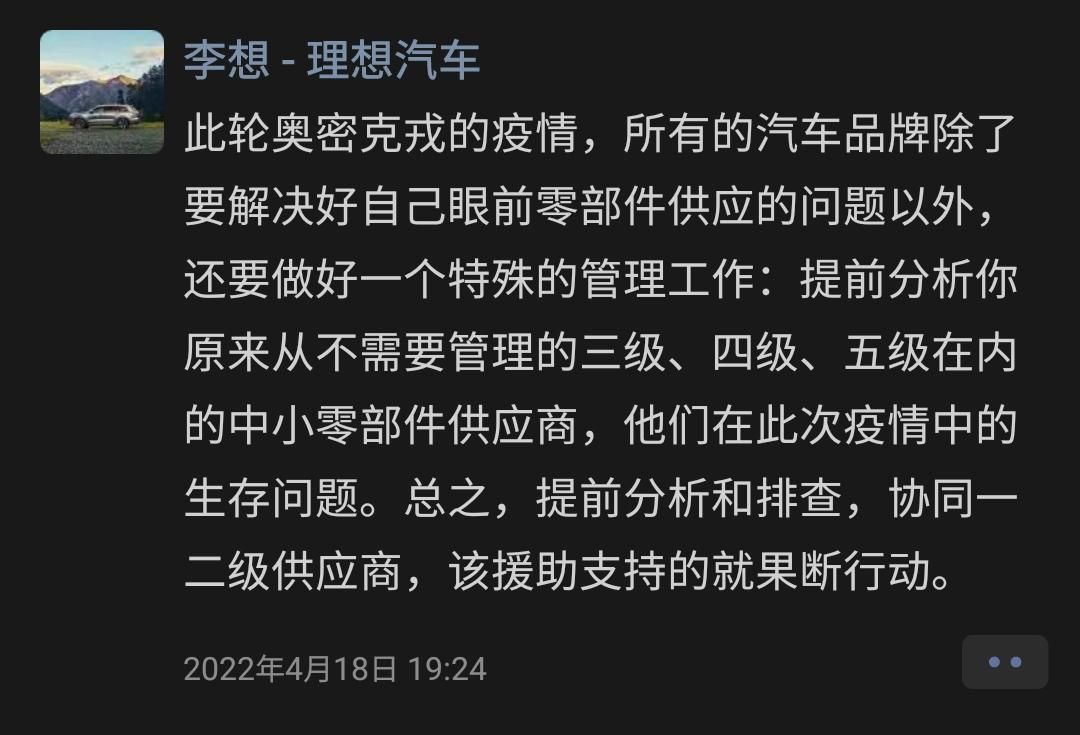

On April 19, Li Xiang himself stated on his social media that in addition to solving their own immediate component supply problems, automotive brands also need to analyze and investigate the survival of secondary and small-component suppliers that were not previously of concern and provide decisive assistance.

The shortage of automotive industry components, led by chip shortages, has continued from last year to the present day. Under the renewed epidemic, supply has become even more severe, resulting in the unwillingness of both enterprises and consumers to face supply and demand crises.

Therefore, the prioritization of supply chain risk management has been raised to a new level, and the accurate inventory on-demand production, a representation of advanced concepts in traditional manufacturing industries, will no longer be applicable during this special period. Appropriately abandoning efficiency and seeking multiple layouts and supplies will instead become a safe choice during the epidemic.

Conclusion

In the first half of April, top-tier host plants such as Tesla and BYD continued to be in a month-on-month growth trend. However, in the second half of the month, as the impact of the epidemic further expanded, logistics were hindered, the economy declined, and the most unwilling supply-demand dual tightness occurred.According to the statistics of China Association of Automobile Manufacturers, the sales volume of domestic passenger cars in April is expected to be around 1.1 million, which may be the lowest point since the outbreak of the epidemic in 2020, with an overall decline of more than 30\%.

On April 16th, Shanghai released the first batch of 666 names of companies that guarantee the supply of materials. As expected, many key suppliers in the automobile industry appeared on the list. Tesla, which suspended production for three weeks since March 28th, officially resumed production on April 19th.

Now it is already May, and the turning point of the epidemic has passed. With the orderly resumption of work, the recovery of the automobile industry is in progress. However, the recovery of the automotive market requires a balancing of supply and demand. The revival of the retail end needs to be buffered. Not only does vehicle selection require caution, but market trends also need to be closely watched. This process will be slower than the supply end.

For China’s new energy market, which is still in the growing stage, Q2 will be a quarter of collective adjustment. After a few large-scale auto shows are smoothly held, with the influx of large numbers of new cars and the increase in consumer desire, the market in the second half of the year will regain momentum and continue to rise.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.