Author: Zhu Yulong

At the beginning of the year, it was observed in the market that almost all domestic passenger car companies were benchmarking BYD’s DM-i strategy – developing new products on the basis of the dedicated hybrid transmission and engine in DHT.

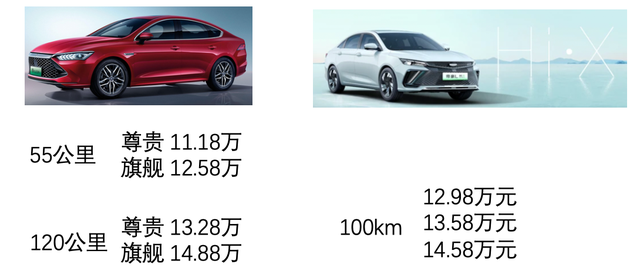

Technical route is important, and price is also important. Therefore, Geely took the lead this time, launching three versions of the Geely Emgrand L Pro Thunder Hi-X Super Electric Hybrid, with a price range of RMB 129,800-145,800. That is to say, currently making plug-in hybrids is to meet the long-term strategy beyond the needs of green license plate cities; at the same time, considering the continuation of subsidies and purchase tax policies, it is necessary to reserve a strategy for the simultaneous development of HEV and PHEV.

Note: I want to sell my green license plate PHEV recently. I’m not sure if anyone wants to buy it. This time may be the last window.

Against the background of high oil prices, new energy vehicles are still very popular among users. From a long-term strategy of the enterprise, whether the subsidy withdrawal and purchase tax will continue in 2022 still needs to find a way forward for the original fuel vehicles. This actually includes several major domestic self-owned fuel vehicle manufacturers (Geely, Changan, Great Wall, and SAIC-GM Wuling) and later several such as Chery, GAC, and SAIC Motor. We should be able to see that such a strategy will be mass-copied.

Geely’s Super Hybrid Configuration

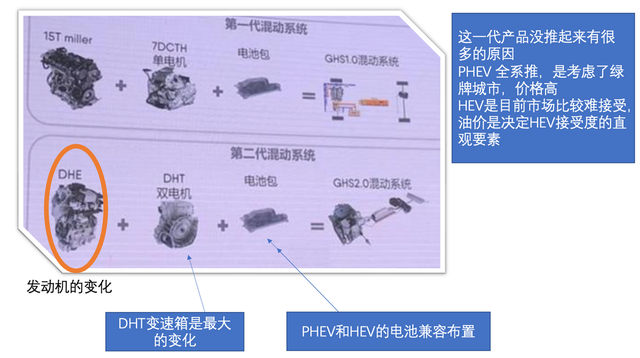

In the hybrid field, BYD took the lead, and actually, it’s easy to copy. This time, Geely also focused on the dedicated hybrid engine and DHT Pro’s hybrid dedicated transmission. Just like BYD can rapidly promote in batches, Geely’s PHEV 1.0 strategy, which has tried the P2.5 hybrid system before, iterates to PHEV2.0 strategy, which is not complicated at all.

At the Guangzhou Auto Show last year, Geely’s problem was that it first promoted the hybrid system, but no one was interested. In the current environment, it is difficult for consumers to understand that your self-owned brand suddenly surpasses Japanese hybrids. Therefore, according to the current logic, the statement that PHEV Super Hybrid should be promoted has BYD’s customer education in front of it, which makes it easier to be accepted in the future when following.

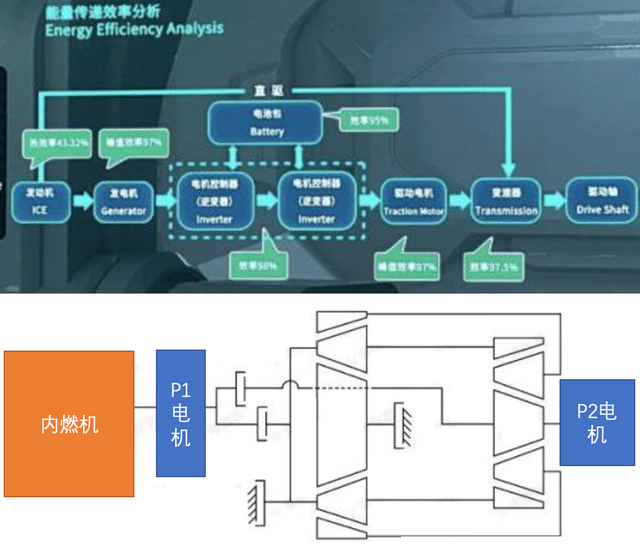

The DHTPro system is somewhat similar to the P1P2 hybrid system previously developed by Hyundai-Kia, consisting of a hybrid electric drive gearbox (120 kg, radial length of 354 mm) composed of a generator unit, a driving motor, a dual inverter power supply, a control module, and a three-speed automatic planetary gearset.

Note: The previously planned P1P4 system by Volvo was not feasible, the P2 system was not good, and the P2.5 single motor was also tried. Therefore, whether the P1P2 system can work remains to be seen, but as Hyundai has tried it before, there should be no big problem.

The DHT Pro3 gearbox can achieve three working modes: pure electric EV, series, and parallel, as follows:

-

The pure electric mode is driven by the driving motor (P2) with a maximum power of 100 kW and a maximum torque speed of 320 N·m. The rated power and torque of the motor are used for low-speed gear to push the vehicle.

-

When driving in low-speed gear, it will also automatically switch to series mode. The engine drives the generator (P1) to generate electricity to charge the battery, which is then used to drive the driving motor (P2). The driving motor (P2) adjusts the engine load, and the main goal is to suppress engine vibration under lower loads.

Pricing of PHEV

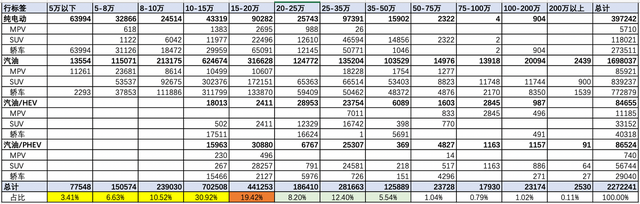

As we mentioned before, the market is facing a lot of problems now, with the battery price and oil price both increasing. What kind of product to offer Chinese consumers becomes very important. In April, there were not only supply problems but also demand problems. In two subdivisions of 80,000-100,000 yuan and 100,000-150,000 yuan, traditional fuel vehicles account for more than 40% of the effective market. Coupled with 20% of 150,000-200,000 yuan, it is the most important 60% of the Chinese market. Under the high oil price system, a considerable number of customers are postponing their purchases or have doubts about the daily use costs.

I believe that this wave of domestic brands pushing forward PHEVs in the 100-150k RMB range, with exemption from purchase tax, can generate a certain cost-effectiveness, which will push the existing vehicle models in the 50-80k RMB and 80-100k RMB range upward. If a large trend could be formed, it would bring about the most important change for the evolution of powertrain technology in the next stage in China. If this takes shape, these automakers may not need to push unprofitable pure electric A00-like vehicles.

I believe that this wave of domestic brands pushing forward PHEVs in the 100-150k RMB range, with exemption from purchase tax, can generate a certain cost-effectiveness, which will push the existing vehicle models in the 50-80k RMB and 80-100k RMB range upward. If a large trend could be formed, it would bring about the most important change for the evolution of powertrain technology in the next stage in China. If this takes shape, these automakers may not need to push unprofitable pure electric A00-like vehicles.

In summary: the proportion of BEVs to PHEVs may evolve from 8:2 to 6:4. The primary change is that pure electric A00 vehicles under cost pressure will no longer be the development direction, and the surge in the cost of batteries for pure electric vehicles in the 100-150k RMB and 150-200k RMB range will leave a great space for low-priced PHEVs. This trend is certain, and we continue to observe it.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.