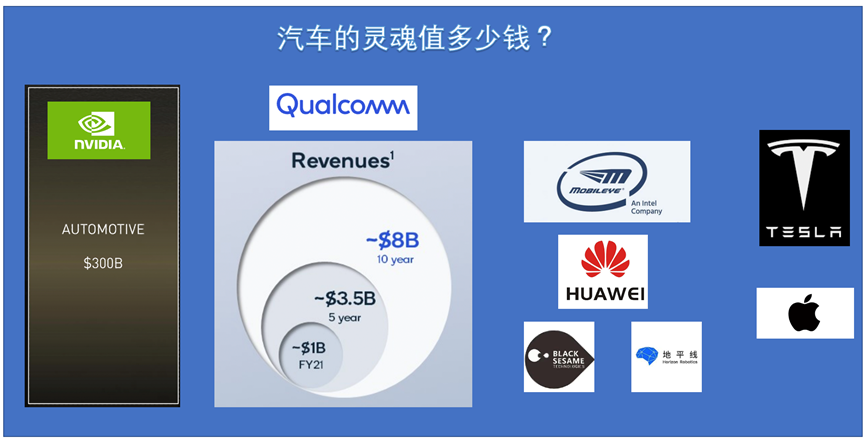

In the field of intelligent automobiles, the two most important pillars are autonomous driving and digital cockpit – these two areas will be the mainstay of the soul of intelligent automobiles in the future. In different manufacturers, such as NVIDIA estimating a future revenue of $300 billion and Qualcomm relatively rationally estimating a revenue of $8 billion.

With the spin-off and listing of Mobileye in the future, including the vertical integration of Tesla, Apple and other companies, how to understand the valuation of NVIDIA and subsequent players in this field is what we want to discuss here.

NVIDIA’s Dominant Position in the Automotive Industry

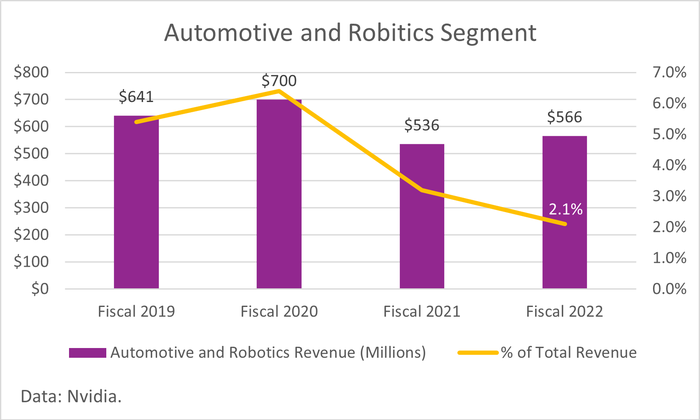

Although the pie chart above is large, NVIDIA’s automotive business was only $566 million, accounting for 2% from the launch of the NVIDIA Drive series platform in 2015 to 2021.

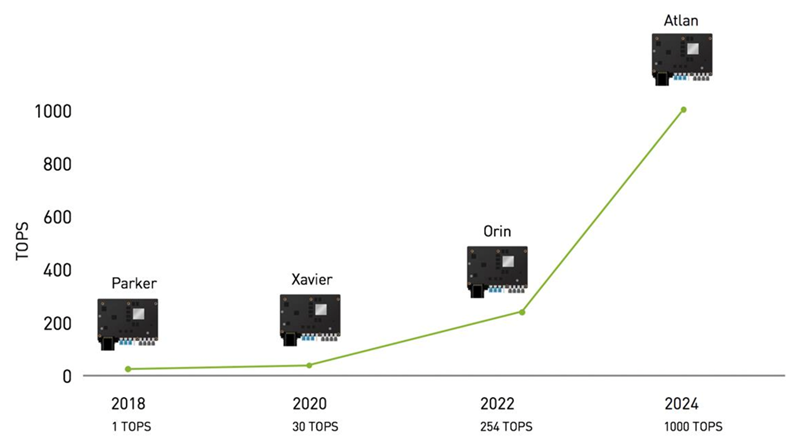

In 2015, NVIDIA launched the DRIVE CX aimed at the cockpit and the DRIVE PX aimed at driving. Since then, it has successively launched multiple autonomous driving platforms, such as DRIVE PX2, Drive PX Xavier, DRIVE PX Pegasus, DRIVE AGX Orin, and the latest SoC chips from Parker, Xavier, Orin to Atlan. There were also many twists and turns in this process, and Tesla got off the boat midway.

From the timeline:

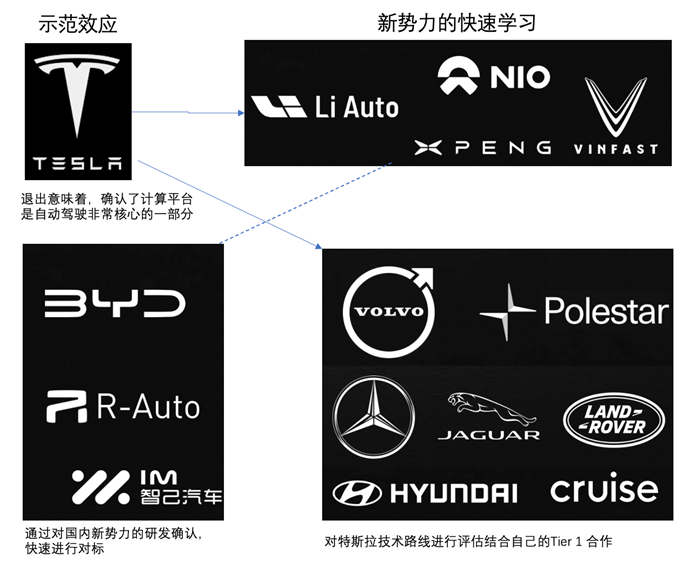

- Tesla

It was the first to use NVIDIA’s platform, and also the first to exit. This confirmed that for a vehicle manufacturer with a large scale (more than one million) focusing on L4 and higher-level autonomous driving, vertical integration attempts are needed.

- New forces

From XPeng to NIO and Ideanomics, these Chinese new car manufacturers have quickly caught up with Tesla’s experience in autonomous assisted driving (before L3) and will be the first batch of customers of Orin in 2022, even surpassing Tesla in the Chinese road environment.

- Domestic traditional automakers

With the confirmation of the route of domestic new forces, this makes SAIC, BYD and many other companies believe that this is a relatively easy route to take, and everyone uses Orin.

- Foreign traditional automakersMercedes-Benz in 2024 and Jaguar Land Rover in 2025, as well as Volvo’s subsequent 2025 models, all require detailed and comprehensive testing due to the characteristics of foreign automakers, so the entire demand cycle is longer.

From the perspective of technology platform, NVIDIA has a history of rapid iteration:

(1) DRIVE PX

CES 2015 introduced the Maxwell GPU architecture and the DRIVE CX (digital cockpit) with 1 Tegra X1, as well as the DRIVE PX (autonomous driving) with 2 Tegra X1.

(2) DRIVE PX2

CES 2016 launched the Pascal GPU architecture DRIVE PX 2, consisting of Parker and Pascal GPU, divided into single-chip AutoCruise, dual-chip AutoChauffeur, and four-chip Fully Autonomous Driving versions. At this time, Tesla, which broke up with Mobileye, was moved and equipped the customized version of DRIVE PX2 AutoCruise on the HW 2.0 in 2016. In 2017, it upgraded to 2 Parker chips for HW 2.5.

(3) Drive PX Xavier

Xavier AI Car Supercomputer was launched at CES 2017 and renamed Drive PX Xavier at CES 2018. It is a Tegra Xavier chip with 30 TOPS computing power, which comes from PX2 with smaller size and higher energy efficiency. Its area is halved, and its power consumption is reduced by about 1/8, which has achieved great success in the XPeng P5 and P7 models.

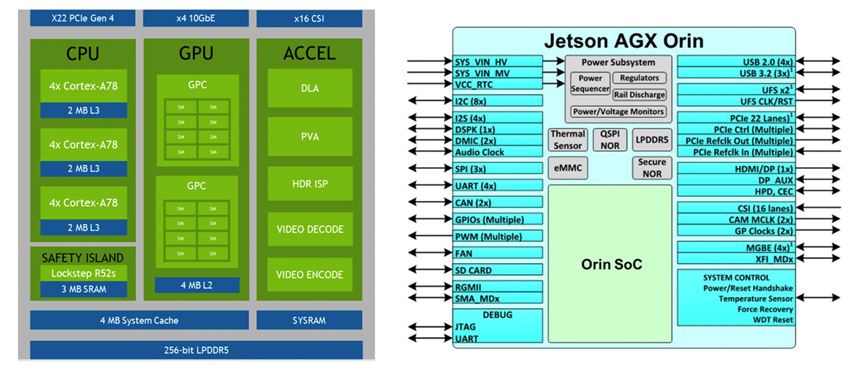

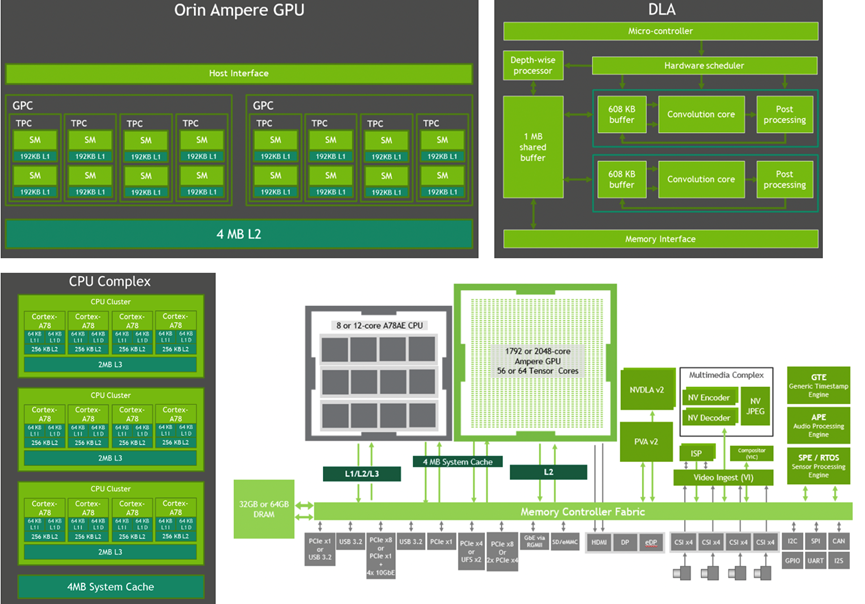

(4) DRIVE AGX OrinAt GTC 2019, the DRIVE AGX Orin platform was introduced, featuring two Orin SoC chips and two Ampere architecture GPUs, with a maximum computing power of 2000 TOPS and 800W power consumption. Orin SoC achieves 254 TOPS computing power with less than 55W power consumption, supporting multi-chip collaboration for computing power expansion. Orin SoC integrates Arm Hercules CPU core, Ampere GPU, a new deep learning accelerator (DLA), and a computer vision accelerator (PVA). The GPU has 2048 CUDA Cores and 64 Tensor Cores. Orin internally integrates Ampere architecture GPUs, with two GPCs (Graphics Processing Clusters) each containing 4 TPCs (Texture Processing Clusters). After the release of this chip, NIO, Li Auto, XPeng, and domestic brands such as IM and R, have all adopted it.

Note: The price of a single Orin SoC is very low.

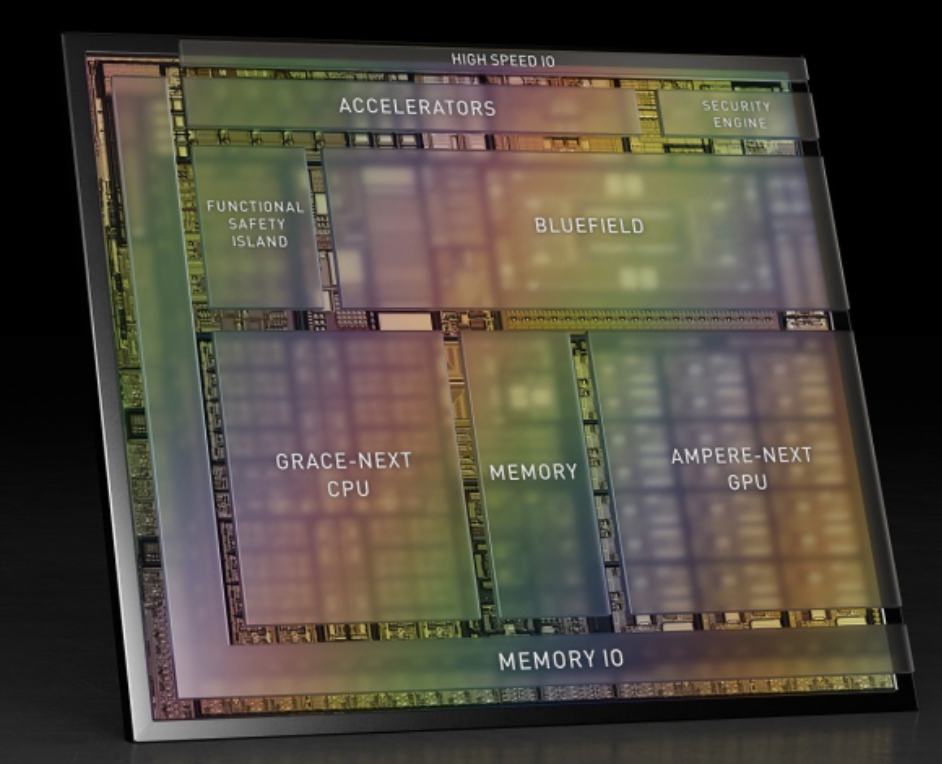

(5) The subsequent release of the Atlan SoC chip platform

Integrated with DPU, a single chip has a computing power exceeding 1000 TOPS, and can be compatible with the software stacks of Orin and Xavier platforms. It adopts a 5nm process and new Arm CPU core, the latest generation GPU, the latest DLA deep learning accelerator, PVA computer vision accelerator, and BlueField DPU built-in for advanced network, storage, and security services, and the network speed can reach 400Gbps. Atlan SoC will provide samples to developers in 2023, and will be mass-produced and integrated into vehicles in 2025.

With this round of promotion, software algorithms will be verified on DRIVE Constellation starting from the chip. After full verification, the software will be deployed for on-road testing through the DRIVE Hyperion architecture and iteratively trained on deep learning models using the DGX high-performance training server. This product includes chips (Xavier/Orin/Atlan), DRIVE AGX hardware platform, DRIVE OS, Driveworks, DRIVE AV autonomous driving software stack, DRIVE Hyperion data acquisition and development validation suite, DRIVE Constellation virtual simulation platform, and DGX high-performance training platform, making it a comprehensive ecosystem.

With this round of promotion, software algorithms will be verified on DRIVE Constellation starting from the chip. After full verification, the software will be deployed for on-road testing through the DRIVE Hyperion architecture and iteratively trained on deep learning models using the DGX high-performance training server. This product includes chips (Xavier/Orin/Atlan), DRIVE AGX hardware platform, DRIVE OS, Driveworks, DRIVE AV autonomous driving software stack, DRIVE Hyperion data acquisition and development validation suite, DRIVE Constellation virtual simulation platform, and DGX high-performance training platform, making it a comprehensive ecosystem.

Reference platform for software and hardware development – DRIVE Hyperion

Orin is already a mass-produced product based on NVIDIA’s development reference mainly referring to Hyperion 9, which is scheduled for release in 2026.

Hyperion 9 uses two Atlan AV processors to achieve fully autonomous driving, and NVIDIA plans to promote Atlan SoC as a cabin chip. Hyperion 9’s sensor combination includes 14 higher-resolution and higher-frame-rate cameras, 1 imaging radar, 3 lidars, and 20 ultrasonic sensors, with 1 radar used for passenger monitoring in the cabin. The sensor supplier for Hyperion 9 is still observing and iterating.

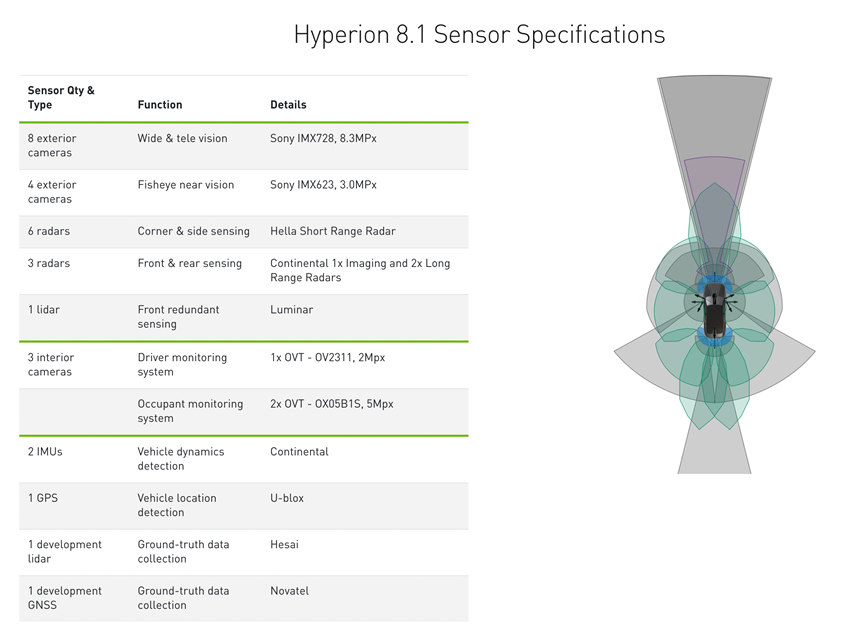

The NVIDIA Hyperion 8.1 architecture locks some vehicle-grade radars, cameras, ultrasonic sensors, and lidars, including cameras from Sony, OmniVision, and Onsemi, Velodyne, Luminar, and Hesai’s lidars (Ouster and Innoviz ONE provide third-party support from the manufacturer), Hera and Continental’s millimeter-wave radar, GNSS/IMU devices, and cameras and ultrasonic sensors from Valeo.

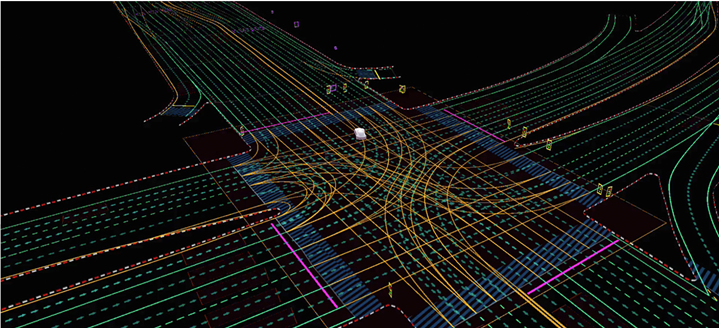

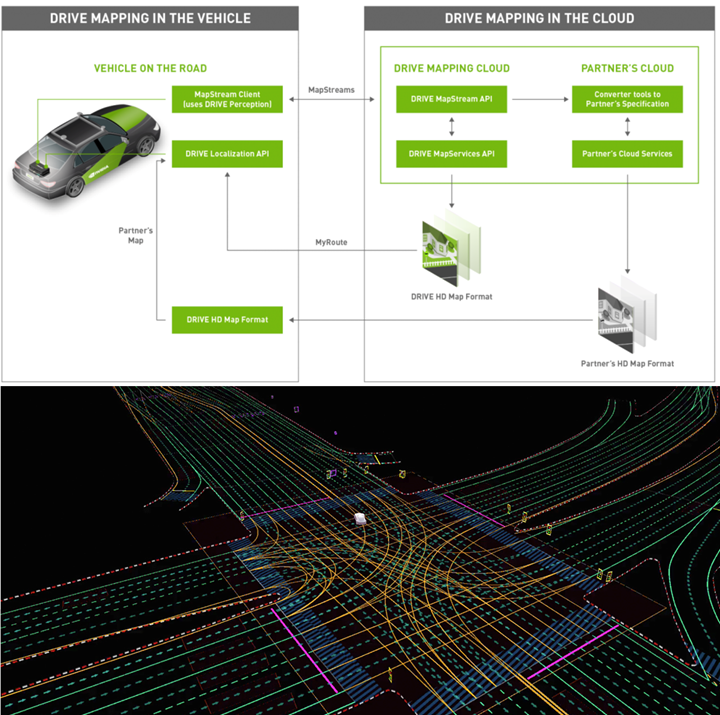

As autonomous driving cars and servers iterate, Nvidia Drive Map becomes an important element, consisting of two map engines: ground reality survey maps and crowdsourced map engines, which collect and maintain collective memory of the earth. The goal is to survey 500,000 kilometers worldwide by 2024, continually updating digital simulations to achieve centimeter-level map accuracy. This Nvidia Drive Map world’s map data is loaded and stored on Nvidia Omniverse, which can support global digital simulation, continuously updated and expanded using automated content generation tools built on Omniverse.

Note: I believe China is not included in the above.

Summary: Nvidia’s automotive story has always been grand. Looking at it from this starting point, new Chinese car brands have responded quickly in terms of technological iteration, but who can keep up with the underlying technical construction remains a question worth considering. Assuming that there is a shortage of Nvidia chips after 2025, how will everyone play the game?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.