Translation

Author | Wang Lingfang and Tian Hui

Editor | Qiu Kaijun

Yes, BYD has been “making chips” for 20 years.

BYD established its IC (Integrated Circuit) design department in 2002, almost simultaneously with the start of its car and battery plans.

Twenty years ago, under unknown pressures, Wang Chuanfu entered the field of chip manufacturing, which was characterized by high levels of capital, technology, and talent, but low profit margins.

Twenty years later, faced with the “chip shortage” problem in the automotive industry, BYD has responded most calmly. While other companies are facing production shutdowns or reductions due to the “chip shortage,” BYD not only has an adequate supply of chips, but also sells chips to others.

The strategic decision made by Wang Chuanfu 20 years ago has now borne fruit. Relying on its vertical integration of the industry chain, BYD’s monthly sales have exceeded 100,000 vehicles, surpassing joint venture brands and becoming the largest vehicle manufacturer in the Chinese market.

So, this time, let’s not talk about new energy vehicles and batteries, but take a closer look at BYD’s strength from a chip perspective.

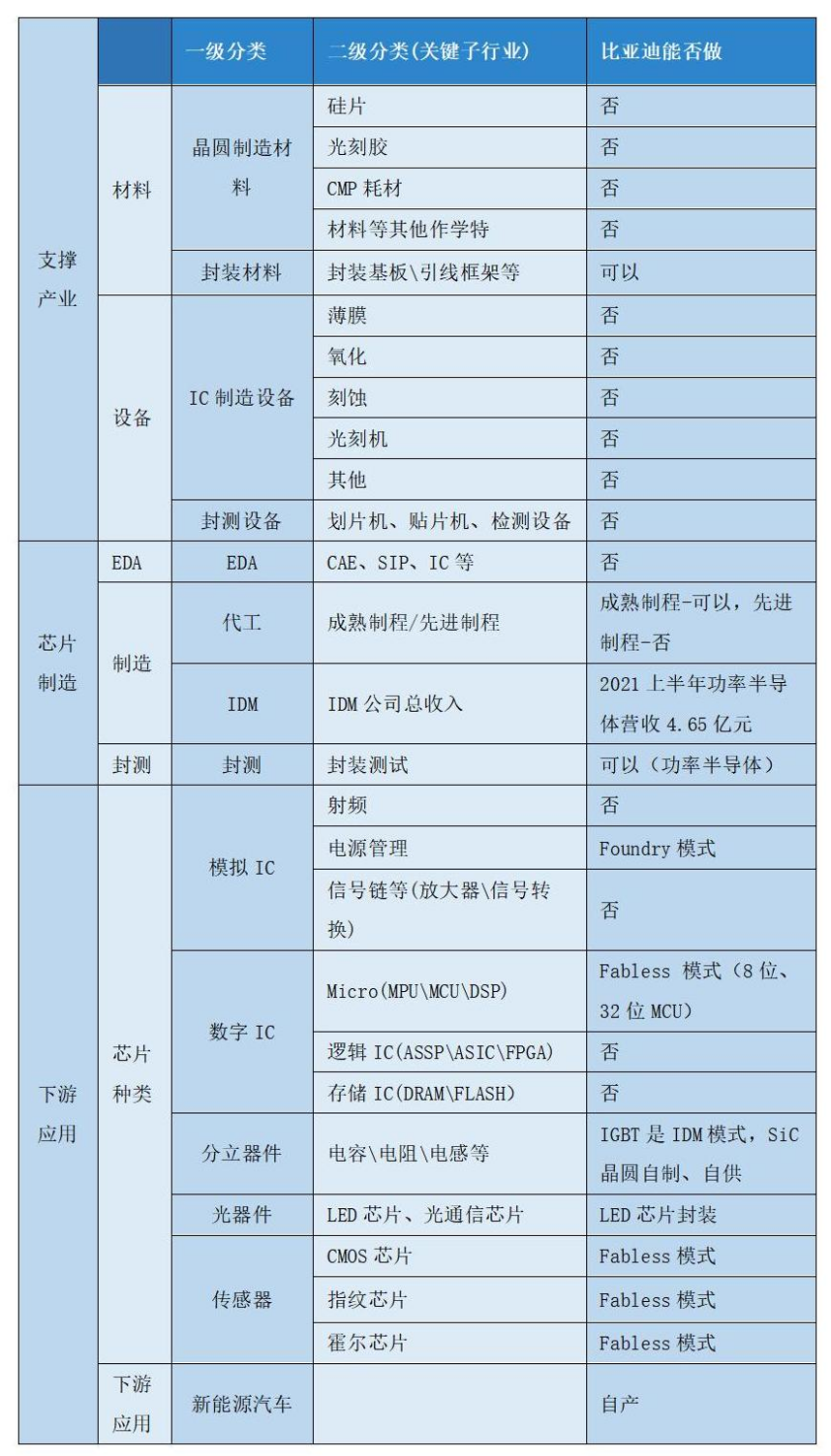

First, let’s take a look at the semiconductor component industry capability chart compiled by the Electric Vehicle Observer, which gives us a quick overview.

From the chart, we can see that in terms of chip types, BYD can produce several types of chips, including discrete devices, power management, MCU, optoelectronics, and sensors, but it has not yet covered computing chips and storage chips required for smart driving technologies. In terms of the chip industry chain, BYD can design and manufacture mature process chips, but it cannot produce upstream materials and equipment.

Therefore, we can say that BYD has the ability to independently develop and produce various chips, but not all types of chips, and it has not yet overcome barriers to production of advanced process chips or materials and equipment.

Next, let’s take a deep dive into this chart.

What Can BYD Do?

As we all know, the semiconductor industry chain is very long and technically very challenging. Additionally, there are many types of chip products, including power chips, computing chips, and analog chips, etc.

Therefore, there is currently no company that can cover the entire industry chain and all products.

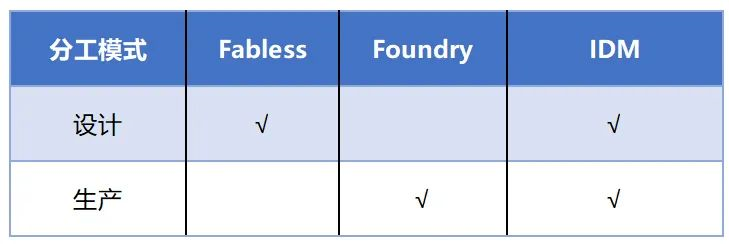

In order to understand BYD’s manufacturing capabilities in the semiconductor industry, we need to first understand the characteristics of the semiconductor industry’s division of labor. The division of labor in the semiconductor industry chain can generally be categorized into three types: Fabless, Foundry, and IDM.

To facilitate understanding, we can use the construction industry as an example. Fabless companies are like architectural design firms, responsible only for design and not construction. Foundries are like building contractors, responsible only for construction and not design. IDM companies are like general contractors, capable of both design and construction.

To facilitate understanding, we can use the construction industry as an example. Fabless companies are like architectural design firms, responsible only for design and not construction. Foundries are like building contractors, responsible only for construction and not design. IDM companies are like general contractors, capable of both design and construction.

Different semiconductor company models have different requirements for capabilities.

For example, Fabless companies require stronger market research and development capabilities to meet market demands. Foundry companies are more like traditional industrial companies, considering process levels and cost control capabilities. IDM companies require higher comprehensive capabilities and must excel in all areas to succeed.

The most famous companies in the chip industry under different models are: Fabless model – NVIDIA, Foundry model – TSMC, and IDM company – INTEL.

BYD (Build Your Dreams) uses different industry chain models for different types of chips:

- BYD has IDM model design and manufacturing capabilities for IGBT and SiC chips;

- BYD operates under the Fabless model for automotive MCU (microcontrollers), CMOS cameras, and fingerprint sensors;

- BYD can achieve Foundry model in analog IC (power management) chips, producing on behalf of other enterprises.

Just like BYD’s new energy vehicles insist on both plug-in and pure electric modes, BYD Semiconductor’s development also considers multiple models.

In terms of product types, BYD Semiconductor’s chips mainly revolve around BYD Group’s business. BYD Group’s main business types are: new energy vehicles, LED light sources, photovoltaics, energy storage, rail transportation, and consumer electronics manufacturing. Therefore, the types of chips that BYD Semiconductor can produce are relatively diverse.

With the exception of analog ICs, all other chips produced by BYD Semiconductor may be used in automobiles.

Overall, the types of chips produced by BYD Semiconductor still revolve around new energy vehicles and consumer electronics. As automobiles and consumer electronics products continue to merge, the chips produced by BYD Semiconductor will increasingly be applied to automobiles.

Customer and Capacity Situation

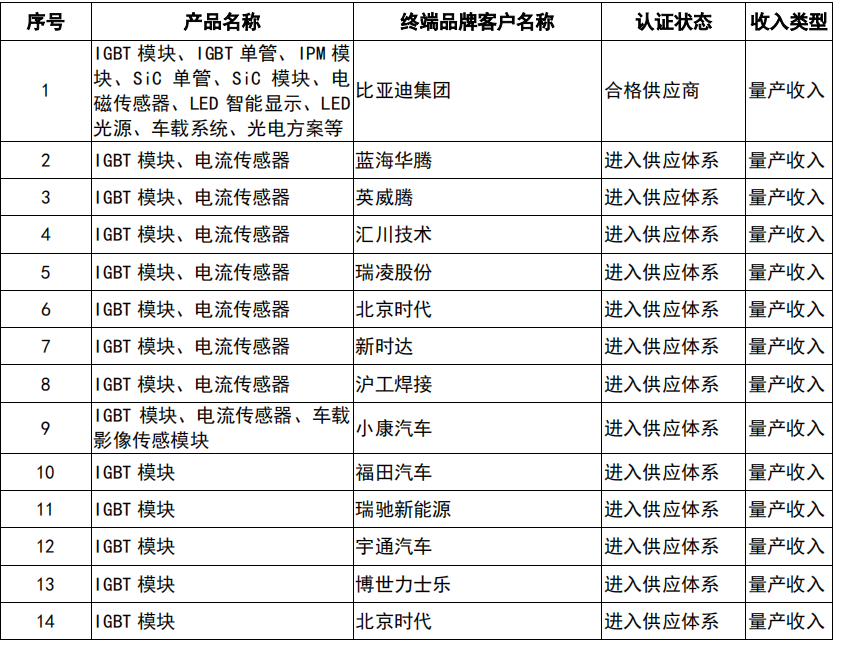

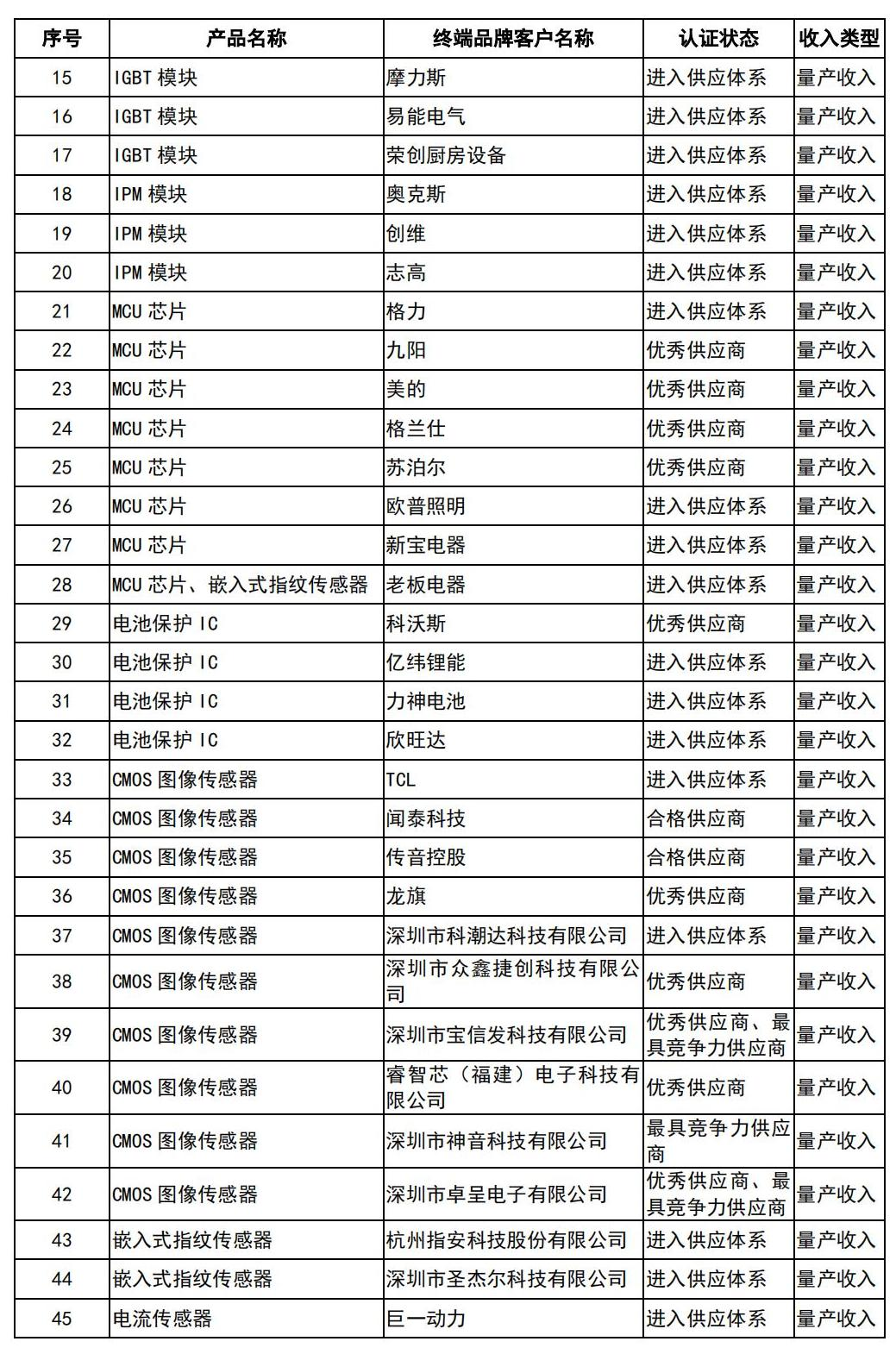

After understanding the products, let’s take a look at BYD’s current customers:

According to BYD Semiconductor’s prospectus, in the automotive field, BYD Semiconductor has entered the supply chain system of brands such as XPeng Motors, Dongfeng’s Voyah, Yutong, Xiaokang Motors, and Changan Automobiles.

In the home appliance field, BYD has entered the supply chain systems of brands such as Midea, Gree, Aux, Galanz, Chigo, Joyoung, and Supor.

In the industrial control field, BYD has entered the supply chain systems of brands such as Rui Ling Technology, Honeywell, Beijing Times, Xinshida, Huichuan Technology, and Bosch Rexroth.In the field of consumer electronics, BYD has entered the supply chain of brands such as Samsung, Transsion Holdings, Yunyi Zhilian, Wentworth Technologies, Longqi, and TCL.

The specific end customers who have already mass-produced are as follows:

In addition to power modules, BYD has strong technological advantages in the field of intelligent control IC. MCU chips and power ICs have rich mass production experience and high-quality customer base, and have entered the supply chain of brand manufacturers such as BYD Group, Midea, Gree, and Galanz.

In the field of intelligent sensors, BYD also has strong market competitiveness and application advantages. Among them, consumer-grade CMOS image sensors have entered the supply chain systems of well-known brand manufacturers such as Samsung, TCL, and Transsion Holdings. The vehicle-grade CMOS image sensor adopts vehicle-grade BSI technology and vehicle-grade IMBGA packaging, which has advantages in star-level image effect and wide dynamic performance.

It can be seen that BYD’s chips enter the market from the vehicle-grade level, and are downward compatible to industrial-grade and consumer-grade products.

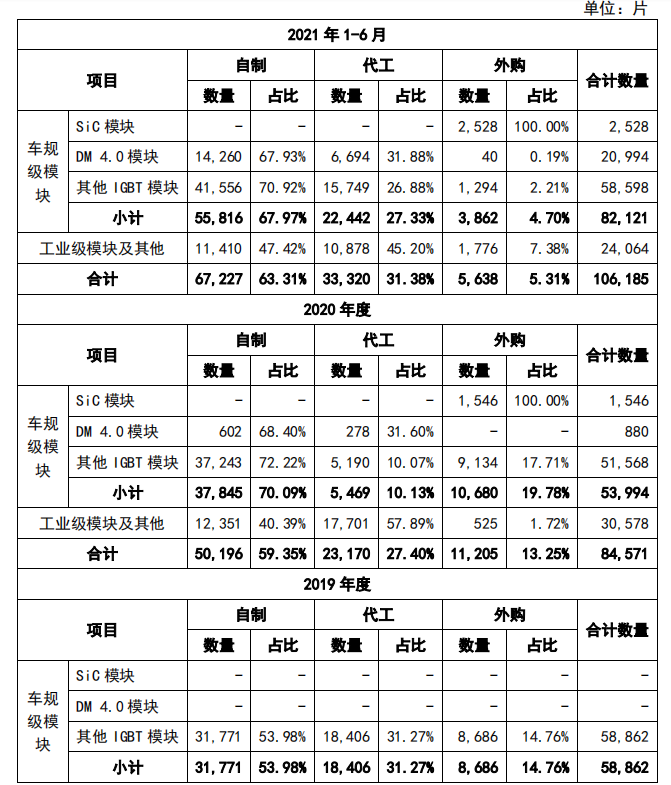

In terms of proportion, whether it is the vehicle-grade module or the industrial module, self-supply is the mainstay, accounting for more than 50%.

From the data disclosed in the prospectus, in 2020 and the first half of 2021, BYD’s power semiconductor sales were mainly concentrated in vehicle-grade modules, accounting for 76.40% and 81.98% respectively, mainly including SiC modules, DM4.0 hybrid modules, and other vehicle-grade IGBT modules.

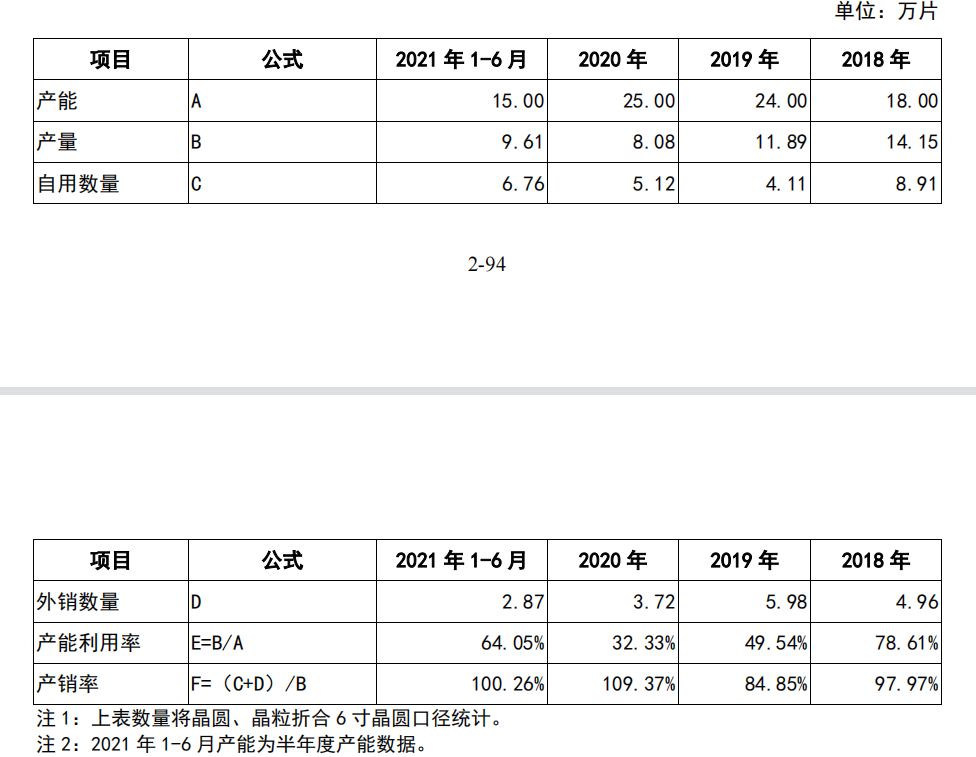

The wafer is the carrier of the chip. In terms of wafer manufacturing, the information disclosed by BYD shows that the wafer utilization rates from 2018 to the first half of 2021 were 78.61%, 49.54%, 32.33%, and 64.05%, respectively; the wafer production and sales rates were 97.97%, 84.85%, 109.37%, and 100.26%, respectively.

From the production and sales rate perspective, BYD has demonstrated full production and sales, indicating the market scarcity of chip products.

From the data in 2020 and 2021, the proportion of self-use in wafer manufacturing has increased, which should be due to the impact of chip shortages, resulting in an increase in self-supply and a decrease in external procurement.## Significant Decline in Production and Sales Proportions in 2019

In 2019, the production and sales proportions of BYD’s silicon wafer manufacturing declined significantly due to the overall impact of the domestic new energy vehicle market. The growth was slower than expected, and the quantity for self-use and external sales decreased. However, since the second half of 2020, BYD’s product sales have continued to increase, gradually digesting the inventory of silicon wafers, and the production and sales ratios have increased significantly.

Here are the capacity, production, self-use, and external sales of silicon wafer manufacturing:

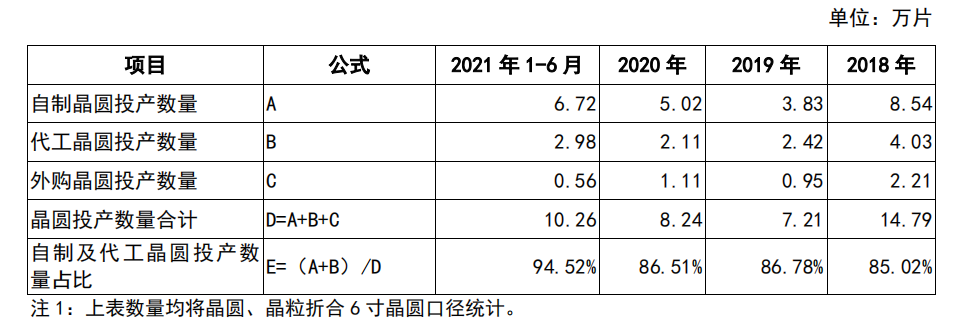

BYD’s self-made silicon wafers are mainly used for power module production.

The production quantity of self-made, outsourced, and purchased power module silicon wafers is as follows:

Competitiveness

BYD laid out a comprehensive plan for core technology and has established a complete independent intellectual property system, with 1167 authorized patents as of the signing of the prospectus, and established high technology barriers in chip design, silicon wafer manufacturing, module packaging and testing, system-level application testing, and other areas.

Let’s analyze BYD’s strongest power devices.

“First, BYD has certain advantages in SiC applications.” Looking at the global market competition pattern, US, European, and Japanese companies dominate the SiC industry chain. Enterprises represented by Cree, Infineon, Rohm Semiconductor, STMicroelectronics operate on an IDM model and have a high market share.

Among domestic manufacturers, BYD Group has been the first to use SiC devices in vehicles. “BYD is also the world’s first and the only domestic power semiconductor supplier with SiC three-phase full-bridge modules that have been mass-installed in motor control units.”

BYD’s SiC module was put into commercial use in the third quarter of 2020 and was installed in BYD Han high-end models, currently only available for BYD Group. In 2020, BYD shipped 12,800 SiC modules, which have no comparable products with similar specifications and batch installation on the market.

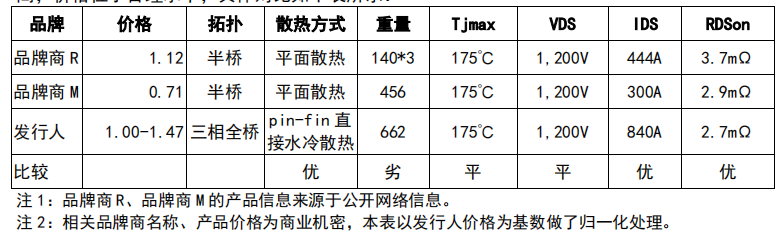

According to public information, compared with brand R and brand M, BYD’s products use the three-phase full-bridge topology, adopt a more advanced Pin-Fin water-cooling system for heat dissipation, and share the same voltage level but have a higher current level, with prices at a reasonable level, and the specific comparison is shown in the table below:

According to the prospectus, BYD’s self-developed high-density trench gate field stop composite IGBT chip technology has achieved a comprehensive performance level in line with international leading manufacturers, with high efficiency in electric drive applications.

Currently, BYD has achieved mass production of IGBT 5.0 technology based on high-density Trench FS.

BYD’s Intelligent Power Modules (IPM) are mainly used in various variable frequency control fields such as new energy vehicle air-conditioning controllers, variable frequency home appliances, stepper motors, and servo motors.

In terms of performance, the turn-on loss of BYD’s IGBT chip is better than that of international leading manufacturers, and the turn-off loss is similar to that of international leading manufacturers. The product has low loss and high efficiency characteristics; The switch loss and reverse recovery loss of the automotive-grade IGBT module are superior to those of international leading manufacturers, and the product has high power density, low loss, and high reliability characteristics. The internal resistance and highest junction temperature of the SiC module are superior to those of international leading manufacturers, and the product has low loss, low inductance design, and high working junction temperature characteristics.

In terms of module technology, BYD adopts a finned direct cooling structure and double-sided heat dissipation packaging technology to improve heat dissipation efficiency and power density.

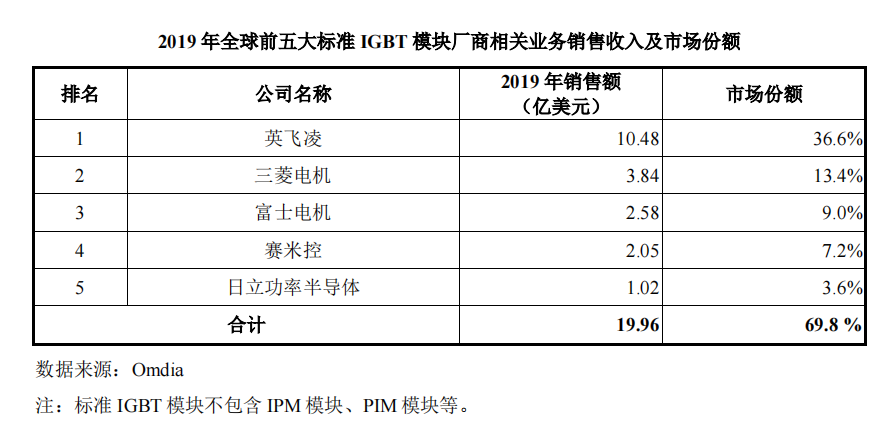

According to Omdia statistics, based on the sales of IGBT modules in 2019, BYD ranked second among IGBT module manufacturers for new energy passenger car motor drive controllers in China, second only to Infineon, with a market share of 19%. It ranked first among domestic manufacturers. In 2020, BYD maintained its leading position as the second-ranked global manufacturer and the first-ranked domestic manufacturer in this field.

However, BYD is still far from being ranked high in terms of global supply and market share.

In terms of wafer manufacturing, BYD masters the core process technology of gate fineness processing and ultra-thin backside processing. In terms of module packaging, BYD adopts a finned direct cooling structure and double-sided heat dissipation packaging technology to improve heat dissipation efficiency and power density.

Overall, BYD has strong competitiveness in the domestic automotive-grade chip, especially in the power device supply aspect, but on the international level, due to its late start and a relatively small number of matching vehicles, BYD still lags behind the international giants in terms of reliability verification.

What are the bottleneck linksAccording to the analysis above, it can be seen that BYD Semiconductor is in a relatively leading position in the field of vehicle-grade power devices in the Chinese market.

However, due to the overall level of China’s chip industry, BYD’s chip industry chain is not perfect.

BYD Semiconductor admits in its prospectus that it has improved production line productivity by purchasing used equipment, and it also said that 8-inch wafer used equipment is in short supply in the market.

BYD Semiconductor does not have self-production ability in the chip design tools such as EDA, IP cores, and other upstream raw materials that it did not mention.

The problems faced by BYD Semiconductor are not only its own problems, but also the overall problems of the Chinese semiconductor industry chain. Independent semiconductor manufacturers with IDM capability all face restrictions on chip design software and production equipment. BYD Semiconductor is no exception.

Compared with international giants, BYD Semiconductor has a shorter history and relatively few product supplies. It can be seen that there is still a certain gap in chip production process and product quality compared with the top manufacturers in the industry.

These gaps need BYD Semiconductor to continuously iterate its technology and accumulate experience in order to make breakthroughs.

Inspiration from BYD Semiconductor

BYD Semiconductor and its subsidiary companies, such as Fudi Power, prove that automotive companies have natural advantages in incubating the industry chain.

From the development history of BYD Semiconductor, this company’s new businesses have always been built around the strategic needs of BYD Group. IGBT, LED and other chips are semiconductor products that BYD Group needs for the development of automotive and photovoltaic industries and play a supporting role within BYD Group.

Today, BYD Semiconductor’s IGBT modules have been accepted by multiple automakers, and camera modules and LED light source chips are being purchased by other automakers. After independent IPO, BYD Semiconductor will be more easily accepted by other automakers.

However, returning to the beginning, whether it was Wang Chuanfu or BYD Semiconductor executives who were interviewed, they all said that they did not want to make chips, but did so because they could not buy them.

In other words, BYD Semiconductor was forced to enter this industry.

But it is precisely because of BYD Semiconductor, who was forced into the industry, that it proves that automotive companies have strong incubation ability for the industry chain. An excellent automotive company should not be limited to sucking blood in the industry chain, but should have the ability to create new blood for the industry chain.

In the automotive industry, large companies such as Toyota and GM have this ability. When China is developing the new energy vehicle industry, it is not surprising to have a BYD company, and there should be more automotive companies with incubation capabilities for the industry chain.

Outside the automotive industry, Huawei was forced to make smartphones, and DJI was forced to make cameras.

Companies that are limited to the automotive industry will eventually be enveloped by the industry. Companies that break through the limits of the industry have the possibility to overturn the industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.