Tesla’s Q1 Report: Crazy Profit, Production, and Robots

Today, Tesla released its Q1 2022 financial report. Despite the Shanghai factory’s hiatus due to COVID-19, the Q1 report added fuel to Tesla’s fire.

Here’s a summary of the key takeaways from Tesla’s 2022 Q1 report:

- Crazy profits

- Crazy production

- Crazy robots

- Ultimate goal: World’s number one

Let’s dive into the details.

Crazy Q1

Whenever Tesla releases a financial report, it’s always a big deal within the industry. The Q1 report for 2022 was no exception, with even dedicated trending topics on Weibo.

What’s different this time is that despite facing multiple unstable factors such as war, material price hikes, COVID-19, and supply chain issues, Tesla still managed to produce a nearly “crazy” answer sheet.

Here are some highlights from the report:

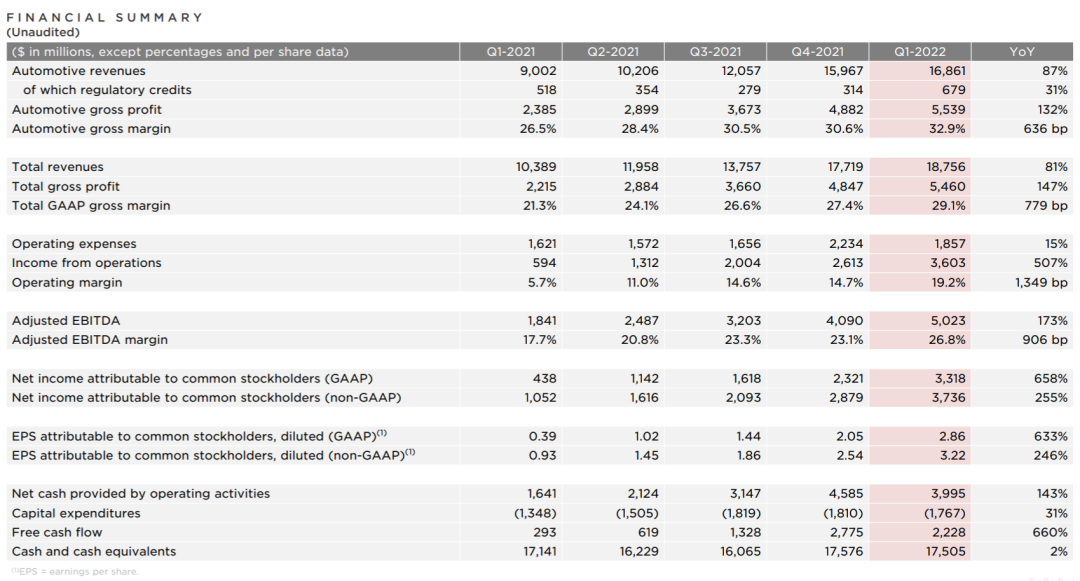

- Automotive revenue was $16.861 billion, an 87% YoY increase. Total revenue was $18.756 billion, an 81% YoY increase.

- Automotive gross profit was $5.539 billion (CNY 35.556 billion), a 132% YoY increase. Total gross profit was $5.46 billion (about CNY 350 billion), a 147% YoY increase.

- Q1 automotive gross margin was 32.9%, and overall gross margin was 29.1%.

- Q1 operating profit was $3.6 billion, and the operating profit margin was 19.2%. Net profit was $3.3 billion, with non-GAAP net profit (excluding stock-based compensation) at $3.7 billion.

- Cash and cash equivalents were $17.505 billion (CNY 1123.7 billion).

- Total deliveries were 310,048 vehicles, a 68% YoY increase. The global average inventory cycle was 3 days, a 63% YoY decrease (previously 8 days).

- There are now 3,724 Supercharger stations and 33,657 Supercharger connectors worldwide, with a 38% and 37% YoY increase, respectively.

- Solar deployment was 48 MW, a 48% decrease YoY. Energy storage deployment was 846 MWh, a 90% YoY increase.

- R&D expenses were $865 million (about CNY 55.5 billion), a 30% YoY increase.

In this lengthy report, there are a few key data points worth noting. Tesla’s Q1 automotive revenue was $16.861 billion (CNY 108 billion), which is significant compared to other new players in the industry:

- NIO’s 2021 Q4 and full-year revenue were CNY 9.9 billion and CNY 36.14 billion, respectively.

- Li Auto’s 2021 Q4 and full-year revenue were CNY 10.62 billion and CNY 27 billion, respectively.- XPeng’s Q4 and full-year revenue for 2021 were RMB 8.56 billion and RMB 20.9 billion, respectively.

In other words, Tesla’s quarterly car revenue has exceeded the total annual revenue of WeRide for 2021. Moreover, Tesla’s Q1 operating profit reached 19.2%.

Therefore, “making money” has become the first keyword for Tesla’s Q1. However, there is still an exaggerated number, and that is the gross profit margin of the car: 32.9%.

Assuming the car’s selling price is RMB 300,000, Tesla’s gross profit for selling one car can reach RMB 100,000, which means every car sold is equivalent to selling a “Euler or NETA” car.

And the data for WeRide in their best-performing fiscal year last year is:

- Ideal Automobile: 2021 car gross profit margin is 20.6%;

- NIO Automobile: 2021 car gross profit margin is 21.1%;

- XPeng Automobile: 2021 car gross profit margin is 11.5%.

What’s more exaggerated is that the global average inventory cycle of Tesla is 3 days, which was 4 days in 2021 Q4 and 6 days in 2021 Q3.

In other words, Tesla has basically no inventory and is even not enough to sell. The demand is strong worldwide, and as long as Tesla is willing, the complete vehicle gross profit margin can be maintained at around 30%.

Regarding such high gross profit margin, Musk said:

It seems unreasonable for us to raise vehicle prices, but our vehicle waiting time is already quite long, and our current vehicle prices actually anticipate the increase in supplier and logistics costs.

Although we have always been committed to reducing manufacturing costs as much as possible, these impacts on the cost structure have prompted us to adjust product pricing.

We do not want to further increase product prices. The current price has anticipated the increase in costs. If costs do not increase, we may slightly reduce prices. Our core is to make electric vehicles as affordable as possible for everyone.

In this case, Tesla is fully capable of not raising prices or even lowering prices in the face of inflation, but Tesla did not do so. What Tesla needs is not low-priced “grabbing the market”, but using products and engineering capabilities to reduce costs and “occupy the market”.

Tesla is highly likely to maintain its gross profit at around 30% – 35%, and the dynamic range of “gross profit” is easy to understand. Tesla’s earlier R&D investment was too large, and investment needs to be returned. Tesla needs sustained profitability, so as long as Tesla’s complete vehicle BOM cost continues to fall, the possibility of a drop in the vehicle price is also high.

Financial conference callTesla chose to release its financial report on the second day of resumption of work at the Shanghai factory, which must have been a deliberate decision as China, the largest single market, has contributed nearly half of its sales while also playing a role in supplying new cars overseas. Keeping the morale stable is important.

Although Tesla has experienced a considerable period of shutdown due to the pandemic, Musk is confident about the total production plan for this year.

Regarding production capacity

Currently, Tesla has five complete vehicle factories, one photovoltaic factory, two battery factories, and component factories worldwide.

In terms of production capacity:

- Tesla’s Shanghai factory has a production capacity of 750,000 vehicles per year;

- The Fremont factory in the United States has a production capacity of 600,000 vehicles;

- The total global production capacity is 1.35 million vehicles.

- The production capacity in Berlin and Texas is still climbing as they have only just started production;

- It is expected that by the end of 2022, the annual production capacity will reach 2.35 million vehicles.

In terms of production volume:

In 2021, the Shanghai factory produced 510,000 vehicles, the US factory produced 430,000 vehicles, and the total production volume reached 940,000 vehicles. The production and delivery work of the Berlin factory officially started in March 2022, and that of the Texas factory started in April.

The production volume of the Shanghai factory in Q2 will be roughly the same as Q1, but Q3 and Q4 will be much better (expanded production and restored capacity).

Musk said:

We are still confident about this year’s annual output of 1.5 million vehicles. It is not difficult to increase production by 50% compared to last year. In fact, we can almost achieve an output of 1.6 million vehicles. Our factory has been put into production, and the capacity climbing will not be slow, but you know expanding capacity is our decision-making core.

However, supply chain challenges still exist, and our team has been struggling with them for more than a year. Meanwhile, we have invested a lot of energy in independent battery production, raw material procurement, and supplier diversification.

In addition to the impact caused by the chip shortage, the recent outbreak of COVID-19 has also put pressure on our supply chain and factory operations.

Thus, Tesla has truly started the rhythm of “mass production,” which should sound the alarm for all traditional manufacturers. All your strategic moves may appear particularly fragile in front of the strong, and it may be more practical to strengthen the deployment of potential popular products than “frying dumplings.”

Regarding the 4680 batteryWe have made steady progress with the 4680 battery, but we cannot control all costs. It will take some time for Model 3 to use the 4680 battery, and it will be greatly improved.

The 4680 battery will reach the best level of existing products on the market later this year, and it will surpass all market batteries next year.

The Berlin factory is currently using 2170 battery packs to produce vehicles. The Berlin factory will switch to 4680 batteries in the third quarter of this year, and the Texas factory supports the production of both 2170/4680 battery versions of Model Y.

The mining and refining of lithium materials are factors limiting battery production. The actual lithium content in the battery is only 2-3%, and some exciting news will be released in the coming months.

As Musk said: “There is no shortage of lithium elements on earth. This substance is really everywhere, but the current technology of lithium extraction is too bad, and we can only extract a small amount of lithium. I think this needs to change.”

About the 800V architecture

Using an 800V voltage platform on Model 3/Y has advantages and disadvantages. Higher voltage is not always better. The cost of 800V is high on small cars, and the advantage is not significant because 800V requires a certain body volume, and the space on small cars is limited.

The switch from 400V to 800V may save $100. Tesla is currently considering using 800V voltage for Cybertruck and Semi, both of which have special purposes and are large.

Highlights

Summarizing the highlights of Tesla’s Q1 2022 financial report in terms of production, models, robots, Robotaxi, software, charging, batteries, and insurance:

Tesla robot:

The importance of Optimus will become apparent in the coming years. Optimus will be more valuable than the automotive business and FSD, and it is the core task of Tesla’s development in the coming years.

Musk aims to use Optimus to eliminate all human labor in industrial production and bring “cheap” manufacturing back to the United States.

Production and manufacturing:

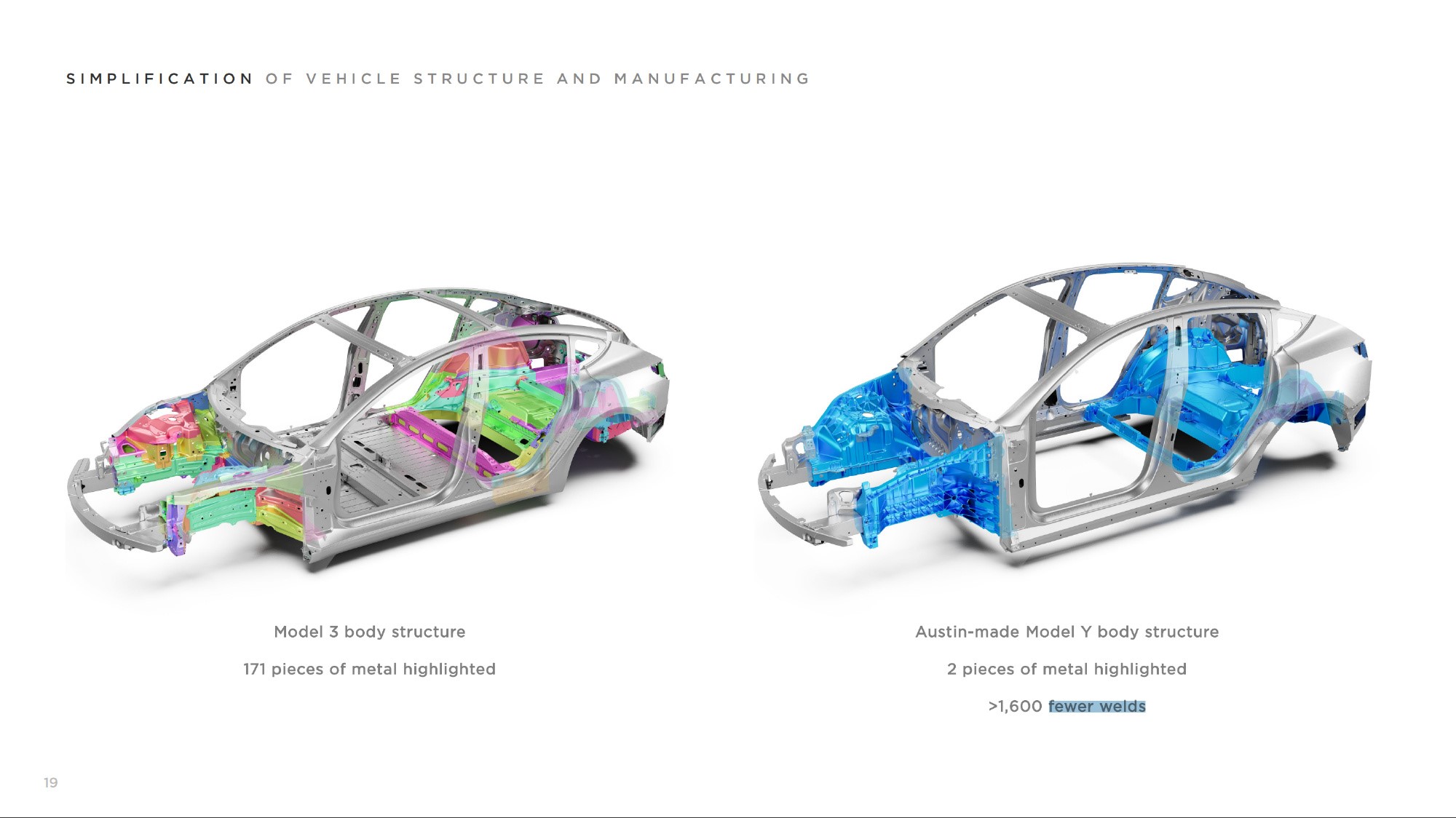

The front and rear integrated die-casting body saves 60% of production line space and reduces the cost of the whole vehicle. Tesla also recycles the aluminum alloy wheels of gasoline cars and smelts them for integrated die-casting of the body. Tesla recovers 50 tons of materials every week in Reno, Nevada. In addition, the main body of the Megapack factory in California has been completed.

The front and rear integrated die-casting body saves 60% of production line space and reduces the cost of the whole vehicle. Tesla also recycles the aluminum alloy wheels of gasoline cars and smelts them for integrated die-casting of the body. Tesla recovers 50 tons of materials every week in Reno, Nevada. In addition, the main body of the Megapack factory in California has been completed.

Model related:

The Robotaxi without steering wheel/pedals will be put into production in 2024, and a Robotaxi-related event will be held in 2023. The Robotaxi will achieve lower operating costs than buses/subways.

The Model 3 will still need a few years to use the 4680 battery. The Model Y manufactured in Texas is available in two versions: 2170 and 4680.

-

When the Model Y is produced in Texas, 1600 welds are reduced.

-

Cybertruck and Semi may upgrade to the 800V voltage platform.

-

Currently, there is not much advantage to the 800V platform, and the cost difference is $100. Switching platforms requires a lot of costs and needs more sales support.

-

Cybertruck reduces 20-30% of components compared to traditional pickups.

FSD software:

FSD Beta software will be pushed to all FSD users in the US within this year. Currently, the number of FSD Beta users has increased to more than 100,000, and FSD Beta has been updated seven times in the first quarter of this year.

Supercharging network:

Investment is accelerating. 248 new supercharging stations were added in the first quarter, and the plan is to open the supercharging network to third-party vehicles around the world. The North American region will be the first to open the supercharging network to third-party vehicles.

Self-insurance:

Tesla is the second-largest insurance company in Texas and may become the largest insurance company at the end of this quarter. It is a fully vertically integrated insurance supplier in these new states. Tesla hopes that self-insurance will cover 80% of the US market by the end of this year.

Final Thoughts

Did you notice an important sentence Musk said, “The importance of Optimus will become evident in the next few years, and Optimus will be more valuable than the automotive business, more valuable than FSD, and is the core task of Tesla’s development in the next few years.”

Is it possible that the Optimus robot is Musk’s core, incidentally producing Tesla vehicles just to maintain cash flow?This question perhaps only Elon himself knows the answer, but there is one piece of information to reveal that most people will think Elon is a great product manager after Tesla’s products enter the market, but in fact “manufacturing” may be Musk’s ultimate goal.

Here, “manufacturing” does not refer to producing a car, but a system applicable to most high-tech “production”, and Optimus may be the starting point.

During the TED interview, Musk said, “I am the most knowledgeable person about manufacturing on this planet.”

Through the Optimus robot, the existing global manufacturing ecology may be changed, and America still hopes to absorb the manufacturing industry back to its country through non-human resources.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.