ID.3 is not only a pure electric car but also represents a new beginning, not only for this factory, the whole Volkswagen Group, and also the German auto industry.

- Herbert Diess

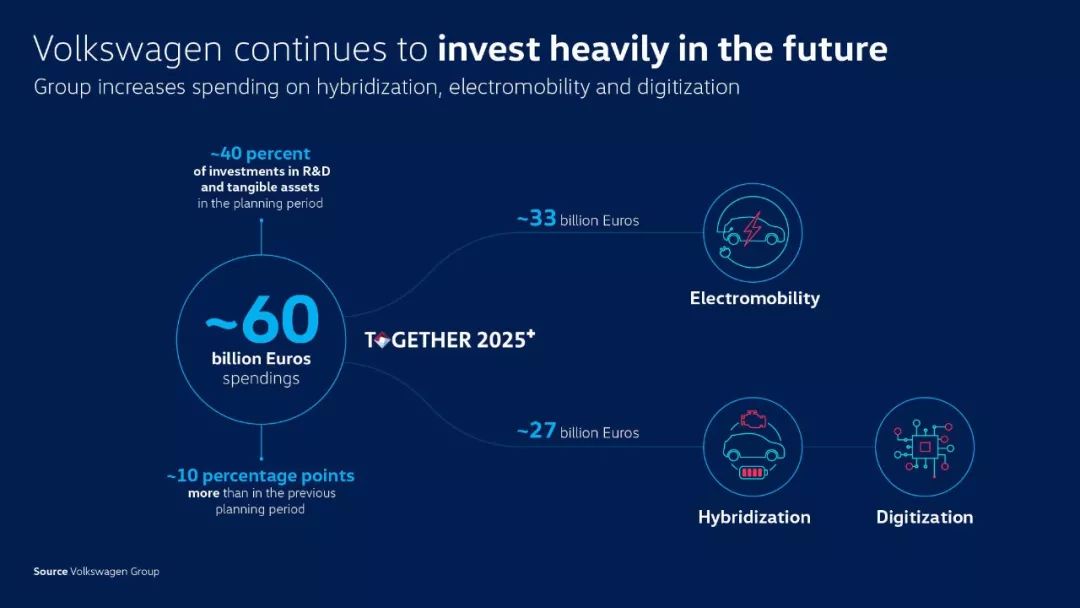

In 2019, Volkswagen announced plans to invest 60 billion euros over the next five years in hybridization, electrification, and digitization, which means that Volkswagen has plunged nearly four years’ profits into the new era at once.

For Volkswagen, this is a grand bet and a great revolution. They are determined to make it and will either succeed or suffer a crushing blow.

Betting on Electrification

Before discussing why Volkswagen is so determined to transition to pure electric vehicles, let’s first take a look at what Volkswagen has done so far.

On November 15, 2019, during the reveal of the new Volkswagen brand, Volkswagen announced that it would invest 60 billion euros (about 467.5 billion yuan) in electrification, hybridization, and digitization between 2020 and 2024.

This figure is 36% higher than the 44 billion euros announced in 2018.

In 2018, the Volkswagen Group’s total revenue was 235 billion euros, with a profit of 17.1 billion euros. 60 billion euros is equivalent to almost four years’ profits for the Volkswagen Group, and over half of that amount will be used to develop pure electric vehicles.

It is essential to spend money to develop a new industry, but the key question is where to spend it.

Here are two pieces of data:

By 2029, Volkswagen will launch 75 pure electric vehicle models and 60 hybrid vehicle models. It is expected that global sales of electrified vehicles will reach 26 million in 2029.

Therefore, Volkswagen will spend over 1 billion euros on battery packs, invest 250 million euros in charging infrastructure construction, and transform or build 18 factories worldwide to produce electrified vehicles, with eight of these factories dedicated to manufacturing MEB platform models.

2029 is too far away? Let’s look at another set of numbers that are closer at hand.

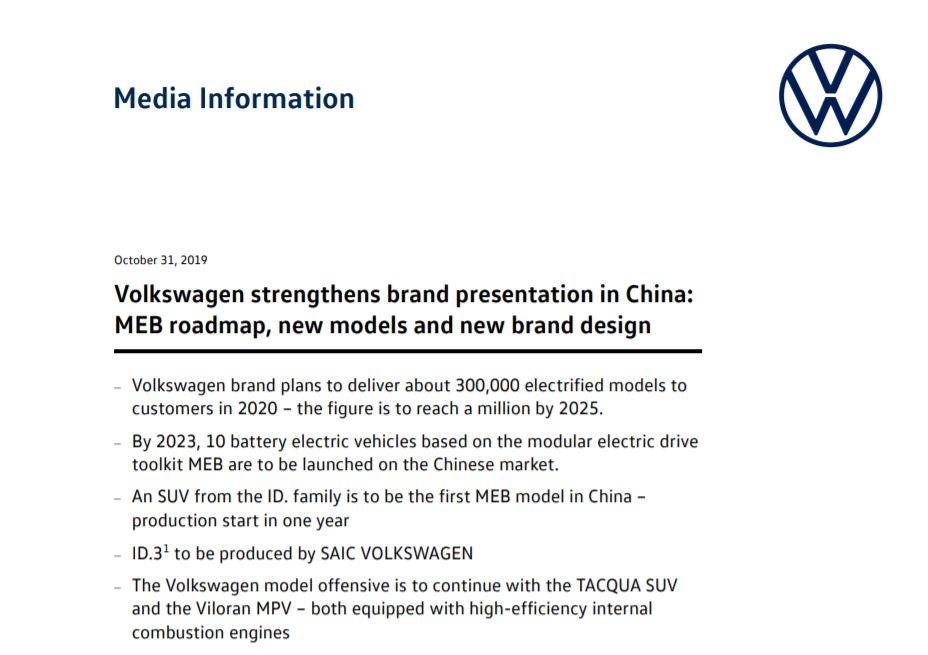

Volkswagen plans to build 33 models based on the MEB platform by 2025 and achieve an annual output of 1 million MEB platform vehicles by 2025 (two-thirds of which will be produced in China).Regarding the Chinese market, Volkswagen plans to deliver 300,000 new energy vehicles in China in 2020, and this number will increase to 1 million by 2025.

What is the concept of 1 million pure electric vehicles based on the MEB platform? The global sales volume of pure electric vehicles in 2018 was 2 million, which means that by 2025, the number of pure electric vehicles based on the MEB platform will reach half of the total global sales volume of pure electric vehicles in 2018.

Volkswagen has invested a lot of money in the field of pure electric vehicles, whether it’s research and development of pure electric platforms, construction of new factories, or supporting facilities for electric vehicle charging. Consumers will slowly begin to feel Volkswagen Group’s transition to pure electric vehicles in 2020, and with the passage of time, this trend will become stronger.

Why did Volkswagen choose the path of pure electric vehicles?

This is the comprehensive transformation that Volkswagen has made to face the new era. So why not make money steadily from gasoline vehicles? Why choose to transition to pure electric vehicles that many people are not optimistic about?

To achieve sustainable profitability.

Since the “Dieselgate” scandal broke out in 2015, Volkswagen has paid a price of more than 30 billion U.S. dollars. This incident has left a deep imprint in the heart of Volkswagen Group and also made Volkswagen realize the bottleneck of internal combustion engines in reducing carbon emissions.

Faced with increasingly stringent emission regulations, Volkswagen Group’s technological reserves are clearly limited. Continuing to focus on gasoline vehicles will make it difficult to meet the increasingly stringent emission regulations in the European Union. Whether it is fines or the price of purchasing credits, it will be a huge amount of money for these non-compliant automakers, which will greatly reduce the group’s profits.

Whether to continue to focus on internal combustion engines or to open up a new energy route also depends on whether Volkswagen wants to make quick money or achieve more long-term profitability.

There have been three major changes in human history, and each major change is accompanied by a change in energy situation. This is an opportunity and a challenge for any participant. At this turning point, Volkswagen has chosen to transition to pure electric vehicles.

Moving on to the second question, why transition to pure electric vehicles?

The core driving force behind Volkswagen’s transformation is emission regulations, but there are many ways to achieve energy saving and emission reduction, such as hydrogen energy, fuel cells, and hybrid power. Earlier, few traditional automakers were optimistic about pure electric vehicles, and most European automakers were moving towards hydrogen energy, while Japanese automakers focused mainly on hybrid power.When it comes to hydrogen energy, the attitude of the public is clear from this graph. The public believes that not only is the technical route for hydrogen energy complicated, but also its conversion efficiency in energy is not high, which is contrary to the concept of improving energy efficiency.

When it comes to hybrid electric vehicles, Japanese automakers began to make efforts as early as 2000 and have since mastered the hybrid technology that can truly reduce fuel consumption. Volkswagen is now lagging behind in the development of hybrid technology and, at an investor meeting on November 19, Volkswagen made it clear that “hybrid is just a transitional technology and our ultimate goal is still pure electric vehicles.”

The original statement is as follows:

In a sense, hybrid electric vehicles are an extension of traditional automotive technology. We have the most advanced engine technology in traditional automobiles. Hybrid is a transitional technology and we need hybrid electric vehicles to help us transition. Secondly, in terms of product differentiation, hybrid vehicles are popular in the high-end car market, but in other markets, considering cost, we believe that hybrid cannot replace pure electric vehicles, so our ultimate goal is still pure electric vehicles.

I don’t know who made Volkswagen decide to switch to pure electric vehicles, but Tesla must have played a crucial role. When everyone was hesitant to move forward with pure electric vehicles, Tesla boldly gave a clear signal.

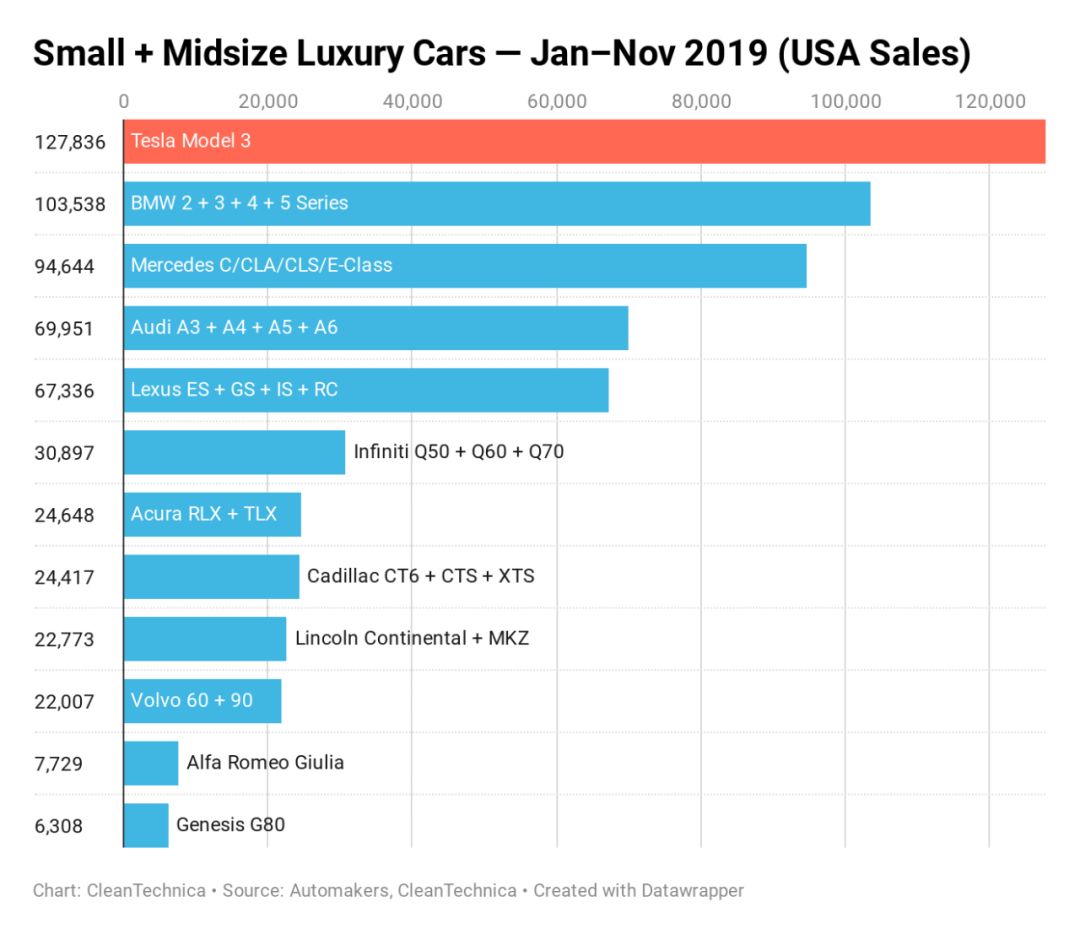

After Tesla officially released the Model 3 model in 2016, it received 180,000 orders within 24 hours, with an average price of $42,000 per order. This means that Tesla received orders worth $7.5 billion in value within one day, and the total order volume of Model 3 peaked at 545,000 after the conference.

Over time, the sales of Model 3 gradually stabilized and achieved milestone sales globally. As of October 2019, the global cumulative sales of Model 3 have approached 400,000.

In the top 20 sales rankings in the US market from January to November 2019, Model 3 ranked tenth. In the compact luxury car sales rankings in the US market from January to November 2019, Model 3 ranked first, far ahead of the combined sales of BMW 2 Series, 3 Series, 4 Series, and 5 Series.

With continuously increasing production capacity, Tesla has brought its super factory to the traditional car-manufacturing hub in Germany. The first phase is planned to have a capacity of producing 250 thousand vehicles, with a maximum capacity of one million vehicles.

This not only shows the feasibility of producing and selling pure electric vehicles to traditional car manufacturers, but also puts them under pressure of the new era. Tesla is too dominant, and if they don’t make some changes, they will certainly become the predecessors left on the beach.

Therefore, many traditional car brands have written their pure electrification strategies into their plans.

After clarifying why the transition is necessary and why it must be to pure electric, let’s explore why this is the right time to make the transition.

An unidentified predecessor once said: being two steps ahead is a martyr, one step is a pioneer, and half a step could be the key to success.

This sentence may not be entirely correct in this industry, but its core idea is still relevant. Being too far ahead of the market and entering too early can be devastating. Therefore, the timing of entry into the market is crucial.

Volkswagen’s entry into the market in 2020 is also for a reason.

In September 2018, the European Union set the target value for carbon dioxide emissions for new passenger cars:

-

By 2020, 95% of new cars meet 95 g/km (about 4.1 L/100 km).

-

By 2021, all new cars will be reduced to 95 g/km.

-

By 2025, there will be a 15% reduction compared to 2021, down to 80.75 g/km.

-

By 2030, there will be a 37.5% reduction compared to 2021, down to 59.375 g/km.

In 2018, the average carbon dioxide emissions of the Volkswagen Group were 121.2 g/km. If the current situation persists, Volkswagen will face a penalty of €9.19 billion. Do you remember Volkswagen’s net profit in 2018 mentioned earlier?

It was €17.1 billion.

This means that most of Volkswagen’s profits in 2021 will be used to pay the EU’s fines.

Therefore, under policy pressure, many European car companies have started their own paths of pure electrification in 2020.

In addition to fines, there are also encouragements. To promote the transformation of car companies into pure electric, European countries have formulated subsidies specifically for new energy vehicles.

Taking Germany as an example:

Germany plans to provide a subsidy of €6,000 for pure electric vehicles priced below €40,000, and a subsidy of €5,000 for those priced between €40,000 and €60,000.Models of hybrid vehicles priced below 40,000 Euros are eligible for a subsidy of 4,500 Euros, while those priced above 40,000 but below 60,000 Euros are eligible for a subsidy of 4,000 Euros. These subsidies will be in effect until the end of 2025.

In response to strict emissions regulations, Volkswagen believes that producing and selling profitable electric vehicles is the most effective way to achieve compliance with carbon emissions.

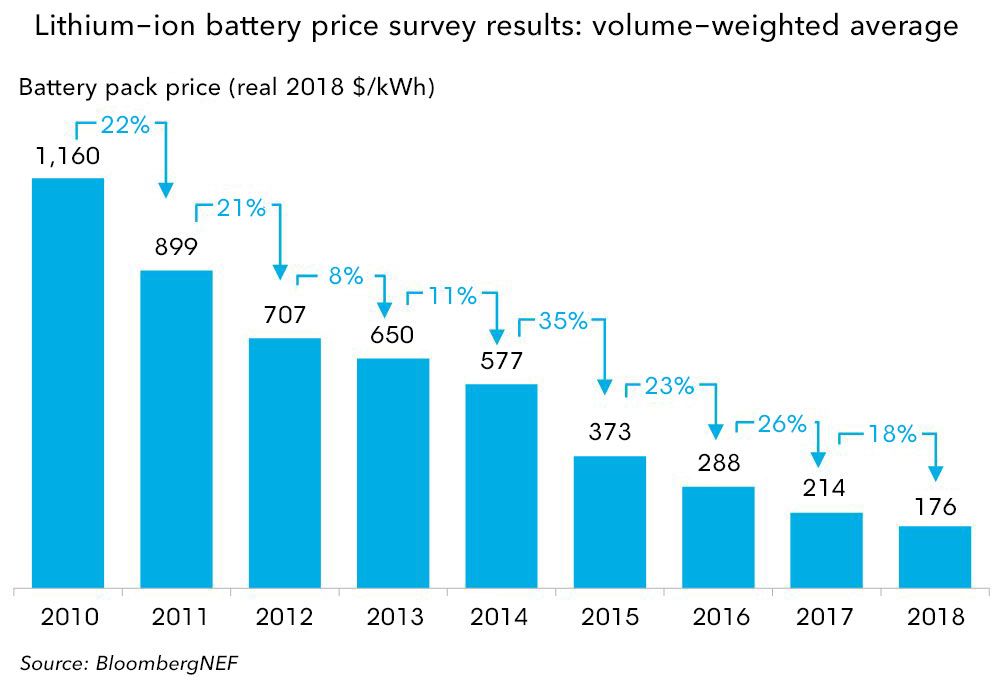

Of course, the price of power battery is also a crucial issue. The chart below shows Bloomberg’s statistics on power battery prices over the years. In 2010, the price of power battery per kWh was $1,160, and the first-generation Tesla Roadster, with a battery capacity of 53 kWh, had a battery cost of over $60,000.

Under these cost conditions, it is understandable that pure electric vehicles are not favored.

However, over time and with the efforts of many battery factories, the cost of power battery packs has now decreased to $176/kWh, getting closer to the industry-recognized cost parity with traditional fuel vehicles of $100/kWh.

Although the cost of power batteries is still relatively high compared to that of fuel vehicles, profits for electric vehicles are visible to all.

All traditional automakers face these objective realities. However, Volkswagen’s approach in transitioning to pure electric vehicles is the most resolute.

This approach is, of course, due to Volkswagen’s management decisions, specifically those made by Volkswagen Group’s new CEO, Herbert Diess.

Herbert Diess was not originally a Volkswagen person. He worked for BMW from 1996 to 2015, then joined Volkswagen in July 2015 and became the group’s CEO in April 2018.

Although Diess has not been at Volkswagen for very long, he arrived during the period when the emission scandal was unfolding and the pressure he faced was enormous.

Volkswagen’s previous CEO, Mueller, publicly criticized Tesla, claiming that it had low production, high investment, and no sense of responsibility, and was not a worthy competitor.

In contrast, Diess regards the Model 3 as a very successful model and Tesla as a successful electric vehicle manufacturer. He has great respect for Tesla, which he considers a significant competitor.

Herbert Diess is a true believer in the pure electric development path.

Herbert Diess is a true believer in the pure electric development path.

The transformation of Volkswagen Group to pure electric is to enhance the company’s future sustainable profitability, to put it simply, to maintain its profitability. The gasoline engine route not only faces high fines, but also new energy companies like Tesla are continuously taking over the gasoline engine market share. A breakthrough solution must be found in the current environment, and Volkswagen believes that the way to do this is to transform to pure electric.

How does Volkswagen ensure that it can achieve profitability?

It was mentioned earlier that Volkswagen’s transformation to pure electric is to achieve sustainable profitability. So the question arises: why does Volkswagen believe that “the most effective way to achieve carbon emission compliance cost is to produce and sell electric vehicles with a positive profit margin” when profitability within the industry is not yet widespread, and how can it achieve a positive profit margin from sales?

Here is Volkswagen CEO Herbert Diess’s response to investors’ questions after the November 19 earnings conference:

Because the Volkswagen ID.3 is built on the MEB pure electric platform, manufacturing costs will be cheaper by 40% compared to the electric version of the Golf, with most of the savings coming from power battery cells and battery systems. The battery in the ID.3 can be used to increase the structural rigidity of the vehicle, and the modular layout of the battery has advantages in packaging and economies of scale. In addition, because a factory specifically for electric vehicle production has been built, the factory can also help reduce costs by 5%-10% (which is included in the previous 40%).

In short, Volkswagen has three ways to reduce costs:

- Create a pure electric exclusive platform

Volkswagen has created three pure electric platforms: MEB (Modular Electric Toolkit), PPE (Premium Platform Electric), and SPE (Sports Platform Electric).

Among them, MEB platform vehicles will be mainly Volkswagen, Skoda, Seat, and entry-level Audi, while PPE is mainly for luxury electric vehicles, and SPE is for pure electric sports platforms, mainly for Porsche and Lamborghini models, with models based on the SPE platform to be launched after 2025.

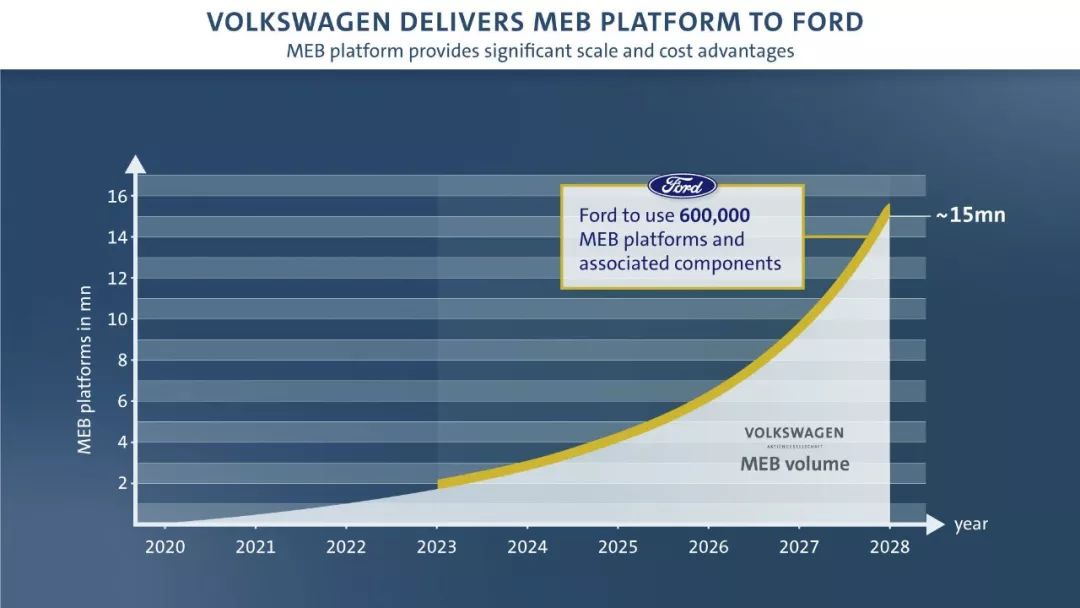

All three platforms are pure electric platforms, solely producing pure electric vehicles. Compared to some gasoline-electric shared platforms, pure electric platforms do not need to carry multiple power systems, only need to balance the position of several core components, greatly reducing the complexity of the platform.The expected number of models based on the MEB platform will reach 20 million units, and those based on the PPE platform will reach 6 million units by 2029. Let’s focus on the MEB platform.

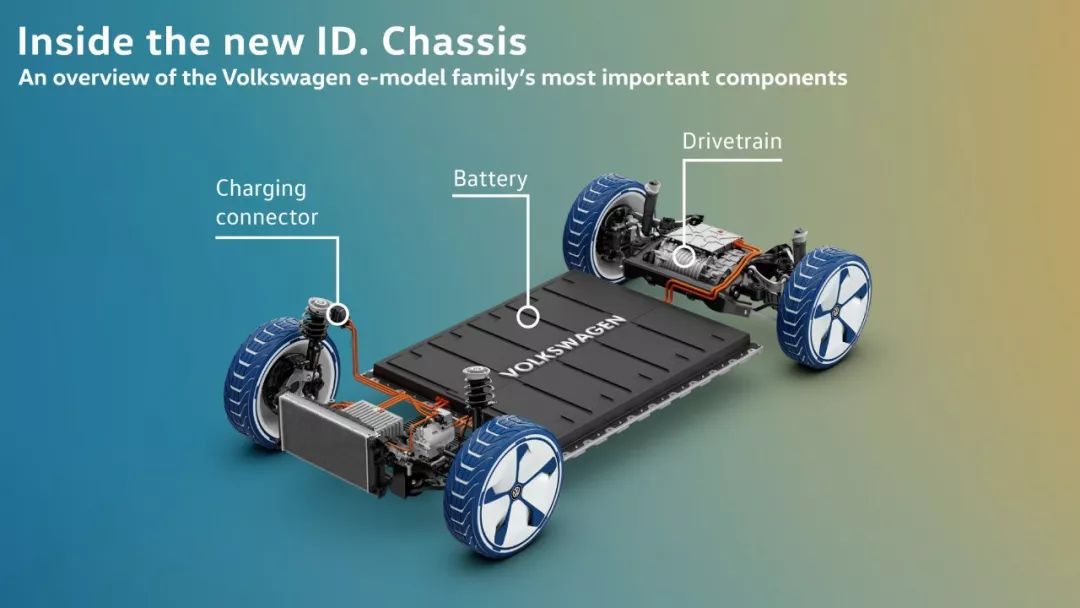

MEB is short for Modular Electrification Toolkit in German. It is a modular platform designed for pure electric vehicles. Volkswagen started its research and development in 2016 and invested $7 billion in this platform.

The first pure electric vehicle built on the MEB platform is the ID.3. The ID.3 has three different models with ranges of 330 km, 420 km, and 550 km according to the WLTP standard, corresponding to actual battery capacities of 45 kWh, 58 kWh, and 77 kWh, respectively.

Here are some of the Volkswagen models that will be launched successively based on the MEB platform:

Volkswagen ID.3

Volkswagen ID.4 (ID. CROZZ)

Volkswagen ID.BUZZ

Volkswagen ID.BUGGY

Volkswagen ID.VIZZION

Volkswagen ID.SPACE VIZZION

What have you noticed after looking at the above vehicles?

They represent compact cars, SUVs, mid-size sedans, station wagons, and even minibuses similar to the Volkswagen T1! From a vehicle planning perspective, Volkswagen’s MEB platform can cover almost all mainstream types of cars.

Moreover, Volkswagen announced at the 2019 Geneva Motor Show that it will authorize the MEB platform to third-party manufacturers, with e.GO Mobile AG becoming Volkswagen’s first external partner.

In addition, Ford has also partnered with Volkswagen, and starting in 2023, Ford will manufacture fully electric vehicles using the Volkswagen MEB platform. Ford expects to deliver more than 600,000 pure electric vehicles based on the MEB platform in Europe within 6 years.

This move can save Ford a great deal of platform development costs, while allowing Volkswagen to further expand MEB platform production and reduce costs.

Moreover, the most critical battery pack, the MEB platform can not only be compatible with multiple specification sizes of batteries based on vehicle function (currently capable of accommodating battery packs up to 125 kWh), but also compatible with standardized VDA modules of soft pack and square batteries.

Platformization is not uncommon at Volkswagen Group, and there have been very successful cases.

Volkswagen officially released the transverse engine modular platform MQB in 2012, replacing the old PQ25, PQ35, and PQ46 platforms. Up to now, Volkswagen and its various brands have produced more than 60 vehicles based on the MQB platform, with a total sales volume of over 100 million units. Moreover, as time goes by, the economies of scale will become more significant, and the cost of vehicles based on the MQB platform will become lower and lower.

MEB’s target development route is the same as MQB, by developing a pure electric platform for mass production, increasing the commonality of components, improving production efficiency, and thereby reducing production costs.

- Exclusive Factories

When it comes to improving production efficiency, factories are of course indispensable.

In order to achieve the sales target set by Volkswagen, 18 factories have been planned for transformation or new construction to adapt to the production of pure electric vehicles. Among them, 8 factories only produce pure electric vehicles based on the MEB platform.

Germany:

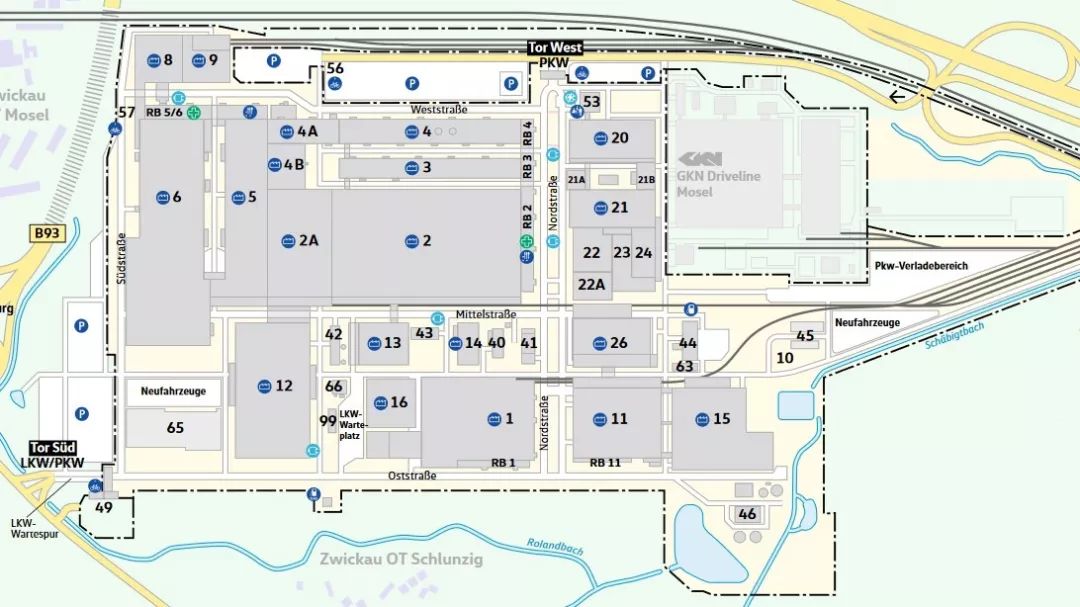

The Zwickau factory, with an original capacity of 250,000 vehicles per year, was used to produce Volkswagen Golf series models and was responsible for the production and spray painting of Bentley Bentayga and Lamborghini Urus white bodies.

With Volkswagen Group’s transition to electrification, Volkswagen has invested 1.2 billion euros in the Zwickau factory, which has transformed itself from a factory that solely produced combustion engine vehicles to one that produces 100% pure electric vehicles.

By 2021, 330,000 pure electric vehicles based on the MEB platform will be produced and rolled off the production line here each year. Volkswagen’s first model based on the MEB platform, the ID.3, has already been successfully produced in mass quantities at Zwickau.

Subsequently, Emden and Hanover in Germany will also be transformed into factories that produce MEB platform pure electric vehicles on a large scale.

China:

As one of the most important battlefields for Volkswagen Group’s pure electric vehicles, SAIC Volkswagen invested RMB 17 billion to build a brand-new factory in Anting, Shanghai, which produces only pure electric vehicles with a planned annual output of 300,000 vehicles. At the same time, FAW-Volkswagen also carried out electrification transformation of its factory in Foshan, which will also become an exclusive factory for the MEB pure electric platform.

Both factories have been built and entered the trial production phase.

Both factories have been built and entered the trial production phase.

The first ID. series model to enter the Chinese market is the ID.4, which is produced at the FAW-Volkswagen factory in Foshan. Shanghai Volkswagen will also produce an SUV identical to the ID.4, but the name of the vehicle has not yet been officially announced. At the same time, the first mass-produced ID. series car, the ID.3, will also be introduced to China by SAIC Volkswagen and achieve domestic production in 2020.

These two MEB factories in China are expected to have a total capacity exceeding 650,000 vehicles by 2025.

USA:

The US market is also one of Volkswagen’s important markets. Earlier this year, Volkswagen invested 800 million US dollars in the Chattanooga factory in the US to make modifications. The first ID. series model for the US market will be officially launched in 2022, but the ID.3 will not enter the US market.

- Laying out the entire power battery industry chain

Both of the above routes achieve cost reduction through scaling, and the core problem with high prices of electric vehicles still lies in the batteries.

I believe that many friends will have a question after reading the first paragraph: with such a huge electrification scale, how can Volkswagen ensure a stable supply of batteries? We will discuss how Volkswagen reduces battery costs while answering this question.

Volkswagen Group’s attitude towards battery technology is very clear: only by controlling the entire automotive industry chain can we remain in a leading position.

Obviously, in order to be in a leading position at all times, Volkswagen must master the core power battery technology of electric vehicles. However, since Volkswagen has just entered the pure electric vehicle field, it is difficult for Volkswagen to quickly master the core technology. Therefore, Volkswagen has divided the battery strategy into two phases.

Phase One: Establish cooperation with major battery manufacturers.

Currently, the mainstream power battery manufacturers include CATL, LG Chem, SKI, Samsung SDI and other companies. Depending on their geographic locations, Volkswagen has established different levels of cooperation with the four power battery manufacturers mentioned above.

CATL: CATL has always been the preferred battery supplier for domestic leading automakers, and Volkswagen is no exception. CATL will not only become Volkswagen’s supplier in China, but also in the European market.In October 2018, CATL officially started the construction of its factory in Erfurt, Thuringia, Germany. The total area of the factory is 23 hectares and it will produce battery cells and modules. It is expected to achieve a production capacity of 14 GWh by 2022, and will supply batteries to many European car manufacturers. This marks an important step for CATL to expand its business globally.

During the signing ceremony with the government of Thuringia, Mr. Zeng Yuqun, the Chairman of CATL, said “For our first investment in Europe, we chose Germany. We hope to bring the world’s most advanced power battery technology to Germany. By forming a localized power battery supply capacity in Europe, we can further get closer to European customers to provide more timely and effective product solutions and respond to customer needs better and faster.”

LG Chem: LG Chem will start supplying batteries to the European market starting in late 2019.

SK Innovation: In March of this year, SK Innovation officially broke ground on its factory in Jackson County, Georgia, USA. The total investment for the factory is US $1.67 billion, and it will start construction in early 2019, with production expected to begin in 2022, achieving a capacity of approximately 10 GWh. The factory is only 200 kilometers away from Volkswagen’s Chattanooga factory in the United States.

In the early stage of developing electric vehicles, Volkswagen not only guarantees the supply of batteries, but also learns many necessary technologies from these battery giants.

Looking at the production plan for Volkswagen’s electric vehicles, it can easily obtain lower prices than its competitors. The rich suppliers enable Volkswagen to quickly overcome the production capacity problem even if there is a short-term shortage of battery production capacity, through the adjustment among suppliers.

Phase Two: Independent development of power battery technology and building a super factory.

Volkswagen has taken two approaches to developing its own battery technology.

- Form the European Battery Union (EBU) with Northvolt.

Northvolt is a Swiss start-up founded by Peter Carlson, the former vice president of the supply chain management department of Tesla, in 2016.

In March 2019, the Volkswagen Group and some European car companies formed the European Automotive Battery Union (EBU) to promote research on power batteries in the European region. The new alliance is led by Volkswagen Group and Northvolt.

In June 2019, Volkswagen invested approximately US $900 million in Northvolt AB to develop battery business. In return, Volkswagen will receive 20% of Northvolt’s shares and a board seat.

- Establish a power battery independent research team.At the end of 2017, Volkswagen officially established the Center of Excellence for Battery Cells, and set up a new executive position for the power battery department.

In September 2019, Volkswagen announced the establishment of a 50/50 joint venture with Northvolt, dedicated to the production of lithium-ion batteries. The factory is planned to start construction in 2020, achieve mass production by the end of 2023, and plan an annual production capacity of 16 GWh.

The essential difference from the first point of “forming a European battery alliance with Northvolt” is that this factory is funded solely by Volkswagen and Northvolt. At the same time, the research and development achievements of Volkswagen’s “Center of Excellence for Battery Cells” will also be delivered to this factory, which can be considered similar to the cooperation between Tesla and Panasonic.

In addition to the three points mentioned by Diess, there is another huge change in the ID.3.

- Restructuring of the parts business

On January 1st, 2019, Volkswagen established an independent business unit, Volkswagen Group Components, which is mainly responsible for the development and production of electric vehicle-related components, including engine manufacturing, transmission, drive motors, chassis, charging facilities, and seats.

Compared with fuel vehicles, the core components of electric vehicles have undergone tremendous changes. For Volkswagen, establishing a new and efficient supply chain system is also an important step in reducing costs.

One More Thing: VW.OS

Electric vehicles are only one of Volkswagen’s energy changes, and it is simply a way to reduce carbon emissions and achieve sustainable profitability. Tesla’s record-breaking sales are not solely due to electric power. The most impressive factor is its intelligence, which is the real difference from traditional fuel vehicles.

In traditional car companies, software accounts for a very small percentage. However, software is becoming increasingly important in the automotive industry, and intelligence often accompanies electrification. Here, intelligence refers not only to the intelligentization of vehicle infotainment systems and driver assistance systems, but also to the intelligentization of underlying electronic devices and architecture.

Only when the underlying architecture is powerful enough can more powerful vehicle intelligence functions be supported. To this end, Volkswagen is implementing two measures:

First, it has raised the amount originally planned to be invested in digitalization from 7.7 billion euros to 14.4 billion euros.

Second, it has established the Car.Software department.

There is no need to explain the first point in detail. The investment amount reflects Volkswagen’s emphasis on software systems.

In June 2019, Volkswagen officially established the “Car.Software” department. Its goal is to develop the “VW.OS” operating system, which will be used in all Volkswagen Group’s vehicles, and link it to Volkswagen’s cloud service.

It is worth mentioning that from January 1, 2020, the “Car.Software” department will operate as an independent business unit, and the company’s software-related 3,000 experts will be integrated into the department. It is expected that the number of employees in the department will increase to 10,000 by 2025.

Volkswagen expects that the internal share of automotive software development will increase from less than 10% to 60% by 2025.

From these measures, it can be seen that in addition to transforming to electric vehicles, Volkswagen has also made significant changes in the field of intelligentization with the ID. series of vehicles.

The first vehicle equipped with VW.OS, the ID.3 model, is scheduled to be officially launched in China in 2020. We are very looking forward to this first product from a traditional carmaker that faces the new era, which will be fully renewed from energy conditions to the underlying electronic architecture of the vehicle.

Conclusion: Volkswagen’s transformation tells us that although elephants rarely dance, it does not mean that elephants cannot dance. Volkswagen Group’s huge size, annual sales, and profits are enviable among observers, but the pressure to lead such a large company’s transformation is also immense.

It is precisely because of Volkswagen’s large size that its firm comprehensive transformation undoubtedly provides a clear direction for this industry, which is full of doubts. Regardless of its impact on other traditional car companies or on the entire supply chain of the new energy industry, it is significant.

Starting in 2020, a new veteran will enter the new energy market. I am most looking forward to whether this veteran can enter the fuel vehicle market with the support of intelligence.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.