Author: Wang Ci

Editor: Qiu Kaijun

Car folks are pursuing chips while battery folks are pursuing lithium.

The core raw material of batteries–lithium carbonate–has risen in price from 50,000 RMB/tonne to 500,000 RMB/tonne.

“Lithium makes the world go round.” The backbone of lithium carbonate companies has never been stronger.

50,000 RMB is expensive and you might not even be able to buy it.

To ensure supply, even the government has stepped in.

In mid-March of this year, some lithium salt companies were interviewed by relevant national departments to ensure supply. At the same time, downstream manufacturers formed a collective boycott and refused to purchase lithium carbonate products priced at over 500,000 RMB. The market has cooled down somewhat, with the transaction price of lithium carbonate staying stable at around 450,000 RMB/tonne–still a sky-high price.

Why is it so expensive? On the one hand, explosive demand is one factor; on the other hand, the supply bottleneck exists–China’s lithium carbonate mainly comes from lithium mica in Australia, and salt lakes in South America and China. Especially for Australia and South America, imported lithium resources account for the vast majority.

What about China’s salt lakes? Why can’t they expand production during periods of high demand to ensure the supply to battery factories?

This article contains four core conclusions:

(1) At current prices, there is a very high profit margin for lithium production from salt lakes, it’s a good business. However, in 2021, the actual production of lithium carbonate equivalent from Chinese salt lakes is about 60,000 tonnes. The production is conservatively estimated to be about 80,000 tonnes in 2022 and 120,000 tonnes in 2025. The growth rate of production is far lower than that of demand for power batteries.

(2) Qinghai salt lake has a relatively poor endowment and produces mainly industrial or quasi-battery level lithium carbonate, which has not been widely used in commercial applications for power batteries. It is still a process of recognition or a process of enhancing the development of the better-endowed salt lakes in Tibet.

(3) The maturity of domestic salt lake lithium extraction technology is relatively high, and the mainstream technology is adsorption plus membrane method, which has low operating costs and can be applied to most salt lakes in Qinghai and Tibet. Some new technologies have emerged, which further improve the efficiency of lithium extraction.

(4) The attitude of the Tibetan government towards the development of salt lakes by enterprises is not positive due to poor infrastructure, large initial investment in energy, and local ethnic issues, which has led to many difficulties in investing in and developing the salt lakes.

Lithium Carbonate Price Up Tenfold in a Year

Large cargo ships are carrying “white oil” to Shanghai and Guangzhou ports. Companies such as Ganfeng Lithium, Tianqi Lithium, and CATL are actively acquiring overseas lithium mines and brine resources, still struggling to meet the high-speed growth of demand for power batteries.

In 2021, China’s demand for lithium carbonate is about 330,000 tonnes LCE, with domestic supply of about 230,000 tonnes and a gap of around 100,000 tonnes, with 80,000 tonnes relying on foreign imports. By 2025, China’s demand for lithium carbonate is expected to reach 600,000 tonnes LCE, and the gap may reach 160,000 tonnes.The demand for lithium carbonate mainly comes from the high-speed growth of new energy vehicles and energy storage areas. Industry experts predict that the sales volume of new energy vehicles will reach 5.5 million in 2022 and 9 million in 2025.

According to the China Storage Alliance, the total installed capacity of electrochemical energy storage will reach 35 GWh in 2025, and the compound growth rate in the “14th Five-Year Plan” period will exceed 60%.

In 2021, the installed capacity of lithium iron phosphate batteries for new energy vehicles surpassed that of ternary batteries and is increasingly dominant. The main incremental growth in energy storage also comes from lithium iron phosphate batteries.

Both lithium iron phosphate and ternary (NCM) materials require lithium carbonate, with the former having a higher demand. Some Japanese and Korean battery companies use ternary (NCA) materials, which require lithium hydroxide and are relatively niche.

China lacks lithium carbonate not because of production capacity but due to a shortage of lithium resources.

There are multiple sources for lithium resources, with most coming from imports. China’s dependence on foreign countries exceeds 70%. The raw materials for domestic supply, of which there is an output of 230,000 tons of LCE, mainly come from Australian lithium mines and South American salt lakes. As foreign lithium minerals continue to be exploited, the lithium content is expected to decrease, making lithium extraction more costly.

There are four domestic sources: lithium mica mines, lithium mineral mines, battery recycling, and salt lake lithium extraction.

China’s lithium mica mainly lies in Yichun, Jiangxi Province, and its resources are relatively limited.

Sichuan’s lithium mineral mines are located in high-altitude areas with a large investment and long construction period, making the mining scale insufficient for the time being.

Last year, the supply of lithium carbonate equivalent through the recycling of batteries was about 20,000 tons, which is still relatively low. Three years later, when a large number of batteries retire, Li Chen, chairman of CATL, believes that by 2040, the total demand for raw materials for manufacturing batteries and materials provided by recycled batteries will reach a balance. Short-term dependence is not possible.

Therefore, China’s salt lakes seem to be the fastest way to supplement the production of lithium carbonate.

Salt Lake Lithium Extraction Technology: High Maturity, Emerging New Technologies

64% of the world’s lithium resources come from salt lakes, making them an important source of lithium carbonate.

But where do salt lakes come from?

We need to go back about 100,000 years.

At that time, the crustal movement formed a lake, but due to arid climate and inadequate external water supply, the lake water was heavily evaporated and salt flats appeared around it, forming a salt lake.

Salt lakes are treasure troves. They contain about 200 kinds of salt minerals, and humans have mined a large amount of important raw materials such as rock salt, alkali, saltpeter, potassium, lithium, magnesium, and boron from salt lakes.

Lithium is just one of many minerals in salt lake deposits, and the content and ratio of magnesium and lithium are different, resulting in different lithium extraction technologies.

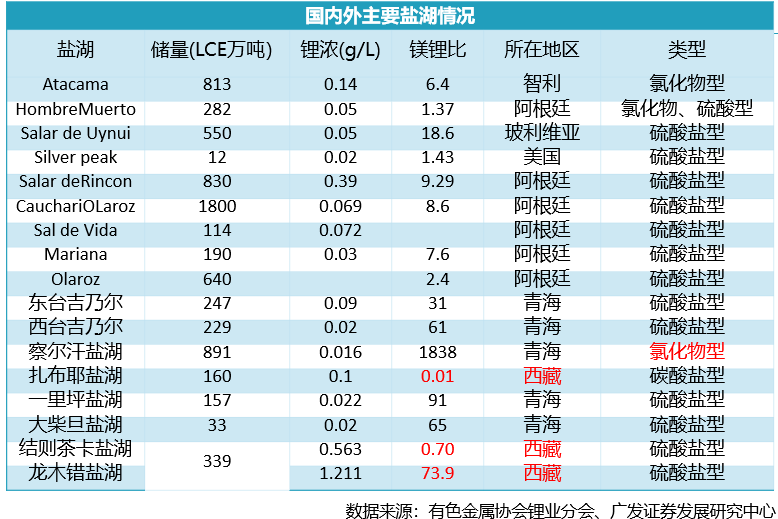

The main salt lakes at home and abroad can be summarized as follows:

(1) Foreign salt lakes have large reserves, low Mg/Li ratio, and good endowment.

(2) Qinghai salt lake has low lithium concentration and high Mg/Li ratio, and poor endowment.

(3) Tibetan salt lake has high lithium concentration and most salt lakes have low Mg/Li ratio, and good endowment.

There are currently four major technical methods for extracting lithium from salt lakes: salt field enrichment method, membrane separation method, ion exchange adsorption method, and solvent extraction method. The appropriate method should be chosen according to the type and characteristics of the salt lake.

“Winter harvests alkali and summer harvests salt.” This is the most common phrase spoken by high school chemistry teachers, referring to the ancient method of salt field enrichment. This method requires the construction of salt fields and the digging of channels to lead brine. It is currently the largest-scale lithium extraction process with mature technology and low production cost, applied on a large scale in South America. However, it has a high requirement for brine grade and is not suitable for processing high Mg/Li ratio brine, so it is not widely promoted domestically due to the threat it poses to the ecological environment. Tibet has strictly forbidden the construction of salt fields.

Membrane separation method includes electrodialysis membrane and nanofiltration membrane, which require old brine with relatively high lithium concentration. It is usually sun-dried until the lithium concentration reaches 4-5g/L before it is used. Total yield is also very low and influenced by high electricity cost, so the membrane method is rarely used alone and generally used in combination with adsorption method.

The ion exchange adsorption method has high selectivity and can directly extract lithium from the original brine. It is simple, environmentally friendly, but requires a large amount of freshwater, which increases the need for water desalination equipment, and the dissolution rate of the adsorbent material is relatively high.

A senior researcher for salt lake lithium extraction said: “Adsorption method is the mainstream technology for domestic salt lakes, but after aluminum adsorption, the concentration is relatively low, so the membrane must be added for further concentration. Bluemountain Chemical Industry uses adsorption membrane process at Chaerhan Salt Lake in Qinghai, with an annual output of about 20,000 tons of lithium carbonate.” However, this method is not suitable for carbonate-type salt lakes because the generated lithium carbonate in the circulation process can block the molecular sieves and cause inactivation.

In general, the mainstream technology for extracting lithium from salt lakes is the adsorption membrane process, which is similar to the water treatment industry principle, and has mature technology and cost advantages.

An investor of salt lake lithium extraction company said: “Taking the production of 10,000 tons of lithium carbonate as an example, the operating cost of the mainstream adsorption membrane technology is generally controlled at 30,000-40,000 yuan, and the cost of producing battery-grade lithium carbonate by further purification is increased by 8,000-15,000 yuan. Cost is not a problem, technology is not a problem, and energy is the real problem.”

In addition, the traditional solvent extraction method using high acid has unavoidable equipment losses, extractant damage, and reflux pollution of the lake water, and does not have good public opinion.

However, now there are more environmentally friendly new extraction technologies, which may be greatly improved in future applications. The Process Institute of the Chinese Academy of Sciences has developed a new technology: carbonate-type salt lake polyfunctional chelating extraction-three-phase reaction lithium extraction technology. This technology has been successfully tested in Tibetan salt lake, and the comprehensive yield of the product is over 90%.According to Lin Daoyong, the general manager of Shanghai Ideen New Material Technology Co. Ltd, the technical partner, “producing 10,000 tons of lithium carbonate with a fixed investment of over 200 million yuan, operating costs of 10-20,000 yuan per ton, and electricity consumption of more than 6,000 kilowatt hours, this extraction technology has great advantages over adsorption methods”. This extraction technology is applicable to carbonate-type salt lakes, such as the Zhabuye Salt Lake in Tibet.

Another new technology from the Institute of Process Engineering of the Chinese Academy of Sciences is the multi-component cooperative solvent extraction-lithium extraction technology with water back-extraction and cleaning. This technology has been successfully tested in the salt lake in Qinghai. Lin Daoyong, who is also involved in promoting the technology, said, “This technology is environmentally friendly, with the only disadvantage being the requirement for high lithium concentration, at least 1 g/L, suitable for South American salt lakes. The lithium concentration of Zhabuye and Namco lakes is relatively high, nearly 1 g/L, while the lithium concentration of other salt lakes is too low, requiring a concentration of at least 0.5 g/L, and will be usable after further upgrade to even 0.3g/L in the future”.

“The new extraction technology’s greatest advantage is its low use of fresh water, followed by its lower lithium extraction cost than adsorption methods, while also being environmentally friendly. If the new technology is put into mass production, it will help expand production capacity”.

So, what is the current status of lithium extraction from salt lakes in China?

Among several salt lake lithium extraction companies, Blue Lithium, with the largest output in Qinghai Chaka Salt Lake, had a total output of approximately 20,000 tons of lithium carbonate last year after the release of its second phase of capacity on July 1. This year, Blue Lithium is expected to produce 30,000 tons of lithium carbonate, but there are no current expansion plans.

In general, although China has abundant lithium resources in salt lakes with low extraction cost and large development potential, the overall production output is still not high.

According to an investment representative of a salt lake lithium extraction company, “the domestic production of lithium carbonate of equivalent to 60,000 tons was recorded in 2021, and the output is expected to reach around 80,000 tons of lithium carbonate by 2022, conservatively estimated to be about 120,000 tons of lithium carbonate by 2025”. Most interviewees also acknowledged the data, indicating limited growth opportunities in salt lake lithium production.

One reason for this is that although Qinghai Salt Lake contributes the most, its inferior endowments make it unable to produce strictly battery-grade lithium carbonate and it is not the main target for future development. By the end of 2021, the Qinghai government and the Ministry of Industry and Information Technology issued the “Action Plan for Building a World-Class Salt Lake Industry Base in Qinghai (2021-2035)”, which mentioned that “the production capacity of lithium carbonate in Qinghai will reach 150,000 tons by 2025”. However, this action plan has not been made public, indicating a weak level of support.The second reason is that despite the strong willingness to develop the salt lakes in Tibet by capital, there are still many uncertainties for large-scale development in the future, due to factors such as poor infrastructure, insufficient energy and power supply, weak government willingness and ethnic issues.

“I went to the Tibetan salt lake for inspection last year, and found that road transportation was relatively difficult, the power source was far away, and other complex problems were affecting the expansion. Personally, I am not optimistic about lithium extraction from the salt lake,” said a guest author of “Electric Vehicle Observer.”

Don’t expect too much

From the market perspective, Qinghai salt lake mainly contributes industrial-grade lithium carbonate. Although most companies further process it into battery-grade lithium carbonate, strictly speaking, it only reaches quasi-battery grade, and the product can only be applied to low-end scenarios such as energy storage, low-speed vehicles, etc. It is difficult to be applied to power batteries in the next two years. Customer recognition requires a process, and a power battery enterprise needs to be willing to be the first to try.

From the perspective of local governments, the government of Tibet does not have economic pressure and mainly focuses on maintaining stability and avoiding ethnic conflicts. Of course, there are also energy and power supply issues. Although wind and solar energy can solve this problem, energy storage lithium batteries have high costs. To extract lithium from the salt lake, a large amount of lithium carbonate needs to be used to make energy storage batteries, which seems to be losing sight of other important issues.

Tibet is a pure land that almost every Chinese person yearns for. Zheng Jun’s “Return to Lhasa” sings out our voice. I believe most people don’t want to see the colorful salt lake damaged by large-scale development.

At the same time, China’s lithium industry giants are accelerating their overseas layout and expansion, and imported lithium resources are still growing rapidly. Domestic Jiangxi lithium mica mines and Sichuan lithium pyroxene mines are also being developed at an accelerated pace. In addition, high prices of lithium, cobalt, and nickel are driving the rapid development of the battery recycling industry, which will gradually fill the gap between supply and demand of lithium carbonate.

Although extracting lithium from salt lakes can partially alleviate the contradiction between supply and demand of lithium carbonate, we should not place our expectations for supply-demand balance solely on the salt lakes. In recent years, extracting lithium from salt lakes has still been a small and beautiful business.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.