Author: Wang Lingfang

Editor: Qiu Kaijun

“When we first went there, there wasn’t even a road, with a machine paving the way and fields all around.”

This was the earliest memory of the Zhongke Lithium battery Industry Park in Jintan, recalled by a veteran employee who drove nearly 800 kilometers from Luoyang to prepare for the Zhongke Lithium new energy battery project.

For Zhongke Lithium, Jintan was a land of hope. After reaching a sales peak of 1.4 billion yuan in 2016, Zhongke Lithium quickly declined and even took on the ST prefix under its parent company Chengfei Integrated Technology due to two consecutive years of losses.

They needed new territory.

After a series of operations, the Jintan district government became the major shareholder of Zhongke Lithium, and equity diversification was achieved, allowing the management team to be fully authorized.

Under the iron-fist leadership of newly appointed Chairman and General Manager Liu Jingyu, Zhongke Lithium reigned in a transformation, overhauling the management team, successfully transforming products, and even rebranding the company as Zhongchuang Innovation Aviation. Installation capacity soared to become the third largest in the industry, making Ningde Times uneasy. Today, with a market valuation of 63 billion yuan, Zhongchuang Innovation Aviation is rising as a newcomer among the second-tier companies to challenge Hong Kong’s IPO.

Looking back at Zhongke Lithium’s development, it grew to become the country’s largest battery manufacturer in just five years, plummeted in two years, and then rebounded from the valley in another two years.

How did Zhongke Lithium fall from grace? How did Zhongchuang Innovation Aviation make a comeback from the ashes?

This article traces the story of Zhongke Lithium and Zhongchuang Innovation Aviation, retelling their legendary journey.

You will read about the following key points:

-

With its technical advantages as a military-turned-civilian company, and the background of the state-owned enterprise, Zhongke Lithium seized a tremendous advantage in the early stages of the new energy vehicle industry and was once the top-ranked power battery manufacturer;

-

As the subsidy policy changed, the market for new energy commercial vehicles shrank while the market for new energy passenger cars grew. Zhongke Lithium did not adjust in time and saw a significant decline in performance. The huge losses dragged down the controlling shareholder, forcing a transfer;

-

The Jintan local government accepted Zhongke Lithium as a major shareholder and enlisted professional manager Liu Jingyu. By employing decisive management measures, Liu Jingyu adjusted the team and business, established new directions for passenger cars and three-element batteries, and vigorously competed on low prices to reverse the situation, with installations rising to third in the country.- CATL has gone through multiple rounds of financing, with diversified equity ownership and autonomous management, as well as equity incentives and strong team morale. However, in comparison with second-tier domestic power battery companies, CATL’s research and development (R&D) capabilities are inferior, and its capital and production capacity are moderate. Although CATL has top-notch domestic customer development capabilities, it has not yet made a breakthrough in serving international customers. Its position as a second-tier leader is still not stable, and it cannot yet launch an attack on first-tier companies such as BYD and Ningde Times.

Nine years ago, it was number one

At No. 66 Binhe North Road, Jianxi District, Luoyang, Henan Province, there are two impressive buildings, one tall and one short.

The tall one is square, and the short one is elliptical. On the side adjacent to the tall building, a cylindrical building is embedded.

If viewed from above, both buildings have a protrusion on their roofs. A sharp-eyed person may notice that one looks like a square battery, and the other looks like an elliptical battery.

The sign on the short building reads “Serve the Country with Aviation, Strengthen the Army and Prosper the People,” while the tall one bears the name “CATL.”

This is the headquarters of old CATL. The company’s name and slogan indicate that it is a military-civilian enterprise.

In fact, tracing back to the history of CATL, it was founded in 2007. That year, the China Academy of Aerospace Aerodynamics incubated Sky Energy (Luoyang) Co., Ltd., which specialized in lithium iron phosphate power batteries.

In August 2009, China Aviation Industry Corporation (AVIC) and the China Academy of Aerospace Aerodynamics jointly invested in and merged Sky Energy to establish CATL.

CATL’s journey thus began.

As a typical high-end manufacturing industry, the development of power battery companies relies heavily on research and development and scale, both of which require huge amounts of capital. Being a non-public company, CATL has extremely high financing costs and is greatly lacking in financing channels and abilities.

In 2010, in order to solve the financing channel problem, AVIC, along with Chengfei Integration Technology Co., Ltd., AVIC Capital Co., Ltd., Hongdu Aviation Industry Group, and Xinghang Investment, jointly increased their investment in CATL, with Chengfei Integration taking control. Chengfei Integration had already been listed, providing more financing channels.

In 2010, Chengfei Integration had a total asset of only 870 million yuan, but raised 1.02 billion yuan for CATL’s development.

However, all these investments were proven to be worthwhile.## Because, The new energy vehicle industry in China has also set sail with CATL.

In early 2009, four national ministries jointly launched the “Ten Cities and Thousands of Vehicles” energy-saving and new energy vehicle demonstration and promotion application engineering, and carried out pilot projects for the promotion and application of energy-saving and new energy vehicles in the first batch of 13 cities, such as Beijing and Shanghai. China’s new energy vehicles began to expand in the field of public transportation in several demonstration cities.

The most crucial component of new energy vehicles is the power battery. CATL, which is marching to the historical rhythm, began to develop rapidly.

In the early stage of the “Ten Cities and Thousands of Vehicles” policy, commercial vehicles were the main focus, and buses were the most important customers, while the private market had not yet been launched. With the help of previous military technology accumulation and state-owned background, CATL has obtained many customers for buses.

By the end of 2012, in the list of electric vehicle models announced by the Ministry of Industry and Information Technology, the total number of models using CATL batteries ranked first. CATL was designated as one of the eight key support lithium power battery companies in the country, and its products were rated as national key new products. Since then, the brand awareness of CATL has been effectively improved year by year.

In 2012, CATL achieved a revenue of RMB 176 million, and its proportion in AVIC Integration increased to 31%. Since then, its proportion has increased year by year, and it reached a maximum of 63.31% in 2016, becoming the largest business of AVIC Integration.

According to Mr. Zhang, an old employee who worked at CATL for more than 10 years, at that time, CATL’s batteries were in short supply, and production capacity could not keep up.

The biggest difficulty for domestic sales personnel is not the lack of customers, but the inability to deliver goods to customers. “Salespeople are nagging in front of the leaders who are in charge of delivery every day, hoping to ensure the delivery of their own customers first.”

The only competitor that can match CATL is the state-owned LS Power.

By the end of 2013, the total number of new energy electric vehicle models announced by the Ministry of Industry and Information Technology, which were equipped with CATL batteries, continued to hold the first place. At the same time, it also won the first place in China’s installed capacity of power batteries. In 2013, CATL’s power batteries for electric vehicles were also the leading ones for exports in the country.

At this time, CATL was a pioneer and leader in the industry, and its peers respected it.

The market’s fortunes have changed, and the drawbacks of state-owned enterprises have begun to emerge.

CATL, which was thriving, received attention from the Group Headquarters.

In December 2013, China Aviation Industry Corporation increased its capital by RMB 140 million, and its shareholding ratio increased from 3.43% to 10.72%, while AVIC Integration’s shareholding ratio decreased from 63.98% to 58.83%.

Since then, CATL has been promoted to a second-level subsidiary of the Group.“`

However, for Mr. Liu, an early employee of China Aviation Lithium Battery, this promotion was a two-edged sword. Before this, although AVIC Integration held the controlling share of CALB, it had limited involvement in CALB management, with more of a role as a funding channel, allowing CALB sufficient operational freedom.

The positive side of being valued by the group is that CALB can more easily cooperate with certain customers such as First Auto Works and Dongfeng after coordination by the group. However, the negative aspect is that the decision-making process is longer, the response speed is much slower, and management is overly restrictive.

“For example, if colleagues responsible for overseas clients need to go abroad for project communications, they have to submit an application for business trip within the company, then bring it to the group for approval, and the group will submit it to the government department for application.” Mr. Liu said, “Due to the nature of the enterprise, the passport is an official one, which means that the approval process is very long. The fastest round-trip requires a month, and urgent matters from foreign clients can be delayed.”

Another typical example is the handling of B-grade batteries, which are produced by battery manufacturers that cannot achieve a 100% qualified product rate.

The handling of these batteries is very sensitive within state-owned enterprises. The price of B-grade product is almost impossible to match that of A-grade, but it’s hard to define by how much it should be lowered.

The benefits of selling this batch of products are obvious, which can ease the cash flow and reduce costs. But within state-owned enterprises, if someone sells these batteries, it is likely to be labeled as the loss of state-owned assets.

For this part of the product, the general approach of state-owned enterprises is to ignore it, but it also takes up a large amount of funds. This may be seen from the 60 million-plus value loss provision made by CALB in 2018.

In terms of external environment, in 2015, BYD’s battery capacity and output were far ahead of CALB. At the same time, ternary batteries had started to rise, and CALB was not yet aware of this.

At this point, CALB’s internal and external problems had already begun to show, but CALB was still immersed in the current dividends, as a latecomer.

From Core Profits to Core Losses

In 2016, CALB reached its peak, with its capacity maximized and its revenue increased significantly.

CALB had grown into the core business of AVIC Integration, accounting for more than 63% of revenue and 78% of profits.

On the secondary market, after AVIC Integration controlled CALB, the stock price rose all the way up to a record high of 78.02 yuan/share, almost 7 times the previous 9.81 yuan/share.

“`The greatest crisis of CATL has arrived as the backwardness of their products has been fully exposed in the face of subsidy policy adjustments.

In 2016, the Chinese new energy vehicle subsidy fraud was exposed, and the state was cautious about the introduction of subsidy policies.

Mr. Zhang recalled that the 2017 subsidy policy was announced exceptionally late. It was not until December 30, 2016, that the new subsidy policy was introduced for the new year, with two major changes: first, the new energy subsidy policy introduced energy density standards, which tilted towards high energy density and low energy consumption technology. Ternary batteries rose up rapidly and quickly became mainstream. Second, the subsidy amount for new energy buses decreased significantly.

CATL was not prepared for this, according to Mr. Liu. He said that January 2017 was during double holidays, with New Year’s Day and Chinese New Year both falling in that month. As usual, the work enthusiasm of employees was not very high near the Spring Festival, and many people started taking time off.

However, from January to the Spring Festival, CATL’s research and development and sales teams were having meetings overnight, hoping to find a way to respond.

From the results, CATL obviously did not find a way to respond. According to Mr. Zhang, this underlying problem has been buried for a long time. “Every time we have a meeting, the boss will use a ‘knife’ to press against the neck of sales, and ask customers what they really want next year?”

In Zhang’s view, it is difficult for car companies to clearly explain their needs, and leading battery companies will actively release new products to provide customers with new choices.

In 2017, CATL’s profit went from a profit of 110 million yuan in the previous year to a loss of 330 million yuan.

In 2018, CATL’s strategy focused primarily on commercial vehicles, and it still could not adjust, with 70% of its vehicle volume in the commercial vehicle market and 30% in the passenger vehicle market. The market once again abandoned it. In 2018, CATL’s losses reached 700 million yuan, dragging Chengfei Integration to the brink of being delisted, with a loss of 200 million yuan.

According to Dianche Hui’s report, from 2015-2016, CATL’s quotations were mostly around 1.6-1.8 yuan/Wh, and they adjusted their quotations and corresponding business strategies according to different quality assurance terms. However, by 2018, NINGDE TIMES’s price had dropped to within 1.3 yuan/Wh, while CATL’s price showed no sign of decrease.

In 2018, Yutong Bus completely cut off all of CATL’s orders and invested its share completely in NINGDE TIMES.

CATL’s losses are uncontrollable, and they have dragged Chengfei Integration to the brink of delisting.

Chengfei Integration throws off the burden.In 2018, new energy vehicle subsidies were substantially reduced again, and standards were raised again. The price of products from AVIC Lithium Battery plummeted, causing a provision for inventory depreciation to be made, resulting in an increase of more than 60 million yuan in impairment losses compared to the previous year. Coupled with a significant increase in research and development expenses, sales expenses, and management expenses, the performance of Chengfei Integration was further dragged down.

On March 22, 2019, Chengfei Integration was suspended for one day, and the securities were renamed “ST Integration”.

Chengfei Integration quickly launched its own rescue plan, determined to get rid of AVIC Lithium Battery as a burden.

Who will take the hot potato?

At a critical moment, Jintan State-owned Assets Supervision and Administration Commission lent a helping hand.

The relationship between the two sides began in 2015.

At that time, Jintan District wanted to attract investment from Aviation Industry Corporation of China, but ultimately failed.

The expansion of AVIC Lithium Battery became an opportunity for cooperation between the two sides.

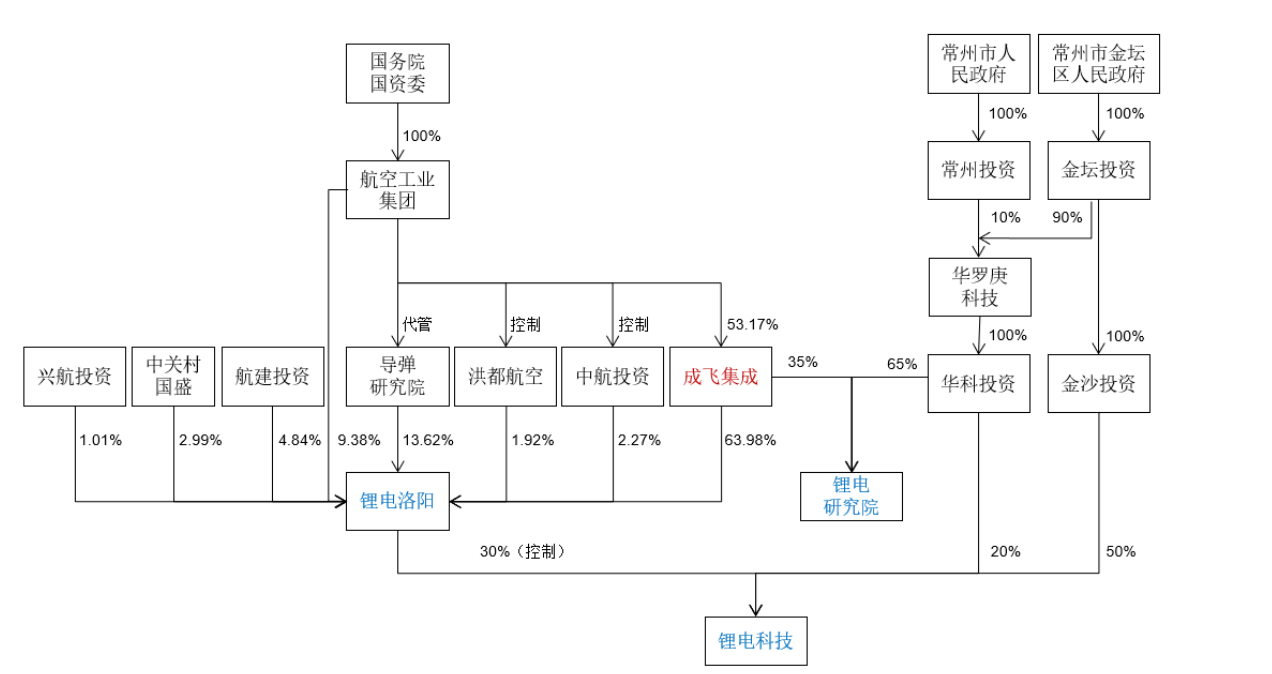

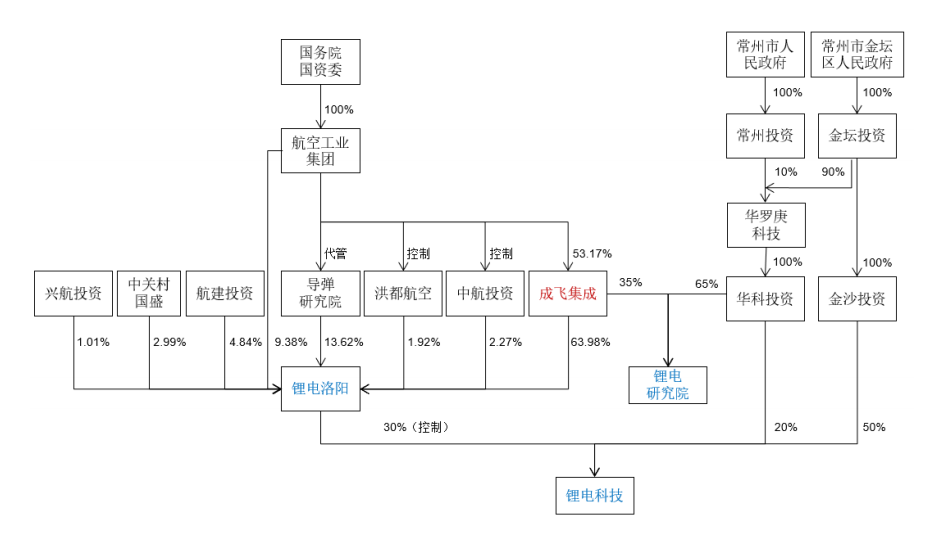

On September 28, 2015, Lithium Battery Luoyang (AVIC Lithium Battery Luoyang headquarters) signed a Cooperation Agreement for “AVIC Lithium Ion Power Battery Project” with the Jintan District Government, stipulating that Huake Investment and Jinsha Investment designated by the Jintan District Government and AVIC Lithium Battery jointly set up Lithium Battery Technology in Jintan District to be responsible for implementing the “AVIC Lithium Ion Power Battery Project”.

At that time, AVIC Lithium Battery Luoyang company held 30% of the shares, but had 51% of the voting rights and became the controlling shareholder. Jinsha Investment and Huake Investment held 50% and 20% of the shares respectively.

AVIC Lithium Battery hopes to use Lithium Battery Technology as a platform for restructuring, which is mainly divided into the following three steps. First, transfer the shares of Lithium Battery Luoyang to Chengfei Integration, and Chengfei Integration controls Lithium Battery Technology; second, Chengfei Integration transfers the shares of Lithium Battery Luoyang to Lithium Battery Technology, completing the transfer of control rights between the parent and subsidiary companies; third, transfer the control rights of the Lithium Battery Research Institute to Lithium Battery Technology through capital increase.

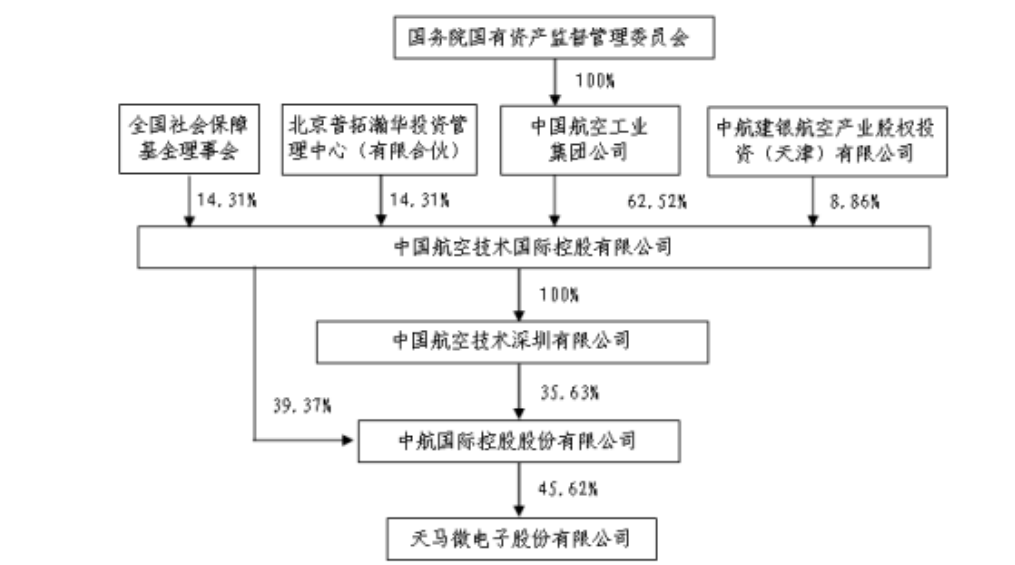

The result of the transfer of control rights between parent and subsidiary companies is shown below:

If AVIC Lithium Battery settling in Jintan in 2015 was the starting point for the takeoff of Jintan’s power battery industry, then Jintan’s capital injection is also a new starting point for the second development of AVIC Lithium Battery.

From then on, AVIC Lithium Battery left Luoyang and became an enterprise in Jintan, Changzhou.After a series of transformations, CATL has transitioned from a subsidiary of a central state-owned enterprise to a local state-owned holding company. The shift in management has brought CATL closer to market-oriented management and thinking, accomplishing the establishment of an enterprise guided by a market-oriented management approach.

This change in equity not only led CATL to relocate its headquarters from Luoyang to Jintan, but also brought about a more flexible mechanism, making it possible for the new leader, Liu Jingyu, to further optimize the equity structure and achieve management autonomy.

Liu Jingyu Takes the Reins

Liu Jingyu is an expert in finance. She holds a Master’s degree in Management from Dongbei University of Finance and Economics and holds professional qualifications as a Chinese Certified Public Accountant, an Accredited Appraiser, and a Registered Tax Agent.

In both 2015 and 2017, Liu was named one of the “Most Outstanding Women in China” by Forbes, often compared to Dong Mingzhu due to her impressive ability to turn things around.

Liu Jingyu’s high appraisal stems from her glorious history of turning things around. In 2013, she was appointed as the director and general manager of Tianma Microelectronics Co., Ltd. She quickly turned the company’s strategy from “profit-oriented” to “customer-oriented” and quickly earned orders from a series of customers such as Huawei, Lenovo, UL, and OPPO. In just 10 months, she successfully led Tianma Microelectronics into the top tier of the display industry, turning losses into profits.

Tianma Microelectronics is also a subsidiary of Aviation Industry Corporation. Liu Jingyu’s ability was recognized by the group’s top management, which marked the start of her second time taking the reins in times of crisis.

In June 2018, Liu Jingyu stepped down from the positions of director and general manager of Tianma Microelectronics Co., Ltd., as well as a member of the Strategic Committee and the Risk Management Committee of the board of directors.

In August of the same year, Liu Jingyu took up the helm of CATL as a professional manager and became board chairman and general manager.

Mr. Zhang recalls that Liu Jingyu’s appointment came as a surprise to everyone. There had been no prior indication of her appointment. According to him, the former general manager, Wang Dongliang, was on a business trip when he received the group’s notice to go to Beijing along with the board chairman Shi Xiaoqing, and then the management change occurred.

The group’s announcement was straightforward and did not allow for any discussion or input.

After Liu Jingyu took office, she was swift and decisive in completing the adjustment of the company’s management team in just 2-3 months. Many people did not have time to react and could only passively accept it.Mr. Zhang said that such a style of doing things was incredible at the time in Contemporary Amperex Technology Co., Limited (CATL), “the company couldn’t appoint a mid-level leader without at least 3 months.” Mr. Zhang gave an example, that CATL had appointed a personnel department minister, but due to the fact that the appointee was not a party member, he was unable to take office after being transferred to several departments. “Because of this, the leaders at all levels of CATL were criticized by their superiors, and some people even had it written into their files.”

In addition to human resources, Ms. Jingyu Liu, who was appointed, also made a “major surgery” on CATL’s business.

Mr. Zhang gave several examples to “Electric Vehicle Observer”. “Firstly, it took Jingyu Liu about six months to switch the commercial vehicle business to the passenger vehicle route.”

“Secondly, in terms of customer pricing, she dared to offer prices below cost.” “Jingyu Liu believed that costs should not be determined by oneself, but by your opponents and the market. If competitors have lower prices than yours, it means that we have huge problems in production, supply chain management, and finance.”

In Zhang’s view, CATL, before Jingyu Liu’s arrival, was so rigid that pricing below cost was impossible.

There is also an example of the decision of the second phase of Jintan.

Mr. Zhang recalled that around October 2017, CATL began to make decisions on how to build the second-phase production line. The company conducted market research every day, wrote research reports, held countless internal meetings, and reported to the Beijing Group headquarters 2-3 times. “At that time, the chairman requested that all department heads be called to the meeting, and everyone should give suggestions, including the department responsible for equipment maintenance. The suggestions were varied, with no unified opinion.”

The decision had to be made before the lunar year, but it was not determined until the company was reorganized. However, shortly after Jingyu Liu came, the decision was made.

The overall headquarters of the company was transferred to Jiangsu, and the development direction was adjusted to passenger vehicles. This not only brought major adjustments to senior managers but also brought earth-shaking changes to grassroots employees.

“At around 2019, changing to the passenger vehicle route means that the lithium-iron route has been marginalized, replaced by the ternary route, and it also means that staff who only master the lithium-iron technology and salespersons of commercial vehicles have changed from core members to marginalized ones. If they cannot keep up with the adjustment direction, they can only leave.”

The adjustment of the headquarters and the relocation of production brought about the demand for personnel relocation. At that time, Jingyu Liu offered a monthly relocation allowance of 1000 yuan for the employees in Luoyang, which was clearly not enough for most people.

Therefore, CATL conducted a round of natural attrition among employees.

“If there are people who leave, there must be others who come, and Jingyu Liu quickly called upon the capable personnel from Tianma Microelectronics to fill in the vacancies.”## Introduction of new shareholders leads to further dispersion of company equity

The senior management of CATL (Contemporary Amperex Technology Co Ltd) includes Dai Ying as Vice President and Secretary of the Board, responsible for investment and financing, who previously served as the Secretary of the Board of Directors of Tianma Microelectronics; Geng Yan’an as Vice President responsible for procurement and information technology, who previously worked as Assistant President and Chief Financial Officer in Tianma; Gao Yan as Vice President responsible for group finance and human resources, who previously worked as Chief Financial Officer in Tianma; and He Fan as Vice President responsible for group engineering projects, who previously served as Senior Manager of the factory, Deputy Director and Director of the factory and Environmental Safety Engineer and Manager in Tianma.

It is also worth mentioning Pan Fangfang, an early employee of CATL who joined the company in 2011 and previously held the position of Deputy Chief Engineer. According to information revealed by former employees of CATL, Pan Fangfang is highly competent and was highly sought after by many companies who offered high salaries, but was underutilized and remained at her position as a deputy.

However, with the arrival of Liu Jingyu, Pan Fangfang was gradually promoted to Vice President and Chief Technology Officer, and became one of Liu Jingyu’s key assistants in the restructuring of CATL.

Introduction of new shareholders leads to further dispersion of company equity

With the direction set, it is still difficult to maintain the course if the captain keeps changing.

To ensure the status of the management team, Liu Jingyu set out to build a more suitable equity structure.

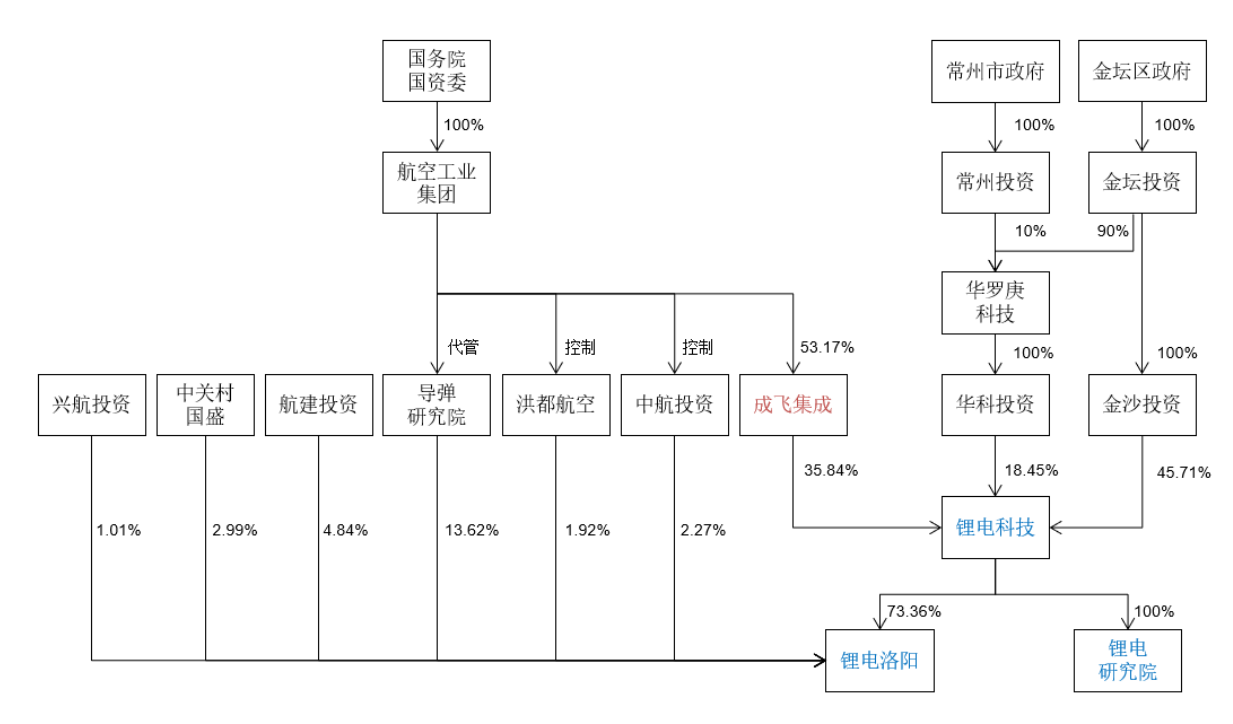

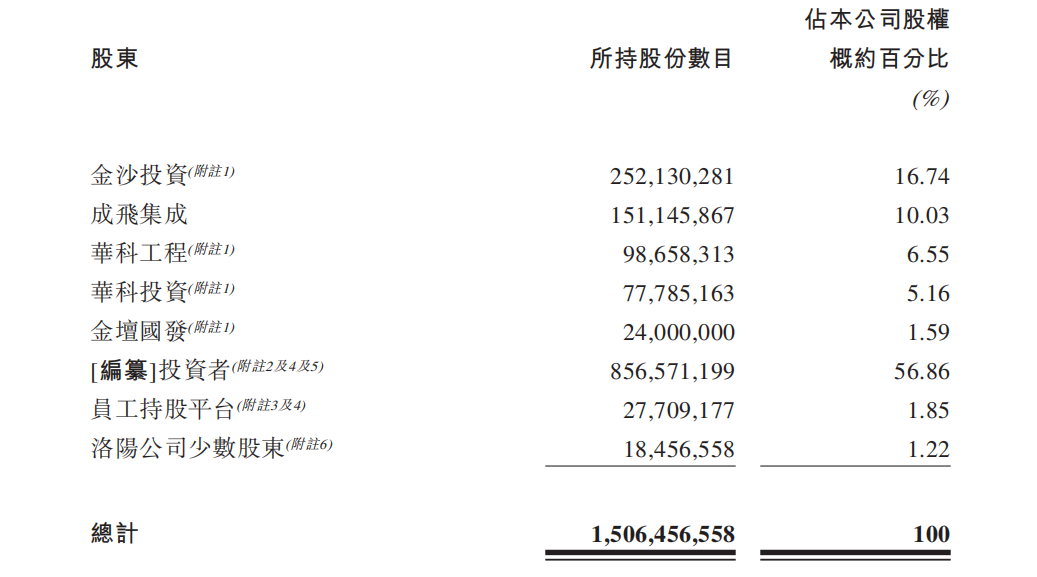

Between August 2019 and November 2021, numerous capital increases were carried out and new shareholders and investors were introduced. In August 2019, Lithium Hangzhou JIN Smart Battery Management and Jinyuan Industrial were introduced. In March 2020, Jinyuan Investment (controlled by Xiamen Municipal Finance Bureau) was introduced. In December 2020, Jinsha Investment and Huake Engineering were further funded, both controlled by the Jinshan District Government. Between November and December 2020, 17 investors, including 11 employee shareholding platforms, as well as GQR, Sequoia Capital China, Xiaomi’s Yangtze River Industry Fund, Linghui Cornerstone, and China National Investment Corp. No. 2 New Energy, were introduced and contributed additional funding.

Finally, in October 2021, with unanimous consent from shareholders, the company was transformed into a limited liability company, and in November 2021, the company was renamed as Zhongchuangxinhang.

As of November 12, 2021, the equity structure of Zhongchuangxinhang was as follows: the Jinshan District Government held approximately 30% of the shares, Aviation Industry Holdings held 10%, and new investors including Xiamen Municipal Finance Bureau held approximately 57% of the shares, with employee shareholding platforms and Luoyang Company shareholders holding approximately 3% of the shares.

The restructuring made CATL a diversified mixed-ownership enterprise with greater freedom for its management team. Additionally, equity incentives were provided for the senior management team with a total of 1.28% of the total share capital reserved for them as of 2020.As of 2020, Liu Jingyu, as a senior executive, held about 0.1% of the shares in four employee stock ownership platforms; Pan Fangfang, as a key technical staff, and Dai Ying, Gao Yan, He Fan, and other high-level managers in Liu Jingyu’s core team, also received corresponding equity incentives.

In 2021, CATL released 0.57% of its total share capital and awarded it to senior management, middle management, core technical staff, and key business backbone staff (excluding independent directors and supervisors). High-level managers led by Liu Jingyu are expected to continue to increase their shareholding proportion.

Under the mechanism of diversified shareholders and key employee equity incentives, the management of CATL is highly motivated.

The Target: Ning Wang

To carry out equity reform and introduce external investments, Liu Jingyu must have outstanding performance. Especially after turning to automobile manufacturing, CATL urgently needs to bind a major customer and open up the market for passenger cars.

Although Chang’an is the first passenger car company that CATL achieved a breakthrough, Chang’an has been slow to produce in the new energy vehicle business. Guangqi, which has been closely followed, is the best choice, but unfortunately, it has already given most of its orders to Ningde Times.

CATL can only wait for the right opportunity.

This opportunity is the conflict between Ningde Times and Guangqi. In 2018, Ningde Times and Guangqi jointly established a battery plant—-Times Guangqi. According to China Business News, the project that should have been put into production at the end of 2020, “the foundation of some buildings, such as dormitory and canteen, has not been laid.”

According to a former employee of Ningde Times, the Times Guangqi project was stagnant for at least one year, and the project leader of Ningde Times was also recalled to the headquarters to be in charge of the energy storage project.

Perhaps Ningde Times had already realized Guangqi’s ambitions in the field of battery cells and was hesitant to cooperate. In any case, the two sides had already planted resentment.

In 2020, Guangqi’s new energy vehicles suffered from a series of spontaneous combustion incidents, which pushed the differences between both sides to the peak, and the cooperation was undoubtedly broken.

A former employee of Ningde Times revealed to “Electric Vehicle Observer” that during the suspension of the battery projects between the two sides, CATL and Tafel started to compete for Guangqi’s projects.

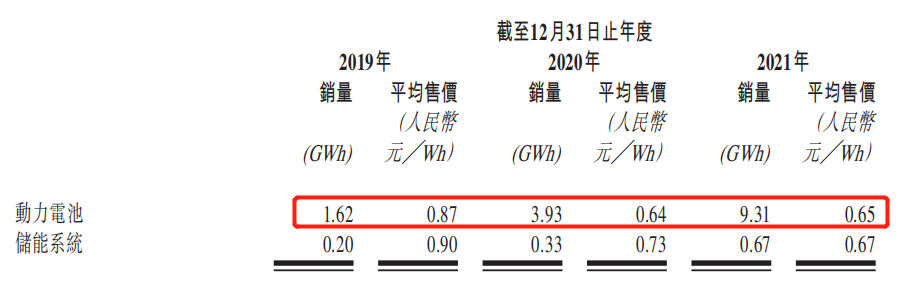

Eventually, CATL successfully won the Guangqi new energy project through a price-cutting strategy.According to the information obtained by “Electric Vehicle Observer”, in 2019, CALB quoted the price of Guangqi battery module excluding tax at 0.78 yuan/Wh, which is nearly one quarter cheaper than Ningde Times’ 1.05 yuan/Wh. By 2020, CALB’s battery module price without tax has dropped to 0.6-0.62 yuan/Wh, while Ningde Times is below 0.9 yuan/Wh. CALB is still much cheaper than Ningde Times.

CALB’s quoting price is on par with second-tier battery companies and much lower than Ningde Times.

The result we see is that a large part of the market share of Guangqi and Changan, the two major customers of Ningde Times, has turned to CALB.

Comparison of customer installations between CALB and Ningde Times (unit: MWh)

History always repeats itself in interesting ways.

In the past, CALB failed to keep Yutong as its client, which made it become Ningde Times’ largest customer for a while.

The discord between Ningde Times and Guangqi has become the engine for CALB’s resurgence.

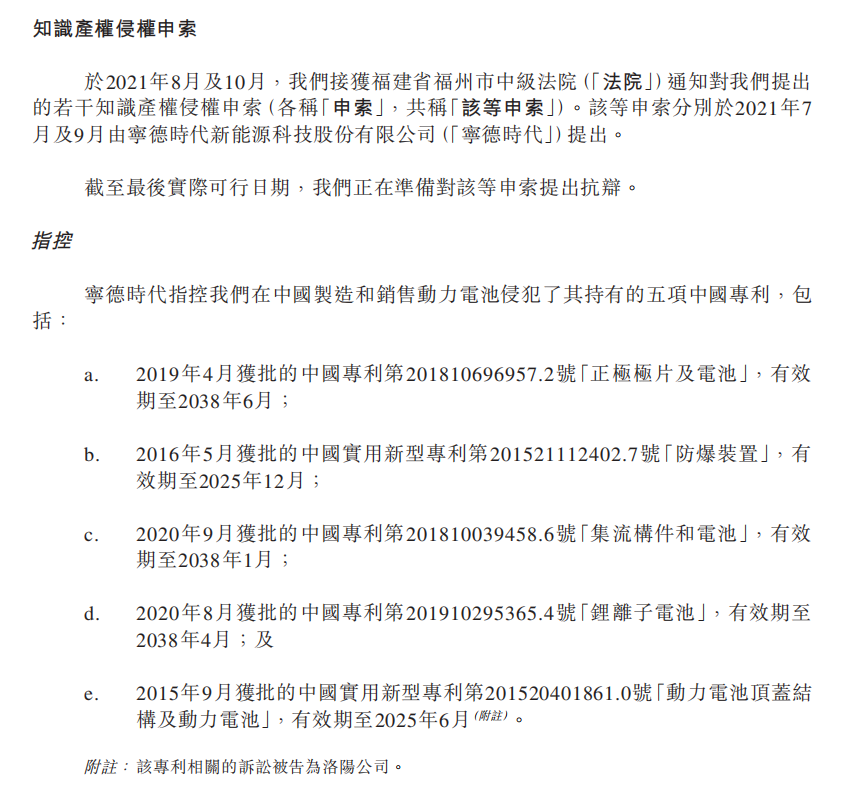

Subsequently, a larger conflict occurred- Ningde Times sued CALB for patent infringement.

According to the description in the prospectus of Zhongchuangxinhang, Ningde Times sued CALB for allegedly infringing five patents, consisting of “positive electrode film and battery”, “explosion-proof device”, “current collector components and battery”, “lithium-ion batteries” and “structure of power battery cover and power battery”.

According to former employees of Ningde Times, CALB may have become the target of a patent infringement lawsuit because it intervened in the production of Guangqi’s products after its specifications had been finalized. The battery pack and other products had been finalized, and CALB’s processes had to be designed to match Ningde Times’ original size, which may have caused infringement lawsuits.

Of course, the final outcome of the patent infringement case will have to wait until a judgment is made.

This also indicates that CALB’s rapid development has caught the attention of Ningde Times. In order to consolidate its own industry position, Ningde Times has resorted to using the big stick of patent infringement in an attempt to suppress CALB’s momentum and aspirations.

What is Zhongchuangxinhang’s current strength?

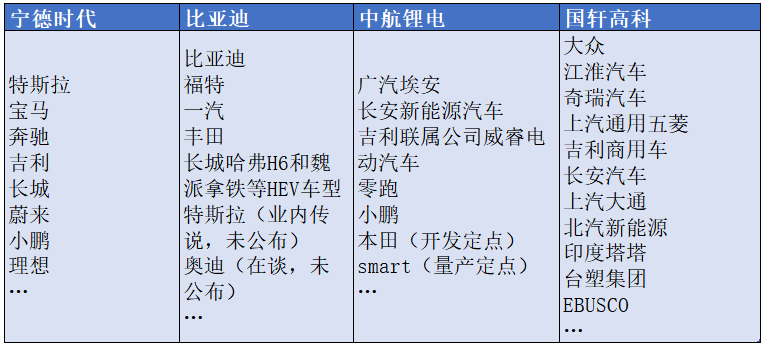

After three years of in-depth adjustments by Liu Jingyu, what is the current strength of Zhongchuangxinhang?”The Electric Vehicle Observer” compiled data from several companies including CATL, BYD, and Gotion in terms of financial data, R&D, technology and products, production capacity, and customers.

On the financial data front, although CATL’s valuation is not low, its revenue is not high. Compared to 2020 data, CATL’s revenue was only 17.8 times that of CATL’s, while Gotion was 2.22 times that of CATL’s. However, CATL’s revenue has grown significantly in 2021, reaching 6.817 billion yuan, an increase of 1.41 times year-on-year.

Of course, CATL’s high revenue comes at the cost of low profit margins. From a profit perspective, CATL’s gross profit margin could reach 13.6% in 2020, but by 2021, it had dropped to only 5.5%, far below the gross profit margin of about 25% of BYD and Gotion.

Despite a gross profit margin of only 5.5%, Gotion’s net profit can still reach 110 million yuan, demonstrating Gotion’s excellent cost control.

In terms of R&D, CATL’s R&D investment accounted for only 4.18% in 2021, much lower than the proportions of 7.09% and 10.35% for BYD in 2020.

Interestingly, although R&D investment is much lower than that of Gotion, the number of R&D personnel is higher than that of Gotion. However, the actual amount invested in R&D may not be too much, except for salaries.

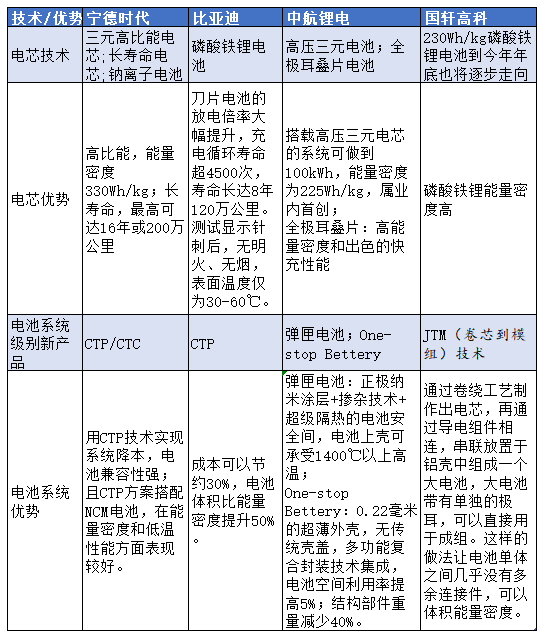

From the overall financial data, it can be seen that CATL is sacrificing short-term financial profits and R&D investment to gain time and space for survival. However, in order to achieve long-term survival and development, such low R&D investment may not be sustainable.At the technology and product level, both BYD and Guoxuan High-tech have focused on lithium iron phosphate batteries as their main feature. BYD’s blade battery further improves the volumetric energy density of lithium iron phosphate batteries, while Guoxuan High-tech has further improved the material to achieve an increase in the energy density of individual cells.

CATL has a more balanced technology layout, with layouts in both ternary and lithium iron phosphate battery fields. In terms of battery cells, there are two directions of high specific energy and long life, as well as the layout of sodium-ion batteries. CATL mainly relies on its 5-series high-voltage products to win GAC’s favor, and improves the energy density of battery cells by increasing the voltage, which improves safety.

In terms of systems, each battery company has launched its own CTP (cell-to-pack) battery pack. CATL has launched the “magazine” battery (which should be GAC’s “magazine” battery) and the one-stop battery pack solution. The feature of the magazine battery is thermal insulation and high temperature resistance, while the one-stop battery solution is highly integrated.

Of course, the common point of these companies is that they have all improved the volumetric energy density of their battery systems.

In terms of customers, CATL, BYD, and Guoxuan High-tech all have international major customers. CATL is bound to international giants such as Tesla, BMW, and Mercedes-Benz; BYD has Ford, Toyota, Tesla (rumored), and other international giants; Guoxuan High-tech is blessed by Volkswagen. In comparison, CATL’s harvest of international clients is relatively small.

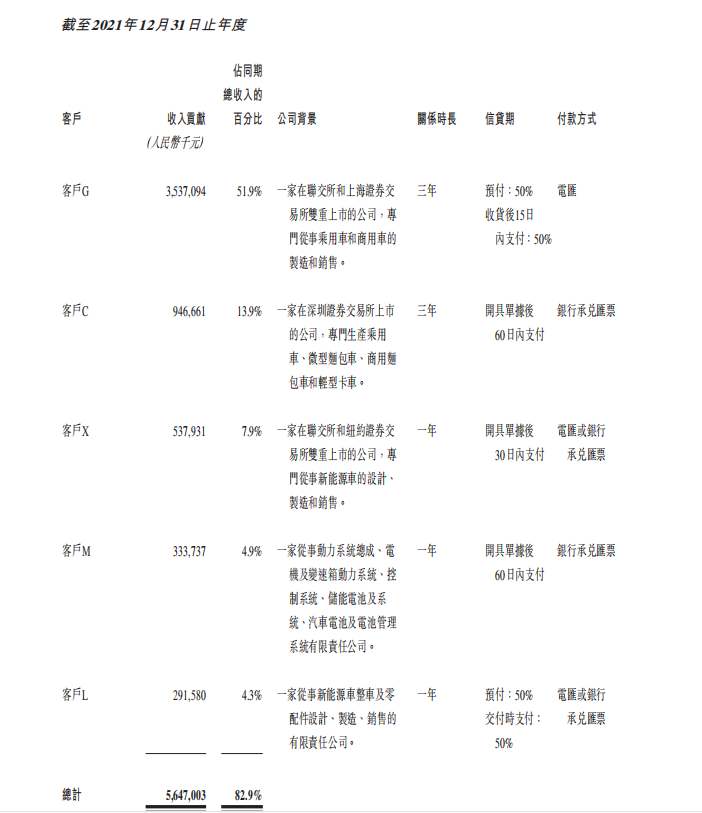

Currently, CATL’s reliance on its top five customers is very high, accounting for nearly 83% of its revenue.

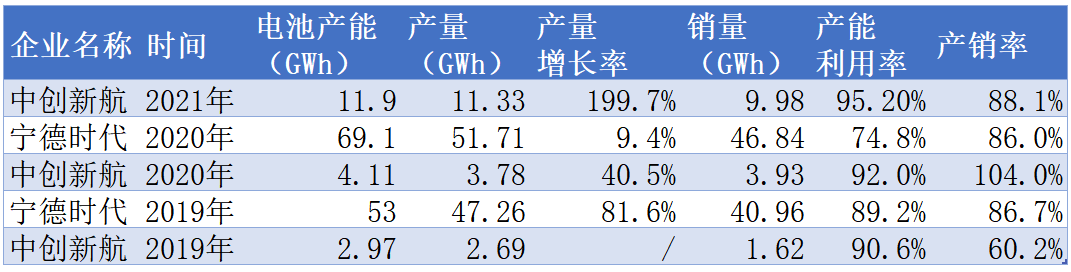

In terms of existing production capacity, CATL’s production capacity is far lower than that of CATL. In 2020, NINGDE times’ production capacity reached 69.1GWh, which is nearly six times that of CATL in 2021.

Based on this shortcoming, CATL has launched the “get-quick-to-work” plan: By 2025, with a production expansion scale of 500 GWh, which is only second to Ningde Times, BYD and Contemporary Amperex Technology; and they are the first to declare the goal of reaching 1 TWh by 2030.

Based on this shortcoming, CATL has launched the “get-quick-to-work” plan: By 2025, with a production expansion scale of 500 GWh, which is only second to Ningde Times, BYD and Contemporary Amperex Technology; and they are the first to declare the goal of reaching 1 TWh by 2030.

At present, CATL already has seven major industrial bases in Changzhou, Luoyang, Xiamen, Chengdu, Wuhan, Hefei and Heilongjiang. They will also construct an industrial cluster development model, planning to establish five major industrial base clusters in the Pearl River Delta, Yangtze River Delta, Southwest Region, Central Region and Northeast Region. Furthermore, they plan to have overseas industrial bases in Europe, North America, etc.

Their ambitious production capacity goals have been set. To overcome the next obstacle, CATL faces the challenges of successfully going public, keeping up with the speed of customer development and smoothly landing production capacity construction. Whether CATL can emerge as the leader among second-tier enterprises remains to be seen.

In any case, the past belongs to CATL, and in the new promising land, Contemporary Amperex Technology is striving forward. (All of the interviewees mentioned above use aliases, and their surnames are fictitious.)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.