New Energy Vehicle Sales in Major European Countries

Author: Zhu Yulong

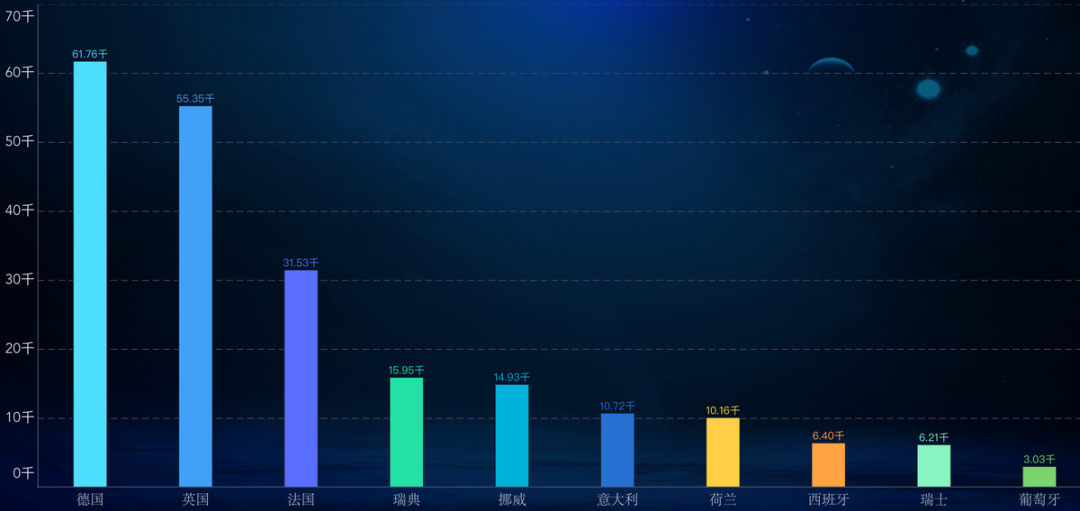

This article mainly summarizes the sales of new energy vehicles in major European countries. With the soaring prices of energy and fuel in Europe, the promotion of new energy vehicles has gained a solid foundation. Germany, the UK, and France have achieved sales of 61,760, 55,350, and 31,530 respectively, while Sweden, Norway, Italy, and the Netherlands have all exceeded 10,000, gradually increasing with seasonal sales in March. Overall, with the previous subsidy promotion, Europe has increased its penetration rate, and with the skyrocketing of fuel prices, it is also constructing its own sustainability towards marketization.

Overview of Major Countries

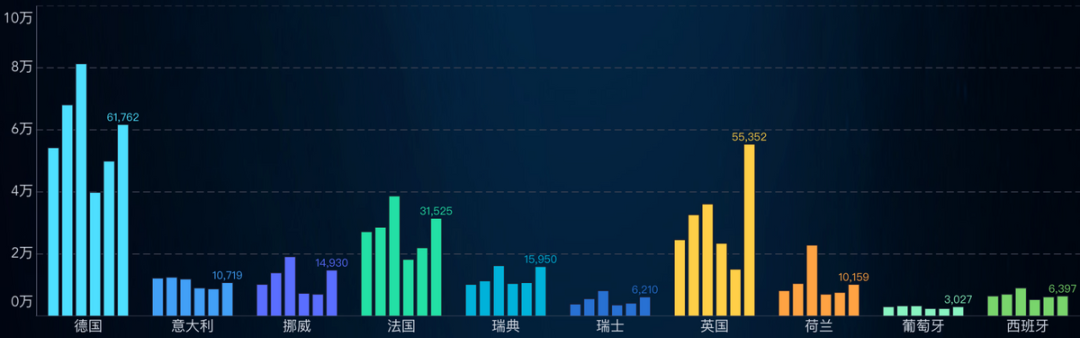

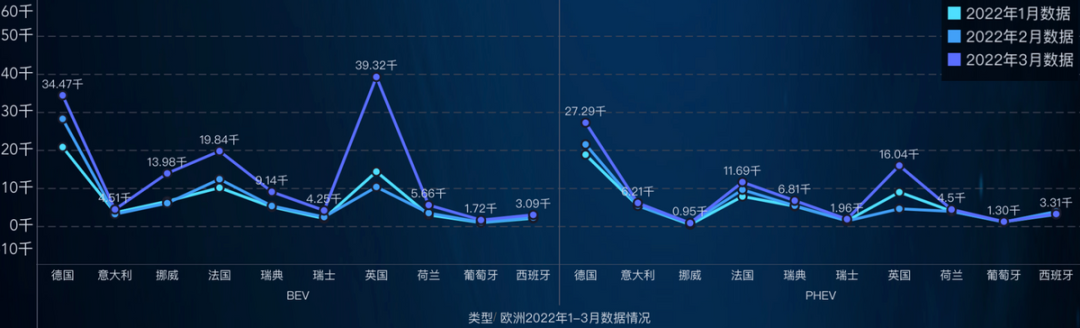

I have listed the sales of new energy vehicles in major countries for six months. Under the condition of a significant year-on-year increase in Q1 of Europe, we can see that the data in March in the UK hit a historical high, approaching the sales volume of Germany. In other words, Europe has experienced a situation similar to China, where the sales of new energy vehicles are not based on year-on-year comparison but rather continue the inertia of each quarter. This situation generally occurs under the model of sudden penetration rate changes and sustained high growth.

Note: New energy vehicles are generally low in the beginning and high at the end of a cycle. With each additional cycle, the demand for new energy vehicles in Europe this year is expected to be high. Of course, this also depends on whether there will be a continuous price increase in Europe.

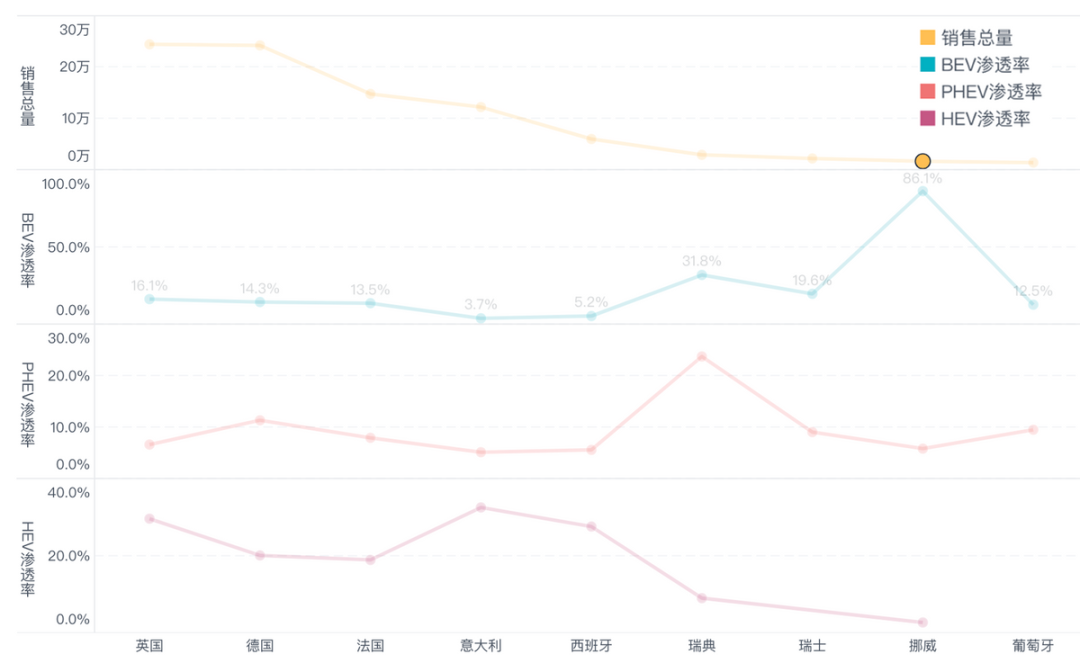

If we look at the sales in several markets in Europe, Germany, the UK, and France are the top three, with the penetration rates of pure electric vehicles being 1.61%, 14.3%, and 13.5%, respectively, which are quite stable. Among these three countries, let’s take a look at the comparison of the penetration rates of HEV and PHEV.

- Germany: PHEV 11.31%, HEV 20.07%

- UK: PHEV 6.59%, HEV 29.58%

- France: PHEV 7.9%, HEV 18.9%

In larger markets, hybrid and plug-in hybrid are still the mainstream transitional choices. Italy and Spain have similar situations, with the penetration rates of BEV being only 3.71% and 5.19%, respectively.

- Italy: PHEV 5.11%, HEV 32.5%

- Spain: PHEV: 5.56%, HEV: 27.55%The transformation is relatively easy in smaller markets, with Norway achieving 86.1% pure electric vehicle (BEV) penetration and Sweden having a penetration of 31.8% for pure electric and 23.7% for plug-in hybrid electric vehicles (PHEV), which is being driven by subsidies.

In terms of volume, from January to March, BEV sales in the UK saw the largest increase, reaching 39,300 units, surpassing Germany as the largest BEV market in Europe for a single month. Market growth for PHEVs from January to March was relatively flat.

Sales Models and Tesla’s Status

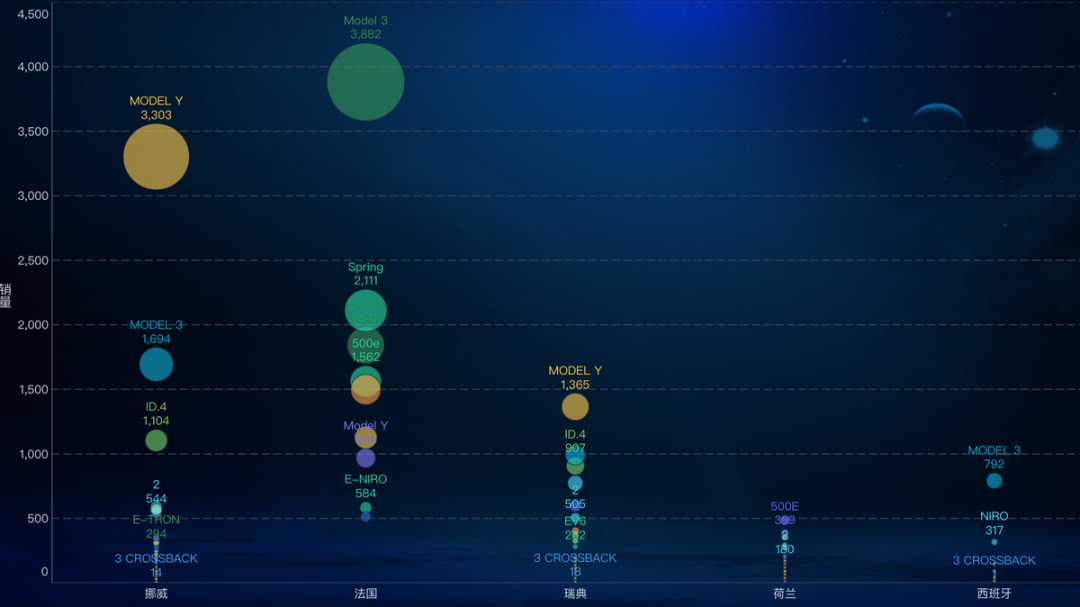

In terms of specific models, with Tesla’s deliveries in Europe, it has taken a leading position in multiple markets. In March, Tesla delivered 3,303 Model Y and 1,694 Model 3 in Norway, 3,882 Model 3 in France, 1,365 Model Y in Sweden, and 792 Model 3 in Spain. Tesla has essentially pulled ahead of all other pure electric competitors.

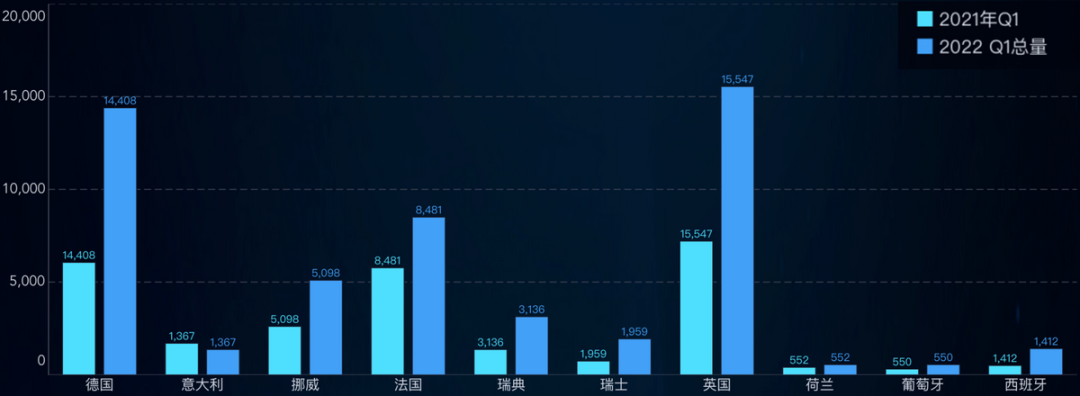

If we look at Tesla’s sales in Europe during Q1, they are:

- 14,408 units in Germany

- 15,547 units in the UK (7773 and 7774 respectively for Model 3 and Model Y, ranked sixth and seventh on the UK’s best-selling car list)

- 8,481 units in France

- 5,098 units in Norway

Tesla prioritizes delivery to these larger markets during Q1.

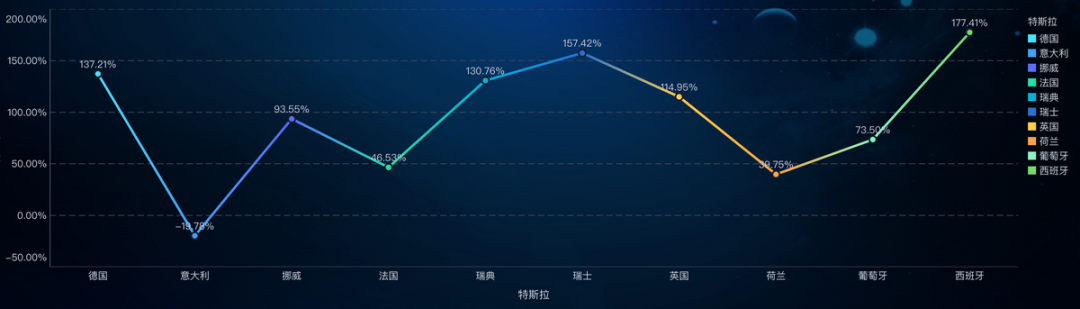

In terms of year-on-year growth rate for Q1, the numbers are basically above 100%. With the Berlin factory realizing localized production, Tesla’s delivery speed in Europe will not depend on factories in the US and Shanghai, which is very positive for expanding the European market scale.

Summary: From the perspective of the overall European automotive industry, it is actually in a very weak period. Whether it is Ukraine’s wire harness factories, various chip shortages or energy prices leading to manufacturing costs. This is the time for Tesla to hit Europe, and with high oil prices as a basic expectation, there is indeed a sense of doing the right thing at the right time.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.