Introduction

Swedish automotive technology company Veoneer confirms that Qualcomm and investment firm SSW Partners have completed their acquisition of the company on April 1st, with a total cost of 4.5 billion US dollars. After the relevant delivery is completed, SSW Partners will transfer Arriver, Veoneer’s software department, to Qualcomm in a short period of time to help Qualcomm make up for the shortcomings in autonomous driving technology. This is a significant milestone in Qualcomm’s layout in the field of intelligent electric vehicles after Qualcomm’s failed acquisition of NXP, the world’s largest car chip manufacturer in 2016.

Why Veoneer Seeks to Sell?

Veoneer was a business unit focused on automotive safety electronics and autonomous driving under Autoliv, the world’s largest airbag and seatbelt manufacturer. It was spun off from Autoliv in 2018 to become an independent company. In 2021, Veoneer’s net sales amounted to US 1.66 billion dollars.

Veoneer’s core competitiveness lies in radar, perception systems, autonomous driving system algorithms, functional safety/expected functional safety, etc. It was deeply bound to Volvo, an early Swedish automaker, and established an autonomous driving company, Zenuity. However, due to different expectations from the two parties, the last two investors split up and Zenuity no longer exists. For Veoneer, if it cannot rely on a car manufacturer, it is difficult to support Level 4 autonomous driving research, both from the perspective of product verification and the company’s own economic strength. Unless it can receive continuous investment from investors or have a reliable and stable source of funding through a successful IPO, or rely on a whole car manufacturer, it is difficult for one company to unilaterally deal with the road of autonomous driving.

Qualcomm Urgently Needs to Fill in the Gaps in Autonomous Driving

In the field of intelligent network connectivity, Qualcomm is undoubtedly leading the way. Through the 8155 chip, Qualcomm has become a product selling point for major automakers in the field of intelligent cabins, and has almost taken over the market for high-end intelligent electric vehicle cabins. Including NIO, XPeng, IM, Great Wall, and Guangqi Aion have all become customers of Qualcomm’s 8155 chip. At present, in the field of intelligent cabins, Qualcomm has built up to the fourth-generation digital cabin platform, bringing consumers a good user experience.

For Qualcomm, success in the smart cockpit field is not enough to ensure a continued market-leading position in the future, especially in the field of autonomous driving where Qualcomm is clearly lagging behind the industry mainstream.

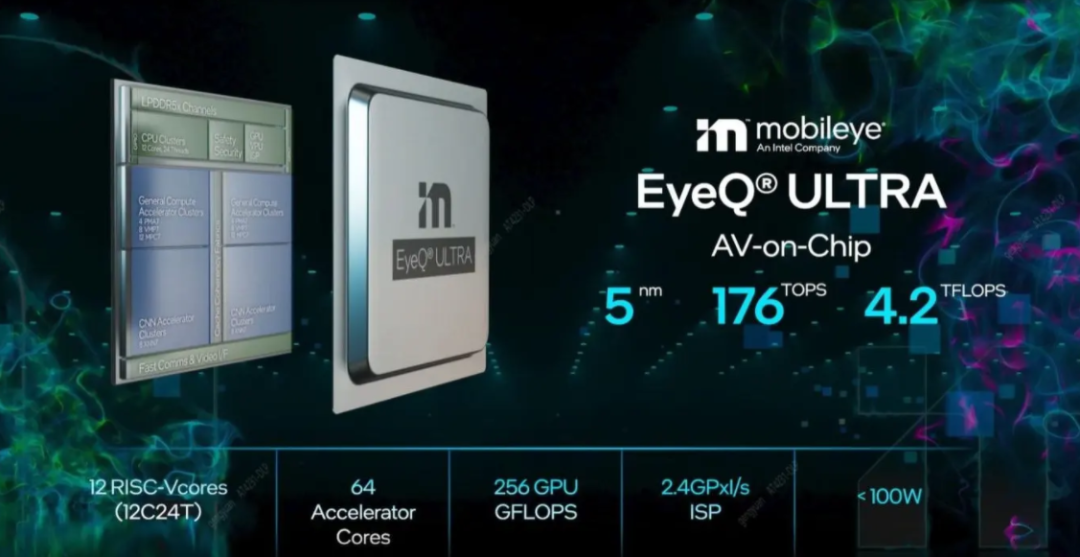

On the one hand, companies like NVIDIA, with their past advantages in GPUs, are currently the top players in the autonomous driving chip field. The latest Atlan chip developed by NVIDIA has a computing power close to 1000TOPS, and the chip will be mass-produced around 2025. Mobileye under Intel has also released the EyeQ Ultra chip for L4-level autonomous driving to take a slice of the high computing power cake. In China, companies like Horizon Robotics and Black Sesame Technologies also hope to enter the market for whole-vehicle autonomous driving control chips from the bottom up.

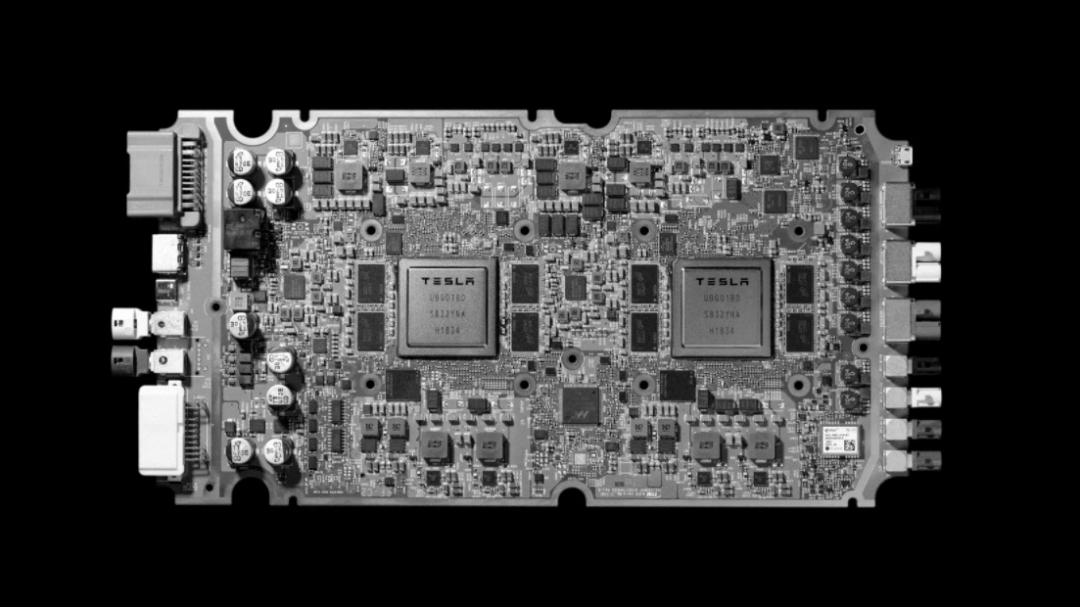

On the other hand, many car companies are starting to develop their own autonomous driving chips to maximize computing power. Currently, Tesla has successfully developed its own dedicated chip, and in China, NIO, XPeng, and Geely have all announced plans to develop their own chips. Once the automakers’ self-developed chips are successful, it will inevitably have a direct impact on their procurement of Qualcomm and NVIDIA chips.

The Snapdragon Ride solution will see further development

After acquiring Veoneer, Qualcomm will directly integrate Arriver’s computer vision, drive policy, and driver assistance business into its leading Snapdragon Ride™ advanced driving assistance system solution. This will greatly enhance Qualcomm’s competitiveness in the field of autonomous driving, upgrading it from a chip provider to a provider of advanced driving assistance/autonomous driving platforms. This will result in an increase in ability in terms of industry influence as well as competitiveness.

### Snapdragon Ride Empowers Automakers with Customized Solutions

### Snapdragon Ride Empowers Automakers with Customized Solutions

Apart from its high computing power, the biggest advantage of Snapdragon Ride is the ability to provide automakers with tailored solutions, allowing them to flexibly combine different components to achieve the optimal performance. This includes the freedom to choose from safety real-time operating systems (RTOS), hypervisor management programs, classical and adaptive Automotive Open System Architecture (AUTOSAR) solutions, and open and programmable security software development kits (SDK), according to their own sensor schemes, driving strategies, and requirements for automatic parking.

As Qualcomm’s latest platform for autonomous driving, Snapdragon Ride has already won over two major customers: BMW and Great Wall Motors. For BMW’s Neue Klasse modular platform, the highlights include adopting Snapdragon Ride for unified analysis and processing of surrounding situational awareness data from cameras, such as front, rear, and surround views, allowing for a better autonomous driving experience. Apart from its self-driving capabilities, Neue Klasse will also implement a completely redefined IT and software architecture, a new generation of high-performance electric drive systems and batteries, and a new method for sustainable development throughout the entire vehicle’s lifecycle, all of which will become BMW’s most powerful weapons to compete with Tesla and other rivals in the intelligent electric car market.

For Great Wall Motors, its new generation of vehicles will also be equipped with the autonomous driving computing platform ICU 3.0. The biggest bright spot of ICU 3.0 is undoubtedly Qualcomm’s Snapdragon Ride solution. The platform’s single-board computing power reaches 360 TOPS, which can be continuously upgraded to 1440 TOPS. Meanwhile, ICU 3.0 has an energy efficiency ratio of up to 5.5 TOPS per watt, which also puts it in a leading position in the subdivision market.

Through this acquisition, Qualcomm now has the ability to build a complete autonomous driving solution based on its own chip hardware architecture and Snapdragon Ride platform, which integrates Arriver software under the Wingtech Group. It will have a broader market stage in the future. With high-tech giants such as Tesla, NVIDIA, and Intel, who control both chips and algorithms, racing to dominate the global autonomous driving market, Qualcomm is sure to grab a share and find a new driving force for its own development, ensuring its position in the global chip industry remains unchanged.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.