“>”This year is the crucial period for testing the product strength of various new energy vehicle companies.”

Author | ZHANG Lianyi

In 2021, XPeng Motors achieved remarkable results, with sales of 98,155 units, an increase of 263% year-on-year, and won the sales crown of China’s new car-making forces for the first time. So far, there has been momentum in the first quarter of this year, with an expected delivery of 33,500-34,000 units.

However, on March 28, 2022, during the 2021 financial report conference call, XPeng Motors CEO He XPeng focused not only on sales, but also on issues such as the progress of intelligentization and supply chain security.

On the one hand, XPeng Motors is steadily promoting the landing of intelligent assisted driving. According to the plan, the City NGP plan will be officially launched at the end of the second quarter of this year; in 2023, XPILOT4.0 will be officially released to achieve intelligent assisted driving in all scenes within the high-speed and city limits. At least 4 models will support XPILOT4.0 in 2023, and the hardware and software platform of intelligent assisted driving for new models will gradually be unified.

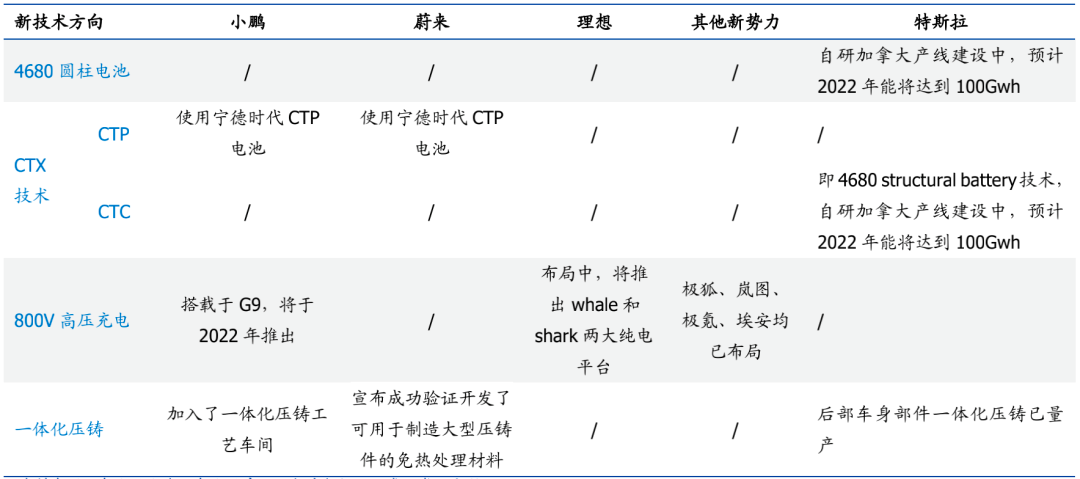

On the other hand, it is positively communicating with major power battery suppliers, with the goal of being able to control the battery cost problem caused by the rise in material prices in 1-3 quarters while ensuring supply.

Meanwhile, XPeng Motors completed the technical upgrade of the Zhaoqing plant during the Spring Festival holiday, and by adjusting the sales and delivery cycle, its new orders in late February and the first half of March have recovered to the best level of the peak period in December last year.

He XPeng believes that in the context of high oil prices, the cost advantage of electric vehicles over fuel vehicles will further increase. The middle and high-end pure electric market positioned by XPeng Motors will usher in greater growth. “Since consumers in this market value electric vehicles and technology more, I believe that this year will be a crucial period for testing the product strengths of various new energy vehicle companies.”

Supply Chain and New Cars

On March 21, XPeng Motors announced a comprehensive price increase, ranging from 10,000 to 20,000 yuan, a significant move. The reason given by XPeng Motors is the continuous and significant rise in upstream raw material prices.Prior to this, He XPeng has mentioned supply chain pressure more than once. At the recent hundred-people meeting responding to journalists’ questions, He XPeng said that there are three external factors this year that directly relate to the increase in the price proportion and cost for new energy vehicle manufacturers.

The first is materials, mainly referring to an unexpected increase in the price of battery cells. The second is chip shortage, and in 2021, they believed that the problem would be alleviated in the second half of this year, but currently, it seems to be trending to worsen. The third is the situation of the epidemic in China this year.

To deal with these issues, He XPeng stated that XPENG Motors’ strategy of choosing multiple battery partners has played a significant role. The company is actively cooperating with its suppliers to find solutions. For example, with battery types, lithium iron phosphate batteries account for a considerable proportion in its sales system, but they have previously delivered only a minimal proportion. They are currently in communication and adjusting to achieving good results and maintaining the supply and cost-effectiveness. He believes that after 1-3 quarters, they will have the ability to control the increase in the material prices that bring problems to the cost of batteries.

While cooperating with the outside world, XPENG Motors also hopes to improve their internal strength. He XPeng stated that the company is planning for different models and platforms to backup each other between various factories.

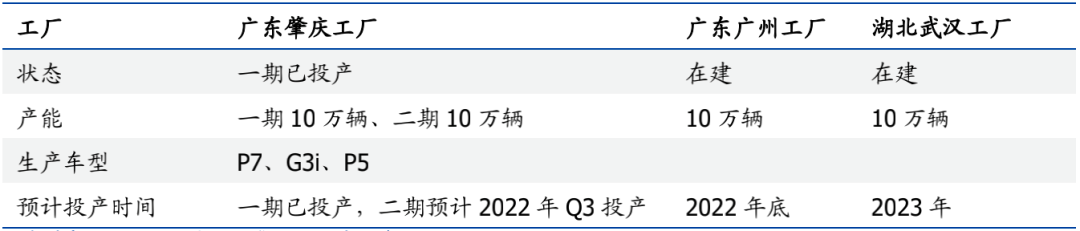

Currently, XPENG Motors’ primary layout consists of three factories, with the Zhaoqing factory as its core production center, and the Guangzhou and Wuhan factories are under construction.

Among them, the total planned annual production capacity for phases one and two of the Zhaoqing factory is 200,000 vehicles, with 100,000 vehicles for phase one, which went into production in May 2020, and phase two is planned to begin production in Q3 2022. The Guangzhou factory is planned to begin production in 2022, with a capacity of 100,000 units, and the Wuhan factory is planned to begin production in 2023, with a capacity of 100,000 units.

However, in the financial report conference, He XPeng stated that the factory’s planned production capacity might increase through system improvements such as overtime. He hopes that the company can achieve the ability to produce over 500,000 vehicles in a relatively short time.

With the production capacity keeping up, new models will not be far behind.

The 5-seater mid-size SUV XPENG G9 is ready, and the PT production sample car has been off the factory line, and it will be officially launched for sale in the third quarter of this year as scheduled.

In 2023, XPENG Motors will also launch two new model platforms and their first models, respectively, the C-class platform and the B-class platform. The new platform will help XPENG Motors improve its ability to control costs and cover a more extensive range of user groups.Two new cars will be global products, and He XPeng said that “the launch of the new car will truly accelerate XPeng’s expansion into international markets”.

Intelligence and Mobility

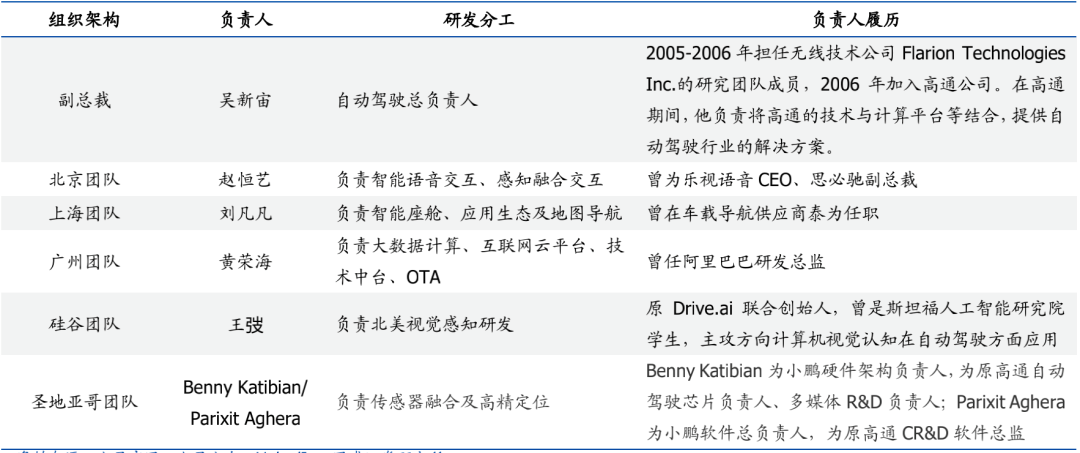

As a newcomer to new energy vehicles in China that is most “like” Tesla, XPeng Motors has always been at the forefront of exploring intelligent driving technology. Therefore, every advancement of their XPILOT series of intelligent driving systems draws considerable attention.

XPeng Motors is the first Chinese automaker to conduct full-stack self-driving research and development in China. Currently, it mainly implements XPILOT 3.0/3.5, VPA intelligent parking, and NGP automatic navigation assistance. Among them, XPILOT 3.5 is equipped with two lidars for the first time in hardware, providing more hardware redundancy than Tesla’s FSD; on the algorithm side, it relies more on visual perception.

In the financial report conference, He XPeng spent a lot of time introducing the new developments of the XPILOT series.

He said that the development of XPILOT 3.5 urban NGP, mainly used by XPeng P5, is progressing smoothly, and the test version is being rapidly iterated. According to the plan, “the technical development of urban NGP will be completed in the second quarter of this year, and OTA updates will be gradually rolled out to cities that support NGP after obtaining relevant approvals for high-precision maps in the city”.

Compared with XPILOT 3.5, he is more optimistic about XPILOT 4.0. “Based on the brand-new architecture and data loop of XPILOT 3.5, we plan to launch XPILOT 4.0 officially in 2023, realizing intelligent assisted driving in high-speed and urban all-scenarios, and gradually unifying the hardware and software platforms of new car models on this basis.”

He XPeng pointed out that “there will be at least four models that support XPILOT 4.0, including new models and revised models of existing models within 2023, and two new products released on a new platform next year will support XPILOT 4.0.” “He believes that XPeng Motors will have a significant technological advantage in mass-producing intelligent driving assistance systems compared to other automakers at that time.”

He XPeng even stated that “XPILOT 4.0 will promote the popularity of advanced intelligent driving systems and drive the arrival of the era of people-machine co-piloting in car transportation.”

The “intelligence” of XPeng Motors is not only reflected in the functions of their smart driving system “XPILOT” and smart cockpit “Xmart OS”, but also reflected in the exploration of their entire product line, such as the robotic horse, the “XPeng Huitian” flying car, and robotaxis.

According to its previous plan, XPeng’s Robotaxi strategy aims to enhance the robustness of its autonomous driving algorithm and verify hardware operation through operating in generalized scenes in the short term. Therefore, XPeng will launch Robotaxi tests on G9 in the fourth quarter of this year and complete the transition to unmanned driving by 2026.

Combining with its previously Launched riding intelligent robot-horse and the plan to lay out flying cars for low-altitude travels through eco-enterprise XPeng Huitian, XPeng is trying to set up a “smart travel big ecology”.

Gross Margin Dilemma

Having enough money is the fundamental support for all these operations.

XPeng has it.

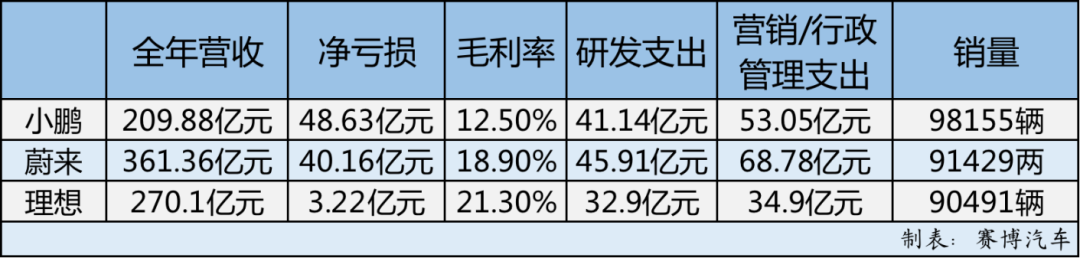

Although XPeng was in a loss-making state throughout 2021, with a net loss of RMB 4.86 billion, they still have a “thick foundation.”

As disclosed by financial reports, as of the end of 2021, XPeng held RMB 43.54 billion in cash flow. Although not as much as NIO’s RMB 55.4 billion and Li Auto’s RMB 50.16 billion, this number can guarantee the healthy operation of the company.

In the face of unfavorable market conditions this year, combined with the increase in supply chain prices and the frequent production shutdowns caused by the epidemic worldwide, “having reserves” helps companies remain composed.

XPeng’s other data is also impressive.

In terms of sales and service networks, as of the end of 2021, XPeng had 357 sales outlets, covering 129 cities, including 209 directly-operated stores and 148 authorized stores. Non-first-tier city sales outlets account for nearly 80%.

In terms of charging network deployment, as of January 17, 2022, XPeng’s branded charging piles have cumulatively come online for 813 units, covering 337 cities nationwide. The next-generation high-power Ultra Charging will begin to be deployed in the second half of 2022.

In terms of overseas market expansion, in February 2022, XPeng announced a strategic cooperation agreement with a leading European dealer group, and will use a combination of direct sales and authorized retail models. The first direct-operated store in Europe has officially opened in Stockholm.

Compared with competitors, gross profit rate is a “pain point” for XPeng.

In 2021, XPeng’s gross profit rate was 12.5%. By contrast, NIO and Li Auto are at 18.9% and 21.3%, respectively, far exceeding XPeng.Therefore, at the financial report conference, He XPeng emphasized that Xpeng’s medium and long-term goal is to increase the company’s overall gross profit margin to over 25%. The company will achieve better cost control through new platform scale, highly integrated design, and advanced manufacturing technologies, such as large-scale integrated die-casting.

This is largely due to Xpeng’s “low price” compared to the other two. Its average transaction price is about RMB 250,000, whereas the ideal average price is RMB 340,000 and NIO is over RMB 400,000.

Therefore, beyond the gross profit margin, Xpeng has always lagged behind NIO and Ideal in terms of revenue. In 2021, despite Xpeng’s sales surpassing NIO and Ideal, it is still the case.

In 2021, Xpeng’s total revenue was RMB 20.99 billion, a year-on-year increase of 259.1%; and its automotive sales revenue was RMB 20.04 billion, a year-on-year increase of 261.3%. NIO’s and Ideal’s revenues were RMB 36.14 billion and RMB 27 billion respectively.

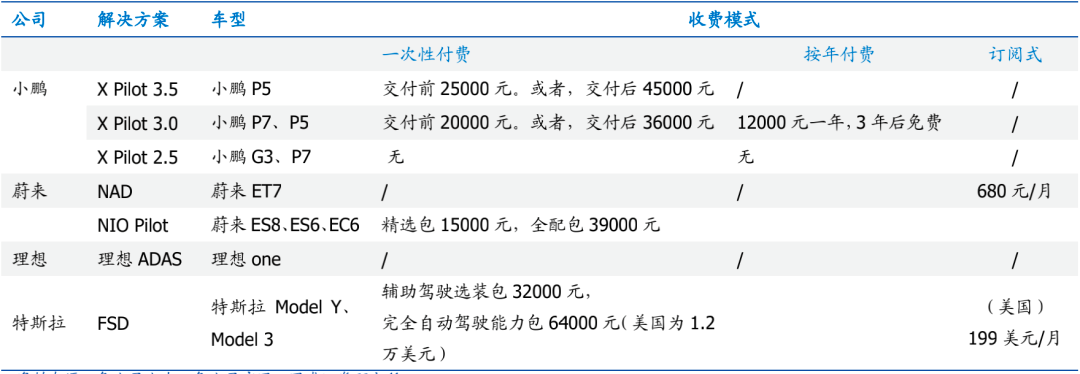

Therefore, intelligent driving is not only Xpeng’s technological advantage but also an important engine for revenue and profit improvement. Growth drivers mainly come from two aspects: the improvement of software payment penetration rate and the increase of software fees.

Once the value of “software” is reflected, Xpeng will distinguish itself from traditional car companies in its business model, and its advantages in travel ecology may emerge.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.