Main Text

In July 2020, Wuling launched the Hongguang MINI EV with a price range of 28,800 to 38,800 yuan. At that time, someone asked me how I viewed this car. I said that Wuling had missed the opportunity to enter the high-end new energy market and had completely shattered its high-end dream over the years.

Today, although the Hongguang MINI EV has become a sensational car, it has deeply fettered Wuling’s high-end development. The higher the sales volume of the Hongguang MINI EV, the more embarrassed Wuling feels about its high-end aspirations.

The launch of the Hongguang MINI EV was undoubtedly a strategic victory, but it was also a strategic failure. The primary person responsible, Shen Yang, the general manager of SAIC-GM-Wuling, who is often referred to as “Old Shen Yang”, was expected to retire last year and enjoy his remaining years, but apparently, the transformed Wuling urgently needs him.

Facing the invasion of new forces like Tesla in the middle and high-end new energy market, we wonder how Shen Yang feels at this moment. Does he regret his decision to launch the Hongguang MINI EV? After all, the high-end has always been his obsession, but he never expected that it would be easily achieved by a few “young people”.

Perhaps this is destiny, or perhaps it is a sign of the times. As a pioneer in the era of fuel cars, Shen Yang might not necessarily be a master in the era of new energy.

Recently, after killing Wuling’s high-end dream, Shen Yang seemed to have made a “crazy move” again, this time targeting batteries.

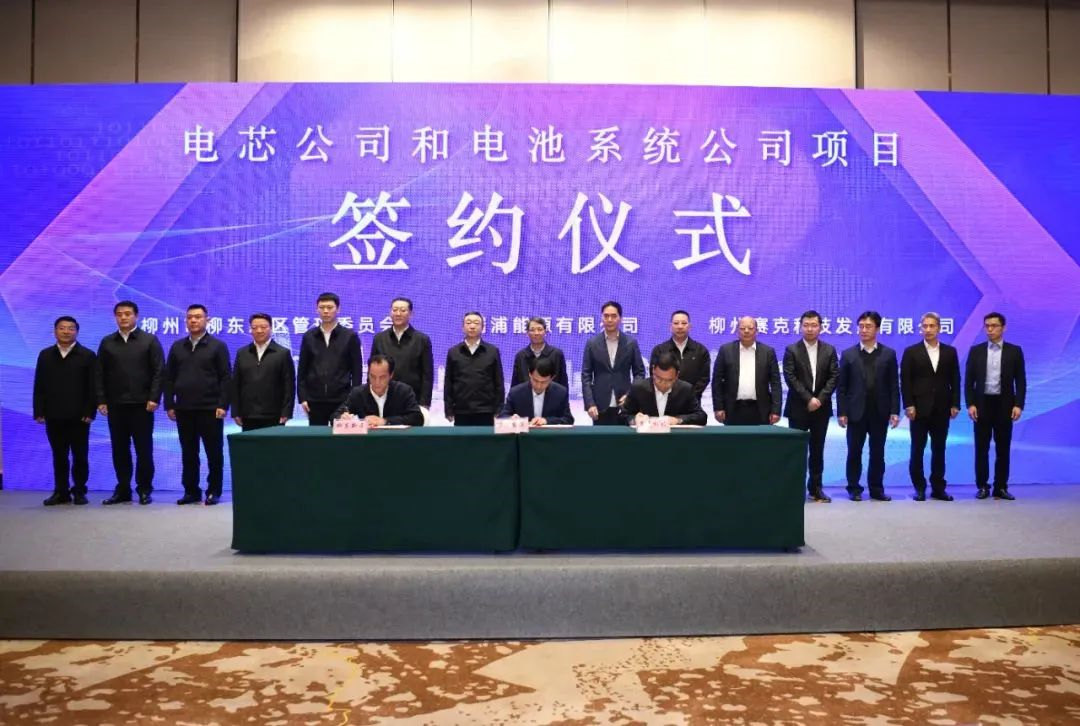

On March 25, Wuling announced via its official Weibo account that SAIC and Qinghua Group had reached a joint venture agreement on March 24 to produce 20 GWh of battery cells and 20 GWh of battery packs in Liuzhou. Yes, you read that right, Wuling is going to make battery cells.

It is not unusual for automakers to say they will make battery cells, but few actually do so. Currently, only GAC persists in making its own battery cells, while the vast majority, including mainstream automakers such as Volkswagen, Toyota, Mercedes-Benz, and BMW, partner with battery manufacturers.

The reason why most automakers do not make battery cells directly is that, first, battery cells fall under the field of electrochemistry, which is not the traditional expertise of automakers, and second, there are too many risks in making battery cells, including high investment and changing technical routines, as evidenced by a typical case.

In September 2018, former German Chancellor Angela Merkel stated that she hoped Europe could gradually achieve self-sufficiency in power batteries for new energy vehicles and that automakers could collaborate with European countries within their strategic capability framework to develop new energy power batteries.In Germany, the responsibility for producing domestic batteries undoubtedly falls on the world’s largest automotive supplier, Bosch. However, Bosch is not interested in producing its own battery cells and has expressly stated that it will not do so, noting that such investment may never be able to generate a return.

Bosch also stressed that it will continue to collaborate with battery cell suppliers to design hybrid and electric vehicle batteries and purchase these batteries from them.

In March of this year, Chinese power battery supplier, EVE Energy, issued a notice stating that it had recently received a supplier appointment notice from Bosch, designating EVE Energy as a supplier for Bosch to provide lithium-ion power batteries for global electric vehicle auxiliary applications.

Ultimately, battery cells are just one type of automotive component. Therefore, as the world’s largest component supplier, Bosch’s decision not to make its own cells seems natural. However, this is not the case, despite calls and pressure from the German government.

Bosch’s choice is indicative of the great risk associated with developing its own battery cells.

I believe that Bosch has the capability to develop its own battery cells, and BMW also claims to possess the technological know-how to do so. However, the problem is, what happens once the cells are developed? What is the product’s performance? How does it compete with existing cells? Can it be profitable? These are very real issues.

As for Wuling’s decision to manufacture battery cells, it may be possible to do so, but how competitive will it be? Will consumers approve? What happens if something goes wrong on a large-scale? Will this investment generate a return? Yes, there are too many uncertainties.

Clearly, whether it is because all mainstream automakers choose to collaborate with battery companies or because of the high-risk nature of developing battery cells, Wuling’s decision to make its own battery cells is not a wise move.

At 61 years old, Lao Shen Yang still maintains a deep understanding of the low-end market. However, the high-end market is probably his lifetime regret. Does Lao Shen Yang understand the technology? There is no clear answer. As for the latest battery cell technology, we have not seen any professional opinions from him.

Therefore, the question arises: how did Lao Shen Yang make the decision for Wuling to manufacture battery cells? Could it be under Wang Xiaoqiu’s instructions?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.