Writing by Zheng Wen

Editing by Zhou Changxian

Three years ago, regardless of whether it was partners, users, investors, media or peers, everyone was questioning NIO: You have such a small window, and once BBA (Mercedes-Benz, BMW, Audi) starts making electric cars, you will die quickly. Some people even claimed that the wave of electrification was coming and that traditional luxury car companies from BBA would soon be thrown onto the beach by Tesla.

In the end, the result was that NIO survived well, and BBA also did well. It turned out that the core difference was not between fuel cars and electric cars, but between high-end brands that survived well and mass-market brands that struggled.

Moreover, although all industries are talking about consumption downgrading, many car companies are still firmly launching high-end brands. The fact is that while consumption downgrading is happening, consumption upgrading is also happening, but in different worlds.

During the more than two years of the pandemic, the high-end car market still showed a very hot situation. Whether it was NIO’s high-end new brand continuously increasing or the 001 orders at an average price of 335,000 yuan skyrocketing, or the double-digit increase in the Mercedes-Benz high-end car series, all proved that high-end car series are not lacking in consumers. Meanwhile, car companies that choose to go the mass-market route are seeing a general decline in sales and net profits.

Fu Peng, chief economist of Northeast Securities, said that after every crisis, the rich always get richer and the poor always get poorer. Several car companies that released their 2021 financial reports last week are evidence.

Interestingly, taking advantage of announcing their results, the leaders of each company also made some tough remarks, which is a good way to boost morale.

NIO expects to turn a profit in 2024

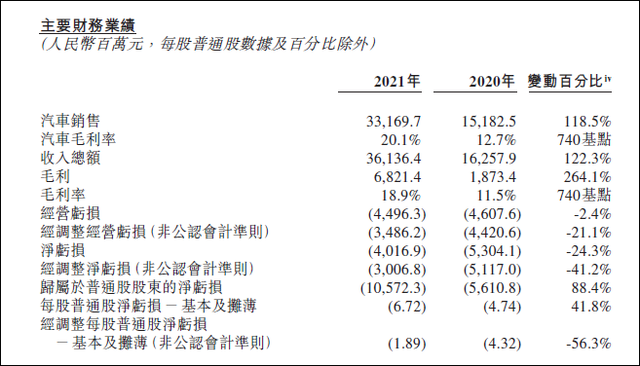

Let’s first look at NIO’s 2021 report card.

Data shows that NIO achieved a revenue of 36.136 billion yuan last year, a year-on-year increase of 122.3%, and narrowed its losses to 4.02 billion yuan, a 24.3% decrease from the same period last year.

Publicly available data shows that NIO’s net losses in 2018, 2019, and 2020 were 9.639 billion yuan, 11.295 billion yuan, and 5.304 billion yuan, respectively. After reaching a low point in 2019, NIO’s financial situation is gradually improving.

Moreover, NIO’s gross profit margin of 20%, which is higher than the previous year’s 12.7%, has made a significant breakthrough, even surpassing that of established luxury car companies.

The specific reason, as explained by Li Bin during the earnings call, is that a lower-cost 75-degree ternary lithium battery pack has replaced the previous 70-degree ternary lithium battery pack. In addition, sales growth has further spread the cost.

Under this situation, Li Bin said that NIO is expected to turn a profit in 2024.# NIO’s Product Power Reveals Itself in a Challenging Market

In 2021, despite the fact that NIO is currently experiencing a downturn in its product cycle, Li Bin, the company’s founder, remains confident in the company’s product power even with new market entrants. According to the 2020 financial report, NIO delivered 91,429 total vehicles, a year-over-year growth of 109.1%. Specifically, the ES8 had 20,050 deliveries, the ES6 had 41,474 deliveries, and the EC6 had 29,905 deliveries. It’s worth noting that NIO has a 23% share of Shanghai’s market for vehicles selling for more than 350,000 yuan, making it the top-selling automaker.

This year marks the beginning of NIO’s product boom. The ET7, priced between 448,000 and 526,000 yuan, has exceeded expectations in terms of conversion rate, while the ET5, which is priced at over 300,000 yuan, has also exceeded expectations for orders. According to Ping An Securities, NIO will have an estimated monthly sales volume of approximately 8,000 units for the ET5 after its official launch, which is close to the combined sales volume of NIO’s three current models.

In addition to these two models, NIO’s president, Qin Lihong, revealed during a media event earlier this year that the company plans to deliver an ES7 that would compete with the BMW X5L. This means that NIO will deliver three new models this year.

NIO has entered a relatively stable platform phase, and the upcoming product launches in 2022 will be a concentrated outbreak of the system capabilities that have been accumulated over time. The ET7, ET5, and ES7 are all new models based on the NT2.0 platform.

With this new round of product launches, as well as the previously launched ES8, ES6, and EC6, NIO has formed a “SUV + sedan” dual-line product matrix, becoming the first new carmaker to walk on two legs.

In addition, during NIO’s earnings call, Li Bin revealed that the team has completed the organization of a new brand targeting the mass market, and the direction of the first batch of products is clear, and R&D has entered a critical stage.

BBA Stocks Soar

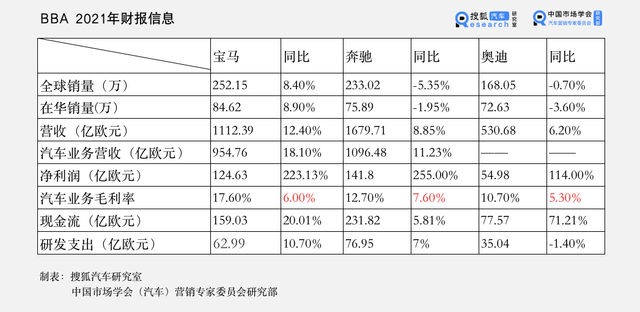

While NIO marks a successful high-end new force in the auto market, BMW, Audi, and Mercedes-Benz have achieved great financial results this year despite various challenges such as recurring pandemics, chip and power shortages, and rising raw materials costs.In terms of revenue, BMW, Mercedes-Benz, and Audi were 111.239 billion euros (equivalent to RMB 778.996 billion), 157.971 billion euros (equivalent to RMB 1,106.255 billion), and 53.068 billion euros (equivalent to RMB 371.630 billion), respectively.

As for net profit, BMW, Mercedes-Benz, and Audi achieved terrifying growth rates of 223.13%, 255%, and 114%, respectively. In terms of gross margin of vehicles, their performance was also good, at 17.6%, 12.7%, and 10.7%, respectively.

It can be seen that BMW’s core data is particularly impressive and is also the most outstanding among BBA. After five years, it has surpassed Mercedes-Benz and taken the top spot in the luxury market.

The data shows that in the 2021 fiscal year, BMW delivered 2.52 million new cars worldwide, an increase of 8.4% year-on-year, surpassing Mercedes-Benz (Daimler AG renamed as Mercedes-Benz AG) by nearly 200,000 vehicles. This is also the first time that Mercedes-Benz has been surpassed by BMW in sales in five years. Interestingly, half of the sales gap of nearly 200,000 vehicles came from the Chinese market.

However, Mercedes-Benz still has the strongest “money-making” ability. Even in the sales downturn of 2021, the revenue of the passenger car business increased by 11.23% year-on-year to 109.648 billion euros (equivalent to RMB 7,653.43 billion), and the net profit increased by 255% year-on-year to 14.18 billion euros (equivalent to RMB 98.976 billion).

The profit growth is attributed not only to cost reduction and efficiency improvement but also to Mercedes-Benz’s excellent product layout. The high-end car series with higher profits have shown significant growth in sales. In 2021, the sales of Mercedes-Benz’s high-end car series increased by 30%, with an average car price of 49,800 euros (equivalent to RMB 354,000).

For example, the sales of Mercedes-Benz’s S-Class increased by 40% year-on-year to 87,000 vehicles, with 35.5% of them sold in the Chinese market; the delivery of AMG models reached 145,900 vehicles, an increase of 16.7% year-on-year; the sales of the Maybach series increased by 50.7% year-on-year to 15,700 vehicles.

Xpeng’s commitment to 650,000 vehicles by 2025 remains unchangedOn February 23, Geely Auto released its 2021 annual financial report. The listed company achieved a revenue of RMB 101.6 billion, breaking the RMB 100 billion annual revenue mark for the first time, a YoY increase of 10.3%. Net profit was RMB 4.35 billion, a YoY decrease of 22%. Due to operating cash inflow and Pre-A round external financing conducted by Geely-controlled Extreme Racing, the group’s total cash increased by 46% YoY to RMB 28 billion.

At present, Geely’s capital market price per share is only HKD 11.96, with a market value of HKD 119.8 billion (equivalent to RMB 97.6 billion). Even compared with other leading traditional independent automakers, Geely’s market value is not high. Great Wall Motors’ market value is RMB 209.7 billion, and BYD’s is RMB 650.9 billion.

“I believe there is a big gap between the current market value and the actual value of the company,” said Gui Shengyue, Geely Auto’s Executive Director and CEO, emphasizing that with the passage of time, the vitality of a traditional global automaker will be significantly demonstrated, and the valuation will fundamentally change after the advantages are unleashed.

Geely Auto Group’s CEO Gan Jiayue said that the company will actively address the uncertainties brought by the supply chain and will continue to strengthen the deployment of domestication and self-developed chip routes, and solve the chip shortage problem through multiple technical solutions and approaches.

It is worth noting that the Extreme Racing, with a single vehicle price of RMB 3.35 million, although controversial, performed well. An Conghui said, “When we announced the price last year, many investors said it couldn’t be done.” He said Extreme Racing’s gross profit was positive, in line with expectations, and with sales growth this year, the gross profit level will be even better.

An Conghui introduced that Extreme Racing began product delivery on October 23 last year, and by February this year, cumulative deliveries had reached 12,453 vehicles. In 2022, the sales target of Extreme Racing is 70,000 vehicles. In the next three years, Extreme Racing will launch six models.

“Although there are great uncertainties such as the epidemic and the supply chain, we are determined to achieve sales of 650,000 vehicles in 2025, and we are confident that our global share of the high-end electric vehicle market will be among the top three globally.”

At the same time, An Conghui also pointed out that Extreme Racing faces two major problems: one is that orders cannot be delivered and the other is that software needs significant improvement. Next, Extreme Racing will increase its investment in intelligentization. Currently, the number of software R&D personnel is more than 2,600, which has increased from 35% of the proportion last year to the current 65%, and is expected to increase to 70% by the end of the year.

这是一个 Markdown 文本

这是一个带有 粗体 和 斜体 的文本,并且有一个超链接,以及一个图片:

还有一个无序列表:

- 项目 1

- 项目 2

- 项目 3

最后一个是一个代码块:

<html>

<head>

<title>示例网站</title>

</head>

<body>

<h1>欢迎来到示例网站!</h1>

</body>

</html>

This is a Markdown Text

This is a text with bold and italic, and also a link, and an image:

And there is an unordered list:

- Item 1

- Item 2

- Item 3

The last one is a code block:

<html>

<head>

<title>Example Website</title>

</head>

<body>

<h1>Welcome to Example Website!</h1>

</body>

</html>

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.