Content:

1,252 words in total.

Estimated reading time: 6 minutes.

In the previous article (Part 1) Four stages of Apple’s ROE, we analyzed the reasons why Apple’s ROE continues to climb from 1.62% in 2002 to 147% in 2021.

Buffett once said, “The main criterion for judging whether a company is good or bad is its return on equity (ROE) of net assets.” Here we need a quantitative reference to judge what is good and what is bad. Buffett believes that an excellent company should have an ROE of at least 20% for at least ten consecutive years.

If we follow Buffett’s standard, Apple should far exceed the level of excellent companies. So, why can Apple achieve such a high ROE?

Here corresponds to the four stages of Apple’s ROE, which are analyzed quantitatively.

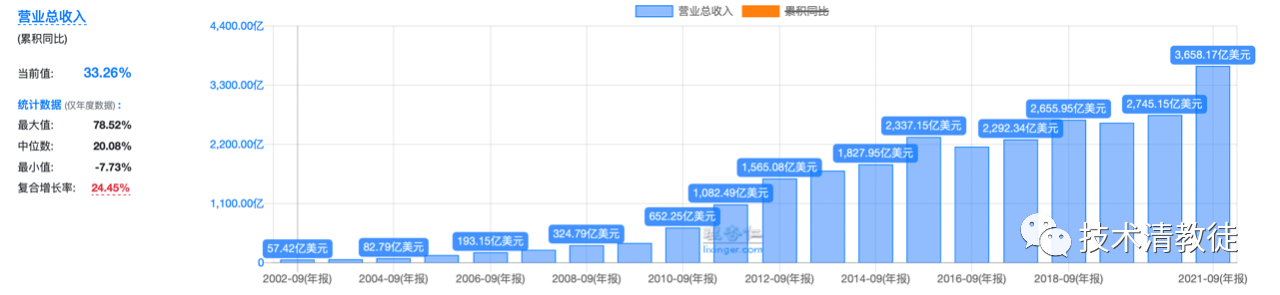

It is not difficult to see that Apple’s total revenue grew rapidly from 2002 to 2015. Next, let’s peel off one layer to see what specific business drove the revenue growth.

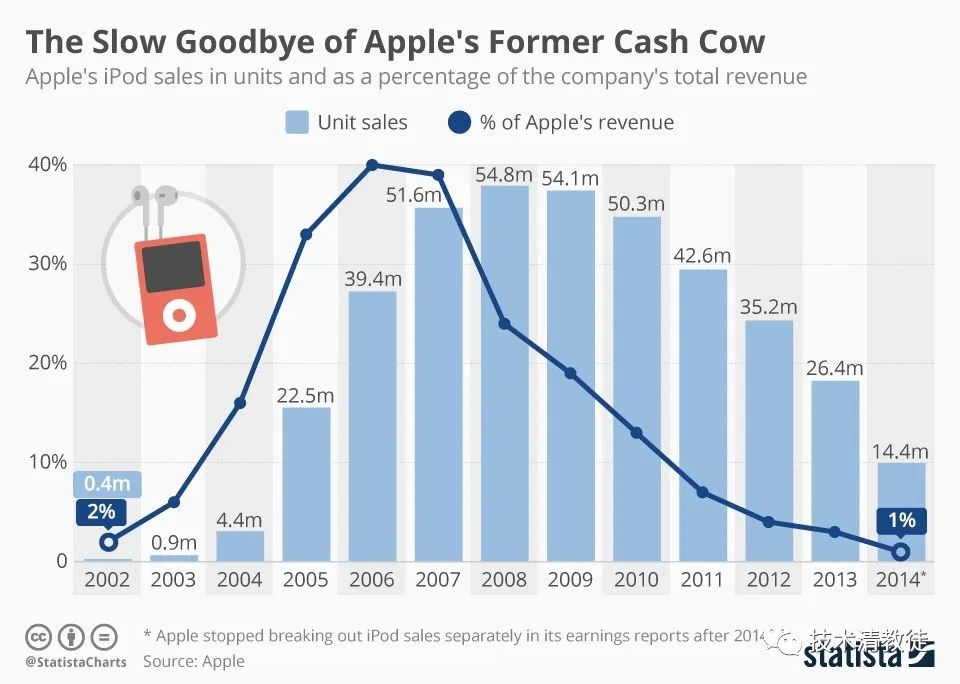

After the iPod was released in 2002, its revenue grew rapidly. By 2006, it had accounted for 40% of Apple’s total revenue. Then came the release of the iPhone.

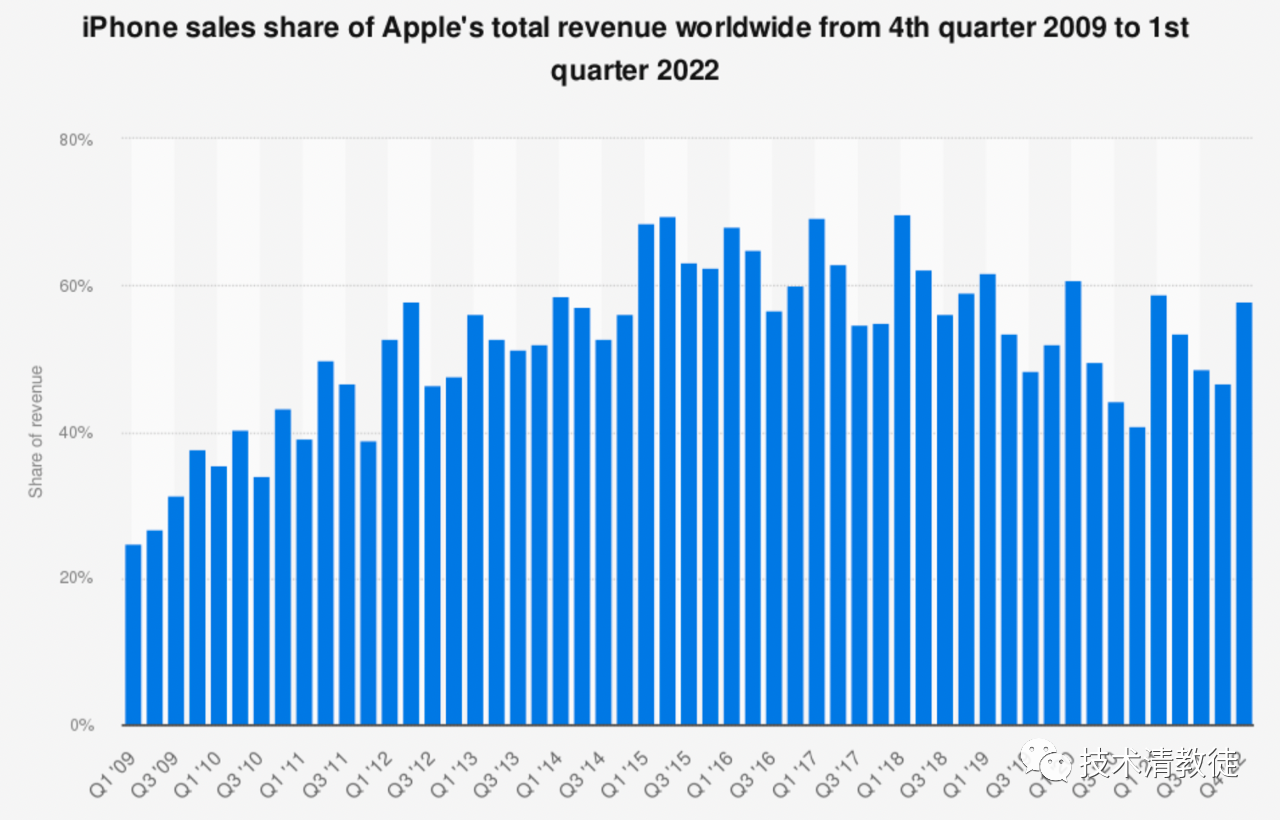

The iPhone did not disappoint Steve Jobs either, and it quickly helped increase Apple’s total revenue. Around 2015, the proportion of iPhone revenue in total revenue reached 70%.

Combining these two charts, we can see that the iPod released in 2002 and the iPhone released in 2007 were the core driving forces of Apple’s total revenue growth. These two products mainly brought Apple’s revenue from the 100 billion level to the scale of 300 billion.The increase in total revenue alone is not enough to drive ROE growth. ROE measures profitability, so in addition to revenue, we need to look at profits, which is reflected in the gross profit margin of the products.

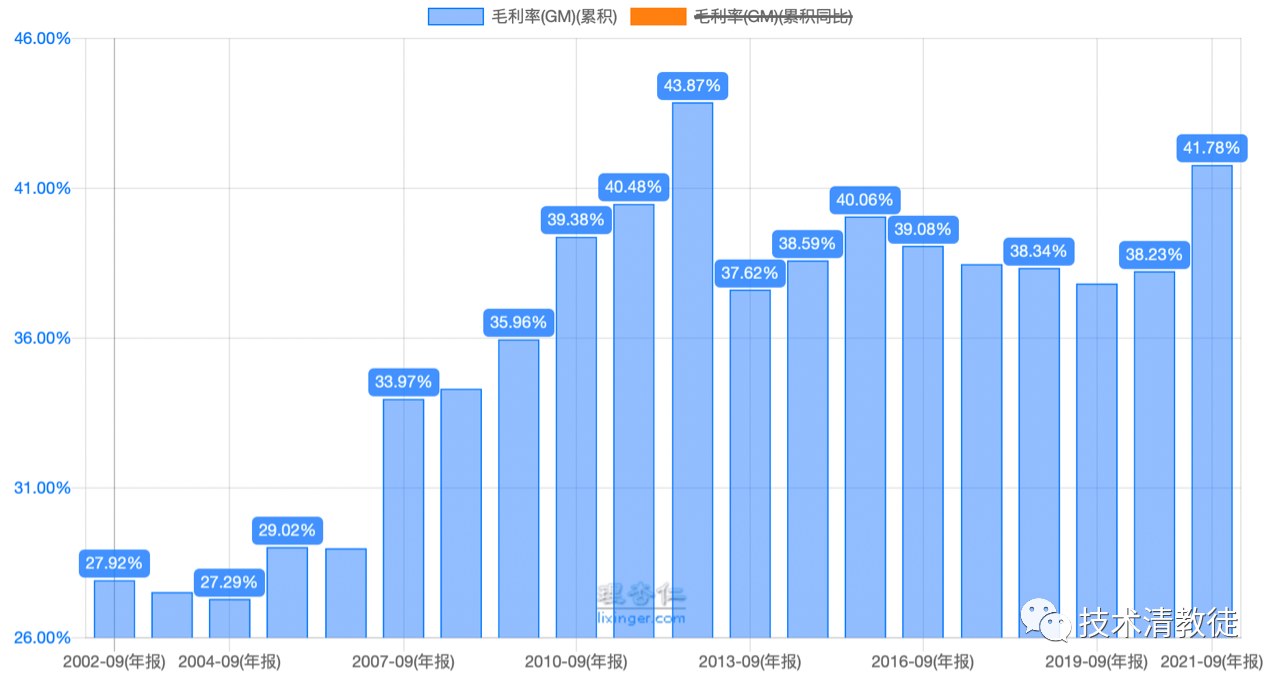

With the release of iPod and iPhone, not only did Apple experience a surge in revenue but also a catalyst for gross profit margin. iPod’s gross profit level was about 27%-29%, while iPhone was between 33%-40%.

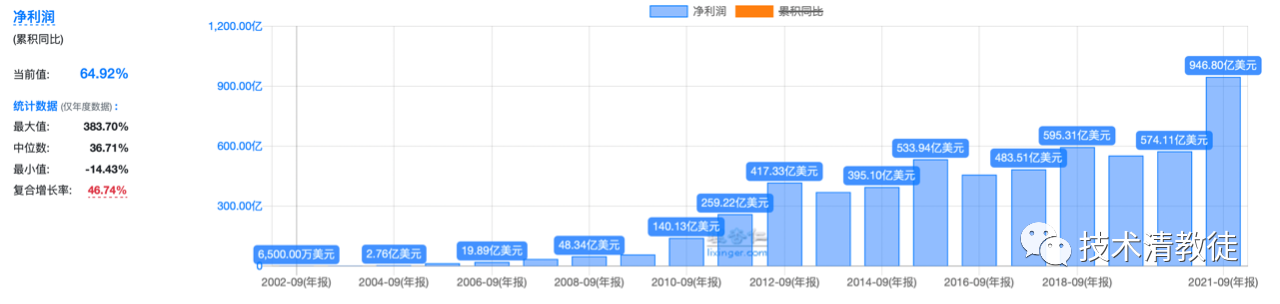

Because of the increase in revenue scale and the increase in gross profit margin, Apple’s profit growth rate is even more staggering. While revenue increased 64 times, profit during the same period increased by more than 1,300 times.

Therefore, returning to the initial question about high ROE, it is the strong market performance (revenue scale) and excellent profitability (high gross profit) of Apple’s core business that bring about such high ROE, at least for the first three stages.

So, when the revenue scale and gross profit margin both reach their limit, how is Apple’s super return-on-equity stage formed?

The answer is: debt.

Apple’s debt ratio skyrocketed from 30% in 2012 to 80% in 2021.

In general, such a high asset-debt ratio would make a company look somewhat precarious. This means that 0.8 yuan out of 1 yuan of assets is borrowed, and even slight fluctuations in asset prices can lead to insolvency, which is often associated with bankruptcy.

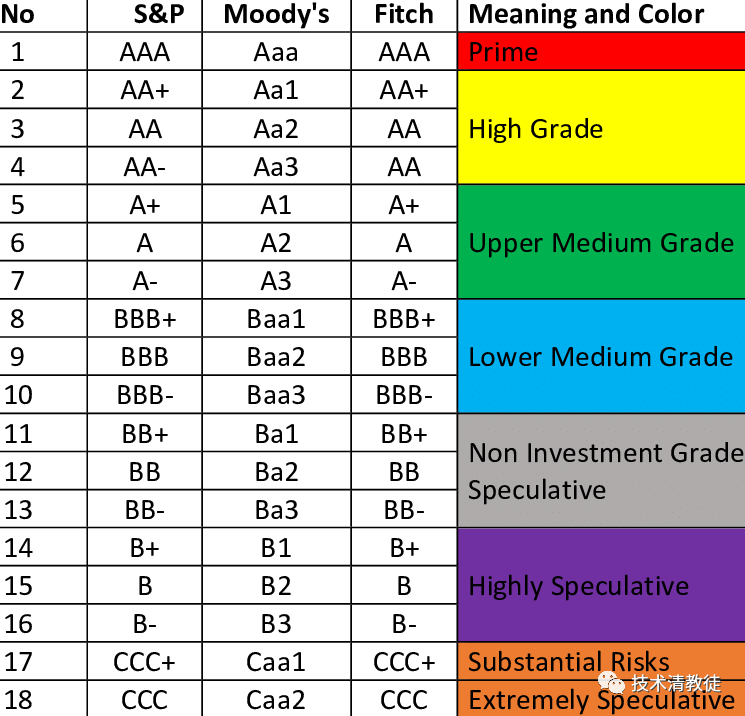

But Apple is not an ordinary company. Apple’s debt rating is the highest rating in the investment-grade AAA, which means that the borrowing cost is extremely low.

The market gives Apple the highest rating because of its strong debt-paying ability, which is actually due to Apple’s strong market performance (revenue scale) and strong profitability (high gross profit), resulting in huge cash flow.As a result, Apple was able to borrow low-interest high-leverage debt, and then feedback shareholders through dividends and buybacks, which was equivalent to reducing the capital invested by the shareholders for doing business.

To give an imperfect analogy, previously, investment capital of 0.7 yuan + borrowed funds of 0.3 yuan = earned 0.3 yuan by the end of the year; after dividends and buybacks, it is equivalent to investing capital of 0.2 yuan + borrowed funds of 0.8 yuan = earning 0.3 yuan by the end of the year. In terms of return on capital, the former is 40%, while the latter is 150%.

Returning to the essence, the core factor driving Apple’s continuous increase in ROE is still due to its strong business. Financial means only magnify the leverage of successful business. If we reverse the priorities, we will become an unsustainable source of water and a rootless tree, which may look beautiful for a while but cannot last.

In the next article, we will continue to quantitatively analyze Apple and Tesla.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.