Author: Zhu Yulong

I have recently been following news about automotive chips and I think it’s necessary to sort out several American core chip manufacturers. Let’s start with Qualcomm.

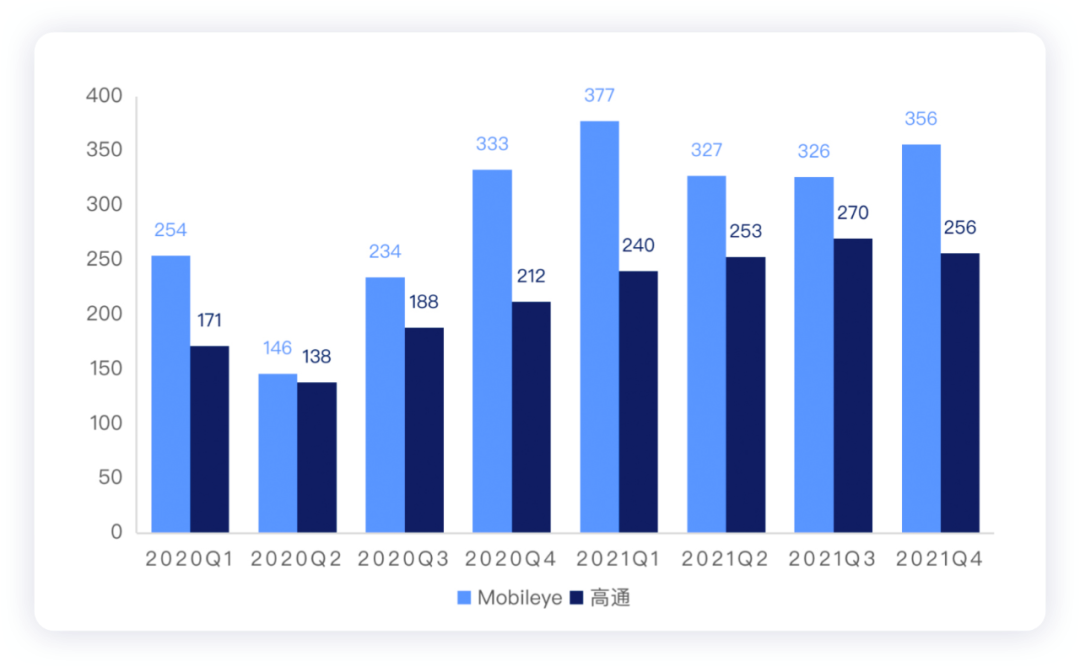

In the fiscal year 2021, Qualcomm had a revenue of 33.6 billion U.S. dollars, a year-on-year increase of 43%, with a net profit of 9 billion U.S. dollars, a year-on-year increase of 74%. The revenue from hardware was 27 billion U.S. dollars, and the revenue from patent was 6.3 billion U.S. dollars (which is really hard to learn from). In 2021, the revenue from automotive business was 1.019 billion U.S. dollars, a year-on-year increase of 43.7% compared to 2020’s 0.709 billion U.S. dollars, and the revenue from the latest quarter of the automotive business was 240 million U.S. dollars, a year-on-year increase of 40%. If compared to Mobileye, after years of hard work and Intel’s support, it’s only 100 million U.S. dollars difference per quarter now.

Qualcomm’s Orders

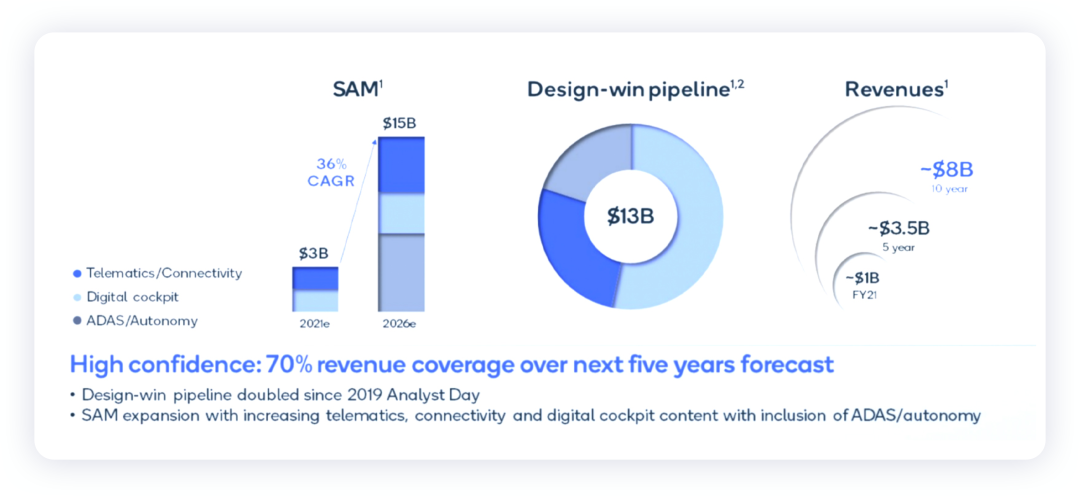

The annual revenue from the automotive business will grow to 3.5 billion U.S. dollars in the next 5 years and to 8 billion U.S. dollars in the next 10 years. With the design platform for cockpit and autonomous driving, Qualcomm has collaborated with more than 25 automakers, and the total estimated value of orders in its automotive business exceeded 13 billion U.S. dollars.

From a logical point of view, Qualcomm’s automotive business in 2021 is centered around vehicle network chips and digital cockpits, and it’s estimated that by 2025, the business volume will be centered around autonomous driving> vehicle-to-vehicle communication>cockpit. We can make some analysis on this path.

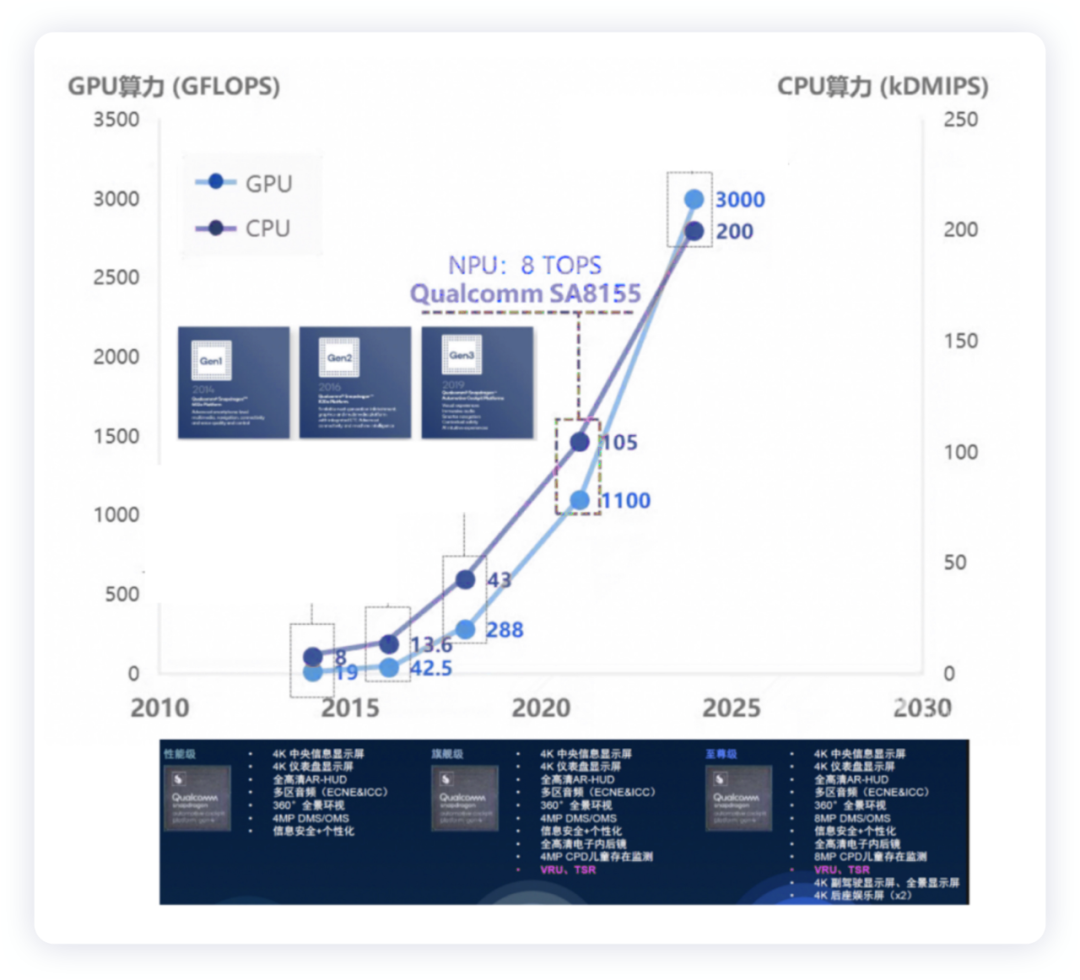

The SoC main chip for the digital cockpit integrates CPU, NPU, GPU, DPU, and various peripherals. It’s mainly responsible for data computation and processing in the entertainment system, including camera video, neural network accelerator NPU, audio processing, voice and image rendering and output of multiple displays (GPU, DPU), in-car Bluetooth, WiFi interconnection, and Ethernet data exchange with other major ECUs inside the car. For Qualcomm:

- Generation One (28nm)

Snapdragon 620A is for practice and exploration.

- Generation Two (14nm)

Snapdragon 820-820A

- Generation Three (7nm)

Snapdragon SA6155, SA8155, SA6155 entry-level cockpit, SA8155 mainstream high-end to flagship smart cockpit

- Generation Four (5nm)# Snapdragon 888-SA8295

The turning point in the cockpit domain was the Snapdragon SA8155 series, which brought in a large computing power (100k DIMPS, GPU 1100 GFLOPS) with its 7nm process, forming a significant differentiation compared to the computational capability of traditional car manufacturers (Renesas, NXP, Texas Instruments). By leveraging mobile technology migration, it exploded the intelligent cockpit market for automotive companies, with numerous luxury car manufacturers turning to Qualcomm. At this time, many domestic automotive companies also started to import this SOC chip.

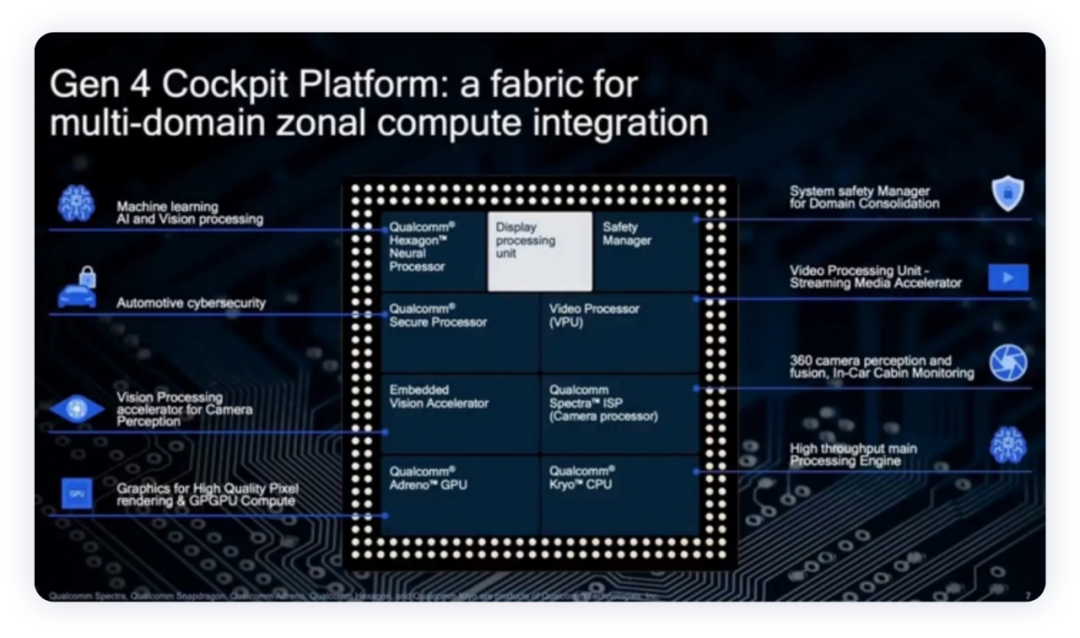

Currently, Qualcomm’s iteration pace is fast. By the fourth generation, it adopts a cross-domain fusion design. According to the concentrated promotional materials of an unnamed OEM, the SA8295CPU created with a 5nm process technology has a computing power exceeding 200KDMIPS, GPU computing power exceeding 3000GFLOPS, supports WiFi6 and Bluetooth 5.2, and has an AI computing power of 30 Tops for NPU. It also includes information security, visual processing accelerator, ISP visual perception processing and fusion (aimed at monitoring inside the cockpit).

At this point, we can clearly see that Qualcomm’s strategy differs from TI and MTK, as well as from Renesas and NXP. It has become a competitor in cross-domain fusion with NVIDIA (which still focuses on the big market of self-driving cars).

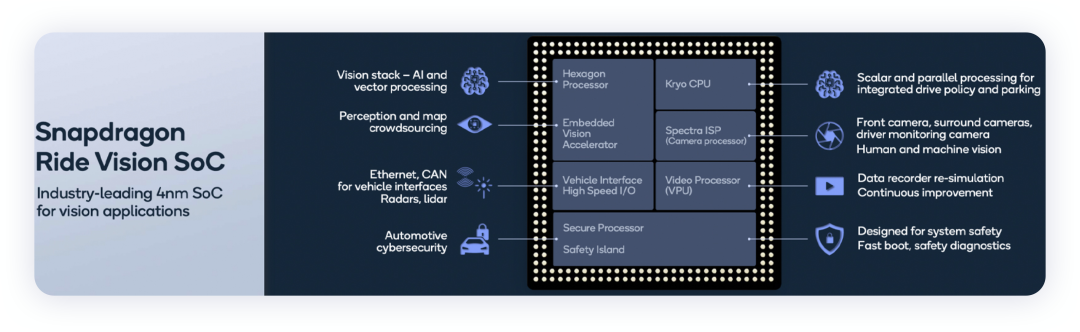

Autonomous Driving Ride Vision SoC

In the field of intelligent driving, Qualcomm has developed the Snapdragon Ride Vision System, which supports multiple cameras (high-resolution 8MP cameras). The SoC processor uses a 4nm process and includes a visual AI processor, a regular data CPU, a visual accelerator for map crowdsourcing, ISP, interfaces and processors related to vehicle safety, and more.

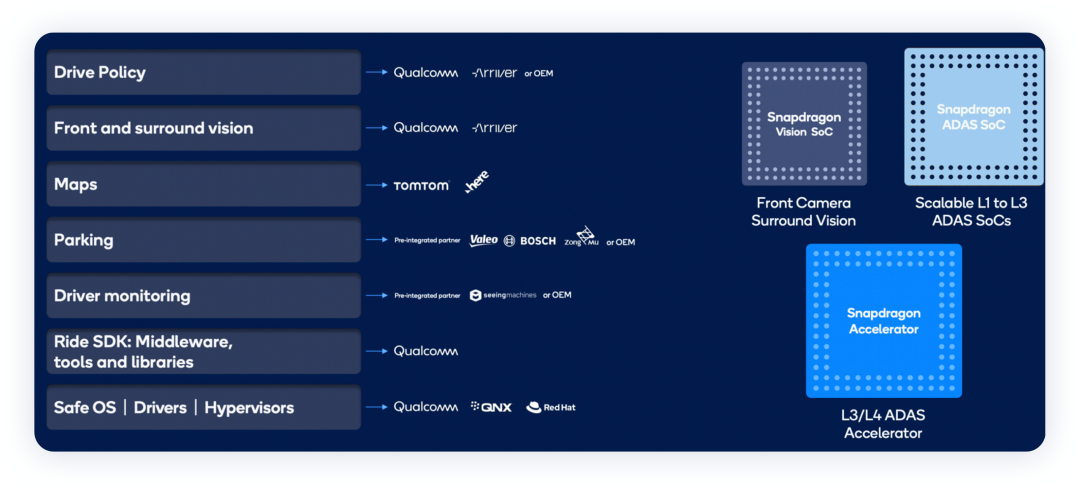

The intelligent driving platform consists of three core processors. The vision SoC is used to process information from cameras, while the ADAS SoC series supports L1-L3 automatic assisted driving, and an additional accelerator chip is required for L3/L4 autonomous driving. The ecosystem support includes:

-

Operating systems and virtual machines can be chosen from Qualcomm, QNX, and Redhat middleware supported by Qualcomm internally.

-

Driver monitoring can be prefabricated, self-developed by automotive manufacturers or Seeingmachines.

-

Parking can be supported by Valeo, Bosch, Zongmu or self-developed by automotive manufacturers.

-

Map data can be processed with Tomtom and Here’s visual fusion techniques.

-

Driving decisions can be made using Arriver or self-developed by the host manufacturer.

In summary, according to Qualcomm’s plan, an intelligent networked vehicle requires one communication chip (V2X, 5G and Wi-Fi), one cockpit chip, and two intelligent driving chips (Vision and ADAS SoC). Moreover, their more expensive and aggressive approach to higher process technology compared to Mobileye will result in more output. From a macro perspective, traditional automotive chip companies cannot compete with this behemoth on aggressive spending.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.