Writing about this topic, mainly for the analysis of NEO’s new electronic and electrical architecture. The engineers at NEO have talked about this topic relatively less, so we can only obtain information from the aftersales manual and teardown analysis.

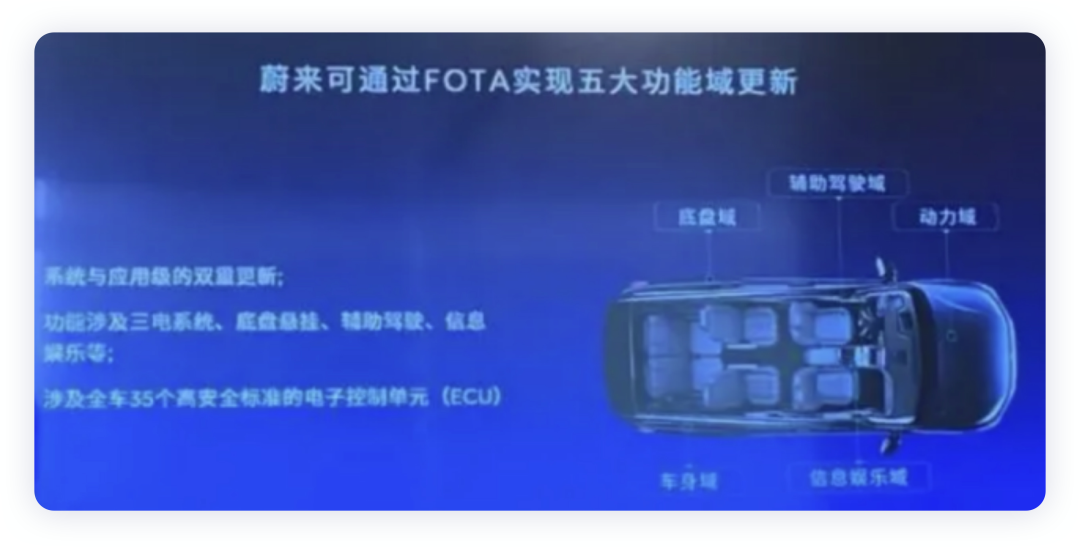

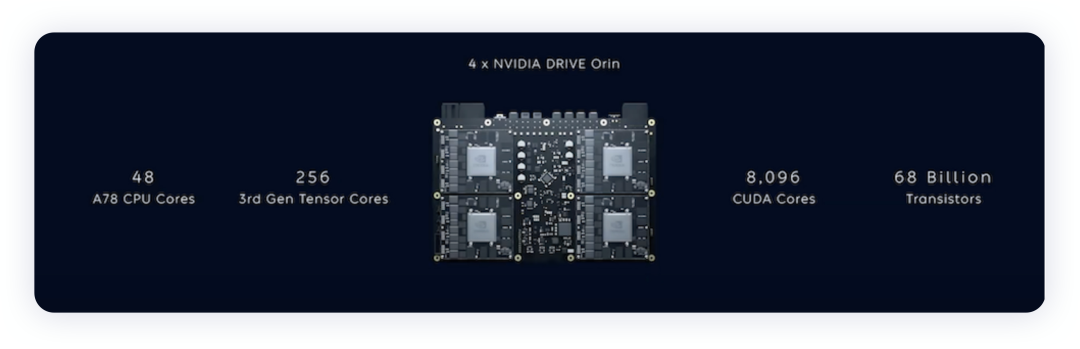

As NEO is not known for its engineering technology, what we see in the vehicle’s electronic and electrical architecture is gradually being developed. By 2020, the intelligent gateway, intelligent cockpit, and intelligent driving system have begun to be deployed from the hardware level to the software application layer, with a 1 Gbps Ethernet network and high-performance electronic control unit forming the overall structure. By 2022, the NVIDIA ORIN chip will be used for the mass-produced autonomous driving domain controller (ADC) and the Qualcomm 8155 chip for the central display controller unit.

Evolution of NEO’s architecture

Breaking it down:

NEO’s first-generation electronic and electrical architecture (ES8): Distributed architecture was adopted, with innovation in the intelligent central gateway (CGW), digital cockpit controller, and autonomous driving. Ethernet was only used in a limited area.

NEO’s improved version 1.5 (subsequently upgraded ES6, EC6, and the updated ES8): Introduction of automatic assistance driving controller and parking architecture, enhancing the cockpit while increasing the investment in self-developed software. The main focus was on intelligent interconnection, intelligent cockpit, automatic assistance driving, while the electrical drive control and part of the body control were relatively slower.

NEO’s new NP2 (ET7 and ET5): Due to the advancements in the software for intelligent driving and cockpit, the independence between software and hardware was introduced in this area. The iteration of the gateway and the body were brought together.

Next generation: This part has been discussed, and there is a lot of information. It is currently in the configuration stage.

So, in my opinion, NEO’s iteration is gradually evolving, with autonomous driving being replaced from Mobileye to NVIDIA’s Orin and the cockpit being replaced with a more advanced processor. Then, some adjustments are made on CGW, and the design is optimized.

- Short-term evolution## Mid-term Evolution

By enhancing the image processing power through software on the basis of hardware that remains unchanged, NIO pushes out new versions to meet customer needs with ES8, ES6, and EC6 models. The primary aim of switching from the ES series to the ET series is to optimize video communication and sharing between intelligent cockpits and autonomous driving domains, while enhancing image perception capabilities and overall three-intelligence module processing power, thereby improving the overall experience of the NIO Pilot. Additionally, efforts are made to improve the bandwidth and use case scenarios of Ethernet.

Long-term Evolution

At the development level, efforts are underway to realize cross-domain integration optimization, enhance computational power, and storage, and introduce a zone-oriented I/O control distribution architecture as much as possible. Electrical designs are being adopted to ensure redundant control. With regards to software, efforts are made to coordinate with the SOA architecture to achieve software and hardware separation as well as separation of operation and I/O.

Actually, NIO’s strategy in this field is not radical, but rather gradual.

Chasing by Traditional Automakers

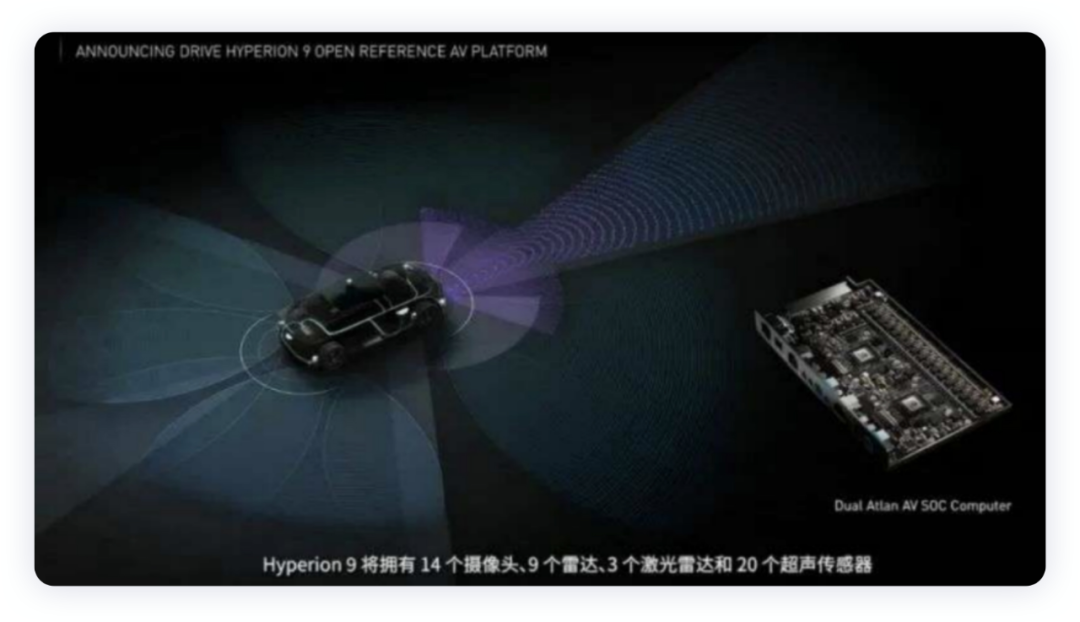

Yesterday, NVIDIA announced its latest autonomous driving technology platform, “Drive Hyperion 9”. They also announced that electric vehicle manufacturers including Lucid Motors and BYD will adopt Hyperion’s platform architecture, and the new Drive Hyperion 9 platform will be launched in 2026. Currently, NVIDIA’s automotive customers can be classified into three categories:

- New EV Entrants: NIO (ET5, ET7), XPeng (P5, P7, G9), Li Auto (X01), WM Motor (M7), FF, Lucid Group, etc.

- Traditional Automakers: SAIC C-ITS, Feiteng Autos, BYD, Mercedes-Benz, Jaguar, Volvo, Hyundai, Audi, Lotus, etc.

- Self-Driving Companies: General Cruise, Amazon Zoox, Didi, Volvo, Kodiak, Tusimple, IMa Technology, AutoX, Pony.ai, Wenyuan Zhixing, Yuanrong Qixing, etc.

In other words, we can see a pattern of distributed evolution, which shows that new entrants and traditional enterprises are not different, just more agile for new entrants.

Their architecture includes a series of sensors, including 14 external cameras, 9 radars, 3 lidar sensors, and 20 ultrasonic sensors in the car. Internally, there are 3 cameras and 1 radar sensor.“`markdown

Summary: I think the rise in battery prices has both intensified competition and slowed down the pace of leaders, as it is difficult to make everyone accept more expensive cars. In the era of constantly changing architecture, traditional companies are also learning and improving. Without significant engineering differences, it is easy to enter a red ocean competition if there are no substitutes.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.