Deng Simiao, posted from the copilot temple

Smart Car Reference | Official Account AI4Auto

Thinking of switching to an electric vehicle because of the skyrocketing oil prices? You better hurry, because electric vehicles are also collectively increasing their prices.

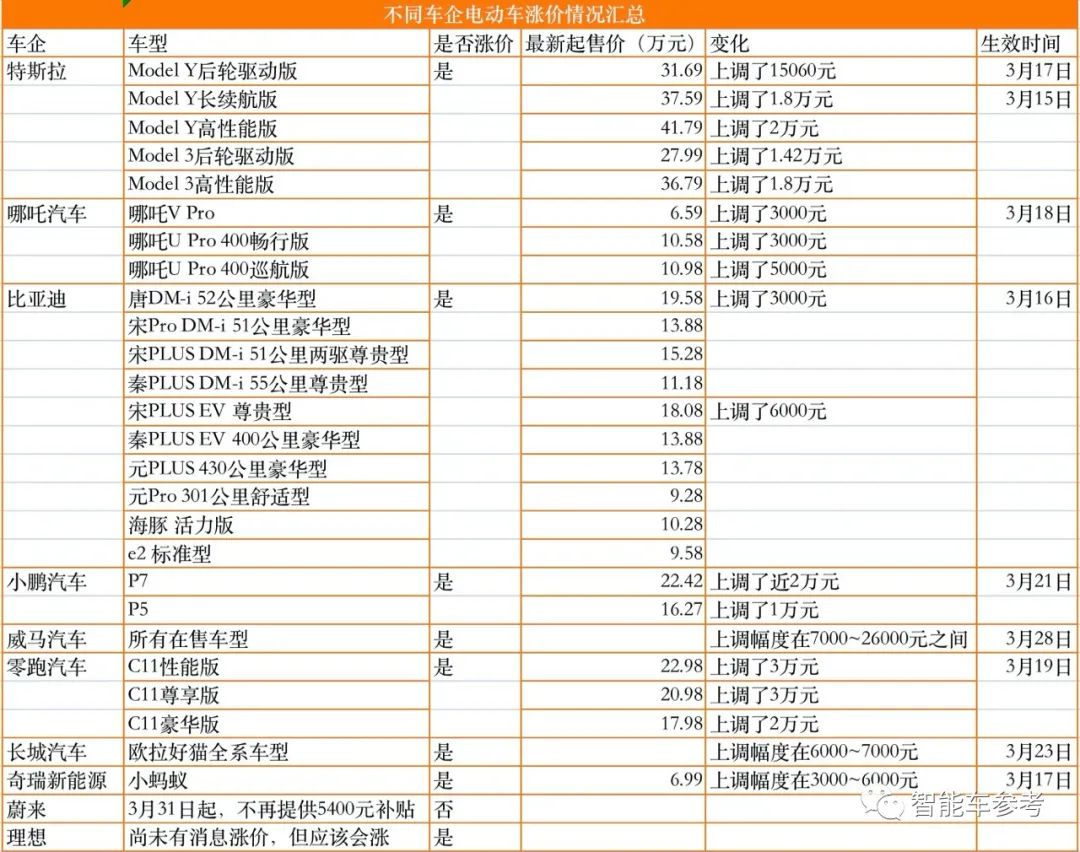

During this time, nearly 20 new energy vehicle companies are raising prices for more than 40 electric vehicle models, mainly due to the increase in raw material prices and the reduction in new energy subsidies.

Tesla, BYD, XPeng, WmAuto, and Leapmotor have all announced price increases.

Which car companies are raising prices?

From March 15th until now, based on the price increase situation of major automobile companies, it can be summarized in the following three points:

First, in terms of the degree of the price increase, Leapmotor Automobiles has the greatest increase, the maximum amount of increase is as high as 30,000 yuan, while some models under BYD, NIO, and Chery New Energy have a smaller increase of 3,000 yuan. Tesla representative models have all increased by more than 10,000 yuan.

Second, in terms of car companies, Tesla raised prices first, followed by BYD, Chery New Energy, NIO Automobile, Leapmotor Automobile C11 Series, XPENG Automobile, Great Wall Ola Cat, and WmAuto Automobile, all raising prices.

Third, it is worth noting two new forces in the car industry: LI and NIO.

LI Motors has not yet raised prices, but its CEO Li Xiang said on Weibo, “For those who have not raised prices, most of them have not negotiated the increase amount, and will generally raise prices immediately after negotiation.”

The official statement of NIO is that they will not raise prices in the short term, but will make flexible decisions according to changes in the objective environment.

So, what is the reason for this collective price increase?

The two major factors make it easy to raise but difficult to lower the prices

Currently, the main reasons for the price increase of electric vehicles for major car companies are as follows:

First, the skyrocketing price of raw materials represented by power batteries and chips.

As we all know, lithium, cobalt, and nickel are the main raw materials for power batteries. The latest data shows that on March 17th, the comprehensive quotation for battery-grade lithium carbonate in the market was 48-52.2 million yuan/ton, while at the beginning of last year, this number was only 50,000 yuan/ton, which means that in about a year, the price of lithium carbonate has increased by nearly ten times.

The cobalt price has nearly doubled, rising from less than 300,000 yuan per tonne in early last year to 568,000 yuan per tonne. Nickel prices have also surged, partly due to Russia’s position as the world’s third-largest producer of nickel, which has seen its output decline due to the Russia-Ukraine conflict.

The cobalt price has nearly doubled, rising from less than 300,000 yuan per tonne in early last year to 568,000 yuan per tonne. Nickel prices have also surged, partly due to Russia’s position as the world’s third-largest producer of nickel, which has seen its output decline due to the Russia-Ukraine conflict.

Taking CATL as an example, power batteries have increased in price twice since the second half of last year.

In terms of chips, as one of Tesla’s chip suppliers, STMicroelectronics said in November last year that it will take until 2024 or 2025 to see a significant increase in production capacity; other semiconductor suppliers, such as NXP Semiconductors and Infineon, have also said that the chip market is still tight.

Looking specifically at the materials that are essential for semiconductor lithography, rare gases such as neon and krypton are required, and Ukraine is a major supplier of neon gas. The international situation has led to a decline in neon gas production.

Secondly, new energy vehicles are currently in a phase of subsidy decline, with subsidy standards having decreased by 30% compared to 2021. In early this year, five Chinese government ministries jointly issued a notice that this year will be the last year of new energy subsidies, with all new energy subsidies cancelled from next year.

During the two sessions this year, many vehicle company executives suggested extending subsidies for new energy vehicles in the hope that the government can help them through this difficult time.

From the current point of view, price increases for new energy vehicle companies are the trend, and they will not end in the short term.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.