Author: Wang Yunpeng

On the evening of March 18, Beijing Automotive announced that its subsidiary, BAIC Investment, and Hyundai Motor have entered into a revised agreement. According to the agreement, BAIC Investment and Hyundai Motor agreed to jointly increase the registered capital of Beijing Hyundai by approximately $942 million (approximately RMB 6 billion) in proportion to their respective shares in the registered capital of Beijing Hyundai. they will each invest approximately $471 million.

From the announcement, the capital increase will be divided into two phases. Before June 30, 2022, shareholders of both parties will pay 50% of the capital increase amount, and pay the remaining capital increase amount before December 31, 2022. After the capital increase is completed, the registered capital of Beijing Hyundai will increase to approximately $2.979 billion (approximately RMB 18.949 billion), and the shareholding ratio of BAIC Investment and Hyundai Motor will remain unchanged, both accounting for 50%.

In response, Beijing Hyundai stated that the capital increase of both parties can not only enable Beijing Hyundai to more effectively cope with the further investment needs of the electrification of China’s automobile industry, but also continuously strengthen the security of Beijing Hyundai’s financial operation. At the same time, through this capital increase, Beijing Hyundai can also comprehensively improve the level of operating funds and further increase strategic resource investment with the shareholders, thereby improving its own corporate operating conditions and continuously enhancing its position in China’s automobile market.

In addition, in Beijing Hyundai’s view, this capital increase will also provide strong financial support for new product introductions, expanded layout in the new energy vehicle field, and increased exports.

It is worth mentioning that this year is the year of comprehensive opening of the equity ratio of Sino-foreign joint ventures in the automobile industry. As Kia’s equity ratio in its Chinese joint venture has been adjusted before this, there has been speculation to some extent about whether there will be any changes in Beijing Hyundai’s equity.

However, with the signing of the latest agreement between BAIC and Hyundai Motor, the matter of changes in the equity ratio of Beijing Hyundai’s joint venture is now considered to be officially settled.

Building momentum for a new round of attacks

In fact, in normal business activities, shareholder increases in joint venture companies are not uncommon. However, there are not many cases that are widely followed like Beijing Hyundai’s.

So why did Beijing Hyundai’s capital increase become the focus of industry attention? The answer is simple: because in the industry’s view, this money is one of the key factors for Beijing Hyundai to successfully launch a new round of attacks.According to public data, Beijing Hyundai’s cumulative sales from 2017 to 2020 were 816,000, 746,000, 703,000, and 502,000 respectively, with year-on-year decreases of 27.8%, 8.6%, 5.7%, and 28.7%. In 2021, Beijing Hyundai’s wholesale sales volume fell again by 23.3% year-on-year to 385,000, only one-third of the annual sales volume of 1.14 million vehicles in 2016.

From the sales data, 2021 is not only the “fifth consecutive decline” in Beijing Hyundai’s annual sales volume, but also has slipped out of the top 15 in the annual domestic automobile company sales ranking.

At the same time as the sales decline, other problems of Beijing Hyundai have also emerged. The first is idle production capacity. Public information shows that before the sale of Plant 1, Beijing Hyundai had a layout of five major plants, namely the first, second, and third plants in Beijing, Cangzhou plant, and Chongqing plant. Among them, the Chongqing plant, which was the latest to be laid out, has a planned annual production capacity of 300,000 vehicles and 300,000 engines. After completion, the total production capacity of the five major plants can reach 1.65 million vehicles.

However, due to underutilization of production capacity, Plant 1, which had an annual output of 300,000 vehicles in 2021, has been officially sold to Ideal Auto. What’s more embarrassing is that even with Plant 1 sold, the production capacity utilization rate is still less than 30% based on Beijing Hyundai’s annual sales volume of 385,000 vehicles in 2021.

It is worth mentioning that due to the low utilization rate of production capacity in 2021, there has been news since entering this year that Beijing Hyundai’s plant in Chongqing may have been in a state of suspension.

Although this news has not been confirmed by Beijing Hyundai, judging from the sales of models such as the Reina, Verna, ix25, and Encino, there may indeed be few orders available for production at the Chongqing plant.

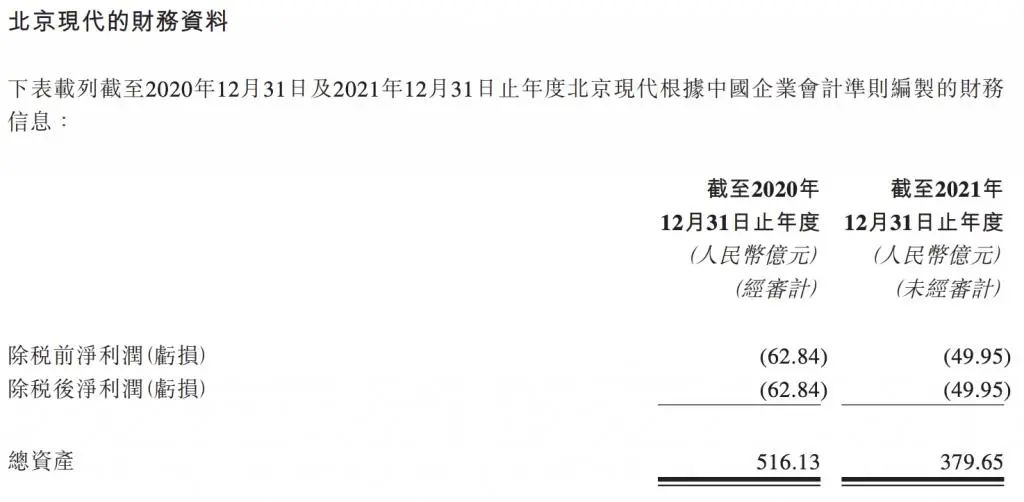

Public information shows that Beijing Hyundai’s Chongqing plant mainly produces Reina, Verna, ix25, and Encino models. Among them, the Reina has not been updated for a long time and is currently off the market. The Verna only achieved sales of 99,000 in its first year on the market and its sales began to decline in 2020. As of December last year, the monthly sales volume of the Verna and Encino were both only in the tens of units.The continued low sales not only led to a significant drop in production capacity utilization, but also made Beijing Hyundai’s business performance quite embarrassing. As announced, Beijing Hyundai’s net loss in 2020 was RMB 6.284 billion and RMB 4.995 billion in 2021, with a net asset of RMB 37.965 billion currently.

From the current situation, although Beijing Hyundai still has a certain scale, it cannot be denied that it is indeed in a crisis in the Chinese market.

Therefore, it is urgent for Beijing Hyundai to make changes in product, technology, channels, sales, and other aspects to improve its operation. And to solve the aforementioned problems, funding is also a key factor.

In other words, it is reasonable to regard the RMB 6 billion additional capital injection by both shareholders as a “preliminary investment” for Beijing Hyundai’s new round of offensive.

Can it return to the mainstream track?

With the decreasing prices of mainstream joint venture brands, the gradual rise of Chinese independent brands, and the upgrade of China’s automotive industry, it can be said that the current Beijing Hyundai has reached the edge of the industry.

However, this reality is one that Hyundai Motor Group does not want and cannot accept.

According to statistics, Hyundai Motor Group’s global sales began to decline in 2015, and it has failed to achieve annual sales targets for seven consecutive years until 2021. After all, the importance of the Chinese market is self-evident if Hyundai Motor Group wants to bring its sales back to the original level. After all, around 2016, when Korean joint venture automakers were at their peak, Beijing Hyundai and Dongfeng Yueda Kia contributed about a quarter of Hyundai Motor Group’s global sales, and Beijing Hyundai even achieved the impressive “Hyundai Speed” that attracted the industry’s attention.

In addition, facing China’s global largest and most active new energy vehicle market that is accelerating its transformation to electrification, Hyundai Motor, which is also accelerating its electrification transformation, certainly cannot let go.

So, how can Beijing Hyundai, which has lost its voice in the fuel vehicle sub-market, reverse its current decline? To this question, Beijing Hyundai’s answer is: seize the opportunities of the intelligent electrification era.

On March 2, Hyundai Motor released a brand-new electrification strategic plan, planning to launch 17 pure electric vehicle models by 2030, including 11 under Hyundai Motor and 6 under Genesis. To achieve this, Hyundai Motor will invest KRW 95.5 trillion (about RMB 496.74 billion) by 2030.# Plan of Beijing Hyundai for Its Electric Vehicle Market

In addition to the IONIQ 6 and IONIQ 7 models that will be launched in the global market, Beijing Hyundai will also launch a new electric vehicle with an internal code name “OE” in 2023 and another pure electric model with an internal code name “CJ” at the end of 2023 or the beginning of 2024.

It is worth noting that although the focus of Beijing Hyundai’s electrification will begin in 2023, there have been layouts before. As early as 2016, Beijing Hyundai released the new energy strategy “NEW Plan” and launched multiple new energy models afterward.

In April 2021, at the “Leap Further and More China” new strategy conference, Hyundai Kia Automotive Group expressed that it will conduct local research and development, electrification, hydrogen fuel cell technology layout, and transformation and upgrading of joint venture brands in the Chinese market.

It is obvious that Hyundai has regarded the Chinese market as one of the main carriers for its electrification transformation landing. However, it is difficult to answer whether the emphasis on the Chinese market and the efforts in the field of new energy can help Beijing Hyundai return to the mainstream.

Some industry insiders believe that based on Hyundai’s global electrification strategy, Beijing Hyundai may leverage it later, but the prerequisite is to stop the downward trend in the next two years. From the perspective of market sales, Beijing Hyundai only sold 15,000 units at the terminal in February this year, which seems to be not ideal.

Regarding this issue, Du Junbao, the executive vice president of Beijing Hyundai, also stated in an interview with the media, “The primary task of Beijing Hyundai in 2022 is still to achieve model profitability, to truly change Beijing Hyundai’s operating conditions, and to make every product profitable and cover cash flow expenditure, which is the core.”

As Shakespeare’s famous saying goes, “It is not in the stars to hold our destiny, but in ourselves.” The future is unpredictable, but through continuous technological investment and exploration, it is not impossible for Beijing Hyundai to return to the mainstream of the market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.