Rising Production and Price of Power Batteries in Electric Vehicles

By Zhu Yulong

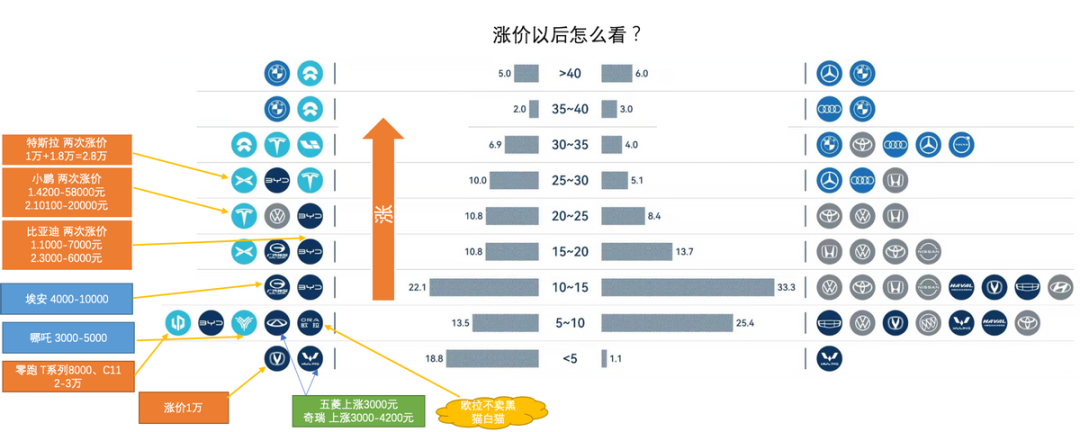

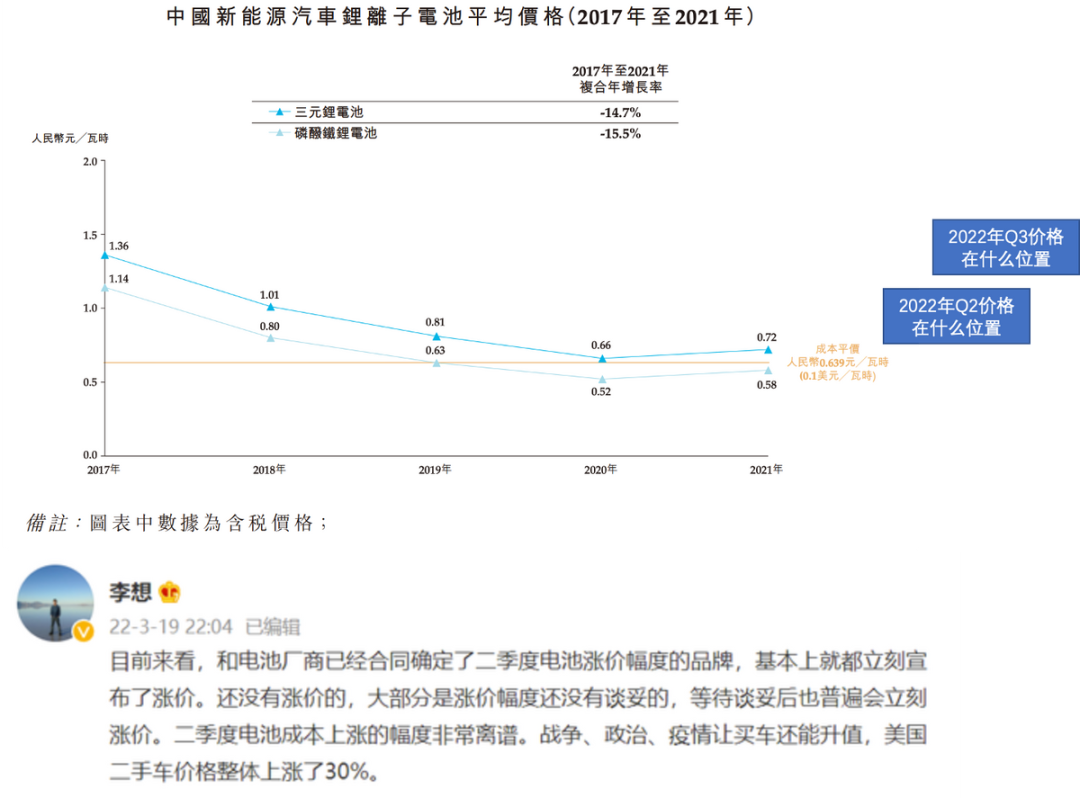

Recently, the production of power batteries for electric vehicles has soared, leading to a corresponding increase in terminal prices. The core logic is clear: as long as demand does not decrease, power battery prices will not decrease either. This is reflected in the further rise in terminal prices, which car companies cannot digest and thus have to transfer to consumers. However, as the prices of traditional gasoline vehicles remain relatively stable or even decrease, it is uncertain whether demand for electric vehicles will keep up.

Pressure Brought on by Increased Production

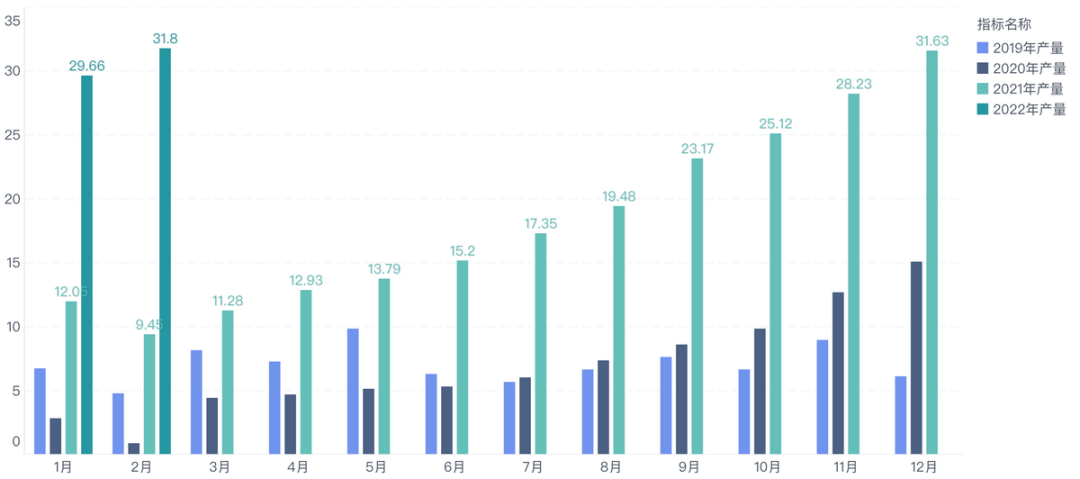

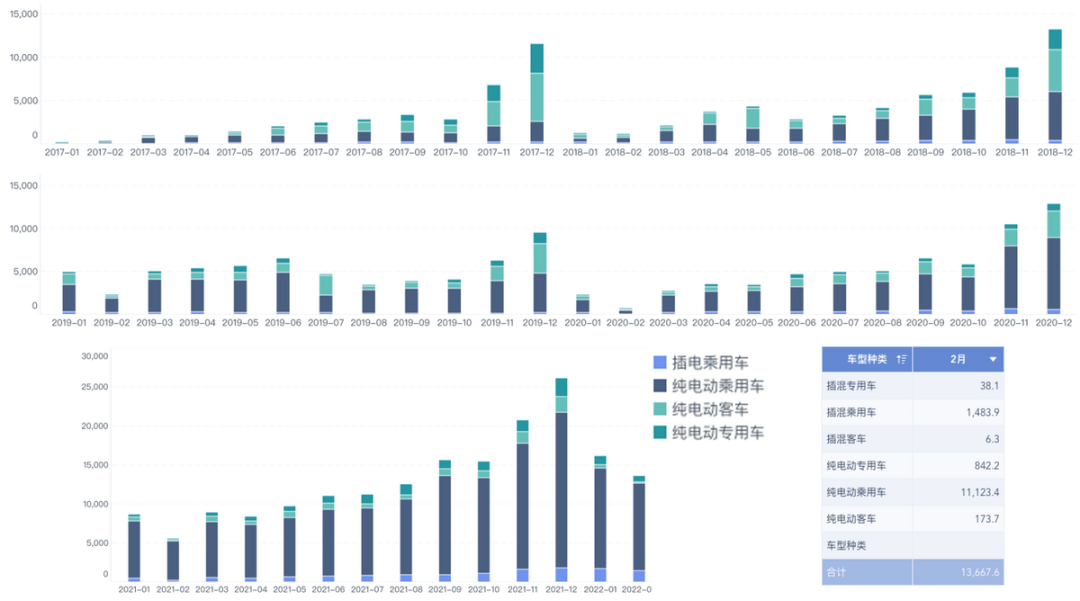

As of the beginning of 2022, the production of power batteries has reached 61.46 GWh, accounting for 73.6% of the total production in 2020 (83.42 GWh) and 23.9% of the total production in 2021 (219.68 GWh). In February, the production of power batteries reached 31.8 GWh, a year-on-year increase of 236.2% and a month-on-month increase of 7.1%, surpassing the production of December of the previous year (31.63 GWh) despite the Chinese New Year holiday. Based on this growth rate (assuming consumers don’t back down), the production of power batteries is expected to reach between 400-450 GWh this year. Such high production indicates that the demand estimated by battery manufacturers is very high, so they rush to produce batteries at the beginning of the year. Even with high raw material prices, there is still significant profit to be gained from anticipating inventory. Even if production decreases later, the batteries produced earlier can still be absorbed.

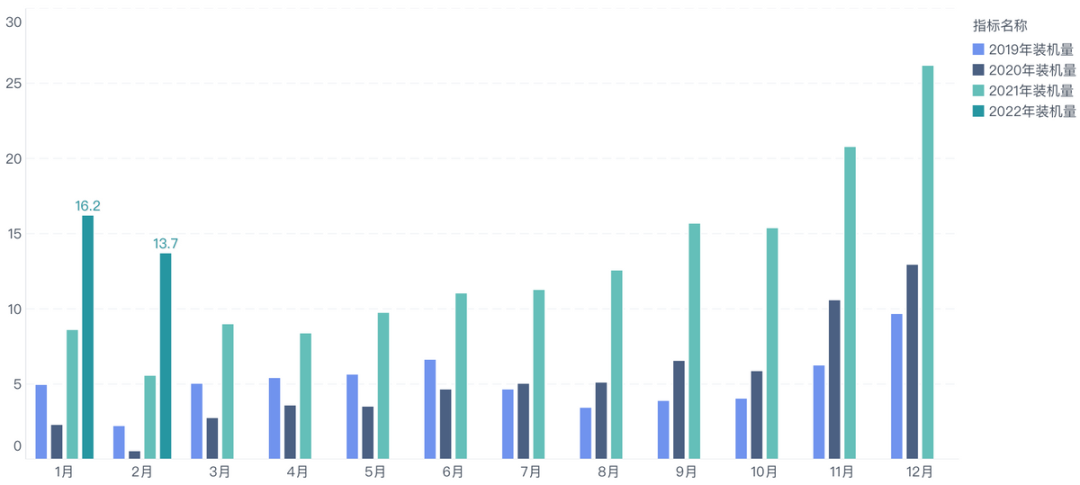

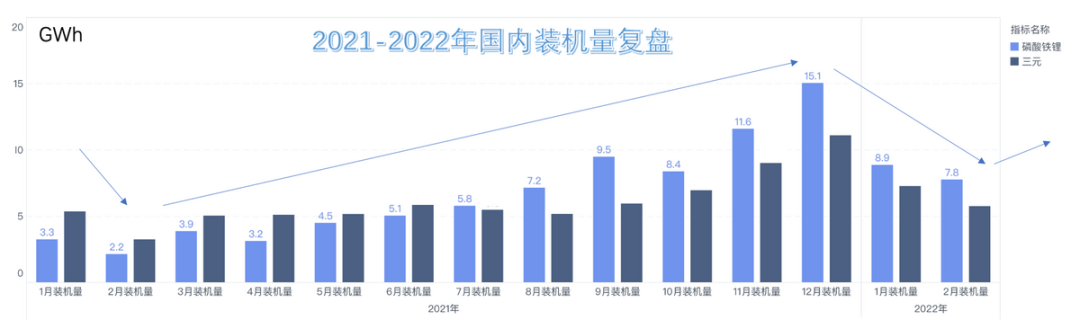

In February, the amount of power batteries loaded into electric vehicles was 13.7 GWh, a year-on-year increase of 145.1% and a month-on-month decrease of 15.5%. Unlike the trend in power battery production, the batteries that each car company actually loaded into vehicles did increase year-on-year, but due to the impact of the Chinese New Year holiday, this data is about half of the peak in December (26.22 GWh). The problem is that as the cost of batteries increases, it raises the price of cars, and it is unclear whether this can be passed on to consumers.

In other words, we expect installation volume to continue declining this year, either due to decreasing demand, which would rebalance supply and demand, or due to Chinese consumers reluctantly paying more for electric vehicles.

Under the current battery price system, the demand for commercial vehicles, except for some rigid logistics sectors, has been withering, which means that passenger cars need to absorb this part of the demand.

How will battery prices be discussed this year?

With the increase in cost, the previous annual locking price model has been broken here:

- Strong battery companies: Due to a large amount of demand, customers who can pass on (the final price will be achieved because the terminal can accept it) and those who cannot accept the price increase form a very interesting “low-price” battery shortage. Those who can buy batteries at outrageous prices have no problem continuing to sell them, otherwise, they won’t be able to get batteries.

- Tied relationship companies: For example, companies like BYD and Fudi, whose primary focus is selling cars, also need to consider whether the batteries can withstand the price increase, and they must increase prices accordingly.

- Weak battery companies: No matter how much they want to deliver, if customers really don’t increase prices, they will pay less or even nothing, but they still have to increase prices a bit.

Therefore, faced with the increase in costs, new energy vehicle prices must rise, letting the market absorb them. This wave is not just about batteries; the cost of many components is also increasing.

Conclusion: I don’t think the issue this year is whether to raise prices or not, but rather who can survive after the price increase – the price increase will cause orders and sales to fall, but if the battery cannot be obtained and there is no supply, they will be phased out.

Currently, it seems that the capital reserves of automakers are a major challenge. Indeed, the development window of emerging pure electric vehicle companies is closing soon.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.