Over the past few years, independent auto brands have made initial progress in overtaking their competitors on the pure electric track.

According to the data from the “2021 New Energy Passenger Vehicle White Paper,” independent brands accounted for more than 70% of the new energy market in 2021, with a new energy penetration rate of 27.3%, compared to only 2.6% for joint venture brands. Nine of the top 10 new energy brands are independent brands, with Tesla being the only overseas brand.

However, plug-in hybrid PHEVs have maintained only about 20% of the composition of new energy vehicles, while in the field of energy-saving HEV hybrids, the Japanese “Two Tonys” have been occupying over 90% of the market share for a long time. In the process of overtaking, independent brands seem to have been “walking on one leg.”

But in 2022, independent brands’ hybrid models will be launched en masse, and their technological content is no less than that of “Two Tonys”. The trend of merging hybrid and pure electric “two legs” overtaking is forming.

Turbulent Hybrid Market, Collective Reversal of Independent Brands

Hybrid cars are much more complex than pure electric vehicles in terms of structural design and control difficulty. The industry is full of various “jargon,” such as series, parallel, hybrid, power distribution, P0, P1, P2, P2.5, P4 motors and other concepts. Combinations of these terms come across as incomprehensible.

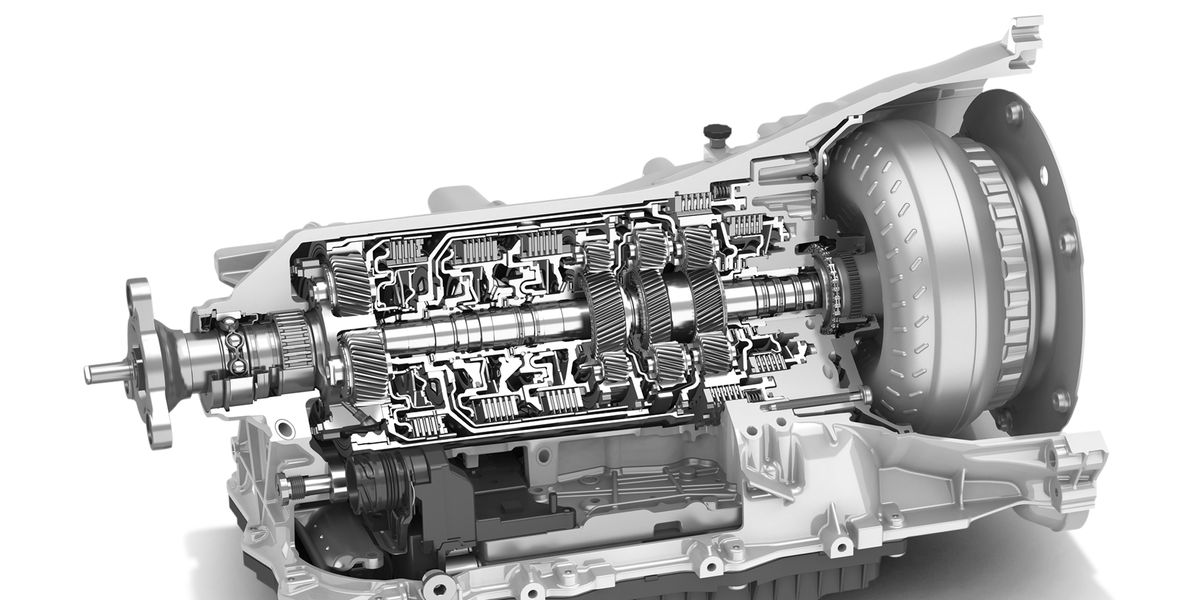

To facilitate understanding, here, we temporarily put aside those mixed fuel cars that are purely aimed at performance, such as Ferrari SF90 and BYD Tang DM. I provide you with a simple and effective standard for judging whether an automaker’s hybrid technology is advanced or not: whether it has a “traditional” gearbox. It should be noted that some automakers annotate E-CVT under their own car model configuration tables under the gearbox, which has nothing to do with traditional CVT gearboxes.

The absence of a traditional gearbox means that automakers are not merely “patching” traditional power, but are redesigning to maximize the advantages of the “electric” aspect of hybrids and ensure that the engine works in the most efficient range for most of the time.

From this perspective, P2 hybrid represented by German brands is not considered an advanced hybrid system. Currently, only Changan iDD hybrid is still following this structure among domestic brands. The other domestic brands have launched more energy-efficient hybrids, of course, without the traditional sense of transmission. We can classify them into three categories:

From this perspective, P2 hybrid represented by German brands is not considered an advanced hybrid system. Currently, only Changan iDD hybrid is still following this structure among domestic brands. The other domestic brands have launched more energy-efficient hybrids, of course, without the traditional sense of transmission. We can classify them into three categories:

-

Range extending: Ideanomics, Voyah, Nissan e-Power, AoTu

-

Planetary gear power-split: Toyota THS, Geely Intelligent Power Hi·X, GAC G-MLL

-

Fixed-axis hybrid: Honda i-MMD, BYD DM-i, Great Wall Lemon DHT, Chery Kunkunpeng DHT

First, let’s talk about range extenders. This is also the most controversial type of hybrid mode. After all, the “generate energy with fuel and drive with electricity” mode does not look very smart. Some people even call range extenders “taking off pants and farting”.

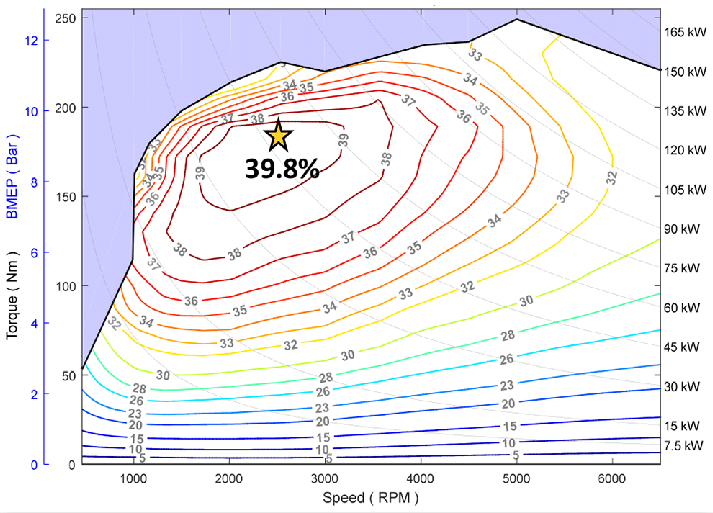

Indeed, the energy conversion path of range extenders is longer, from an engine-generator-motor, and there will inevitably be some energy loss at each step. However, in reality, the engines of traditional fuel vehicles rarely work in high-efficiency intervals. Even though the current number of gears in the gearbox has reached 10 AT, engines’ efficiency is still below 30% in most road conditions. If it is in urban areas with frequent starting and stopping, the thermal efficiency is probably less than 20%.

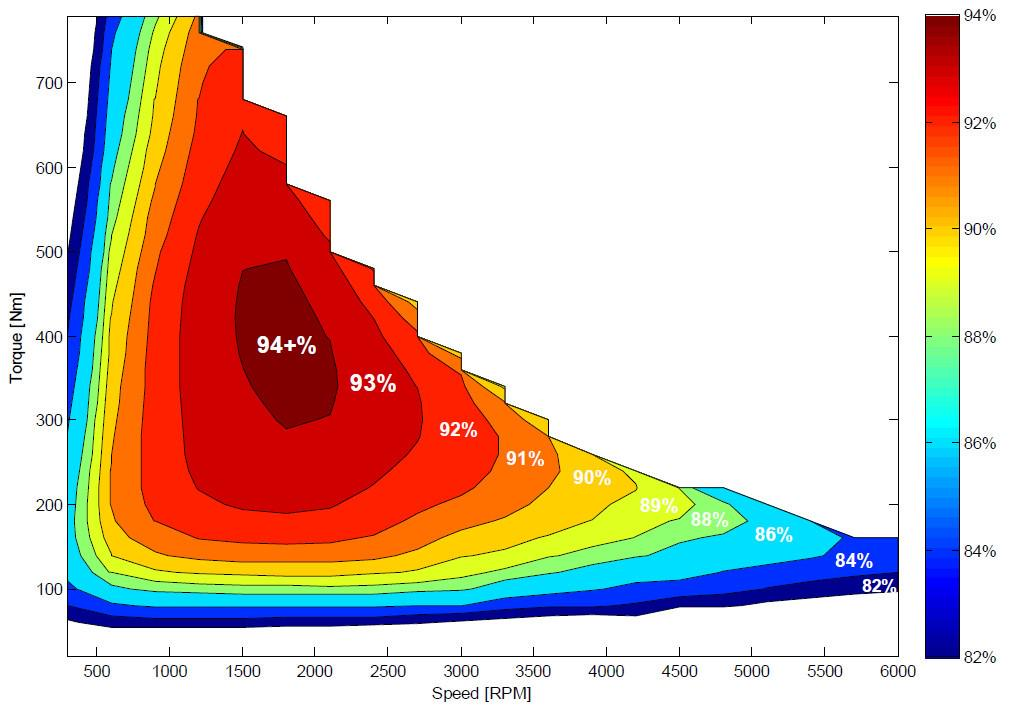

Range extenders can improve engine efficiency to above 30% for most of the time, and motors’ efficiency can easily reach over 90%. Even with an energy loss of about 10% during the power generation process, range extender hybrids can still save a lot of fuel compared to traditional fuel vehicles. Still, this is an overall analysis based on comprehensive road conditions. If driving continuously at a high speed, range extenders may be more fuel-consuming.

Overall, range extenders are a hybrid path with relatively simple technology, a low lower limit but a high upper limit. They are more friendly to “new entrants” who lack technical accumulation, and they also have great potential for future development.The following are two hybrid vehicles with high technical difficulty and complex structure, but with a higher potential.

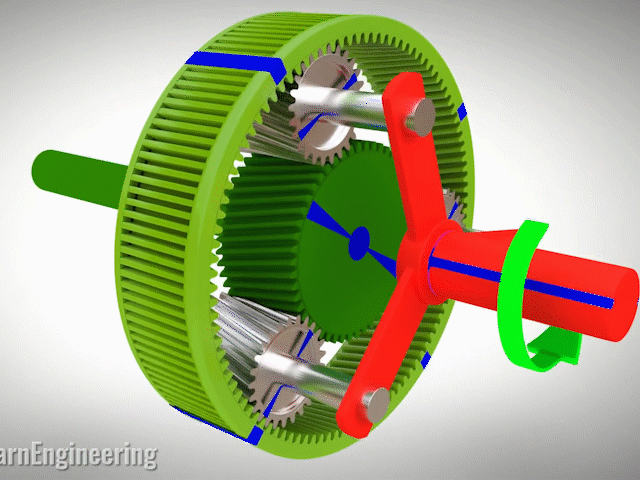

Firstly, there is the world-famous Toyota THS, whose core is the power split device composed of a planetary gear structure. The power of the engine can be split into two parts, one part is used to generate electricity for the M1 motor (corresponding to the central sun gear), and the remaining power is used to drive the outer ring gear through the gearbox to drive the wheels. The proportions of the two are adjusted according to the battery SOC, the vehicle speed, and power requirements.

This can maximize the engine’s efficiency and torque without waste, coupled with a high thermal efficiency engine, achieving the purpose of energy saving and emission reduction.

Turning back to independent brands, GAC Trumpchi is no stranger to the “Toyota-authorized” technology. However, the GS8 hybrid version uses a more powerful 2.0T engine, with much higher performance than the same level Toyota Highlander.

Geely’s hybrid journey is more tortuous and interesting. It mainly takes two routes. One is to develop 48V mild hybrids and P2.5 plug-in hybrids with Volvo. Among them, the P2.5 scheme is an upgrade to the P2 structure. These two European-style hybrids may have been somewhat competitive a few years ago, but now they are undoubtedly outdated. The other route is to learn from Toyota in a roundabout way. In 2014, Geely and KOLI FAR signed an agreement to establish the CHS joint venture. This KOLI FAR had established a joint venture battery company with Toyota in 2013, dedicated to producing batteries for Toyota THS. With this background, Geely obtained relevant technical materials of Toyota THS.

Therefore, Geely has also mastered the relevant technical know-how of Toyota THS. After several years of research, the Geely Smart-Linked Hi·X hybrid we see today was born. Compared with Toyota’s single-row planetary gear, Geely ingeniously formed a three-speed dual-clutch transmission through its double-row planetary gear structure, and of course, its structure is quite different from traditional DCT, the result being a further improvement in the efficiency and performance of the hybrid system.

## Comparison of Geely Star Plus L Hybrid and Toyota RAV4 Two-wheel Drive

## Comparison of Geely Star Plus L Hybrid and Toyota RAV4 Two-wheel Drive

In terms of size and weight, Geely Star Plus L is larger than RAV4, but its official comprehensive fuel consumption is 4.3 L/100 km and 0-100 km/h acceleration time is 7.9 seconds, which is better than RAV4’s 4.7 L/100 km and over 8 seconds acceleration time. The reliability of Geely’s hybrid system still needs to be observed.

GAC Trumpchi and Geely have adopted a power-split mode similar to Toyota THS, while the fixed-axis hybrid structure represented by BYD DM-i and Honda i-MMD has more potential.

It should be noted that THS, a representative of the planetary gear power-split hybrid system, can also be classified as a hybrid system, but we use the term “fixed-axis hybrid” to distinguish it from other hybrid systems, which is essentially an “range extender + engine direct drive” mode.

We know that the most fuel-efficient speed range for traditional fuel vehicles is around 70-120 km/h on highways, while electric vehicles are relatively weak in this range. If we use electricity at low speeds and oil at high speeds, we can achieve the highest efficiency and fuel economy, filling the gap between traditional fuel vehicles and range extenders.

For example, BYD DM-i and Honda’s i-MMD hybrid systems can take advantage of the electric drive system at low speeds and switch to engine direct drive at around 70 km/h.

The Great Wall Lemon DHT hybrid system adds a gear, which allows the engine to engage in direct drive at lower speeds (such as 40 km/h), theoretically improving efficiency.

Wei, the CEO of Changan, even claimed that the Lemon DHT hybrid system was the world’s best new energy technology, which, in large part, was true. However, when it comes to technology, structural complexity, and system control difficulty, Geely’s Smart E Hi·X and Chery’s Kunpeng DHT may be the “ceiling” of the hybrid system industry.The first completely self-developed engine and transmission in China is from Chery, and in the field of hybrid, Chery has hundreds of patents in the “State Intellectual Property Office”. Finally, the Chery Unipower DHT chose a solution with far greater complexity than Honda and BYD.

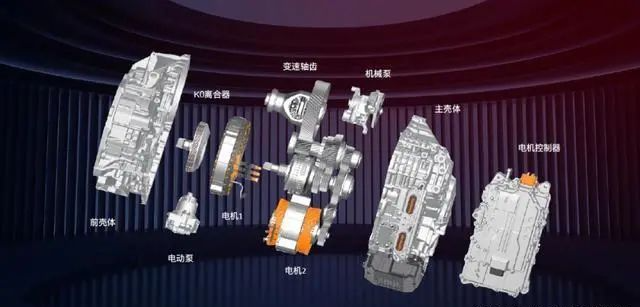

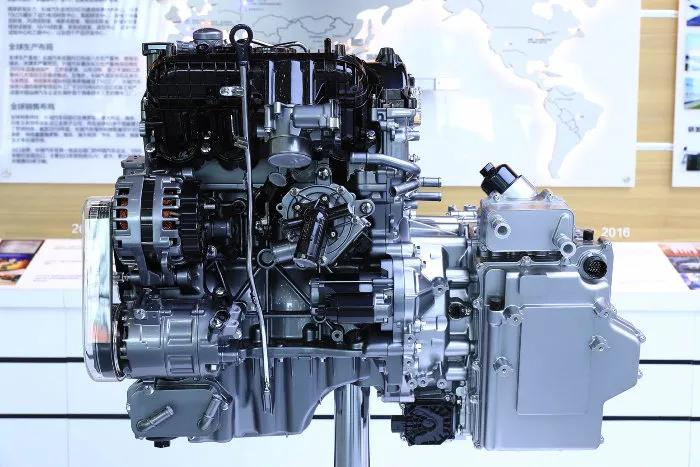

The basic structure of Honda i-MMD, BYD DM-i, and Great Wall Lemon DHT mentioned above are: one engine, one GM generator, one TM drive motor, and one to two-speed direct drive clutch. The GM and TM motors cannot substitute for each other, so the power of the two motors must be relatively large, but the control logic is relatively simple.

Chery Unipower DHT adopts the P2+P2.5 dual-motor three-clutch scheme. Both motors can serve as generator/drive motor at the same time. The patent describes a total of 29 working conditions (not necessarily all used), and there are 3 pure electric modes with a total of 9 gears. Its advantages are multiple modes, multiple gears, high upper limit, and the two motors do not need to have such high power, so we can see that the maximum power of the two motors on the Chery Tiggo 8 e+ is 70 kW and 55 kW, respectively, while Honda and BYD’s two motors are both above 130 kW.

Overall, after years of dedicated research and development, the technical aspects of the self-branded hybrid system are no longer inferior to that of Toyota and Honda, and the pattern of the hybrid market will undergo a transformation.

Avoiding being “blocked at the neck”: the unexpected joys of hybrid

When it comes to gasoline-powered vehicles, people focus on the engine. However, those familiar with China’s auto industry know that the biggest weakness of self-branded cars is the transmission.

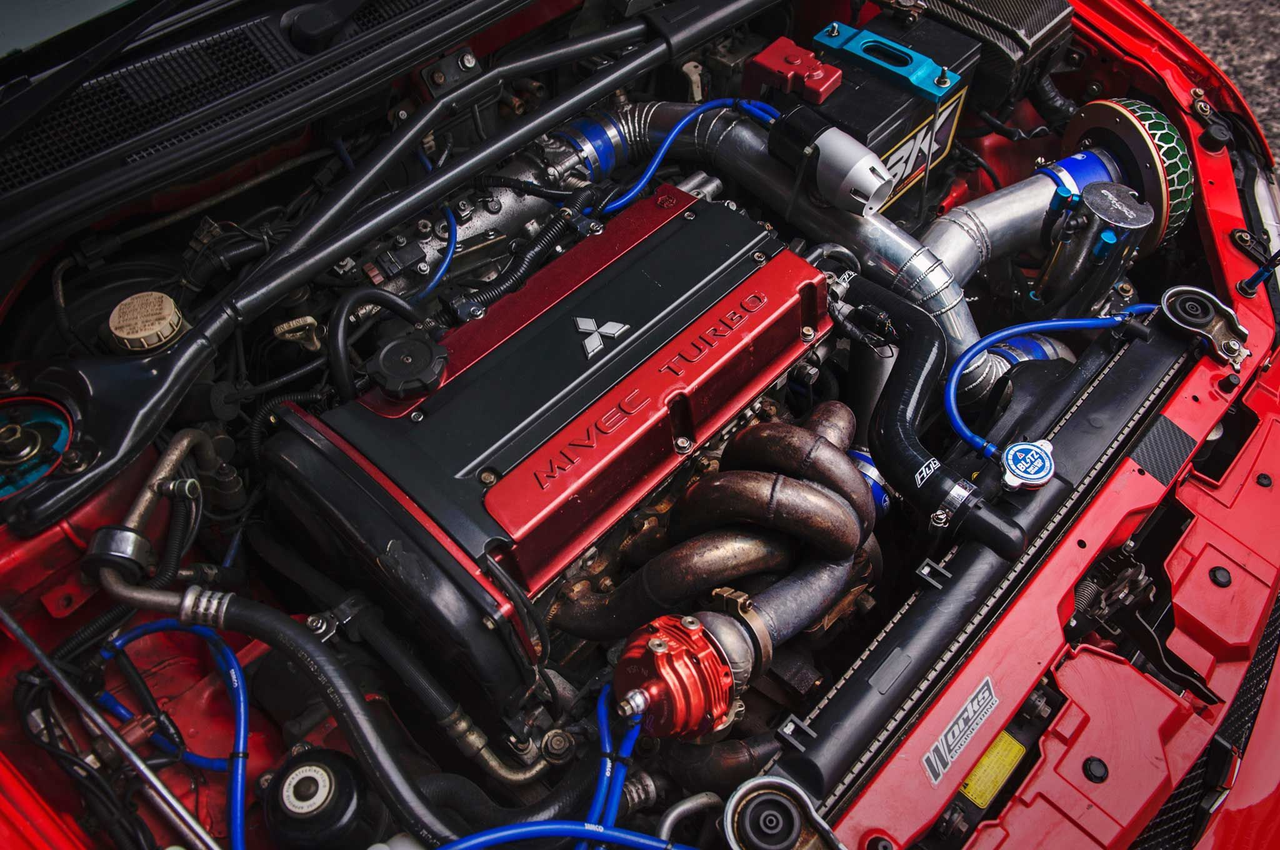

Over a decade ago, someone jokingly said that “half of the domestic brands were powered by a Mitsubishi 4G63 engine.” The Haval H6, BYD F3, and Chery Tiggo were all equipped with this “gran’s engine.” But now, mainstream Chinese automakers have developed their own signature engines, such as the Chery 2.0T Kuunpeng engine, which has surpassed the high-power 2.0T engines of BBA mainstream models in terms of fuel consumption and power. Great Wall Motors has launched the 3.0T V6 engine, which has far superior power than other off-road vehicles of its class, and Geely, in collaboration with Volvo, developed the 1.5/2.0T engine absorbing the essence of the Volvo Drive-E series. Of course, there is also the Blue Whale series engine by Changan…

Over a decade ago, someone jokingly said that “half of the domestic brands were powered by a Mitsubishi 4G63 engine.” The Haval H6, BYD F3, and Chery Tiggo were all equipped with this “gran’s engine.” But now, mainstream Chinese automakers have developed their own signature engines, such as the Chery 2.0T Kuunpeng engine, which has surpassed the high-power 2.0T engines of BBA mainstream models in terms of fuel consumption and power. Great Wall Motors has launched the 3.0T V6 engine, which has far superior power than other off-road vehicles of its class, and Geely, in collaboration with Volvo, developed the 1.5/2.0T engine absorbing the essence of the Volvo Drive-E series. Of course, there is also the Blue Whale series engine by Changan…

Overall, in the field of domestic-use cars, the engines of domestic brands are no longer their weak points but are even their strengths, whereas the traditional petrol cars still have a major problem – the transmission.

In recent years, domestic brands have also realized the shortcomings of their transmission and accelerated their catch-up. Consequently, a batch of outstanding transmission products has emerged, such as the Qingshan Industrial’s 7DCT, the 7DCT jointly developed by Geely and Volvo, the CVT and the 9DCT self-developed by Chery and Great Wall Motors, respectively. However, in the area of AT (automatic transmission) transmission, domestic brands still do not have a product that truly satisfies consumers.

If one wants to go up-market, it is challenging to neglect the AT gearbox. The ZF 8HP gearbox of BMW, the 9 AT gearbox of Mercedes-Benz, and the 10 AT gearbox of General Motors are all their signature products and one of the key points for obtaining price premiums.

However, as mentioned earlier, a good hybrid system does not require a traditional gearbox, and the hybrid technologies of Toyota, Honda, BYD, Chery, and Great Wall Motors are all characterized by this. This greatly helps domestic brands to bypass their most significant weakness, avoiding significant purchase costs from Aisin, ZF, and Getrag automakers (and sometimes avoids being blocked due to the supplier’s lack of goods or supply restrictions).

So in the era of hybridization, the cost-performance ratio of domestic brands will be more prominent, especially the DM-i series of BYD, the starting price of Qin PLUS DM-i is only 111,800 yuan, and this is still the PHEV model with a battery pack, which is still two to three yuan cheaper than HEV models like Toyota Corolla Hybrid and Honda Ling Pai Hybrid without a large battery pack.

This is especially true for the most popular compact SUVs. The price of BYD Song PLUS DM-i is 152,800 to 205,800 yuan, the price of Chery Tiger 8 PLUS e+ is 151,800 to 165,800 yuan (without four-wheel drive), while the price of Honda CR-V Plug-in Hybrid (without four-wheel drive) and Toyota RAV4 Plug-in Hybrid has reached 273,800 to 299,800 yuan and 248,800 to 296,800 yuan respectively, the plug-in hybrid models of compact SUVs from the “two Japanese” brands are over RMB 100,000 more expensive than those from domestic brands.

In addition, one point that is easily overlooked is that hybridization also happens to avoid another major shortcoming of domestic brands—four-wheel drive. In traditional fuel vehicles, “four-wheel drive” is also a big selling point and premium point, such as Audi’s quattro, Acura’s SH-AWD, BMW’s xDrive, etc. Adding four-wheel drive requires an additional cost of tens of thousands of yuan, and the four-wheel drive of domestic brands is almost all purchased from Bosch and BorgWarner, which is even more “limited” than the transmission.

But in pure electric or hybrid power, it’s very easy to add “electric four-wheel drive” by adding a rear electric motor on the rear axle. The four-wheel drive version of BYD Song PLUS DM-i has already been launched, and its acceleration rate is just 5.9 seconds per 100 km, while brands such as Chery, Great Wall, and Geely have already planned for four-wheel drive versions of their hybrid systems, and they will all be launched one by one.

Is hybridization really just a “transitional technology”?According to the article, the self-owned hybrid brand will have a big outbreak in 2022 with outstanding cost-effectiveness. However, some scholars argue that hybrid technology is only a transitional technology, and suggest that pure electric or hydrogen energy will be the ultimate source of energy in the future, and it is better to achieve it in one step directly. It is worth noting that the Chinese government has formulated the “Technology Roadmap 2.0 for Energy-saving and New Energy Vehicles”, which states that by 2025, hybrid vehicles will account for more than 50% of traditional energy passenger vehicles, and by 2035, traditional energy passenger vehicles must achieve an average fuel consumption of 4.0 L/100 km (WLTC) and 100% hybridization. Among them, energy-saving vehicles and new energy vehicles will each account for 50%. In other words, by 2035, the proportion of HEV and strong hybrid vehicles should reach 50% according to the plan. It is also backed by relevant policies such as subsidies and double credits, the latter of which will become the dominant force in the future. Double credits are divided into two parts: CAFC (Corporate Average Fuel Consumption) credits and NEV (New Energy Vehicles) credits. The former mainly assesses whether the fuel consumption of the sold fuel vehicles of the automaker meets the standard. If the credits are negative, they need to purchase credits from those new energy vehicle companies. In 2020, the price of one credit was about 1,200 yuan. It is shown that in 2021, Tesla earned $ 1.465 billion globally by selling carbon credits.Last year, Professor Masayoshi Yamamoto from Nagoya University in Japan and his team disassembled the Chinese Wuling Hong Guang MINI EV and found that its material cost alone, at ¥26,900, exceeded its selling price of ¥28,800. Factoring in the costs of research and development, transportation, and distribution, the vehicle is expected to operate at a loss. However, if selling points are taken into account (internal transactions with big fuel consumers such as SAIC-GM), the situation becomes clearer.

As the 2021-2025 Double Credit Policy further tightens, it becomes increasingly difficult for traditional companies to meet the double credit requirements:

-

Passenger vehicle companies whose actual average fuel consumption rate (accounting only for traditional energy passenger vehicles) exceeds the standard by more than 123% cannot carry forward their new energy vehicle positive credits from that year;

-

The fuel consumption test method is switched from NEDC to the more stringent WLTC. For the same model, WLTC fuel consumption is expected to be 10% higher than NEDC;

-

The calculation method for fuel consumption target value has changed, lowering the target value by 6.5%-10% under the new calculation method;

-

The maximum value for new energy vehicle credits per vehicle has decreased. For the years 2021-2023, the highest per-vehicle credit for pure electric/plug-in hybrid vehicles has been reduced from 5 points and 2 points to 3.4 points and 1.6 points, with a further downward adjustment likely to occur between 2024 and 2025.

In other words, to meet the double credit requirements in the future, companies will not only need to develop new energy vehicles, but also place more stringent emphasis on “fuel economy,” with their own new energy credits unable to be carried forward if fuel consumption exceeds standards by more than 23% and new energy credits likely to become more expensive. Additionally, fuel consumption calculation switches to the stricter WLTP cycle, while fuel consumption targets are lowered, requiring automakers to reduce fuel consumption by 15% or more.

However, the means to achieve fuel economy in traditional internal combustion engines has already run out of steam. The combination of small-displacement turbocharging and dual-clutch transmission is currently the best solution, with a 1.5L displacement engine being the final holdout; further reducing engine displacement will leave only K-Cars. Countless tragic examples have already shown that pursuing a three-cylinder engine alone is ill-fated, with the likes of the Buick Excelle and Ford Focus experiencing a precipitous decline from their prime, forcing a return to four-cylinder engines. Nissan’s New Qijun, which is equipped with a 1.5T three-cylinder engine, now has a monthly sales volume of only about 2,000 units.

Therefore, the conclusion is clear: the future will see a growth of both pure electric and hybrid vehicles, with the importance of hybrids not lagging behind pure electric, and the urgency of hybrid layout being even higher.Since the second half of 2021, raw materials have fluctuated greatly. For example, the price of lithium carbonate in 2021 was about 50,000 yuan per ton, but now it is around 500,000 yuan per ton. Combined with subsidy reduction, price hikes have become the main theme in the electric vehicle industry. In just five days, Tesla has raised its prices twice. The starting price of Model 3 Rear-wheel Drive version has now risen to 2.799 million yuan, which is 44,000 yuan more expensive than in the second half of 2021.

Faced with rising raw material costs, the cost pressures on electric vehicles of different price ranges are not significantly different. For an electric vehicle that costs over 250,000 yuan, a price increase of 30,000 yuan may represent a 10% increase, but for consumers in the 80,000 to 200,000 yuan range, a 20% increase is difficult to accept.

At the same time, the problems of range anxiety, lack of home charging facilities, and poor customer experience in the northern regions make it difficult to solve these issues in the short term. Therefore, the growth potential of hybrid vehicles in the next few years will be significantly greater than that of pure electric vehicles.

Thus, hybrid vehicles are not a transitional technology; they will continue to play a significant role in the next 20-30 years. And if we stretch the timeline to over 50 years, then one can only say “in the long run, we are all dead.”

Ignoring hybrid vehicles, Volkswagen has already suffered the consequences. In 2018, former BMW CTO Herbert Diess was officially appointed as CEO of Volkswagen and “ALL IN Pure Electric” strategy was launched. The plan was to introduce about 70 new pure electric vehicle models globally by 2028 and deliver more than 22 million pure electric vehicles worldwide, with more than half of them coming from the Chinese market.

However, after more than three years, Volkswagen’s performance is not particularly impressive. In 2018, the Volkswagen Group sold 10.83 million cars globally, but in 2021, it only sold 8.88 million units, a decline of 18.0%, which is higher than the global market’s decline of 15.2% relative to 2018. Meanwhile, Toyota, Volkswagen’s long-standing rival, was slightly behind Volkswagen in 2018 with global sales of 10.58 million vehicles. But by 2021, its global sales reached 10.5 million, almost no decline, and it has begun to outperform Volkswagen.

We can see this trend in Volkswagen’s most important European and Chinese markets.Firstly, in the European market, Volkswagen Group’s passenger car sales in Europe decreased from 3.73 million vehicles in 2018 to 3.16 million vehicles in 2021. Although this performance is already considered good for the European market (new car sales in Europe have declined significantly in the past few years), as a comparison, Toyota Group’s sales in Europe increased from 760,000 vehicles in 2018 to 778,000 vehicles in 2021.

If we only compare Volkswagen and Toyota brands, the changes become more obvious. Volkswagen brand’s sales in Europe were 1.75 million vehicles in 2018, with a market share of 11.2\%, and decreased to 1.274 million vehicles in 2021, with a share declining to 10.6\%. Toyota brand’s sales in Europe were only 713,000 vehicles in 2018, with a market share of only 4.6\%. By 2021, Toyota’s sales had reached 706,000 vehicles in Europe, increasing its share to 6.0\%.

In this process, Volkswagen’s pure electric vehicles performed brilliantly. In 2021, Volkswagen brand’s electric vehicles sold 112,000 units in Europe, beating Tesla to become the best-selling electric vehicle brand in Europe. Toyota, on the other hand, did not sell many electric vehicles in Europe. However, in its home market, Toyota continuously narrowed the market share gap with Volkswagen, and the reason lies in Volkswagen’s lack of hybrid vehicles.

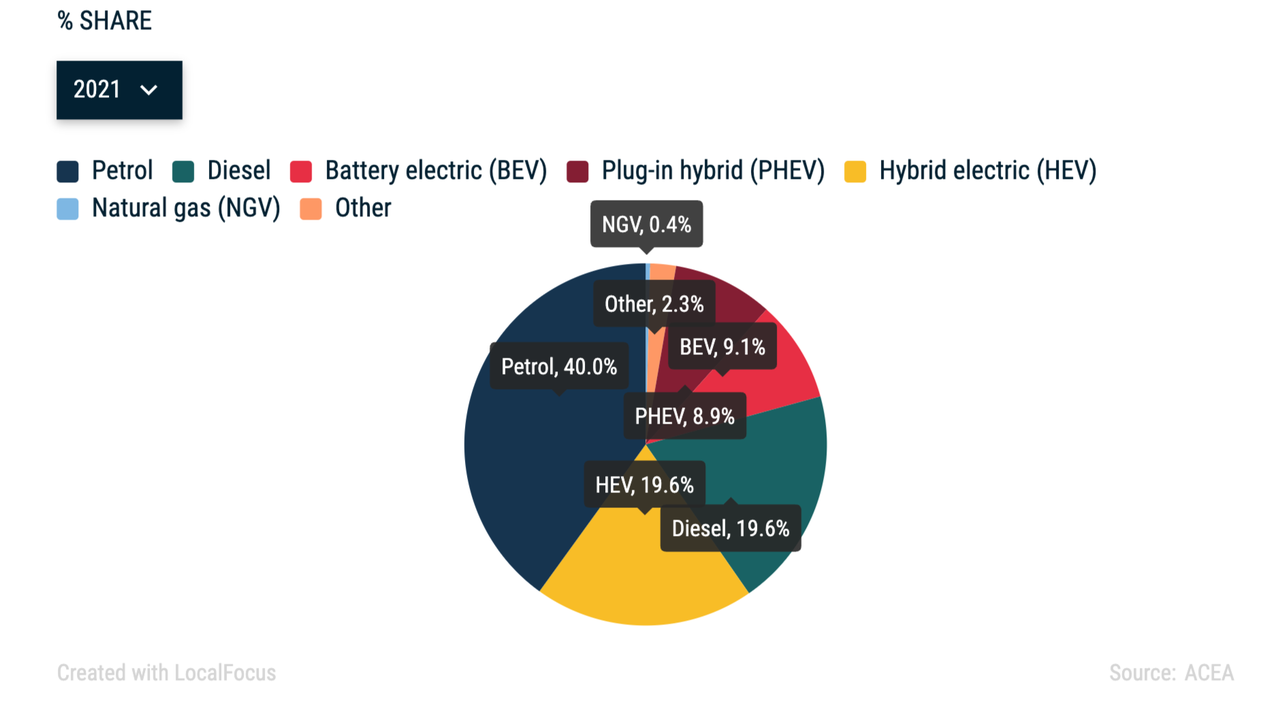

According to statistics from the European Automobile Manufacturers Association (ACEA), the market for hybrid electric (HEV) vehicles is more than twice that of battery electric (BEV) vehicles, and Volkswagen has almost no presence in this field.

Moving on to the Chinese market, Volkswagen’s sales in China plummeted from 3.1 million vehicles in 2018 to 2.405 million vehicles in 2021, a decrease of 22.4\%. Meanwhile, Honda and Toyota’s sales increased by 6.6\% and 26.3\%, respectively, from 2018 to 2021.

The reason why Volkswagen fell so fast is partly due to the poor performance of Volkswagen’s “ALL IN” pure electric strategy in the Chinese market, and the cumulative delivery of the Volkswagen ID. series in China in 2021 was 70,625 vehicles, which is not only far lower than Tesla, but also lower than new forces such as “WEY”.

The reason why Volkswagen fell so fast is partly due to the poor performance of Volkswagen’s “ALL IN” pure electric strategy in the Chinese market, and the cumulative delivery of the Volkswagen ID. series in China in 2021 was 70,625 vehicles, which is not only far lower than Tesla, but also lower than new forces such as “WEY”.

Although the ID. series has excellent product power, in China’s extremely competitive electric vehicle market, it is somewhat powerless against higher cost-effective domestic brand products. For example, the pricing of ID.3 in China is between 159,900-179,300 RMB, which is not a problem in Europe, but the BYD Dolphin next door sells for only 102,800-130,800 RMB at the same level.

The lack of hybrid models may be a bigger risk, as data shows that the sales volume of energy-saving HEVs in China in 2021 was 586,000 vehicles, a year-on-year increase of 43%, and the HEV and PHEV hybrid market in China is currently rapidly growing. Volkswagen, which lacks advanced hybrid technology, may be chased or even surpassed by Japanese and domestic brands in the next few years.

In February 2022, a historic scene occurred. BYD sold 91,078 vehicles that month, while SAIC Volkswagen sold 90,604 vehicles. BYD surpassed one of the “North-South Volkswagen” for the first time. It is also reported that BYD has accumulated 400,000 orders in hand and is still increasing rapidly, with DM-i hybrid accounting for three-quarters of them. If BYD’s monthly production capacity can be increased to more than 200,000 vehicles, surpassing the sum of “North-South Volkswagen” will not be a dream.

Of course, this does not mean that Volkswagen’s “ALL IN pure electric” strategy is completely wrong. Compared with brands such as Toyota and Honda, Volkswagen still has very obvious advantages in the pure electric field. However, for a company of Volkswagen’s size, it is absolutely necessary not to be biased. New forces can survive well by focusing on one route, but Volkswagen has hundreds of thousands of employees, dozens of factories and a huge dealer network around the world. If it continues to “lie flat” in the hybrid field, continue to use the P2 architecture and 48V light hybrids that are difficult to cope with the WLTP fuel consumption test, the pressure of double points will only become greater, and in the future, it can only face the embarrassment of slow growth of pure electric vehicles and rapid decline of the dominant fuel vehicle market.

Meanwhile, this is not only the dilemma of the mass brands, but also the entire European vehicle brands. BMW and Mercedes have been doing very well in the global luxury car market in the past few years due to its overall growth. However, if they fail to achieve rapid breakthroughs in the field of pure electric vehicles, the crown of a hundred-year-old luxury brand may fall off.

Meanwhile, this is not only the dilemma of the mass brands, but also the entire European vehicle brands. BMW and Mercedes have been doing very well in the global luxury car market in the past few years due to its overall growth. However, if they fail to achieve rapid breakthroughs in the field of pure electric vehicles, the crown of a hundred-year-old luxury brand may fall off.

Of course, as the saying goes, “if one hasn’t far sight, they must have near worries”. Although Japanese car brands are doing well in the field of hybrid vehicles, they will not miss any lessons to catch up with pure electric vehicles in the future.

In the past two years, we have deeply felt that we are in a great transformation of the automotive industry that has not been seen in a hundred years. In 2022, we will witness the collective rise of domestic brands in the field of hybrid vehicles, and the acceleration of overtaking overseas brands has already been pressed.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.