Author: Xiao Dong

Editor: Chris

On March 10th, GAC Aion’s self-developed power battery trial production line began construction. This means that the last step of battery system construction in the “Neutron Star Strategy” released by GAC Group has begun.

According to the official statement of GAC Aion, the self-developed battery trial production line project covers a total area of about 10,500 square meters, including the entire process of battery production from slurry preparation to battery pack production, as well as material research and development, physical and chemical testing, and electrical performance laboratory.

Simply put, GAC Aion will be producing its own batteries.

It is expected that the Aion self-developed battery trial production line will be completed by the end of 2022 and put into operation. The self-developed batteries by GAC Aion, including silicon sponge negative electrode batteries, will be produced independently on this trial production line.

This has also raised some questions about the current level of GAC Aion batteries. Why do they want to make their own batteries? Can the batteries made by Aion go further?

Self-developed and self-produced

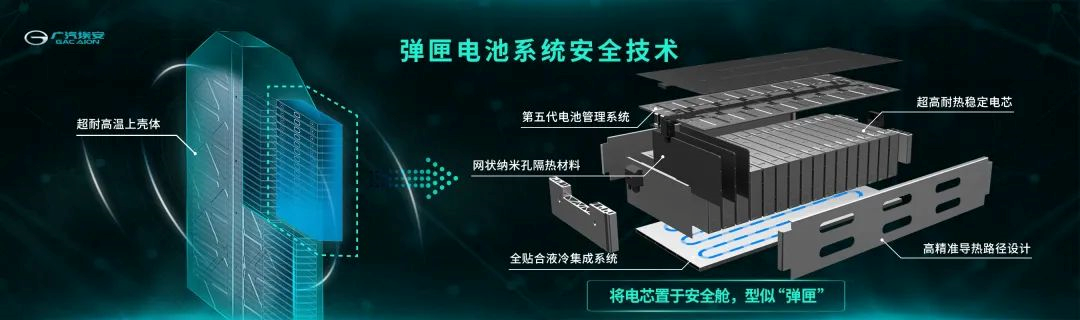

Speaking of GAC Aion’s batteries, we need to start with the magazine battery released by Aion in 2021. After all, the blade batteries by BYD were once very popular, and the needle puncture experiment became a favorite topic.

The primary challenge of the magazine battery’s development was also the needle puncture test. This time, the more unstable ternary lithium was compared to lithium iron phosphate, and it became more honest.

Not catching fire means that Aion has started investing in battery cells.

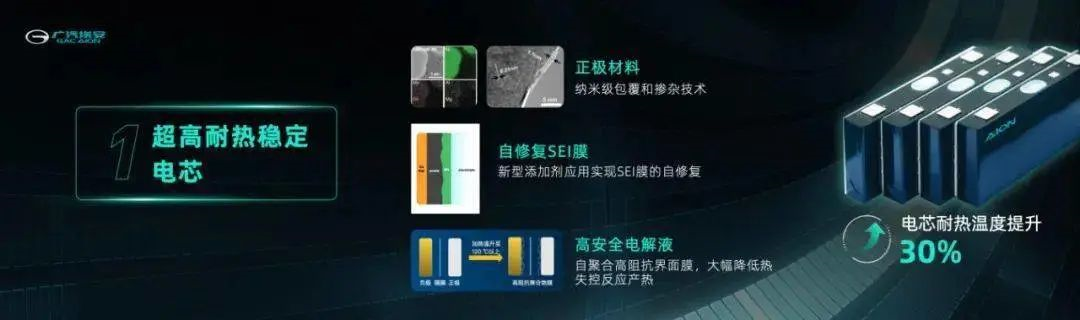

In terms of battery cell design, Aion improved the thermal stability by using packaging and doping technology for the nanometer-level packaging of the positive electrode material. The application of a new type of electrolyte additive realizes the self-repair of SEI model and reduces the risk of short-circuits. The high-safety electrolyte forms a high-impedance interface film under high-temperature conditions, greatly reducing the heat generation of thermal runaway reactions.

This has increased the heat-resistant temperature of the battery cell by 30%, making Aion’s battery cells only available for customization.

The magazine battery is also equipped with GAC Aion’s fifth-generation battery management system (BMS), which can perform data collection 10 times per second and 24-hour uninterrupted monitoring of the battery pack’s health status. In the event of an abnormality, the battery rapid cooling system can be activated to cool down the battery.In addition, high thermal insulation battery compartment, integrated liquid cooling system, precise heat conduction path design, and other aspects present the high safety of the final magazine battery.

One month after the announcement of the magazine battery, GAC Group released the “Neutron Star Strategy,” including sponge silicon negative electrode battery technology and supercharging technology, as well as BMS and battery pack target establishment.

Here we focus on the sponge silicon negative electrode battery.

At present, sponge silicon negative electrode battery technology has been put into mass production and used in AION LX Plus, with a range of 1008 km under CLTC conditions, becoming the vehicle model with the highest range in the domestic market, which is of significant importance for GAC Aion. For many small partners who have said “I will buy an electric car when the range exceeds 1000 km,” it is even more “meaningful.”

The name sponge silicon negative electrode battery has already explained its biggest feature: silicon negative electrode. Unlike the graphite negative electrode used in general power batteries, GAC Aion has placed silicon in the negative electrode. Porsche, Mercedes-Benz, Tesla, and other automakers have also chosen to use silicon as the negative electrode. But why silicon?

The advantage of silicon is that it has a large capacity. Silicon is currently the lithium-ion battery negative electrode material with the highest theoretical specific capacity (4200 mAh/g), while graphite has a theoretical specific capacity of only 372 mAh/g. However, the specific capacity of graphite has now been increased to 360 mAh/g using battery technology, and it cannot continue to grow. In the long run, the CTC structure has already pushed the magic of space utilization in battery packs to the limit. Before solid-state battery technology is perfected, to further improve the range of electric vehicles, the first thing to do is to start with the current negative electrode of the battery cell.

Anything with advantages will also have disadvantages.

The advantage of a large capacity also makes silicon have an unspeakable problem. Silicon will increase the volume change during the charging and discharging process, resulting in a decrease in cycling capability, as well as damage to the SEI membrane, which in turn reduces battery capacity.The solution from GAC is just as its name suggests: they make the silicon negative electrode soft like a sponge, reducing the damage caused by volume changes. Of course, achieving this is not easy. EAAN used nanocomposite silicon, self-healing adhesive, and gradient compliant coating technology. We won’t go into details here.

Finally, GAC Group stated that the sponge silicon negative electrode battery technology can reduce the volume of lithium-ion batteries by 20%, reduce the weight by 14%, and the energy density of the battery cell can reach 280 Wh/kg, with further room for improvement in the future.

With the battery pack, battery cell technology, and BMS all in place, it would be perfect if they could also manufacture their own battery cells.

This is also the ultimate goal of GAC’s “Neutron Star Strategy.” Within three years, they plan to achieve large-scale application of independently developed battery cell technology and eventually achieve the goal of self-research and production in the medium and long term. The EAAN’s self-developed battery trial production line mentioned at the beginning of this article also became an important part of the “Neutron Star Strategy.”

As a car manufacturer, it has become commonplace to purchase from suppliers. Why is a state-owned company like EAAN so insistent on manufacturing their own batteries?

“Defense”

For EAAN, the most important purpose of self-production is to “guarantee the supply chain”. The lesson learned from the global shortage of chips highlights the importance of the supply chain. EAAN is more well prepared for batteries this time.

In 2020, the first generation NCM 811 ternary lithium battery from Ningde Times caused multiple spontaneous combustion incidents when used in Aion S vehicles. However, GAC and Ningde Times “blamed each other” and eventually parted ways.

Because of this, GAC chose another partner, CATL (Contemporary Amperex Technology Co. Limited).

CATL quickly replaced Ningde Times as GAC EAAN’s largest battery supplier. In 2021, CATL’s installed capacity has jumped to third place in China and has become a power battery supplier for many auto brands such as Dongfeng, Changan, Geely, and XPeng.

Of course, CATL’s current position could not have been achieved without GAC. On one hand, GAC has brought them a large number of orders, and more importantly, GAC has provided CATL with a great deal of technical support, similar to the relationship between BMW and Ningde Times a few years ago. According to 36Kr, GAC has put forward more than 2,000 rectification suggestions to CATL, helping it establish a mass production and quality system.The contradiction between suppliers and carmakers in battery supply has also occurred in Tesla. In the early days of Tesla, only Panasonic’s 18650 lithium batteries could meet Tesla’s requirements for power batteries. In 2012, Tesla Model S was born, and the demand for Tesla’s batteries further increased, while the production capacity of Panasonic’s batteries did not keep up. This made Elon feel a crisis, so Elon proposed to build a battery factory together with Panasonic-the Nevada Giga 1.

However, with the advent of Tesla Model 3, global demand skyrocketed, which greatly increased Tesla’s production capacity requirements. In April 2019, Elon publicly stated that the battery production capacity of Giga 1 had already affected the production of Model 3. Under Elon’s strong pressure, this caused dissatisfaction from Panasonic. In September 2019, Panasonic President Tsuga Kazuhiro told the media that “Elon asked many times to lower the purchase price, and I responded to Elon. If this continues, we may consider withdrawing all Panasonic employees and equipment from Super Factory.” A month later, Tsuga Kazuhiro, President of Panasonic, once again stated that “if there is a chance to do it again, Panasonic will not invest in the super factory.”

Obviously, the relationship between Panasonic and Tesla has become subtle. The demand for Model 3 is still rising, and the completion of the Shanghai factory in 2019 is imminent. It is definitely not enough to rely solely on Panasonic’s production capacity. This enabled Tesla to choose LG Chem, CATL, and even BYD’s blade batteries as its battery suppliers in China. At the same time, globally, Tesla chose to establish battery factories near its California and Berlin factories to ensure its supply chain needs. Tesla is even more extreme, planning to reach a production capacity of 100 GWh for the California battery factory and 200 GWh for the Berlin battery factory.

So for GAC, in addition to supporting ZhongChuang New Energy, building its own battery production line is also the most reliable way to ensure its battery supply chain.

Of course, self-production requires capability, and GAC has never stopped its research and development of battery technology. As of the end of 2021, GAC Group has a research and development team of more than 600 people, as well as battery laboratories and test fields. It also has more than 80 patents, of which the proportion of invention patents is as high as 70%. Since it can support ZhongChuang New Energy, it naturally has the ability to self-produce batteries.“`markdown

Another role of in-house battery production is bargaining power. For mid- to high-end brands like GAC Aion, the cost of batteries is undoubtedly a major part of their electric vehicle cost. Although the cost of in-house battery production is still unable to compete with major battery manufacturers like CATL and BYD, having large-scale production capacity is important for GAC Aion’s bargaining power in external procurement, and at the same time, it is a guarantee for its own vehicle production capacity.

If GAC Aion’s in-house battery production capacity is substantially improved, will it also supply batteries for other companies like BYD in the future?

Going Global?

It is difficult for GAC Aion to be self-sufficient at present.

Battery demand is closely related to vehicle sales, and GAC Aion’s end-user sales volume exceeded 123,660 vehicles in 2021, which is expected to increase in 2022, with an expectation of over 200,000 vehicles. Also, most Aion models use a relatively large battery. Calculated based on an average of 70 kWh per vehicle, GAC Aion’s battery demand in 2022 is expected to reach 14 GWh.

Apart from adopting the supplier’s scheme, GAC is also promoting joint ventures to produce batteries.

The largest production line of the joint venture at present is Guangzhou Automobile Group Company and Contemporary Amperex Technology Co. Limited (CATL)’s joint venture Guangzhou CATL New Energy Co., Ltd. This project has a total capacity of 15 GWh, and it is built in two phases. However, it was delayed for nearly a year due to the joint from Ningde and GAC. The first phase of the 10 GWh project has been put into production in October 2021 and is currently in capacity ramp-up period.

The other is GAC’s incubation company JIEWAN Technology, mainly responsible for R&D, such as high-rate batteries, 480 kW fast charging piles, etc. Of course, JIEWAN is also constructing capacity.

JIEWAN Technology has stated that it will establish R&D and production bases in Huangpu Development Zone of Guangzhou, which will be responsible for R&D and production of super-fast charging cores, next-generation new energy storage devices, and PACK integrated systems. The project is expected to have a total investment of RMB 3 billion and a capacity of 8 GWh, and it will be put into production in the first quarter of 2023. The first phase of the Nansha PACK factory for graphene batteries has been built, with a planned capacity of 4 GWh.

JIEWAN Technology plans to reach a capacity of 120 GWh in the medium and long term. Both of the above-mentioned joint ventures are still mainly led by GAC and do not entirely belong to Aion.

“`

So this time, Guangqi Aion started building a self-developed power battery trial production line with a total investment of only 336 million yuan. Based on the investment cost of 300 million yuan/GWh, the production capacity of this production line is only about 1 GWh. If this trial line is a success, further expansion is necessary.

Of course, the chances of supplying at the scale of BYD are very low. After all, Aion is still affiliated to Guangqi Group, while BYD started with batteries, the two have a huge gap in strength.

As mentioned above, self-sufficiency is also difficult. It will take at least several years of capacity expansion to supply Aion models. Moreover, it is even more difficult to supply to external customers in such a fiercely competitive battery market in China.

In summary, Guangqi Aion’s self-made batteries mainly target its own vehicle demand and can apply more battery core technologies more quickly. The possibility of occupying a certain position in the battery market is extremely low, unless they develop battery cores that are competitive enough and have production capacity that can be massively expanded. However, the difficulty of these two tasks is no less than launching a popular vehicle model.

At the end of 2022, the self-developed battery trial production line of Guangqi Aion will be completed, which means that Aion has achieved closed-loop control from research and development to manufacturing in the battery cell sector. Although it is difficult to go global, new battery technologies can be more quickly implemented, and both cost and supply can be effectively controlled. For Guangqi Aion at this stage, this is undoubtedly a brick to further consolidate its technological barriers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.