The Evolution of Power Battery Cell Size: Trends and Future Directions

By Wang Lingfang

Edited by Qiu Kaijun

Power battery cells used in vehicles come in all sorts of shapes and sizes – round, square, flat, long – with up to 145 varieties of dimensions and specifications recommended by the Chinese National Standards for EV power battery products in 2017.

In contrast, the VDA standard in Europe, with 10 dimensions established around 2012, only covers five types of square cells, one type of cylindrical cell, and four types of soft pack cells.

Although incredibly diverse, the battery market has still shown some clear trends, emerging from the close partnership between the EV and battery industries. By focusing on the scenes and requirements for vehicle power batteries, and by introducing high-standard battery manufacturing processes, significant progress has been made in the form and functionality of power batteries, with several distinct trends emerging:

- Larger Battery Cells: Cylindrical cells have evolved from 18650 to 21700 to 4680, while square cells are being produced as long, flat strips (e.g. BYD’s “blades” and “short swords” shaped cells) or as thick, large squares. Soft pack cells have progressed from VDA modules to MEB’s 590 modules.

- Stronger Structures: For example, Tesla’s 4680 cells, BYD, Contemporary Amperex Technology (CATL), and Hiking Energy’s cells are made from formulated copper foil (CTP) or even coated tinned copper (CTC) that enables the cells to become structural components.

- Trade-off Between Energy Density, Costs, and Safety: As electric vehicles aim for longer ranges, car manufacturers no longer simply prioritize energy density but are attempting to balance costs and safety.

But what drives these trends? Will battery cells just keep getting larger?

In an interview conducted by “EV Observer” with more than ten industry experts and company officials, an attempt was made to summarize the evolutionary process of power battery cell specifications and to identify the underlying patterns to forecast future trends.

Note: Dimensions are in millimeters throughout this article.

Cylindrical Cells: Direct Applications in Consumer Battery Market

Electric vehicles were invented earlier than gasoline powered cars. However, due to the rapid development of internal combustion engines, battery-powered vehicles were left behind in history’s wheel. Nonetheless, car makers never gave up on producing electric cars. As early as the 1990s, Peugeot, General Motors, and Nissan had been experimenting with battery-powered cars, which is extensively described in the “History of Vehicle Power Batteries” for better understanding.

In the 21st century, there were some preliminary results of these efforts. Only Nissan and Tesla were able to mass-produce electric vehicles with some impacts. These two carmakers had initially chosen cylindrical cells.

When discussing Nissan’s electric vehicles, the first car that comes to mind is the Leaf, which was first introduced with cylindrical cells. However, Nissan’s earlier Prairie Joy EV also used cylindrical cells, but was not as well-known as Tesla’s Roadster.

Let’s start with Tesla.

1. Cylindrical Battery: Tesla’s First Choice

Tesla’s first car- the electric supercar Roadster- chose the 18650 battery that had the most stable stability and optimal cost.

In 1991, Sony Corporation in Japan invented the 18650 battery. It is the world’s first commercial lithium-ion battery. In order to save costs, Sony named this lithium-ion battery model 18650, where 18 represents a diameter of 18, 65 represents a length of 65, and 0 represents a cylindrical battery.

The cylindrical battery cell is the oldest shape in the battery field, and its technology was the most mature and cost-effective at the time.

The birth of this battery pack may be accidental, but the popularity of this model became inevitable with the explosion of the 3C and small household appliance product markets.

Once released, this model was eagerly mass-produced by major battery companies in Japan and Korea, and became one of the best-selling battery models in the consumer electronics field.

Martin Eberhard, one of Tesla’s founders, was a sports car enthusiast and had deep concerns about America’s dependence on Middle Eastern oil imports and global warming. This ultimately led him to co-found Tesla with Marc Tarpenning.

The two founders did not have the ability to develop and produce batteries on their own, so the only choice was to select the right batteries from the market. After a lot of experimentation, they selected the 18650 cylindrical battery.

After careful comparison, Kurt Kelty, Tesla’s battery technology director at the time, believed that Panasonic’s 18650 battery had absolute advantages in energy density, cycle stability, and batch repeatability.

However, Panasonic believed that notebook batteries were useless in the automotive field and therefore rejected Tesla.

Tesla did not give up, and offered to show Panasonic their battery cells arranged in groups.

Although Panasonic saw the feasibility, they still believed that there were significant safety risks when the batteries were arranged in groups, and rejected Tesla again.

It was not until Tesla presented their battery cooling solution that Panasonic reluctantly agreed, but with the caveat that: 1. Tesla cannot publicly state that Panasonic is their battery supplier. 2. They are not responsible for any problems.

In 2009, Panasonic’s bet on the lithium-ion battery business failed and they lost $4 billion. Desperate to pull themselves out of the mud with new business opportunities, Panasonic strengthened its cooperation with Tesla.

From this tug-of-war, it is clear that Panasonic did not believe that consumer batteries could really be used in cars.

Fortunately, Tesla managed to achieve a balance between safety and performance with their powerful battery cell grouping technology, thereby making an explosive breakthrough.As Panasonic’s cooperation with Tesla deepened, the two sides began to improve the battery design and material at the battery design and material levels.

Without a doubt, there was too much room for improvement from the consumer battery’s direct use of 18650. A simple logic is to enlarge the battery size, reduce the complexity of grouping, enhance energy density, and also ensure the original yield rate.

In addition, in terms of materials, the anode material was changed to a silicon-graphite composite material to improve energy density.

Thus, the 21700 battery was born, which was fatter and taller than the 18650.

If 18650 were likened to “primary school students,” then 21700 entered the “middle school student” stage, with obvious improvement in size, capacity and energy density.

Starting from the first quarter of 2016, the Gigafactory, a super factory in Nevada, USA, began to produce 21700.

At that time, Panasonic provided this battery exclusively for the Model 3 by Tesla. By adopting this battery, the Model 3 effectively improved energy density and capacity, reduced the number of cells and pack attachments, and upgraded weight reduction, which drove down the overall vehicle cost and price.

Panasonic’s original 18650 battery for Tesla was limited in volume and critical components, with capacities generally between 2.2-3.6Ah, while the first-generation 21700 battery could achieve 4.8Ah, and is developing towards 5-5.3Ah.

Compared with the 18650 battery, the 21700 increased energy density by about 20%, to nearly 300Wh/kg.

As Tesla grew, Panasonic’s production capacity and profits could not keep up, and the two parties, who had accumulated grievances, turned hostile. In 2019, the war of words between Tesla and Panasonic became the focus of public opinion.

At that time, Tesla realized that it might be difficult to keep up with their speed and cost requirements solely relying on third-party suppliers. According to considerations such as control of core components and increasing negotiation chips, Tesla accelerated the plan of developing self-made batteries.

Unexpectedly, not only did Tesla insist on self-research, but it also quickly released a “trump card” level product.

In September 2020, Tesla unveiled the 4680 cylindrical battery at Battery Day, with a single cell’s capacity increased by 5 times compared to 21700.

The cylindrical cell became “fatter” again, but its height only increased slightly.At this stage, the 4680 cylindrical battery has entered the “college student” phase, with further cost reduction compared to the 21700, and significant increases in capacity and power.

Regarding cost, the reduction in the number of batteries required for the battery pack, the decrease in the proportion of metal casings, and a significant decrease in the number of structural components and welding contribute to cost reduction, with a 14% reduction compared to the 21700 battery.

On the performance side, the 4680 battery innovatively adopts full tab technology, which widens the current path of the battery, significantly reduces internal resistance, and reduces internal losses, thus greatly improving battery power, which is six times that of the 21700 battery.

On February 19th, Tesla announced through its official social media platform that it had produced the 1 millionth 4680 battery in January of this year.

Earlier, Tesla CEO Musk said in a conference call that the 4680 battery will be first used in the Model Y in the first quarter of 2022.

In addition to Tesla, companies such as Panasonic and LG are also developing and producing this type of battery to supply the world’s largest electric vehicle companies.

(2) China follows suit with cylindrical battery strategy.

It’s not just Tesla trying to use cylindrical batteries to make electric vehicles.

In 1998, before Tesla was founded, China’s old battery company-Tianjin Lishen, had built a capacity of 300,000 18650 batteries. However, at this time, the capacity was still aimed at 3C products such as mobile phones.

After seeing Tesla’s success in using 18650 batteries, Chinese companies also accelerated the application of 18650 batteries to vehicles.

In 2012, Lishen’s 18650 battery was the first to be installed and sold and was installed in only 100 of Jianghuai’s iEV2s. Later, in 2014, it was also installed in Kandi, and in 2015, it was installed on a large scale on Jianghuai’s iEV5s.

During the same period, China’s BAK Battery also began to explore the application of 18650 batteries in vehicles. In 2010, BAK cooperated with Dongfeng to provide power for the Taiwan Flower Expo event vehicles; that same year, BAK also cooperated with Beiqi Foton to become a demonstration model for Beijing’s new energy taxis.

In 2014, BAK began mass-producing 2.4Ah cylindrical 18650 batteries.

With China vigorously promoting new energy vehicles, Korean battery companies that saw business opportunities began to invest in China, with Samsung SDI selecting the 18650 cylindrical battery route in Tianjin in 2015, and began to supply Jianghuai Automobiles the following year.

After Tesla adopted the 21700, Chinese companies represented by Lishen Battery also began to introduce this model. In 2017, Lishen’s 21700 batteries were first put into production and installed in a pure electric logistics vehicle.While 21700 batteries are rising, companies such as CATL have developed 15Ah cylindrical LiFePO4 cells in 32131 and 32135 sizes. Currently, CATL’s 32 mm diameter products are mainly used in small cars such as BAIC, JAC, and Chery.

Later, following Tesla’s lead, 4680 batteries have also been introduced to China, and companies such as EVE Energy and BAK are following this path, trying to supply Tesla or other car manufacturers with large cylindrical batteries.

(3) Difficulty of grouping cylindrical cells

Tesla, which uses cylindrical cells most successfully, produced the first Roadster’s module, which was designed with the help of Toyota.

However, Toyota chose a different path, using square batteries instead of cylindrical ones. This shows that cylindrical batteries were not the first choice for car manufacturers at that time.

In China, only JAC Motors can be considered the most faithful user of cylindrical batteries.

Mr. Song, a former engineer at CATL, told “EV Observer” that theoretically, cylindrical cells should be the lowest-cost option, but the difficulty lies in grouping them. At that time, Tesla used wire bonding technology with aluminum, a process that was mainly used in the electronics industry more than a decade ago, and no domestic auto parts manufacturers could do it.

“At that time, the idea of companies was to stamp an aluminum plate or copper plate, then press the corresponding pole point of the cell, push it down, and laser weld the mother plate to the cell, but this design was prone to soldering or falling off,” said Mr. Song.

Mr. Song recalled that car manufacturers could have completely left supplier to find solutions, such as using a multi-layer plastic frame to connect multiple cell heads and tails into a long module. But constrained by the historical environment at that time, most of the designs did not fully utilize the limited packaging volume, resulting in cylindrical batteries’ advantages not being fully utilized.

Mr. Song believes that before 2015, Chinese car manufacturers’ response to the electrification of cars and new energy vehicles was relatively slow, and they did not study and improve it seriously.

In Mr. Song’s opinion, at that time, car manufacturers’ top management had their minds on making money from joint venture cars, and they were not very proactive in fulfilling the political mission of new energy vehicles. “In the case of small quantities at that time, it was difficult for suppliers to cooperate, and the cost of opening the mold was very high, so it could not be amortized early.”

“From 2012 to 2014, there was no mass production of new energy vehicles, and only a few car companies like BAIC, JAC, and Chery had done some tentative tests with cylindrical cells. By the time electric cars started to be produced in large quantities in 2016-2017, because of policies and various reasons, battery suppliers such as Ningde Times and BYD monopolized the market again.” said Mr. Song.In addition, Mr. Song believes that cylindrical batteries have not been developed during the high-speed development period of electric vehicles in China for another reason: when cylindrical batteries are grouped, there will be many “dead” spaces left in the battery layout, resulting in a low volume utilization efficiency, which is not conducive to the improvement of volume energy density.

Even now, the increase in the proportion of cylindrical batteries in the Chinese market is also due to the application of Tesla. With the application of Tesla’s NCM square battery in the Ningde era, the proportion of cylindrical batteries has fallen again.

Square: China’s most popular shape for automotive batteries

In addition to cylindrical batteries, square batteries have also entered the automotive field early.

The earliest application of square batteries should be by the Japanese company Sanyo Electric. In 1995, Sanyo Electric launched a square lithium-ion secondary battery, with an aluminum alloy shell process that reduced the weight by about 30% compared to a steel shell.

Due to its light weight, this type of battery has been continuously used in products such as mobile phones.

In 2008, Panasonic acquired Sanyo Electric and obtained the relevant technology of square batteries.

However, it is worth noting that Panasonic did not output the technology of square batteries to Tesla.

Regarding this, a person in charge of a battery company gave his opinion: “The technology of cylindrical batteries is mature and standardized, and the production difficulty of square batteries is much higher than this.” However, the person also pointed out that although the manufacturing difficulty of square batteries is great, grouping is relatively simple, so square batteries can grow into an important direction in the field of automotive use.

(1) Foreign Squares: From VDA to 590 modules

Square batteries almost entered the automotive field at the same time as cylindrical batteries, but due to the lack of support from best-selling models, the overseas progress of square batteries in the early stage was not significant.

In 2012, Panasonic’s square batteries began to be adopted by companies such as Volkswagen, Toyota, and Ford, such as the Volkswagen e-golf, e-up, Golf GTE hybrid, Audi Q5 and A6 hybrids, Toyota’s eQ, Prius PHV1 generation, and Ford Fusion2 generation, etc.

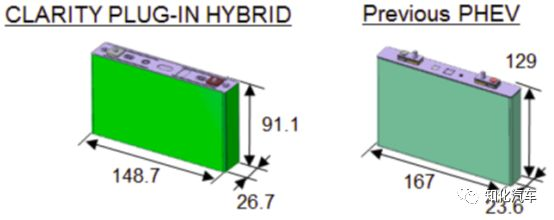

Panasonic’s earliest square cell is a 5Ah cell that meets the VDA HEV size, with dimensions of 120 * 85 * 12.5.Toyota’s Clarity PHEV uses Panasonic’s square battery, which also meets the size requirements of VDA PHEV2 and is used in plug-in hybrid models. The battery size has also increased significantly.

Samsung SDI also developed square cell technology, such as the battery size for the BMW i3 model, which meets the BEV2 size in VDA, and measures 17345125.

The development of Samsung’s squared power batteries is similar to the replacement process of Panasonic in the consumer battery market, and has gained higher recognition in markets outside of China.

Of course, the size of square batteries has also been continuously increasing from small to large, mainly in thickness and length.

In Mr. Song’s view, the overall electrification strategy in Europe is a process of gradually increasing battery size, following the development path of 48V, HEV, PHEV and then BEV.

In the early stages of development, China was used to referring to European standards. Around 2012, as the VDA standard size was introduced in Europe, Chinese automakers and battery companies began to reference this standard. However, the largest size for VDA is BEV2, and the largest capacity battery under this size is only 120Ah.

A power battery industry insider told Electric Vehicle Observer that Samsung SDI is still making batteries according to the VDA standard for square batteries. The development of China’s square batteries has already exceeded the VDA size standard because by 2017-2018, the 120Ah capacity could no longer meet the needs of Chinese automakers.

Overseas automakers are also considering adopting a pure electric platform to break through the VDA size limit.

Around 2017, Volkswagen began to consider launching the pure electric MEB platform, and launched the 590 module to provide conditions for further increasing cell size.

Enlarging square cell sizes has also become the direction for overseas automakers.

(2) Diversification of square battery sizes in China

The development path of BYD, CATL, Lishen, and other companies represent the development path of China’s square batteries.

BYD started with batteries and then began manufacturing cars. Its development path is completely different from that of consumer batteries migrating to vehicles, as it considered the battery-vehicle matching from the beginning of battery design. Many of CATL’s automotive battery fields’ talents came from BYD, so there has been inheritance in technology. Lishen’s square batteries have been favored by overseas system suppliers and were migrated from military batteries to the automotive field.

a. BYD – The leader of China’s square batteries.BYD started as a battery company. In 2003, BYD’s sales of nickel-cadmium batteries surpassed Sanyo Electric and became the world’s number one.

Founder Wang Chuanfu’s other goal was to manufacture electric vehicles. In 2003, while BYD was topping the battery sales chart, it acquired Xi’an QinChuan Automobile Co., Ltd., and established BYD Auto Co., Ltd.

According to early BYD employees, the company established an electric vehicle department immediately after the establishment of BYD Auto.

According to public information, BYD started the research and development of lithium iron phosphate batteries in 2002, conducted basic research on ternary batteries in 2003, launched the first lithium iron phosphate power battery in 2005, and applied power batteries to the e6 and F3DM dual-mode vehicles in 2008.

In terms of batteries, BYD targeted the automobile market from the beginning, and their battery cell sizes were larger than those of other battery companies at the same time. For example, the F3DM cell size is 35610028.

From the size comparison, BYD’s 2008 PHEV battery cell size (35610028) was already larger than later VDA EV (17311545) sizes.

Compared with the overseas market, in 2008, the battery specifically developed for electric vehicles by BYD had been installed in their own vehicles, while AESC, the joint venture power battery company of Nissan Motor, NEC and NEC Tokin, had just been established.

At this time, BYD had already clearly taken the lead in the development of power batteries in the world.

From the size of BYD’s power battery, it is clear that their specific idea is to make the battery cell longer.

b. CATL Started from VDA and Broke Through VDA

In the field of vehicle power batteries, BYD is considered the teacher of CATL: In 2010, when ATL (at that time, CATL had not yet been spun off) began to focus on power batteries, BYD had already been working on this field for about 8 years.

However, unlike BYD, CATL’s cell mainly expanded along the VDA size.In 2010, BMW began to work with ATL, and the first battery size required for BMW’s project was the VDA EV2 size of 17311545. Of course, the VDA cell standard was not yet finalized at that time.

Mr. Song revealed that the project at that time was sheet metal plus square batteries, directly modified on the platform of the fuel car, and was fitted with three packages in the vehicle’s gap, with a battery weight of more than 400 kilograms with a very low cruising range, exposing the weakness of phosphate iron lithium batteries.

Around 2012, independent Ningde Times did another project for BMW-the BMW X1. BMW gave a cell size of 1739221, close to the size of VDA PHEV1.

With the national policy beginning to lean towards commercial vehicles, there are more and more plug-in hybrid and pure electric commercial vehicles. BYD’s electric bus carries between 150-300 degree electric power. For example, BYD K8 uses phosphate iron lithium batteries, and the electric power can reach 270 degree.

Mr. Song recalled that such a high power stimulated Yutong Bus. Yutong then found Ningde Times for cooperation. However, the first vehicle Ningde Times made for Yutong was HEV, with only 13 degrees of electricity and a sheet metal frame to support the battery cells.

The battery cell size of Ningde Times for Yutong buses is 173*45, with a height of more than 200, which is roughly based on the size of VDA, but has made some breakthroughs.

Overall, the battery cell size of Ningde Times is still smaller than the battery cell size of BYD at that time.

At the same time, another early lithium-ion battery company in China, Lishen Battery, also tried to apply square batteries to electric vehicles. Lishen’s square battery originated from the early development of the Tuan Ying Radio. Lishen Battery Deputy General Manager Zou Yufeng recalled that the American Miles Electric Car Company discovered this battery at that time and hoped to cooperate on research and development for use in the automotive field.

In 2008, Miles and Lishen began to contact, and the joint venture company was established in 2009.

“At that time, the size of Tuan Ying Radio’s battery was about 2770, and it increased from 60 to 120 when used on a car, becoming 2770*120.” Zou Yufeng said, “The heightening was based on the bottom design, and there is still room in the space, in order to fully utilize the increase to 120.”Although the cooperation with Miles did not achieve the expected results, Lishen applied square batteries to Chinese vehicles.

(3) From Enlarging Cells to Optimizing Structure

BYD, CATL, and Lishen have all embarked on the road of optimizing cell size and structure in the development of the new energy vehicle industry.

In the view of Mr. Li, the marketing director of a certain battery company, under the pressure of the energy density requirements of China’s new energy vehicle subsidies, battery companies do not have time to iterate through the normal chemical material system development process of NCM111-NCM523-NCM622-NCM811. The best way is to optimize the structure.

For example, by increasing the height of the cell, since there is often wasted space in conventional battery design where the shoulder height of the cell is 91 and the height of the module is about 108 mm. On BEVs, more space can be left by simplifying the control board, and the height can be increased from 91 to 95, and then to 102, which is the general direction of the evolution of domestic cell design.

Another direction is to enlarge the windings in a cell, for example, increasing the windings from two to one, which can also increase the energy density.

An example of this is Ningde Times’ NCM811 battery for GAC AION.S in 2019, which has reached a size of 79 * 148 * 103, compared to the VDA size of 26.5 * 148 * 91. Ningde Times has expanded the height and thickness of the cell, especially the thickness, which has reached three times the thickness commonly used in the industry.

In contrast, in 2021, Samsung SDI’s battery for BMW was still 61.5 Ah and twice as thick.

Chinese companies have taken the lead in breaking free from the constraints of VDA size.

Following this line of thinking, in 2019, BYD launched the blade battery and Ningde Times introduced the CTP structure, both of which further enlarged the cell and simplified the module structure.

However, BYD and Ningde Times have similarities and differences.

Ningde Times has two development directions: one is to gradually increase the height and thickness of the cell, with a length starting from the VDA size of 100+; the other is to elongate the cell and make it thinner, such as the cell length of 250 made for NIO’s 100 kWh battery pack.

BYD’s approach is to insist on making the cell longer and thinner, with a start of 300+.

Mr. Song believes that BYD’s ability to produce such size of battery cells at that time is due to its independent capability in the vertical industrial chain. BYD’s self-developed equipment can support the production of such battery cells. Meanwhile, Contemporary Amperex Technology’s production equipment mainly relies on purchases from suppliers, and the ability of the suppliers’ equipment and CATL’s own consideration of utilizing old equipment have limited their ability to make bigger battery cells in one step.

Looking back at BYD’s manufacturing capabilities in the field of power batteries, we can see that its process is advanced, thanks to its ability to independently produce battery manufacturing equipment. Its precise manufacturing ability also comes from its mobile phone OEM business. After all, in the year before BYD’s acquisition of Qinchuan Motors in 2003, it first ventured into the mobile phone OEM business. Two out of every ten phones in the world use BYD’s electronic technology.

It has to be said that BYD’s vertical integration ability ensures its leading position in the industry.

Stepping onto the historical rhythm and being innovative, both BYD and CATL have led the direction of the entire industry with their constantly iterating square battery cells.

At this point, China’s square battery cells have already taken the lead in Europe.

Soft pack: difficult to make big

There is another direction for automotive power batteries, which is soft pack.

Soft pack batteries were first developed by Sony as early as 1990. In 1994, research on soft pack batteries began, and they were already applied to cars in 1998.

However, it is still Korean battery companies that have made soft pack batteries flourish. A prominent representative is LG Chem.

(1) LG Chem – Pioneer of soft pack batteries for cars

LG Chem was also a newcomer in the field of lithium-ion batteries. It began lithium battery research in 1995, produced the world’s first batch of PHEV soft pack battery cells LMO/NCM111 in 2010, and BEV soft pack battery cells in 2011.

In terms of battery shape, LG Chem also has three forms: circular, square, and soft pack. However, in the automotive field, LG Chem chose soft pack battery cells.

Soft pack battery cells are limited by aluminum-plastic films and can only be made wider and flatter.

In 2010, LG Chem successfully developed the first batch of PHEV soft pack battery cells and built a comprehensive manufacturing center in the United States. In 2011, it began to produce BEV soft pack battery cells.

LG Chem has a deep foundation in materials, and it has accumulated quite a wealth of knowledge in aluminum-plastic films. This may also be the reason it chose the soft pack path.

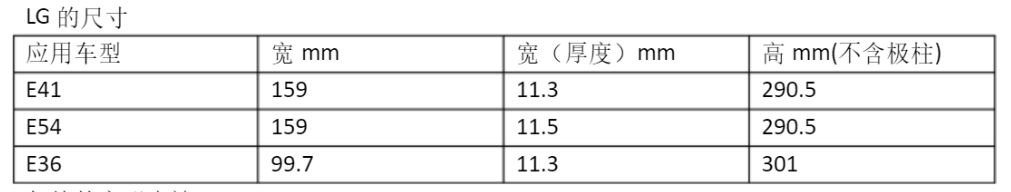

The mainstream sizes of LG battery cells are mainly 15911.3290.5, 15911.5290.5, and 99.711.3301, among others. However, in order to match the Volkswagen MEB platform’s 590 module, LG has also made elongated battery cells, with the longest side reaching nearly 550.

Representative enterprises of overseas soft pack batteries include SKI of Korea and AESC of Japan.

The advantage of the soft pack battery lies in its relatively flexible size, but it is difficult to get larger.

According to Mr. Li in the industry, there are only a few enterprises globally that can produce soft pack batteries well.

Due to the limitation of the aluminum-plastic film, it is difficult to break through the thickness of the soft pack cells, and the length is also greatly restricted by the production process.

A relevant person in a car company said that its inspection found that the length of soft pack cells had reached its limit at 500-600, and if it was longer, the production process would not be able to handle it, and the pass rate would drop significantly.

Mr. Li said that even LG can only make soft pack cells up to 600 in length.

(2) Slow Progress of Chinese Soft Pack Batteries Represented by Wanxiang

One of the early representative enterprises of soft pack batteries in China was Wanxiang 123.

In 1999, Wanxiang began researching and producing soft pack power batteries for vehicles, but the real breakthrough came after the acquisition of A123 in the United States.

In 2010, Wanxiang’s founder, Lu Guanqiu, first encountered A123 at the Shanghai World Expo, and was deeply impressed by its excellent product performance.

It is worth noting that by this time, Wanxiang Group had been in the automotive parts industry for over 30 years and in the field of power batteries for 10 years, investing a total of $1 billion in research and development, but its products were still far behind A123. Therefore, Lu Guanqiu would often lament that A123’s lithium battery and energy storage core technologies were the world’s leading at that time.

However, even a professional company like A123 would have to leave eventually.

In 2012, A123 had a large-scale recall incident and went bankrupt. Wanxiang took over A123. Subsequently, relying on A123’s lithium iron phosphate soft pack technology, Wanxiang 123 occupied over 50% of the global market share in the field of car low-voltage 48V.

Wanxiang’s route in the field of high-voltage car is the three-element soft pack. According to an insider close to Wanxiang 123, around 2010, Wanxiang’s soft pack cell size was relatively diversified, mainly based on customized cells for Chinese market customers. Due to the differences in the chassis of customers’ gasoline to electric vehicle conversion, the diversified size of the soft pack cells was fully utilized, which could quickly meet market demand.

Later, Wanxiang 123 made its 48V low-voltage the largest globally, and its 48V cell size of 160220 gradually became the mainstream, and has been used in many pure electric car models in China.With the widespread adoption of VDA355 module in 2015, Wanxiang’s battery length gradually became close to it and had a size of about 355100. In 2018, the 590 module became popular and Wanxiang also developed batteries suitable for it, with a size of about 590*100.

It was also acknowledged by the source that if the length of the battery cell exceeds 600, the balance between yield and cost cannot be achieved well, and continuous improvement is needed in battery cell design, processes, and equipment.

Mr. Li explained that since it is not easy to increase the capacity of soft pack batteries, they need to be connected in parallel when used in cars. This leads to the need for more heat dissipation and fixing brackets. Moreover, the soft pack battery itself lacks mechanical strength, and its advantages in high energy density are offset by the increasing number of attachments during grouping.

Funeng Technology and Jeev Power are also representative companies of Chinese soft pack batteries.

However, in the early days in China, there were almost no companies that could perfectly solve the production process and grouping problems of soft pack batteries, so power batteries were almost monopolized by square batteries.

Currently, LG’s soft pack batteries are mainly used by many auto manufacturers including GM, Honda, Ford, Daimler, Nissan Renault, Volvo, and so on. There are very few domestic enterprises that use soft pack batteries.

In Mr. Li’s view, the biggest advantage of soft pack batteries is their single-cell application, which is the best solution for mobile phones or laptops, but their advantages in vehicle applications are not obvious.

In the short term, the technology of soft pack batteries is a technology that is being ignored by most Chinese car companies. However, in the field of solid-state batteries in the future, whether it can regain vitality is worth looking forward to.

Will the size of the battery cells for automobiles become larger?

Looking back on the development of power batteries, it is easy to conclude that as the battery becomes more compatible with the vehicle, the size of the battery seems to be getting larger.

However, from a relatively microscopic time scale, automotive battery technology is still in a stage of diversified development, and it is difficult to say whether the current mainstream technology will remain dominant in the future.

For example, one of the current technological trends is the leap-forward development of the voltage platform, which has jumped from 400V to 800V. However, the overall power of the vehicle is developed step by step, with every 10 degrees of electricity being a step, and the growth of power has not kept pace with the growth of the voltage platform.The impact of this asynchrony is that in the current 800V platform, the increasing number of cells in series to some extent squeezes the space for cell volume growth. Therefore, there will be a certain stage in which the volume of cells will shrink.

Looking at the current level of technology, for the three-element system of passenger cars with a 400V system, it may be the maximum size for a NIO car with 100 kWh to have a 285Ah battery pack (250.366.72112);

for an 800V system, if a super-long endurance model of no more than 1,000 km is not pursued and calculated according to the maximum capacity of a single cell at 150 kWh, the corresponding maximum capacity of a single cell is around 200Ah, and the typical size of CATL’s cells is 54174201.

Overall, the development direction of the size of power battery cells is the result of mutual balance among technology, cost control, and manufacturing systems, among other factors. It is difficult to simply say that the development direction of cells is getting bigger or smaller.

However, what can be confirmed is that as automakers become more familiar with batteries and battery companies become more familiar with cars, there will be more cell sizes in the future that are better suited for use in cars through continuous adjustment and optimization.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.