Author | Tian Hui

Editor | Qiu Kaijun

“18 thousand, 18 liters of oil, fantastic driving experience.”

This used to be a joke among the owners of the Great Wall Wei brand VV7. However, with the launch of models using the Lemon Hybrid DHT technology, Great Wall will remove the “Oil Tiger” label.

On March 1, the Wei brand mid-size SUV model, Mocha DHT-PHEV, was launched at a price of 305,000 yuan. The vehicle’s fuel consumption is only 5.55 liters in a discharged state, demonstrating the impressive capabilities of the Lemon Hybrid DHT technology.

In addition, Great Wall will launch a new brand to promote Lemon Hybrid DHT cars.

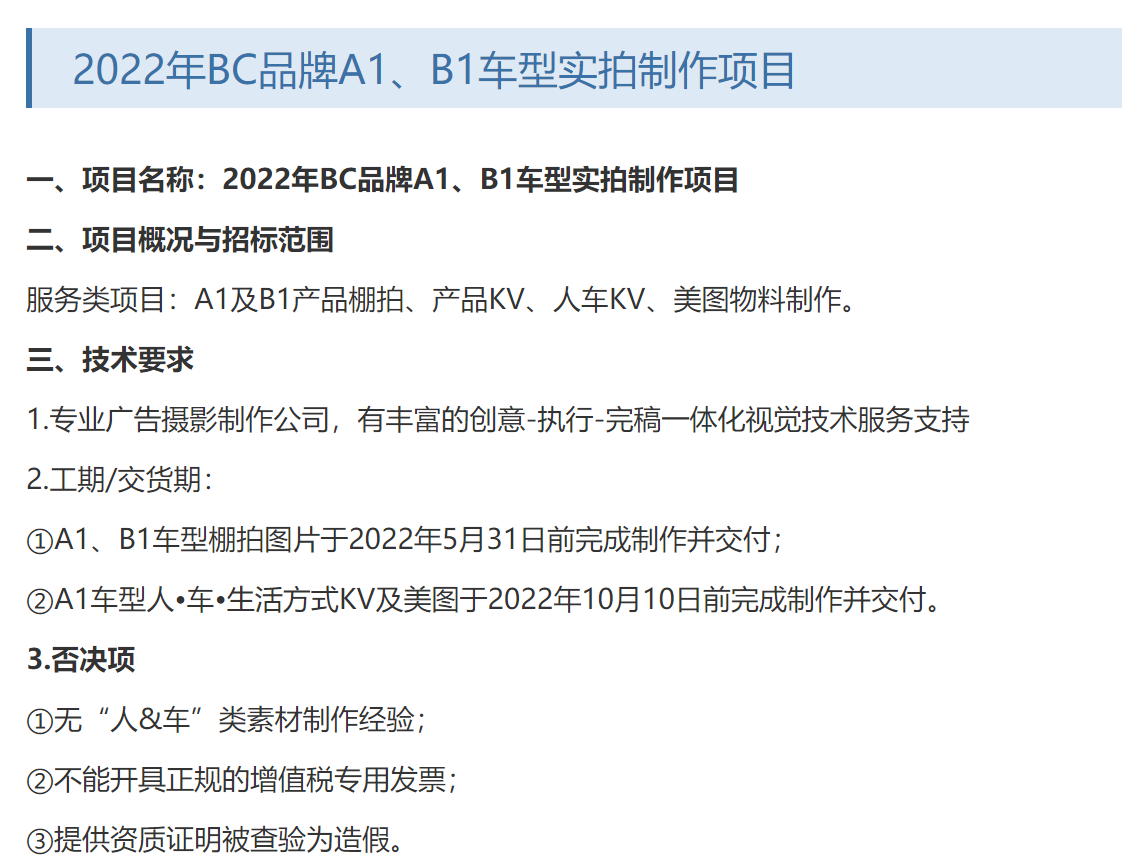

Furthermore, Great Wall’s new brand will start with sedans. The A1 and B1 models of BC brand, which are being tendered on the Great Wall Motors bidding website, will use the Lemon Hybrid DHT-PHEV powertrain. These sedan models, which have been absent from Great Wall Motors for a long time, will be launched with the Lemon Hybrid DHT-PHEV, a bold move by Great Wall in the hybrid game. However, BYD is even bolder, having already equipped all its models with DM-i super hybrid technology.

The Lemon Hybrid DHT technology, similar in structure to BYD’s DM-i technology, is a hybrid technology based on the DHT dual-motor scheme. Lemon Hybrid DHT has yet to make a big splash in the market, but DM-i has already proven to be in high demand in the market, helping BYD outsell SAIC Volkswagen every month.

So what are the differences between Great Wall and BYD’s PHEV strategies? Great Wall positions HEV and PHEV together, starting with high-end models, without rushing to push them out in full.

Under the pressure of double credit points, Great Wall will further electrify and launch a PHEV sedan brand soon.

In the process of electrification, Great Wall Motors emphasizes profit, while BYD pursues scale. When smart EVs are seeing considerable growth, Great Wall’s strategy seems to be relatively conservative.

In this article, you will learn:

-

Technical differences: Great Wall’s Lemon Hybrid DHT design tends towards oil, while BYD’s DM-i design tends toward electricity.

-

Strategic differences: Great Wall will push forward with HEV and PHEV together, starting with high-end models, but not hastily expanding fully.

-

Double credit point pressure is driving Great Wall towards further electrification, and a PHEV sedan brand is coming soon.

-

In the process of electrification, Great Wall Motors emphasizes profit, while BYD pursues scale.## DHT, DM-i: Different But Similar

Although Great Wall Motors calls its hybrid technology DHT, it is not unique to the company.

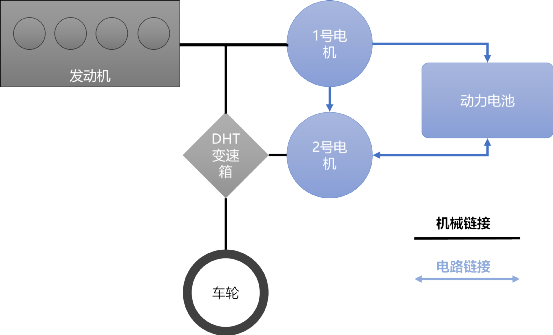

DHT, or Dedicated Hybrid Transmission, is a hybrid-specific gearbox.

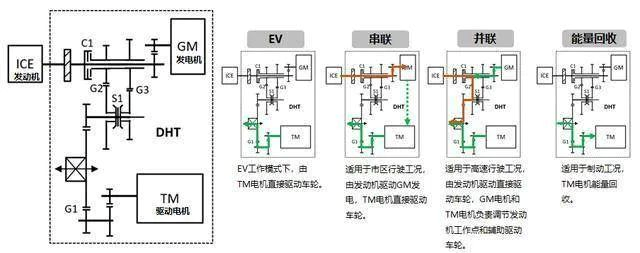

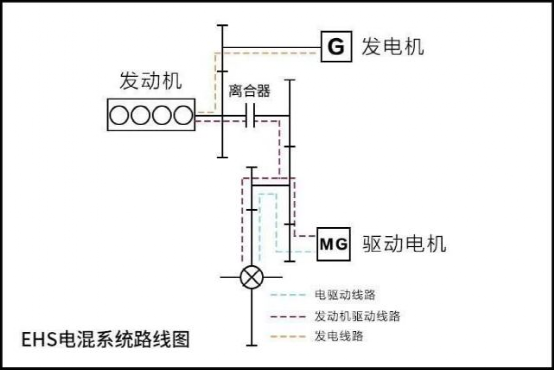

The DHT technology connects the engine to the first electric motor, which is responsible for generating electricity, while the second electric motor drives the vehicle. The transmission selects the power source based on the driving conditions.

The advantage of DHT technology is that it maximizes the efficiency of the gasoline engine and electric motor, achieving fuel efficiency while allowing the vehicle to be driven either by gasoline or electricity.

Compared to Toyota’s hybrid technology, DHT can compete in both technical and commercial aspects. In terms of driving performance, DHT relies more on electric drive, while Toyota’s hybrid technology mainly relies on gasoline engine drive. Therefore, the acceleration of DHT is faster and more direct, with a driving experience close to that of a pure electric vehicle. For example, the acceleration time of an A-class vehicle with DHT can be less than 5 seconds from 0 to 100km/h, faster than Toyota’s hybrid technology.

In terms of fuel economy, DHT hybrid technology can reduce the B-mode fuel consumption of an A-class SUV model to less than 5L/100km, which is similar to that of Toyota’s hybrid technology.

In terms of commercial factors, DHT technology requires only two electric motors and can be equipped with a variety of power batteries, including small-capacity battery packs and lithium iron phosphate battery packs. Although the cost is higher than that of Toyota’s hybrid technology, it is not significantly higher.

Therefore, DHT is almost the best choice for various automakers. Especially, the core patent of DHT technology belongs to the American company, Paice, and has expired in 2019. If adopting Toyota’s power split hybrid technology, many of Toyota’s patents will be difficult to circumvent. Therefore, many automakers have adopted DHT technology.However, all DHTs are different. The Changan Leimeng Hybrid DHT and the BYD DM-i are the representative solutions.

The basic structure of the Changan Leimeng Hybrid DHT is similar to that of the BYD DM-i. The internal combustion engine has two options: 1.5L and 1.5T. Multiple modules are highly integrated to support parallel, series, and mixed hybrid modes.

From a technical perspective, the Changan Leimeng DHT technology is more complex, supporting 2-speed variable transmission function, while the BYD DM-i has a simple structure as a single-gear structure.

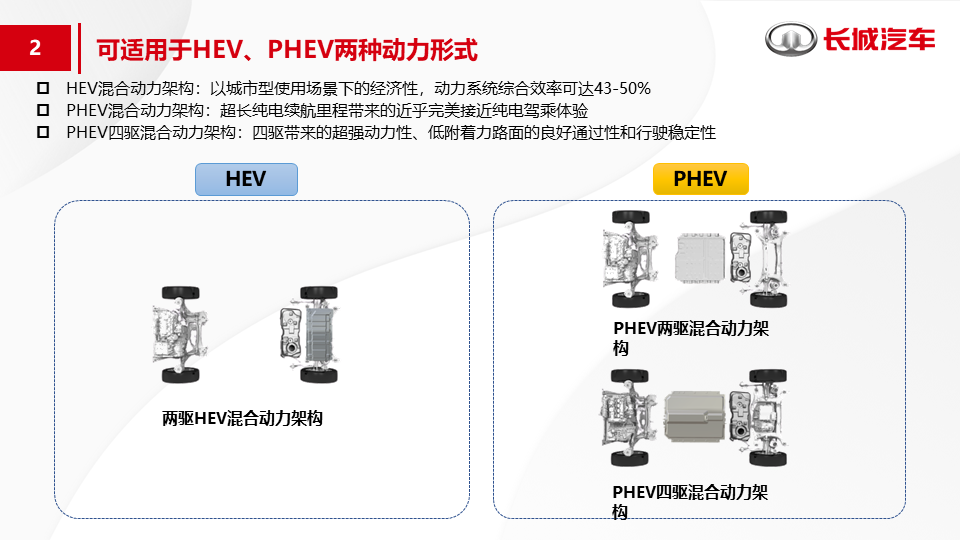

The Changan Leimeng Hybrid DHT technology consists of a gasoline engine, GM/TM dual motors, and DHT power assembly. The hardware structure adopts a seven-in-one structure, and all components are integrated into one. The Leimeng Hybrid DHT technology covers both HEV and PHEV, and the driving mode is divided into 2WD HEV, 2WD PHEV, and 4WD PHEV.

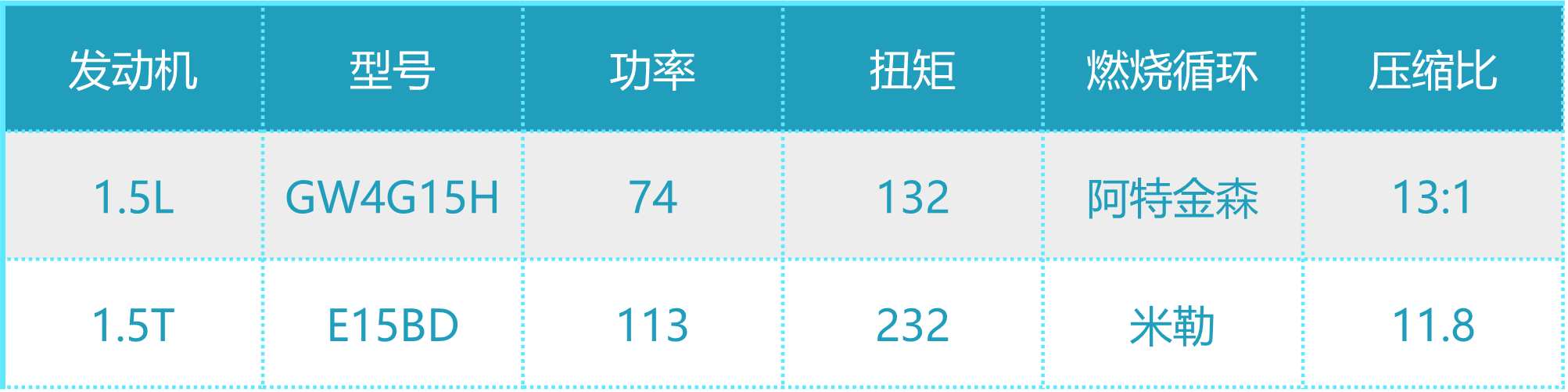

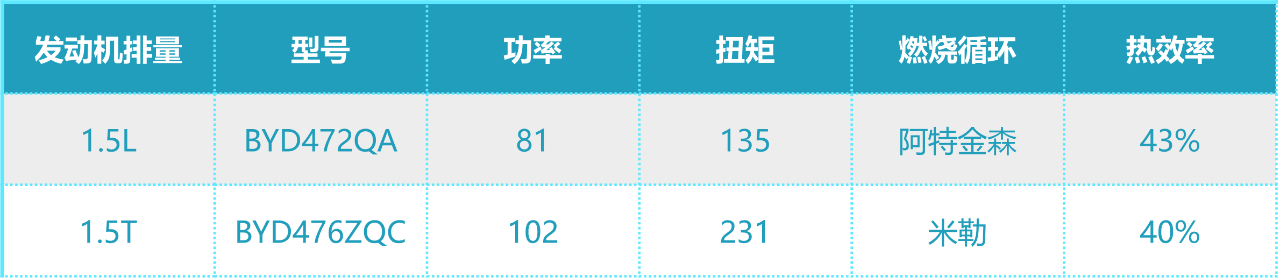

For the selection of gasoline engines, a 1.5L (1499ml) naturally aspirated engine or a 1.5T turbocharged engine can be chosen. The 1.5L naturally aspirated engine uses the Atkinson cycle and increases the compression ratio to 13:1. Combined with low-pressure EGR, electronic water pump, and other technologies, the engine power is 74 kW, and the torque is 132 N.m. The 1.5T turbocharged engine uses the Miller cycle with a compression ratio of 11.8, and the engine power is 113 kW, and the torque is 232 N.m.

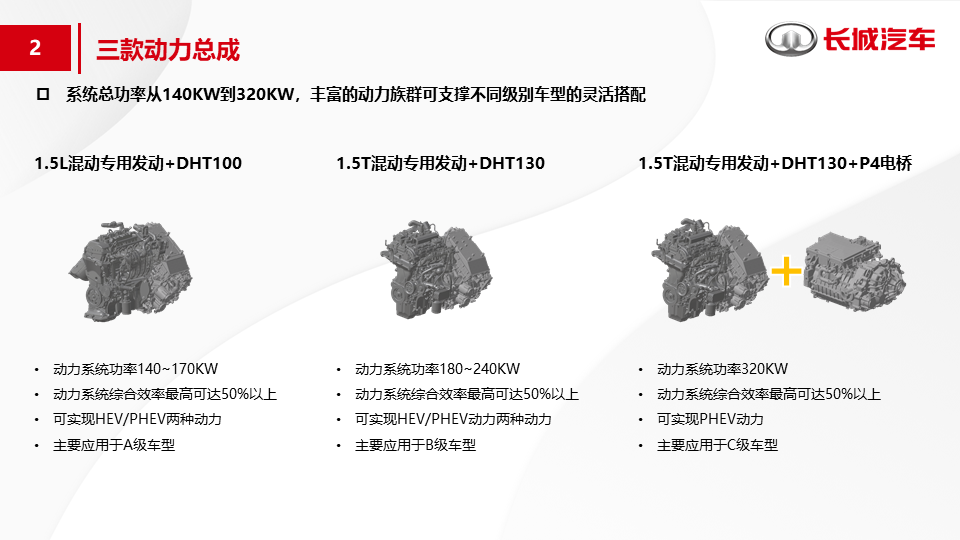

When different power gasoline engines and electric motors are combined, the Leimeng Hybrid DHT is subdivided into three versions of power units: 2WD 1.5L+DHT100 and 1.5T+DHT130, and 4WD 1.5T+DHT130+P4. Among them, the 2WD power unit can realize both HEV and PHEV, while the 4WD version can only achieve PHEV.

The Leimeng Hybrid DHT adopts a two-speed design to guarantee the operating efficiency of the gasoline engine for HEV models. The effect is two-fold: reducing the energy consumption of HEV models and shrinking the displacement of the gasoline engine to below 1.5L, which reduces consumption tax.The minimum basic displacement of Toyota HEV models’ gasoline engines is 1.8L, which has a 2% higher tax rate than models with a displacement below 1.5L. Hardware-wise, the Lemon hybrid DHT achieves a two-speed structure by adding a gearshift fork inside the gearbox. In simple terms, Great Wall added a dual-clutch AMT gearbox inside the DHT gearbox.

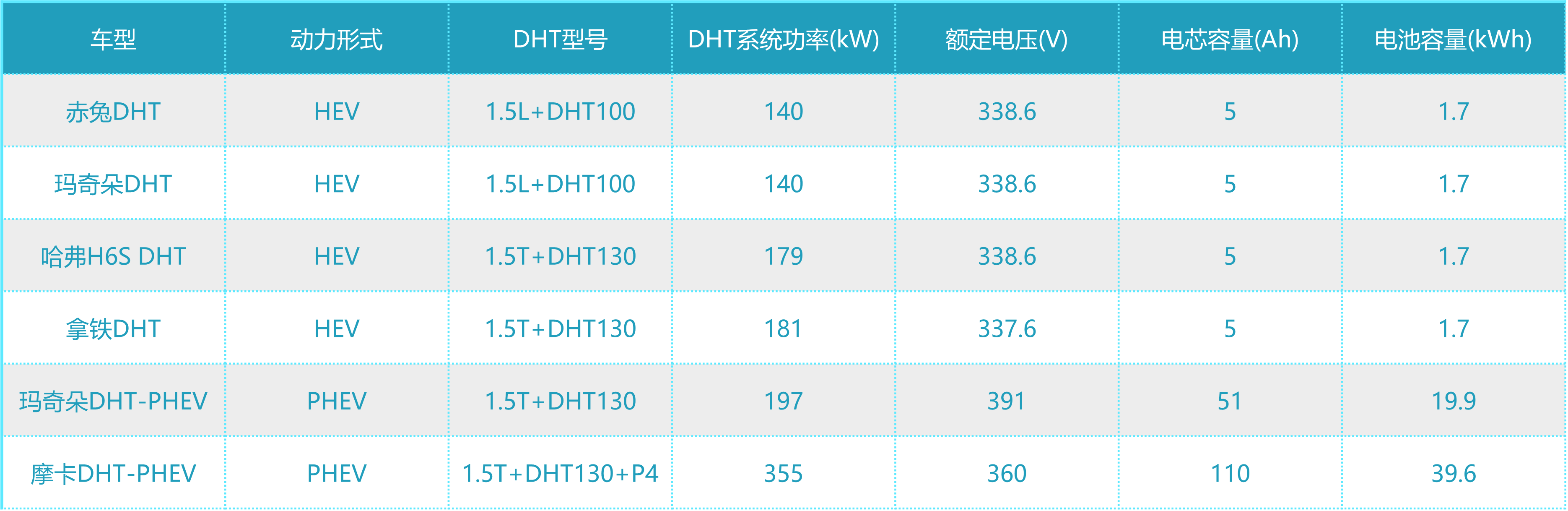

In terms of batteries, the Lemon hybrid DHT technology uses a CTP structured battery pack, which theoretically supports power batteries with various materials, but models on sale all use ternary lithium-ion batteries. The capacity of the power battery pack ranges from 1.7kWh to 45kWh depending on the powertrain, with a maximum pure electric range of over 200km.

Currently, all three Lemon DHT powertrains from Great Wall have achieved mass production, including 4 HEV models, each equipped with 1.5L+DHT100 and 1.5T+DHT130 powertrains, and 2 PHEV models, including 1.5T+DHT130 two-wheel drive version and 1.5T+DHT130+P4 four-wheel drive version.

How does the BYD DM-i hybrid differ?

BYD’s DM-i Super Hybrid technology was designed with a focus on PHEV models. In terms of engine selection, there are two options: a 1.5L naturally aspirated engine and a 1.5T turbocharged engine.

BYD refers to the DM-i technology’s DHT gearbox as the EHS electric drive system, which works similarly to the Lemon hybrid DHT in terms of operating mode but does not have a gear-shifting function and only has one gear. However, thanks to the DM-i’s focus on PHEV models, the power battery pack has a larger capacity and can regulate the efficiency of the gasoline engine through its power generator, eliminating the need for a dual-clutch design like the Lemon hybrid DHT.

According to different choices of gasoline engine and electric motor, BYD DM-i’s electric driving system can be composed of three powertrains: EHS132, EHS145, and EHS160. The BYD DM-i technology can also achieve four-wheel drive by adding a rear motor.

According to different choices of gasoline engine and electric motor, BYD DM-i’s electric driving system can be composed of three powertrains: EHS132, EHS145, and EHS160. The BYD DM-i technology can also achieve four-wheel drive by adding a rear motor.

On the selection of power batteries, the battery used in BYD DM-i is a self-developed power-type blade battery technology, using lithium iron phosphate battery material.

Overall, the system structure of Great Wall Lemon Hybrid DHT is similar to that of BYD DM-i, but with different design goals, thus both sides have their own trade-offs in specific technical details. Both technologies have outstanding performances in energy saving.

Generally speaking, Great Wall Lemon Hybrid DHT tends to favor gas while BYD DM-i tends to favor electricity.

On the commercial route selection, Great Wall Lemon Hybrid DHT chooses the route of HEV and PHEV, while BYD is more radical, and all DM-i models are PHEV.

HEV and PHEV parallel development is the choice of most carmakers. Honda i-MMD also takes this technology route. BYD DM-i’s choice of PHEV is niche.

The reason why BYD models are all PHEV is threefold. At the market level, BYD has no burden of fuel vehicles, and PHEV models can enjoy various policy incentives such as subsidies, tax exemption, no restriction on driving, and no restriction on purchase, making the cost-effectiveness of PHEV models outstanding. At the technical level, BYD DM-i has accumulated advantages in PHEV technology, and technologies such as blade batteries have been verified in their pure electric vehicle models. At the supply chain level, it is BYD’s biggest advantage. BYD Automotive has the support of the BYD supply chain, and power batteries, chips, and so on can be allocated internally within the group, without external procurement, and has a unique advantage in supply volume and supply guarantee.

Great Wall’s HEV and PHEV parallel development plan also has its own advantages. Great Wall’s fuel vehicles have formed a scale effect and have a very large customer base for upgrading and replacing fuel vehicles. Although PHEV and HEV can bring performance advantages, the purchase cost has risen, so Great Wall has chosen to start applying Lemon Hybrid DHT technology to high-end models.# Wei brand is the pioneer of the Great Wall Motor Lemon Hybrid. Currently, among the three models marketed by Wei brand, except for the Mocha model that still has fuel vehicles for sale, the other models have all been fully hybridized, and different models have verified the market acceptance of HEV and PHEV. In the 180,000 to 200,000 yuan price range for buying a car, the three models of Wei brand, Latte HEV, Macchiato PHEV, and Mocha fuel cars are competing with each other.

This strategy of Great Wall Motor is also related to its hybrid supply chain and cost control capabilities.

In terms of power batteries, FCEV which belongs to the Great Wall Group is the core supplier of Lemon Hybrid DHT models. However, the power battery of FCEV is still in the early stages where it cannot meet the scale of the group’s full conversion to hybridization for all models.

Currently, many HEVs such as Macchiato HEV and Haval H6S indicate on the MIIT announcement that FCEV is responsible only for the power battery package, not the supplier of the battery cell. Ningde Times, BYD, and Jiewei Power are all battery cell suppliers of Lemon Hybrid DHT.

The limited supply chain of Lemon Hybrid DHT from Great Wall Motor is evidenced by the installed capacity. It must not be forgotten that both Lemon Hybrid DHT and DM-i were new technologies launched in the fourth quarter of 2020, but it was not until the summer of 2021 that the first Lemon Hybrid DHT model was launched, when the monthly sales of BYD DM-i models had already exceeded 20,000 and continued to grow.

The rhythm of Great Wall Motor’s push for the new Lemon Hybrid DHT was clearly intentionally slowed down. Looking back at the timeline, it can be found that in the first half of 2021, Great Wall Motor was plagued by a shortage of chips, and many models were temporarily shut down. Therefore, the push of hybrid cars, which require a large number of chips, was slowed down until the industrial chain companies achieve scale, and then they can fully switch to hybridization or even electrification.

If the time span is extended, FCEV, invested and established by Great Wall in recent years, as well as Hao Mo Zhi Xing, an industry chain company, have gradually entered the right track. Although there is still a huge gap from Fudi Power, which was split from BYD, the overall direction has already been verified by BYD. Great Wall Motor is currently keeping its base of fuel cars while making hybrid cars. After the industrial chain companies achieve scale, it can fully switch to hybridization or even electrification.

BYD only makes PHEVs because the butt of DM-i is sitting at the top of the entire new energy vehicle industry chain, and it is comfortable no matter how it sits. However, the butt of Lemon Hybrid DHT from Great Wall Motor is still in the process of moving from a fuel car to new energy vehicles.## The Hybrid Game for Great Wall Motors

In the summer of 2021, Great Wall Motors held a strategic conference in Baoding to announce its full-line hybrid transformation and set a target of achieving 80% sales of new energy vehicles by 2025, which is not easy for the company covering pickup trucks, commercial vehicles, and SUVs as the main product.

The overall shift to hybrids is a clear strategic direction, but Great Wall Motors has its own considerations on how to control the pace of transformation.

BYD’s strategy of converting fuel vehicles to PHEVs has been successful in stages, but Great Wall Motors cannot and should not copy BYD’s tactics. From the perspectives of industry policies, market demand and business routes, there are difficulties as well as opportunities for Great Wall Motors’ full-line hybrid transformation.

On the industry level, dual credits policy forces Great Wall Motors to accelerate its transformation, especially when the production capacity of Euler brand is limited by the chip shortage, which puts more pressure on positive new energy credits of Great Wall Motors.

According to the dual credits data released by the Ministry of Industry and Information Technology in 2020, the energy consumption credits of Great Wall Motors in 2020 were -368977 points, but the positive new energy credits were only 191183 points, indicating that there was a large gap in credits. In 2021, Euler’s brand sold 135,000 vehicles, while the combined sales of fuel vehicle brands Haval, Weyp, and Tank were 513,000 vehicles. Although the positive new energy credits will increase due to the rise in Euler’s brand sales, the Tank brand’s sales of nearly 100,000 off-road vehicles are doomed to have poor performance in energy consumption credits.

If the negative energy consumption credits and positive new energy credits cannot offset each other in 2022, Great Wall Motors will bear huge costs under the dual credits policy.

On the market level, Great Wall Motors has a very good market opportunity. Consumers have been educated by car manufacturers such as BYD and Wey Xingrong, and are beginning to accept the trend of electrifying cars. With a huge existing user base, Great Wall Motors only needs to meet the demands of consumer replacement and upgrading to take on a large number of existing customers, reducing marketing costs.

The most difficult part is still the choice of the business route. After the HEV and PHEV models of models under Haval and Weyp completed market demand testing, the decision-makers of Great Wall Motors must make a choice on what kind of approach to take in accelerating the transformation. Combining the process of recent new brands such as Euler, Tank, and Salon entering niche markets, creating a new car brand based entirely on hybrid technology is Great Wall Motors’ first choice.

At the 2021 strategic conference, Great Wall Motors announced the launch of a brand new sedan brand in September of the same year, built on the Lemon Hybrid DHT platform and mainly producing PHEV plug-in hybrid models.

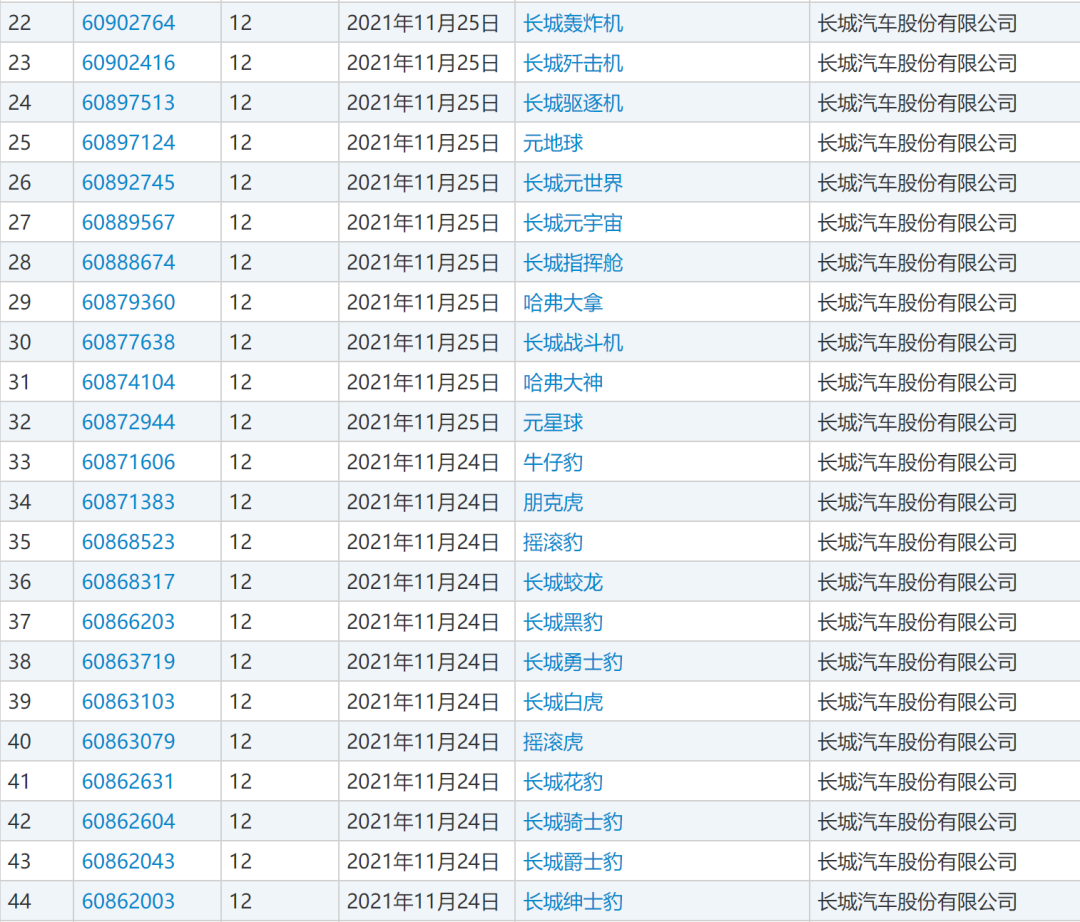

From the official website of the State Intellectual Property Office’s Trademark Bureau, we can find trademarks related to Great Wall, including feline animals and aircraft, which may be used to name this new PHEV car brand.

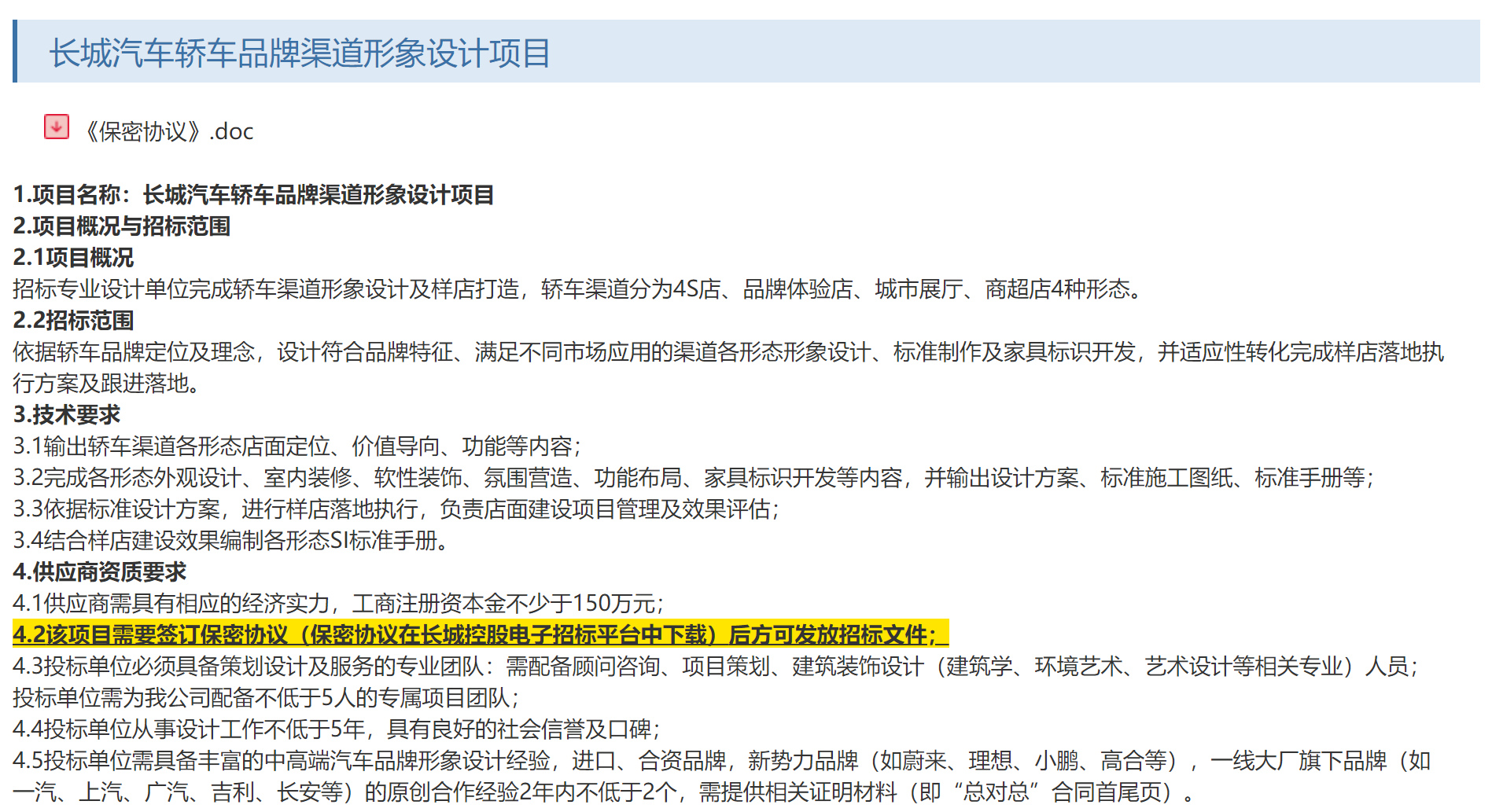

In terms of product types, in September 2020 at the Beijing Auto Show, Great Wall Motors showcased a concept car named “Chao Pai”. At the end of 2021, Great Wall Motors also launched a tender for a new passenger car brand channel image design project.

In March of this year, Great Wall Motors posted a tender notice on its official website, inviting tenders for real-life shots and CG visual materials of the BC brand A1 and B1 models.

Considering various pieces of information, it is expected that Great Wall Motors will launch a new PHEV passenger car brand named after a “leopard” or “aircraft”. The first product will have two versions, one of which might be the production version of the “Chao Pai” concept car showcased at the Beijing Auto Show. The marketing channels include 4S stores, experience stores, city showrooms, and supermarkets.

Based on the technical advantages of Ningmeng Hybrid DHT, it is expected that the new model of Great Wall Motors’ new brand will have excellent performance. Considering the market situation, the Beijing Auto Show is a good timing for the debut of a new brand and new models. In terms of brand positioning, the first model of the new brand will undoubtedly maintain a high-end positioning to enhance the brand effect, but the overall positioning of the brand will remain between RMB 150,000 to 400,000, and it will not rashly enter the high-end car market.

In terms of production capacity, Great Wall Motors’ own production capacity is sufficient to meet the needs of a new brand. In terms of the supply chain, Great Wall Motors has two choices for power batteries: Fecory Energy and Dayu Battery. However, chip supply is more difficult. From the previous situation, Great Wall Motors’ control over the chip industry chain is not strong and easily affected by chip shortages.

Profit for Great Wall and Scale for BYD: Who Will Have the Last Laugh?

In 2022, BYD and Great Wall Motors are traveling on two different paths.

BYD is expanding production madly and is expected to sell around 1.5 million new energy vehicles in 2022, of which most will be PHEV models based on DM-i technology. This will affect all fuel vehicle companies, especially domestically produced independent fuel vehicle brands. Moreover, BYD has already made it clear that it will control the gross profit of the whole vehicle and battery and emphasize scale.

Great Wall Motors is making choices. In terms of hybrid power, HEV and PHEV will develop simultaneously, Wei and high-end passenger cars will focus on promoting PHEV. In terms of pure electric power, Ora abandons entry-level models and focuses on mid-to-high-end models, and Salon will also take the high-end route.## Which strategy is better?

The gasoline car market has entered a mature or even declining stage. Leading companies like Great Wall have high profits and market share, but they must face a declining demand curve. Great Wall, which is already “specialized, new, and unique,” may become even more “specialized, new, and unique.”

For emerging technology products like smart electric vehicles, the conventional strategy is to first seek scale to form a large market share and maintain technological leadership, and then reap high profits later.

In terms of future planning, BYD is undoubtedly ahead in electrification, while Great Wall is more advanced in intelligence. Both sides need to continue to invest and establish research and development, supply, production, and operational capabilities to compete with strong competitors such as Tesla.

Currently, the gross profit of automobile sales and the assistance of the capital market allow companies to have sufficient ammunition for continuous expansion. The current market for smart electric vehicles is rapidly breaking through, and Great Wall’s strategy seems somewhat conservative.

Do you want to have now or have in the future? You can’t have both at the same time.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.