Author: Zhu Yulong

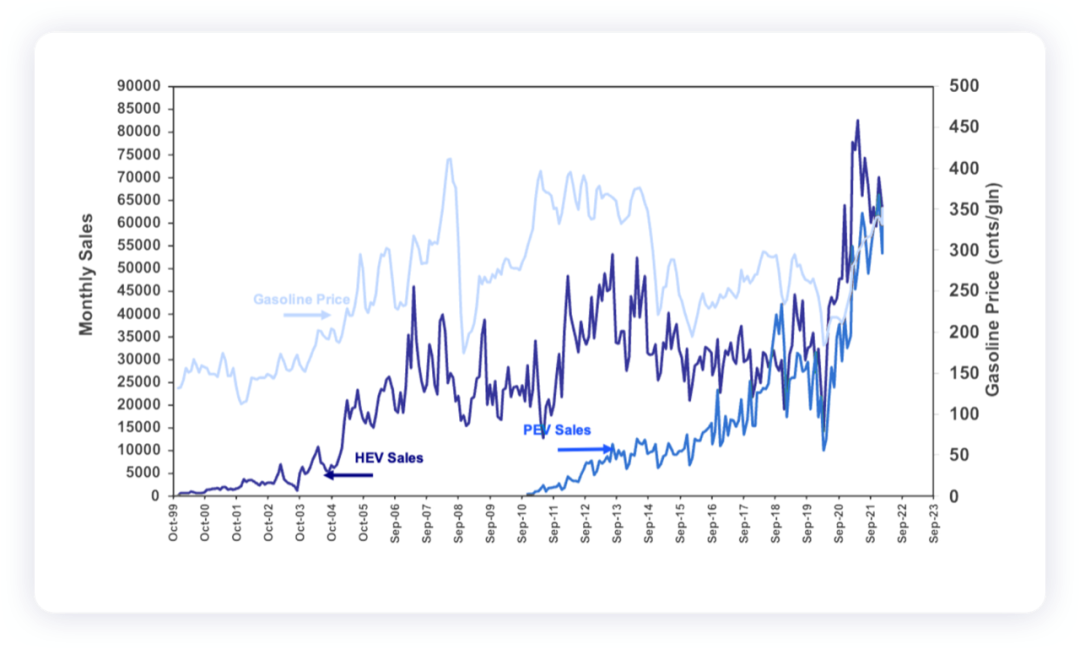

The market data for new energy vehicles in the United States is also out. Below is a monthly summary by Argonne National Laboratory:

-

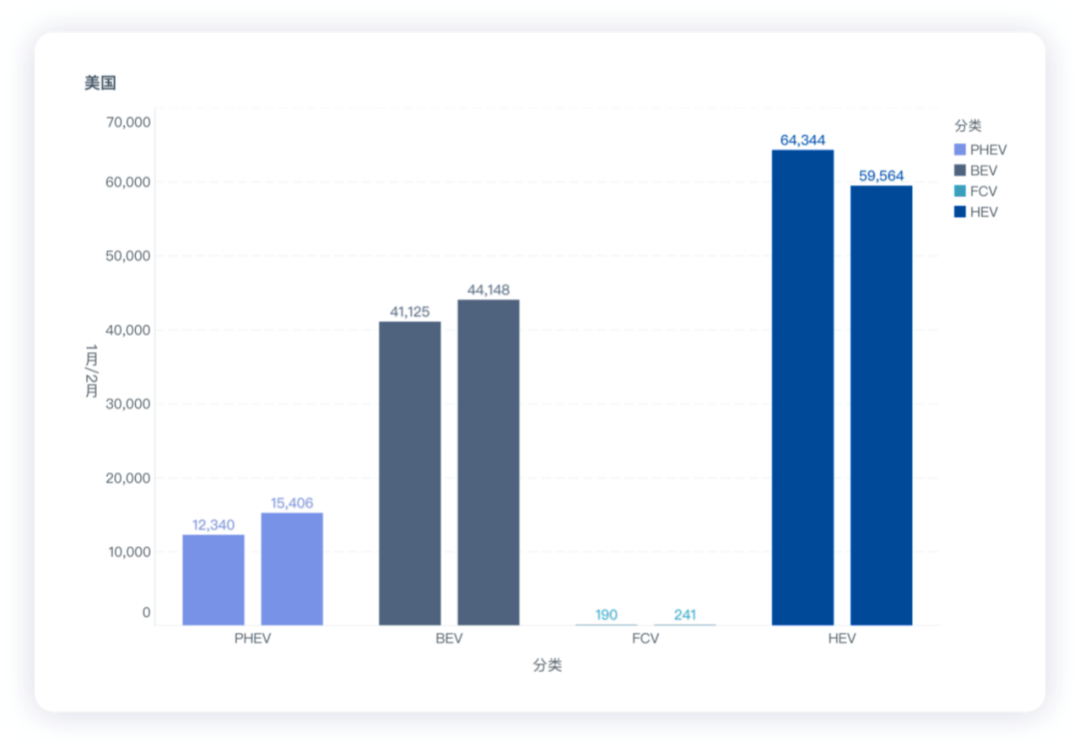

In February, a total of 59,554 new energy vehicles were sold in the U.S. market (44,148 BEVs and 15,406 PHEVs), a year-on-year increase of 68.9%. The penetration rate of new energy vehicles (LDV) was 5.66%.

-

In February, a total of 59,564 HEVs were sold in the U.S. market (15,763 cars and 43,801 LTs), a year-on-year increase of 10.2%. Fuel cell enterprises sold a total of 241 FCEVs last month (a cumulative total of 431 units in 2022).

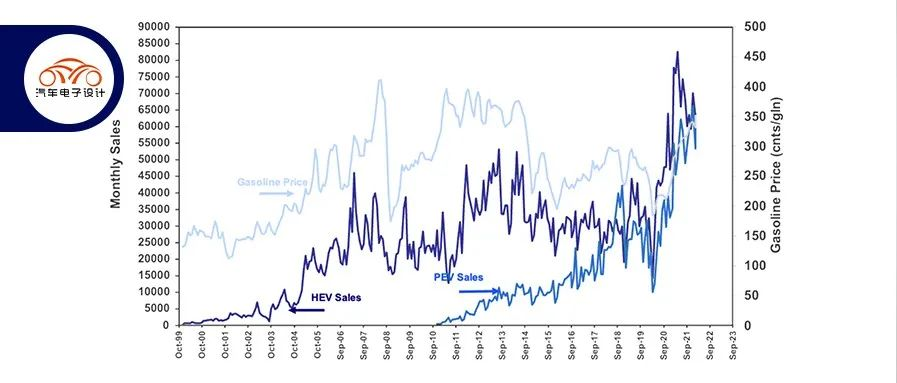

From the overall data, in 2022, the United States has sold 112,829 units, and the demand growth in this area in the United States is relatively obvious as oil prices rise.

The situation of the U.S. market

- The situation with new energy vehicles

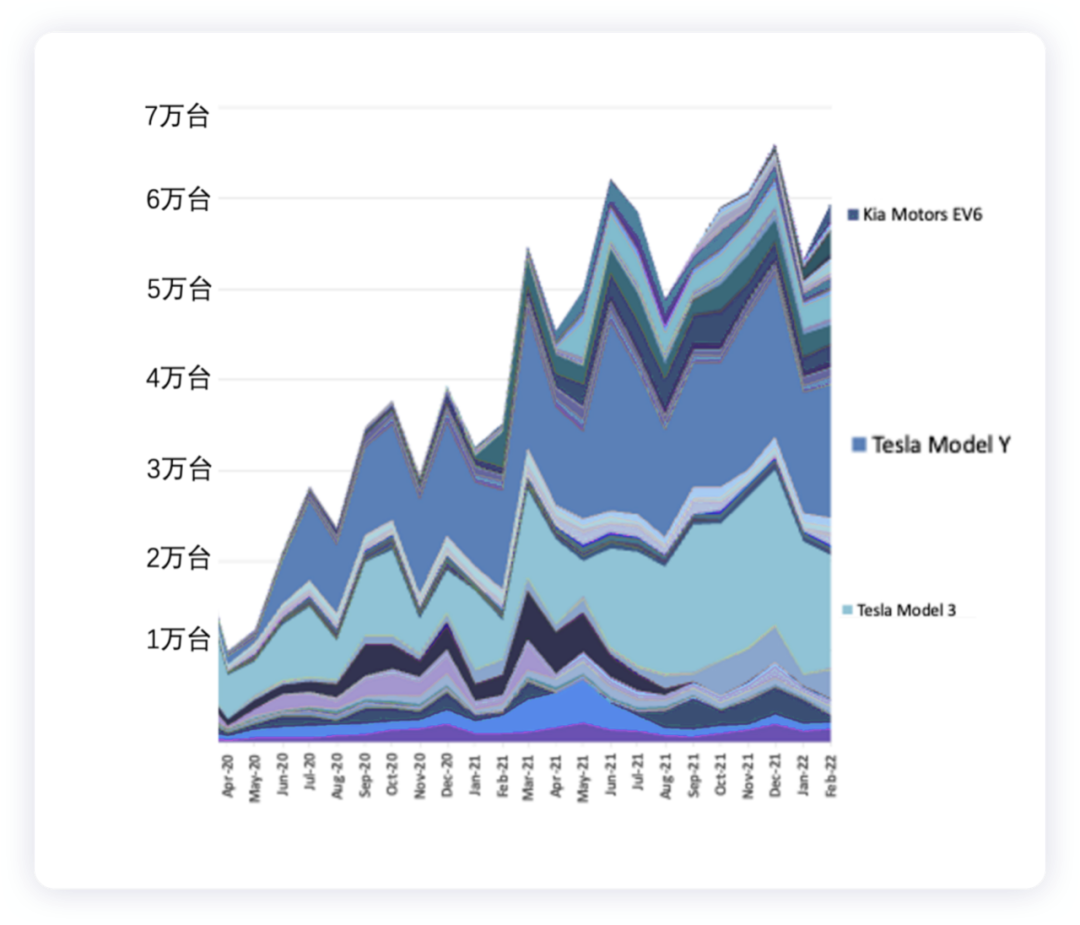

In February, the number of new energy vehicles in the United States was nearly 60,000 units, an increase of about 6,000 units compared to January’s 53,400 units. In terms of actual sales, the Model 3 and Model Y dominate the new energy vehicle market, with both models selling around 25,000 units in a typical month.

Tesla Model Y: 18,500 units in January and 21,000 units in February.

Tesla Model 3: 13,600 units in January and 11,000 units in February.

Ford Mustang: 2,370 units of the Mach-E in January and 2,001 units in February.

- The situation with hybrid vehicles

In February, a total of 59,564 hybrid vehicles were sold (15,763 cars and 43,801 LTs), a year-on-year increase of 10.2%, but the growth rate is slowing down. Toyota is still the major producer of hybrid cars, accounting for 63.7% of total hybrid vehicle sales.

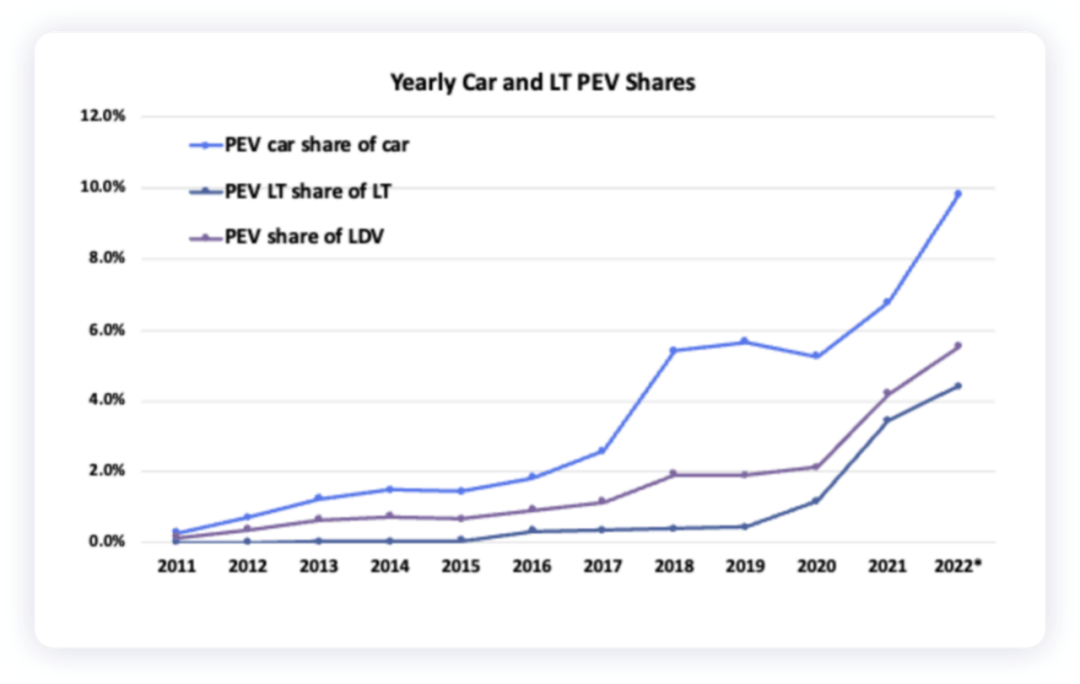

- Penetration rate of new energy vehicles

In terms of new energy vehicles, sedan penetration is the highest in the United States, while LT and LDV sales are slower. It will take a significant increase in the delivery of electric pickup trucks to see large growth in this area.

Currently, with high oil prices in the United States, sales of new energy vehicles and hybrid vehicles are continuously climbing. This is also a historical opportunity under specific oil and gas time conditions, and the United States’ subsidy policy has not yet begun.

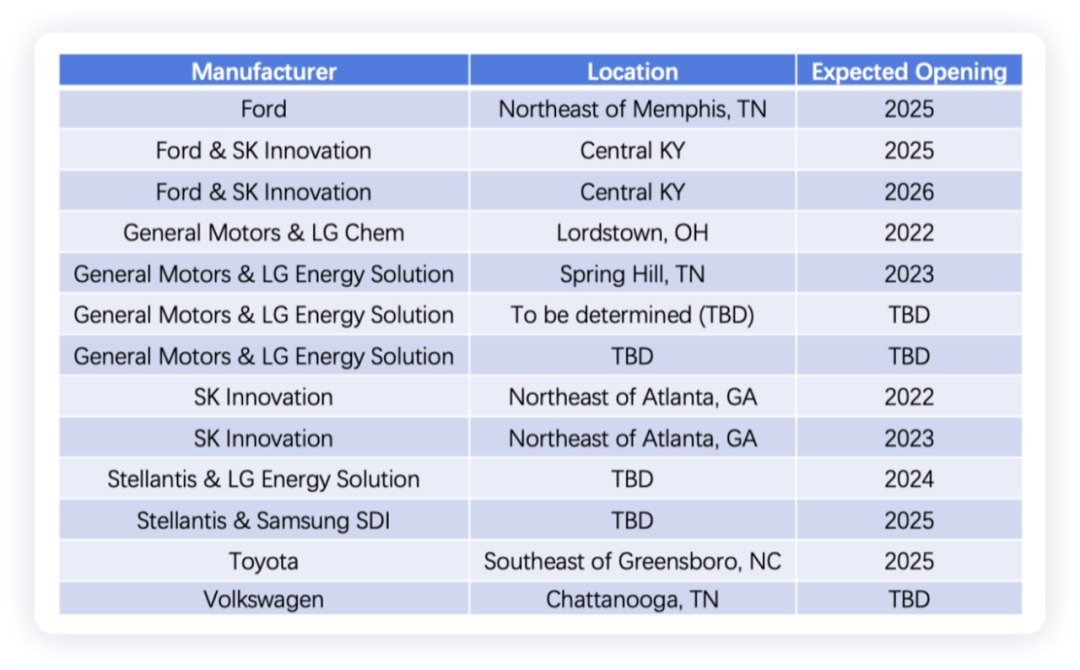

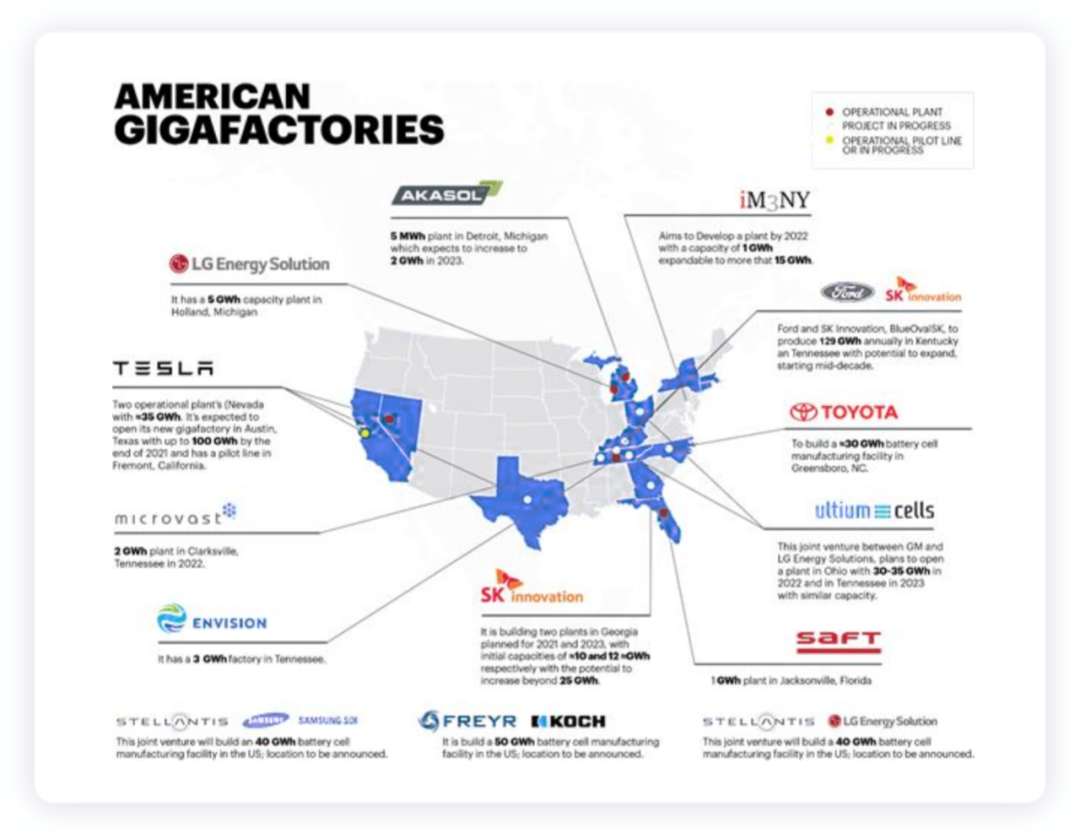

Battery production plan in the United States

In this wave of auto sales in the United States, the contribution of traditional US automakers is relatively small. With Ford, GM, Stellantis, Toyota, and Volkswagen all setting up battery factories in the United States, this part of the increment is continuous and certain. The current expansion of pure electric vehicles is mainly reflected in Tesla’s super factories.

In addition to investments from other companies in the United States, the local battery production capacity in the United States will also have a steep growth curve in the future.

Currently, Rivian in the United States has also announced the use of LFP batteries, and Lucid also needs a large amount of batteries to support the deliveries of the two highly valued US startups in 2022-2023. In fact, there are not many battery companies that can truly deliver large quantities of batteries both domestically and abroad. It can be understood that the United States also lacks continuous high-quality power battery supply.

In summary, tracking the development of new energy vehicles and power battery capacity expansion in the United States has strong comparability with China. Due to the inaction of the Trump administration in the new energy market, the United States has lost its leading position in terms of the volume of electric vehicles (except for Tesla).

In the era of smart cars, with the entry of Amazon and Apple, the competition between China and the United States in the field of smart cars will become more intense.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.