WM Motor posted from Copilot Temple

Intelligent Car Reference | WeChat official account AI4Auto

In February, with fewer days and the Chinese New Year holiday, the “winter period” of annual sales for the auto market puts auto manufacturers’ production and delivery capacity to the test. And under this test, the Matthew effect was more apparent in February, with the strong getting stronger and the weak getting weaker.

According to the latest domestic sales data released by the China Association of Automobile Manufacturers, traditional powerhouses such as BYD and Tesla led the market in sales growth.

However, domestic new energy vehicle manufacturers, in contrast, faced challenges in February after a period of rapid growth.

The Real Winners of the Winter Season: BYD and Tesla

BYD and Tesla were the biggest winners in the “winter” of February.

According to the China Association of Automobile Manufacturers’ data, BYD sold 87,473 cars in February, an increase of 764.1% compared to the same period last year, but a decrease of 8.1% from the previous month.

Of these, BYD sold 44,300 hybrid models and 43,173 pure electric models.

BYD was able to withstand sales pressure thanks to its self-developed super hybrid system DM-i and vast new energy product matrix. According to the data, the model with the highest growth rate in February was the BYD Tang equipped with DM-i, which increased by over 10 times compared to the same period last year, with the entire BYD Tang family selling 10,426 cars in February. In addition, the Qin PLUS DM-i also became BYD’s key model, with the Qin family selling 24,503 cars in February.

On the other hand, BYD’s pure electric models are also becoming the company’s main sales support. In February, sales of pure electric vehicles reached 43,173 units, accounting for almost half of the overall new energy vehicle sales.

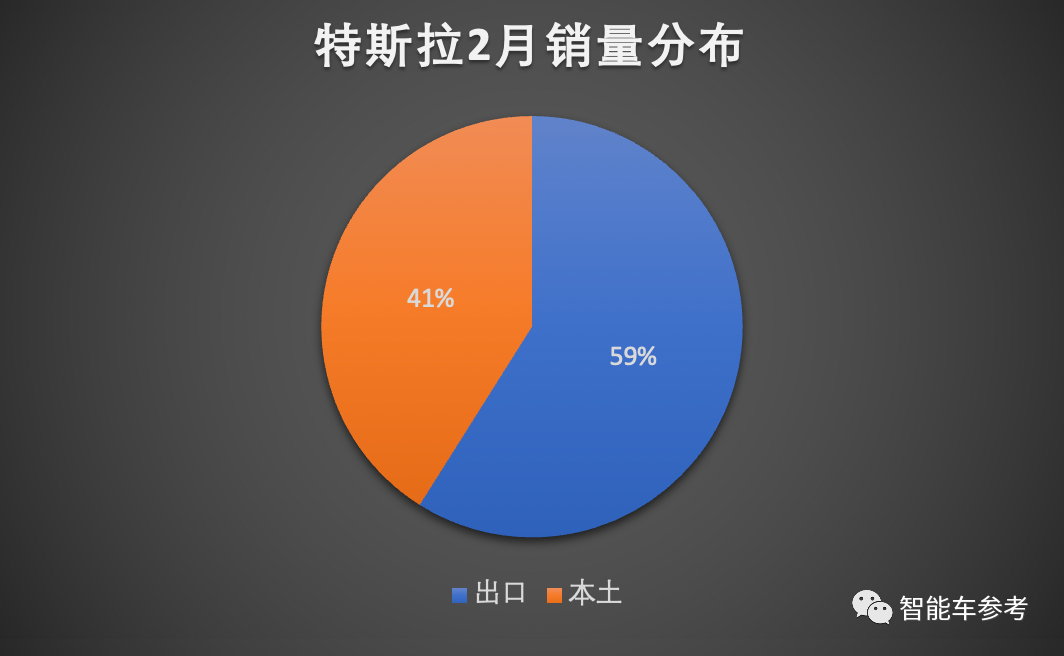

Unlike BYD, Tesla, another strong player, relied mainly on exports in February. Tesla sold 56,515 cars in China in February, up 208.5% from the same period last year but down 5.6% from January. Of these, 33,315 Tesla cars produced in China were exported abroad, while 23,200 were sold domestically in February. This means that Tesla’s sales in China in February are mainly from overseas markets.

In fact, after entering 2022, Tesla China has relied mainly on exports and local sales as secondary. In January, for example, Tesla sold 59,845 cars in China, 40,499 of which were exported while 19,346 were sold domestically.

This situation is due partially to the increased production capacity at Tesla’s Shanghai factory, which has become one of Tesla’s major export centers, and also due to Tesla’s delivery strategy:

Tesla produced in Shanghai mainly for exports in the first half of the quarter, and mainly for local markets in the second half.

However, at present, there is still pressure on the delivery of Tesla’s local market due to production capacity constraints. It has been reported that the estimated delivery cycle for Model 3 and Model Y is as long as 4-5 months.

Therefore, Tesla is currently considering building its second factory in China. Recently, it was rumored that nine cities, including Shenyang, Qingdao and Jinan, are candidate cities for Tesla’s second factory.

Tough February for China’s Domestic New Forces?

Compared with Tesla and BYD, China’s domestic new carmakers in February had a tough time. The sales volume of the first-tier new forces did not reach ten thousand, and the growth rate lagged far behind the market.

Specifically, there were two trends in the new forces:

One is the rank reshuffle.

The other is that both year-on-year and month-on-month growth rates have dropped significantly.

Let’s take a closer look at the rankings.

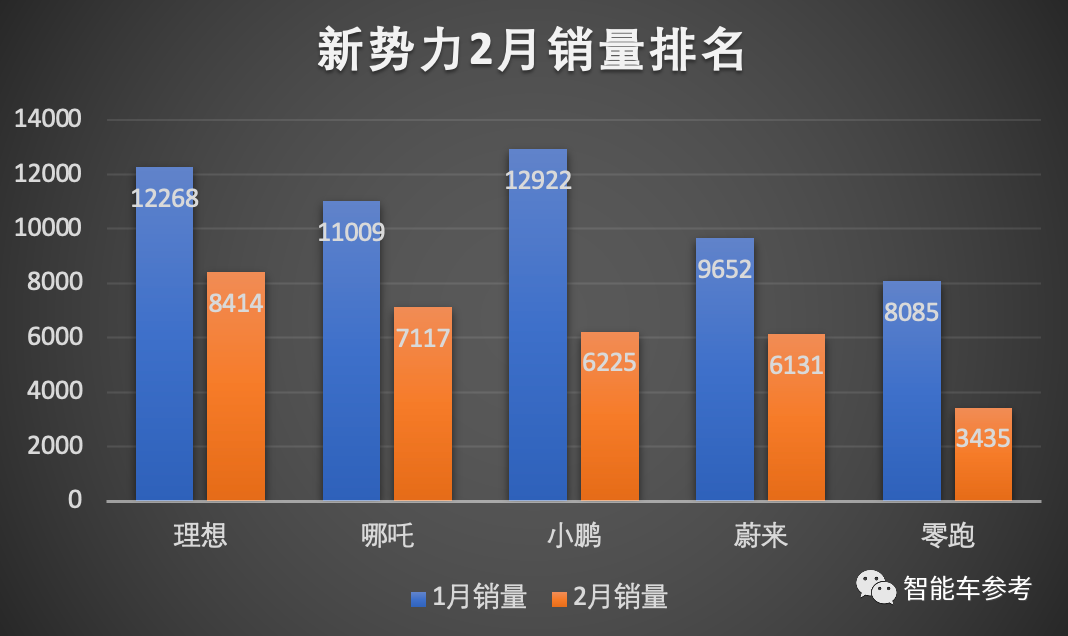

According to delivery data, the top-ranked new force is Ideal, a brand reliant on one model. In February, Ideal delivered 8,414 units of the Ideal ONE, an increase of 265.8% year-on-year, but a decline of 31.4% month-on-month.

NIO, which broke into the top 3 in deliveries last month, advanced one spot to the second place this month with a delivery of 7,117 units. The growth rate in deliveries compared with the same period last year was 255%, but fell 35.3% compared to last month.

Meanwhile, XPeng Motors, the champion of new energy vehicle sales for four consecutive months, fell into third place with a total delivery of 6,225 units in February, increasing by 180% YoY but decreasing by 51.8% MoM.

Why did sales plummet so much? XPeng Motors offered a similar explanation to NIO:

During the Spring Festival, XPeng’s Zhaoqing base underwent technical renovations which affected deliveries.

NIO ranked fourth, delivering 6,131 units in February, an increase of 9.9% YoY, and a decrease of 36.5% MoM since it encountered delivery troubles in October last year.

Leapmotor still ranks fifth with the delivery of 3435 vehicles in February, a year-on-year increase of 447%, and a month-on-month decrease of 57%.

Although the internal rankings have changed, looking at the overall delivery situation, new car-making forces in February did not differ much and did not cross the threshold of 10,000 deliveries.

Rather than competing with each other, they are going through difficult times together.

This difficulty is that as a representative automotive enterprise group, new car-making forces are far behind the market’s benchmark. Generally speaking, February, due to the influence of days and the Chinese New Year holidays, is considered the “winter period” in the annual auto market, and the overall sales volume will decrease significantly.

In terms of this year, according to the latest sales data released by the China Passenger Car Association, the sales of new energy vehicles in China in February (based on wholesale volume) decreased by 24.1% month-on-month in the new energy vehicle market.

And the top 5 new car-making forces are lagging behind the market benchmark by more than 10 percentage points, with Xpeng and Leapmotor lagging behind the market benchmark by more than 20 percentage points.

How is the overall market performance?

Overall, there are two bright spots in the sales of new energy vehicles:

The sales decline is smaller than that of fossil fuel vehicles, and the penetration rate has reached a new high.

According to the China Passenger Car Association’s analysis of the February auto market, the sales of new energy passenger vehicles reached 317,000 units in February this year, a year-on-year increase of 189.1% and a month-on-month decrease of 24.1%, which is less than the decrease of previous years.

Among them, the sales of pure electric vehicles were 245,000 units, a year-on-year increase of 161.7%, and the sales of plug-in hybrid vehicles were 72,000 units, a year-on-year increase of 350.9%.

The month-on-month sales decline of new energy vehicles was 8 percentage points less than that of the overall auto market, which means that new energy vehicles are becoming a key variable in supporting the growth of China’s auto market.

In terms of penetration rate, in February, the wholesale penetration rate of new energy vehicle manufacturers was 21.8%, an increase of 12.2 percentage points from the 9.6% penetration rate in February 2021.

Among them, the penetration rate of new energy vehicles in the independent brand sector was 38%, 29.4% in the luxury car sector, and only 3.3% in the mainstream joint venture brand sector.

In addition to Tesla and BYD, three other new energy vehicle manufacturers achieved the milestone of delivering more than 10,000 vehicles in February:

SAIC-GM-Wuling ranks third in sales of new energy vehicles with 26046 units sold, thanks to its popular model, the Wuling Hong Guang Mini EV. BYD and Chery follow closely behind, with sales of 14285 and 10271 respectively.

However, the problem is that domestic independent brands may have good sales figures, but they are not in the same price range as Tesla…

National independent brands in the same price range cannot outsell Tesla.

In the end, the key is still to have a good balance between sales and cost-effectiveness.

Nevertheless, there is a positive trend in the transformation of new energy and intelligent vehicles, as foreign and joint venture models are becoming less and less discussed.

Do you agree, or do you have other reasons?

–End–

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.