Author: Zhu Yulong

Over the weekend, I checked the insurance sales data for February.

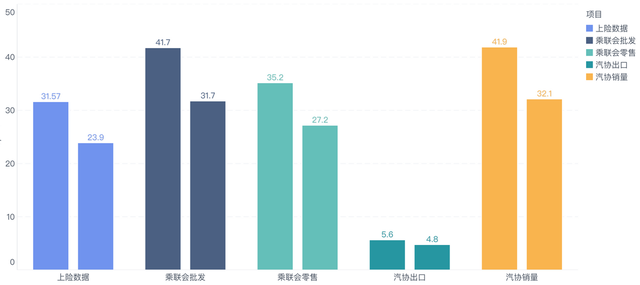

Overall, the data for passenger vehicle insurance in February was 1.157 million units, a year-on-year decrease of 10.6%. Here are some of the data points related to new energy vehicles:

-

China Association of Automobile Manufacturers (CAAM) passenger vehicle sales (including exports): 419,000 in January, 321,000 in February, totaling 740,000 units

-

CAAM passenger vehicle exports: 56,000 in January, 48,000 in February, totaling 104,000 units

-

China Passenger Car Association (CPCA) wholesale (including exports): 417,000 in January, 317,000 in February, totaling 734,000 units

-

CPCA retail: 352,000 in January, 272,000 in February, totaling 624,000 units

-

Insurance data: 315,700 in January, 239,000 in February, totaling 554,700

It should be noted that there is a time lag with insurance data, which lags behind retail (store) data reported by manufacturers and wholesale data. This causes the discrepancies between the above data.

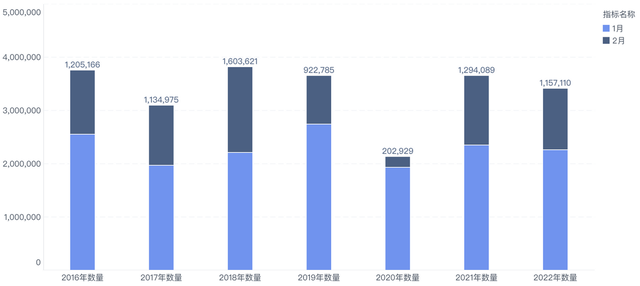

Overview of Macro Data for Insurance

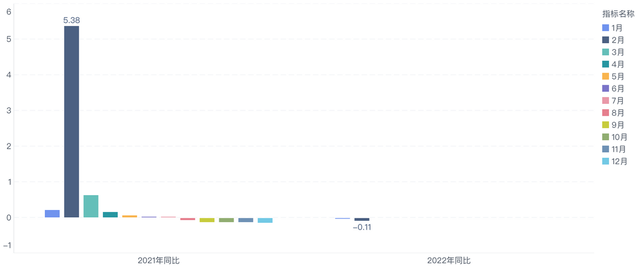

I compared the insurance data for January and February (to eliminate the differences caused by the Chinese New Year falling in different months), and found that the total data for the two months was less than 4 million. With the rising oil prices, demand for traditional fuel vehicles will be further suppressed. We need to consider an interesting core issue: in the process of pursuing the price parity between electric vehicles and fuel vehicles, due to the continuously widening usage cost gap caused by high oil prices, a considerable number of high-mileage commuters will first switch to electric vehicles and plug-in hybrids. This change is objective.

This year, the chip supply problem still objectively exists. With various home policies starting in March, the first half of 2022 will be similar to 2020.

This means that there will continue to be difficulties in the supply side, whether it is whole car companies or auto parts companies. Disturbance is objectively present before finding ways to deal with the epidemic in 2022.

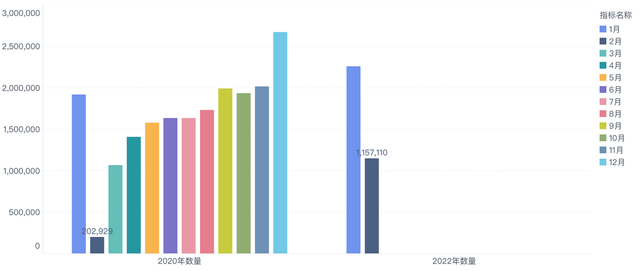

According to the factory data, the overall situation in February is shown in the table 2 below, and I won’t go into details one by one.

Analysis by new energy vehicle type

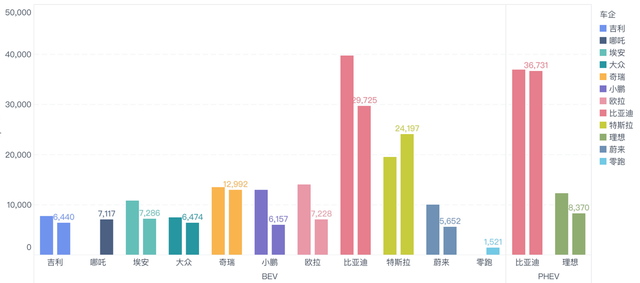

Regarding the situation of key enterprises’ BEV and PHEV, I have made the Figure 5 below.

In the field of pure electric vehicles, Wuling ranks first with 30,408 units (I regularly follow up with Wuling’s situation because the data has always been impressive, and I often feel like it’s a bit of exaggerating). BYD ranks second with 29,725 units, and third is Tesla with 24,197 units.

In terms of plug-in hybrid, BYD has 36,731 units and Ideal has 8,370 units. The good news is that Geely and Changan have successively achieved over 1,000 units of plug-in hybrids, surpassing the traditional PHEV giant, SAIC Motor.

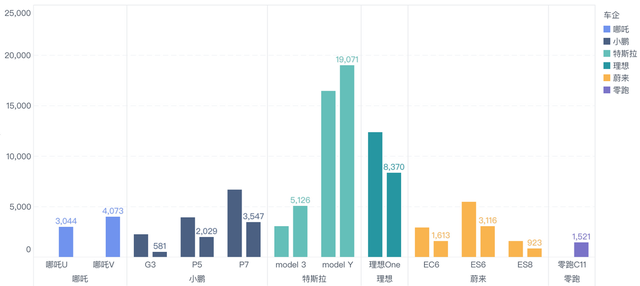

Starting from 2022, Tesla, which leads the continuous rise in price, still maintains a high level of sales. The difference in cost digestion ability this year is mainly reflected in the brand and consumer recognition. The volume of new forces in the future may be further differentiated.

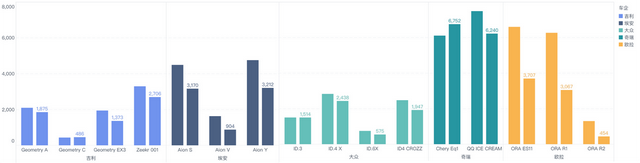

For traditional forces, in 2022, with the large sale of new energy credits, there will be differentiation in the attitudes of wanting to transform and invest or continuing to mix. Ora’s black and white cats have been discontinued and moved towards higher-end products, which is actually a strategy for traditional car companies to maintain the continuous existence of their car models. Geely Zeekr is doing well on this road. Although there are more negative news, it can still stand firm with its high cost-effectiveness.

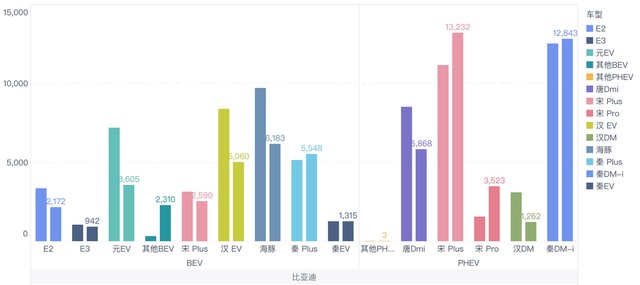

The DM-i series has gained a growing reputation and practicality among customers under high oil prices, making it more competitive in 2022. As Han DM switches to DM-i, the sales of this series are expected to further improve. In terms of pure electric vehicles, the E3 series (Dolphin) that takes an integrated approach is far beyond expectations in terms of its sales growth.

The DM-i series has gained a growing reputation and practicality among customers under high oil prices, making it more competitive in 2022. As Han DM switches to DM-i, the sales of this series are expected to further improve. In terms of pure electric vehicles, the E3 series (Dolphin) that takes an integrated approach is far beyond expectations in terms of its sales growth.

Conclusion: The changes in the automotive industry in 2022 have been following the macro environment. Under the influence of market, automakers, and consumers, these changes may accelerate and promote the overall development of the market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.