Author: Zhu Yulong

The attempt made by GAC to separate the operation of electric and traditional vehicles in China is among the leading edge of the domestic industry.

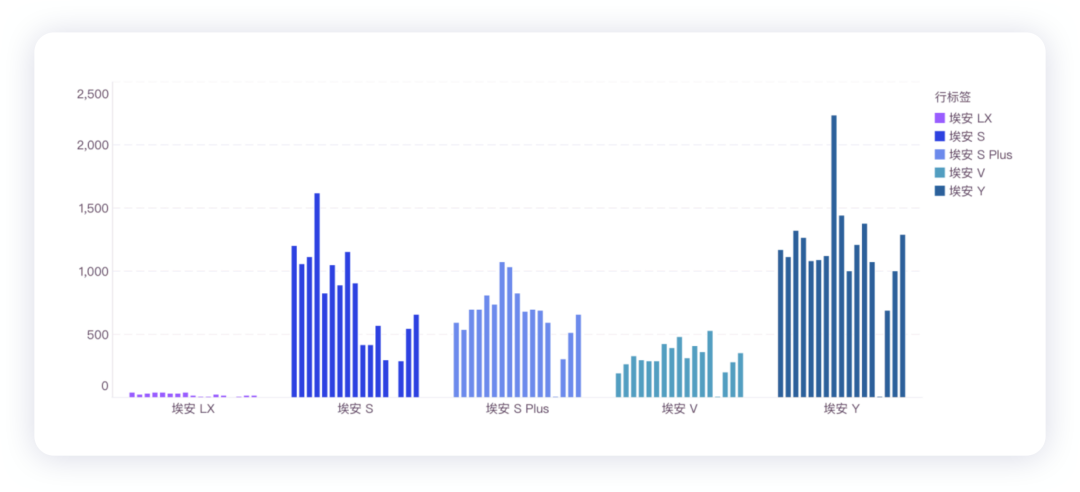

The figure below provides an overview of the total vehicle sales data from November 2021 to February 2022. Currently, the pricing adjustment for Aion LX has put it in low operation; Aion S and Aion S Plus have been relatively steady in sales through the 2B business model; Aion V caters to the niche market; and currently, the main success in terms of sales volume and leaning towards the 2C market has been achieved through Aion Y.

I would like to summarize the situation of automatic driving assistance for Aion, to see where GAC can go next.

Existing automatic driving assistance systems

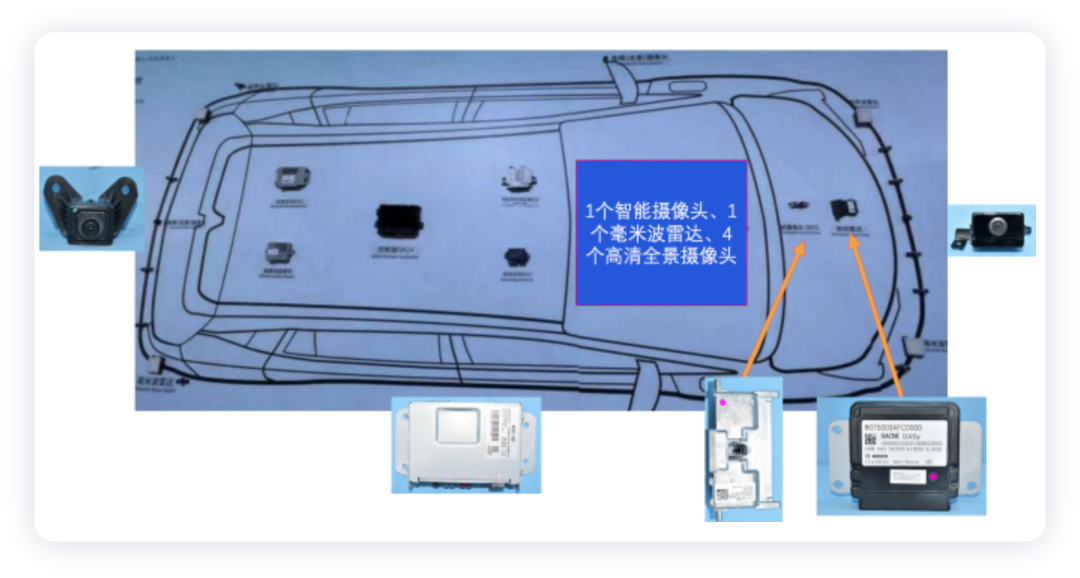

At present, GAC Aion’s automatic driving assistance can be basically divided into ADiGO2.0 (Aion Y), ADiGO2.5 (Aion Y), and ADiGO3.0 (Aion V, Aion LX). AION Y, with large sales volume, is equipped with the ADiGO2.0 automatic driving assistance system, which integrates functions such as forward collision warning, lane departure warning, lane keeping assistance, driver monitoring, and traffic congestion assistance. This system mainly includes one intelligent camera, one millimeter-wave radar, twelve ultrasound radars, and four high-definition panoramic cameras. The active safety system relies on the fusion of cameras and millimeter waves, while parking has a separate controller.

ADiGO2.5 and ADiGO3.0 automatic driving assistance systems have some improvements. In terms of perception configuration, ADiGO2.5 mainly upgrades to the Bosch parking system and configuration (11 ultrasound radars, one millimeter-wave radar, and four high-definition panoramic cameras, as well as an SRR lateral millimeter-wave radar) for Aion V. ADiGO3.0 has added high-precision maps and made some software upgrades to enable more functions.

Localization and Mapping Module

The localization and mapping module mainly relies on map collection and recording on specific road sections in advance, and supplements the surrounding environment with positioning functions. It stores high-precision maps of 320,000 kilometers of highways and urban expressways throughout the country. The high-precision map data is combined with lane lines detected by cameras, GPS signals, RTK differential positioning, and IMU inertial navigation chips to output vertical 1m and horizontal 20cm positioning accuracy.

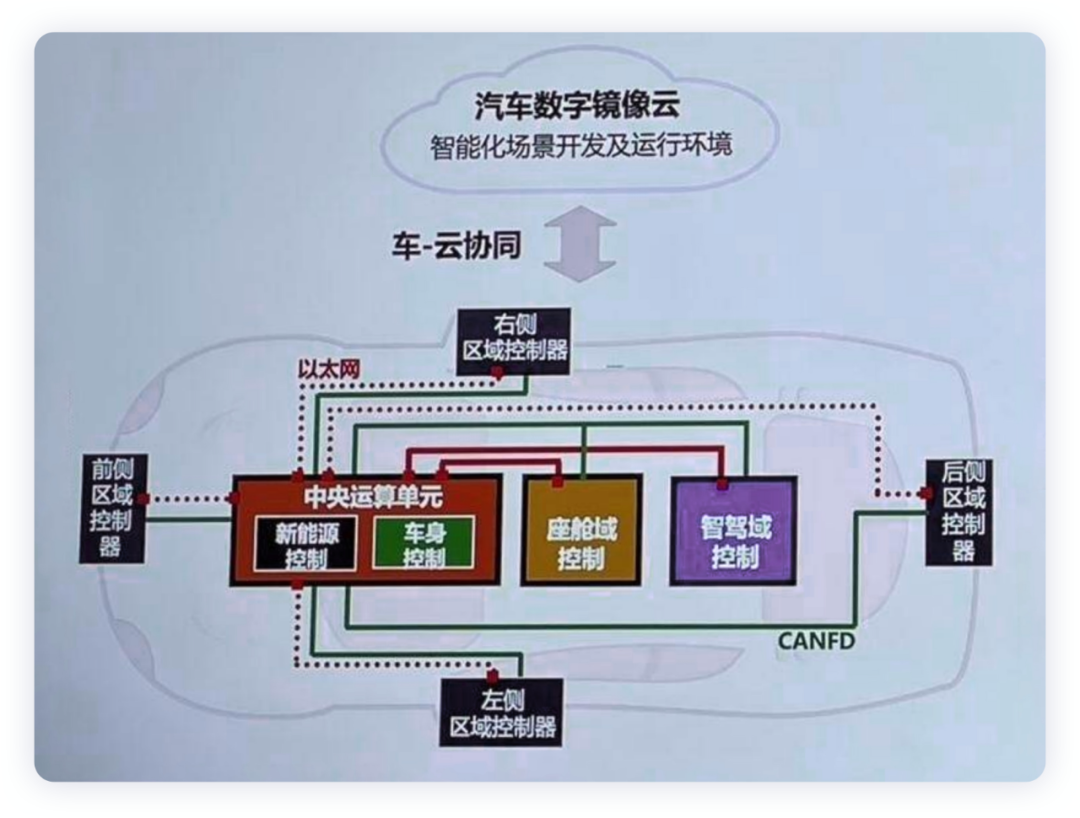

Overall, at this stage, Aiways’ autonomous driving assistance functions mainly rely on integration and optimization on suppliers’ software. In the future, the GAC Aiways ADiGO autonomous driving system will continue to add perception capabilities and carry the RoboSense second-generation solid-state LiDAR. As Aiways is the electric vehicle business that GAC wants to incubate and split, there is a need for systematic strengthening in the field of autonomous driving, which has shown interesting situations in the previous three-domain architecture.

The Next Stage

In the three core units, including the central computer, intelligent driving computer, and information and entertainment computer, the intelligent driving domain is mainly equipped with Huawei Ascend 610 high-performance chips, with a computing power of 400TOPS, and the ability to achieve 2.4 GPix/sISP image processing capabilities.

In May 2021, Didi’s autonomous driving company announced a strategic cooperation with GAC Aion New Energy Automotive Co., Ltd., and GAC invested 200 million U.S. dollars in Didi’s autonomous driving company, also extending to L4 level autonomous driving.

In October 2021, Baidu and GAC Aion released the Apollo Moon Aion version of the pre-installed mass-produced unmanned vehicle, which can meet the needs of unmanned operation.

In November 2021, Horizon Robotics announced the completion of exclusive financing in the C1 round invested by GAC.

In December 2021, GAC Group strategically invested in WeRide, laying out Robotaxi commercial operations.

From this perspective, how EAON takes itself as the core to establish its value and position in the field of autonomous driving is an interesting observation point.

Conclusion: Among domestic auto companies, GAC has been moving at a fast pace, especially in facing the challenges from XPeng Motors in Guangzhou. In terms of autonomous driving cooperation and investment, GAC is an active player. Whether they can incubate an autonomous driving technology core team within the company will depend on the landing of future collaborations and self-growth.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.