作者: Zhu Yulong

Recently, the conflict between Russia and Ukraine has become a persistent variable this year. There have been some short-term impacts and changes at the macro level. In the long term, energy policy and supply chain management will become a persistent topic.

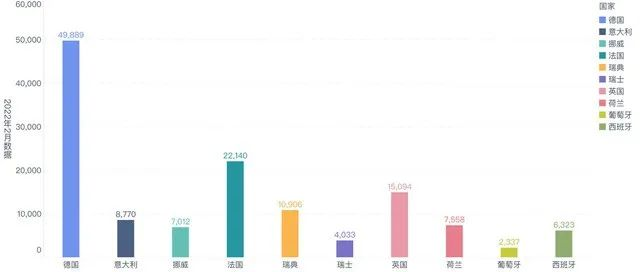

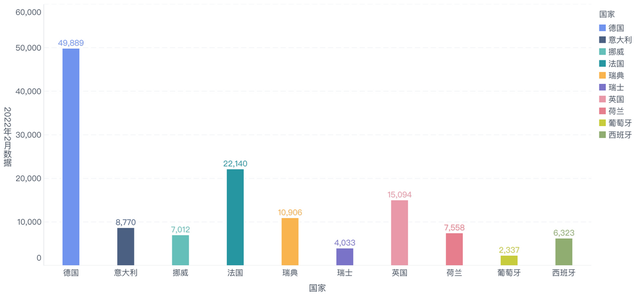

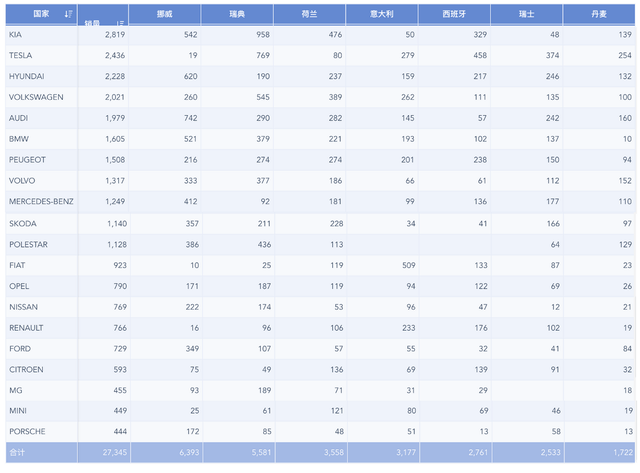

In February, the sales of new energy vehicles in European countries remained stable. In terms of gradient, Germany still maintains a sales volume of nearly 50,000, leading the first group. France and the UK rank second and third, respectively, and Sweden has more than 10,000. It is difficult for the sales of new energy vehicles in other European countries to change in the short term. It is expected that the growth rate of new energy vehicles in Europe will gradually slow down under conditions of high penetration by 2022.

Macro Trends

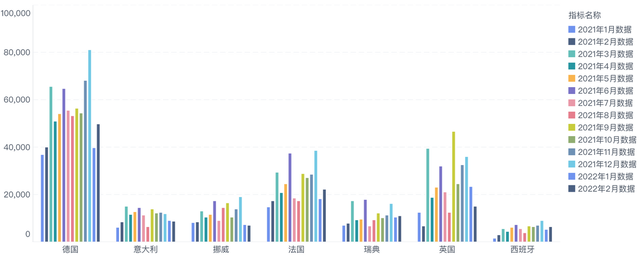

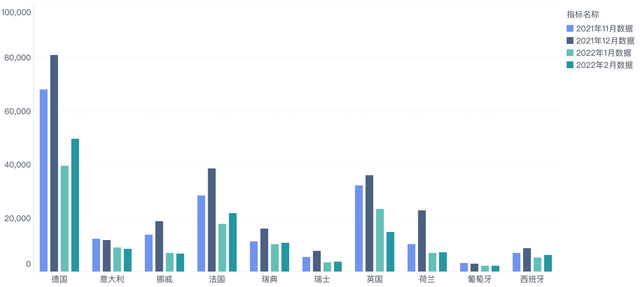

I put the sales of all new energy vehicles in 2021 and the volume in 2022 together. The good news is that most countries have comparable data year-over-year. But it can also be seen that there is a clear platform effect here. The countries we are tracking are difficult to improve on the basis of Q4.

If we look at the data of the past four months, we can see that the decline is still quite obvious compared with the volume in November-December last year and January-February this year. The macro environment that car companies need to deal with is more complicated. Supply chain interruptions are not just about chip supply issues (chip problems still persist in 2022) but also other disturbing factors.

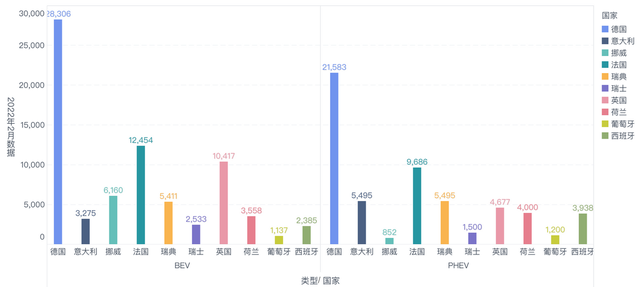

Pure electric vehicles and plug-in hybrid electric vehicles in Europe are still in a relatively balanced state. Except for Norway, most countries are in a relatively equal proportion, with Germany and France having slightly more pure electric vehicles. With battery prices experiencing a certain increase globally, plug-in hybrid electric vehicles will still exist for a considerable period of time.

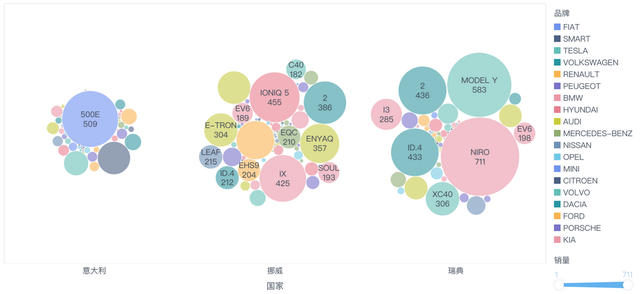

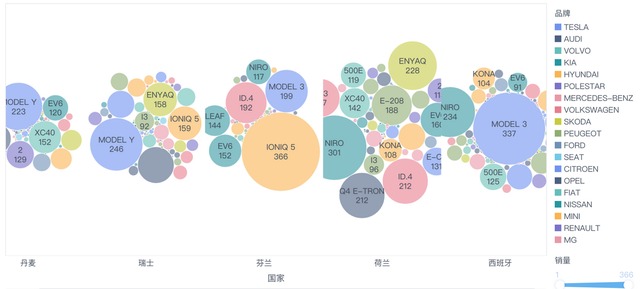

Specific Models SalesIn February, in some European countries — Norway, Sweden, Netherlands, Italy, Spain, Switzerland, and Denmark — Kia and Hyundai ranked first and third among pure electric car models, with Hyundai on the second spot.

Actually, the highest sales in these countries are only 711 units of NIRO. A large number of Tesla cars are waiting for delivery in shipping, and the February data are still in a relatively early stage.

In the low sales market, we see some familiar names, such as Model Y, Model 3 and Ioniq 5.

Conclusion: although the numbers are constantly increasing, more than 45% are plug-in models in Europe’s new energy vehicle market; pure electric vehicle models are still relatively scattered and gradually transforming in small markets. There seems to be no particularly outstanding points to share with you after writing for so long. On the other hand, the changes in the US new energy vehicle market in 2022 are quite significant. Let’s compare the data when they are fully available.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.