Yesterday, Feichi Motors held a media co-creation exchange meeting in the Innovation Harbour Conference Center on Antuo Road in Shanghai.

Feichi Motors may seem unfamiliar to many people. In fact, it is the former SAIC R brand.

On October 30, 2021, SAIC Group announced that it plans to invest in the establishment of Feichi Motor Technology Co., Ltd. and will separate it from SAIC Group’s passenger car division as the independent R brand of Feichi Motors, which will be operated in a market-oriented way with light assets.

The registered capital of Feichi Motors is 7 billion yuan, of which the company’s subscribed capital is 6.65 billion yuan, accounting for 95% of the registered capital, and the employee holding platform’s subscribed capital is 350 million yuan, accounting for 5% of the registered capital.

Wu Bing was appointed as the CEO of Feichi Motors. Mr. Wu previously served as the COO of SAIC Group’s mobile travel brand “Enjoy Travel,” participated in the establishment of SAIC Insurance, and served as the general manager of the Chevrolet Marketing Division. With more than 20 years of experience in SAIC Group, he has enough internal entrepreneurial experience.

This media co-creation meeting was also hosted by Wu Bing, and he shared information about the brand’s first flagship SUV, the Feichi R7, and the logic behind the Feichi brand’s independent operation.

Feichi R7 has a generous configuration

On February 23, Feichi Motors’ official website opened the pre-order channel for the R7, and currently only released the appearance and partial configuration information.

According to the introduction at the co-creation meeting, the Feichi R7 prototype was offline in March this year, debuted at the Beijing Auto Show in April, and started delivery in July-August.

As the first model since the brand’s independence, the Feichi R7 is a mid-size SUV. The vehicle size is:

- Length, width, height: 4,900 mm × 1,925 mm × 1,655 mm, wheelbase 2,950 mm.

For reference, the size of the NIO ES6 is as follows:

- Length, width, height: 4,850 mm × 1,965 mm × 1,758 mm, wheelbase 2,900 mm.

In addition to being slightly narrower and lower than the NIO ES6, the Feichi R7 is 50 mm longer with a longer wheelbase than the NIO ES6.

The smart driving system PP-CEM under SAIC’s R-TECH technology platform, which costs 20 billion yuan of investment, is also equipped on this car. It includes a total of 33 sensors, such as Luminar’s lidar (which has the best field of view and detection distance currently) and a 192-channel 4D millimeter-wave radar from Continental, and Nvidia’s Orin autonomous driving chip.

In terms of intelligent cockpit, the FEYVAN R7 is equipped with Qualcomm 8155 chip, with interior featuring a 43-inch screen and an AR-HUD with a 70-inch giant screen as a visual focus at 7.5 meters away. The audio system adopts BOSE’s 14-channel sound system, and is the first model in China to support BOSE EVSE engine sound simulation technology. The official claims it can simulate the sound effects of supercars like Lamborghini.

In terms of motors, FEYVAN claims that the maximum power of the four-wheel drive model is 400 kW, the maximum torque is 700 N·m, and the acceleration from 0 to 100 km/h is around 4 seconds. Moreover, the motor of FEYVAN R7 adopts oil cooling technology, which will have better heat dissipation performance during intense driving.

The official has not disclosed the capacity of the battery pack, but it is confirmed that two battery pack capacities will be provided for the launch. The official claims a range of more than 600 km for the high-end model, with an estimated battery pack capacity of 90-100 kWh.

There are two interesting aspects regarding the battery:

-

FEYVAN R7 supports rapid battery swap, and the entire swap process can be completed in as little as 2.5 minutes, according to the official.

-

FEYVAN claims that it will consider separate power and vehicle schemes in the future.

However, at the Co-Creation Event, FEYVAN only showcased its plan for charging stations, without mentioning the layout plan for swapping stations. According to their statement, FEYVAN will deploy its own swapping system in the future.

If this is true, FEYVAN must speed up its pace. Without enough swapping stations to meet the demands of users, this feature will naturally become a gimmick, and the convenient experience will be difficult to achieve.

What are the advantages of brand independence

SAIC’s methodology for success

At the beginning of the conference, Wu Bing did not rush to introduce FEYVAN’s brand concept. Instead, he talked about a concept: “Chasm Theory.”

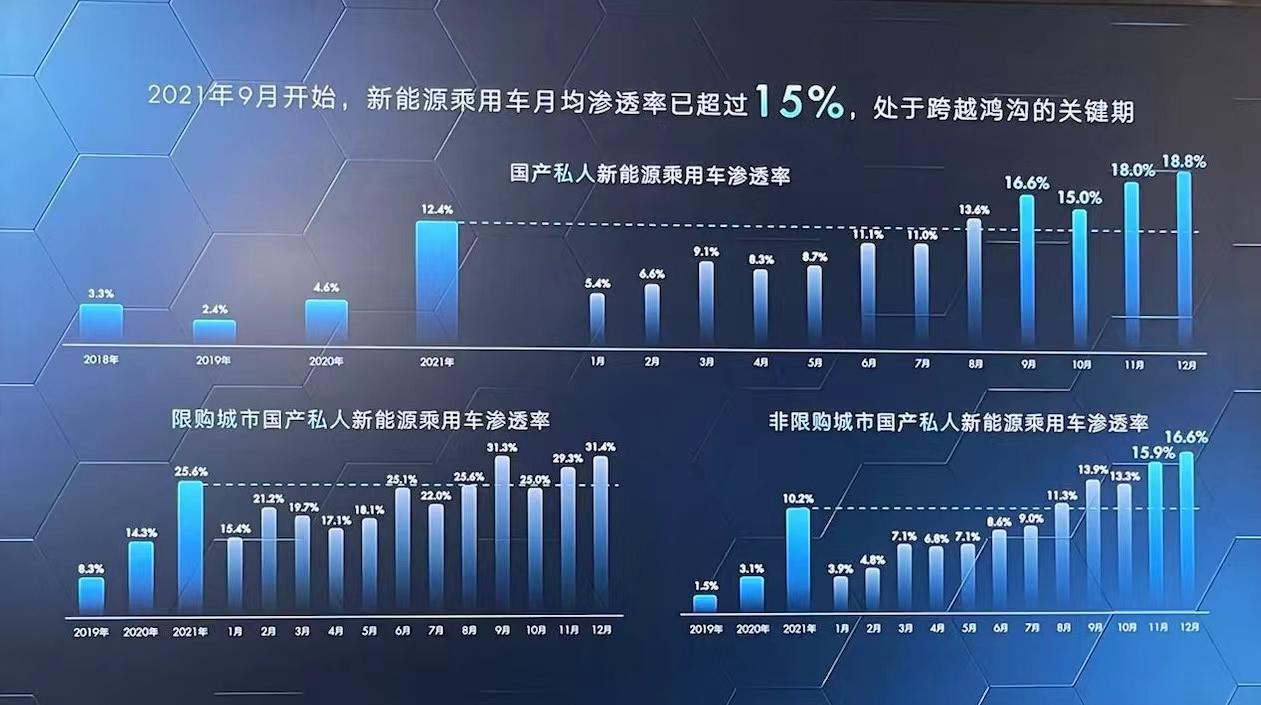

After a new technology or product appears, a 16% diffusion rate will be a chasm. Once this obstacle is overcome, this technology or product can quickly spread to the mass market.

It is worth noting that since September last year, the monthly penetration rate of domestic new energy passenger vehicles has exceeded 15%. According to the Chasm Theory, we have entered a period of rapid growth in the new energy vehicle market. This is also when FEYVAN Automotive considers taking action.

Wu Bing has worked in SAIC for more than 20 years, and has successfully created many projects from 0 to 1 within SAIC Group. In his methodology, SAIC’s past successful experiences have become an indispensable part of it. Seeing everyone’s doubts, Wu Bing actively explained why SAIC changed from the R brand to the R logo, and finally independently established FEYVAN Automotive.# Reviewing the history of SAIC Group, the multi-brand strategy has always been its development cornerstone. During the process of SAIC-GM from 1997 to 1998, many people did not understand why SAIC needed to establish SAIC-GM when it already had SAIC Volkswagen. Was the market capacity enough for this multi-brand development route?

However, the fact proved the correctness of the multi-brand strategy. From SAIC Volkswagen in 1980 to SAIC-GM in 1997 and then to Roewe in 2006, the multi-brand strategy allowed SAIC to occupy 25% of the Chinese market share. In 2004, SAIC-GM-Wuling was born, and once again, many people raised the same question: is it really necessary to have so many brands?

Sales volume proved it was necessary. Today, SAIC-GM-Wuling has become a large group with an annual output of 2 million vehicles.

Wu Bing summarized that when a market is developing rapidly, consumers’ demands can be better satisfied through different brands, different positioning, and different business models. Looking to the new energy market, SAIC has set a goal to sell more than 2.7 million new energy vehicles and account for no less than 32% of the total vehicle sales by 2025.

To achieve this goal, Wu Bing believed that SAIC needs to layout more competitive products in the mid-to-high-end market, and these products need to be supported by differentiated brands and unique business models. Moreover, facing this huge potential market for new energy vehicles, independent operations can unleash potential and create unique products.

Therefore, looking back at the independent operation of FEIFAN Auto, everything is traceable.

Releasing productive forces: Lightweight assets + Co-creation + Independent operation

Focusing on the business logic and operation ideas of FEIFAN Auto, Wu Bing emphasized two main points: lightweight assets and independent operation.

The so-called lightweight assets refer to the inherent advantages of FEIFAN Auto in integrating SAIC’s technology, resources, and capabilities, which greatly reduces the pressure on technical investment and production facility construction for FEIFAN Auto compared to other car companies. Specifically, SAIC’s latest electronic and electrical architecture technology, design language, and intelligent driving and cockpit technology can all be applied to FEIFAN Auto for the first time.

# RisingAuto and SAIC’s Co-creation Model

# RisingAuto and SAIC’s Co-creation Model

Both RisingAuto Automotive and SAIC’s core business units have established co-creation centers. For example, SAIC’s design department will assign RisingAuto’s co-creation team to participate in the entire design process. SAIC’s intelligent driving team and intelligent cockpit team, as well as its intelligent manufacturing base located in Shanghai Lingang, will also allow RisingAuto Automotive to use them in its research and development.

Traditionally, “light assets” means “no technology accumulation” and “buying solutions to find outsourcing”, but with the support of SAIC, the “light assets” model allows RisingAuto Automotive to focus more on the three major strategies of user-driven, digitally-driven and superintelligence-driven, which is also the benefit brought by the co-creation concept.

Independent operation can make RisingAuto Automotive’s organizational structure more clear and efficient. As an independently operated company, RisingAuto Automotive is divided into 10 departments, achieving flat management. Wu Bing said that all departments are directly managed and responsible by him to ensure that information is transmitted at the fastest speed.

Three survival pillars

Wu Bing defined “user-driven”, “digital-driven”, and “superintelligence-driven” as the three survival pillars of the company. Through the co-creation model, the pressure of design, research and development, and production has been reduced, and RisingAuto Automotive’s three strategic cores of independent operation have sufficient productivity support.

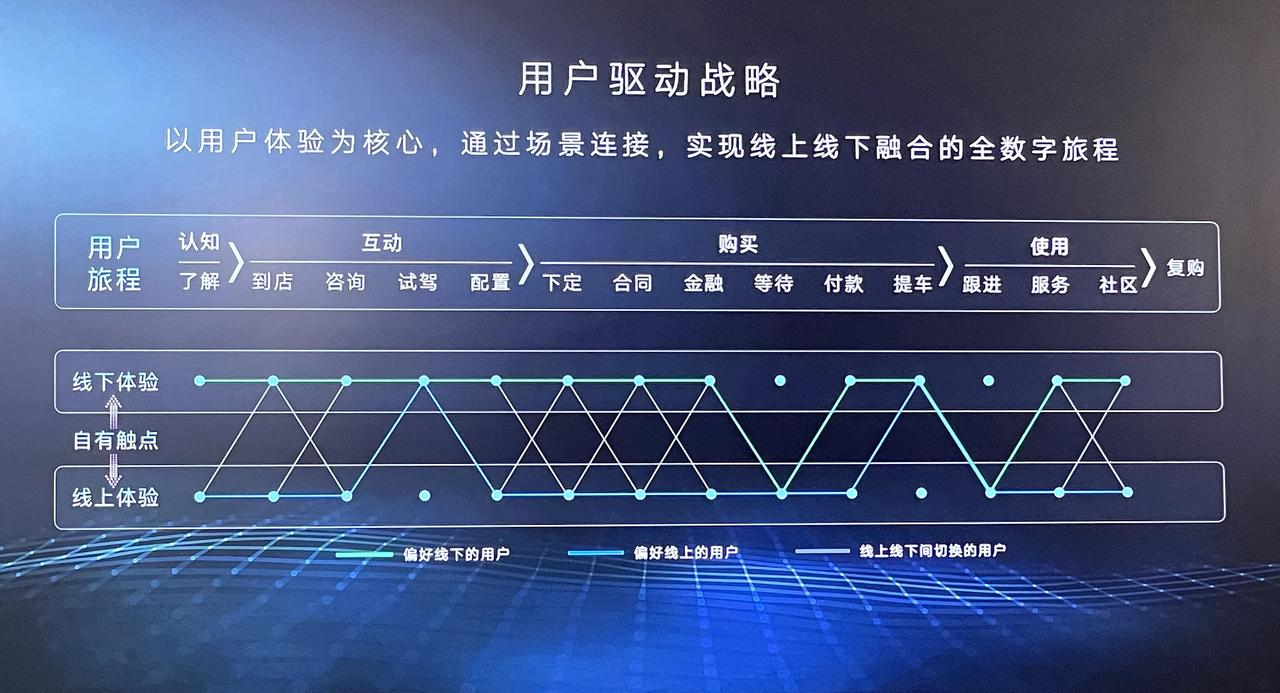

The meaning of “user-driven” is actually to improve the user experience. Since NIO pioneered in this field, it has also become one of the battlefields where everyone competes in the new energy vehicle track. RisingAuto Automotive’s understanding of “user-driven” does not simply mean that the company only has a user operations department. They subdivide the user experience process into experience centers, delivery centers, and service centers, etc., within the company, to ensure that each link has enough manpower to support the user experience.

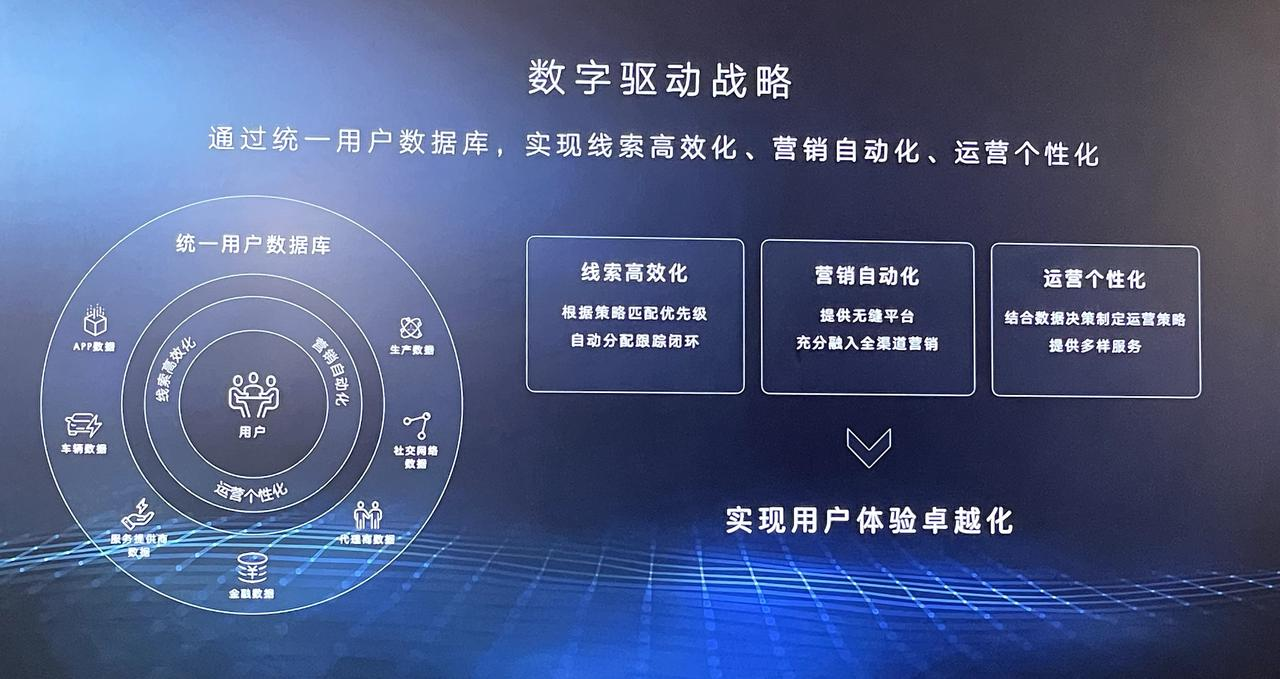

The core of digital-driven is “data”. With the same concept of “user-driven” strategy, RisingAuto also subdivides this aspect, and will collect and integrate the vehicle’s data, user data, and experience data in the future. The results obtained from these data will feedback to vehicle development, positioning, and adjustment. Wu Bing explained that through these data, it is also possible to understand user demands more directly and agilely, and in the future, it can also provide exclusive and differentiated services. In order to achieve these goals, RisingAuto Automotive’s year-end company size will reach about 600 people, and one-third of them will be responsible for the digital team.

Superintelligence-driven refers to intelligent driving and intelligent cockpit. The core driving force of research and development is the co-creation team established by SAIC’s technology center and SAIC Software Co., Ltd. with RisingAuto Automotive. Under this category, RisingAuto Automotive will collect technology demands, feedback from users collected by the digital team, and user opinions from the user operations team to the co-creation team.

The RisingAuto car, which operates with light assets, can gain more detailed understanding of users and market demand. The co-creation team conducts targeted technical development iterations, and the three strategic components complement each other.

Where are the retail and charging network systems?

The retail system and charging network system are equally important battlefields for new energy vehicle companies.

For new forces, building a retail system from scratch requires huge investments and a long time to achieve significant coverage. For RisingAuto, although the brand is new, thanks to the early layout of SAIC, its current retail system is already considerable.

In terms of the retail system, RisingAuto currently has 188 experience centers in various parts of the country, covering core business districts in 85 cities such as Shanghai, Sanya, and Harbin; 18 delivery centers are set up nationwide, and the delivery center in Shanghai was put into use at the end of December 2021; and 123 after-sales service outlets are set up nationwide, covering 80 cities.

However, there is still much room for improvement for RisingAuto’s self-built charging network.

RisingAuto’s approach is to jointly deploy brand charging stations, equity charging stations, and third-party cooperative charging stations. Currently, RisingAuto has set up 144 brand charging stations, 1,006 equity charging stations across the country, and has accessed charging piles from brands such as Techrules and State Grid.

In comparison, Zeekr Auto aims to set up 290 self-built charging stations nationwide in 2021, Kamaisi charging station, a joint venture of Volkswagen Group, plans to go online with 607 charging stations by the end of 2021, NIO has more than 1,200 charging stations and 605 supercharging stations by the end of 2021, covering 226 cities.

In conclusion

At the co-creation meeting, Wu Bing stated that RisingAuto will launch at least one new model each year from 2022 to 2025, covering core markets such as cars, SUVs, and MPVs. And by 2025, RisingAuto hopes to become a profitable top-tier smart electric vehicle company.

SAIC Group behind RisingAuto has long laid out in the intelligent and electrified fields, and the R-TECH technology platform has taken five years and 20 billion yuan to develop. SAIC Group’s listed company Huayu also has a leading enterprise in the intelligent cockpit field, and in the 2021 Global Top 100 Auto Parts Enterprises list, Huayu ranks 17th.Combining the concept of lean assets, independent operation and co-creation, Fayan Auto has enough energy to focus on the user experience without being overly anxious about R&D and production capacity. It is evident that Fayan has matured thinking and complete planning for vehicle manufacturing, with sufficient support for software, hardware and intelligence.

However, the biggest problem at present is that the

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.