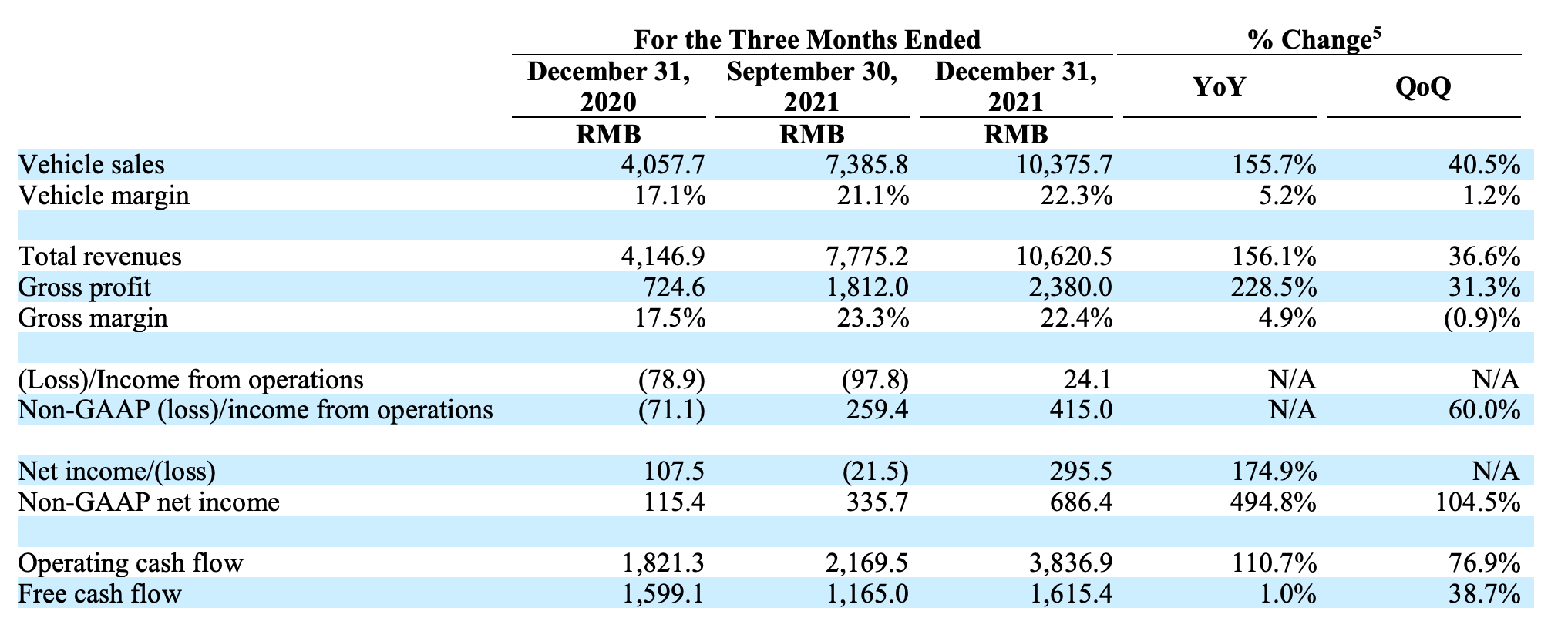

2021Q4 Financial Data

-

Total revenue was RMB 10.62 billion, reaching a quarterly record high and increasing by 156.1% compared to RMB 4.15 billion in 2020Q4, and by 36.6% quarter over quarter in 2021Q3;

-

Automotive sales revenue was RMB 10.38 billion, reaching a quarterly record high and increasing by 155.7% compared to RMB 4.06 billion in 2020Q4, and by 40.5% quarter over quarter in 2021Q3. The main reason for the increase in revenue was due to the increase in the number of deliveries;

-

Gross profit was RMB 2.38 billion, increasing by 228.5% compared to RMB 0.725 billion in 2021Q1 and by 31.3% quarter over quarter in 2021Q3;

-

Gross margin per vehicle was 22.3%, which increased from 21.1% in 2021Q3, mainly due to the higher per vehicle transaction price of the 2021 Ideal ONE in Q4;

-

Overall gross margin was 22.4%, compared to 17.5% in 2020Q4 and 23.3% in 2021Q3;

-

Sales cost was RMB 8.24 billion, increasing by 140.8% compared to RMB 3.42 billion in 2020Q4. The increase in sales cost was mainly due to the increase in the number of vehicle deliveries;

-

Net profit was RMB 0.296 billion, compared to a net loss of RMB 0.0215 billion in the previous quarter 2021Q3;

-

Operating cash flow was RMB 3.84 billion, an increase of 110.7% year over year and an increase of 76.9% quarter over quarter. Free cash flow was RMB 1.62 billion;

-

As of December 31, 2021, the company’s cash reserve (including cash, cash equivalents, restricted cash, deposits and short-term investments) was RMB 50.16 billion, compared to RMB 48.83 billion in 2021Q3;

-

Research and development expenses for the fourth quarter of Ideal Auto were RMB 1.23 billion, a 38.4% increase quarter over quarter from RMB 0.8885 billion in 2021Q3, accounting for 11.58% of total quarterly revenue.### 2021 Annual Financial Data

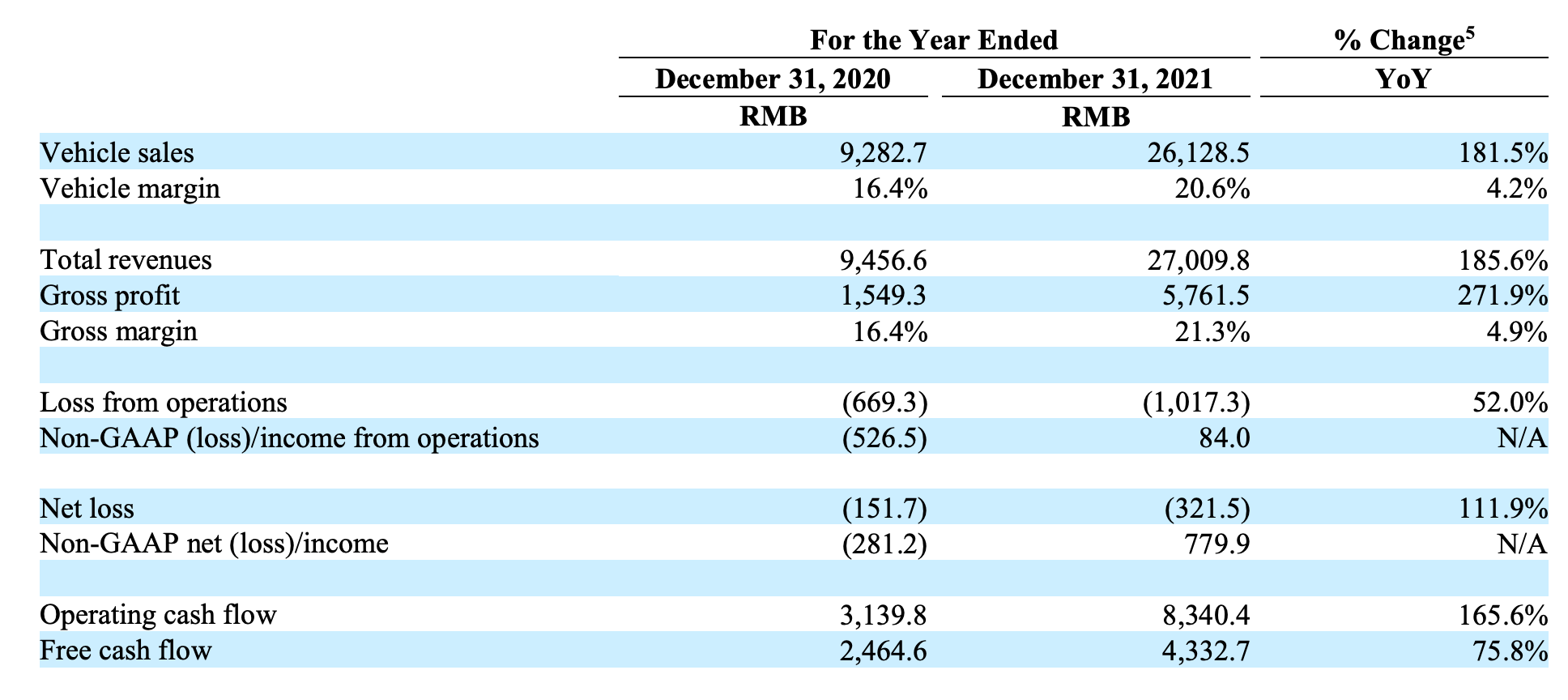

-

Sales, general and administrative expenses were CNY 1.13 billion, an increase of 10.2% from CNY 1.02 billion in 2021Q3, and a year-on-year increase of 162.2%. The increase in expenses was mainly due to personnel growth, site leasing, network expansion and other aspects due to the company’s expansion.

-

Auto sales amounted to CNY 26.13 billion, an increase of 181.5% from CNY 9.28 billion in the previous year. The increase in auto sales revenue was mainly due to the increase in auto deliveries in 2021.

-

Total revenue was CNY 27.01 billion, an increase of 185.6% from CNY 9.46 billion in the previous year.

-

Other sales and services amounted to CNY 0.8813 billion, an increase of 406.8% from CNY 0.1739 billion in 2021.

-

Sales cost was CNY 21.25 billion, an increase of 168.7% from CNY 7.91 billion in 2021. The increase in sales cost was consistent with the increase in revenue and was mainly driven by the increase in vehicle deliveries in 2021.

-

Net profit was CNY 5.76 billion, an increase of 271.9% from CNY 1.55 billion in the previous year.

-

The unit profit margin was 20.6%, an increase of 4.2% from 16.4% in 2020, mainly due to improvements in supply chain cost management and higher average selling prices.

-

The net profit margin was 21.3%, up from 16.4% in 2020, mainly due to the growth of vehicle deliveries.

-

Operating expenses amounted to CNY 6.78 billion, an increase of 205.5% from CNY 2.22 billion in the previous year.

-

Research and development expenses were CNY 3.29 billion, an increase of 198.8% from CNY 1.10 billion in 2020. The increase in R&D expenses was mainly due to the increase in R&D personnel and the development of new company products.

-

Operating loss was CNY 1.02 billion, an increase of 52.0% from CNY 0.6693 billion in the previous year.

-

Net loss was CNY 0.3215 billion, an increase of 111.9% from CNY 0.1517 billion in 2020.

-

Sales, general, and administrative expenses were CNY 3.49 billion, an increase of 212.1% from CNY 1.12 billion in 2020, mainly due to the increase in employee compensation and sales network expansion.

-

Operating cash flow was CNY 8.34 billion, an increase of 165.6% from CNY 3.14 billion in 2020.

-

Free cash flow was CNY 4.33 billion, an increase of 75.8% from CNY 2.46 billion in the previous year.- As of December 31, 2021, there were 11,901 employees at the Ideal Automotive company.

Factory Situation

In December 2021, Ideal Automotive established a strategic cooperation framework with the Chongqing municipal government and is building a manufacturing base in the Two Rivers New Zone of Chongqing. The addition of this production base will further enhance the company’s ability to meet increasingly strong market demands and solidify its foundation for sustained growth.

2022Q1 Business Expectations

-

It is expected that 30,000 to 32,000 vehicles will be delivered, representing a growth of about 138.5% to 154.4% compared to 2021Q1.

-

Total revenue is expected to be between RMB 8.84 billion and RMB 9.43 billion, representing a growth of about 147.2% to 163.7% compared to 2021Q1.

Source: [Ideal Official]

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.