Author: Zhu Yulong

I have been deeply contemplating investment opportunities in the second half of the intelligent automotive industry, while organizing the relevance between new energy vehicles and intelligent vehicles currently available on the market.

Here are some characteristics: In recent years, Tesla and new forces such as NIO, Li Auto, and XPeng have indeed made significant investment in intelligence and assisted driving for new energy vehicles, but we see that traditional car manufacturers such as BYD and GAC Aion still surrounding traditional ADAS when developing their electric vehicles, and switching to self-developed software to achieve SOP and iteration maturity requires a transition period of 2-3 years.

From the current point of view:

-

In the next 2-3 years, we will see these mainstream models gradually transition from L1-L2 functionality provided by foreign-owned components to independent integration and algorithm modes in China.

-

With the rise of new car manufacturers, corresponding traditional car manufacturers will also switch to new platforms, and from the perception level, they will also take a step towards intelligent driving and parking.

Automatic assisted driving configuration of Han EV and Qin DM-i

In this part, I carefully organized the perception and configuration of the Han EV and DM-i, and BYD named the automatic assisted driving for Han EV as DiPilot (DiDAS+DiTrainer) in the publicity.

The functions of DiDAS include AEB, forward collision warning system, ACC, traffic jam assistant, LCC, lane-keeping system, BSD, automatic parking, panoramic image, remote driving, and other functions. The entire automatic assisted driving hardware combination consists of 3 millimeter-wave radars (one front and two rear), 1 monocular camera, 12 ultrasonic radars, and 4 surround-view cameras.

The Qin DM-i series does not differ much in the overall driving configuration, but the parking system has been integrated into the vehicle body system for a while, just like the BYD E2.0 system.

In the update of powertrain represented by the blade batteries (EV and PHEV), BYD has a relatively high level of self-research and completion in entertainment and body electronics integration, but fewer resources allocated to autonomous driving. Therefore, BYD’s automatic assisted driving mainly relies on mature foreign suppliers L1-L2 to achieve large-scale production.

In the update of powertrain represented by the blade batteries (EV and PHEV), BYD has a relatively high level of self-research and completion in entertainment and body electronics integration, but fewer resources allocated to autonomous driving. Therefore, BYD’s automatic assisted driving mainly relies on mature foreign suppliers L1-L2 to achieve large-scale production.

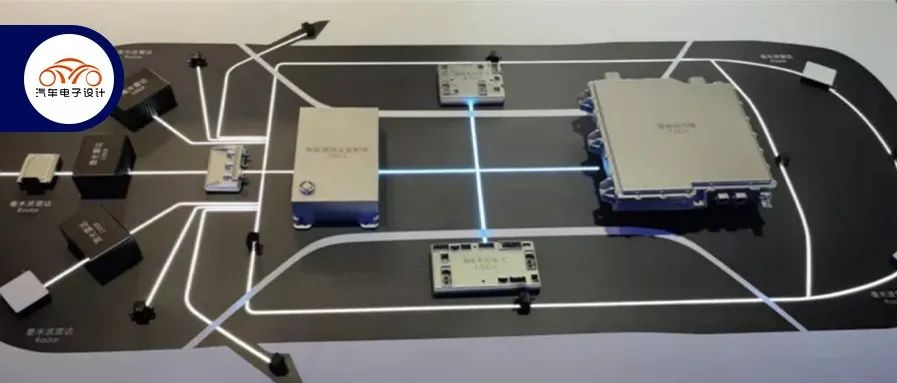

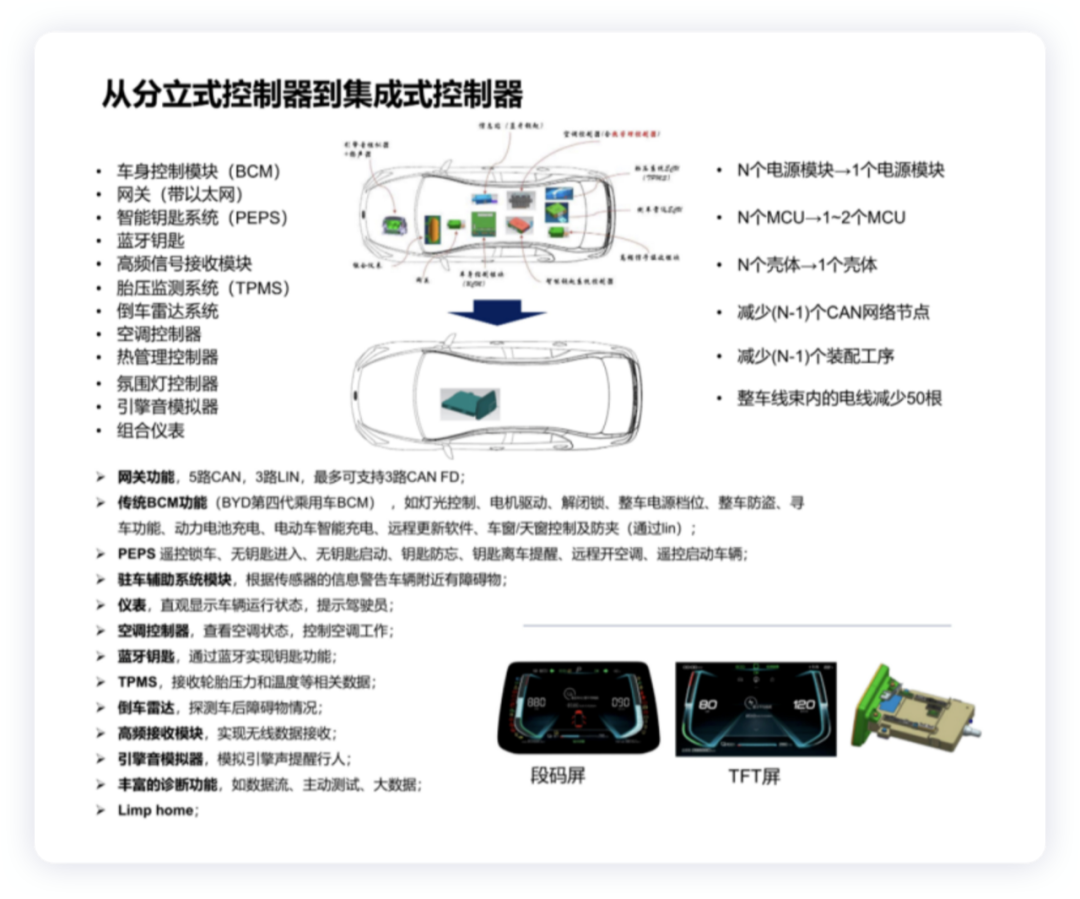

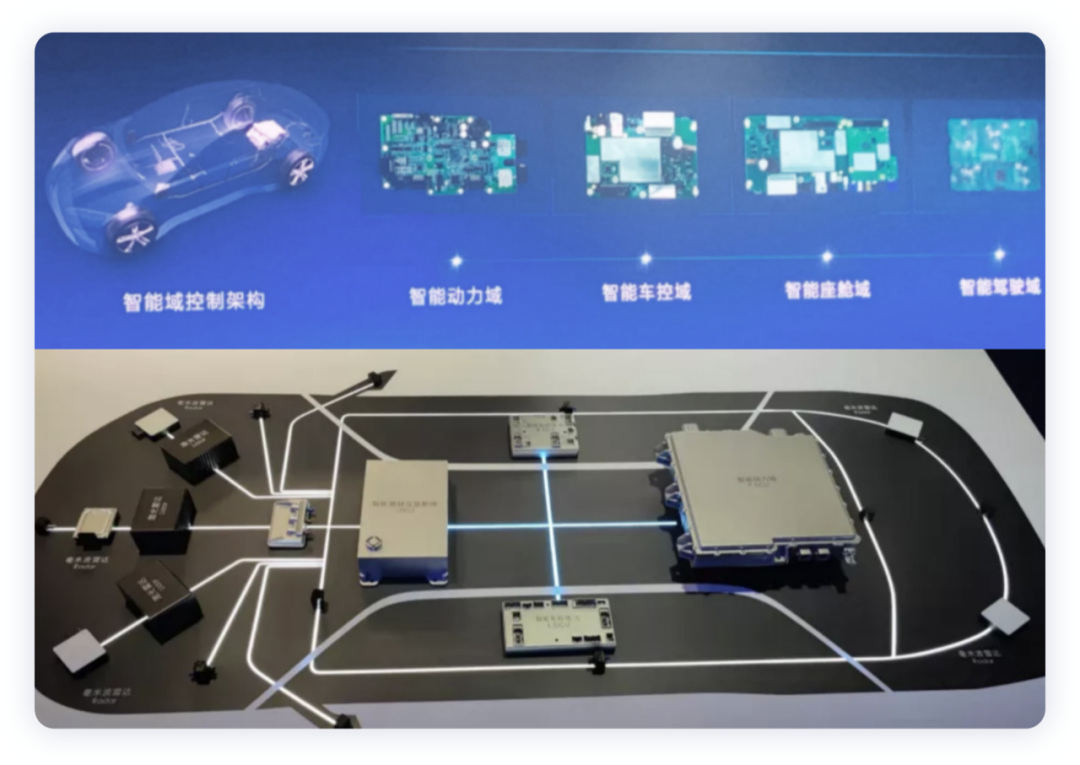

The next-generation E3.0 architecture

From my understanding, the E3.0 architecture was launched last year, and it was relatively fast to land in terms of power and vehicle control aspects-when the dolphin is disassembled, we can go and check it out. However, in terms of intelligent driving, the transition takes time.

At the end of last year, BYD and Momenta officially announced the establishment of DIP AI, a joint venture company for intelligent driving. From the import cycle, BYD may need to implant algorithms into its own platform. Due to the accumulation of intelligent driving data before, iteration also requires a cycle, which we can generally expect around 2 years.

What is interesting is that BYD is in the basic and cooperative level in terms of intelligence. It officially released the third-generation pure electric unmanned delivery vehicle jointly designed and developed with Nuro. BYD is responsible for the development of the whole vehicle, vehicle testing, and production manufacturing, while providing core first-level components such as blade batteries, motors, electronic controls, and human-machine interaction. Nuro provides technologies such as autonomous driving, gateway, control module, and sensors.

Summary: I personally think that the transformation of intelligence, especially automatic assisted driving, exists. Even the most conservative automakers are moving towards self-research to fill the gaps in the overall system. With iteration for 2-3 years, additional value and demand will increase.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.