China’s Power Battery Recycling Industry: Status Quo Analysis

Author | Wang Xuanqi

Editor | Qiu Kaijun

I remember more than four years ago, Shenzhen held a “China Power Battery Recycling Industry Alliance Annual Meeting”. Over 300 battery recycling companies gathered together, making the scene lively.

At that time, many media reported that 2018 would be the first year of power battery recycling.

However, everyone believed that power batteries would eventually retire. The recycling industry is like a treasure chest and will undoubtedly gather trillions of wealth before the market explodes.

Before this trillion-level market explodes, what is the current situation in the industry? As a practitioner, I try to provide you with a comprehensive and in-depth analysis.

In this article, you will read about these keywords and core content:

-

Entry ticket: The power battery recycling industry has not yet carried out qualification management, and the “whitelist” is like an entry ticket. Obtaining an entry ticket means having “recycling qualifications,” and various players fiercely compete for it.

-

50% tax rebate: In the short term, guiding policies will still be the main instruments. Utilizing tax preferential policies reduces enterprise operating costs.

-

Core competitiveness: Technological processes and equipment are the core competitiveness of recycling enterprises. Ensuring that batteries are processed with the highest degree of safety and environmental protection and improving the quality of recycled materials are of utmost importance.

-

Game rules: Business models emerge in endlessly varied ways, and combining with each enterprise’s background and characteristics, tracing out suitable business models for oneself.

-

Material prices: As material prices increase, enterprises can easily make profits. Researching material price trends, differentiating market strategies, and resisting business risks are essential.

Players: Small Workshops and the Regular Army

Power battery recycling began with the promotion of new energy vehicles.

However, the first batteries to be recycled were not retired batteries.

In the early stages of promoting new energy vehicles, power battery manufacturing technology was immature, and the qualification rate was low, which gave rise to a group of small workshops that recycled electrode piece waste.

Later, recyclers began to collect waste batteries, sell those with high remaining capacity and good test indicators at different usage levels, and manually dismantle and sell the remaining ones to downstream smelting companies to extract positive electrode material precursors.

During this period, small workshops were the main force of battery recycling.

As the promotion of new energy vehicles continued, the issue of retired battery recycling gradually received attention from regulatory authorities due to the possibility of environmental pollution and potential safety hazards. Regulatory authorities implemented a whitelist system for power battery recycling.

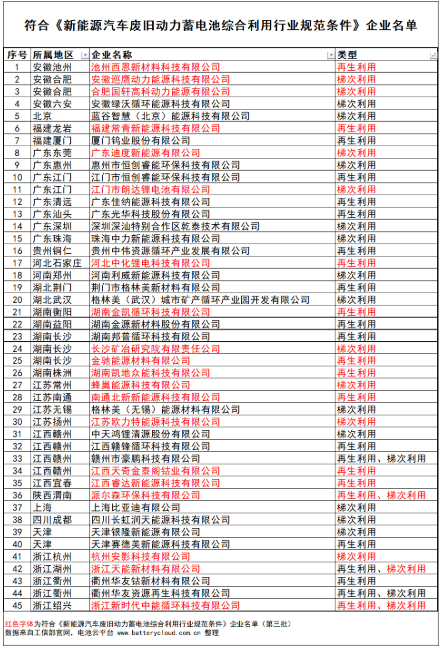

On September 5, 2018, December 16, 2020, and December 16, 2021, the Ministry of Industry and Information Technology successively released a list of companies under the “Conditions for Comprehensive Utilization of Scrap Power Batteries from New Energy Vehicles,” creating the first, second, and third batches of the “regular army”.

From just over 300 in 2017, the number of Chinese firms registered for electric vehicle (EV) battery recycling has grown nearly tenfold to nearly 3000 in 2021. However, only 45 enterprises are fully compliant with the “Industry Norms on the Comprehensive Utilization of Waste Power Batteries of New Energy Automobiles”.

Many of these enterprises are powerhouses in their respective fields. Six of them, including BRUNP Recycling, HuaYou Cobalt, GEM, and GanZhou Haopeng, stood out by becoming part of the first batch of companies to be included in the government’s “White List” of EV battery recyclers. These firms had earlier embarked on recycling nickel-cobalt batteries used in consumer electronics, thereby obtaining hazardous waste disposal qualifications. BRUNP Recycling is associated with Contemporary Amperex Technology, HuaYou Cobalt has unique mineral reserves and is a leading cobalt smelter in the country, while GEM, as the titan of NMC (Nickel Manganese Cobalt) precursor, has an automobile disassembly network.

Meanwhile, many new companies are also seizing battery recycling opportunities and joining the ranks of EV battery recyclers included in the White List. During the pandemic in early 2020, Shenzhen Bus Group sought to retire over 200 electric buses, which together contained over 700 tons of batteries. This resulted in battery competition, and Hunan CRRC Times Electric Vehicle won the largest battery recovery order ever and gained widespread media coverage.

Zhejiang Sedem Recycling also stands out as an industry role model. Lacking substantial capital or backgrounds, the firm uses its material recovery techniques for second-life battery applications to generate valuable contributions, ultimately enabling it to be included in China’s enterprise white list of EV secondary life-cycle battery recycling companies.

Now that legitimate EV battery recycling firms have appeared, has EV battery recycling begun to take a proper course?

The first question that comes to mind is how many EV batteries are available for recycling.

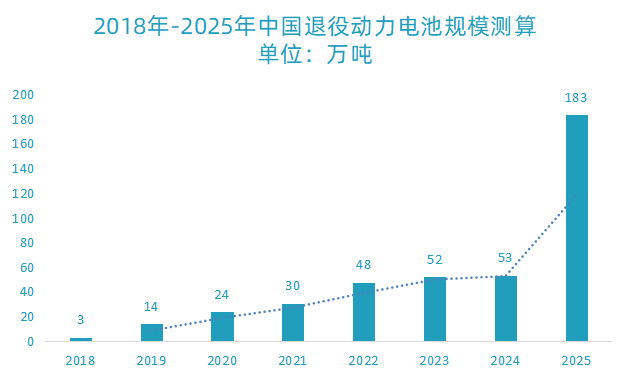

Based on the annual installation of new energy vehicles and a power density of 120 Wh/kg for EV batteries, the volume of retired batteries is roughly calculated after four years of usage. In 2020, about 240,000 tons of power battery packs were retired.

Where have the 240,000 tons gone?

According to industry-wide statistics, fewer than 50,000 tons have been recovered by legitimate recyclers. In 2021, most EV battery recycling enterprises experienced an overall increase in their capacity, with several firms seeing their quantities double. However, limited recovery quantities come from a variety of factors, including the number and price of retired batteries, long-distance transportation, among other issues. Thus, the majority of retired batteries, after life spanistically serve as a carbon sink, still remain recycled in small workshops in situ.

In mid-July,2021,9 key new energy vehicle and battery producing enterprises and released a joint declaration, urging the strict limitation of “white-listed” bidding participants in the auction of expired power battery packs to prevent intermediaries and small workshops from buying them en masse, thereby normalize the flow of such packs.The trend is hard to reverse. Players are trying their best to collect batteries, but small workshops, due to the low cost of disposal and lack of environmental responsibility, often dare to bid higher prices, resulting in the phenomenon that legitimate recycling companies cannot get enough batteries.

Legitimate companies not only collect fewer batteries, but also have a hard time making profits.

A profitable example is Ganfeng Recycling.

Before 2020, when the lithium carbonate market was depressed, Ganfeng Recycling was the first to profit from recycling lithium iron phosphate batteries. Its core competitiveness lies in the lithium extraction technology, and it also benefited from its acquisition of a batch of low-priced lithium iron phosphate batteries in 2017. This case deserves attention and research in the industry.

Policy Orientation Is Insufficient

It’s unreasonable to auction waste batteries to the highest bidder to select a recycling provider.

Let’s take a look at the practices in foreign countries.

In Europe and the United States, legislation has been established to establish a complete legal framework for the recycling of waste materials, clarify the penalty provisions for violations, and cooperate with “deposit systems” to recycle batteries.

Japan advocates reverse recycling and encourages citizens to voluntarily return their waste batteries to battery manufacturers and professional battery recycling companies for processing.

In foreign countries, waste batteries are hazardous waste, and holders not only cannot sell them, but also need to pay battery recycling companies for harmless treatment.

The combustion furnace of a battery recycling plant of the global famous material company Umicore costs as much as 10 billion yuan, which shows the high cost of recycling. How can any small workshop afford it?

But Umicore can do it because developed countries attach particular importance to environmental protection, and holders of waste power batteries are willing to pay for the processing cost with Umicore.

In China, waste power batteries have not yet been included in the “hazardous waste list”, and recycling companies need to bid high prices to purchase waste batteries, making it extremely difficult for them.

Policy guides are beginning to pay attention to the huge social costs of battery recycling and are taking a strict attitude towards regulation.

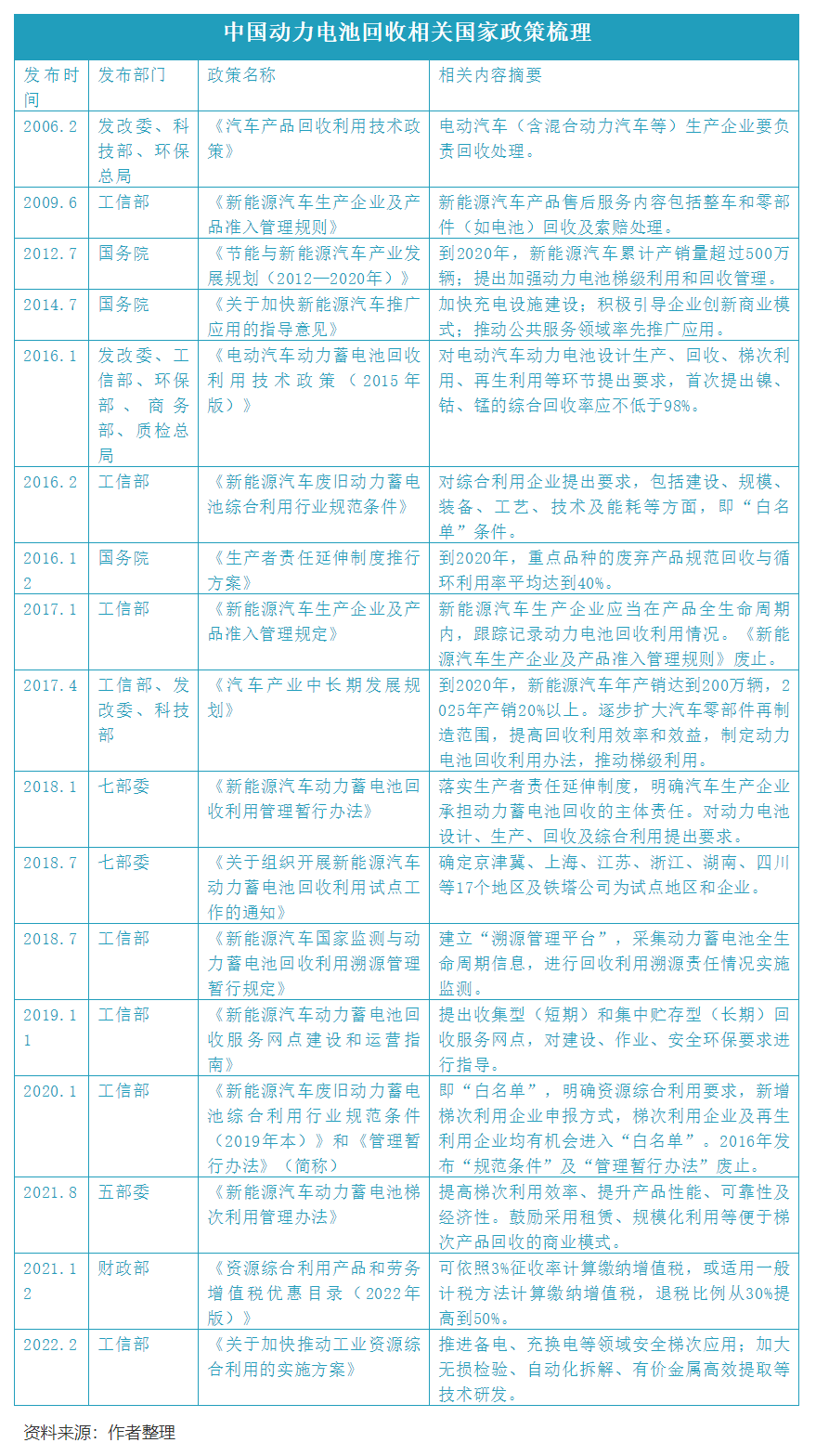

Since the “white list”, China has issued a series of policies related to power battery recycling, proposed industry standards, carried out battery recycling pilot projects, established traceability management platforms, provided guidance for the construction of recycling outlets, modified industry standards to increase declarations of ladder-use enterprises, and encouraged innovation in the ladder-use model by launching a series of guiding policies.

At least on the surface, the policy hopes to plug the loophole and prevent waste power batteries from flowing into the hands of non-compliant recycling and battery processing companies.

However, in terms of interest arrangements, the policy has not yet provided a solution. Waste power batteries are still assets waiting to be priced.Only recycling companies can enjoy tax incentives. The recycling companies calculate and pay VAT at a rate of 3% or use the general taxation method to calculate and pay VAT, and the tax refund ratio has increased from 30% to 50%.

At the local level, recycling subsidies have emerged. For example, Shanghai provides direct subsidies to car companies for the utilization of secondary businesses, rewarding 1000 yuan for a set of recycled batteries; Shenzhen car companies provide a special provision of 20 yuan per kWh.

However, from the central level, there will be no large-scale subsidies for battery recycling, as with subsidies for new energy vehicles. Enterprises still need to research tax incentives policy and put more effort into technology research and development, striving for self-reliance.

Technical Line

Battery standards differ, and the model is diverse, which makes it difficult for battery cascading utilization and recycling.

Cascading utilization requires disassembly, testing, capacity division, and recombination, mainly by hand and semi-automation, there is not much difference in technology among various companies, and so far, they mainly rely on demonstration projects, unable to form economies of scale.

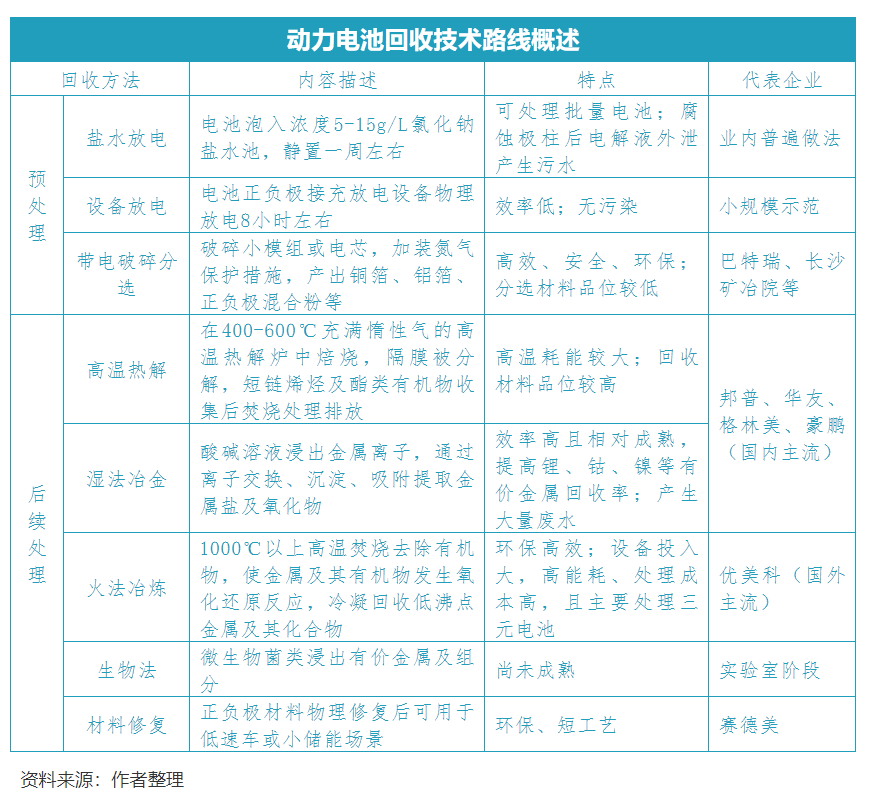

Recycling can be divided into pre-processing and post-processing. The pre-processing technology is divided into discharging and disassembly and crushing under current. The current crushed materials are sorted into copper foil, aluminum foil, black powder, shell, diaphragm, and other materials. Post-processing includes high-temperature pyrolysis, wet metallurgy, pyrometallurgy, material restoration, etc.

The dynamic battery recycling industry is still in the early stages of development. The recycling methods under study are numerous but no more than the above technical lines.

Under these technical lines, the material recovery rate, industry standard requirements for nickel, cobalt, manganese comprehensive recovery rate should not be less than 98%, lithium recovery rate not less than 85%, comprehensive recovery rate of other major valuable metals such as rare earths should not be less than 97%.

Of course, the higher the recovery rate, the better. However, improving the recovery rate requires not only excellent technology but also depends on the grade of the material in the pre-processing stage.

Take lithium iron phosphate batteries as an example, the market demand for crushed black powder with lithium content greater than 2.5%, preferably up to 3.8%. Hand separation of positive and negative electrode plates easily achieves the highest standard of purity, while the lithium content of crushed positive and negative electrode mixtures is basically below 3.0%.

This has led to the phenomenon of bad money driving out good.

A large number of batteries are recycled by small workshops, manually disassembled into shells, copper foil, aluminum foil, and black powder, with positive and negative plates finely disassembled, and material grade is high and priced at a premium. Some regular armies have even won bids to purchase batteries and outsource them to small workshops in poor areas such as Guizhou and Jiangxi for disassembly and pre-processing, followed by wet metallurgy recycling.

Low-cost, high-value recycling is the advantage of small workshops, and the cost of manual disassembly and sorting of one ton of batteries is 600 yuan, less than half the cost of regular army equipment disassembly and sorting.

The cost of power battery recycling is sacrificing the environment and personal health, which is not worth it. We truly hope that the country will establish a management system for supervising and managing measures, and truly achieve harmless and orderly recycling of power batteries.

The recycling technology route of power batteries is also evolving because the technology route of power batteries has not yet been finalized.

In the early stages of development, various batteries in power batteries, such as nickel-hydrogen batteries, manganese lithium batteries, lithium iron phosphate batteries, ternary lithium batteries, and lithium titanate batteries, all showed their strengths and had commercial applications. Later, lithium iron phosphate and ternary lithium batteries became absolute mainstream due to their strong performance advantages. In 2018, with the decline of subsidies, safety accidents of ternary batteries frequently occurred, and the installation volume of lithium iron phosphate batteries gradually expanded, showing signs of surpassing ternary lithium. Until 2021, the market chose to make lithium iron phosphate overtake ternary lithium, the successful reversal of share.

Development is still ongoing.

It is expected that in the next 3-5 years, quasi-solid-state batteries will begin to be applied on a large scale. In the next 10 years, solid-state batteries are expected to occupy a place.

With these changes, battery recycling technology and equipment will face bigger challenges.

Business Model To Be Perfected

The commercial model of power battery recycling must be established with good sources of recycling first.

There are a few but good sources of recycling, which are the test vehicle battery pack that can be recycled from the main machine factory. There may be only a few or several dozen but most of them have the value of hierarchical utilization. A few vehicle batteries can be directly regenerated and reused after the battery is burned or damaged by violent testing.

In addition, better sources include polar plate waste, un-liquidated battery cells, B- and C-grade battery cells, battery packs that can be recycled from battery factories, and so on. Polar plate waste market channels are stable and difficult to shake. B- and C-grade battery cells can be used for low-speed vehicles, two-wheelers, backup power supplies, street lamps, charging treasures, and other purposes. The market demand is huge.

There are also very good sources of recycling namely retired new energy buses in public transportation companies. This source is fiercely competitive, and hundreds of tons of lithium iron phosphate batteries can be recycled when a batch of buses are retired. Recyclers bid for the batteries, and based on the battery production year, brand, and battery condition, the price ranges from 100 to 200 yuan per kilowatt-hour. The batteries are manually disassembled on-site, pulled back to the factory, tested and sorted. Usually, 80% can be used in a hierarchical manner, and sold to hierarchical utilization enterprises or traders at a price of 200 to 300 yuan. Of course, the price of lithium carbonate is continuously soaring, and the price of battery-grade lithium carbonate has risen to 400,000 yuan per ton. Nowadays, the recycling price also needs to consider the value of regenerating and reusing.

The power batteries on the new energy vehicles scrapped by the automobile dismantling factory are also popular commodities. In 2018, more than 1,000 new energy vehicles were scrapped in the dismantling factory, 80% with batteries. In 2019, the dismantling factory also recovered more than 1,000 new energy vehicles, and 80% of the vehicle batteries were dismantled and sold in advance. What’s more, some traders sell a car of batteries, and the buyer has not yet driven on the expressway, and a new buyer will offer a higher price to intercept, in a battle for batteries.

Before the real cascade utilization and recycling enterprises, there are trading companies shuttling among them.

Trading companies are good at back-to-back sales, finding battery sources, inquiring about battery status and price ranges, verifying on-site, preparing for bidding, and looking for buyers. The purchase of waste batteries is a cash transaction, payment upon delivery, never arrears, but earning the difference. The most diligent salesmen even drive their private cars to sweep goods along the streets. Repair shops, scrapyards, and electric vehicle dealers are their frequent bases. It is not uncommon to pull two hundred kilograms of waste batteries in the trunk for one day, and it is a high-risk occupation.

After obtaining good sources of goods, how do real recycling companies make money?

Small workshops recycling battery businesses are flexible, with many routines, at the cost of sacrificing the environment and employee personal safety. It will not be described here in detail.

Although the regular army recycling can cooperate with host factories and battery factories, and some foreign car companies will provide free battery processing, the recycling volume is limited, and the existing business models are still difficult to profit.

There are also new business models.

In order to lock in battery sources in advance and achieve bulk recycling, recycling companies began to layout battery swapping businesses. The new energy vehicle battery swapping model has been explored, and NIO has built its own battery swapping station to be self-sufficient and favored by users. O-Dynamic built a battery swapping platform to provide battery swapping services for taxis, and some sites have already made profits. The battery swapping model reduces the cost of purchasing a car, solves the problem of charging, improves utilization efficiency, and is also conducive to recycling companies to achieve sustainable development of recycling. Based on the battery swapping of power batteries, recycling companies also promote the battery swapping mode in cascade utilization. A typical example is battery swapping for two-wheeled vehicles. The earliest delivery riders used lead-acid batteries and often interrupted service because of the inability to charge in time. The battery swapping mode for two-wheeled electric vehicles solves this problem very well and is the first to commercialize and make a profit.

Furthermore, in the process of battery recycling, there are often several tons of scattered batteries, which are not enough to fill a car and transport it back to the factory for processing. Recycling merchants can choose to store them temporarily at the recycling site, accumulate 30 tons, and then use a 15-meter truck to haul them away at one time. The number of power battery recycling service outlets registered with the Ministry of Industry and Information Technology has exceeded 10,000. It is difficult to profit from building a self-owned service outlet, with an annual operating cost of around 300,000 yuan. Therefore, cooperative construction and shared recycling sites are hotspots studied by recycling companies.

Rise in Material Prices Drives

The profit from battery recycling comes from either cascade utilization or material recycling and regeneration value.

Before 2021, the recycling and utilization of lithium iron phosphate batteries could be carried out in stages, but it was a common industry phenomenon to lose money in the utilization of regeneration. Most companies are unwilling to recycle, and there have been phenomena of giving away for several hundred yuan per ton or even free with self-paying for transportation fees.

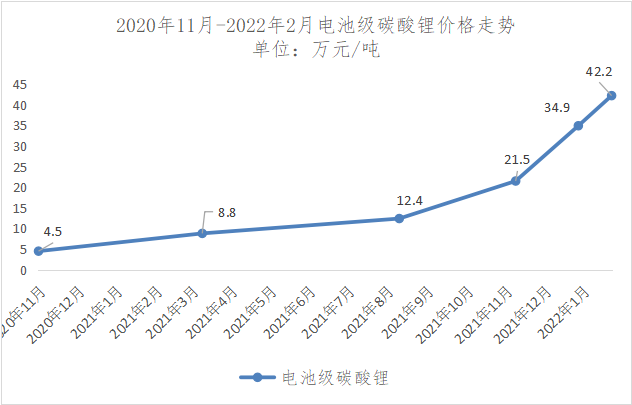

At the end of 2020, the price of lithium carbonate was still at a historical low level. Starting in 2021, it began to rise, soaring from 50,000 yuan/ton to 350,000 yuan/ton at the end of the year. As of February 17, 2022, the average price of lithium carbonate soared to over 430,000 yuan/ton.The recycling price of waste lithium iron phosphate batteries has also skyrocketed, and the price of aluminum shell cells has risen from about 2,000 yuan/ton at the beginning of 2021 to a quoted price of 15,000 yuan/ton (excluding tax and freight) now. Clearly, if material prices continue to rise, it will boost the profitability of the battery recycling industry.

So, what is the trend of battery material prices?

Good news: material prices are basically soaring. Let’s mainly take a look at lithium carbonate and cobalt.

In 2021, the price of battery-grade lithium carbonate rose for three main reasons. First, the sales of new energy vehicles have grown much faster than expected, and the supply of resources from abroad is insufficient while domestic smelting companies cannot operate at full capacity. Second, the capacity of lithium extraction from salt lakes in China was affected by winter, equipment maintenance periods and end-of-year inventory accumulation, leading to a decrease in supply. Third, 52% of the world’s proven lithium ore reserves are in Chile. In late 2021, President Boric, who is focusing on social change, won the election in Chile and promised to increase mining concession fees and corporate taxes, leading to increased mining costs.

In addition, the momentum of new energy vehicles will not slow down in 2022. Some experts predict that this year’s sales will reach the goal of selling 5 million vehicles in 2025 early and may even impact 6 million vehicles.

Lithium energy storage is also developing rapidly, and the demand for lithium batteries in the future may exceed that of electric vehicles. On the supply side of lithium carbonate, many new projects are not expected to start production until late 2023 at the earliest. Therefore, it is highly likely that the price of lithium carbonate will continue to rise and remain in a high range this year.

Global cobalt resources are concentrated in the Congo. In China, cobalt resources are very rare. Three-element lithium batteries mainly recover cobalt and nickel, and now waste three-element soft pack cells (523 systems) are prized commodities for recycling companies, with a purchase price approaching RMB 40,000/ton.

Cobalt, commonly known as “Cobalt Granny,” has a cyclical and significant price fluctuation. In Q1 2018, the estimated price reached a historical high of 680,000 yuan/ton and then dropped rapidly. By the end of 2018, the price had fallen to 340,000 yuan/ton. The main reason was that after May 2018, the growth rate of new energy vehicles slowed down, and demand decreased more than expected. At the same time, the production plans of cobalt mines began to be gradually realized, resulting in a significant increase in supply. From 2019 to 2020, the cobalt price fluctuated and stabilized at a low level of 200,000 to 300,000 yuan/ton. In 2021, due to tight raw material demand, the cobalt price continued to rise to more than 400,000 yuan/ton. As of February 17, 2022, electrolytic cobalt had risen to 530,000 yuan/ton.Africa’s Democratic Republic of the Congo is a politically unstable country with underdeveloped logistics capacity. Fortunately, the share of lithium iron phosphate batteries is gradually expanding, and the application of 811 low-cobalt system batteries is increasing. The demand for cobalt resources is not as urgent as that for lithium, and this year it may remain in the range of 500,000 to 600,000 yuan/ton.

The price of recycled ternary battery black powder in the market is mainly calculated based on the cobalt content, nickel content, and cobalt price coefficient.

With the high price range of cobalt and high price coefficient, the value of recycled ternary cathode black powder also increases, which is beneficial for the development of the industry.

The high price of materials is one of the prerequisites for recycling companies to operate. Recently, there has been news that in some scenarios, the price of old batteries is not inferior to that of new batteries because recyclers value the value of material recycling.

Conclusion

Based on the current situation in the industry, I also have some suggestions.

In terms of policy, I hope the country can establish a regulatory and punishment mechanism, include waste power batteries in the “Hazardous Waste List” plan, and gradually implement the qualification management for the recycling of waste power batteries.

In terms of society, I hope that car companies can establish battery recycling mechanisms or encourage consumers to exchange old batteries for new ones, guide individual users to directly hand over ownership batteries to regular recycling companies, reduce intermediate links, and enhance environmental awareness to devote to harmlessness of batteries recycling.

In terms of technology, I hope that recycling companies can strengthen process technology and equipment research and development, focus on the development trend of power battery technology, plan research and development directions and priorities, and devote themselves to safe, environmentally friendly, refined, and automated recycling overall solutions.

The reason why the power battery recycling industry is interesting mainly lies in the uncertainty of the value of waste batteries. Just like “gambling on a stone,” it is difficult for you to judge how much jade is contained in a stone and what is the value of the jade found. Of course, experienced battery recyclers can accurately judge the value of waste batteries through certain methods and assistive tools. Besides, it also depends on your recycling technology, whether you can really turn waste into treasure.

At the beginning of the new year, everything is renewed. I wish the power battery recycling enterprises roar like tigers with the wind, accumulate wealth, and create a future!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.