ADS 4 is finally on its way.

Released this April, ADS 4 and HarmonySpace 5, part of Huawei’s Intelligent Automotive Solutions BU, will start rolling out from next month, as recently disclosed by Jing Yuzhi.

On August 22, Garage No. 42 had a deep discussion with Jing Yuzhi. He provided insightful answers on ADS 4’s positioning, Huawei QianKun’s ultimate goal for intelligent driving, and how Huawei envisions the next phase of smart driving.

He emphasized that Huawei’s pursuit in assisted driving is zero fatalities, and ADS 4’s new architecture is designed to make driving safer, more efficient, and smoother. In terms of technology, he believes the pure vision path will continue to improve, but lidar remains necessary for safety redundancy.

In its business model, Huawei acts more as a “companion,” filling the intelligence gaps for car manufacturers from product definition to design and manufacturing to marketing. He also agrees that charging for assisted driving is an inevitable trend in the industry; the key to measuring value is whether users are willing to pay for safety and experience.

Jing Yuzhi specifically mentioned ADS 4 as an architectural evolution: it’s akin to adding a “digital driver” to the car, making driving safer and more efficient, while HarmonySpace 5 resembles a “digital nanny,” actively understanding and serving vehicle owners’ needs.

Jing Yuzhi also introduced the latest updates on Huawei QianKun Intelligent Driving as of July:

- Vehicles equipped with Huawei QianKun Intelligent Driving have reached 1 million units;

- The number of cars featuring Huawei’s lidar has also surpassed 1 million;

- The cumulative usage of parking-to-parking navigation assistance has exceeded 10 million times;

- The cumulative assisted driving mileage surpassed 4 billion kilometers and is expected to exceed 4.5 billion kilometers by August;

- Potential collision prevention has been achieved 2.54 million times;

- So far, 28 models equipped with Huawei QianKun Intelligent Driving have been launched, covering a price range of 150,000 to 1 million.

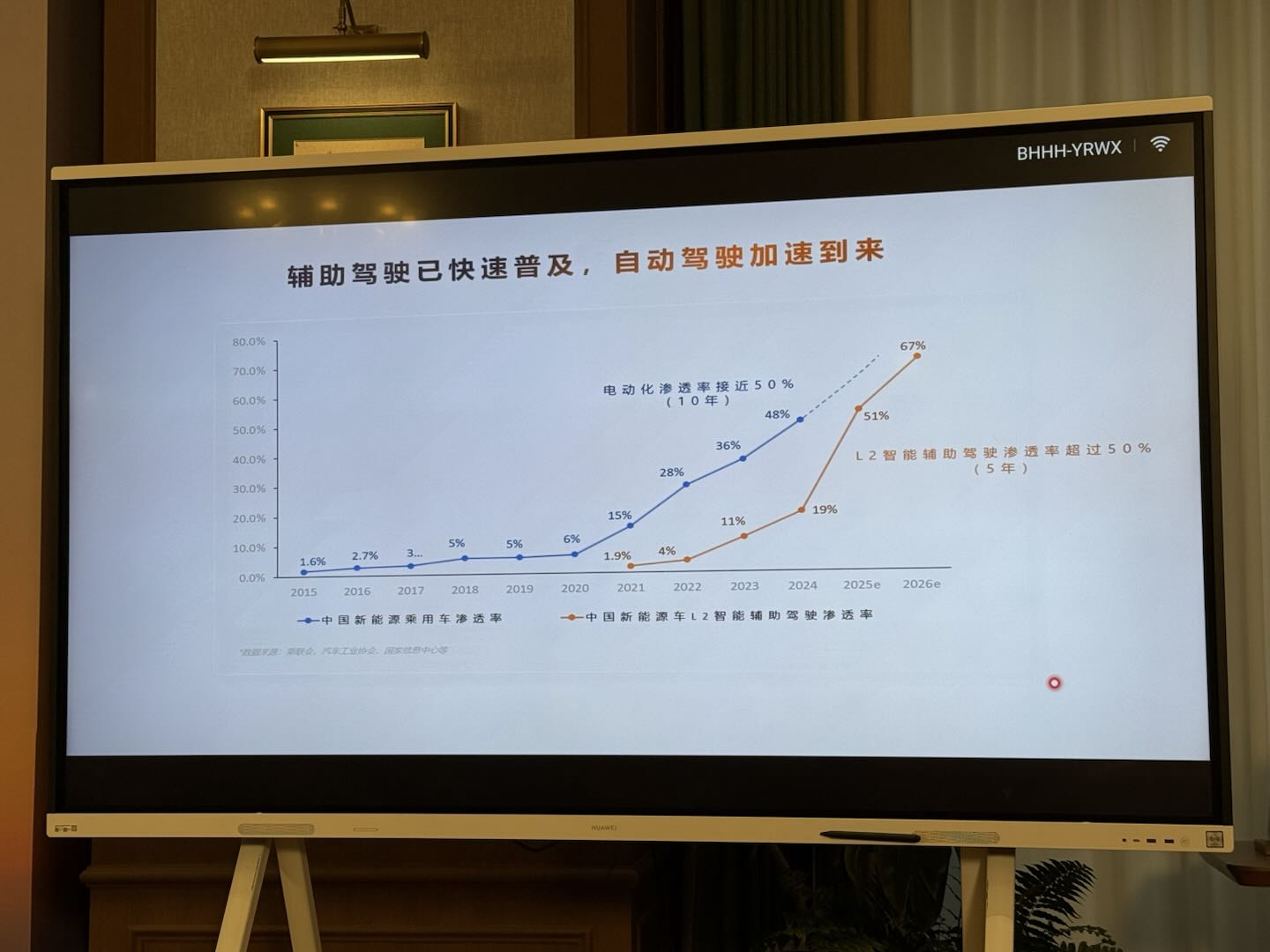

These figures showcase Huawei’s leading advantage in the scale of smart driving deployment and reflect the industry’s transition from novelty to widespread adoption of Huawei QianKun Intelligent Driving.

Below are the main contents of the interview, edited without changing the original intent:

The ultimate goal of QianKun Intelligent Driving is zero fatalities

Q: Huawei has made significant achievements in assisted driving. What did Huawei do right, and what are the future aspirations?

A: The key was maintaining a user-centered value system and committing to long-term investment rather than focusing on short-term gains. Our future aspiration, as depicted in our slogan, is to make travel safer and life better, with zero fatal accidents as the ultimate goal. Zero fatalities mean ensuring safety, safety, and more safety, which is the ambition for autonomous driving. In the pursuit of the cockpit, the goal is to transform it into a stronger AI assistant, gradually evolving into an AI Agent, and ultimately achieving a more intelligent, organized, and innovative setup, making it seem as intelligent as a human, minus many of the inconveniences associated with human service.

Q: Some car manufacturers now view VLA as a long-term technological path, possibly leading to genuine L4. What is Huawei’s perspective on this technological evolution, and looking ahead a few years, how many global players will have genuine L3, L4 capabilities?

A: Regarding technology routes, two typical paths exist in the industry: one with LiDAR and one without. As AI capabilities strengthen, pure vision-based approaches will undoubtedly improve. However, adding LiDAR undeniably enhances everyday safety.

VLA’s attempt is to convert video into language tokens for training, ultimately translating into actions to control vehicle trajectories.

This diverges from our approach. We won’t pursue VLA, as we believe this seemingly clever path isn’t the genuine route to true autonomous driving. We emphasize WA (world action), bypassing the language stage. We aim to navigate directly to this challenging yet ultimate path, where control is achieved through direct input—whether from sound, vision, or touch—rather than converting various data into language and using a language model to control the vehicle.

This is our understanding of future technological development. While it may be more challenging, it represents the ultimate solution.

Ultimately, autonomous driving companies will consolidate. Five or six years ago, it was as hot as embodied intelligence is today, but the numbers have significantly diminished, and they will further decrease.

As autonomous driving progresses, it will significantly rely on data-driven development, requiring vast data volumes, computational power, and algorithms. Eventually, it will become clear that a shared intelligent platform is crucial for the industry, as independent investment is not cost-effective.

Q: I noticed in September, the OTA updates do not cover any Ultra version cars. Will all non-Ultra models not be upgradeable to Ultra, or does it require additional hardware for the Ultra version?

A: Let me clarify: to support L3, the hardware must meet specific requirements. However, lacking L3 hardware currently doesn’t prevent upgrades to ADS 4. ADS 4 is built on a new MoLA architecture, enhancing safety, efficiency, and smoothness, independent of having L3 hardware.Many users are concerned whether hardware configurations can be updated like software OTA. However, according to current regulations, this area has not been opened up, primarily to ensure user safety. We also hope to allow hardware upgrades in the future, enabling the original car to upgrade to L3 or even L4. The core is to ensure quality and safety during the upgrade process. This needs to be a gradual process as the industry develops.

Q: Why are more and more LiDAR units being added? Some people say this is Huawei’s attempt to justify a price premium. How do you respond to that?

A: Adding sensor configurations is meant to enhance safety. Our ultimate pursuit is zero fatal accidents. Any improvement in safety is worth the investment. In addition to forward-facing LiDAR, the Zunjie S800 features three more units—two lateral and one rear solid-state LiDAR. Ultrasonic radar lacks precision, and cameras need training because they capture 2D images without depth information. Many scenarios require LiDAR for safety redundancy, driven by scenarios, not by deliberate addition.

Q: What significance do horizontal and vertical concepts in the cockpit have for the future of the cockpit? What are the future development trends?

A: Cockpits will develop towards more digitalization and digital assistance. Horizontally means we need to horizontally integrate various vertical applications based on the MoLA architecture, connecting all everyday applications for operation and task execution. Vertically, people often pursue cost-effectiveness and decoupling, where screens, hardware, and software are provided by different companies, appearing economical. However, it’s not the most economical or reasonable over the entire lifecycle, as it leads to high complexity and experience deterioration. Integrating different brands’ audio systems, screens, cockpits, domain control, and software results in a reduced experience. This is why our assisted driving never separates sensors, hardware, and software—it involves safety, and issues can make it unclear where the problem occurred.

Exploring New Collaboration Models

Q: Currently, Audi is the only foreign brand among Huawei’s 28 collaborative models. Upcoming partnerships include GAC Toyota. Can you disclose the progress with GAC Toyota? When can we expect to see a third foreign or joint venture brand collaborating with Huawei?

A: Audi is the first foreign brand, but surely not the last. The second, third, and fourth are on the way, awaiting official announcements.

Q: Is Huawei exploring a new business model for collaboration with automobile companies? What are the reasons behind Huawei’s in-depth full-stack collaboration with automakers? How does Huawei empower car manufacturers deeply in branding, product design, definition, and marketing under this new model?

Q: Is Huawei exploring a new business model for collaboration with automobile companies? What are the reasons behind Huawei’s in-depth full-stack collaboration with automakers? How does Huawei empower car manufacturers deeply in branding, product design, definition, and marketing under this new model?

A: The reason for in-depth empowerment is that many automakers, especially those in central and state-owned enterprises, have strong mass manufacturing capabilities, with extensive experience in quality and process control. As they transition from fuel to electronic and intelligent vehicles, there are still areas where automakers need to strengthen both at the front and back ends. Huawei has a wealth of successful experience in these areas, and many car companies are adopting Huawei’s IPD and IPMS processes. Huawei takes on a supportive role, accompanying companies from product definition to design, manufacturing, and marketing channel management, providing deeper empowerment along the way.

Q: Huawei’s client base is expanding, but with limited resources, how long does it take Huawei QianKun smart driving to match with a car model? Can your team manage the workload? What are the future plans?

A: Our primary focus is to ensure quality and delivery, aiming for excellent alignment between both parties. The fastest matching time is approximately 6-9 months.

Q: Why do many automakers still choose to work with other suppliers? What do you think is the reason behind these different choices?

A: Each company has its unique way of survival. Huawei’s market coverage in car models above 300,000 has been high, suggesting that future luxury or high-end car buyers have more faith in Huawei. Cars with excellent autonomous driving features can fetch better resale prices. In contrast, those with inferior or obsolescent systems may struggle in the second-hand market.

Q: What are the commercialization goals for Huawei Automotive BU now?

A: We don’t have specific commercialization targets. When asked at last year’s Beijing Auto Show if we planned to achieve current profitably, I emphasized that profitability for a particular year is not our focus. We will naturally achieve it as long as we persist in doing the right thing, focusing on users, and maintaining long-term investment.

The Core is Long-term Investment

Q: Bosch’s executive, Wu Yongqiao, recently called for charging for advanced driver assistance systems, rather than offering them for free. Will Huawei’s systems be priced at 70,000, while competitors might charge 50,000 or 40,000?

A: I believe there’s no such thing as free. Although some online services appear free, they are monetized through ads or other forms of payment. In cases where assistance is temporarily free, it is either time-limited or its costs included in the vehicle’s price. Ultimately, the pricing depends on user expectations. While buying such services seems like a one-off transaction, automakers must continuously update and upgrade throughout the vehicle’s life cycle for better, safer, smoother experiences, requiring long-term investment. It’s possible some may find their initially perceived economical choice unsustainable after a couple of years due to outdated technology.## Q: A few competitors mentioned that in the autonomous driving field, the market share among suppliers is approximately 7:2:1. How do you see this ratio evolving in the future? Compared to intelligent cabins, the differentiation of autonomous driving seems lower. As competition intensifies, do you foresee a downward trend in pricing? With increasing partners, how might Huawei’s pricing power be affected?

A: The statistics from competitors may have certain conditions. We hope influential third parties provide objective data to users. Autonomous driving essentially offers a digital chauffeur, aiming for zero accidents and casualties, operating as smoothly as an experienced driver with high efficiency. The pursuit shouldn’t differ, whereas cabins are more personalized.

Pricing power is determined by users; whether users see value in your system is the key measure. If users feel that the system replaces a professional driver, meeting or exceeding professional standards, they might find spending thousands on it worthwhile.

Q: So far, the lowest price of a model equipped with Huawei QianKun’s intelligent driving is around 150,000 RMB. The cost-reduction effect due to scale will gradually manifest. In China’s passenger car market, the 100,000-150,000 RMB range is the largest segment. Is it possible the price of models with QianKun’s intelligent driving will further decrease to this range in three to five years?

A: We hope our technology serves more users progressively. Regarding the 100,000-150,000 RMB range, there is no clear plan yet, but I think it’s possible in the future as we progress. We aim to expand to this price range eventually, offering users more choices and serving more users. For various reasons, we currently focus on a limited price range.

Q: Audi successfully equipped its fuel cars with QianKun intelligent driving, breaking the notion that only electric cars can excel in autonomous driving. What does this strong collaboration between Huawei and Audi signify for the automotive industry, and what impact does it have?

A: Audi, a century-old luxury brand, equipping QianKun intelligent driving, signifies that luxury brands must consider intelligence in the future. It also suggests that in the new energy era, high-end brands aren’t set in stone, providing a great opportunity for Chinese brands to move from low to high-end.

Q: The ADS system actually includes four hardware versions. In future communications, carmakers might emphasize ADS 4 more and downplay ADS SE versions. Could this approach lead to user misconceptions, not understanding the boundaries of SE and other versions?

A: If you paid attention to the QianKun intelligent automotive solutions tech release during the Shanghai Auto Show in April, you’ll see that ADS 4 includes ADS SE, which will also upgrade to ADS 4. We cover ADS SE, Pro, Max, and Ultra, with L3 being called Ultra. Just to clarify.With SE models, usage scenarios such as highway support, parking assistance, and urban LCC Plus clearly outline the capability boundaries, emphasizing its role as an advanced driver assistance system (ADAS). These capabilities are well within its application limits. After upgrading to ADS 4, both forward braking, activation, and longitudinal lane changes will become more seamless, which enhances the overall experience. However, the inherent application boundaries remain unchanged.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.