In 2025, assisted driving once again became a focal point.

At the beginning of this year, multiple car manufacturers such as BYD, LEAPMOTOR, and Chery announced the democratization of technology, with cars priced at 100,000 RMB equipped with urban assisted driving functionalities, and vehicles costing 120,000 RMB featuring LiDAR. However, in April, a trend toward pragmatism swept the industry as the First Division of Equipment Industry of the Ministry of Industry and Information Technology organized a meeting to advance smart connected vehicle admission and software online upgrade management, with Huawei leading an initiative for intelligent driving safety in partnership with over a dozen automotive manufacturers.

But this does not imply that the development of assisted driving will experience a downturn. On the contrary, technological advancement will not cease, nor will the progress of democratization. Behind the democratization of assisted driving is an important player, Qualcomm. At the Shanghai Auto Show this year, over 65 enterprises were Qualcomm’s automotive ecosystem partners.

Earlier this month, Yuanrong Qixing and Qualcomm Technologies announced a collaboration to develop assisted driving functions based on the Snapdragon Ride Platform (SA8650), offering high-performance and cost-effective assisted driving solutions. During the Shanghai Auto Show, Qualcomm also teamed up with partners such as BAOJUN, LEAPMOTOR, Chery, SAIC-GM Buick, Hong Qi, and ECARX to showcase multiple models and products equipped with Snapdragon Ride. Currently, vehicles using the Snapdragon Ride platform cover various market tiers, ranging from 60,000 to 340,000 RMB.

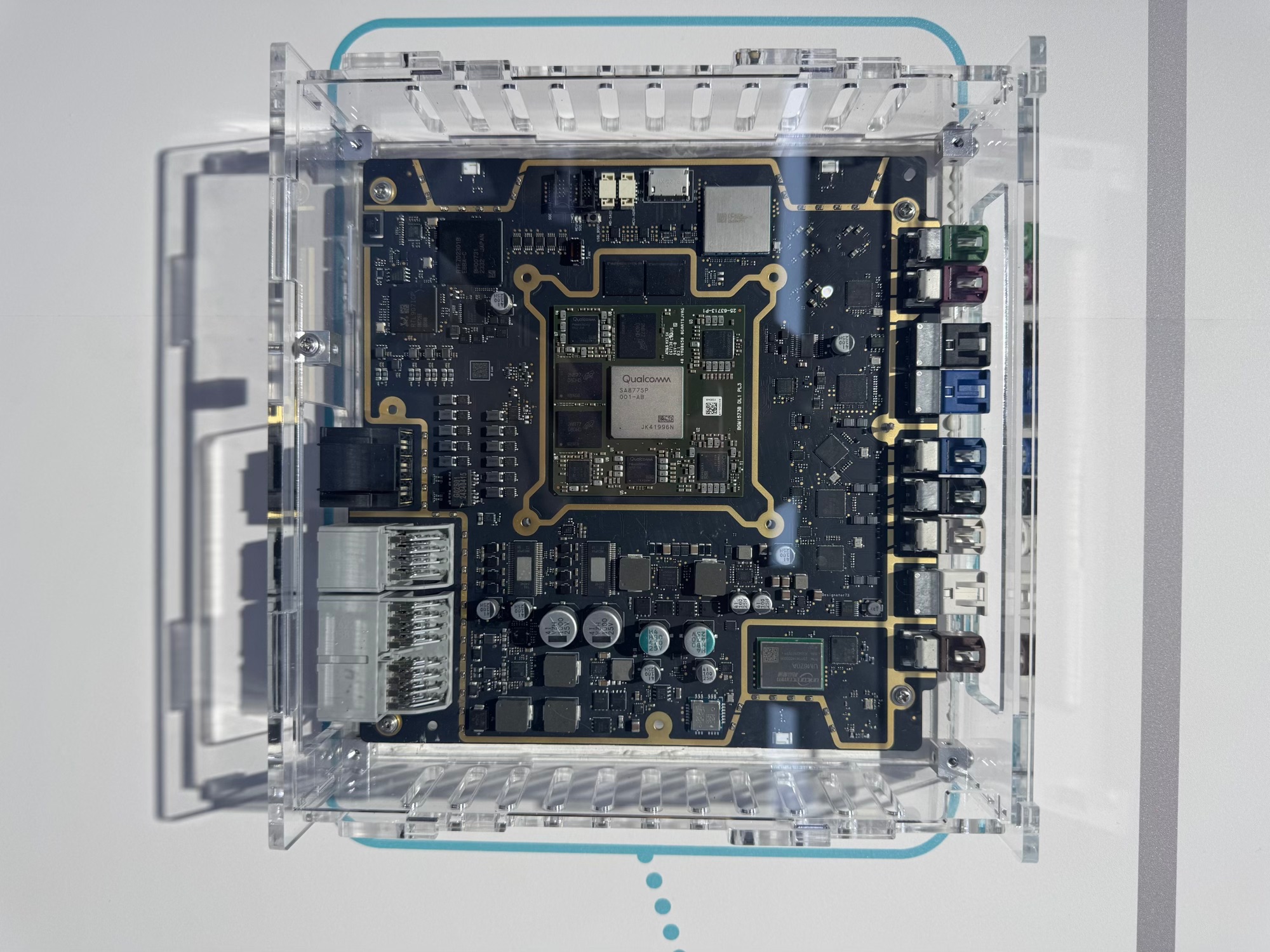

Furthermore, Qualcomm’s Snapdragon Ride Flex platform (8775), which supports cockpit-driving integration, has also entered mass production. During the exhibition, SAIC-GM Buick showcased the “Unrestrained” super integration architecture, and BAIC Group’s cockpit-driving AI platform were both built on the 8775 chip.

In the process of technological democratization, Qualcomm has taken center stage.

Once, urban assisted driving functionalities were features of high-end models priced at 300,000 to 400,000 RMB. Now, under the backdrop of technological democratization, they are available for under 100,000 RMB. How was this achieved? Why does Qualcomm hold a unique position in this market?

During the Shanghai Auto Show, several media outlets, including Garage 42, jointly interviewed Nakul Duggal, GM of Automotive, Industry Solutions, and Cloud at Qualcomm Technologies, and Anshuman Saxena, VP of Product Management. They provided a more detailed interpretation of various issues, including software-defined vehicles and the democratization of assisted driving.

Why Focus on the Chinese Market?

At the beginning of the interview, the first topic Nakul mentioned was the Chinese market.

Chinese car manufacturers prioritize electric vehicles without the influence of preceding traditional architectures. Nakul believes that electric propulsion, intelligent cockpits, and assisted driving naturally make vehicle architecture design more intuitive.

He mentioned that, besides the lack of influence from previous traditional architectures, Chinese car manufacturers have another significant advantage: a large pool of excellent software talent. He stated, “Because China is home to some of the world’s best software and AI talent, Chinese car manufacturers have the ability to apply cloud-first and mobile-first software architectures to automotive platforms, which is crucial for advancing China’s automotive ecosystem.”It is precisely because the Chinese market is leading the world in electric and intelligent fields that Qualcomm has established a large team in Shanghai, China, focused on the automotive sector. Nakul said, “This team maintains close collaboration with our automotive partners and customers. Whenever we observe a need for faster response and innovation in the market, we can assemble specialized teams to align with the local rhythm of Chinese customers, fulfilling localized development requirements.”

Around the Shanghai Auto Show, Qualcomm announced partnerships with companies such as Yuan Rong Qixing, Pateo, Desay SV Automotive, and ECARX to further promote the implementation of smart cockpits and assisted driving features. Meanwhile, Qualcomm also has in-depth cooperation with suppliers such as ThunderSoft, Synopsys Technology, Momenta, and Zhooyu Technology, forming a large-scale ecosystem in China. In addition to cooperation, Qualcomm and the Chinese company ThunderSoft have jointly established Thundersoft Auto, which also owns automotive solution products.

Nakul said, “For us, co-development has become a very natural part of Qualcomm’s business operations.”

Meanwhile, Qualcomm also collaborates with overseas automakers such as Mercedes-Benz, BMW, and Volkswagen. When these car manufacturers need to conduct business in the Chinese market, Qualcomm can cooperate like a local enterprise with their Chinese teams. “Similarly, when Chinese companies like Momenta wish to expand overseas, we also provide support globally,” Nakul added.

Two Key Factors for Assisted Driving: Safety and Scalability

In China, assisted driving is still rapidly growing, but the challenges are significant. On one hand, users are highly sensitive to safety, while on the other, there is cost and price competition.

Nakul pointed out that over the past two years, the quality of assisted driving deployment has significantly improved, whether on highways or in urban road scenarios. The two most critical factors are safety and scalability.

Nakul explained that in the field of assisted driving, Qualcomm specifically added safety features to multiple technical modules during the chip design process. This allows development teams to achieve the highest performance while meeting safety standards. In the chips, including modules like cameras, GPUs, and NPUs, the entire system is designed with safety at its core. Qualcomm also built a Safety Island Controller into the SoC to meet ASIL-D level safety standards.

From a software standpoint, whether it’s the Hypervisor or third-party solutions like QNX, they possess global applicability. Nakul emphasized that Qualcomm ensures product designs meet the highest safety certification requirements, providing products that comply with ASIL-D standards.Beyond security at the chip level, Qualcomm has also made arrangements in software safety and process security. In other words, apart from ASIL functional safety, Qualcomm’s products must also comply with ASPICE (Automotive SPICE) and MISRA coding standards.

Nakul said: “This places higher demands on our development, system, and testing teams, but it also brings a benefit: we can ensure that our solutions meet the safety requirements needed for driver assistance scenarios.”

Safety is also reflected in quality, as Nakul shared a key statistic: the failure rate per million products is kept within single digits.

He stated that achieving this requires not only significant company investment but also a deep technical understanding, rigorous processes, comprehensive testing systems, reliability control, and continual tracking mechanisms.

“Frankly, only a company with substantial accumulation and long-term experience in the chip development field can truly achieve this.” This statement by Nakul implies that manufacturing automotive chips is not something just any company can do. Relying on Qualcomm’s 23 years of experience and accumulation in the automotive sector, combined with its comprehensive R&D system, Qualcomm has the confidence to declare that its hardware for driver assistance is “safe.”

Another key point Nakul mentioned is scalability, corresponding to the current democratization trend in the driver assistance field.

Nakul stated: “Our technology planning and product roadmap are always designed around one premise: as features gradually standardize, we must fully consider the cost of the chip. One way we optimize costs is by ensuring that the features we support on high-end or mid-range chips are progressively transferred to lower-tier chip platforms.”

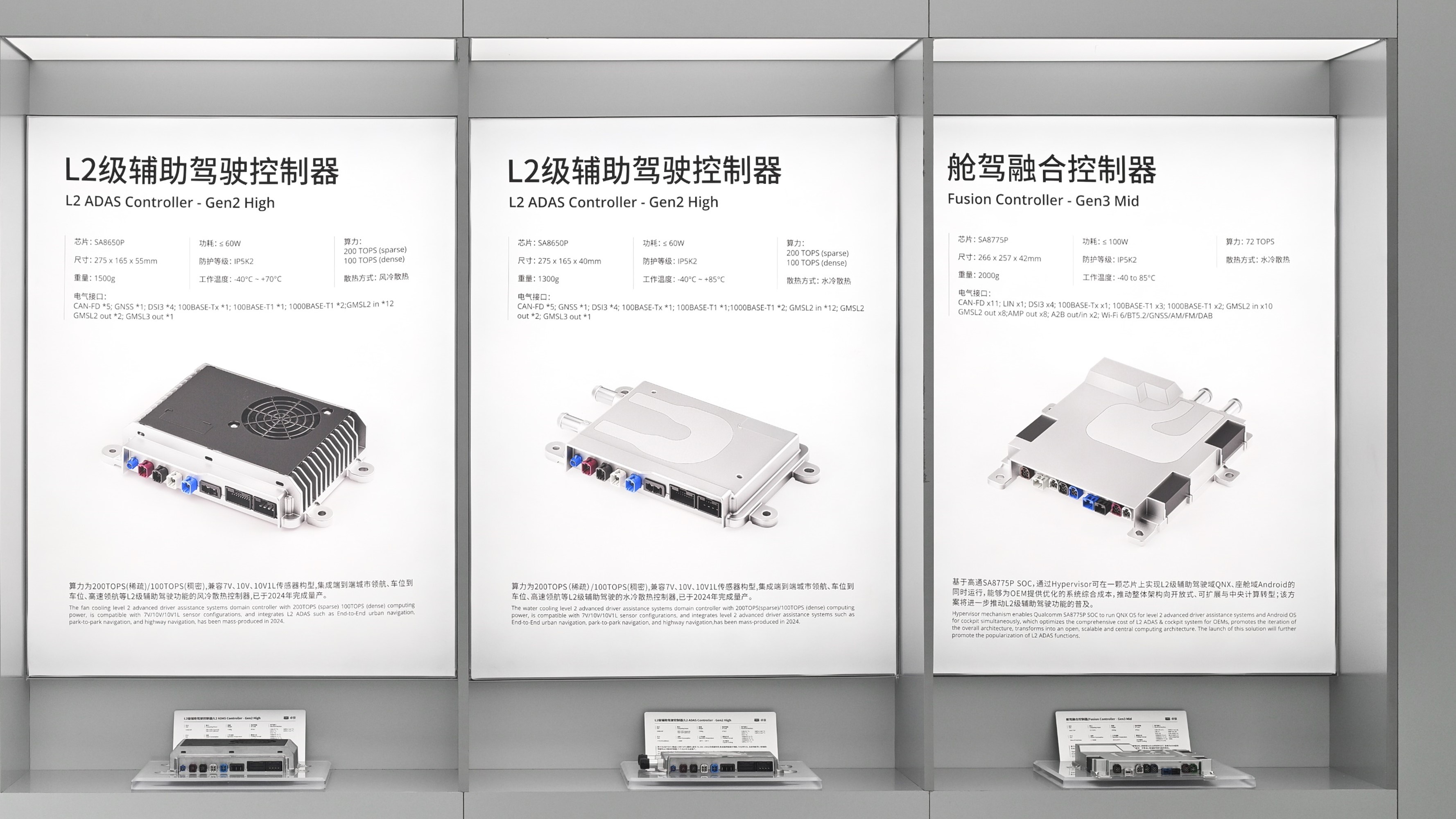

Currently, Qualcomm offers three types of solutions in the driver assistance field. The first is based on the Snapdragon 8620 chip, which supports high-speed driver assistance with cost advantages and passive cooling (suitable for fuel vehicles as well). The second is based on the Snapdragon 8650 chip, which supports urban driver assistance. The third is based on the Snapdragon 8775 chip, which can handle both intelligent cockpit and high-speed driver assistance functions in real-time, achieving cockpit fusion.

Apart from reducing chip costs, Qualcomm also strives to support more types of sensors when designing hardware. For instance, even the entry-level 8620 chip supports lidar integration. Nakul further mentioned: “A unique advantage of Qualcomm’s platforms is that they are designed primarily to provide the best overall and AI performance for different usage scenarios within a controllable thermal capacity range.”

Speaking of the cockpit fusion chip Snapdragon 8775, Nakul believes that cockpit fusion can eliminate the cost of the physical modules, interfaces, cooling solutions, and memory subsystems of two systems, further reducing costs.

Nakul shared that, during the Shanghai Auto Show, he had observed six or seven different road testing projects in Shanghai, showcasing that a single Snapdragon 8775 SoC could support high-speed, urban assisted driving, and intelligent cockpit functions. He remarked, “This indicates that once the technology matures, it can achieve light-weighting and integration while reducing costs.”

This also signifies Qualcomm’s continued deep involvement in the Chinese automotive market, advancing technology democratization.

Appendix: Original Key Interview Content

Q: How do you perceive the uniqueness of China in the transition to software-defined vehicles, and how does it compare with other countries? Moreover, in collaborating with Chinese automakers, how does Qualcomm balance standardized technology with the personalized demands of car manufacturers?

Nakul Duggal: From the perspective of software-defined vehicles, I think one aspect from which Chinese car manufacturers benefit is: the ability to launch platforms prioritizing electric vehicles without the influence of legacy traditional architectures. These new architectures can be designed on the basis of contemporary modern software, considering automotive capabilities in three dimensions: the first is the electric drivetrain, the second is the intelligent cockpit, and the third is driver assistance. Thus, the creation of a software-driven, software-defined, software-first platform undoubtedly makes the design of the entire architecture more intuitive.

The second major advantage for Chinese automakers is the abundance of excellent software talent throughout the industry, enabling them to apply cloud-first and mobile-first software architecture to automotive platforms, which is crucial for advancing the Chinese automotive ecosystem.

Another unique advantage of the Chinese automotive ecosystem is the large number of OEMs in its supply chain, forming a competitive market that’s also rich in collaboration opportunities. The pace of technological advancement, the introduction of new functionalities, and the emergence of new concepts and innovations are remarkably fast. Being part of such rapid changes allows Qualcomm to continually break new ground, drive innovation, and provide new momentum for the Chinese automotive ecosystem.

Over the past three years, we have observed that whenever we introduce innovative capabilities for Qualcomm’s chips and platforms, different car manufacturers choose different integration timelines. We are eager to collaborate with those willing to push the boundaries of innovation, which also prompts Qualcomm to accelerate its innovation efforts.

And I can proudly tell everyone that we have a large automotive-focused team in Shanghai, working closely with our automotive partners and clients. Whenever we see a need for quicker responses and faster innovation in the market, we can assemble specialized teams to align with the pace of our local Chinese clients and meet localized development needs.

Q: How does Qualcomm balance between rapid technological iterations and long-term service support?

A: I believe Qualcomm has an inherent advantage in the automotive industry. First, Qualcomm is a large semiconductor supplier with a significant number of technological inventions and technical accumulations, which provides us with a high degree of autonomy over our products. Additionally, we possess an extensive global R&D team. When we decided to enter the automotive sector, an area characterized by long product life cycles, we understood clearly that it is essential to support these products over a longer timeframe from both a supply perspective and as ecosystem supporters. We’ve consistently done this, and till now, Qualcomm has been in the automotive industry for 23 years, so automotive is not a new business for Qualcomm but a long-term, global endeavor. When we understand customer needs, we continually adjust our business processes and investment directions to ensure equal levels of support for our clients.Q: How does Qualcomm perceive its partnerships with these Chinese companies? Will there be more in-depth customized development similar to the existing cooperations with domestic suppliers and automakers? Are there any cases of this?

A: We have always maintained collaborative development relationships with all our customers, working with many primary and secondary supplier partners. We not only cooperate with some partners but have also invested in them. Thundercomm is a joint venture between Qualcomm and ThunderSoft. So, for us, co-development is an integral part of Qualcomm’s business operations. In the automotive field, due to the rapid market development, we must ensure that we collaborate with top-notch partners in the ecosystem to provide the most competitive products.

For example, in our collaborations with global automakers like Benz, BMW, and Volkswagen, when they need to operate in the Chinese market, we engage with them as if we were a local company and work with their local teams in China.

Similarly, when Chinese companies like Momenta seek to expand into overseas markets, we provide global support. Our philosophy is a global strategy—not only helping clients succeed in the Chinese market but also assisting them in achieving success abroad. As Chinese automakers continuously seek to expand overseas, we will continue to support them.

Q: How does Qualcomm view the risks and opportunities brought about by the Chinese assisted driving market this year? Considering the continuous cost reduction of lidar, how does Qualcomm perceive whether the semiconductor field will experience or has already undergone a similar development trend?

A: We have been observing the developments in the assisted driving field in China over the past five years, and the progress is indeed rapid. This is not surprising, as China possesses some of the world’s best software and AI talent.

In the past two years, whether on highways or in urban scenarios, the quality of deployment for assisted driving solutions has significantly improved. Your question touched on both safety and scalability.

Firstly, China has a wealth of talent and industry experience. Although technology is constantly maturing, the standards followed during implementation vary among parties. In this context, establishing a safety standard which all participants must adhere to is a natural outcome.

Secondly, we are seeing assisted driving functionalities permeate different vehicle tiers, including those priced at 100,000, 200,000, and 300,000 yuan. Different tiers of vehicles deploy different combinations of functions, which do not entirely depend on the cost of sensors or processors. We are working with partners to create multiple platforms to meet the needs of varying market tiers.

Q: Lidar costs are continuously decreasing, and semiconductor costs cover various ranges. Will there be a downward trend in costs moving forward?

Nakul Duggal: As technology matures, once everyone understands the functionalities a technology can offer, the next step tends to involve spending considerable time optimizing chips and hardware to meet specific standards at the lowest possible cost. We are currently in this phase.In China, the development of driving assistance can be broadly categorized into three types: Highway Scenario NOA (Navigation on Autopilot), Highway+Urban NOA, and the use of lidar for more complex urban scenario planning. For highway NOA, we have seen the industry invest heavily in optimizing chip and sensor costs. Qualcomm offers two solutions in the driving assistance domain: the Snapdragon 8620, providing a cost-efficient solution for highway NOA, and the Snapdragon Ride Flex series, a comprehensive solution enabling digital cockpit and highway NOA functionalities on a single chip. As driving assistance features become more widespread, evolving from highway NOA to Highway+Urban NOA, the Snapdragon 8650 offers higher performance support, while the Snapdragon 8775 can support both functions.

Our technical planning and product roadmap are always designed with a premise: as features become standardized, we must fully consider the cost of chips. As a chip company, Qualcomm is deeply aware of this, which is why we maintain a close collaboration with car manufacturers, top-tier suppliers, and software stack providers to understand which technologies are mature and which are evolving. Once a technology stabilizes, cost optimization pressure ensues. One cost optimization approach is to ensure features supported on high-end or mid-tier chips are gradually extended to lower-tier chip platforms.

Anshuman Saxena: Additionally, lidar is a critical sensor, providing advanced functionality by adding an additional perception modality to systems based on cameras and radars, thus supporting more use cases and design operating domains (ODD).

Furthermore, when we optimize cost, scenarios must be clearly defined. For instance, the Snapdragon 8620 is an entry-level solution for highway and basic urban NOA, and we assess system optimization based on established functional requirements. Snapdragon 8620 supports passive cooling systems, meeting the needs of both electric and fuel vehicles. Qualcomm continuously focuses on system and SoC optimization, allowing customers to enhance cost efficiency while maintaining consistent experience levels. For scenarios requiring lidar, all our SoCs support lidar integration.

Q: How do you view car manufacturers developing their own chips? Also, in the development of Qualcomm’s next-generation platform, will there be more interfaces for multisensory fusion?

Nakul Duggal: All our chip products support lidar. Our chip designs typically focus on cost alignment for the functions they need to support, and models using Snapdragon 8650, Snapdragon 8775, and Snapdragon 8797 generally support lidar.Qualcomm platforms have a unique advantage in that they are designed with the primary consideration of providing optimal overall performance and AI performance within a controllable thermal capability range for various use scenarios. We believe that as sensor costs continue to decrease, manufacturers will be able to deploy increasingly complex software stacks, supported by our platforms. Moreover, as the cost of LIDAR decreases to a point where it becomes an industry-standard configuration and LIDAR sensors must be added to ensure compliance with safety standards, our chips are capable of supporting this capability.

Regarding automakers’ self-developed chips and how Qualcomm maintains competitiveness in a constantly changing market environment: Qualcomm, as a semiconductor chip company, possesses the core technology for semiconductor creation, covering a wide range of product fields. This is a highly systematic framework, integral to what we do and our expertise.

When it comes to safety, especially in the domain of Advanced Driver Assistance Systems (ADAS), Qualcomm incorporates safety-related technology into every technological module it creates. We apply the same design philosophy to each module, including cameras, GPUs, and NPUs. The entire system is designed with safety at its core. We also have a safety island controller built into the SoC, and our chips are specifically designed to meet the highest level of automotive functional safety, the ASIL-D level, and have been certified by multiple global authoritative certification bodies.

From a software standpoint, whether Hypervisors or third-party solutions like QNX that we utilize, they possess global applicability. QNX, our long-term partner, has been a benchmark in the safety Real-Time Operating System (RTOS) field for decades. Therefore, we ensure that the products we offer in this realm are designed to meet the highest safety certification requirements, adhering to the ASIL-D standard.

Beyond chip-level security, we also focus on software and process safety. All our products are required not only to strictly conform to ASIL safety standards but also to meet ASPICE (Automotive SPICE) and MISRA coding standards. This means that not only the software itself but also the entire process we use to write software, develop hardware, and integrate hardware and software must meet safety compliance requirements. This sets higher expectations for our development, systems, and testing teams, yet it also brings a benefit: we can assure that our solutions meet the necessary safety requirements in driver assistance scenarios.

A final crucial point previously mentioned is the emergence of competitive chips. In the automotive industry, quality is paramount. From the start, we strictly adhere to a Defective Parts Per Million (DPPM) quality standard in the single digits, which means the failure rate of our products must be controlled to single digits per million units produced. Achieving this requires substantial investment, a profound technical understanding, rigorous process controls, comprehensive testing systems, reliability assurance, and continuous tracking mechanisms. Frankly speaking, only companies with significant accumulation and long-term experience in chip development can truly achieve this.Q: The domestic new energy vehicle market is fiercely competitive, with car prices continuously decreasing and driving assistance companies promoting the popularization of such technologies. In this context, how does Qualcomm plan to lower the entry barrier for automakers through hardware and software collaboration? Is there a future plan to introduce more lightweight integrated cockpit and driving solutions?

Nakul Duggal: One of the reasons we are developing an integrated cockpit and driving architecture is to assess the maturity of certain systems. When these systems are mature enough, our approach is to integrate them to reduce the overall system cost. Currently, the cockpit systems and ADAS are two separate entities, each with its own hardware, memory, interfaces, connectors, and PCBs. When proposing the integrated cockpit and driving architecture, the initial question we asked ourselves was whether the ADAS solutions are mature enough to be integrated in a way that remains fully isolated and interference-free, while still running both infotainment and ADAS on a single chip. By running both systems on one chip, costs such as physical modules, interface solutions, thermal solutions, and memory subsystems for two systems can be cut, consolidating all hardware into one unit.

Automakers, Tier 1 suppliers, software stack providers, OS providers, and chip suppliers need the confidence that a combined system can maturely and practically support digital cockpit and driving assistance on a single chip. This week, we observed six or seven different road test projects in Shanghai. These cars, equipped with the Snapdragon 8775, are capable of supporting highway NOA, urban NOA, and infotainment functions simultaneously on a single SoC. This demonstrates that once the technology matures, cost reduction and lightweight integration can be achieved.

Q: Are car manufacturers simplifying their solutions by adding driving assistance features with minimal modifications to the vehicles?

Nakul Duggal: Indeed, this is one of the core strategic directions we adhere to in our automotive business—we are continually committed to integrating as many functions as possible into chips and software. The overall concept of “software-defined vehicles” is to integrate functions traditionally reliant on different hardware modules into a single chip or software, thus continually promoting the development of lightweight solutions.

Anshuman Saxena: Let me return to the original strategic intent—creating a unified “Digital Chassis” platform. This involves considering safety and reliability from the initial design stage and supporting different functionalities via a unified software platform to meet the holistic demands of the automotive industry ecosystem. For example, in the Chinese market, we introduced the Snapdragon Ride Flex SoC, which supports both digital cockpits and ADAS with a single SoC, alongside standalone cockpit and ADAS solutions, enabling even stand-alone cockpit solutions to benefit. For instance, with a 360-degree camera, users can view images on the in-car display while we ensure safety in the solutions we provide to customers. Even with cockpit solutions, we ensure that users see safe and visualized content. This is where Qualcomm’s differentiated advantage in cockpit, ADAS systems, or integrated cockpit and driving solutions lies.Q: Does Qualcomm have clear targets for market size or shipment volume by 2025 or in the short term?

Nakul Duggal: In fact, the colleagues participating in today’s interview have been working together with Chinese partners to promote the development of driver assistance over the past two years. Indeed, we have achieved significant results with Chinese automakers, Tier 1 suppliers, and software stack ecosystem partners. This week, we announced several new collaborations with partners, and we have also secured many designated projects. Starting this year, you will gradually see the outcomes materialize. There will be an increasing number of mass-produced models equipped with Qualcomm Snapdragon solutions, coming from different automakers and ecosystem partners. I am confident that by 2025 and 2026, you will witness the progress and success we’ve achieved in the driver assistance field, just as we’ve succeeded in the cockpit domain before.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.