Lynk & Co merges into ZEEKR, marking a crucial turning point for ZEEKR, Lynk & Co, and Geely.

On November 14, Geely Holding Group officially announced the merger of ZEEKR and Lynk & Co, aiming by 2026 to develop ZEEKR and Lynk & Co into a global new energy vehicle group with an annual production and sales volume of one million units.

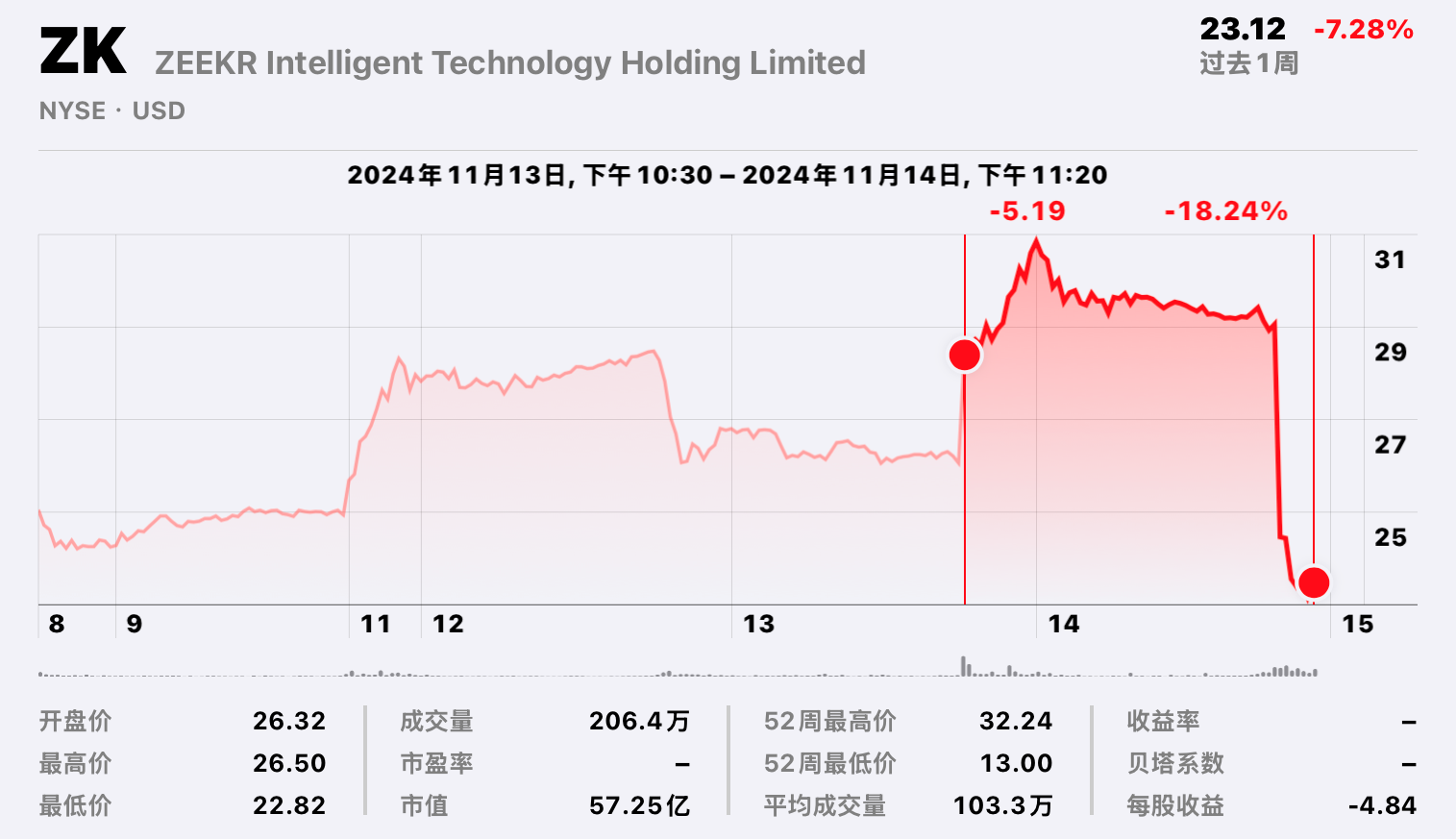

The capital market’s sensitivity is always sharp. By the U.S. market close today, ZEEKR’s stock price had risen by over 12%, nearing an all-time high with a market value exceeding $7 billion. After the U.S. market closed, Geely announced the merger of the ZEEKR and Lynk & Co brands. Following the announcement, ZEEKR’s stock price plummeted nearly 20%, evaporating almost $2 billion in market value within a day.

China’s new energy vehicle market is intensely competitive. ZEEKR and Lynk & Co are joining forces to create a stronger combined competitive edge. On Weibo, the two companies played a game of addition, subtraction, multiplication, and division: ZEEKR is 1 + 1 > 2, and Lynk & Co is 1 x 1 = ♾️. Simultaneously, it’s an internal transformation within the Geely system focusing on resource integration to reduce internal friction and achieve steady operations.

Judging by the current situation, leveraging Geely’s comprehensive resource advantages with the combined strengths of ZEEKR and Lynk & Co, a bigger and stronger entity may emerge, while the broader Geely system takes a pivotal step forward towards modernization and stability.

ZEEKR’s Greater Ambitions

Geely undertook a new round of equity restructuring concerning the ZEEKR and Lynk & Co integration.

According to official information, ZEEKR will purchase a 20% stake in Lynk & Co from Geely Holding at a price of 3.6 billion RMB and a 30% stake from Volvo Cars (China) Investment Co., Ltd. at 5.4 billion RMB.

Simultaneously, ZEEKR will subscribe to the new registered capital of Lynk & Co for a price of 367,346,940 RMB.

In the end, ZEEKR will hold 51% of Lynk & Co shares, with the remaining 49% held by Ningbo Geely Automobile Industry Co. Therefore, Lynk & Co will become a subsidiary of ZEEKR, with its financial results reflected in ZEEKR’s financial statements.

ZEEKR CEO An Conghui stated that following today’s announcement, actions related to the ZEEKR and Lynk & Co integration would commence immediately. The joint management of ZEEKR and Lynk & Co will continue to be personally overseen by An Conghui himself.

Regarding this bold integration move by ZEEKR and Lynk & Co, Geely Holding Group’s official statement indicated that the two will enhance collaboration in technology, products, supply chain, manufacturing, marketing and services, and international market expansion. They are committed to turning ZEEKR and Lynk & Co into a global new energy vehicle group with annual production of one million units by 2026.

Additionally, An Conghui stated in today’s ZEEKR Q3 earnings call that this is not a simple integration but a business restructuring, providing a detailed explanation of the process.In terms of branding, ZEEKR and Lynk & Co will maintain their independent brand identities, while their positioning and differentiation will further clarify — ZEEKR targets the luxury market, whereas Lynk & Co is aimed at the mid-to-high-end market. Although their roles differ, together they aim to cover a broader market.

In product strategy, ZEEKR will focus more on mid-to-large-sized products, while Lynk & Co will concentrate on mid-to-small-sized offerings.

Regarding energy forms, ZEEKR’s medium-sized cars will focus on pure electric products, while its large cars will concentrate on hybrid technologies. Meanwhile, Lynk & Co will focus on hybrids for medium-sized vehicles and pure electric for small ones.

In the technological domain, ZEEKR and Lynk & Co aim to achieve maximum platform unification in 2-3 years across electronic architecture, mechanical architecture, cockpit design, intelligent driving, and the three electrical systems, transitioning from independent operation to a unified approach. However, in terms of in-car systems, the underlying technologies of ZEEKR and Lynk & Co will remain consistent, but at the application layer, ZEEKR will continue to use ZEEKR OS, and Lynk & Co will retain Flyme Auto.

In distribution, Lynk & Co will continue with the dealership model, while ZEEKR will adhere to a direct-sale model. However, their after-sales and logistics systems can be shared.

Regarding administrative management, ZEEKR and Lynk & Co will further integrate and optimize organizational structures to enhance system efficiency.

Additionally, An Conghui mentioned that Lynk & Co currently has partnered with Volvo on over 30 channels in Europe, with plans to expand to over 100. This also presents an opportunity for ZEEKR to circumvent European anti-subsidy investigations and boost overseas business growth.

Post-integration, An Conghui believes ZEEKR and Lynk & Co’s total R&D investment will decrease by at least 10-20%, with the BOM cost expected to drop by 5-8%. Combined, ZEEKR and Lynk & Co aim to further expand the 150,000 to 300,000 unit market segment. An Conghui predicts that this year ZEEKR and Lynk & Co could achieve sales of 500,000 units.

He also stated that, by the end of this year under Hong Kong accounting standards, ZEEKR will achieve a break-even point, and next, it will strive for profitability under US accounting standards.

An interesting detail is that during the ZEEKR Q3 earnings call, An Conghui referred to the integrated ZEEKR and Lynk & Co as the “New ZEEKR.” From An Conghui’s expectations, it seems ZEEKR is ushering in a new era of development.

Rejection of Internal Strife, United Front

The direct catalyst for the integration of ZEEKR and Lynk & Co was the release of the “Taizhou Declaration” by Geely Holding Group in September.

The “Taizhou Declaration” states that Geely Holding Group will seek progress while maintaining stability through “strategic focus, strategic integration, strategic synergy, strategic prudence, and strategic talent.”

In simple terms, compared to the previous global expansion through acquisitions, Geely Holding Group now aims to integrate internal resources to drive sustainable development with high efficiency and high quality.

The integration of ZEEKR and Lynk & Co is a key measure for Geely to implement the “Taizhou Declaration.” In fact, their previous parallel operation highlighted a representative challenge within Geely’s system in resource integration and efficiency improvement.An Conghui mentioned in the ZEEKR Q3 earnings call that many investors are concerned about the competition between ZEEKR and Lynk & Co in the same industry.

In 2016, Geely Holding, Geely Auto, and VOLVO jointly established the Lynk & Co brand, which became a representative of the Geely brand’s upward movement.

Lynk & Co began with Lynk & Co 01, and currently, the models available include Lynk & Co 01 to Lynk & Co 09, as well as Lynk & Co Z10, covering fuel, hybrid, and pure electric energy forms. Last year, overall sales reached 220,000 units. This year, by the end of October, Lynk & Co’s cumulative sales have reached 226,677 units.

For Geely, Lynk & Co is undoubtedly a pillar brand.

Notably, Geely’s pure electric vehicle business was once led by Lynk & Co. In 2020, Lynk & Co launched the Lynk & Co ZERO concept car. However, in pursuit of further brand ascension, the ZEEKR brand was born in 2021, and the Lynk & Co ZERO concept was eventually transformed into the mass-produced ZEEKR 001.

Since the birth of ZEEKR, although product sales have not matched Lynk & Co, standing at the forefront of the new energy industrial revolution, leveraging Geely’s finest resources, ZEEKR has launched striking products such as the ZEEKR 001, effectively becoming a new driving force for Geely’s transition to new energy and brand elevation.

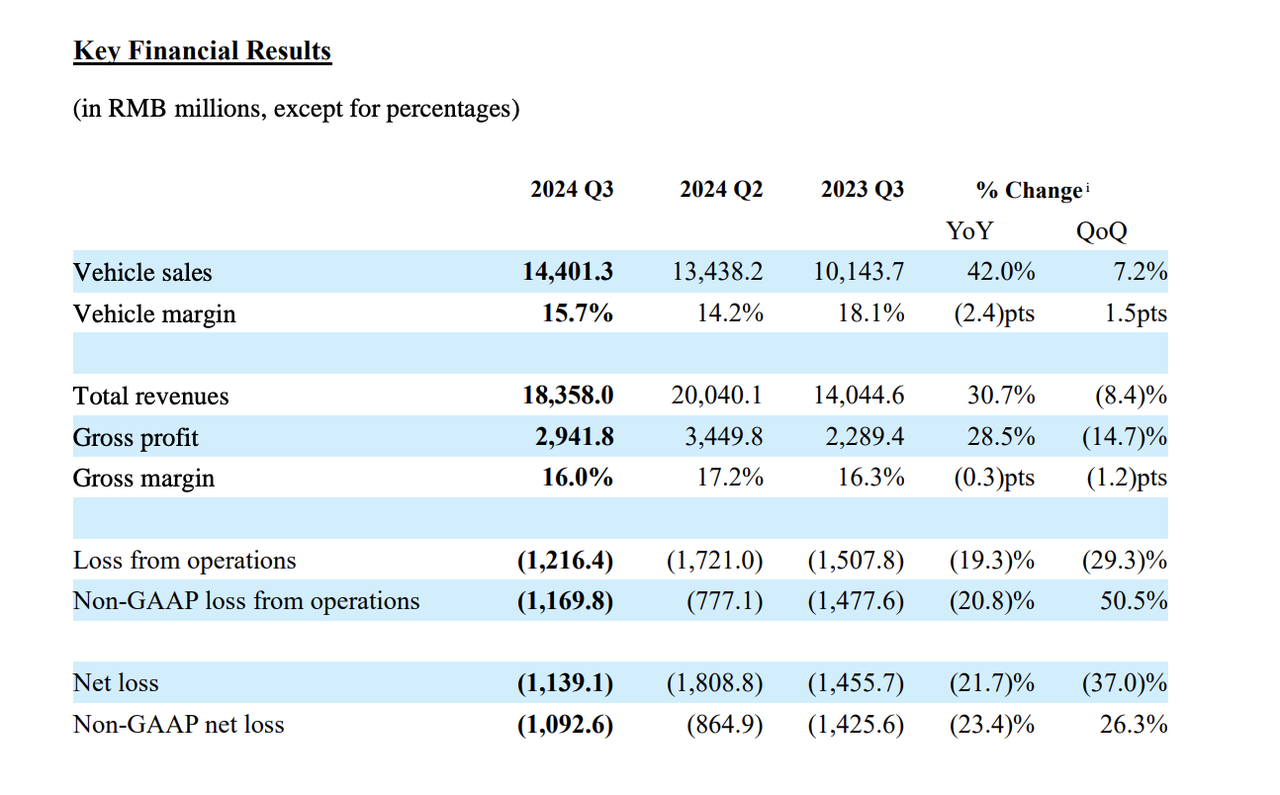

This year, ZEEKR is on one hand preparing for a US listing, garnering more market attention; on the other hand, its revenue and sales are climbing continuously. According to the Q3 financial report, ZEEKR’s Q3 revenue exceeded 14.4 billion, growing by 42% year-on-year, with deliveries reaching 55,000, up by 51%, while the gross margin increased to 15.7%, showing very positive growth momentum.

However, compared to ZEEKR, Lynk & Co’s growth momentum is relatively weaker. Although Lynk & Co currently outperforms ZEEKR in both annual and monthly sales, it faces a significant risk—insufficient transition to new energy, particularly in pure electric products. For instance, the Lynk & Co Z10 launched in September with a starting price of 196,800, but due to lackluster market response, to boost sales, Lynk & Co Z10 currently offers a limited-time comprehensive package price starting from 180,800.

The arrival of the Lynk & Co Z10 has once again spotlighted the “sibling rivalry” issue between ZEEKR and Lynk & Co. The price of the Lynk & Co Z10 mostly ranges around 200,000-300,000, overlapping not only in price with ZEEKR 007 and ZEEKR 001 but also sharing a similar emphasis on control features. Additionally, the design of ZEEKR X and Lynk & Co 06 similarly causes confusion about whether they are ZEEKR or Lynk & Co.

With Lynk & Co being integrated into ZEEKR, the relationship and positioning between ZEEKR and Lynk & Co have been further clarified. ZEEKR and Lynk & Co can now eliminate internal friction, concentrating their efforts externally.An Conghui stated that after the integration of ZEEKR and Lynk & Co, resources can be synergized to quickly create value.

Regarding the future of ZEEKR and Lynk & Co, An Conghui also revealed some new information. ZEEKR is already developing an entirely new super electric hybrid technology suitable for large vehicles, which will be equipped on future large SUVs and MPVs. This system will be significantly ahead of other hybrid technologies on the market.

Conclusion

The integration of ZEEKR and Lynk & Co is of transformative significance for ZEEKR, Lynk & Co, and Geely.

For ZEEKR, the expansion in scale allows it to resist market fluctuations while organizing a strong offensive. Subsequently, in the capital market, ZEEKR can tell a more beautiful story.

For Lynk & Co, merging into ZEEKR enables a gradual advancement towards a deeper transition to new energy in a soft landing manner, balancing current and future market performance as much as possible.

For Geely, the integration of ZEEKR and Lynk & Co reduces internal consumption and increases efficiency, gradually transitioning from large-scale territorial expansion to high-efficiency resource integration and stable operations.

Currently, within the Geely system, the roles and tasks of Geely Galaxy, Lynk & Co, and ZEEKR have been clearly defined, covering the broad new energy market from high to low end.

In October, Geely Holding Group’s sales were 332,258 units, with new energy vehicle sales reaching 165,625 units, achieving a penetration rate of 49.8%.

Previously, Geely Auto Group CEO Gan Jiayue stated that Geely has completed the initial layout for new energy and has reached a critical breakout point. The integration of ZEEKR and Lynk & Co adds further strength to Geely’s new energy breakthrough.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.