After the Li L6 was officially launched, we carried out a questionnaire research among the pre-order buyers. Below are the core results of this research.

Survey Channels: 42How Li L6 Pre-order Buyers

GroupSample Size: 100 valid samples

Data Collection:42HOW

User Profile

Li L6 has a broad user base spread across China, with over half of its users hailing from key provinces such as Shandong, Henan, Jiangxi, and Guangdong. The Li L6 owners are highly educated, with the vast majority—over 85%—holding at least a Bachelor’s degree. Professionally, a significant portion of these users, over 40%, are employed in sectors like IT, telecommunications, electronics, and the internet industry.

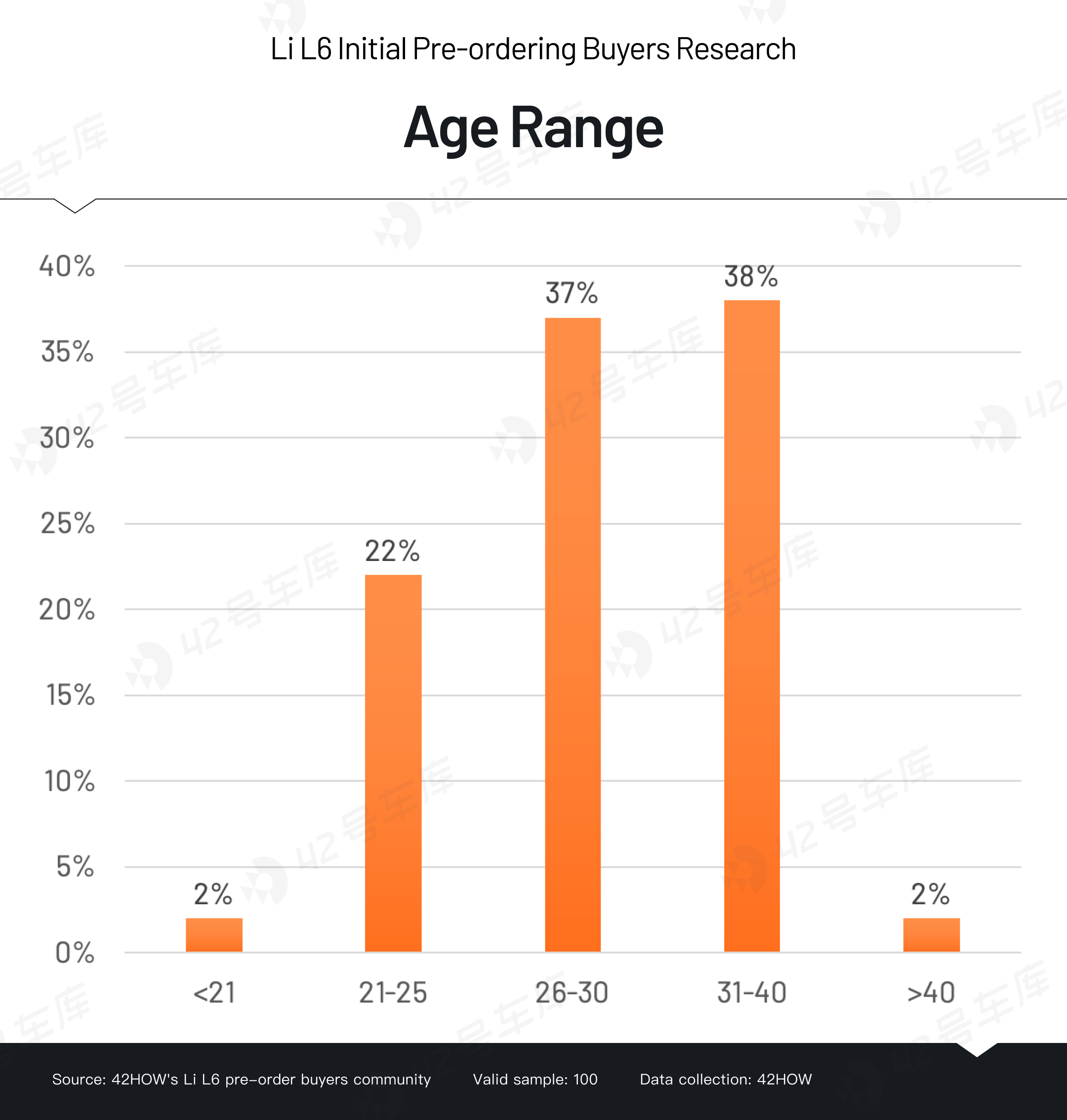

The survey reveals that the average respondent is 29 years old, with those between 26 to 30 years old representing 37% of the sample, while individuals aged 31 to 40 and older constitute 40%. Regarding family structure, a significant majority of participants (56%) are married, predominantly with one child, which accounts for 74% of the sample. The educational stages of the children in these families are fairly balanced, with 42% in preschool and 46% in elementary school.

Car Purchase and Ownership

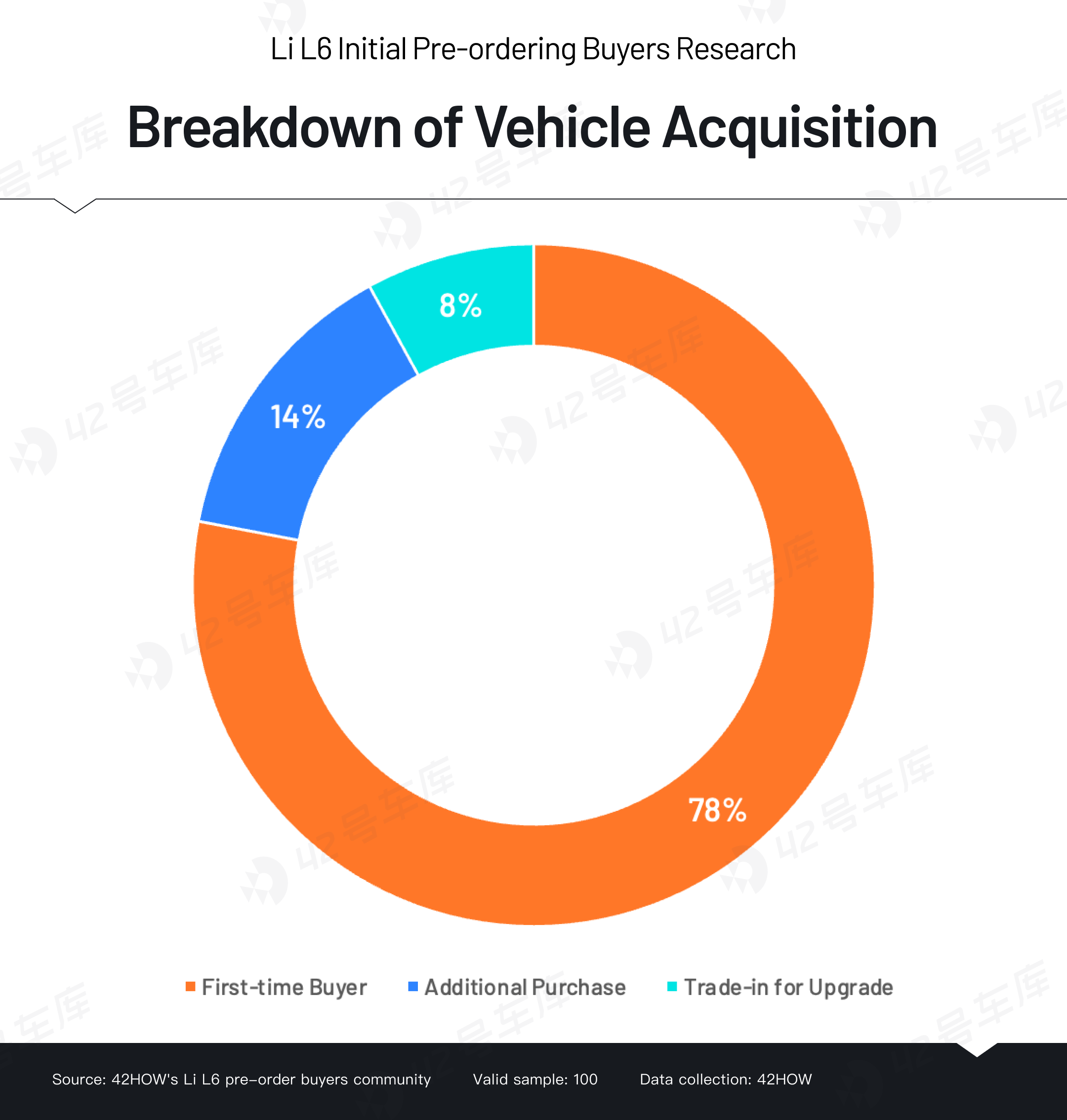

Our car purchase behavior analysis indicates that a significant majority of purchasers are acquiring their first vehicle. The data reveals that 78% of consumers have selected the Li L6 as their inaugural car. Moreover, there’s a 14% segment of buyers who are making additional purchases, and a smaller fraction, at 8%, are engaged in trading up their existing vehicles.

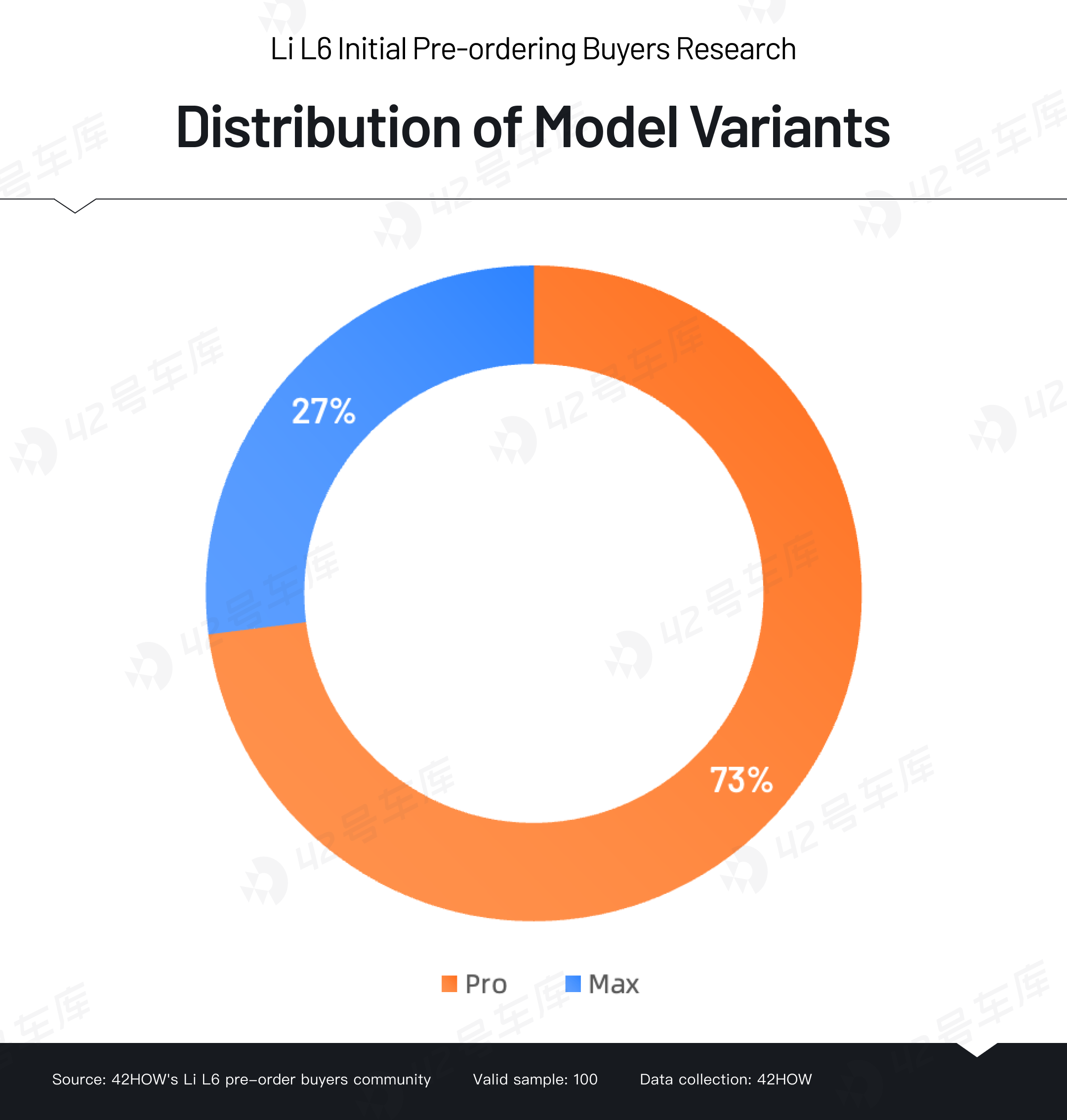

The Pro model is highly favored for its value for money, being the choice of 73% of buyers. On the other hand, the Max model, despite its enhanced features like laser radar, built-in refrigerator, and premium audio system, comes with a 30,000 RMB price hike, which is why only 27% of customers opt for it.

Car-Buying Decisions

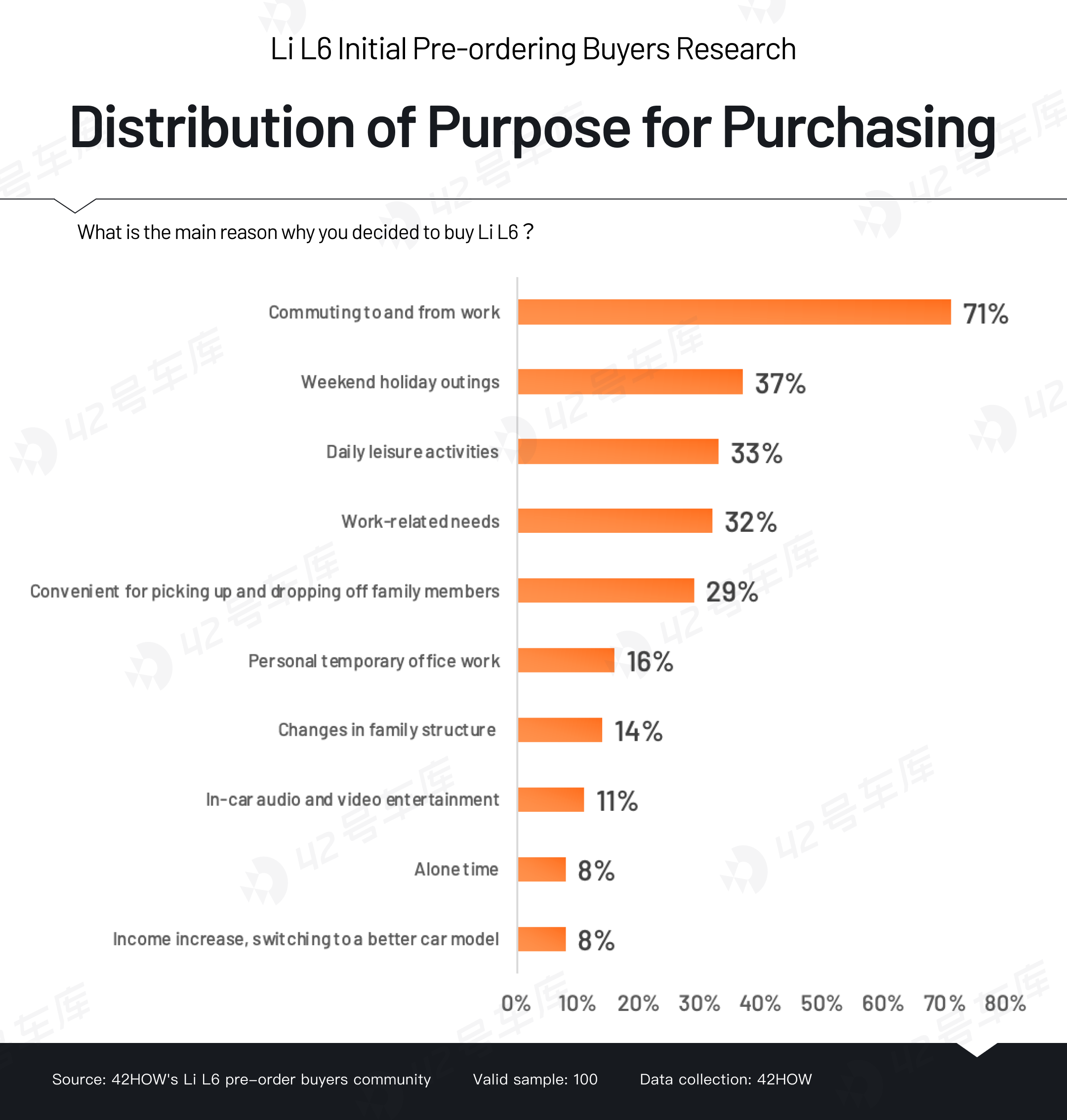

Pre-order buyers of the Li L6 are primarily drawn to its versatility, as it caters to the everyday commute of young families while also accommodating the varied demands of leisure activities, weekend getaways, and professional settings. The LI L6’s market positioning effectively targets the essential needs of this demographic, offering a smooth transition between work and leisure.

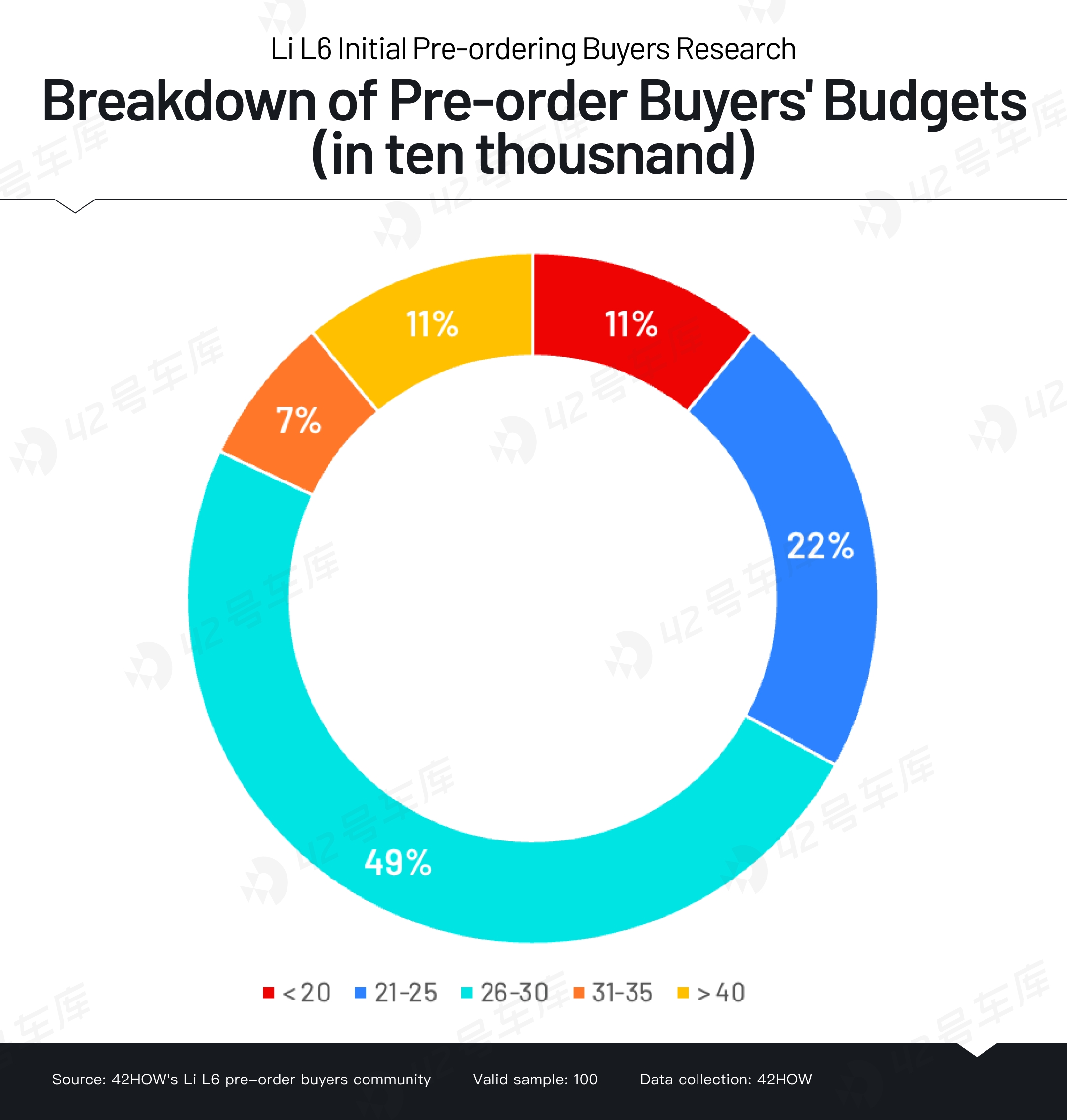

Nearly half of the buyers who pre-ordered their vehicles have set a car-buying budget within the 260,000 to 300,000 RMB range, making up 49% of the total. The next significant segment, at 22%, is looking at the 210,000 to 250,000 RMB range. The Li L6, priced between 249,800 to 279,800 RMB, aligns perfectly with the financial expectations of these prospective buyers.

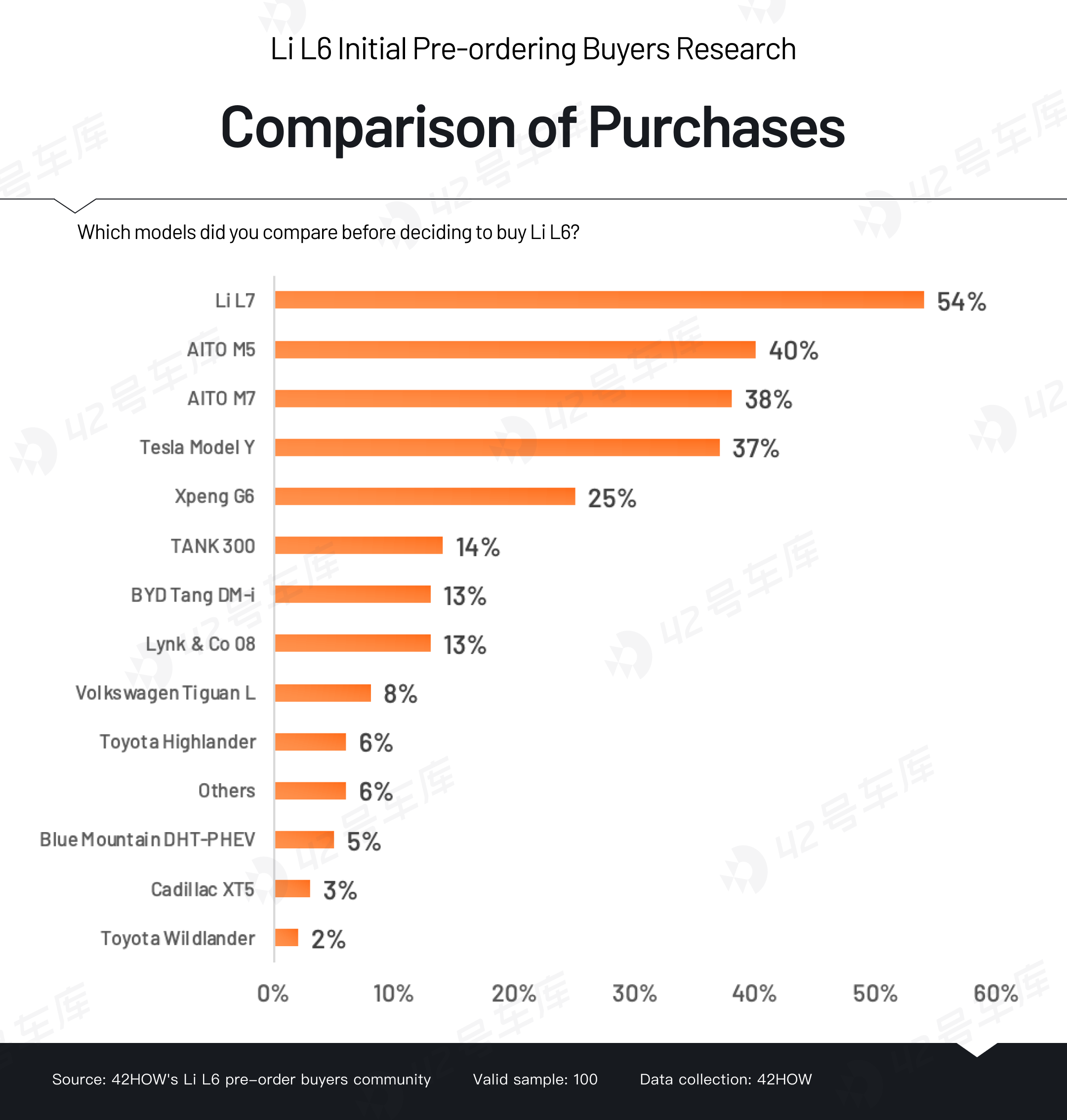

Among those who have pre-ordered the Li L6, a significant 54% primarily compared it with another model from the same brand, the Li L7. Moreover, should the Li L6 not be available, the Li L7 stands as the second choice for 37% of these potential buyers.

In the competitive landscape, AITO’s M5 and M7 models are proving to be strong contenders against Li, capturing 40% and 38% of the comparison market share respectively. Not far behind, Tesla’s Model Y, with its status as last year’s global best-selling SUV, holds a significant 37% share, making it another popular choice for benchmarking.

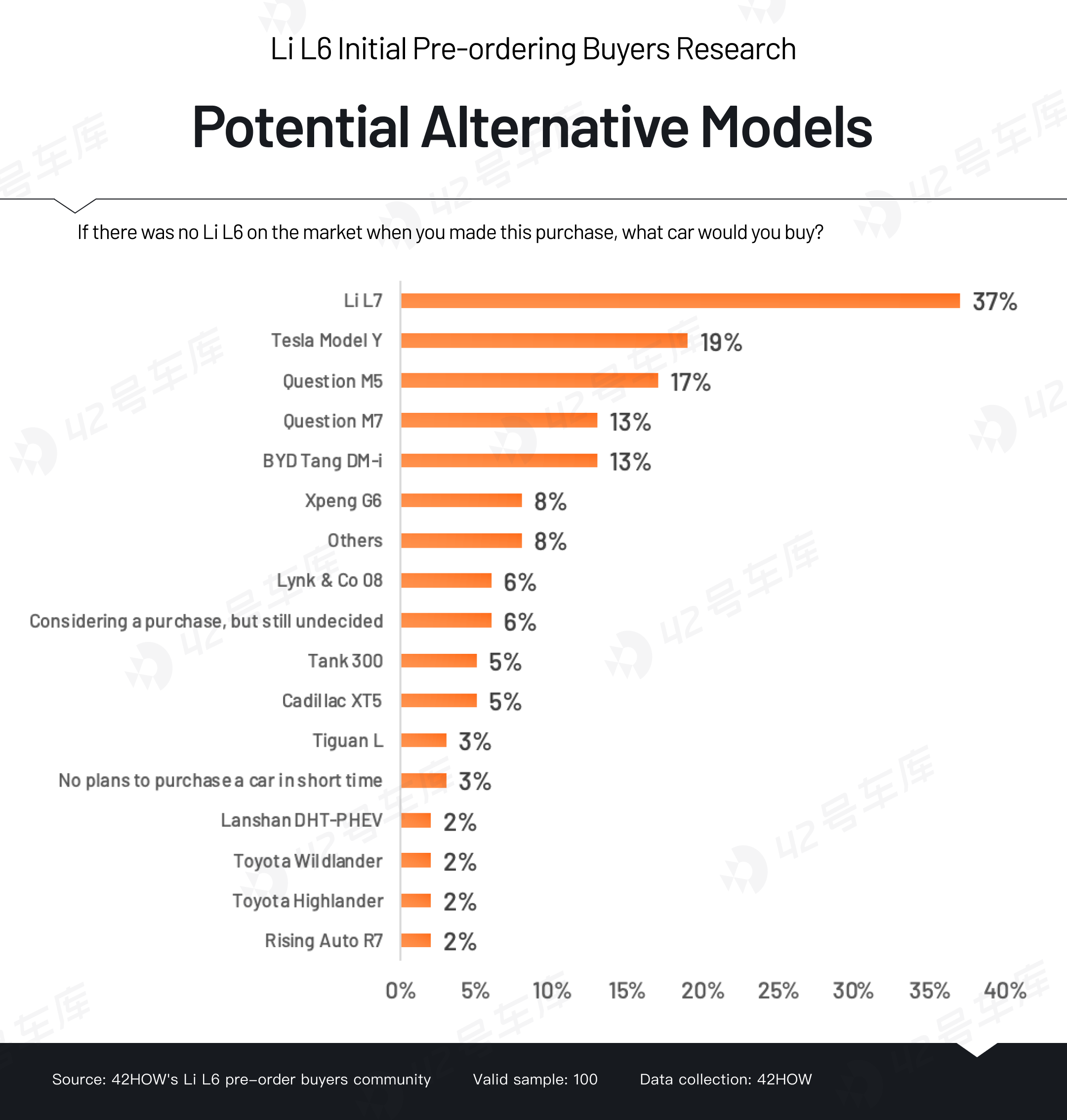

With the Li L6 off the table, the Li L7 and Tesla Model Y emerged as the top alternative choices for most survey participants. The AITO M5 and M7 also ranked as potential substitutes, with the M5 slightly more favored, suggesting these models are quite attractive to consumers. It’s particularly noteworthy that the BYD Tang DM-i’s consideration rate matches that of the AITO M7, signifying its relevance among prospective buyers. Moreover, 3% of the respondents stated they would hold off on buying any car in the near future if the L6 isn’t available.

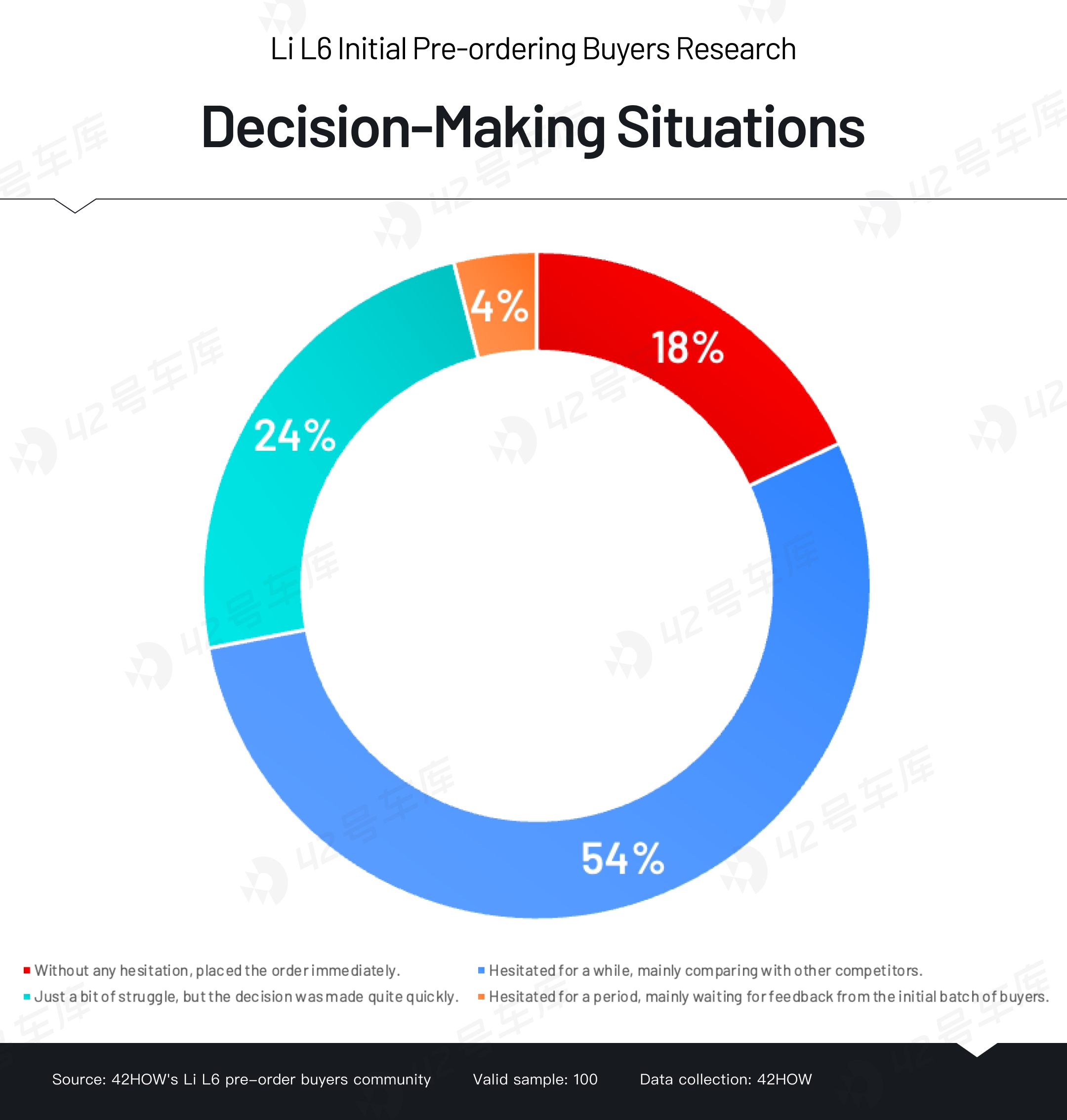

When it comes to making car-buying decisions, 54% of those who pre-ordered the Li L6 said they only hesitated briefly before quickly placing their orders. Another 24% took some time to decide as they weighed their options against competitors. A decisive 18% of customers placed their orders without any second thoughts. Only a small fraction waited for feedback from the first batch of buyers, a testament to the solid reputation built by the Li L789 in the past.

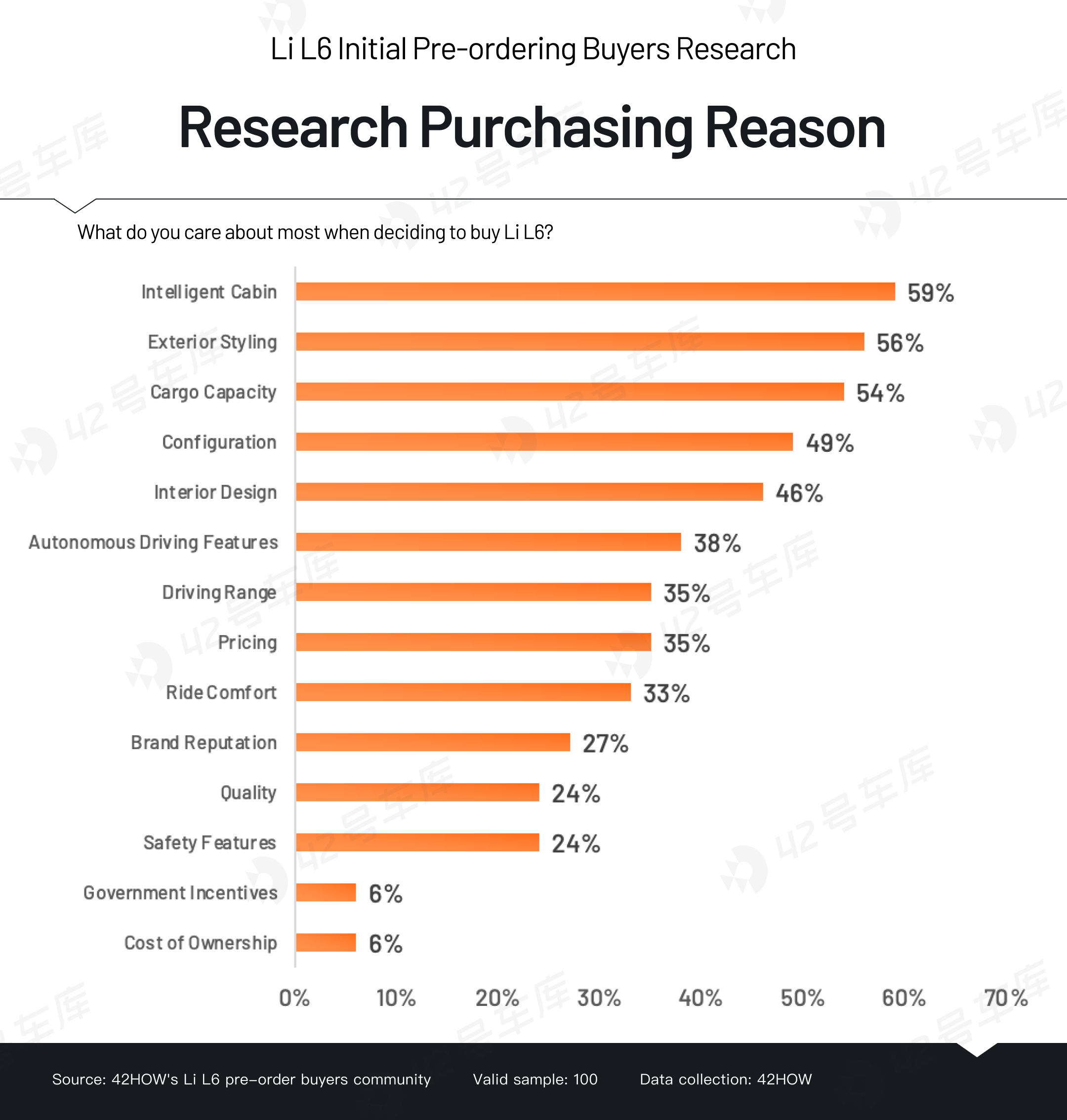

The smart cockpit is central to the evolution of intelligent vehicles, a fact that was distinctly highlighted in the research findings, with a notable 59% of participants showing a preference for it. Other aspects that impact the sensory experience, such as the exterior styling, spatial configuration, and interior design, as well as autonomous driving features, were also popular choices among respondents. The driving range, a critical metric for electric vehicles, garnered a 35% preference rate. Moreover, Li’s range-extending technology has emerged as a significant draw for consumers.

It appears that government incentives and the cost of ownership are not the primary concerns for those surveyed, suggesting that these aspects are less influential in the decision-making process of purchasing a car. While safety features and product quality are considered important, with a selection rate of only 24%, it seems consumers are more inclined to prioritize tangible, immediately noticeable attributes and functionalities when choosing a vehicle.

Before its official launch, the Li L6 garnered considerable attention from potential buyers with its pre-launch teasers highlighting the car’s exterior and interior designs. Survey results reveal that the exterior styling and interior design of the Li L6 piqued the interest of 57% and 56% of participants, respectively. These figures suggest that the Li L6 has made a significant impact in the market with its design excellence.

In addition, aspects such as the vehicle’s space and the intelligent cabin are areas of interest for consumers, albeit to a slightly lesser extent compared to the exterior styling and interior design. This information indicates that when selecting a vehicle, consumers place importance on both aesthetic appeal and the practical and technological attributes of the car.

The research report revealed that 16% of the participants expressed certain compromises or areas of dissatisfaction, with the primary concerns being the absence of air suspension, pricing exceeding their expectations, and the lack of massage features in the rear seats, among others.

Brand Perception

Survey participants commonly view “intelligence,” “technology,” and “comfort” as standout attributes of the Li brand. Despite a few negative associations like “aggressive marketing” and “bulky size,” the overall sentiment from those who have pre-ordered is predominantly favorable. This suggests that the Li brand’s reputation among consumers is largely shaped by the positive perception of its products’ smart features, technological innovation, and comfort.

Li L6’s initial buyers have expressed strong satisfaction with the vehicle, praising its standout performance in areas like exterior styling, ride comfort, practicality, smart technology, and value for money. This wave of positive feedback underscores the high level of overall contentment among owners with the Li L6.