On March 28, 2024, the Xiaomi SU7 was officially launched, and we carried out a questionnaire survey for the pre-order buyers. Below are the core results of this survey.

Survey Channels: 42How Xiaomi SU7 pre-order buyers GroupSample Size: 100 valid samplesData collection:42HOW

User Profile

The pre-order buyers of Xiaomi SU7 are spread across all-level cities, with relatively more sets in first-tier cities and predominantly young individuals with a Bachelor’s degree or higher.

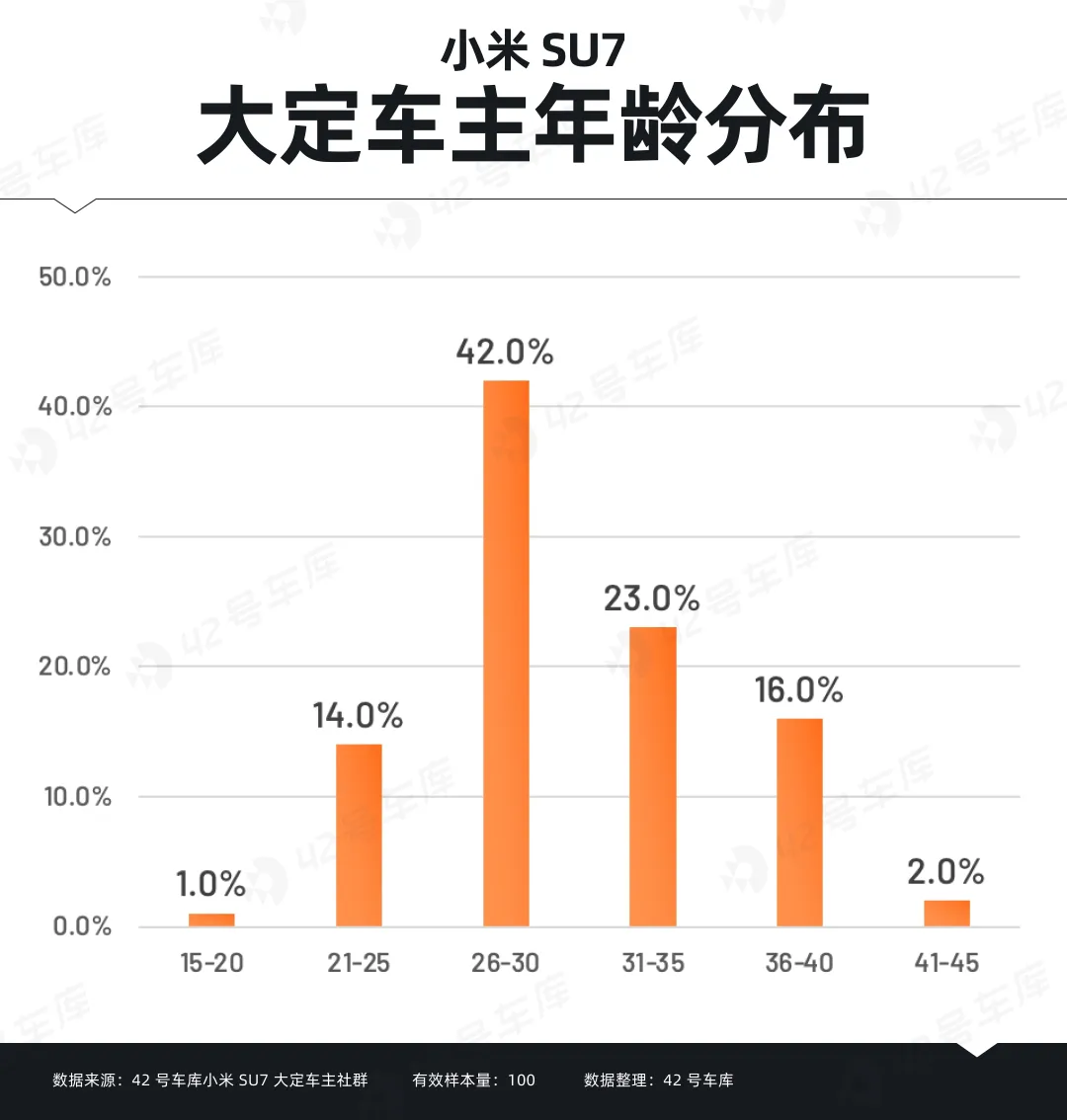

The average age of respondents in this survey is 30.9 years, including 42.0% aged 26-30 years and 23.0% aged 31-35 years. The majority of respondents are relatively young.

Both married and unmarried respondents account for half of the sample, and over 70% of respondents are currently childless.

Car Purchase and Ownership

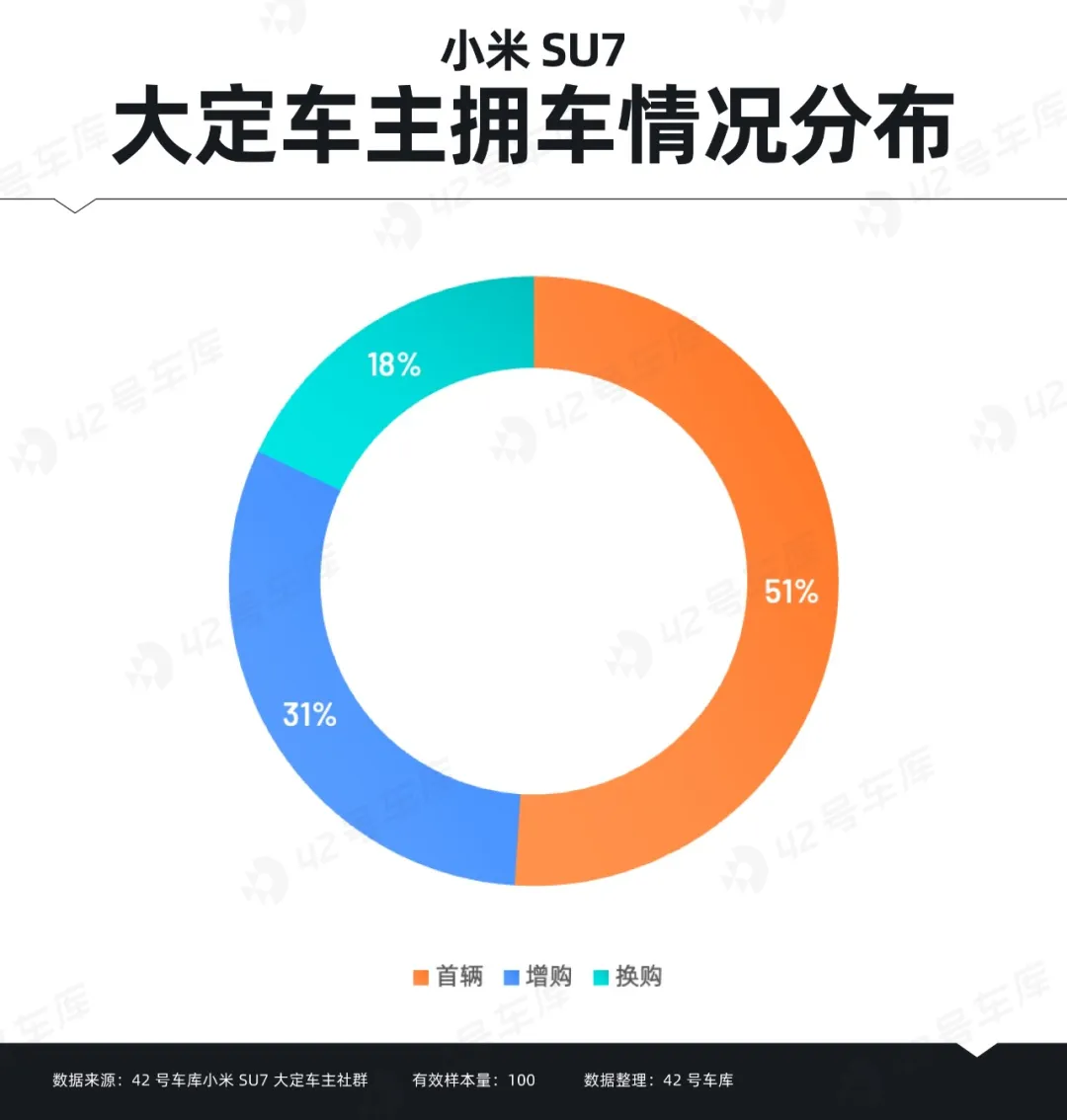

Over half of the pre-order buyers of Xiaomi SU7 are first-time car buyers. The remaining 18% are replacement purchases, with 31% additional purchases.

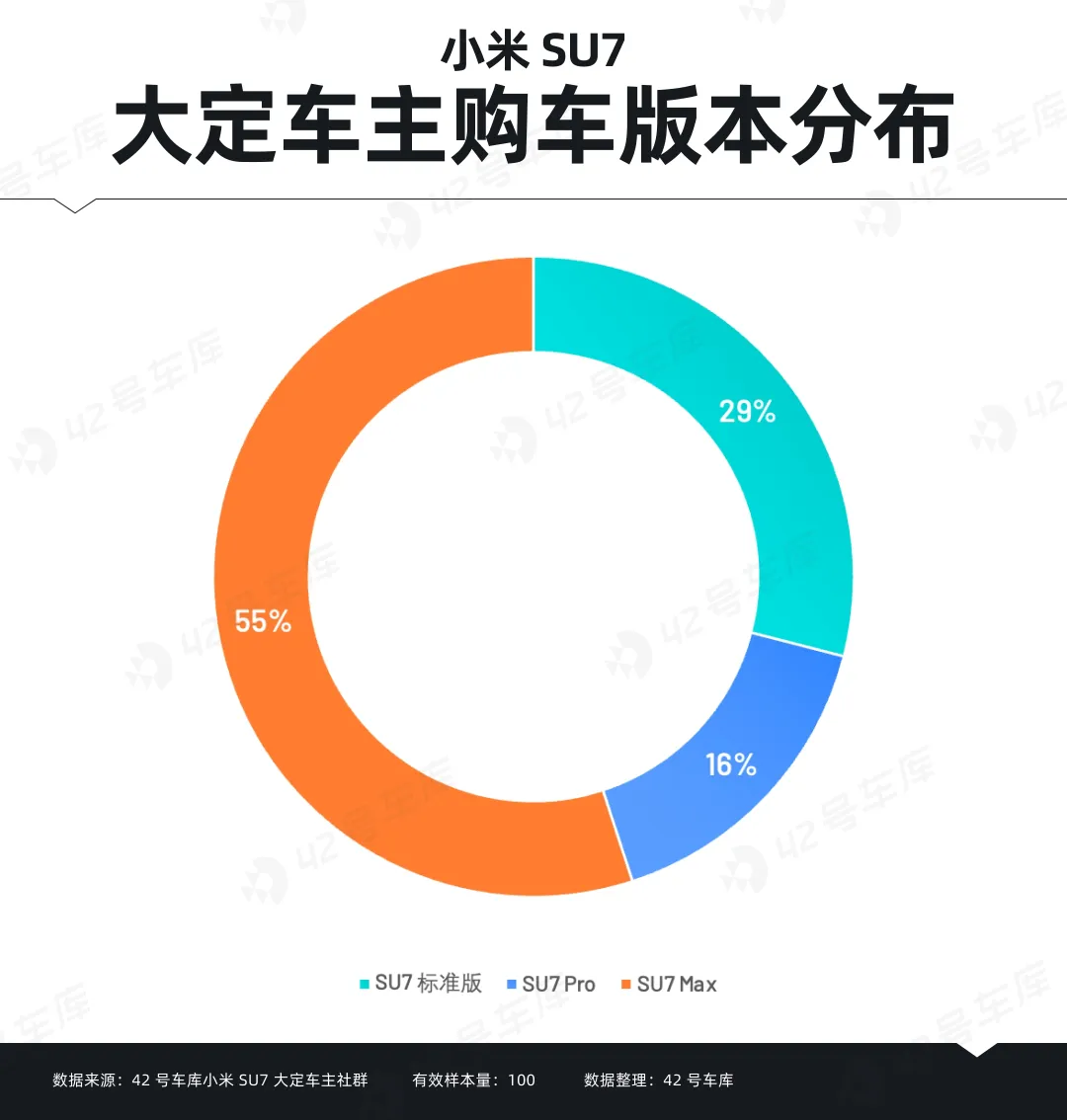

The most chosen model among respondents is the SU7 Max, accounting for 55%, with 15% opting for the founder’s edition. 29% of users chose the standard SU7, with 9% being the founder’s edition. The remaining 16% purchased the SU7 Pro.

The respondents who made additional or replacement purchases previously had a variety of car models ranging from traditional gasoline vehicles such as Toyota, Honda, Buick, to luxury brands like BMW, Audi, VOLVO, and LAND ROVER. Simultaneously, new energy vehicle owners from Tesla, Xpeng, and LI also purchased the Xiaomi SU7.

Car-Buying Decisions

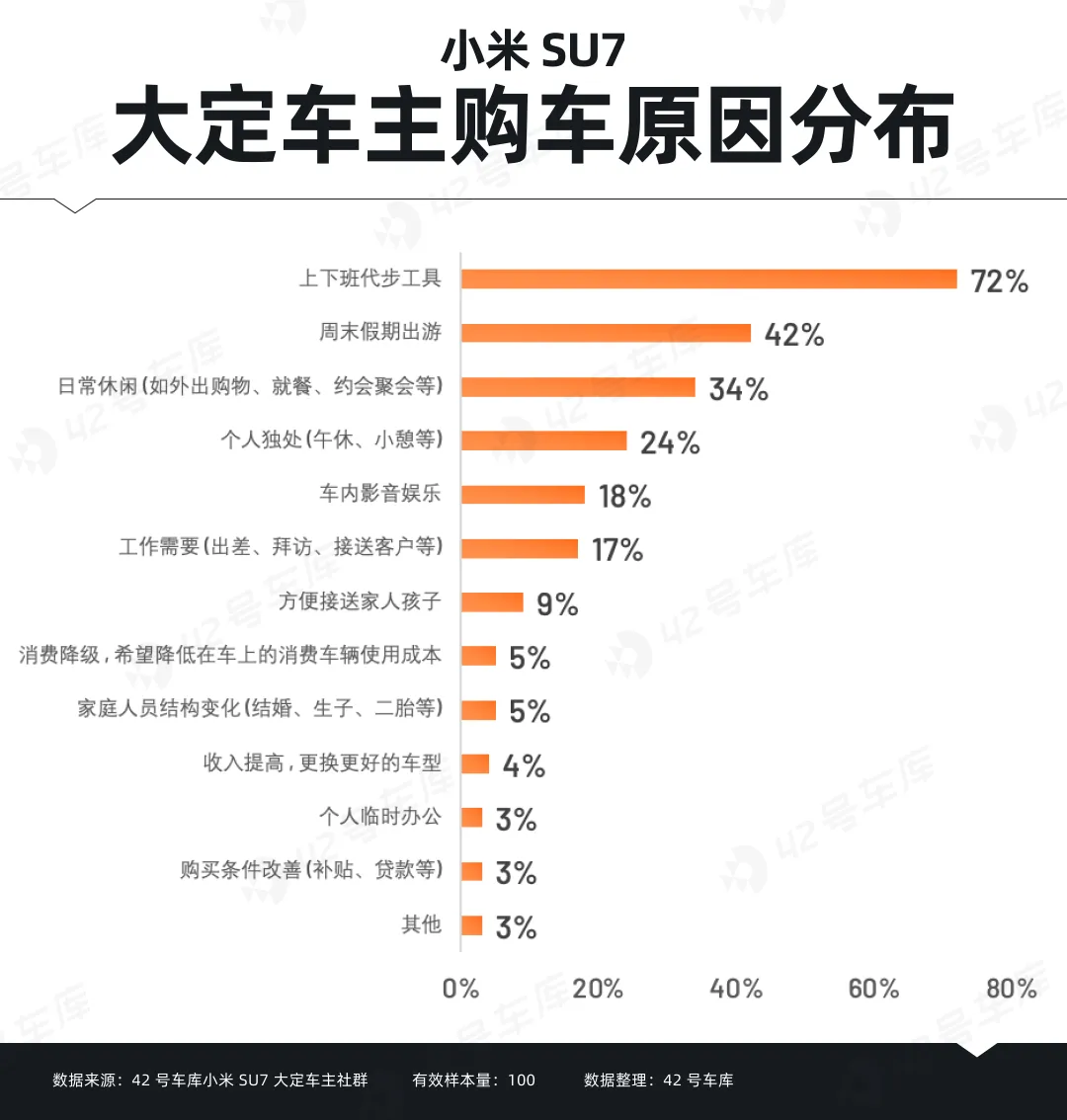

Commuting, weekend holidays, and daily leisure are the primary reasons for purchasing for Xiaomi SU7 pre-order buyers. This aligns with the main target audience’s relatively young characteristics.

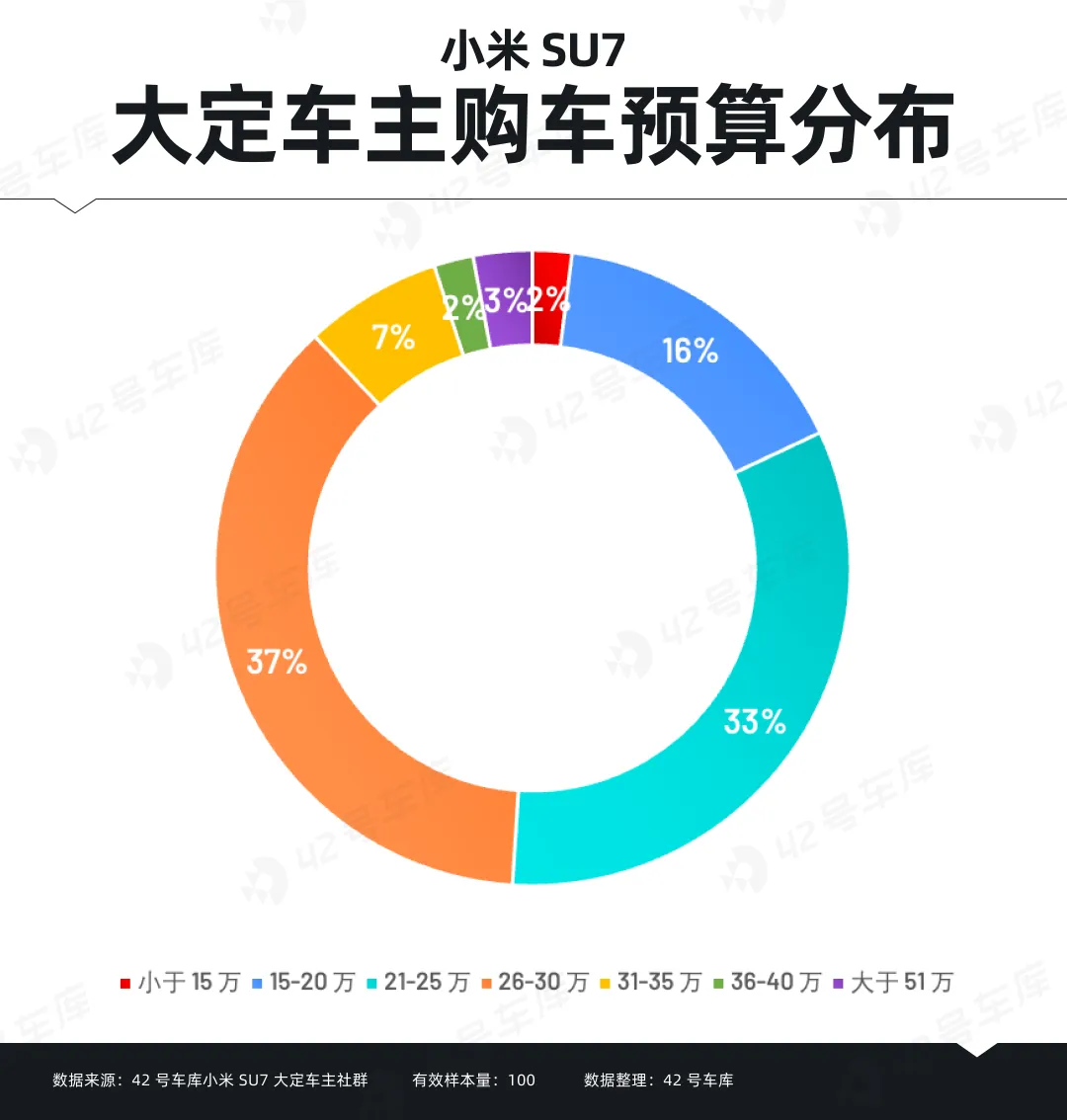

Regarding the budget for car buying, the average budget of the respondents is 287,000 RMB, with the majority of users planning a budget ranging from 200,000 to 300,000 RMB.

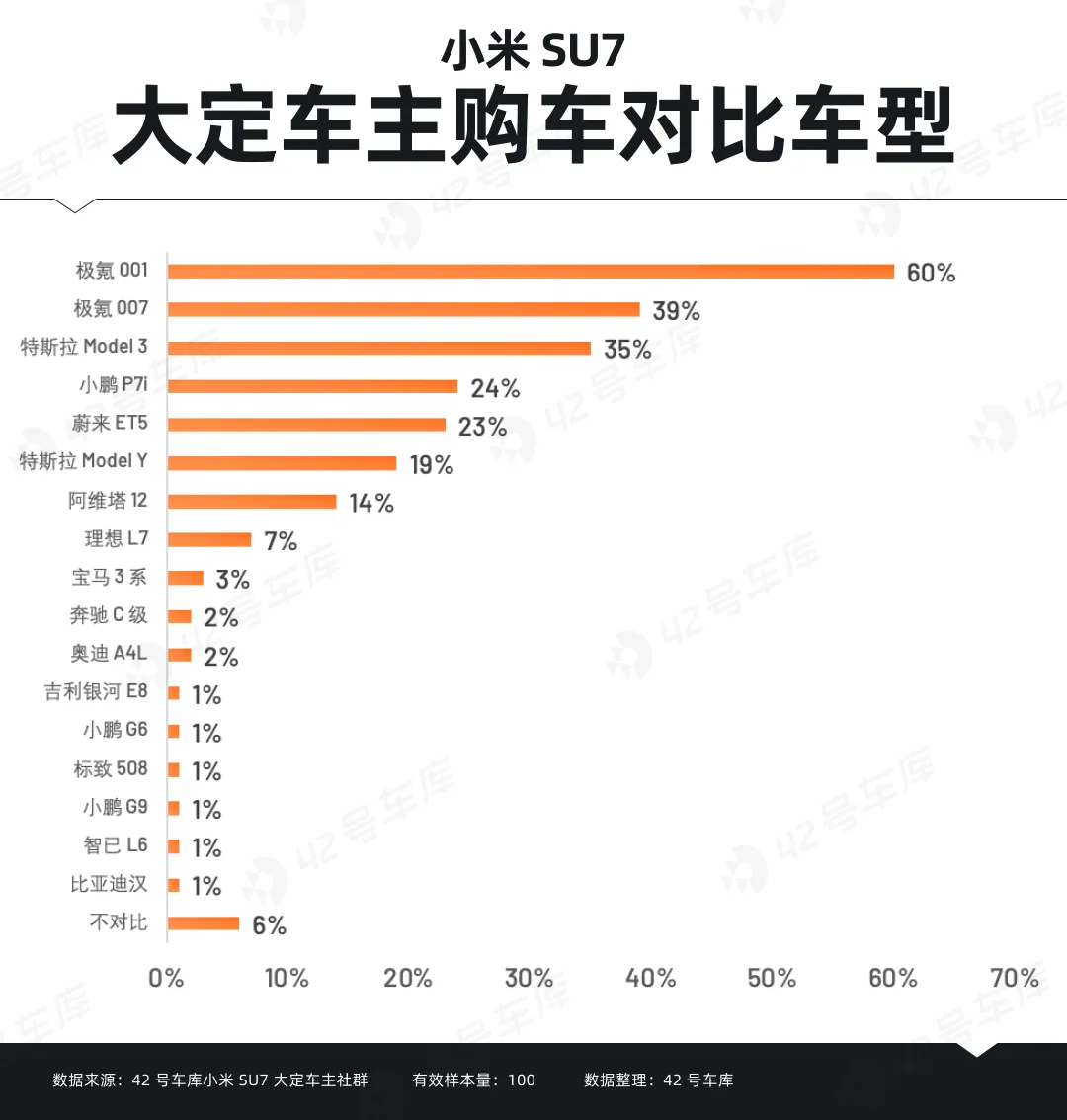

The ZEEKR 001 is the primary benchmark for Xiaomi SU7 pre-order buyers, accounting for 60%, followed by the ZEEKR 007, with a share of 39%.

Interestingly, among the pre-order buyers, there are those who claim to be fans of Xiaomi, considering only the Xiaomi SU7 when purchasing a car and not comparing it with other models. Such customers account for 6%.

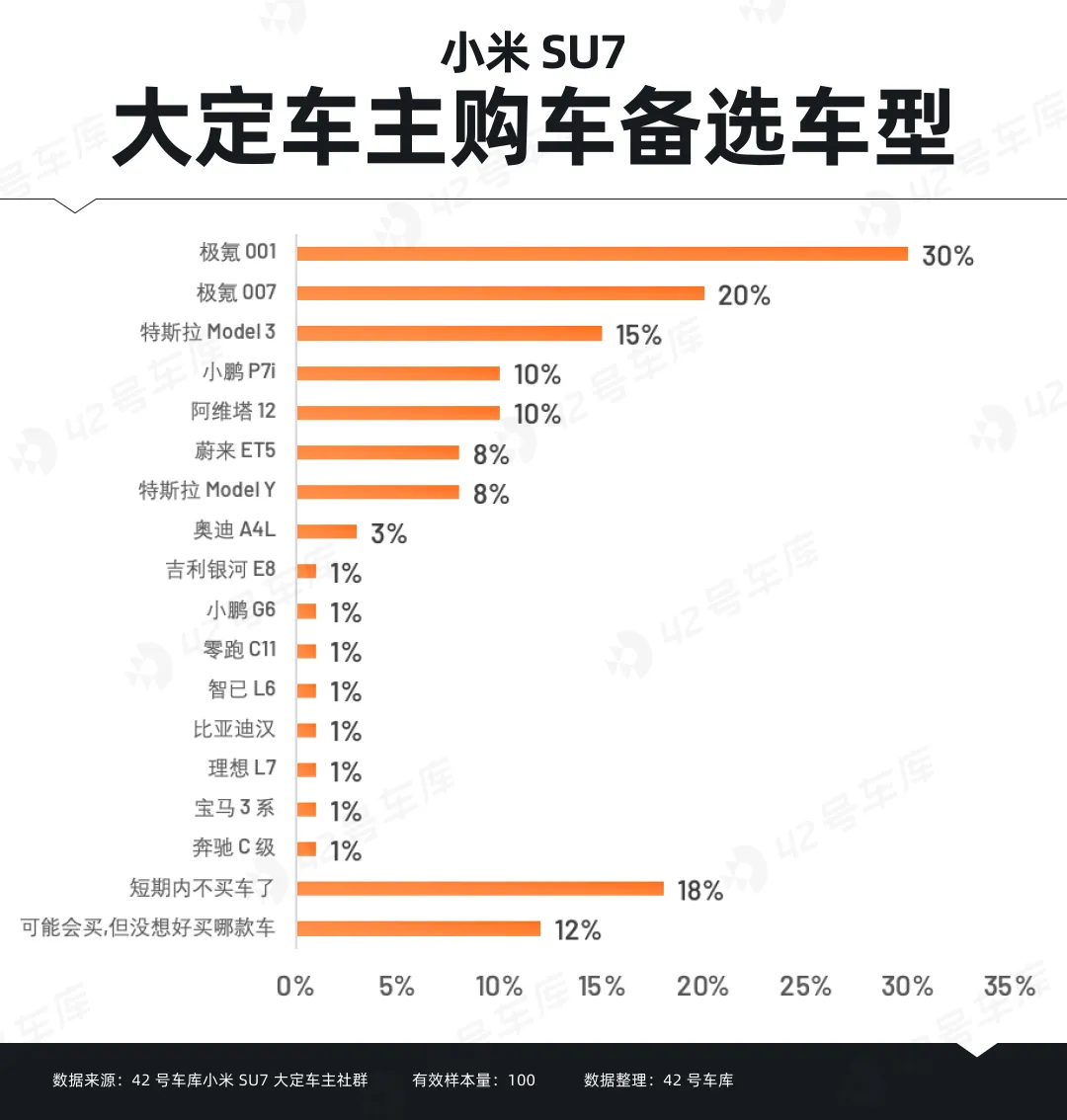

When asked what car model they would choose if the Xiaomi SU7 were not available on the market during their time of purchase, most users would choose ZEEKR 001 as an alternative, accounting for 30%, followed by the ZEEKR 007, with a share of 20%.

Notably, 18% of buyers stated that if the Xiaomi SU7 were not available when purchasing a car, they would not purchase a car in the short term. Also, 12% of buyers stated that without the Xiaomi SU7, they are not sure whether they would still buy a car and if so, no specific model to choose.

Regarding the purchase decision, the vast majority of respondents stated that their hesitation period for buying a car is quite short, with no hesitation or just a little struggle before making a decision. Users of this kind account for 88%.

Additionally, 12% of respondents expressed that they wanted to compare with competitors or wait for feedback from the first batch of car owners before making a decision.

Exterior design, smart cockpit, and performance handling are the most frequently mentioned factors by respondents in car buying. Battery life is next, while factors like passenger space and comfort have comparatively lower proportions.

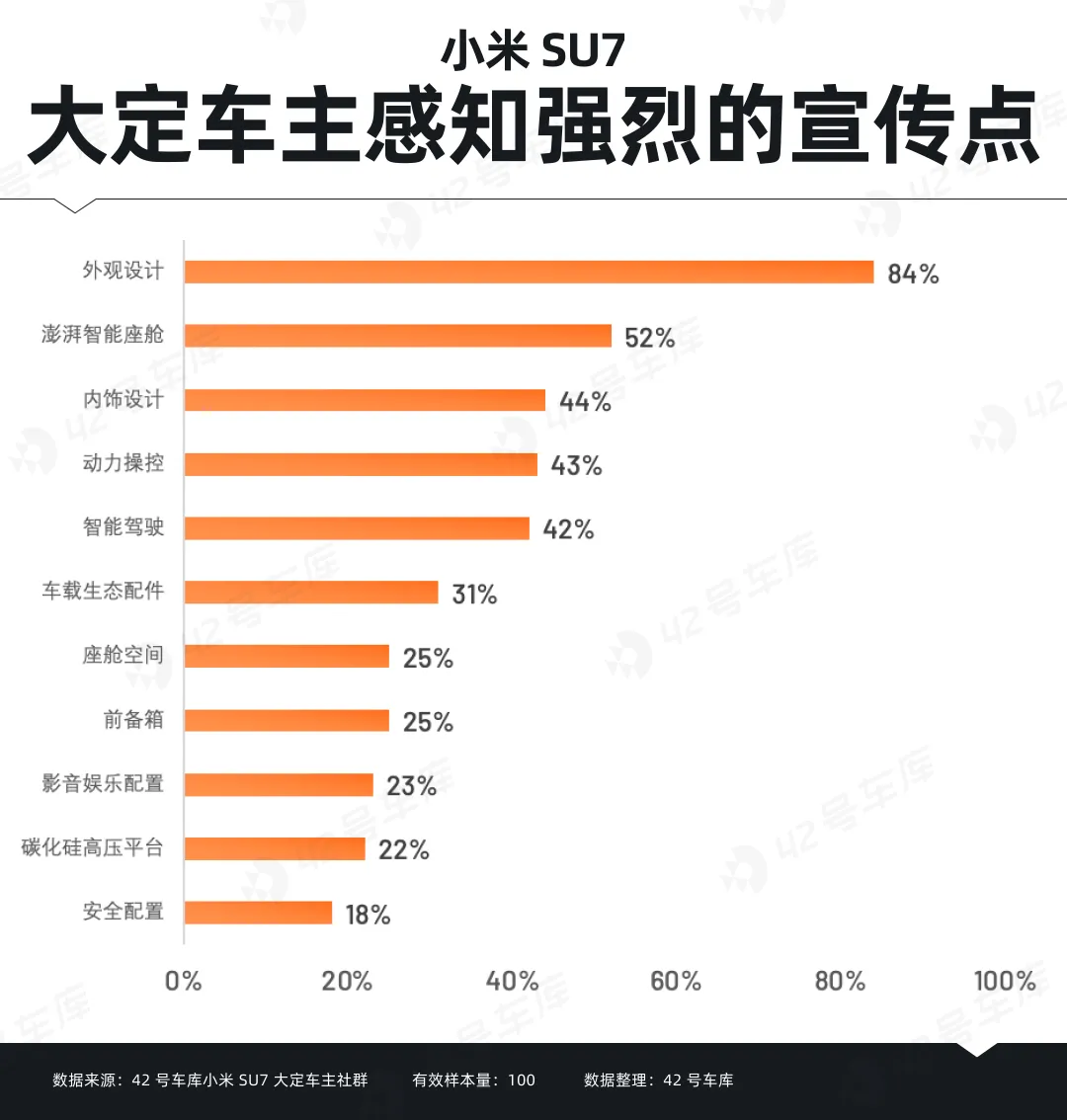

Prior to the launch of the Xiaomi SU7, extensive advertising was done to highlight the product’s features. When asked which product advertising point encouraged their car purchase, exterior design was the most mentioned, accounting for 84%, followed by the dynamic smart cockpit and interior design.

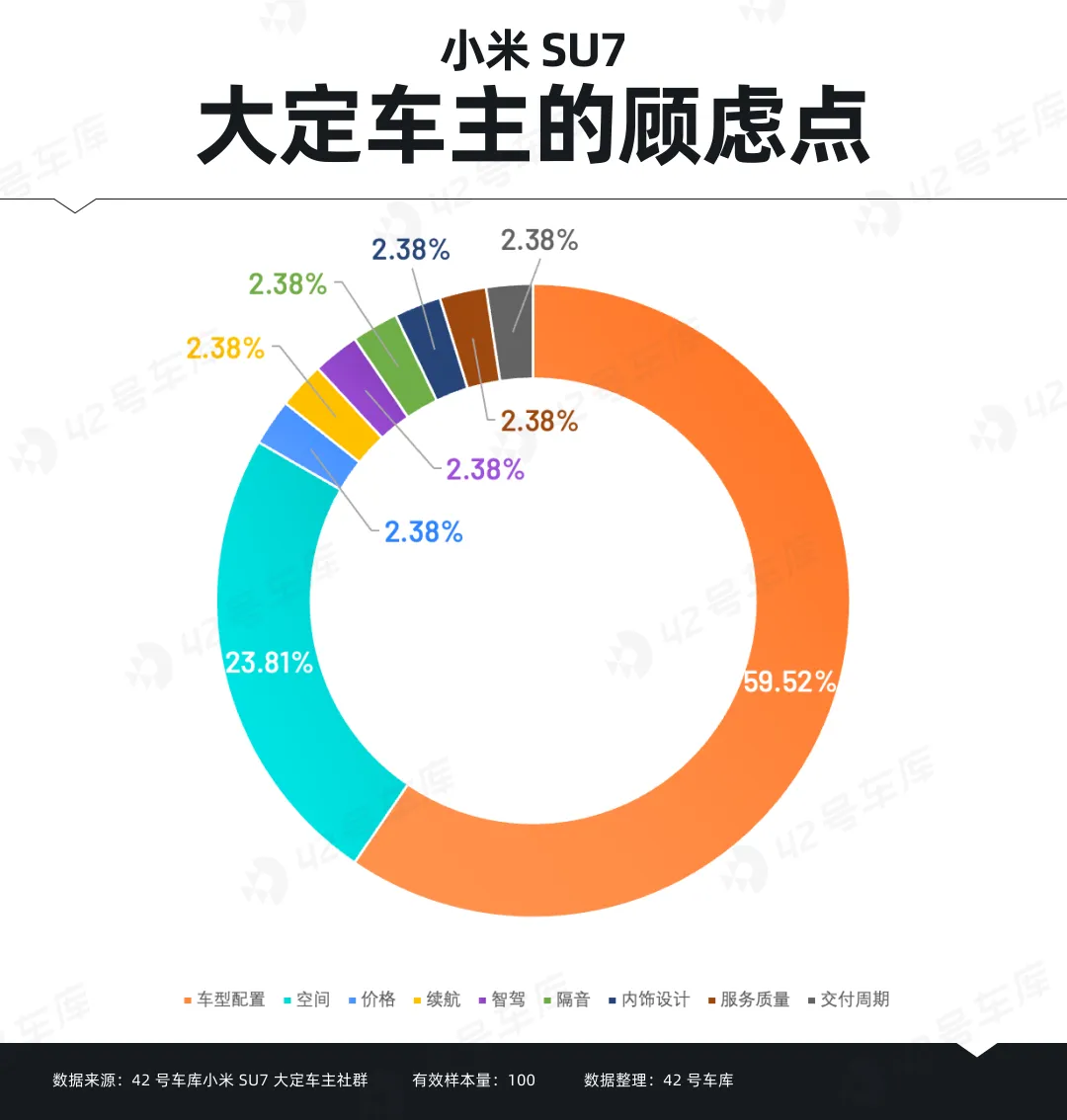

Among the respondents, 45% of buyers still had reservations or areas of dissatisfaction when deciding to buy the Xiaomi SU7. The most common reflection was that the configuration division of the car models was unreasonable, accounting for 59.52%. Additionally, 23.81% of respondents expressed dissatisfaction with the vehicle’s space.

When asked about whether the pricing of the Xiaomi SU7 met expectations, 63% of buyers stated it met their expectations, while 20% felt that the price was higher than expected, and the remaining 17% of buyers felt the Xiaomi SU7 was priced below expectations.

Brand Perception

When evaluating the Xiaomi brand, buyers frequently mentioned cost-effectiveness, ecosystem and technology.

Buyers’ evaluations of the Xiaomi SU7 product frequently mentioned appealing exterior design, intelligence, and driving dynamics.

Among the mobile phone brands used by the respondents, Xiaomi accounted for 66%, followed by Apple, which accounted for 41%.

When asked about Xiaomi brand products used daily besides mobile phones, 99% of respondents stated that they had used Xiaomi’s products, with the most popular being home gadgets, accounting for 67%, followed by watches and wristbands, accounting for over 60%.

Among the respondents, only 1% said they had not used Xiaomi products.

Produced by the 42HOW User Research Group

If you are interested in our research, please feel free to contact us via email at huangjun@42how.com.