Author: Tao Yanyan

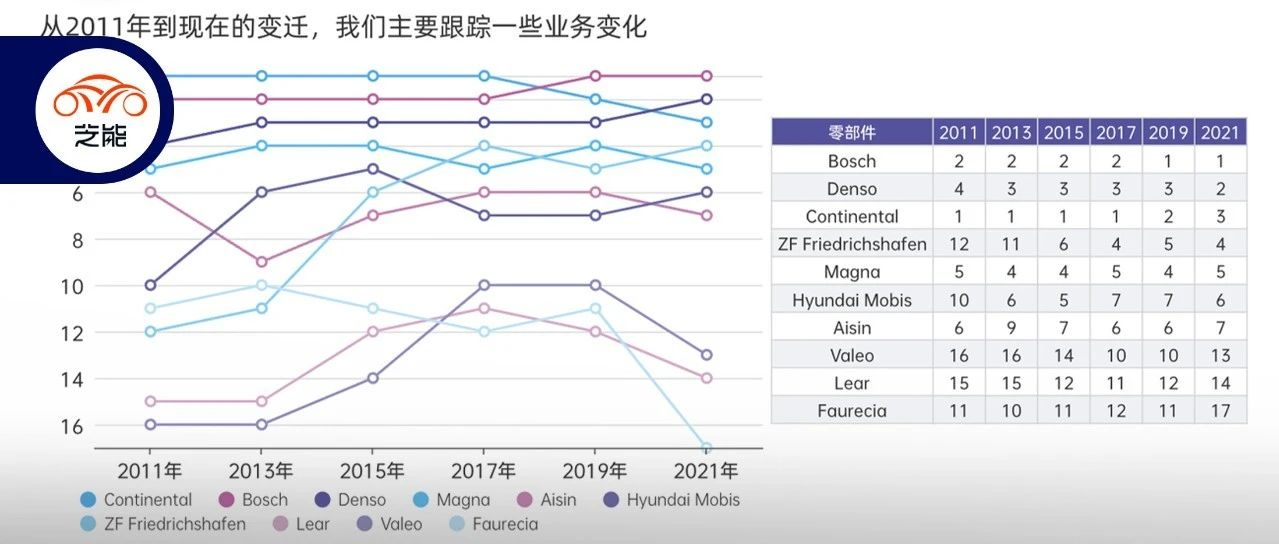

While organizing battery companies, we also want to sort out traditional parts companies’ past in 2022 and their route to the future. First, let’s start with Lear, which Mr. Zhu entered the automotive industry with.

Why choose this company? On the one hand, this is one of the few stable US parts companies that has been able to develop steadily, from the seat business to electronics, and now the E-System segment for new energy vehicles. Lear has never stopped tossing through its financial and management capabilities.

In 2022, sales increased by 8% to USD 20.9 billion (USD 19.3 billion in 2021), net profit was USD 409 million, gross margin was 7%, and net profit margin was 2%. The traditional business segment really “doesn’t make much money,” so the market value is only about USD 8.5 billion.

Lear’s Core Business Situation

Seat Business

The profit margin and adjusted profit margin of the seat business are 6.4% and 6.8% of sales, respectively, which is still a profitable business within the entire company. The main characteristics are that the five major customers mainly revolve around General Motors, Mercedes-Benz, Volkswagen, Ford, and Stellantis, and the main business is in Europe and North America.

The core competitiveness of seats is mainly surface material design, thermal management, and structural design. In continuous polishing of high-end products, Lear achieves vertical integration through the acquisition of upstream suppliers.“`

Business of E System

The profit margin and adjusted profit margin of the Electronic Systems Department are 0.7% and 4.8% of sales, respectively, which is not very profitable. One reason is that the business is somewhat miscellaneous, including electronic distribution, connectors, electronic components, V2X, and electrification components. It feels like they do a little bit of everything, and it’s all through integration and acquisition; it’s hard to say which area is really strong.

The current standout business is the BDU business that is closely integrated with high-voltage connectors, which has supplied a lot to General OTT North America.

Lear’s M&A history

Lear was built around acquisitions: in 1999, it acquired UT Automotive, an automotive electrical and electronic systems supplier, for $2.3 billion, which served as the foundation of Lear’s Electronic Systems Department, and transferred UT Automotive’s automotive interior products to International Automotive Components Group.

Starting in 2010, Lear continued to acquire companies. From an overall strategic perspective, its main approach can be divided into:

◎ Upstream of seating: Continuously focus on the core competitiveness of seating and make improvements to materials, fabrics, leather, and more.

◎Electronic: Expand its boundaries through purchases.

In fact, Lear has also adopted joint ventures to expand its boundaries.

“`Summary: Now let’s track the whole development model of Lear company. They are relatively strong among American automotive Tier 1 suppliers, with a self-retained market in seat business. They have made efforts to expand in the electronics field with some effects, but it’s not very profitable. This is actually a common problem among American automotive component suppliers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.