Author | Xiao Ying

Editor | Qiu Kaijun

Without waiting for their killer move, Great Wall Motors’ shares hit limit down first.

Recently, a price war in the auto industry has caused chaos in the stock market. On March 10th, Great Wall Motors’ A shares fell 10\%, while other car stocks such as SAIC Group, Changan Automobile, and BYD all closed with a drop of around 5\%.

That night, during the Intelligent New Energy Information Conference held by Great Wall Motors, the company’s CEO Mu Feng asked a question at the beginning of his speech, “Are you anxious about the current wave of price reductions?”

How to respond to the increasingly fierce and even vicious price war in the auto market? Great Wall Motors presented a solution to offer more cost-effective and competitive technology – the new intelligent hybrid technology Hi4, which is also the focus of this Intelligent New Energy Information Conference.

Amid the wave of new energy vehicles, the appearance of Great Wall Motors’ Hi4 technology is undoubtedly a “hard battle” against competitors like BYD who have already seized the lead and against best-selling technologies like BYD DM-i.

“Once we’ve implemented this new technology, we must take back our own market,” said an insider at Great Wall Motors.

Can Hi4 take on this great responsibility?

“4WD” Replacing Original “2WD”

In the field of hybrid technology, BYD has long been in a state of pressing its competitors against the ground in China. The release of Great Wall Motors’ Hi4 technology can be seen as a forceful counter-attack against BYD.

Hi4, where H (Hybrid) represents the hybrid system, i (Intelligent) represents the intelligence, and 4 stands for (4WD) the four-wheel-drive system, is a self-developed intelligent control hybrid technology by Great Wall Motors with a dual-motor architecture for the front and rear axles in series and parallel.

For this reason, Great Wall Motors developed a new generation of power system components, including hybrid-specific engines, hybrid-specific transmissions, high-power and high-efficiency electric rear axle, and low internal resistance power batteries.

Hi4 has two sets of powertrains: 1.5L+DHT+P4 and 1.5T+DHT+P4, with a maximum system output of 340kW, covering A-C class vehicles. The hybrid-specific engine achieves 41.5\% optimal thermal efficiency. Hi4 also covers two types of electric capacity – 19.94kWh and 27.5kWh, achieving a pure electric range of more than 100 km.

At the same time, this scheme also adds dual-motor and dual-axis control function, with the power of the front and rear axles being decoupled. Together with millisecond-level response of iTVC intelligent torque vector control system, the vehicle can smoothly pass through low-adhesion road conditions such as curves, ice, sand, and gravel.Based on different driving conditions and demands, the Hi4 system can achieve dynamic switching between three engines and nine modes. By intelligently calling the front and rear dual-motors, the hybrid-specific engine, the system can switch between nine different modes, including pure electric two-wheel drive, pure electric four-wheel drive, series mode, first gear direct drive, second gear direct drive, parallel two-wheel drive, parallel four-wheel drive, single-axis energy recovery, and dual-axis energy recovery.

According to Great Wall Motors, the Hi4 system will first be used in Haval’s new energy models and will be officially launched in April this year. By 2024, the four-wheel drive technology will be popularized across the entire new energy product line. Based on the demonstration video from the press conference, the first model to be equipped with this technology is expected to be the Haval Xilong (codenamed B07), which has already been listed in China’s new vehicle announcements.

Although the Hi4 system is impressive, the core of its competitiveness still lies in pricing. Great Wall Motors did not mention the issue of pricing in the event, but revealed that they can offer four-wheel drive at the same price as two-wheel drive, and even promote “universal electric four-wheel drive”. This may be the overall pricing strategy of Great Wall Motors. Whether or not they can successfully compete with BYD remains to be seen in the subsequent pricing announcements.

“Not only do we want to create Great Wall’s new energy, but also make new energy the Great Wall,” said a promotional video at the event, which represents Great Wall Motors’ attitude towards a comprehensive transformation towards new energy.

Great Wall Motors has the most comprehensive layout in the field of new energy: pure electric, plug-in hybrid, and hydrogen fuel cell vehicles. However, they have not yet produced a popular new energy core model.

In the second half of 2022, Great Wall Motors underwent a very deep thinking and reform process. Internally, the organization structure system underwent significant adjustments, and externally, the sales channels were fully integrated.

Specifically, Great Wall Motors carried out a “541” full-stack organizational model reform, which integrated the research, production, supply, and sales model and achieved internal goals and synergy.

Among them, “5” refers to the establishment of five middle platforms, including the brand, channel, user, data, and sales service platform. Currently, the organizational structure of the five middle platforms has been established.

“4” refers to four task forces, including the Tank and Veyron Task Force, the Euler and Salon Task Force, the Haval and Pika Task Force, and the Overseas Market Task Force. In the future, Great Wall Motors will be led by task forces, and will use the five major middle platforms to fully empower the task forces to coordinate and apply resources.- “1” emphasizes the concept of the Great Wall, achieving unified systematic management through a common action plan.

- Externally, to solidify its dealer channels, Great Wall Motors will merge channels for Wei and Tank, Euler and Salon, and Haval and Pickups respectively. This model will increase the profitability of dealerships and subsequently increase investment enthusiasm.

- The core of these changes is to prepare for the comprehensive transformation of its brands towards new energy.

- Haval will launch a brand-new new energy product series, with new names and channels. Within the Haval brand, the H series and dog categories will mainly support combustion models, while the new product line will cover new energy products, including plug-in hybrid models and pure electric models.

- New energy vehicle models under the Wei brand will focus primarily on plug-in hybrids, and there will be pure electric vehicle models in the future. Tank brand will also have more plug-in hybrid models to support, and Euler and Salon will focus on pure electric vehicle models.

- ## Forest ecology lays the technological foundation

- Great Wall Motors’ comprehensive transformation towards new energy is a judgement call and proactive response to the trend.

- On March 10, the Association of Automobile Manufacturers released the sales volume of the Chinese car market for February 2023. In the first two months, a total of 3.121 million passenger vehicles were sold, a YoY decrease of 15.2%. Among them, new energy vehicle sales reached 933,000 units, a YoY increase of 20.8%, and market share reached 25.7%.

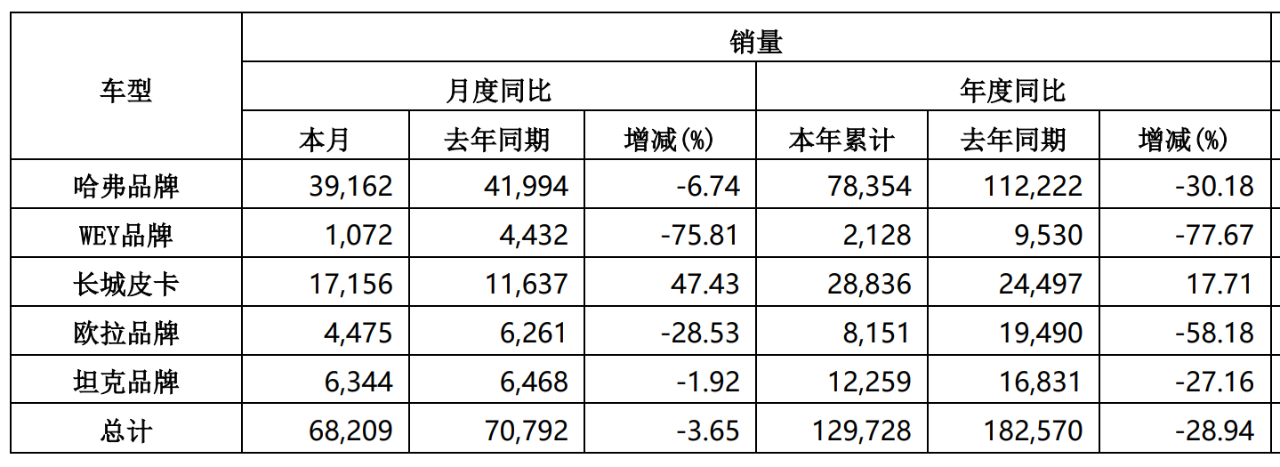

- In terms of Great Wall Motors’ sales, cumulative sales in the first two months decreased by 28.94%. All brands except for Great Wall pickups maintained relatively strong growth momentum, while other brands experienced a significant decline in sales. In particular, WEY brand’s monthly sales, which mainly targets the high-end market, have shrunk to around 1000 units, and Euler has not achieved sales of more than 10,000 units in the first two months.

- Hence, it is imperative for Great Wall Motors to undergo a transformation from within to without.Great Wall Motors defines 2023 as the “squat and jump” year by opening up the market through comprehensive electrification. Despite the pessimistic views on the transformation of traditional car companies, Great Wall Motors is still one of the players with money in the pockets and cards in the hands facing the competition in the next stage of the market.

However, the competition in the automotive market is becoming more and more intense, leaving few opportunities for players to make moves. It is important to seize every opportunity to make a move.

Great Wall Motors defines the upcoming market competition as the competition of intelligent electrification, which includes both the transformation of electrification and the construction of intelligent capabilities.

Mufeng, the CEO of Great Wall Motors, introduced that the competitiveness of Great Wall Motors comes from its core supply chain layout through the forest ecosystem. Specifically:

-

Regarding power battery technology, Honeycomb Energy has laid out power batteries of multiple chemical systems such as lithium iron phosphate, lithium manganese iron phosphate, cobalt-free, ternary sodium-ion, and solid-state around power battery technology, and planned three solutions of economy, long range, and high performance.

-

For electric drive technology, FruitRobotics builds electric drive products around integration, high voltage, high speed, and high efficiency, constructs two major platforms of M and L, and has serialized products from 100kW to 220kW, which can cover passenger cars from A to D segments.

-

For the third-generation power semiconductor SiC, Great Wall Motors has also entered into an in-depth layout, and the module testing and sealing project focuses on core technology. Through CSS technology platform, the module control density can be increased by 50% while reducing cost by 30%, which is mainly used in the main appliance and charging fields. The planned annual production capacity of vehicle-level modules is 1.2 million sets.

-

For hybrid technology, Great Wall Motors has constructed a technical route of parallel multiple architectures and transverse-vertical integration, and took the lead in launching two-speed dual-motor plug-in hybrid DHT.

-

Regarding intelligent cockpit technology, NIOBIT developed the V3.5 high computing power cockpit platform, and the sales volume of models equipped with it has exceeded 200,000 units. At the same time, the higher computing power V4 cockpit platform will also be launched. Meanwhile, Great Wall Motors participated in the development of the cockpit operating system CoffeeOS. The upgraded second-generation CoffeeOS has a voice wake-up speed of 250 milliseconds and a car control domain execution speed of 900 milliseconds.

In terms of intelligent driving technology, Mu Feng believes that Great Wall Motors has the ability to conduct self-research and development from perception hardware to computing platform.

In terms of intelligent driving technology, Mu Feng believes that Great Wall Motors has the ability to conduct self-research and development from perception hardware to computing platform.

In terms of perception hardware, Orbcomm self-developed it’s own perception hardware, including a car-mounted camera with a 17 million pixel photosensitive chip and a 4D mm-wave radar, and combined it with the high computing power platform independently developed by NuoBo Technology to build an intelligent driving hardware architecture.

In terms of software ecology, Haomo Zhixing deployed full-stack resources from the underlying software middleware toolchain to the upper application software, and released the city NOH navigation assisted driving product that can be mass-produced and landed.

Through the supply chain ecology, Great Wall Motors has comprehensively laid out the core technology of intelligent electric vehicles, giving them the confidence to compete in the intelligent new energy era. The release of Hi4 means that Great Wall Motors is officially launching its efforts towards intelligent new energy.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.